devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the February and March reports.

Table of Content

- StreamElements & Rainmaker.gg: Elden Ring made to top-10 by views on Twitch in February 2022

- DFC Intelligence: The Console Market in 2022 will reach $48.7B

- GfK: Largest game franchises in the UK market

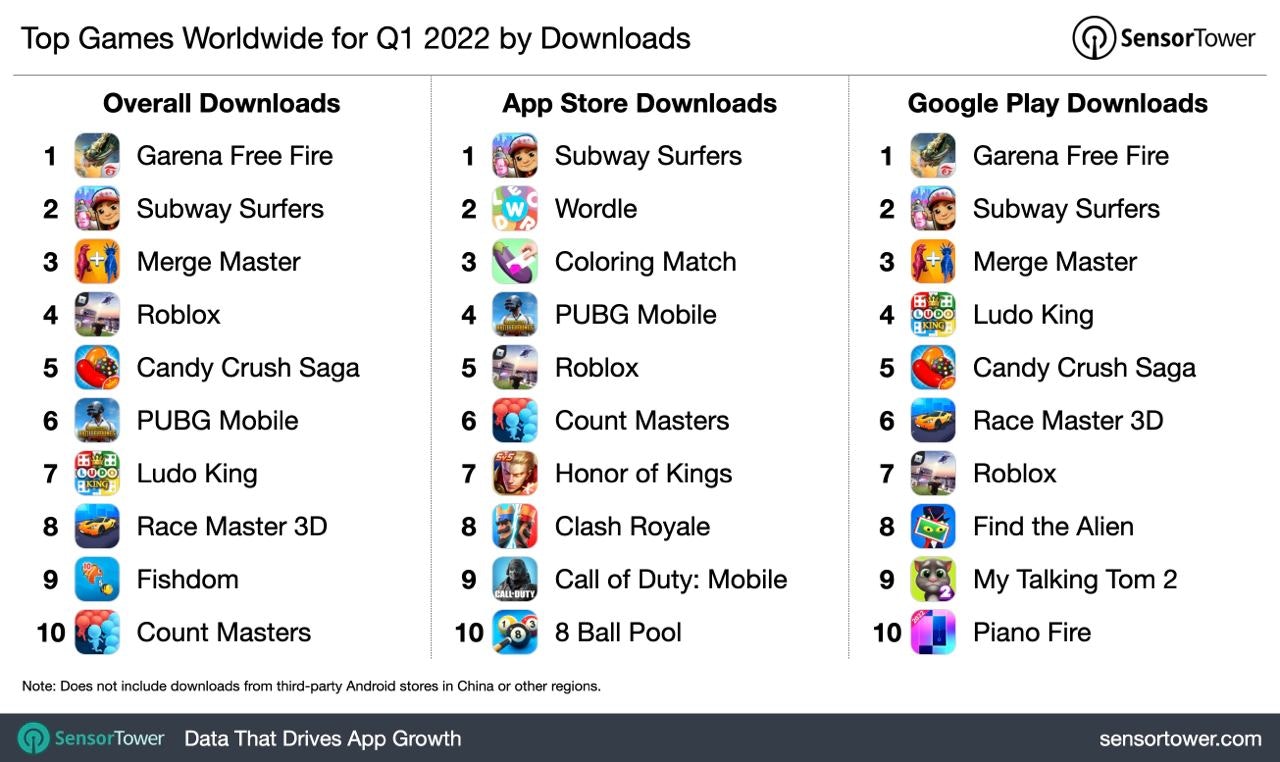

- Sensor Tower: Top Mobile Titles by Downloads in February 2022

- ata.ai: Brazilian App Market in 2021

- MY.GAMES: Russian Gaming Market reached $2.4B in 2021

- data.ai: Indonesian App Market in 2021

- GameRefinery: Casual Mobile Games Trends (March 2022)

- UKIE: British Gaming Market reached $9.14B in 2021

- Sensor Tower: Mobile Games earned $21B in Q1 2022

- AppMagic: Top Grossing & Top Downloaded Games of March 2022

- Tenjin & Growth FullStack: "39% of mobile companies lost their revenue in post-IDFA era"

- Xsolla: Indian Gaming Market Review

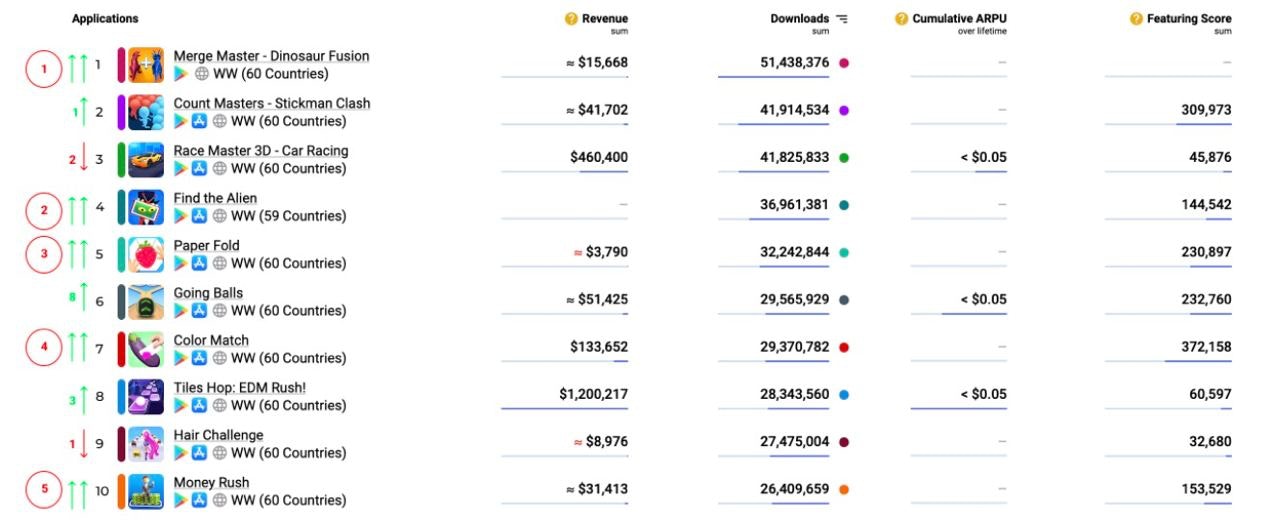

- AppMagic: Top 10 Hypercasual Titles in Q1 2022 by Downloads

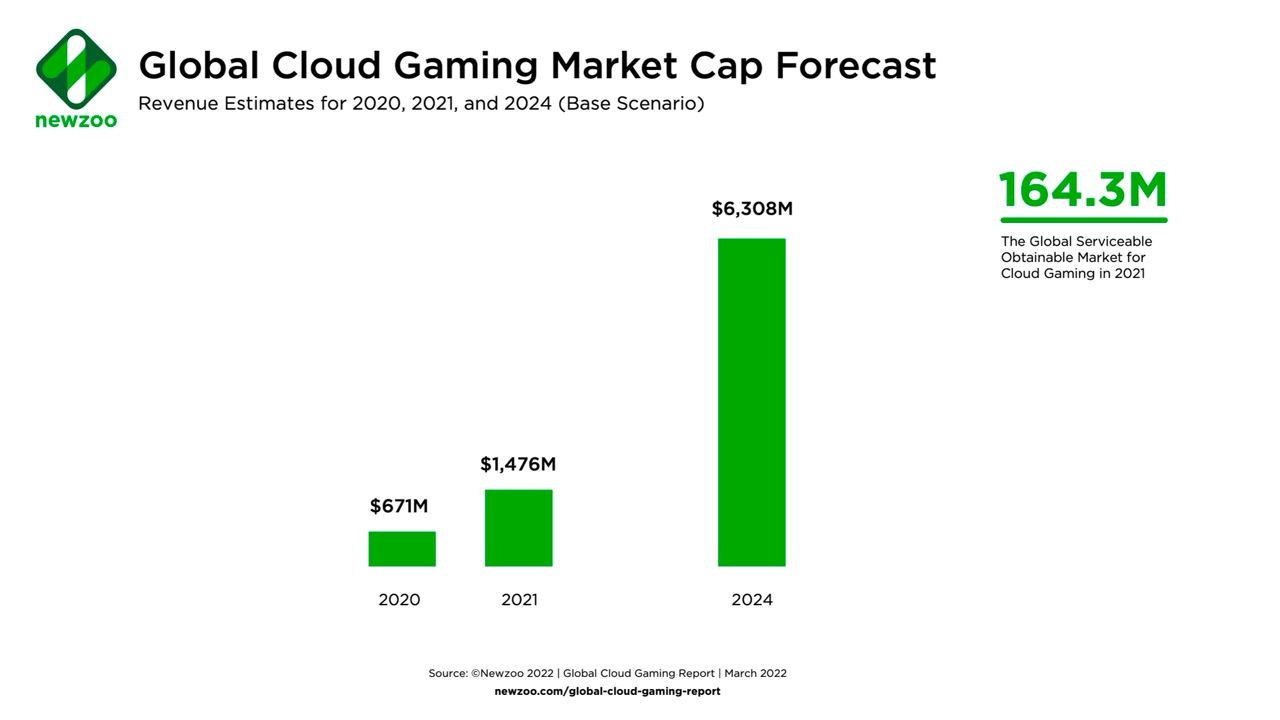

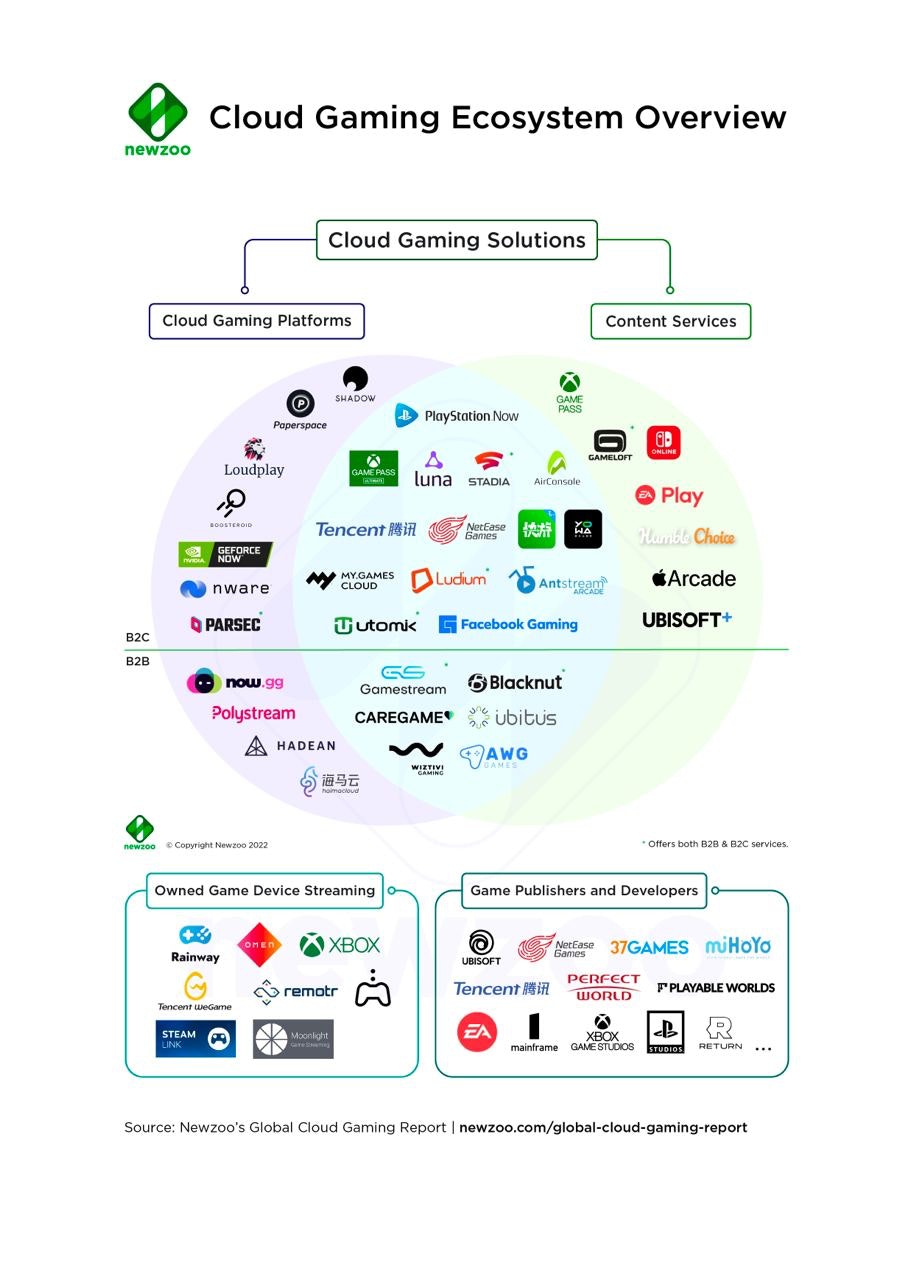

- Newzoo: Global Cloud Gaming Market reached $1.5B in 2021

- App2Top & Talents in Games: 42.3% of Russian Game Industry already left or leaving the country

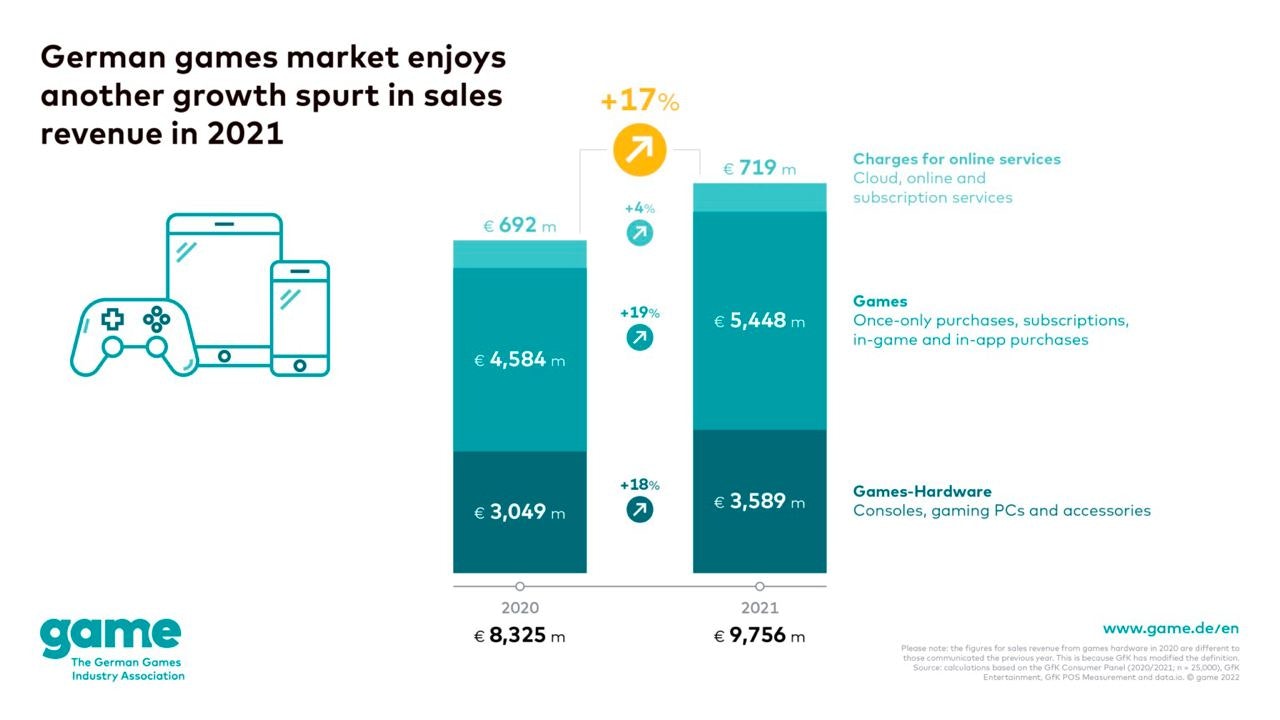

- German Games Industry Association: German Gaming Industry in 2021 reached $10.6B

- Sensor Tower: Top Grossing Mobile Games of March 2022

- Sensor Tower: Top Mobile Games Worldwide by Downloads in March 2022

- Amdocs: 82% of Gamers are hardware-neutral

- Liftoff & Vungle: Playables is the most cost-effective Ad format in Games

- Adjust: 27% of overall game downloads in the last two years were hypercasual

- Newzoo: Global Esports & Live Streaming in 2022 Report

- data.ai: Mobile Anime Games were responsible for 20% of overall mobile gaming revenue in 2021

- Sensor Tower: U.S. Mobile Puzzle Revenue reached $5B in a year

- NPD: The US Gaming market dropped in March and Q1 2022 overall

- Barclays: Women's spending on Games in the UK grew the most since 2019

- Gamma Data: Chinese Gaming Market in Q1 2022 earned $12.1B

StreamElements & Rainmaker.gg: Elden Ring made to top-10 by views on Twitch in February 2022

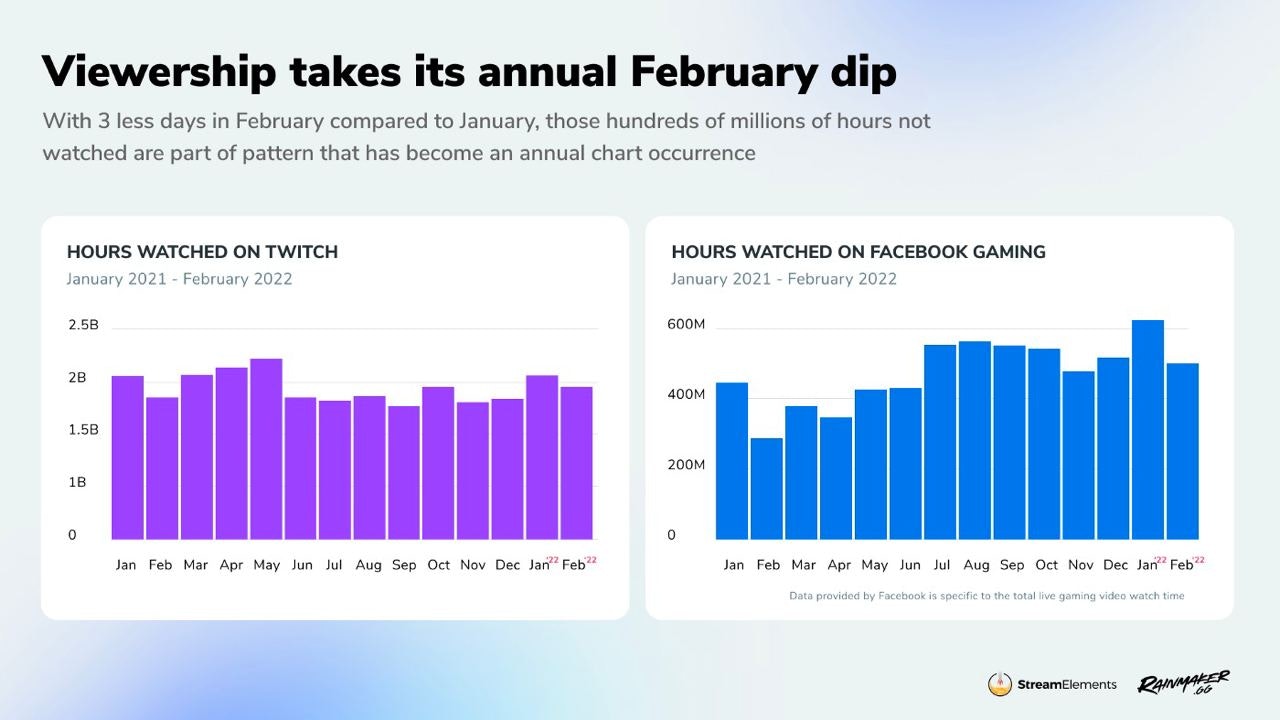

- More than 2B hours spent users watching content on Twitch. Facebook Gaming had 497M hours of watches. Both platforms had a minor drop in views in February compared to the previous month. The reason is simple: there are a few days in February.

-

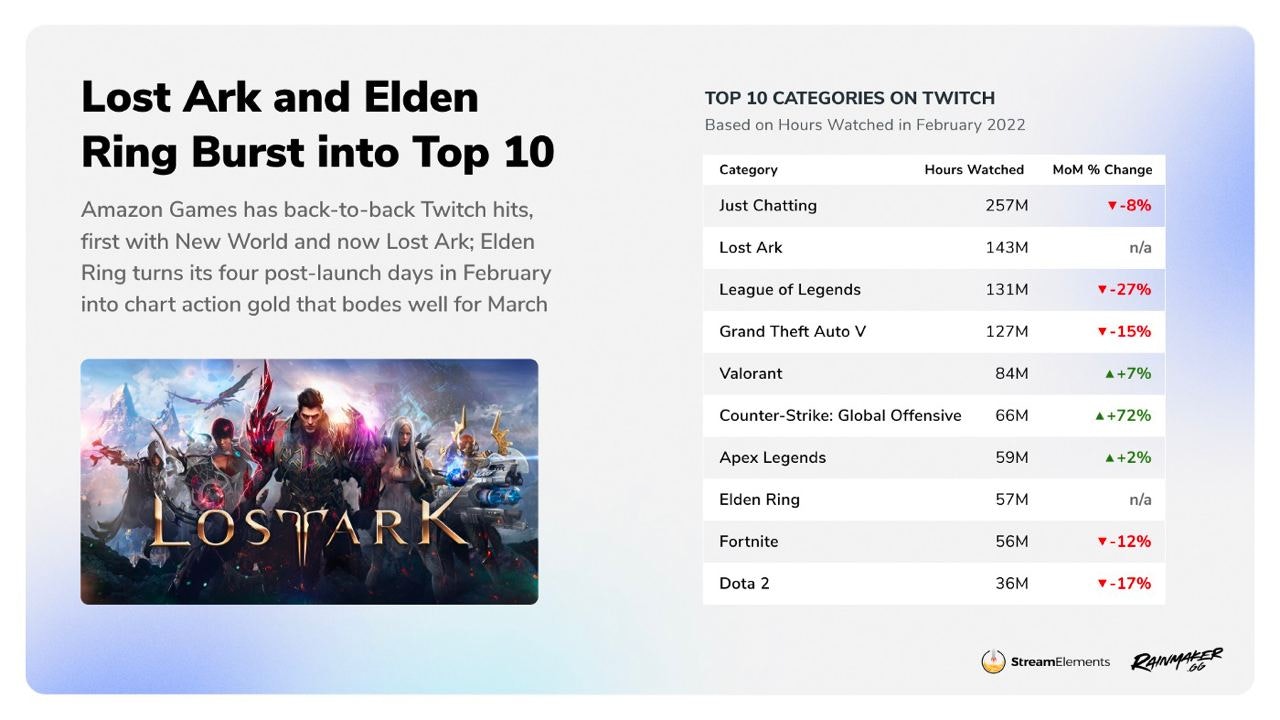

Lost Ark became the most popular game on Twitch in February with 143M hours of content watched. League of Legends (131M hours), GTA V (127M), and Valorant (84M) are next.

-

Elden Ring had a great performance too. It was a single not-MMO and not-GAAS game that made it to top-10. It had 57M hours watched on Twitch.

-

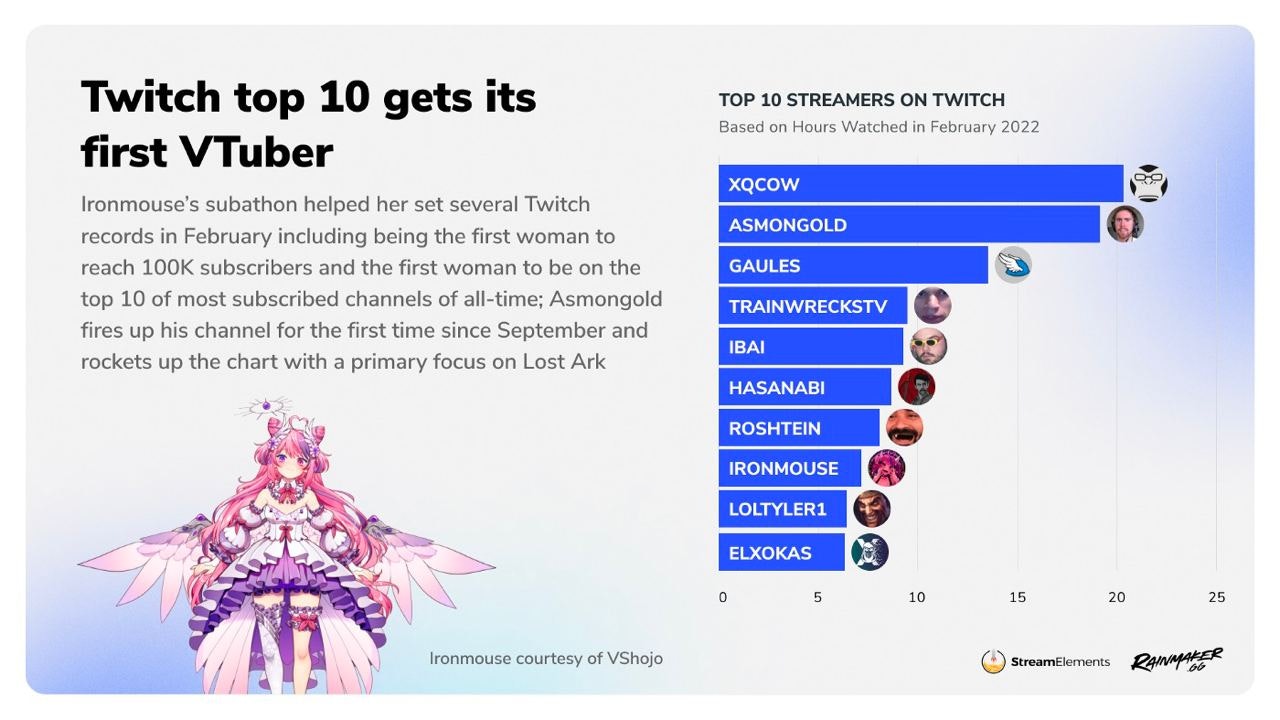

February 2022 was the first month ever when VTuber entered the top-10 by popularity. VTuber is a content creator in the form of a virtual avatar, not a real person. The nickname of the creator is Ironmouse.

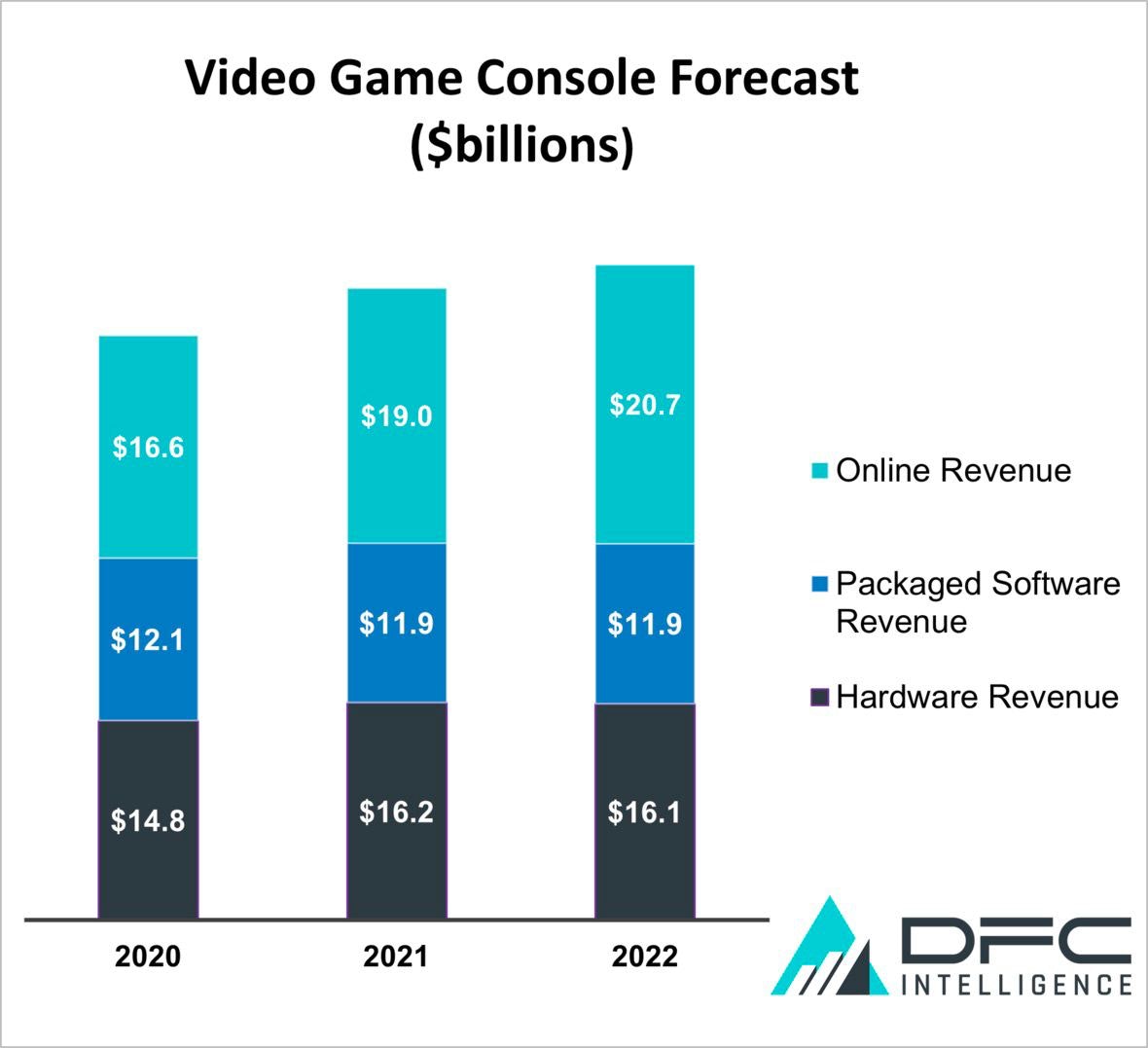

DFC Intelligence: The Console Market in 2022 will reach $48.7B

-

An increase from the previous year will be just around 4%. The main trouble is still in semiconductors, which leads to the lack of platform holders to supply demand.

-

DFC Intelligence analytics are sure that in 2022 the majority of consumers will choose PlayStation 5.

-

Console sales in 2022 in money terms will be lower ($16.1B) than it was in 2021 ($16.2B).

-

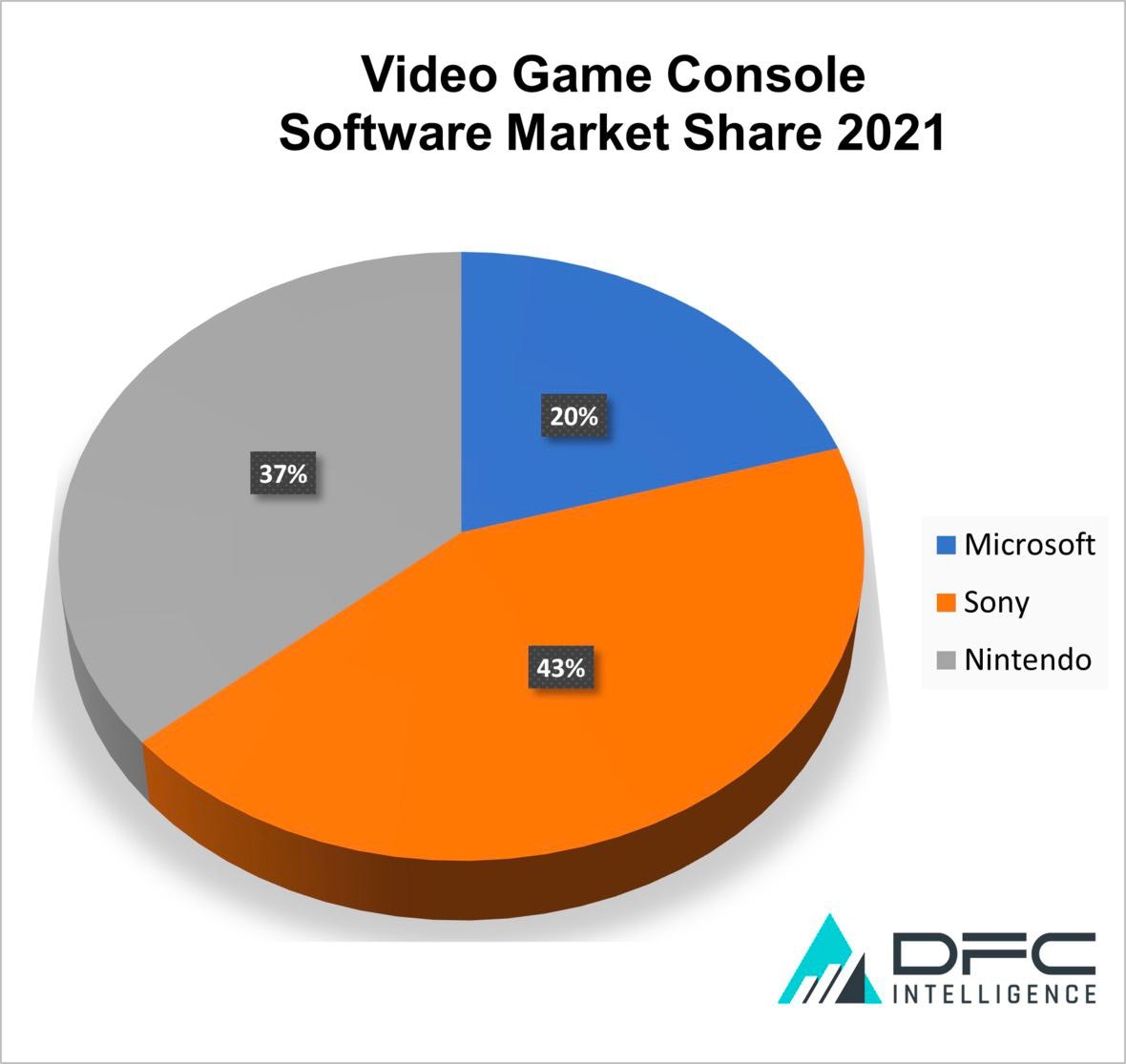

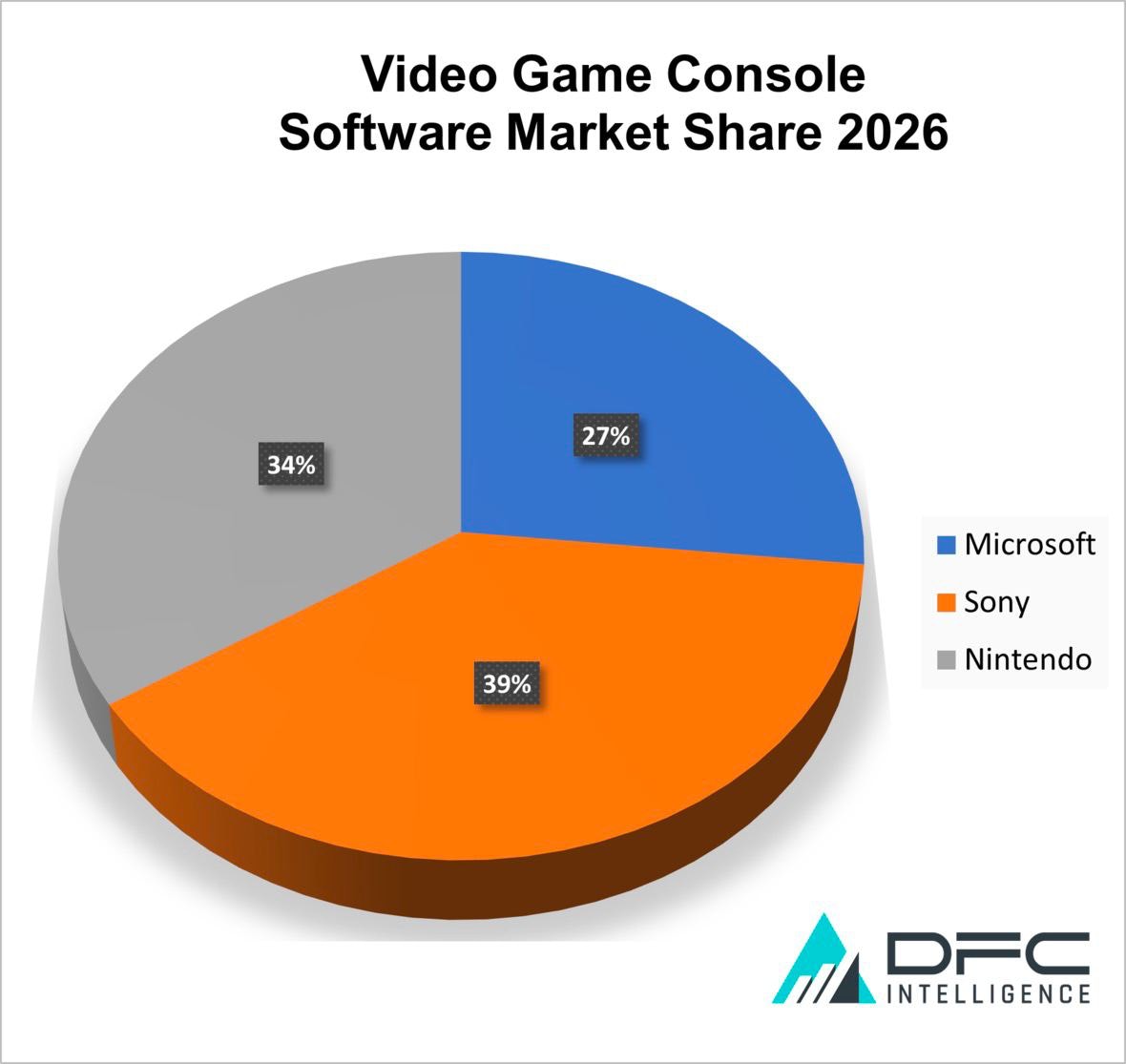

By 2026 market shares of both Nintendo and Sony will decrease (from 37% and 43% in 2021 to 34% and 39% allegedly), but Xbox market share will grow from 20% in 2021 to 27%. The main growth driver will be Xbox Game Pass.

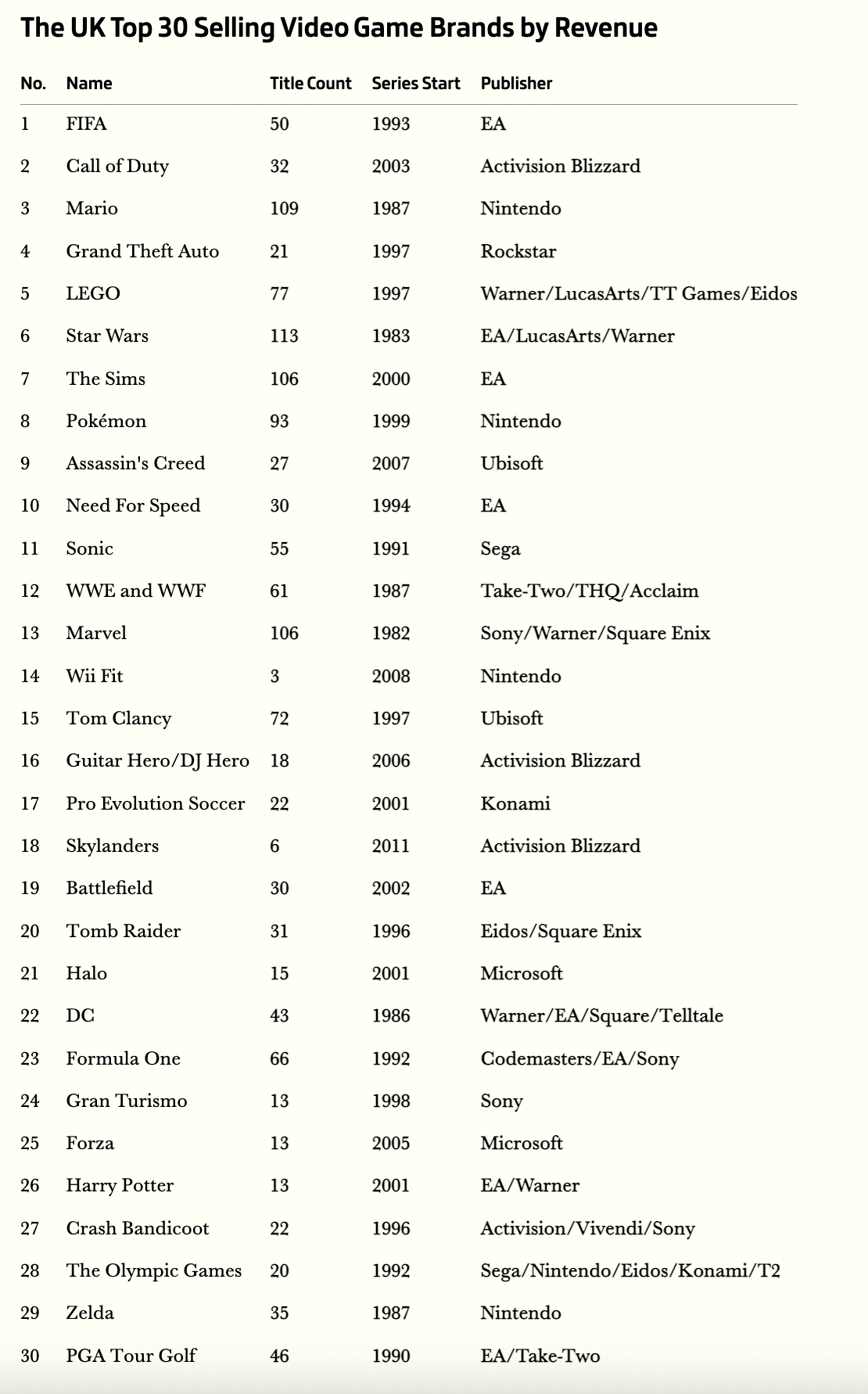

GfK: Largest game franchises in the UK market

-

For the last 27 years, which data is collected, those franchises earned £12.7B.

-

The leader is FIFA which had 50 projects released in the last 27 years.

-

Second place by popularity belongs to Call of Duty with 32 games within the last 20 years. The peak of physical game sales was in the Call of Duty: Black Ops and Call of Duty: Modern Warfare 3 era.

-

The third place is taken by Mario. Leaders by sales are Mario Kart Wii, Mario Kart 8 и New Super Mario Bros. 109 Mario games have been released since 1995.

-

GTA is in fourth place. GTA V is responsible for 40% of all physical sales of the series in the UK.

-

Licensed-base games (WWE, F1, PGA Tour, LEGO, Star Wars, FIFA) earned more than £2.8 in the last 27 years.

Sensor Tower: Top Mobile Titles by Downloads in February 2022

-

Garena Free Fire is first again with 21.8M of downloads (+22.7% YoY). The majority of downloads came from India (41%), and Brazil (9.4%).

-

Evergreen Subway Surfers is second - 19.5M downloads (+45.3% YoY). India (18.8%), and Brazil (7.8%), as in the case of Garena Free Fire, are the main suppliers of users.

-

World from Goldfinch Studios, which doesn’t have anything in common with web-hit, bought by The New York Times, had February the best month ever. It was downloaded 6.7M times (+171% MoM). Interesting, that by the end of 2021 it had just 31.8k downloads.

-

Clash of Clans experienced local success with the best month since 2019 and more than 6M of downloads.

-

In February 2022 games were downloaded 4.4B times (+0.7% YoY).

-

The first place by worldwide downloads belongs to India (670M of downloads - 15% of the overall amount), second is the US (8.7%), third is Brazil (7.8%).

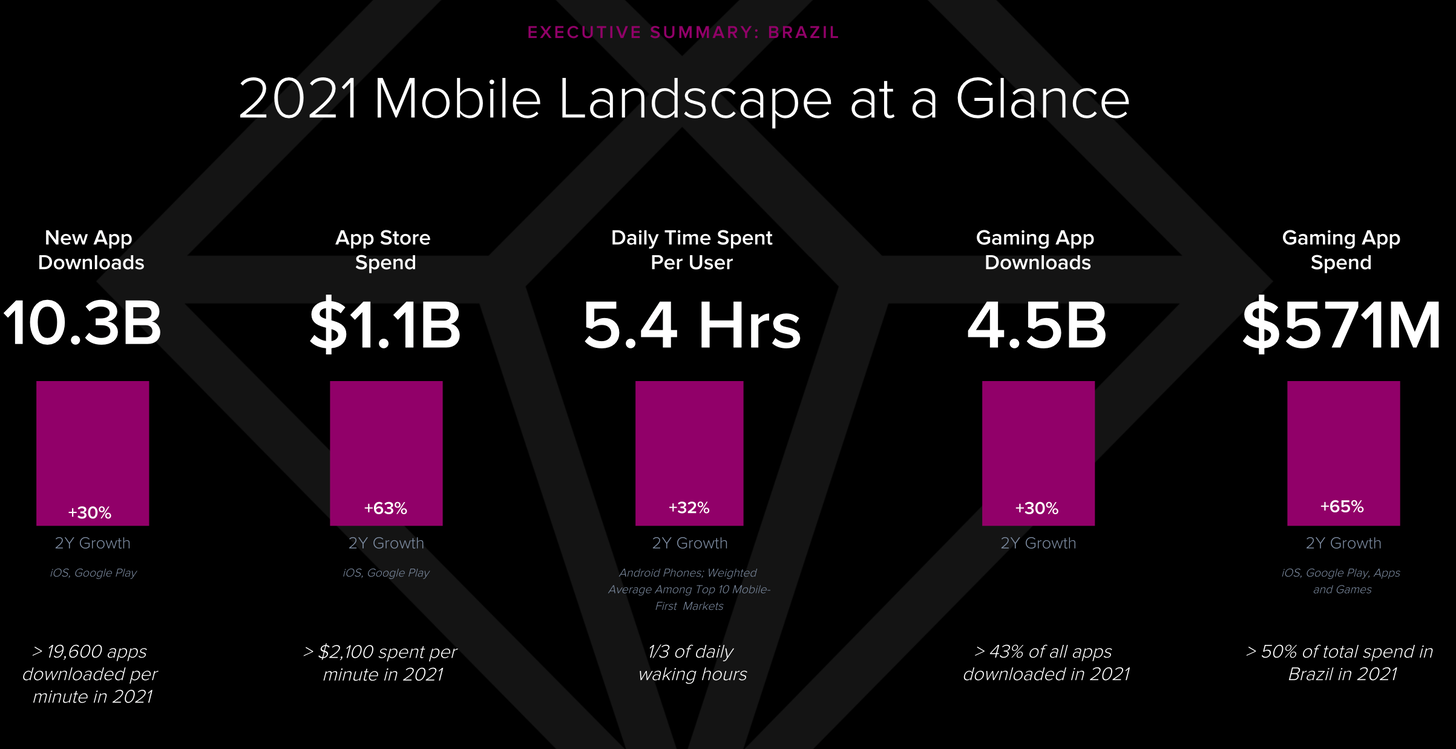

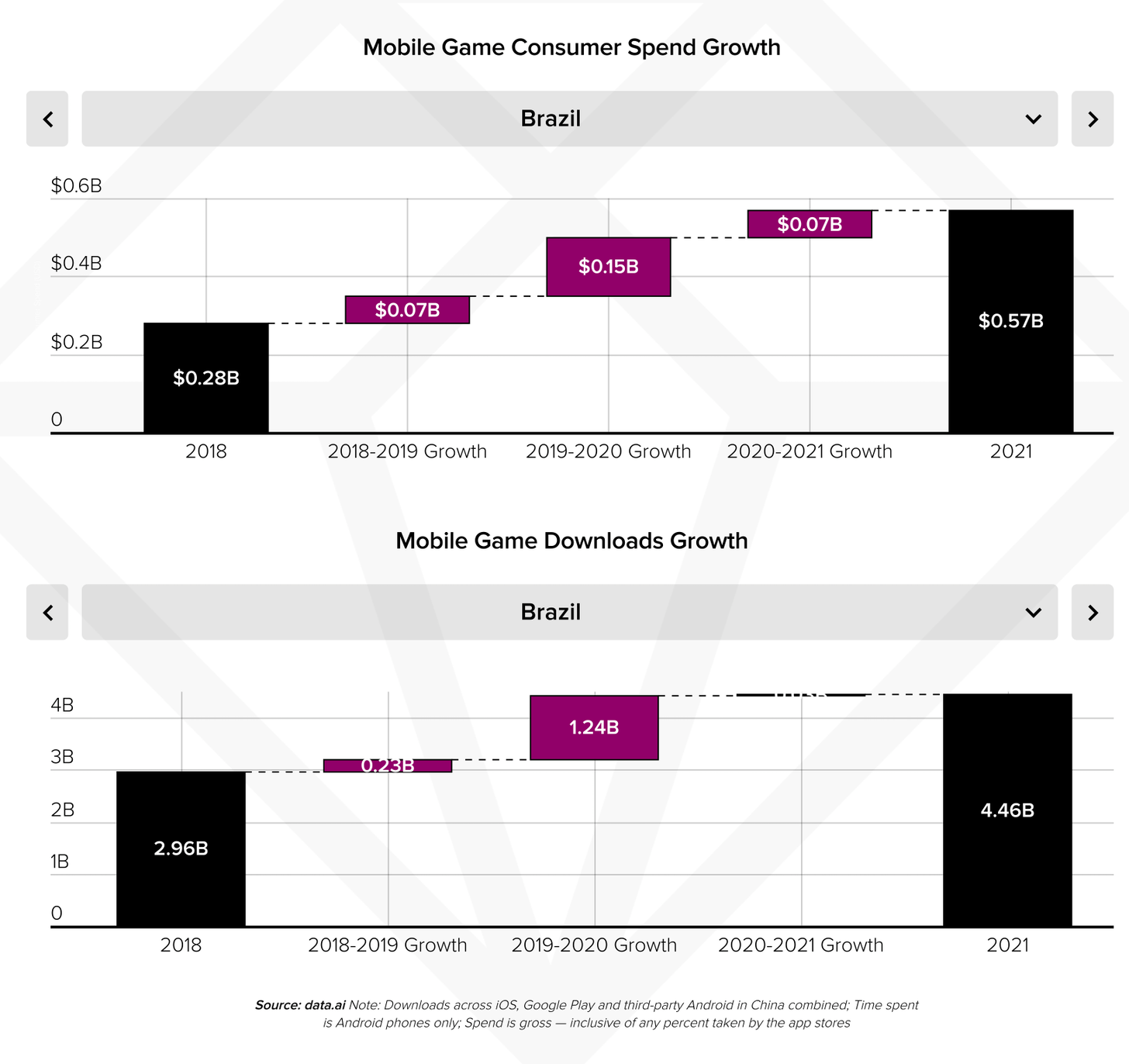

data.ai: Brazilian App Market in 2021

-

The overall valuation of the app market in Brazil is $1.1B. It’s 63% more than in 2019.

-

The gaming segment is responsible for $571M. It’s growing faster than the market - by 65% compared to 2019.

-

Revenue growth in 2021 was $75M. The same amount the gaming industry showed in 2019, the pre-pandemic year.

The number of downloads in 2021, compared to 2020, almost hasn’t changed. Seems like the high base effect.

-

Hypercasual titles are first by far in terms of downloads. Most monetizable genres are 4X Strategies and MMORPGs.

MY.GAMES: Russian Gaming Market reached $2.4B in 2021

- Growth to 2020 resulted in 9%, which exceeded expectations.

-

$1.16B came from the PC market. Growth was 4.2%.

-

Mobile games brought $1.04B of revenue. Growth was 14%.

-

Console market revenues were about $211M. Growth was 8.7%.

-

The majority of Russian players prefer F2P games (84.7%). Premium games revenue fell by 6%.

All growth numbers above are in roubles.

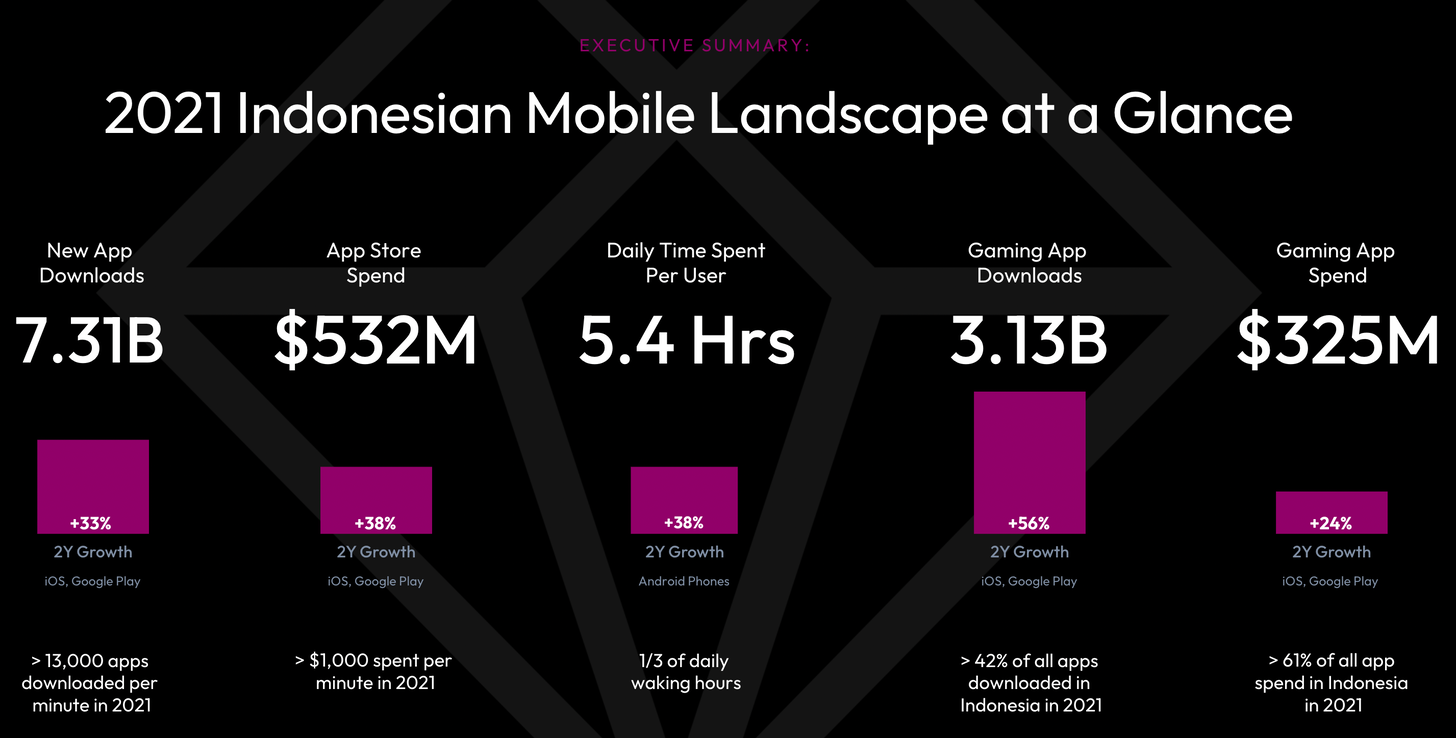

data.ai: Indonesian App Market in 2021

-

The overall amount of the market in 2021 was $532M - it’s 38% more than in 2019.

-

Games are responsible for $325M of this sum. Segment growth to 2019 was 24%, which is lower than the market average.

-

data.ai analytics emphasized significant growth of downloads - by 490M to 3.1B in 2021.

GameRefinery: Casual Mobile Games Trends (March 2022)

-

More and more developers are adding meta-elements and doing experiments with new game mechanics.

-

All projects from top-100 by revenue in the US on iOS in the last 2 years had a renovation game mechanic.

-

Now, elements of renovation & decor can be found in 49% of Match-3 games from Top-100 by revenue in the US on iOS.

-

Developers started to add mini-games and special game modes more often to entertain users.

-

Social elements and community building are started to be used often in projects, previously considered as single-player, like Match-3. It helps developers to retain motivated and competitive players.

UKIE: British Gaming Market reached $9.14B in 2021

-

An increase to 2020 was about 1.9%, but to 2019 - a significant 32.8%.

-

Console sales increased by 32.9% to $1.48B. VR hardware sales increased by 41.9% to $240M. Overall hardware sales increased by 17.4% to 2020 and reached $3.49B.

-

Sales of games, subscriptions, and in-apps decreased by 6.32% to 2020 to $5.62B. However, this category showed an increase compared to 2019 - by 11.4%.

-

Mobile games is the only segment that didn’t show fall in 2020. Its valuation is about $1.92B.

-

Digital sales increased by 5.59% on consoles and by 7% on PC. Boxed game sales dropped down by 21%.

-

Licensed-based merchandise & toys in the UK were sold in the amount of $208.7M. An increase to 33.6% YoY.

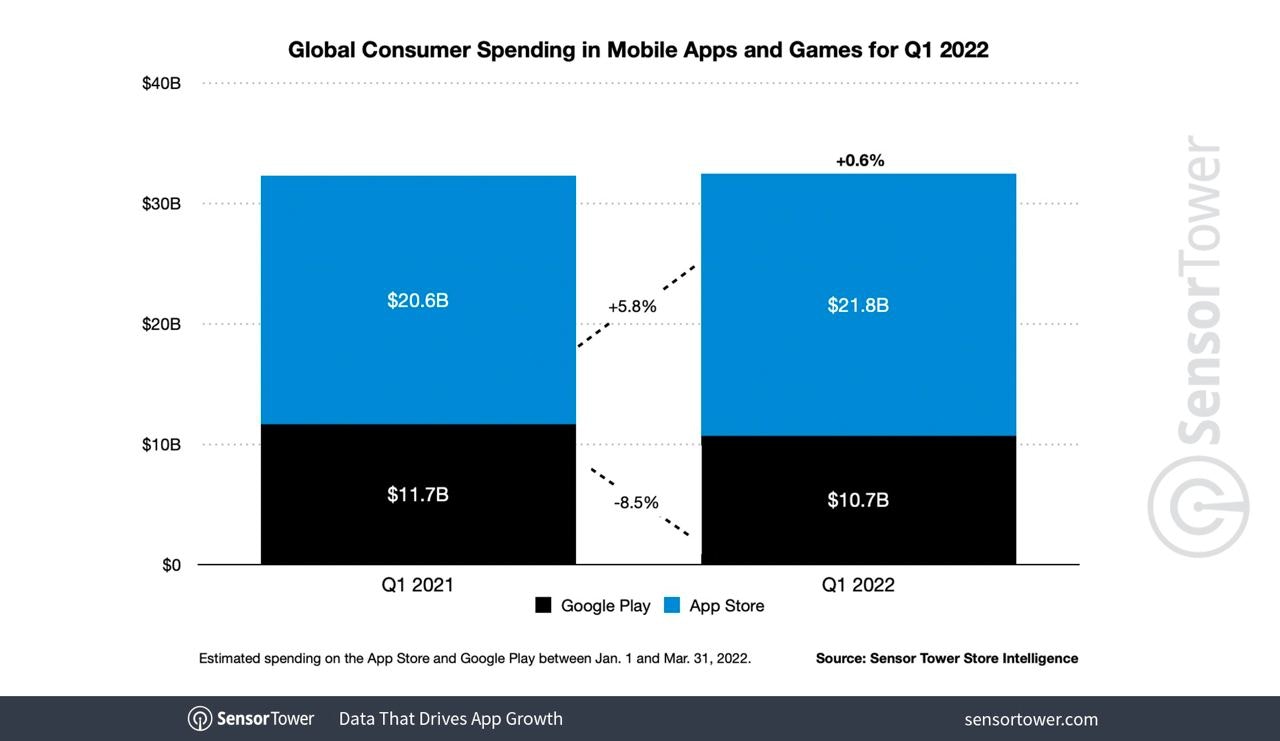

Sensor Tower: Mobile Games earned $21B in Q1 2022

-

Users spent $32.5B on mobile apps overall. About 64% of this amount is on games.

-

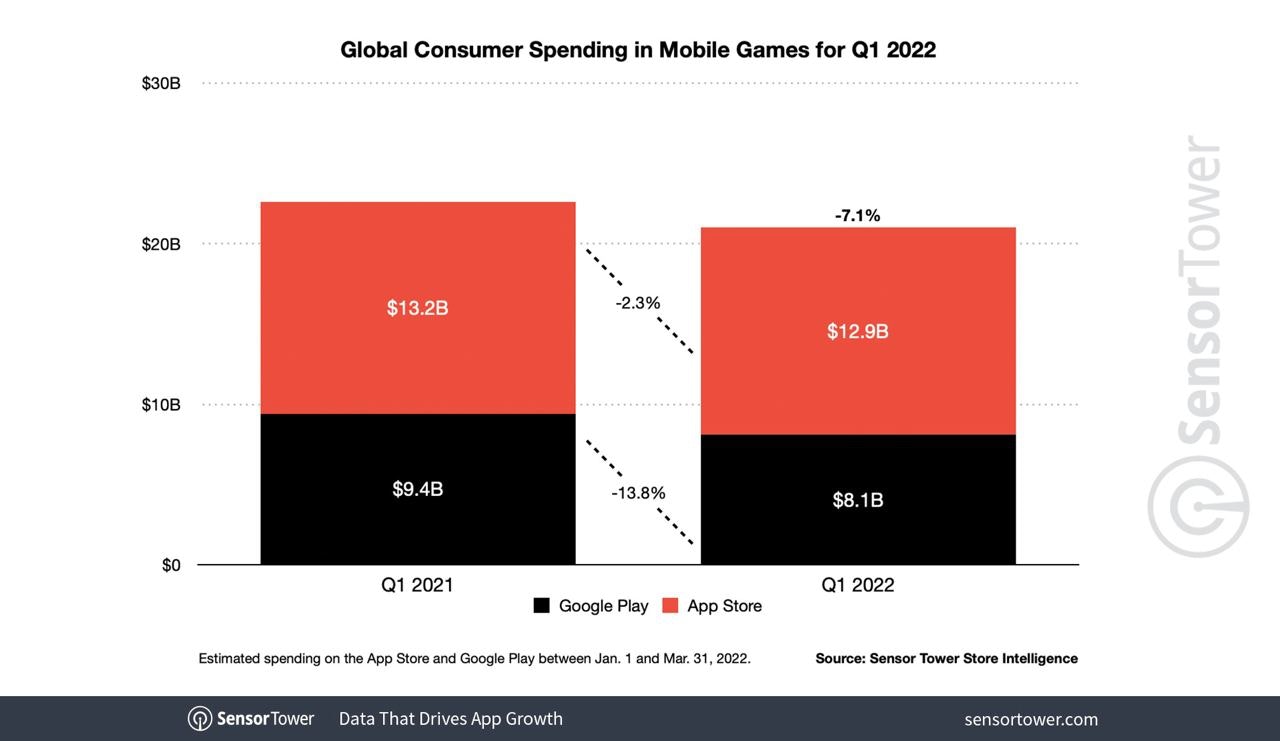

Despite the large number, mobile games revenue went down by 7.1% compared to Q1 2021.

-

App Store revenue was $12.9B (-2.3% YoY); Google Play - $8.1B (-13.8% YoY).

-

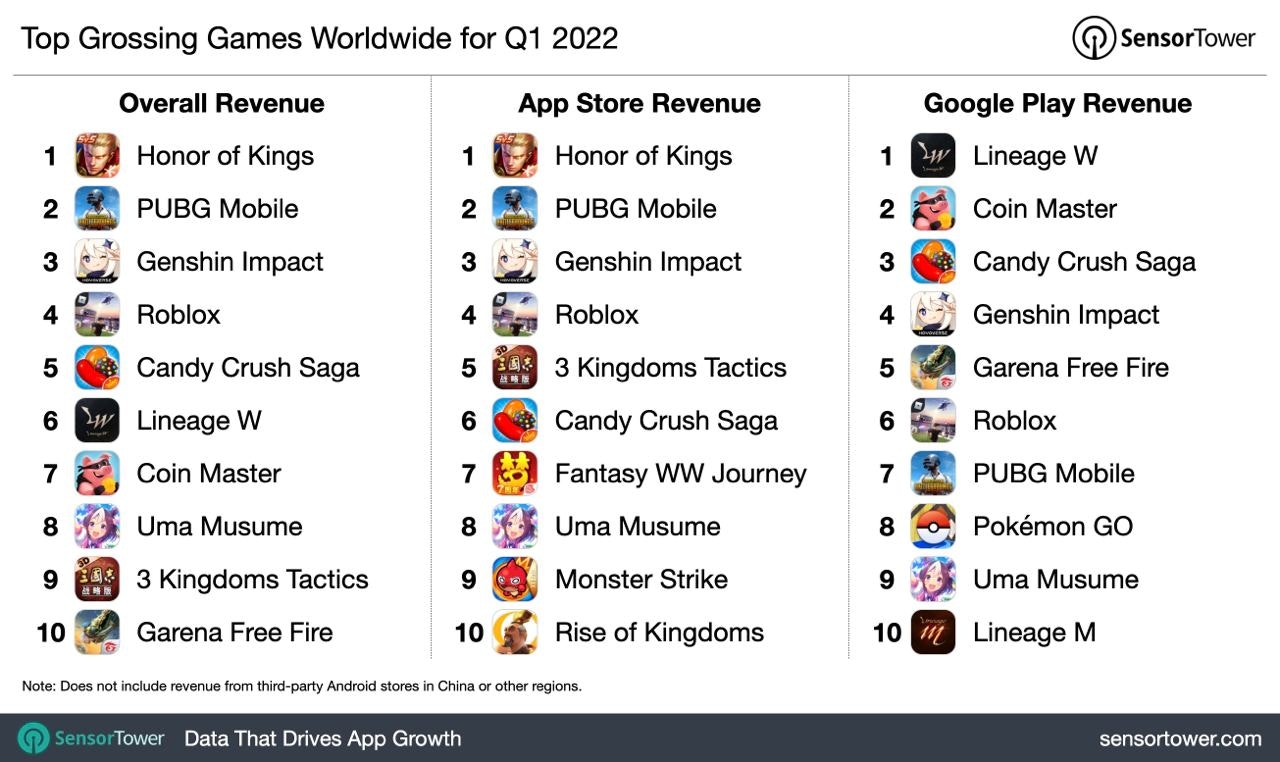

Three top-grossing games on the App Store in Q1 2022 were from Chinese developers. Honor of Kings ($735.4M) was first; PUBG Mobile ($643M) - second; Genshin Impact ($551M) was third.

-

The situation is different on Google Play. First place by revenue belongs to Lineage W; Coin Master & Candy Crush Saga are next.

-

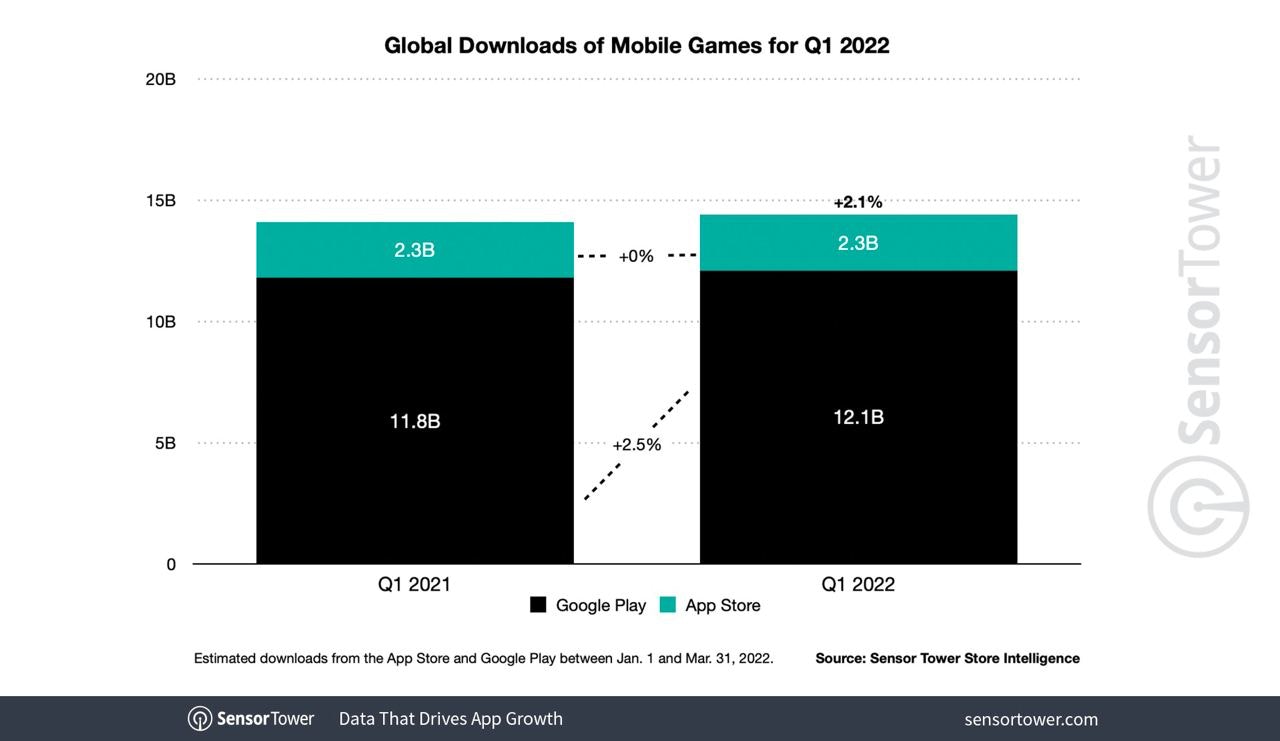

Downloads in Q1 2022 increased by 2.1% YoY and reached 14.4B. 12.1B of this amount came from Google Play (+2.5% YoY). The remaining 2.3B are from the App Store, which didn’t show growth.

-

The largest amount of downloads - 71.2M - experienced Garena Free Fire.

AppMagic: Top Grossing & Top Downloaded Games of March 2022

Revenue

-

Honor of Kings is still king of the chart with $171M of revenue in March.

-

Lineage W managed to get to the first place on Google Play and earned $64.7M last month.

Downloads

-

Merge Master - Dinosaur Fusion from Homa Games reached first place with 32.4M of downloads done only on Google Play.

-

The first place on the App Store surprisingly was reached by Subway Surfers, which released 10 years ago. The game was downloaded 5.8M times.

-

Fill The Fridge from Rollic Games, and Army Commander from Lion Studios were two new projects to the top.

Tenjin & Growth FullStack: "39% of mobile companies lost their revenue in post-IDFA era"

Tenjin & Growth FullStack with Atomik Research helped surveyed 302 people that are responsible for marketing usage for apps, and game marketing in the UK and the US.

-

55% of them mentioned that marketing in 2021 became much harder than it was before.

-

39% have checked the revenue drop after the IDFA implementation. 75% of them admitted that changes put the future of their business at risk.

-

59% of those surveyed decreased their spending on iOS and moved it to Android. 27% did the opposite.

-

84% of respondents are worried that Google will follow the Apple steps with IDFA.

Xsolla: Indian Gaming Market Review

-

By the end of 2022, the market volume will reach $2.2B. In 2019 its valuation was only $899M.

-

There were 628M gamers in India in 2021, 433M of which are playing online games.

-

Mobile games by the end of 2022 will be played by 368M people, revenue from this segment will reach $943M. Android will be responsible for 95% of the overall amount.

-

29% of Indian citizens are paying with cards, and 25% prefer digital wallets.

AppMagic: Top 10 Hypercasual Titles in Q1 2022 by Downloads

-

Hypercasual titles were downloaded 4.2B times in Q1 2022. It’s 8.3% lower than in Q4 2021.

-

The first place with 51.4M downloads belongs to Merge Master from Homa Games.

-

Second and third places have gone to Count Masters (41.9M of downloads), and Race Master 3D (41.8M of downloads).

Newzoo: Global Cloud Gaming Market reached $1.5B in 2021

-

In the same year, it attracted 21.7M of users.

-

Newzoo forecasts that by 2024 the Cloud Gaming segment will reach $6.3B (+420%), and the number of users will increase to 58.6M (+270%).

App2Top & Talents in Games: 42.3% of Russian Game Industry already left or leaving the country

- 17.8% of respondents already left Russia. Turkey, Armenia, and Georgia are the most popular destinations. 58.2% paid with their own money, an employer hasn’t helped them. 83.6% of relocated respondents are happy with their decision. However, 75% are planning to get back to Russia when the “situation will calm down”.

-

24.5% are planning to leave Russia in the following months. The first place by popularity got Cyprus, however, Turkey, Georgia, and Armenia are still on top. 29% of those, who want, but haven’t left the country yet, are not planning to get back to Russia anymore.

-

57.7% of respondents are staying in Russia. However, 1/3 of them are planning to leave the country one day, but no actual activity has started yet.

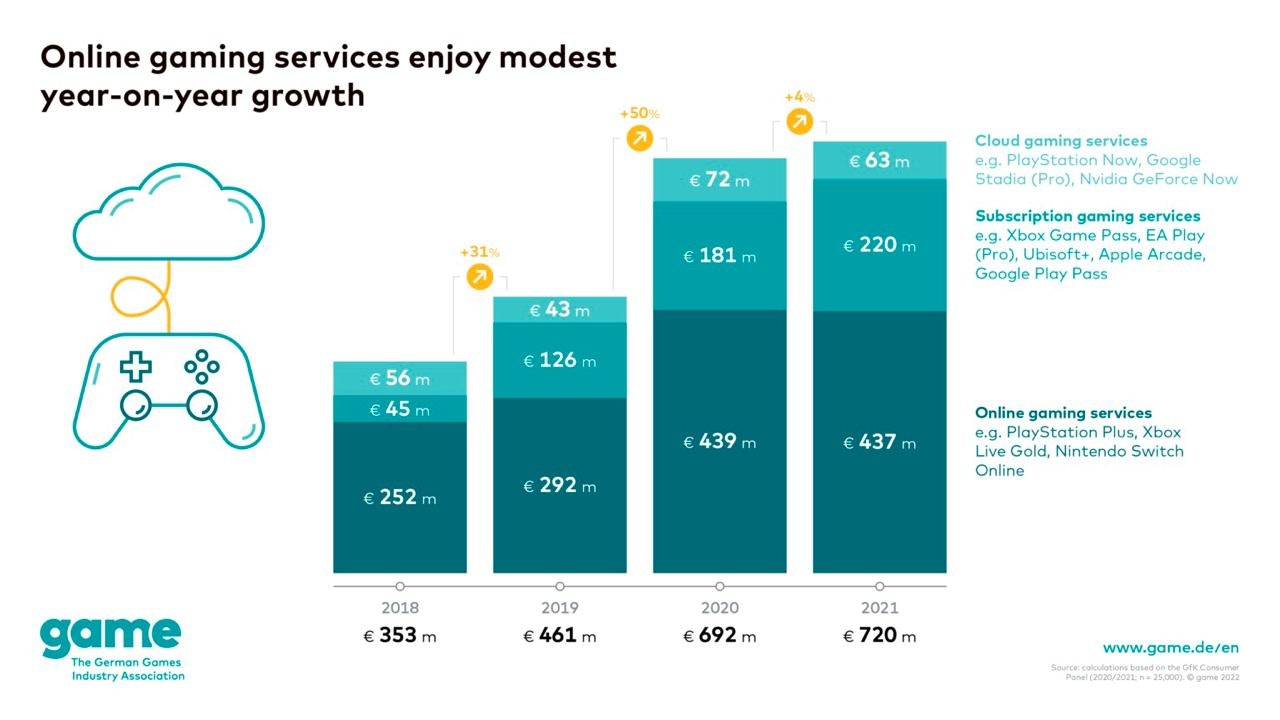

German Games Industry Association: German Gaming Industry in 2021 reached $10.6B

-

Growth to 2020 was 17% despite the high base effect.

-

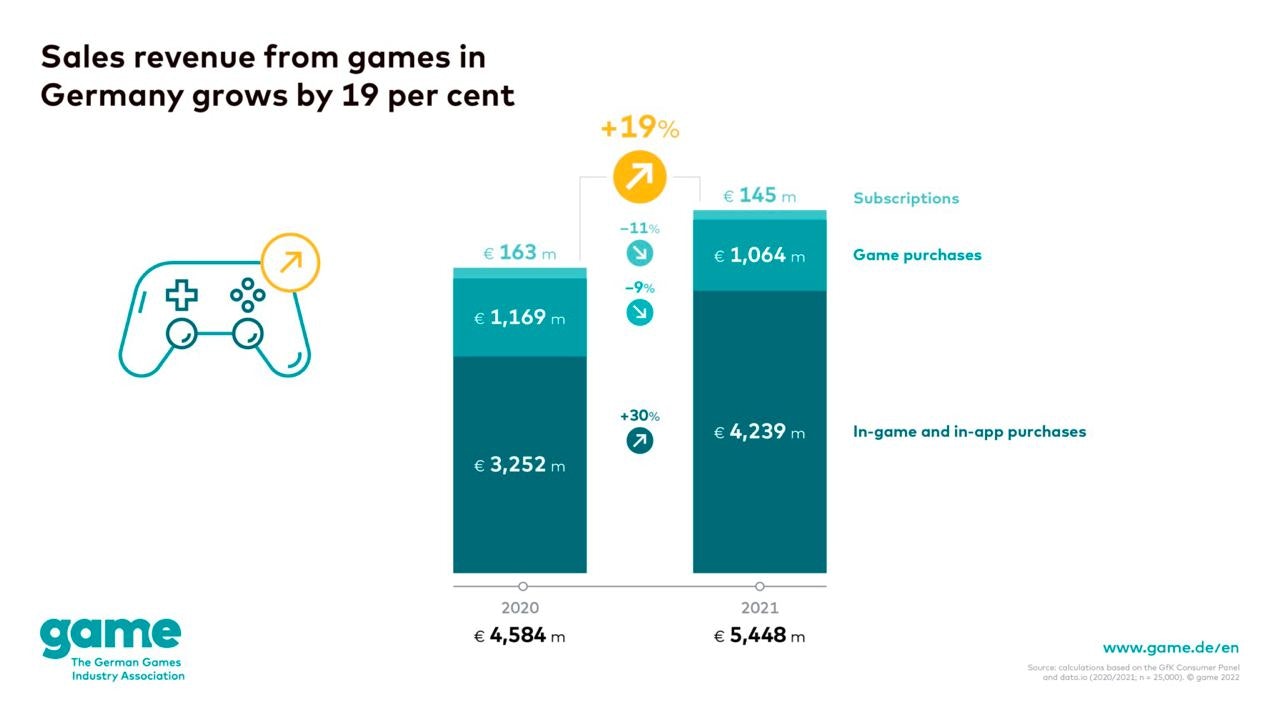

Software sales (game sales, subscriptions, IAP) increased by 19% and reached $5.92B.

-

The structure of software sales shows us that subscription revenue fell by 11% compared to 2020, and games sales revenue dropped by 9%. But IAP increased by a significant 30%, from $3.53B to $4.6B which led the category to growth.

-

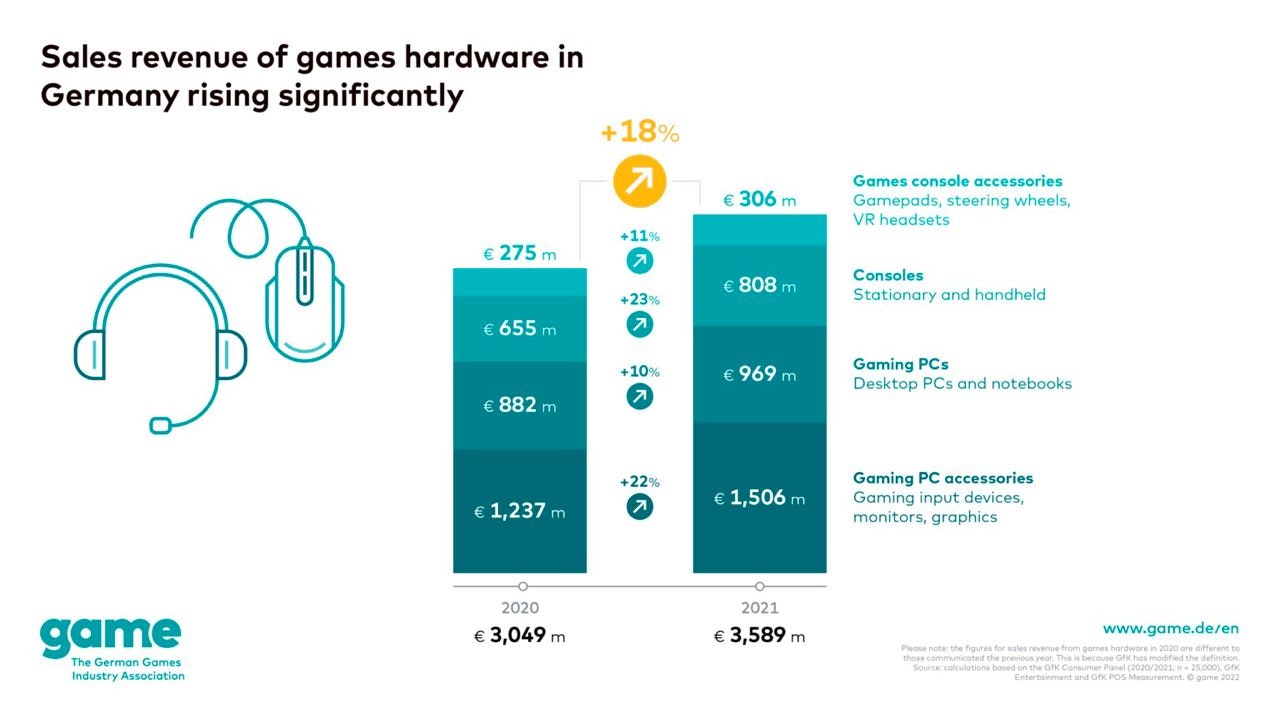

Hardware sales grew by 18% - from $3.3B in 2020 to $3.9B in 2021.

-

In hardware, all segments are growing. The fastest one is consoles with a +23% YoY. Gaming PC Accessories are next with 22% growth. Console accessories added 11% to the 2020 revenue, while Gaming PCs brought 10% more revenue than in 2020.

Sensor Tower: Top Grossing Mobile Games of March 2022

-

Honor of Kings reached solid first place with $272.4M of revenue. An increase from the previous year was 5.8%. About 96.6% of the overall revenue came from China.

-

PUBG Mobile is second, in March 2022 the game earned $199.8M. 56.4% of overall revenue came from China, 9.5% from the US.

-

About $7B was spent on mobile games in March 2022. It’s 6.3% lower than in March 2021.

-

The first place by revenue was taken by the US ($1.9B, 27.4% of worldwide revenue). China (19.2% of the overall amount), and Japan (19%) are next. Noting that Sensor Tower is not tracking third-party Android stores.

Sensor Tower: Top Mobile Games Worldwide by Downloads in March 2022

-

Merge Master from Homa Games was in first place last month with 28.3M of downloads. The majority came from India (38%) and Brazil (7.5%).

-

Garena Free Fire secured second place and managed to get 25.5M of downloads, which represents a 41.8% growth over the previous year. In this case, India & Brazil are leaders too with 35.5% and 9% of the downloads accordingly.

-

In March 2022 users downloaded mobile games 4.7B times - it’s 2.4% more than a year before.

-

India is responsible for 761.2M of downloads (16% worldwide). The US (8.7%) and Brazil (7.6%) are next.

Amdocs: 82% of Gamers are hardware-neutral

Amdocs research includes 1,000 UK respondents, which are playing games at least once a week.

-

Only 18% will choose a dedicated platform - console, PC, or Mobile.

-

62% of gamers already used or planning to use Cloud Gaming this year. Xbox Game Pass is the most popular choice.

-

65% of respondents are feeling good about Cloud Gaming, 38% think that the technology will change the gaming industry.

-

78% of gamers are ok with paying about $10 for a Cloud Gaming with 5G-subscription bundle. 44% are ready to pay $20.

-

With Metaverse the situation is not as bright yet. 21% think that their internet connection won’t be enough. 33% suppose that the hardware will be too pricey (VR headsets, for example). 41% think that it’s too early for any metaverse.

-

However, only 18% don’t believe in metaverse popularity. The majority agrees that it will be popular, but in the long run.

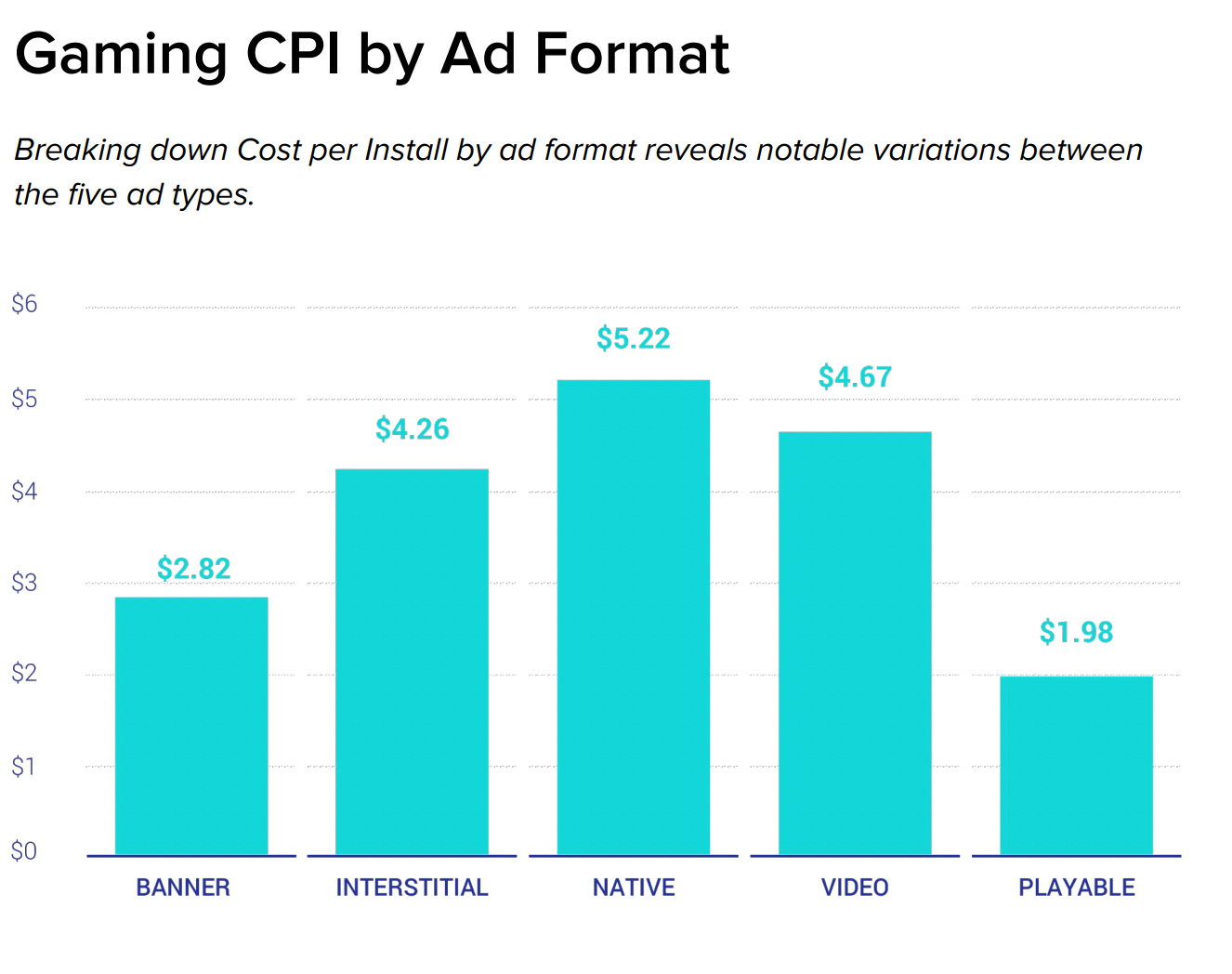

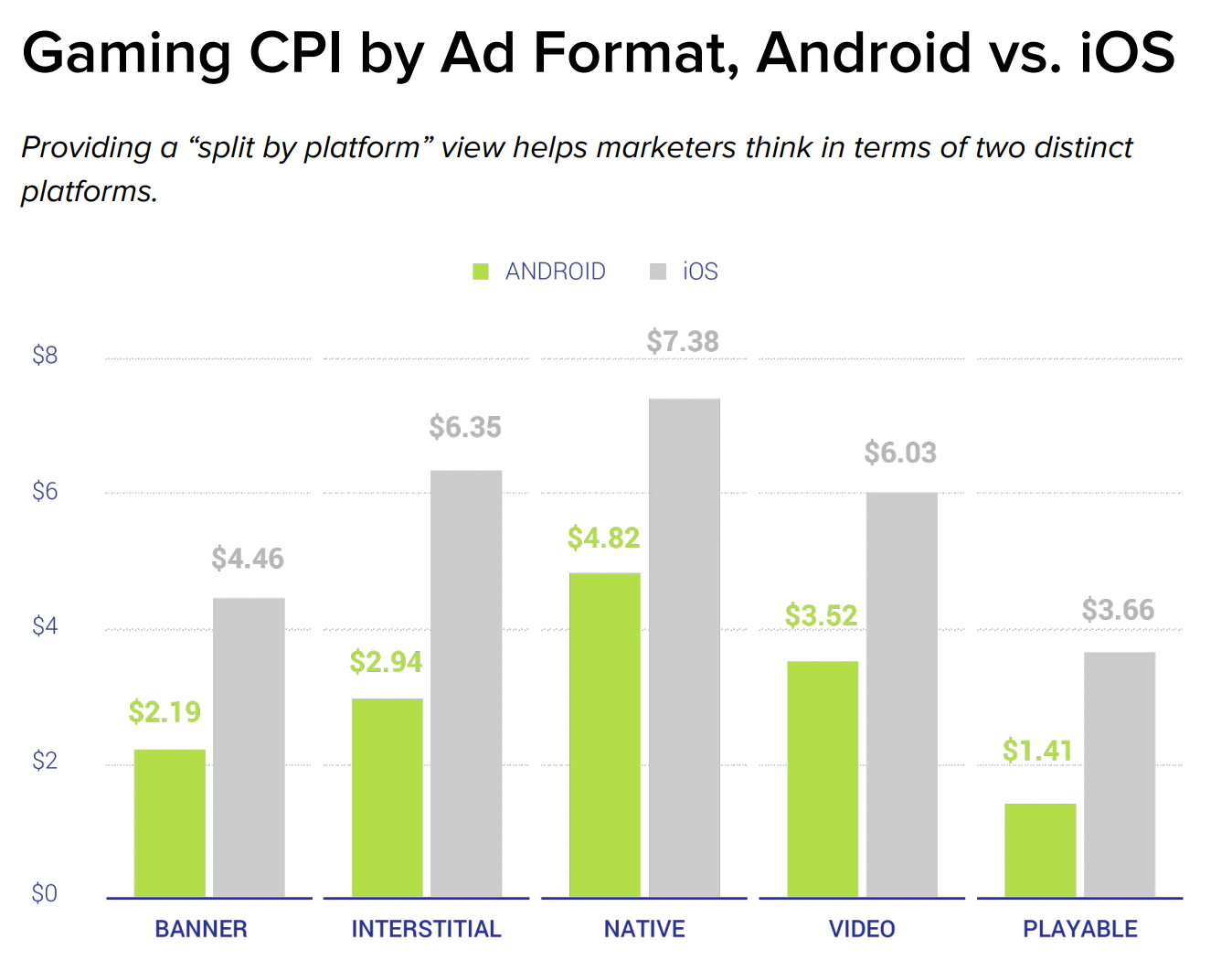

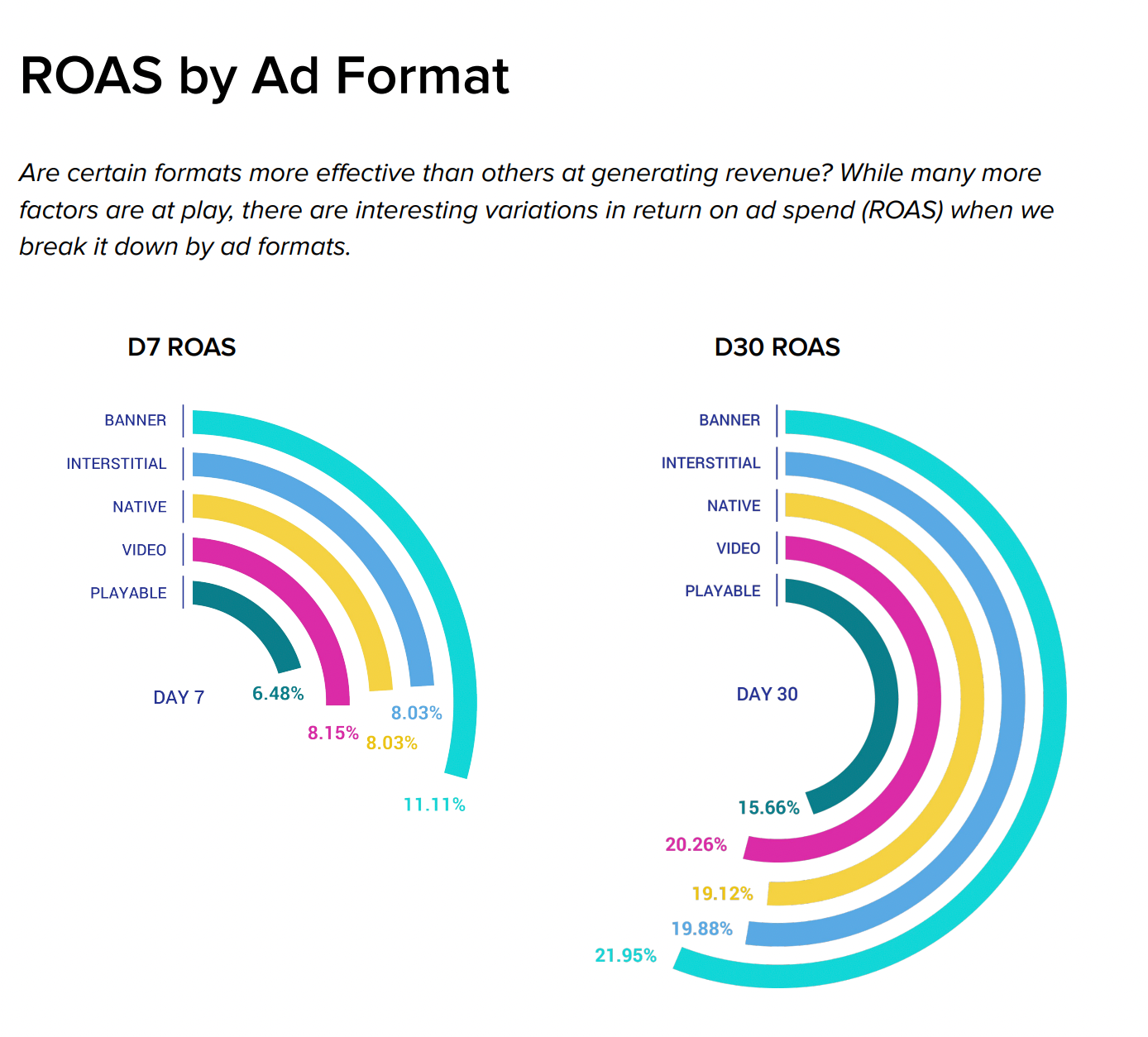

Liftoff & Vungle: Playables is the most cost-effective Ad format in Games

-

The information was collected based on 805B of impressions, 12.6B of clicks, and 200M of installs.

-

The average CPI in Playables is $1.98. It’s the lowest across all ad formats.

-

The average CPI of banner ads is $2.82. Interstitial - $4.26, video ads - $4.67, native - $5.22.

-

The average CPI on iOS is 30-90% higher than the market average. On Android, the opposite, lower by 20-50%.

-

The best ROAS by both D7 and D30 banner ads is showing - 11.11% and 21.95% respectively. Playables, despite the low CPI, show the worst ROAS - 6.48% for D7 and 15.66% for D30.

-

Only 4% of casual games ads motivate users to install the game.

Adjust: 27% of overall game downloads in the last two years were hypercasual

-

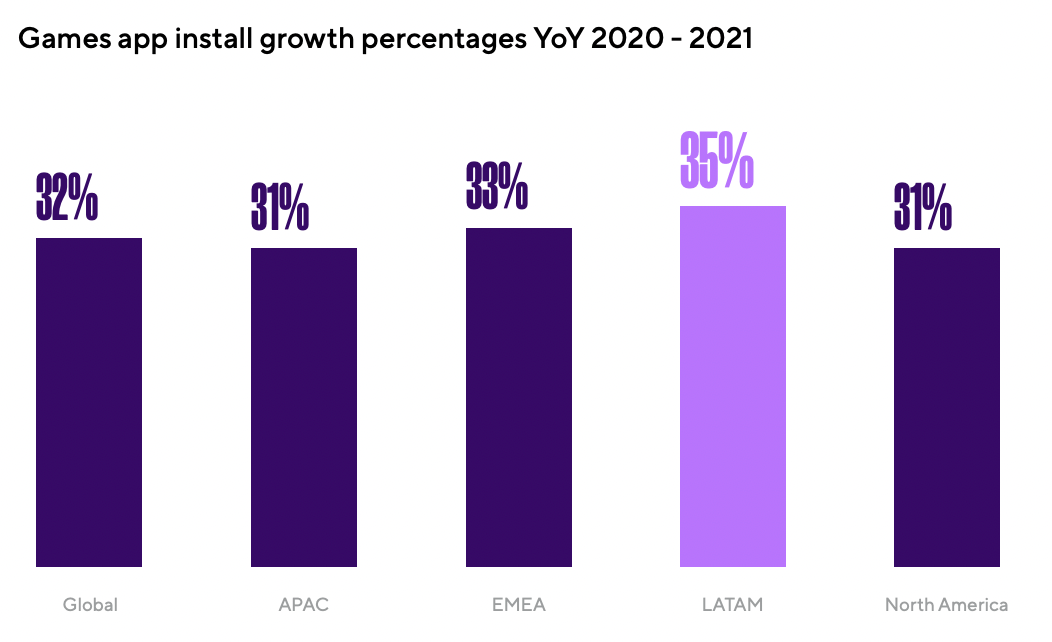

An overall number of downloads in 2021 increased by 32% compared to 2020. The largest growth dynamic showed the LATAM region - +35% YoY.

-

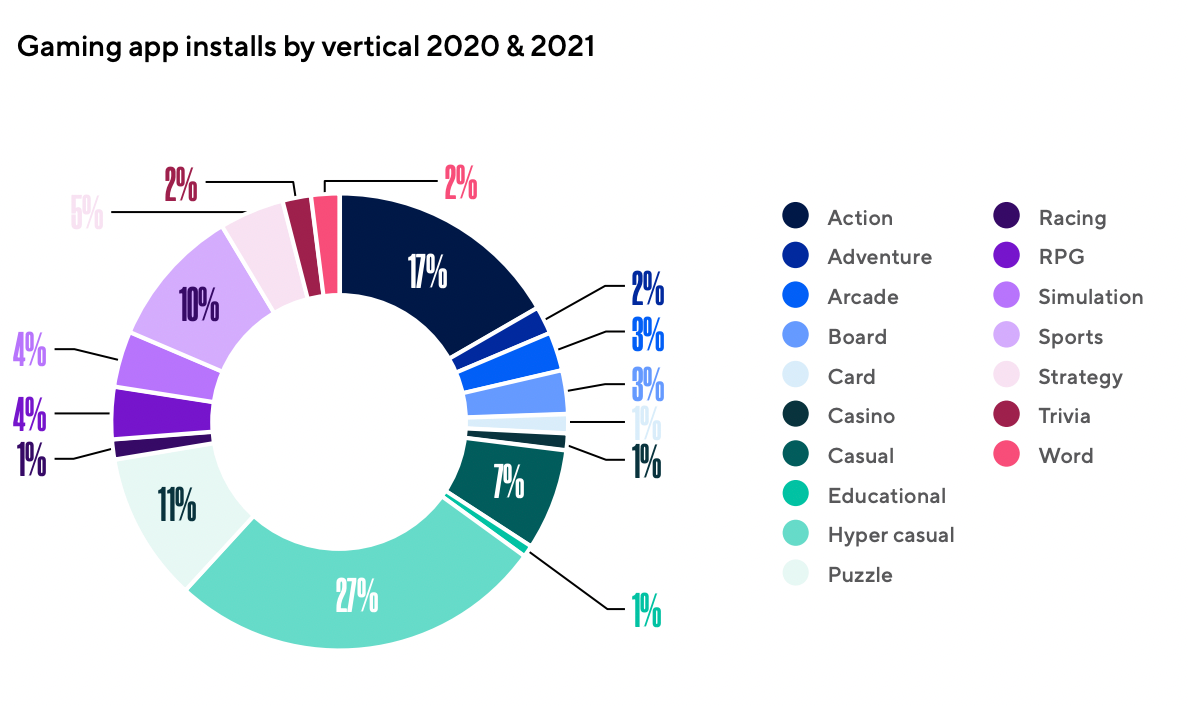

27% of overall game downloads secured hypercasual titles. Action games (17%), Puzzles (11%), Sports games (10%), and Strategies (5%) are next.

-

Paid to organic traffic ratio in 2021 increased from 0.73 (2020) to 0.81. The hypercasual category is showing the highest number of paid users - 3 paid users for each organic.

-

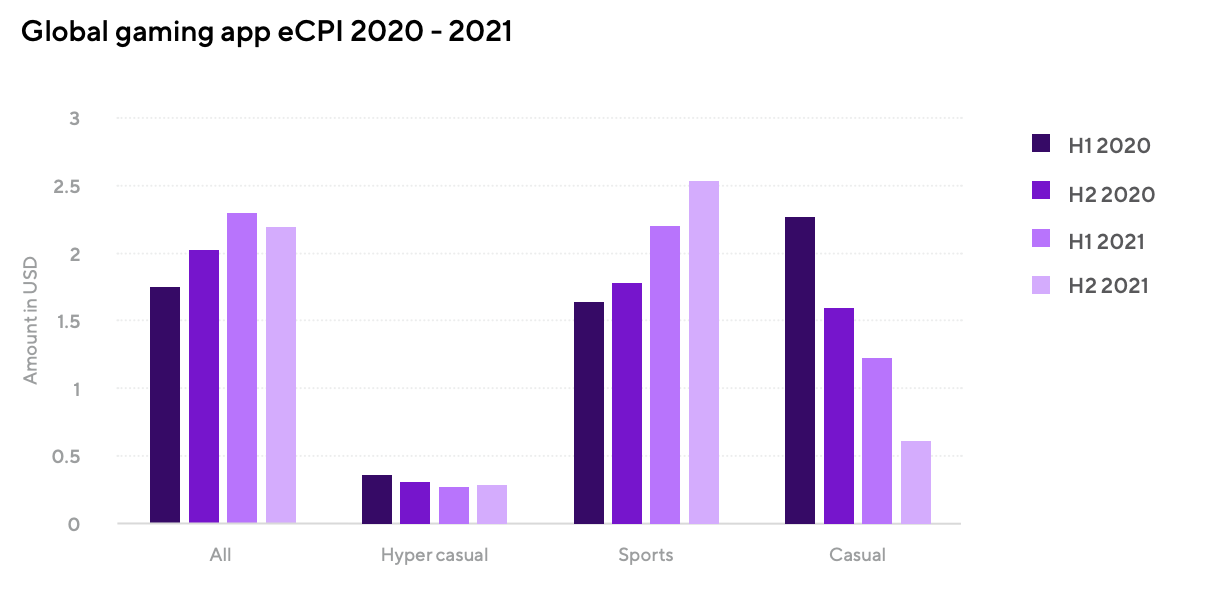

Median eCPI increased from $1.74 in 2020 to $2.18 in 2021.

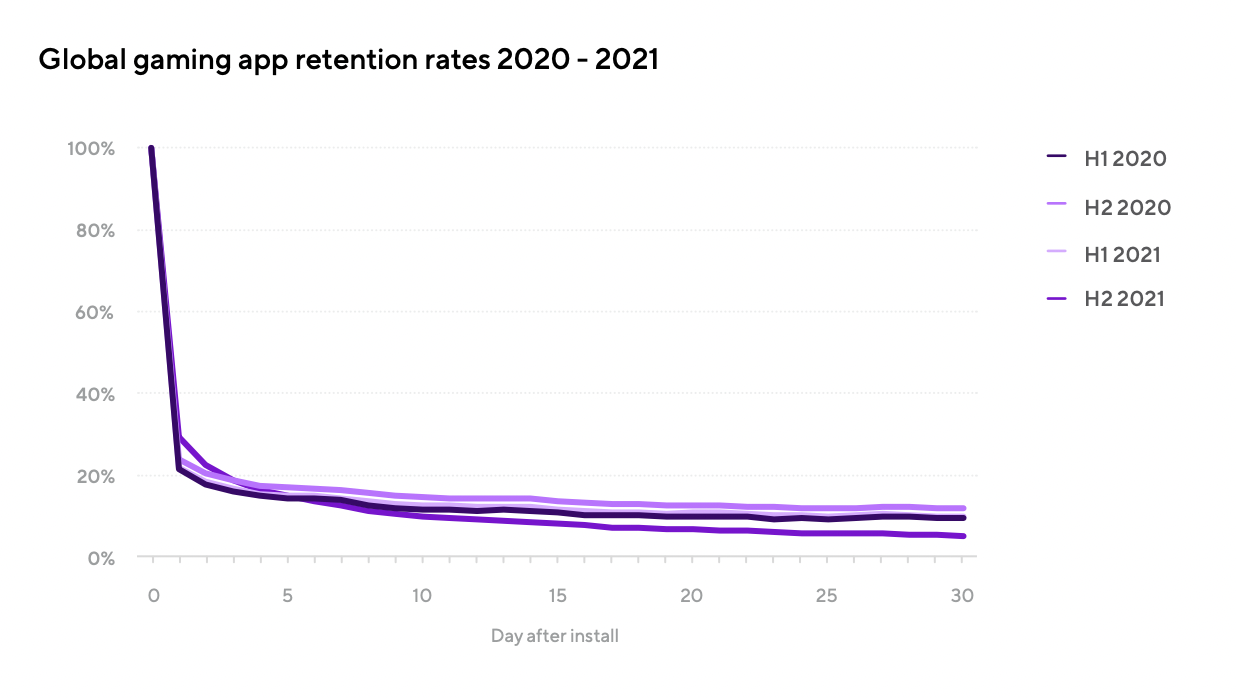

-

Median Ret D7 increased from 12% in H1 2020 to 14% in 2021. Median Ret D14 increased from 8% to 13%. Median Ret D30 increased from 5% to 9%.

- For the hypercasual games median Retention results in Q4 2021 are as follows: Ret D1 - 25%, Ret D3 - 13%, Ret D14 - 3.8%, Ret D30 - 1.6%.

-

The average duration of sessions in 2021 dropped compared to 2020. Contrary, the number of sessions increased slightly.

Newzoo: Global Esports & Live Streaming in 2022 Report

-

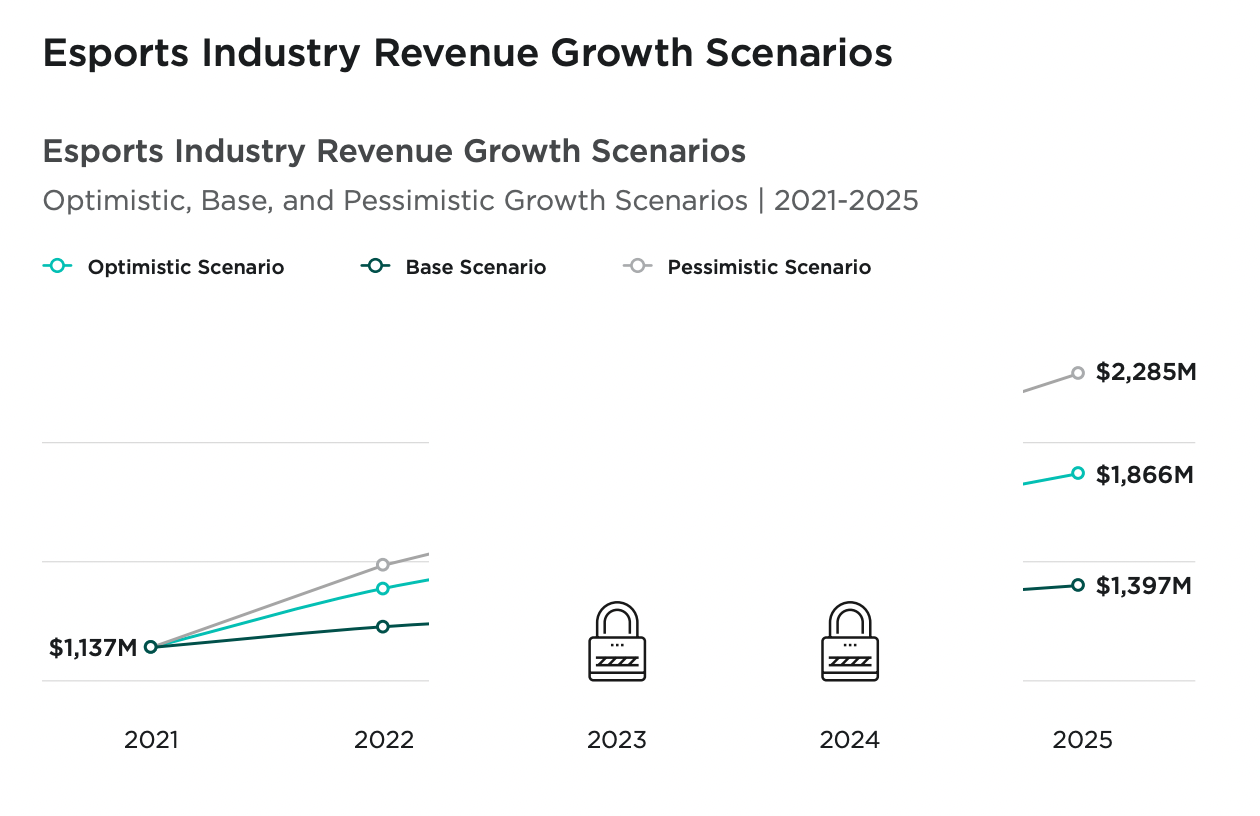

By the end of 2022, the Esports market will reach $1.38B. China will generate 1/3 of this amount. Southeast Asia, Central Southern Asia, and Africa are growing faster than others. By 2025 the market will reach $1.86B.

-

The main source of revenue for Esports organizations is sponsorship. By the end of 2022 different brands will pay $837.3M - it’s about 60% of worldwide Esports revenue.

-

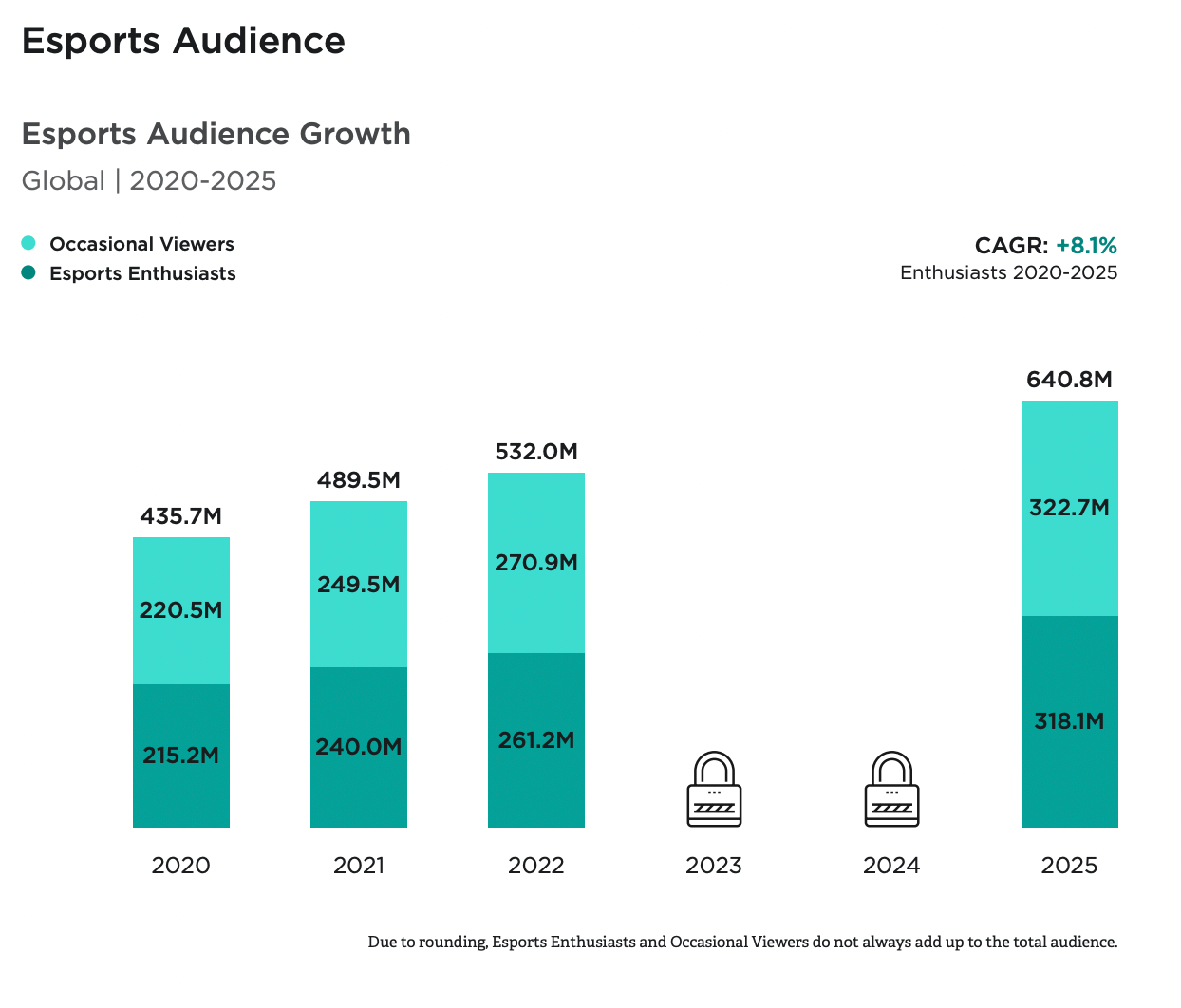

Global Esports audience by the end of 2022 will reach 532M people, 261.2M of which can be called enthusiasts. By the end of 2025, the global audience might reach 640.8M people.

- PC\Console Esports is popular in developed markets - not only in Europe, but in China, South Korea, and Japan. Mobile Esports is rapidly developing in Latin America, the Middle East, Africa, and India.

-

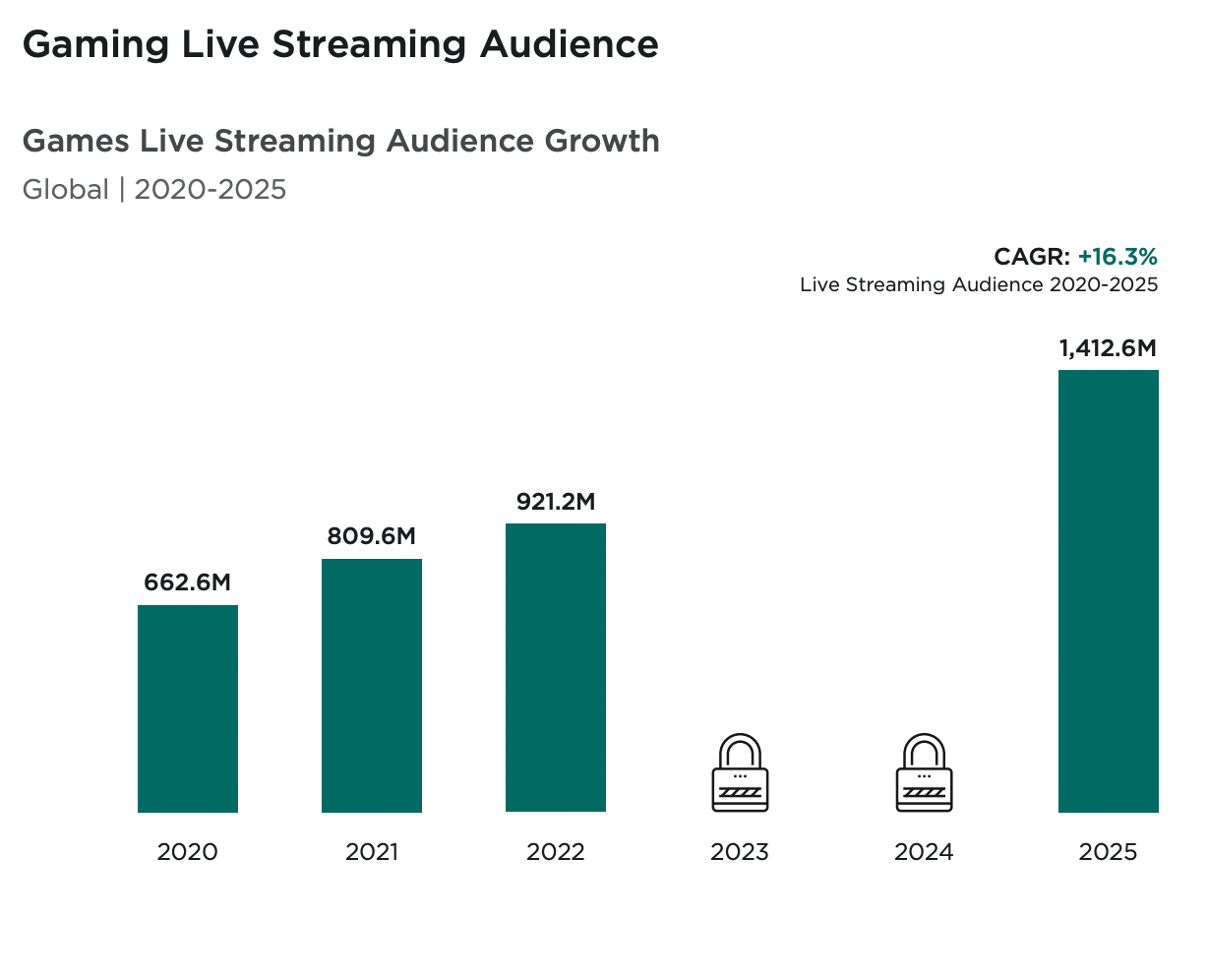

The live Streaming audience in 2021 reached 810M people. By the end of 2025, it will grow to 1.41B users (CAGR - +16,3% from 2020 to 2025). About 21% of hours are spent on non-gaming content.

-

More than 84% of watchers of non-gaming content are watching gaming streams too. This breaks the idea that non-gaming content cannibalizes the audience.

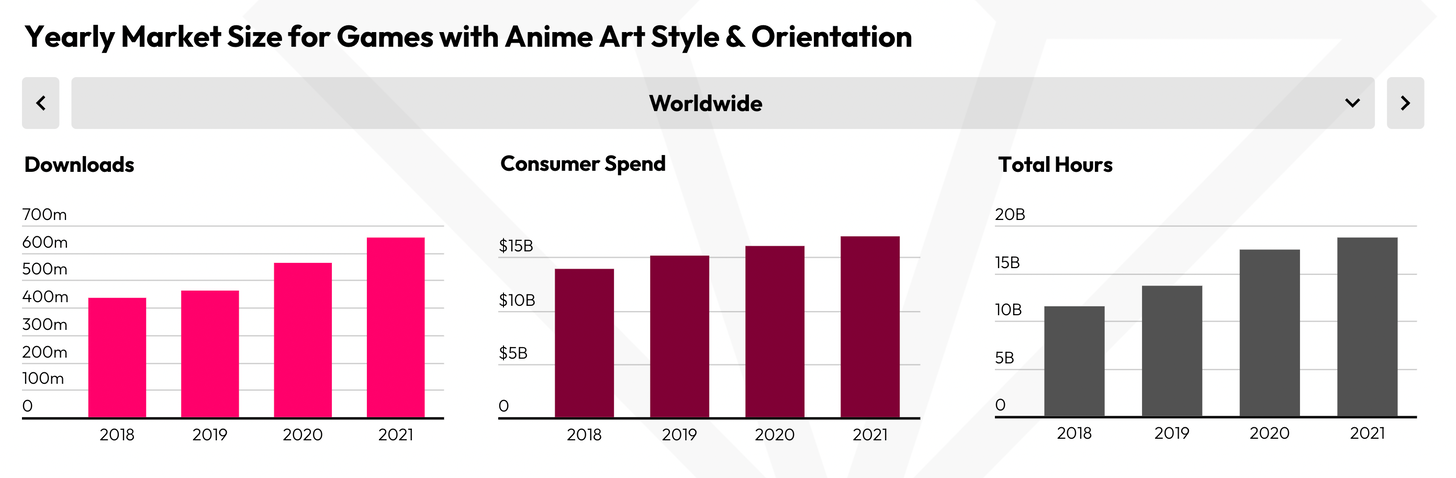

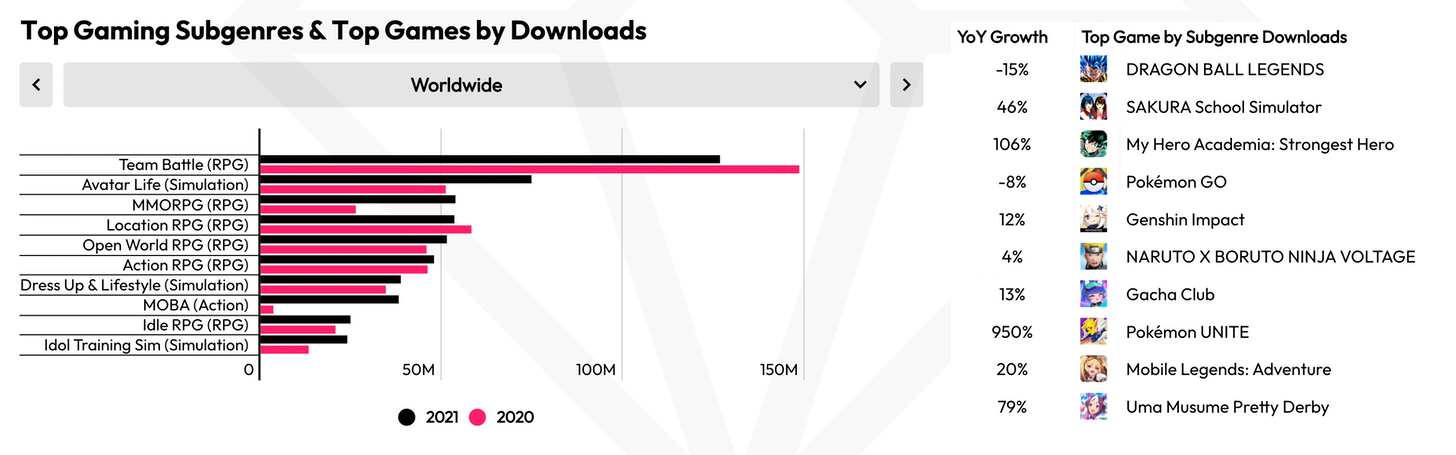

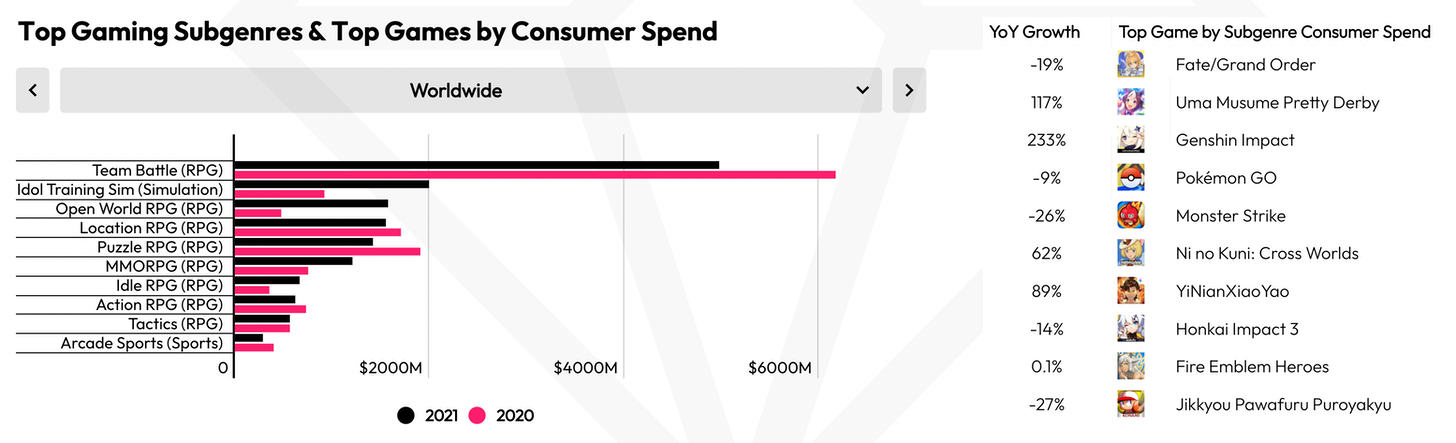

data.ai: Mobile Anime Games were responsible for 20% of overall mobile gaming revenue in 2021

-

The revenue of mobile anime-styled games in 2021 was $16.97B. Downloads reached 658M.

-

The majority of anime-styled mobile games come from the Team Battle (RPG) genre. In 2021 in China, South Korea, and the US a huge leap showed MMORPG with +854% YoY growth in downloads.

-

Three top games by downloads are Pokemon GO, Genshin Impact, and SAKURA School Simulator.

-

The Team Battle (RPG) genre is in the first place by revenue among anime-styled mobile games. They’re responsible for $4.9B. Open-world RPG in 2021 - thanks to Genshin Impact - grew by 233% in revenue.

-

Japan is responsible for 55% of overall anime-styled mobile games revenue.

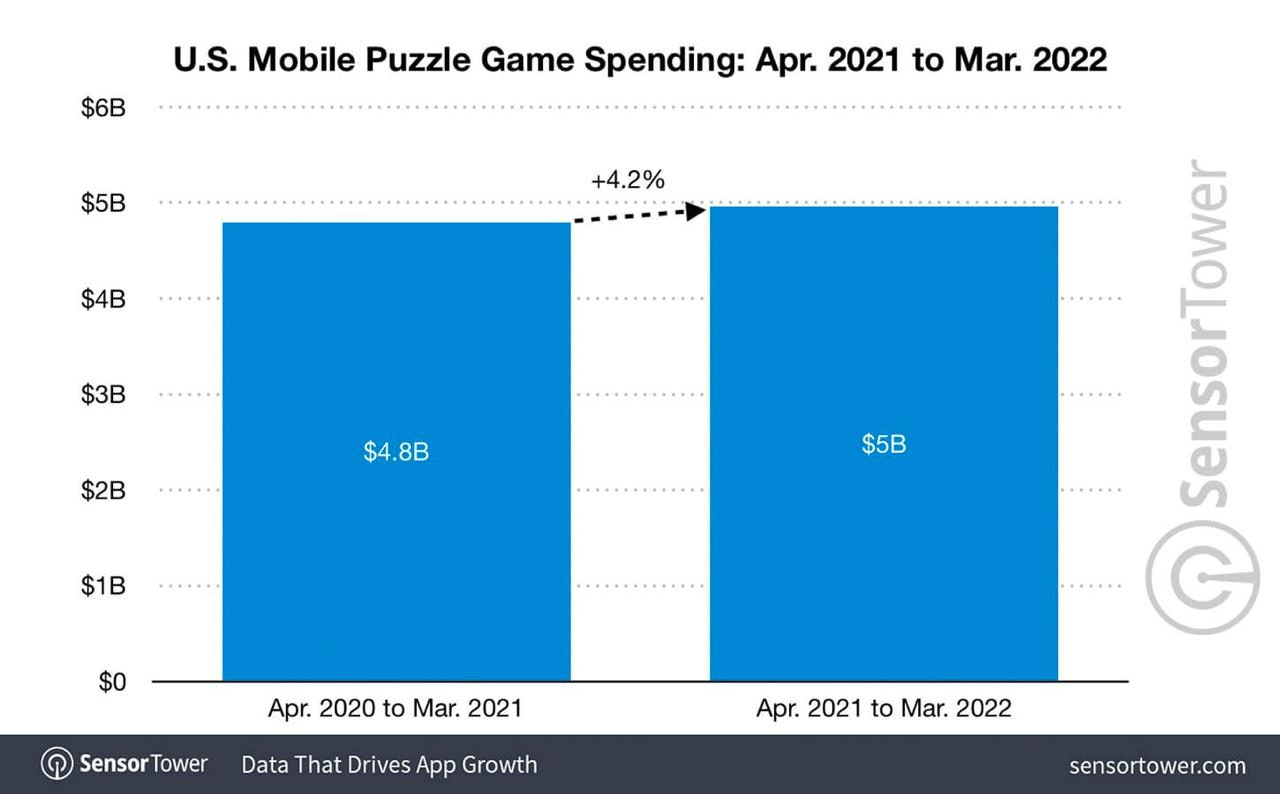

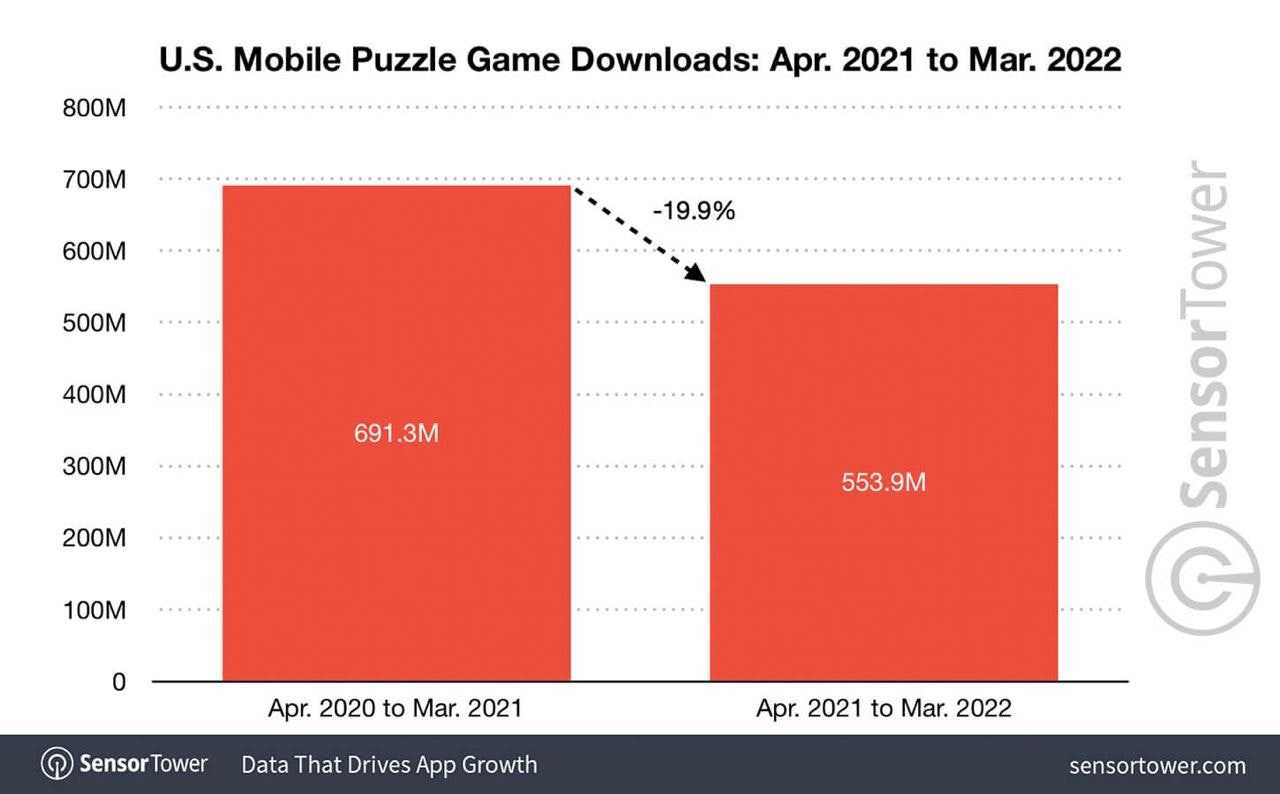

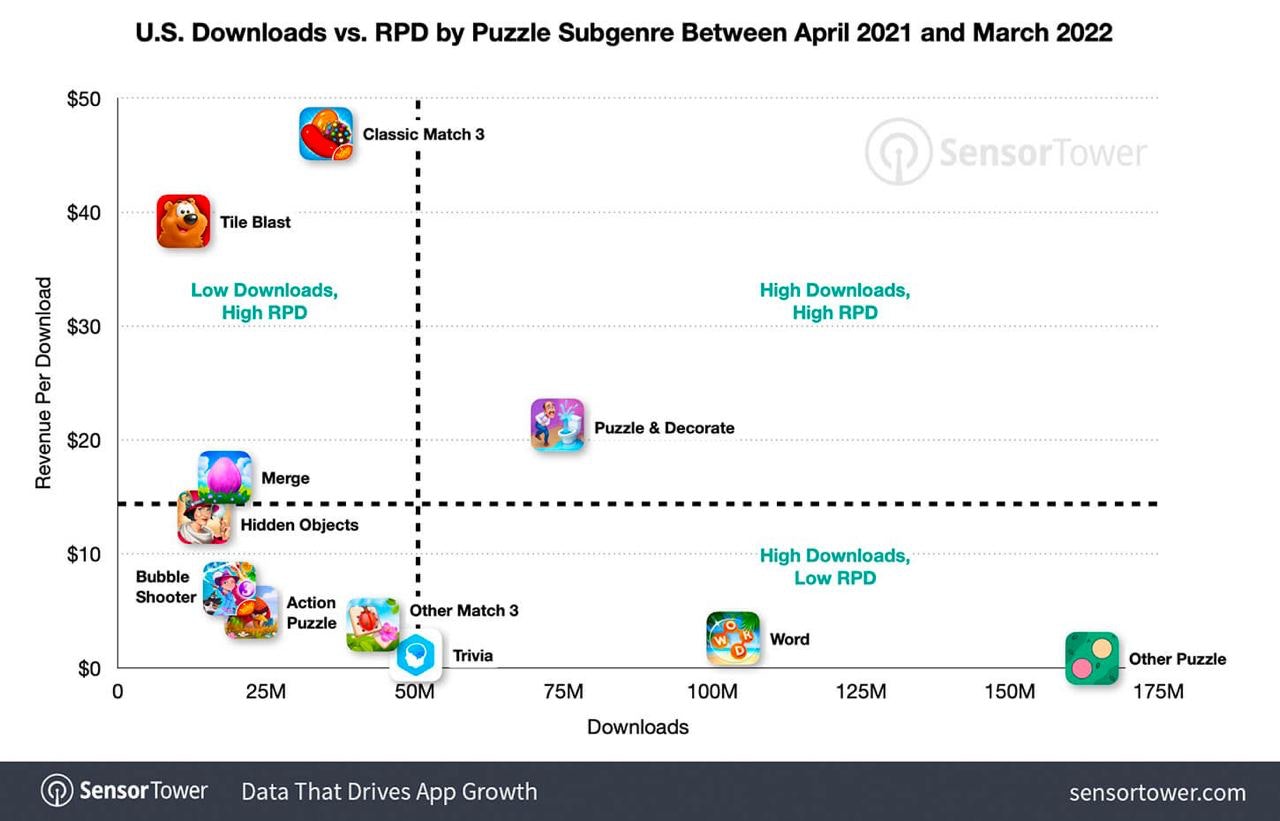

Sensor Tower: U.S. Mobile Puzzle Revenue reached $5B in a year

-

Growth is 4.2% to the previous year.

-

The first place by revenue from April 1, 2021, to March 31, 2022, belongs to Candy Crush Saga with $845.5M. Second place is taken by Homescapes, Candy Crush Soda Saga is third.

-

During the last year, Puzzle games were downloaded 554M times, it’s 20% lower than a year before. The decline is connected with pandemic situation improvements.

- Leaders by downloads are Project Makeover (14.5M), Wordscapes & Candy Crush Saga.

-

Classic Match 3 is a leader among Puzzle subgenres by revenue. It’s responsible for $1.6B of overall genre revenue (+12.3% YoY). The Other Match 3 category (Zen Match & Angry Birds Blast are presenting it) is growing at the fastest tempo - by 101.3% YoY to $161M.

-

RPD in classic Match 3 is $47 according to Sensor Tower.

NPD: The US Gaming market dropped in March and Q1 2022 overall

-

The US gaming March 2022 revenue was $4.9B, which is 15% lower than a year before.

-

Q1 2022 revenue during the same period dropped 8% YoY and was $13.9B. The decline touched all categories: software sales decreased by 7%; hardware - by 15; accessories - by 16%.

-

Speaking about March 2022, software sales was $4.1B (-13% YoY). The best-selling game was Elden Ring.

-

Elden Ring has all chances to become the most successful game of the year. For the last 12 months, it lost competition by revenue only to Call of Duty Vanguard.

-

Hardware sales in March 2022 were $515M (-24% YoY). Xbox Series X|S is first by revenue, while Nintendo Switch secured first place by unit sales.

-

In March 2022 Microsoft broke the Xbox records of sales in both dollar and unit counts.

-

Accessories sales went down by 23% in March 2022 - to $227M.

-

Mobile revenue decreased by 12%. iOS experienced a tiny decline of -0,25%, while Google Play collapsed with -25% revenue YoY. The most successful game of March 2022 was Candy Crush Saga.

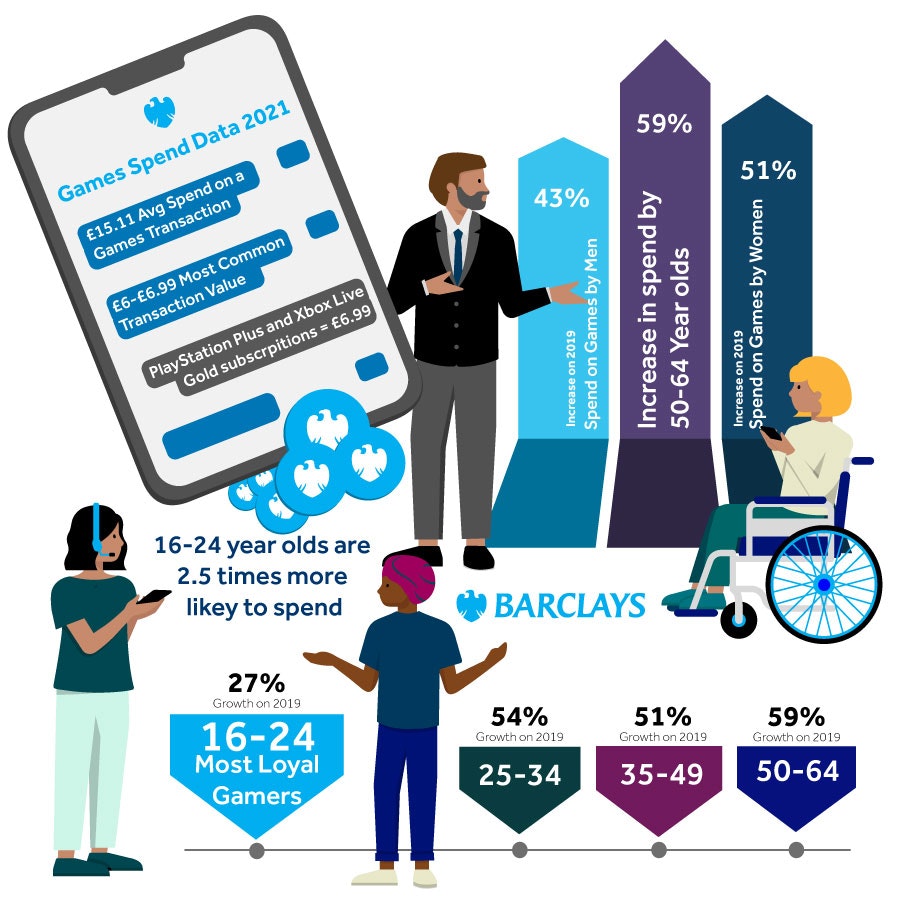

Barclays: Women's spending on Games in the UK grew the most since 2019

Bank Barclays analyzed gaming transactions and compared pre-pandemic 2019 with 2021 in the UK.

-

During the pandemic, women started to spend 51% more on games.

-

Men are still the dominant audience when it comes to absolute revenue. Since 2019 this segment has grown by 43%.

-

When it comes to age, surprisingly, the 50-64 years old segment grew the most since 2019 - by 59%. However, it’s only 12.2% of the overall revenue in the UK.

-

The 16-24 years segment is the most loyal. In 2021 this segment's representatives were paying 2.5 times more often than others. Category growth was 27%.

-

The average amount of gaming transactions in the UK was £15.11.

-

The most popular transaction size was in the range of £6.00 и £6.99 (monthly Game Pass / PS Plus subscriptions). Second popularity - ranges from £3 to £3.99 (average microtransaction cost).

-

Videogames is the second segment of the UK market by growth during the pandemic. Only video streaming platforms overpassed it.

Gamma Data: Chinese Gaming Market in Q1 2022 earned $12.1B

-

It’s 3.17% more than during the same period a year before.

-

Growth rates declined in comparison to Q1 2021.

-

Mobile games are responsible for $9.2B of overall revenue. It’s 2.72% more than a year before.

-

Out of the new releases (2022 year), Civilization and Conquest was the top-grossing game of Q1 2022 in China. It earned $76.2M during this period. Second place was Return of Empire (mobile version of Age of Empires from Tencent). It generated $45.7M of revenue.

-

Growth was secured by sustained titles such as Genshin Impact and Fantasy Westward Journey 3D.