devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the April and May reports.

Table of Content

- data.ai & IDC: The Gaming Spotlight 2022

- Niko Partners: Console market in China reached $2.16B in 2021

- Ofcom: 58% of UK citizens have an active gaming subscription

- AppMagic: Top Mobile Titles by Downloads & Revenue in May 2022

- Sensor Tower: Pokemon GO earned $6B in lifetime

- ESA: Gaming Industry portrait in the US in 2022

- Google: Mobile Gaming Insights in 2022

- GameRefinery: Mobile Games Monetization trends (June 2022)

- The Pokemon Company: Pokemon-related software was shipped 440M+ times

- Sensor Tower: Non-Gaming apps will outperform gaming apps in mobile spending

- NPD Group: May US Gaming sales are the worst since the pandemic

- McKinsey & Co.: The Metaverse market will reach $5T by 2030

- Bango: 31% of game developers from the US & UK will close if ad regulati/ons will strengthen

- AppMagic: Diablo Immortal earned $24M+ in the first two weeks on mobile

- Newzoo: People's reception of games in 2022

- Sensor Tower: Top Mobile Games by Downloads in May 2022

- Video Game Insights: Steam Publishers Landscape - US Publishers generating almost 50% of sold copies

- Sensor Tower: Netflix Mobile Games has been downloaded 13M times

- Alconost: The Most Popular Localisation languages

- Newzoo: American Player Portrait in 2022

- Gamma Data: Chinese Gaming Market Revenue is dropping third consecutive month

- data.ai: Mobile Games will earn $21.4B in Q2 2022

data.ai & IDC: The Gaming Spotlight 2022

The full version of the report is available here.

-

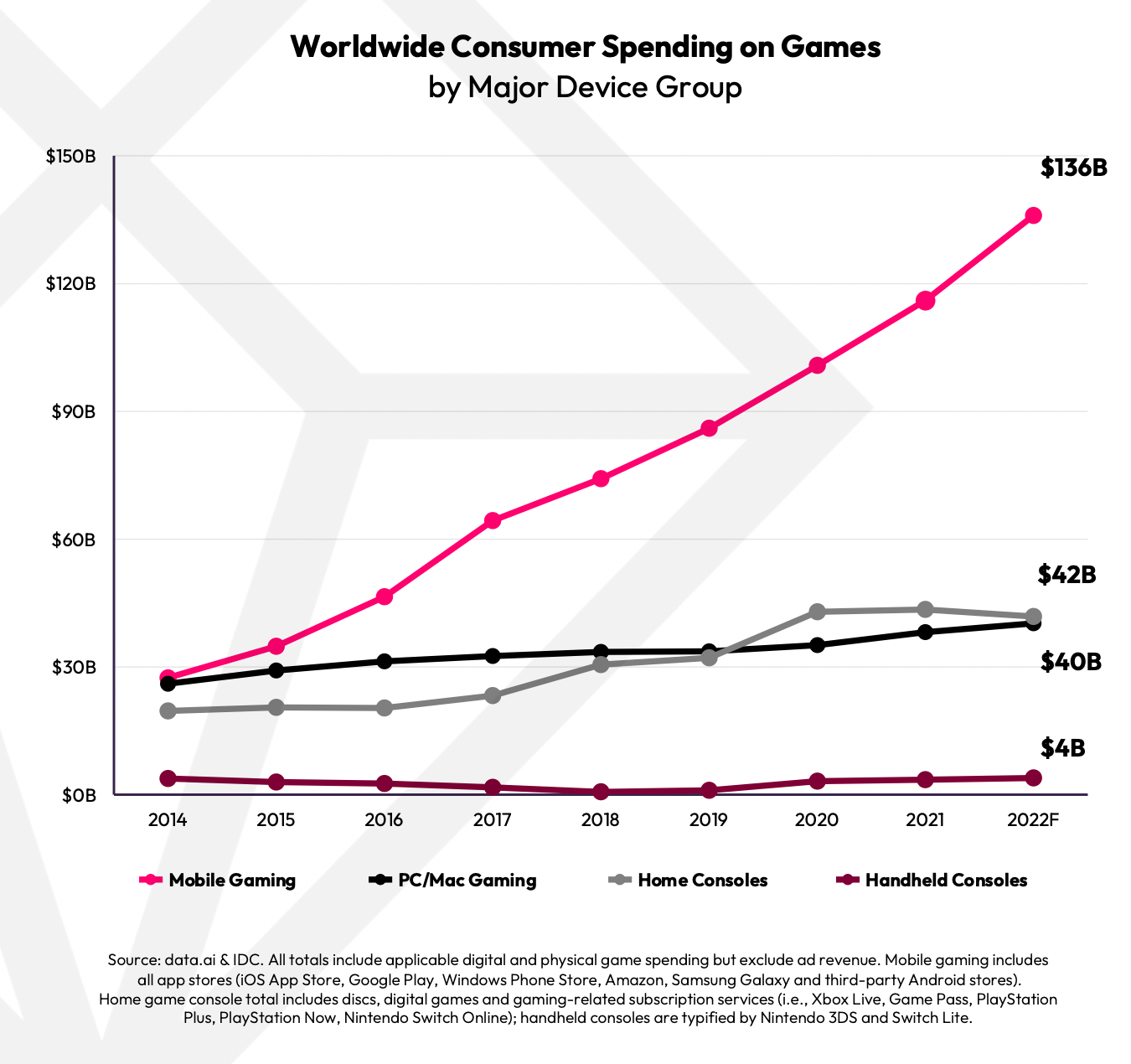

The gaming market will reach $222B in 2022. Mobile games will generate $136B; Console - $42B; PC - $40B. Another $4B will be generated by handheld consoles (Nintendo 3DS & Switch Lite).

-

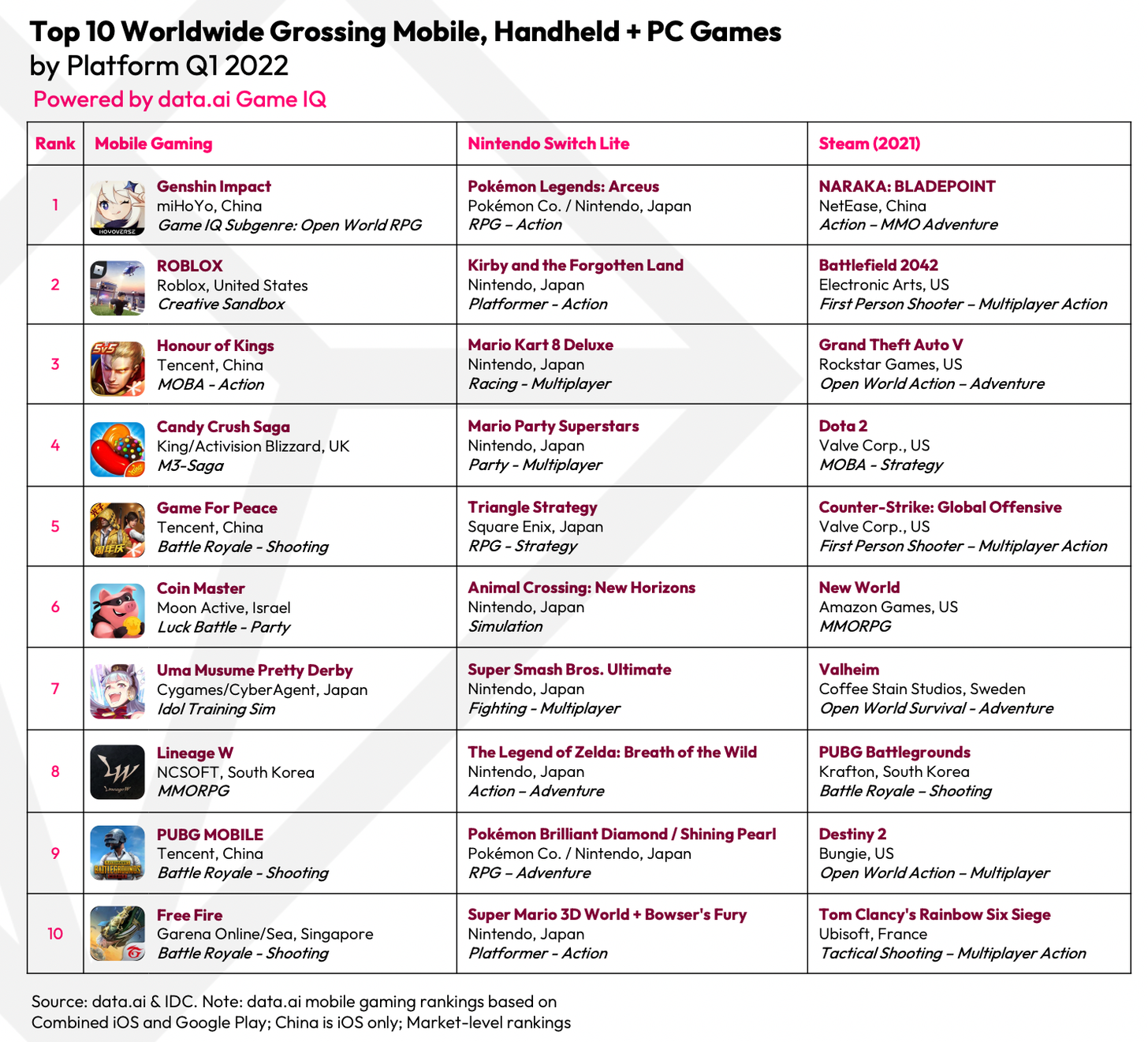

Analytics are seeing better genre differentiation in mobile games compared to PC/Console titles.

-

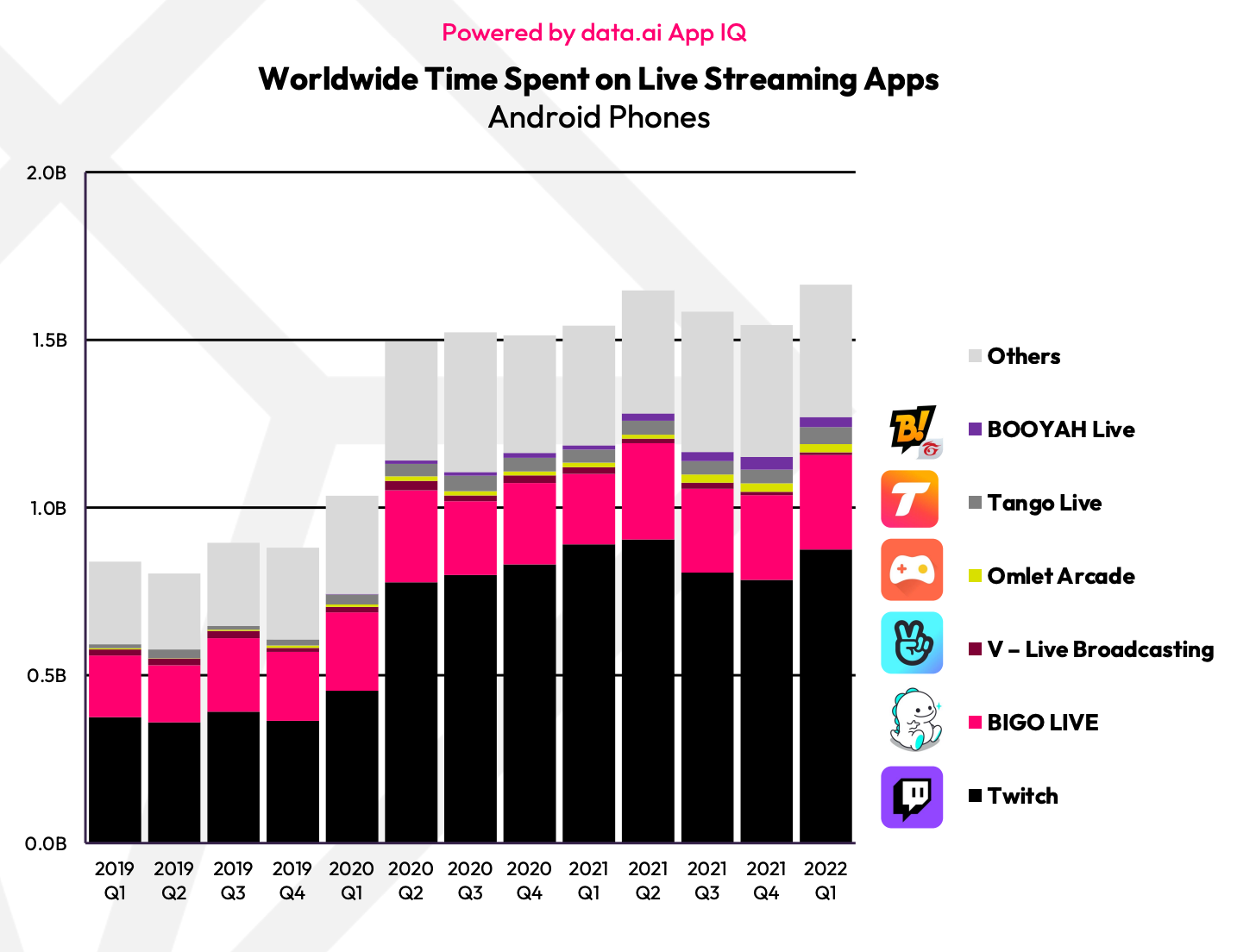

Twitch is responsible for about half of Android time spent on gaming streams.

-

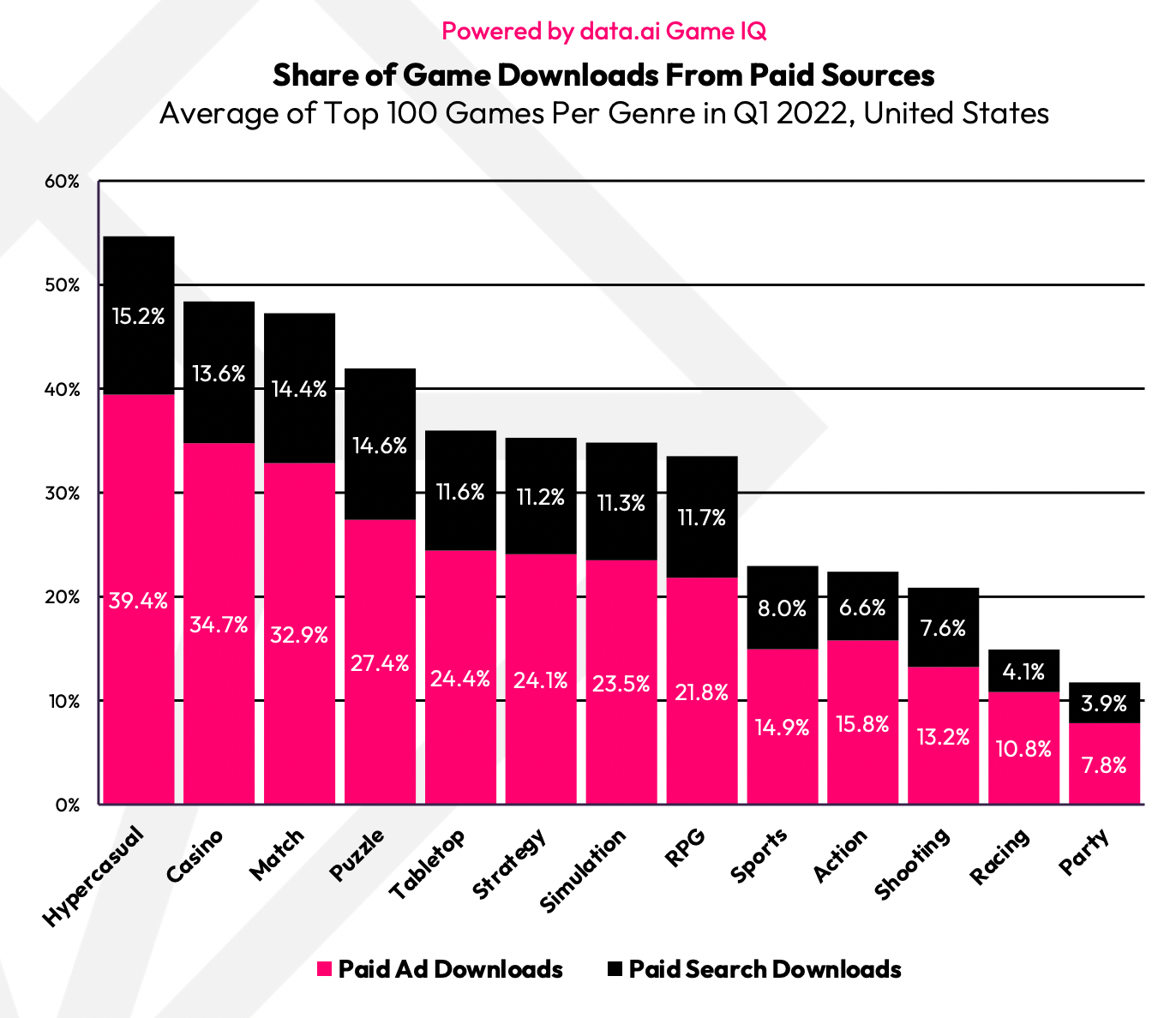

Hypercasual games (54.6% of paid traffic), casino games (48.3% of paid traffic) & Match Games (47.3% of paid traffic) are the largest consumers of the paid traffic sources.

-

Cross-platform games will continue to take the market share from mobile-only titles.

-

Oversaturation of the ads market will negatively affect projects with ads-only monetization.

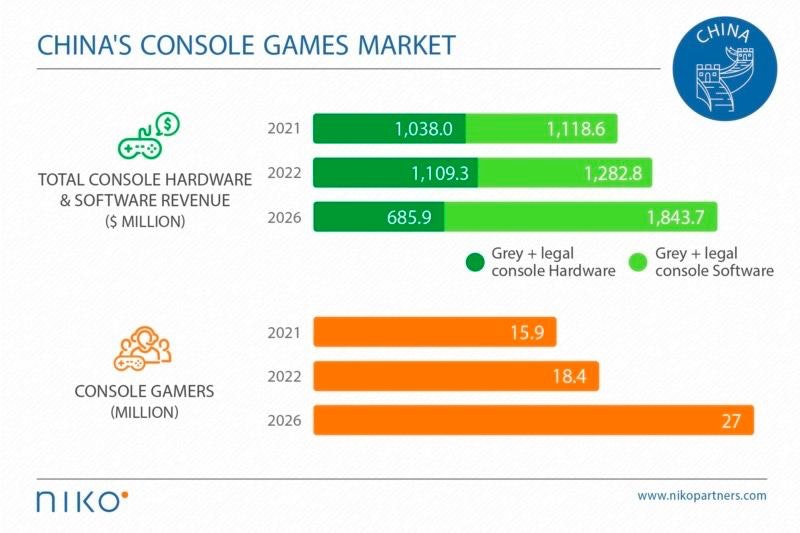

Niko Partners: Console market in China reached $2.16B in 2021

-

By 2026 based on Niko Partners’ assumptions, it will reach $2.53B.

-

Niko Partners takes into account “gray” sales as well, which share is about 80% in the console market in China.

-

The number of console players in China in 2021 reached 15.9M people. By 2022 there will be 18.4M; by 2026 - 27M.

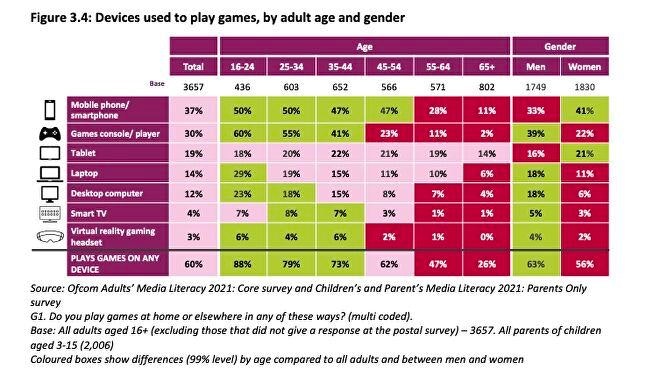

Ofcom: 58% of UK citizens have an active gaming subscription

-

The data is based on the survey made in Q4 2021. 3,657 people participated in it.

-

PlayStation Plus is the most popular gaming subscription service in the UK with 3.2M UK citizens subscribed in 2021. Xbox Game Pass (2.6M), Xbox Live Gold (1.5M), and Nintendo Switch Online (1.49M) are next.

-

By the end of the year, 2.1M users in the UK were subscribed to the Cloud Gaming services. PlayStation Now is the leader. There were 2.9M people subscribed to GeForce Now & Google Stadia, but it was free subscriptions.

-

60% of adult UK citizens and 91% of the aged under 15 are playing games.

-

British gamers in Q4 2021 spent on average 7 hours 33 minutes per week on games.

-

Only 3% of adult UK citizens are playing VR games. Sony managed to get around Oculus by market share - PS VR now has 32%, while Oculus took 25% of the British market.

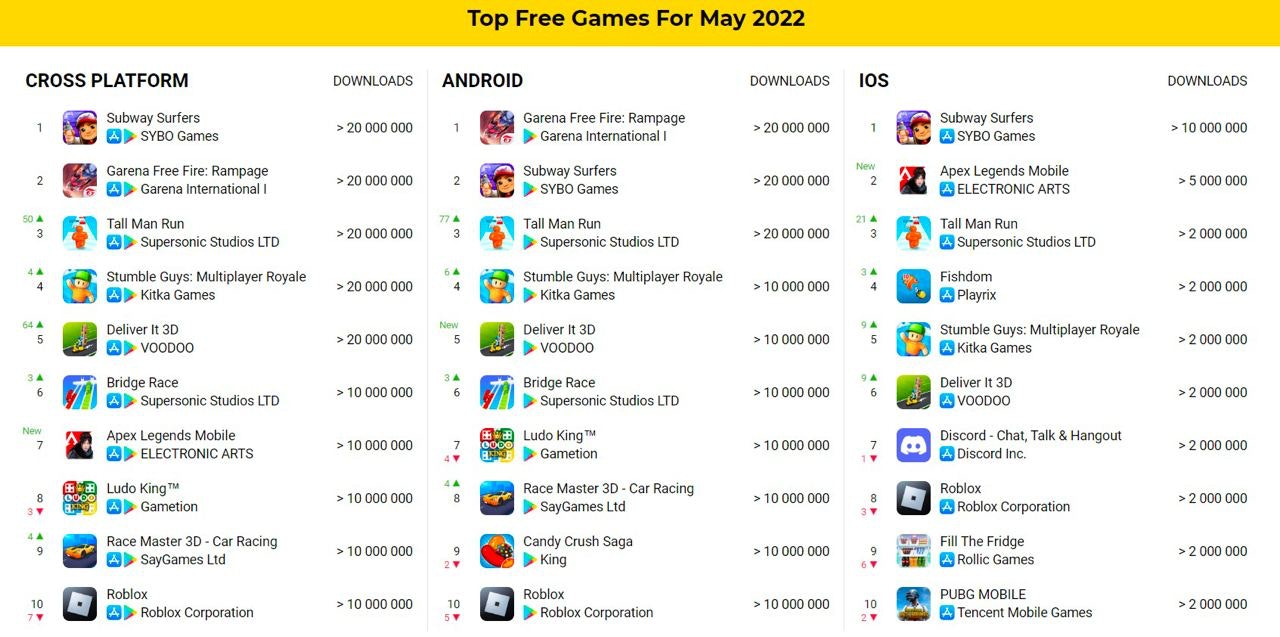

AppMagic: Top Mobile Titles by Downloads & Revenue in May 2022

Downloads

-

Subway Surfers made it again - the game is on top with 36.9M downloads.

-

Garena Free Fire is the most popular game on Android in May with 30.6M of downloads.

-

There are 2 newcomers to the top-10 - Apex Legends Mobile & Deliver It 3D. Voodoo publishes the second game and it’s a delivery guy arcade game.

Revenue

- Honor of Kings continues to harvest the Chinese market with $167.3M of revenue in May.

-

Android leader in May by revenue was Lineage W with $55.29M. Overall with App Store the game earned $61.1M

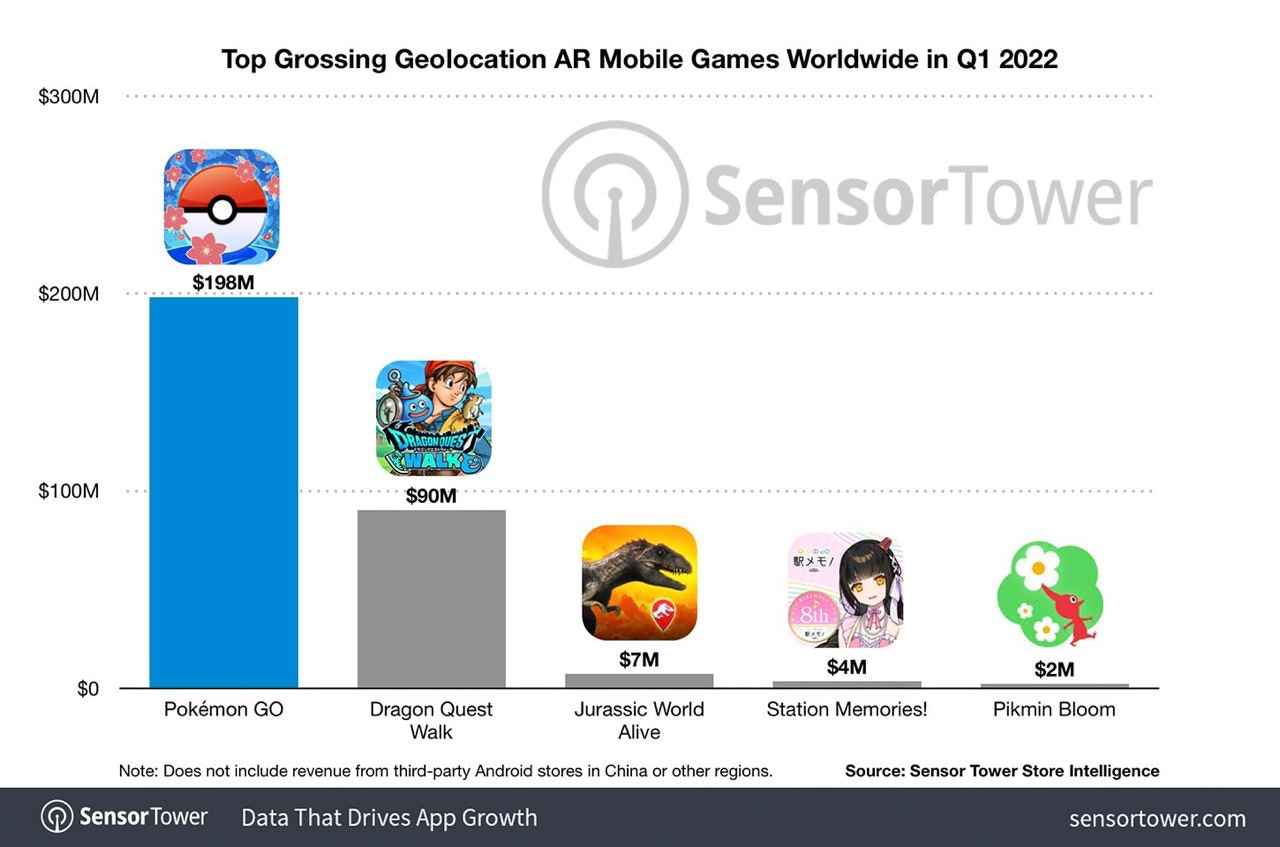

Sensor Tower: Pokemon GO earned $6B in lifetime

-

In 2021 the game earned $1.3B and became the #7 in the top by revenue. In Q1 2022 Pokemon GO generated $198.2M of revenue and earned #11 in the top-grossing chart.

-

The closest geolocation AR games by revenue are Dragon Quest Walk ($90.4M) & Jurassic World Alive ($7.2M).

-

The US is the main market, which is responsible for $2.2B of revenue (36.6%). Japan is second (32.6%), and Germany is third (5.2%).

-

Google Play brought Pokemon GO $3.1B (52.3% of overall revenue). App Store was responsible for $2.8B (47.7%).

-

The game has been downloaded 678M times since the launch. 123.2M of downloads (18.2%) came from the US. Brazil & India are next.

-

76.3% of overall downloads came from Google Play.

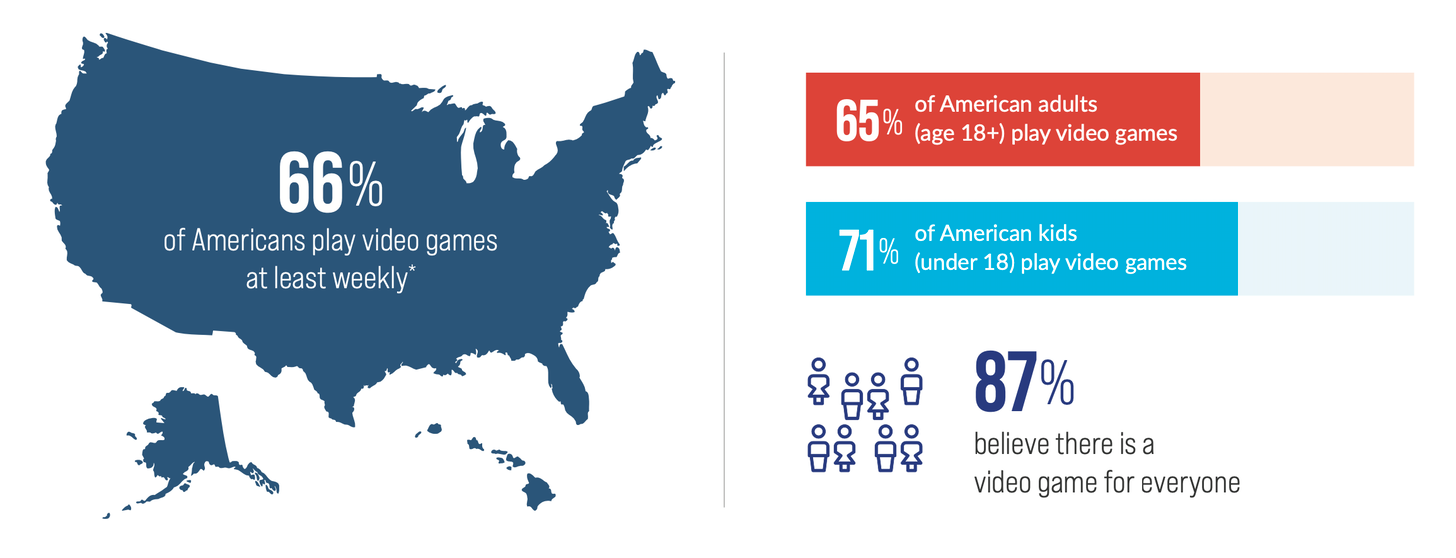

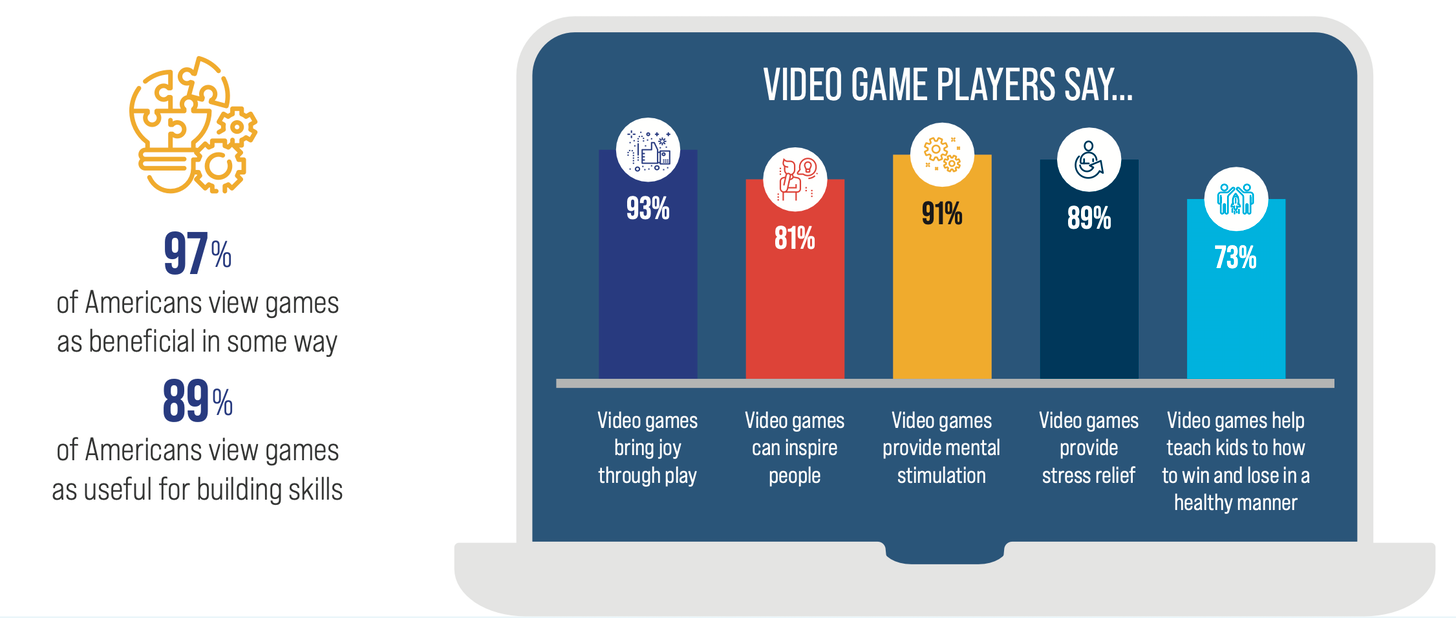

ESA: Gaming Industry portrait in the US in 2022

-

66% of the US people are playing games at least two times per week.

-

The average US gamer age is 33 years. 76% of all players are older than 18.

-

97% of Americans are sure that games are useful. 89% think that they help to develop skills. The majority is positive that games help to relieve stress, get joy, make your brain work, and inspire.

-

The younger the player, the more often he plays for excitement. As the time passes another motivation strikes - gamers are trying to quality spend their free time, develop some skills & use their brains.

-

83% of gamers are playing with friends online or in person.

-

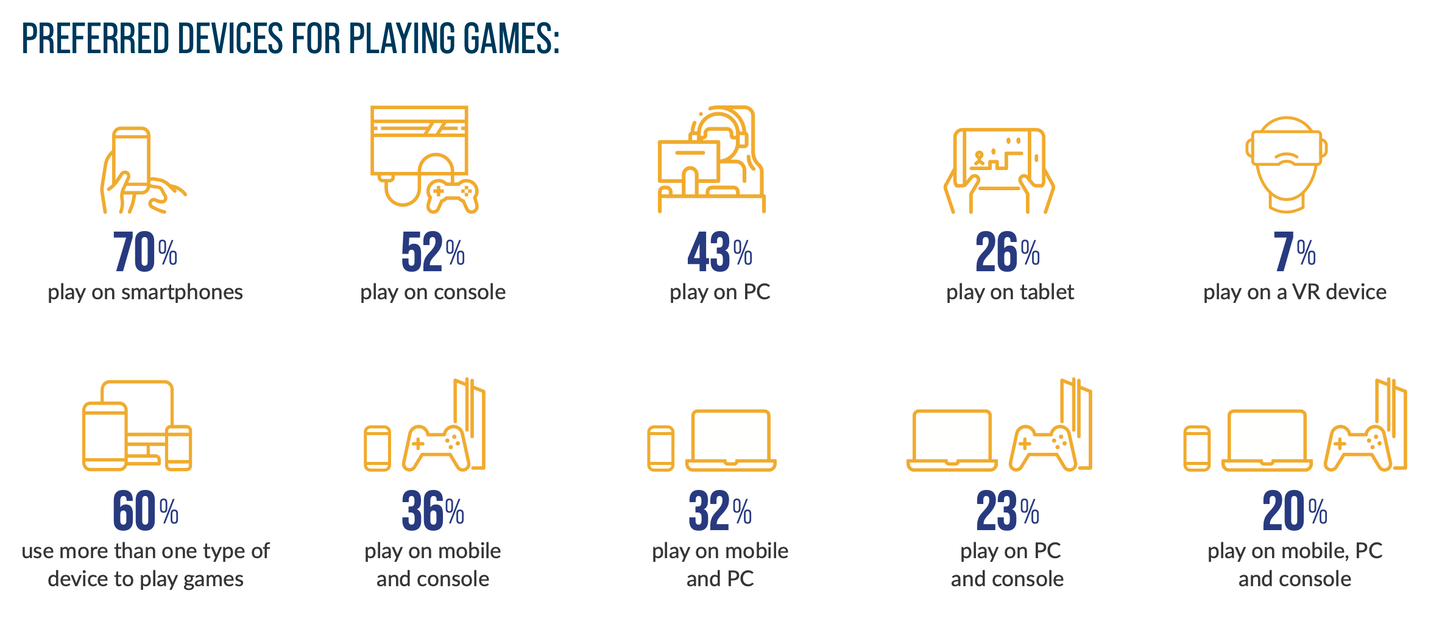

70% of the Americans are playing on smartphones, 52% - on consoles, 43% - on PC, 26% - on tablets, 7% - on VR-devices. 60% of gamers are using more than one device.

-

The most popular genre is Puzzles (65% of players are playing it).

-

The average American player is spending 13 hours per week on games.

Google: Mobile Gaming Insights in 2022

-

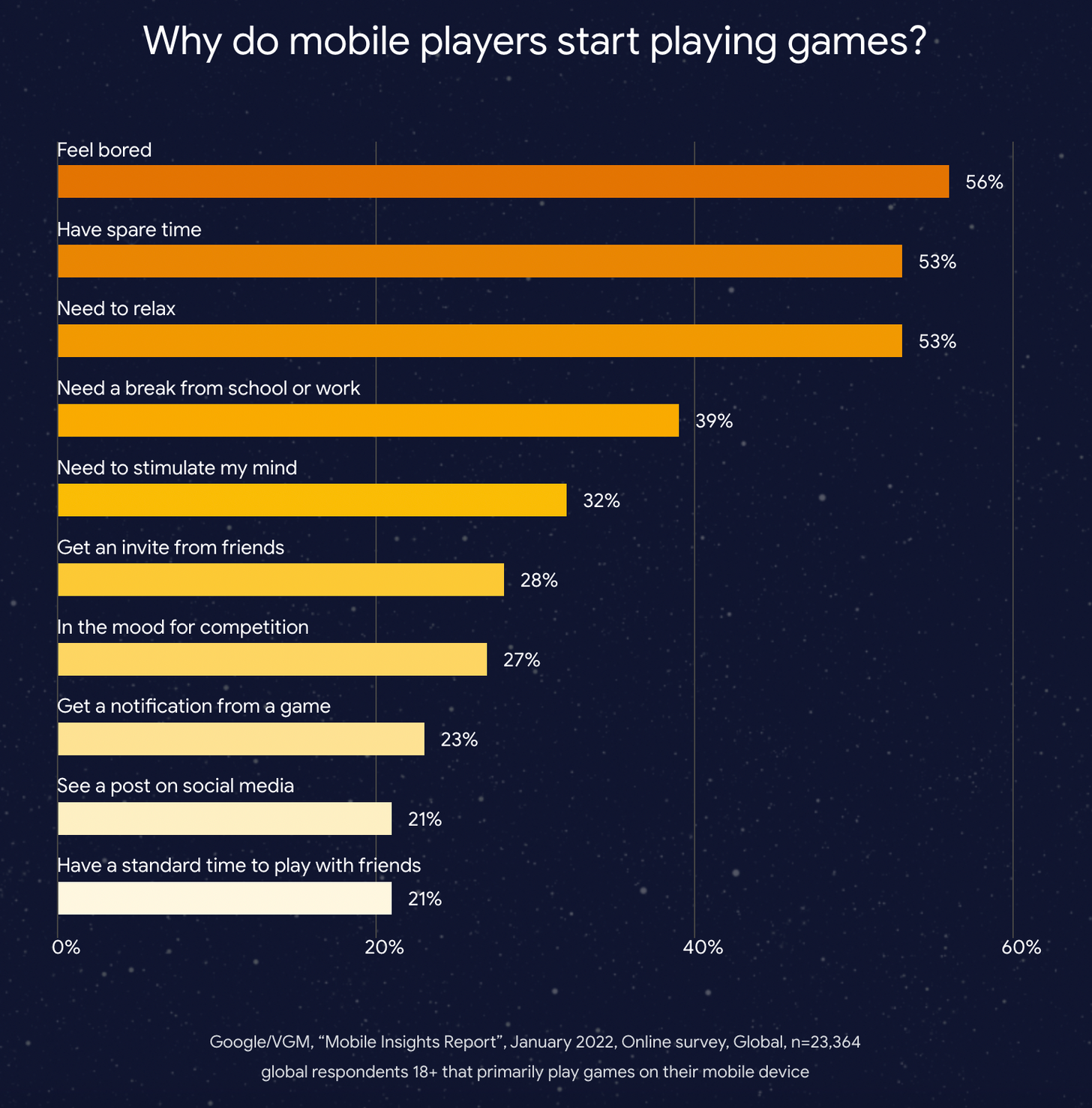

People are starting playing games because of being bored (56%), having spare time (53%), and needing relaxation (53%).

-

37% of users are playing two games. Only 2% are playing 7 or more games.

-

For 83% of gamers, localization is important.

-

67% of users are sure that games must have different (including inclusive) characters and stories.

-

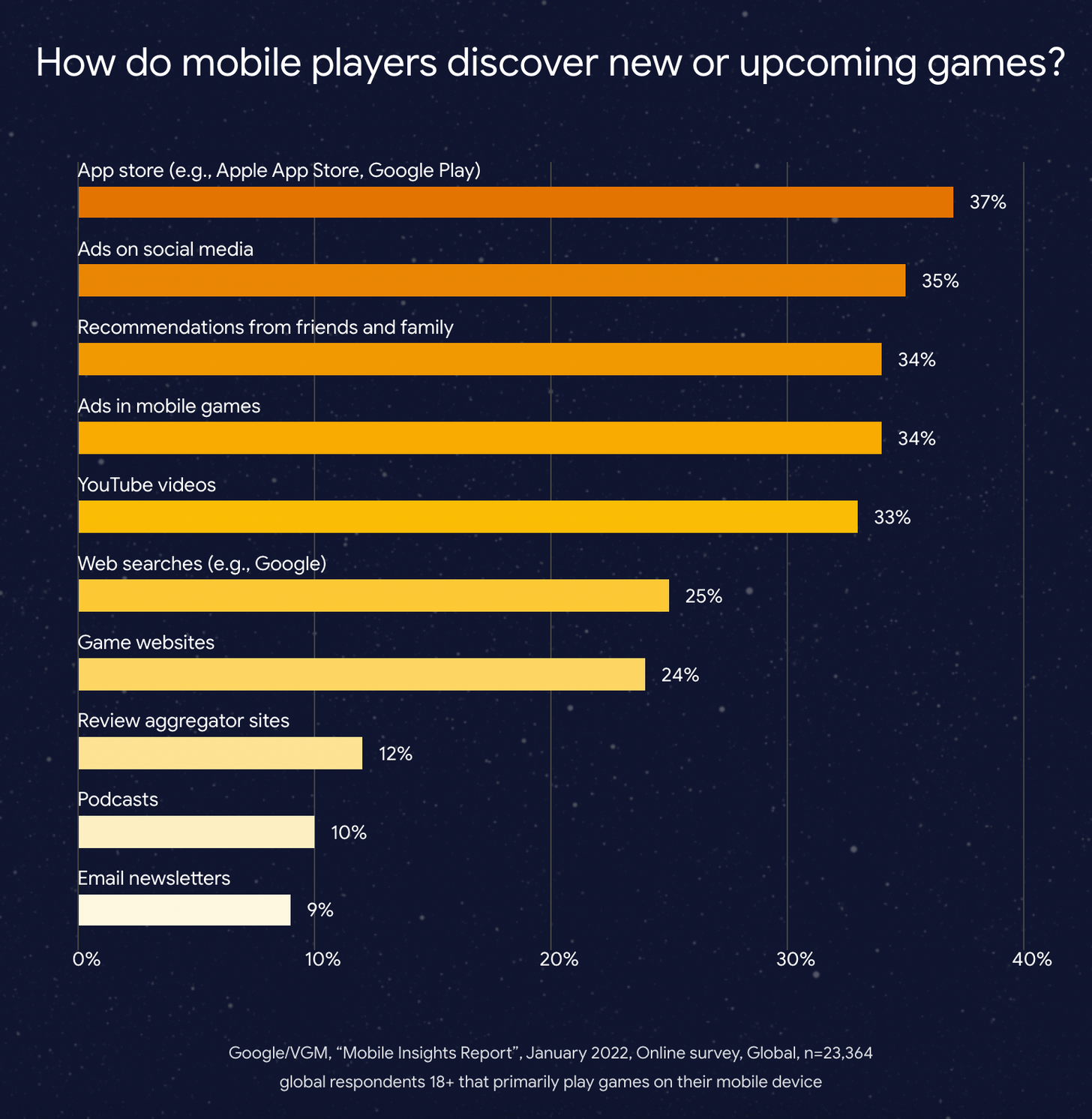

37% of gamers are finding new games through App Store / Google Play search; 35% because of social media ads; 34% thanks to friends’ recommendations; 34% through in-game ads; 33% - with YouTube videos help.

-

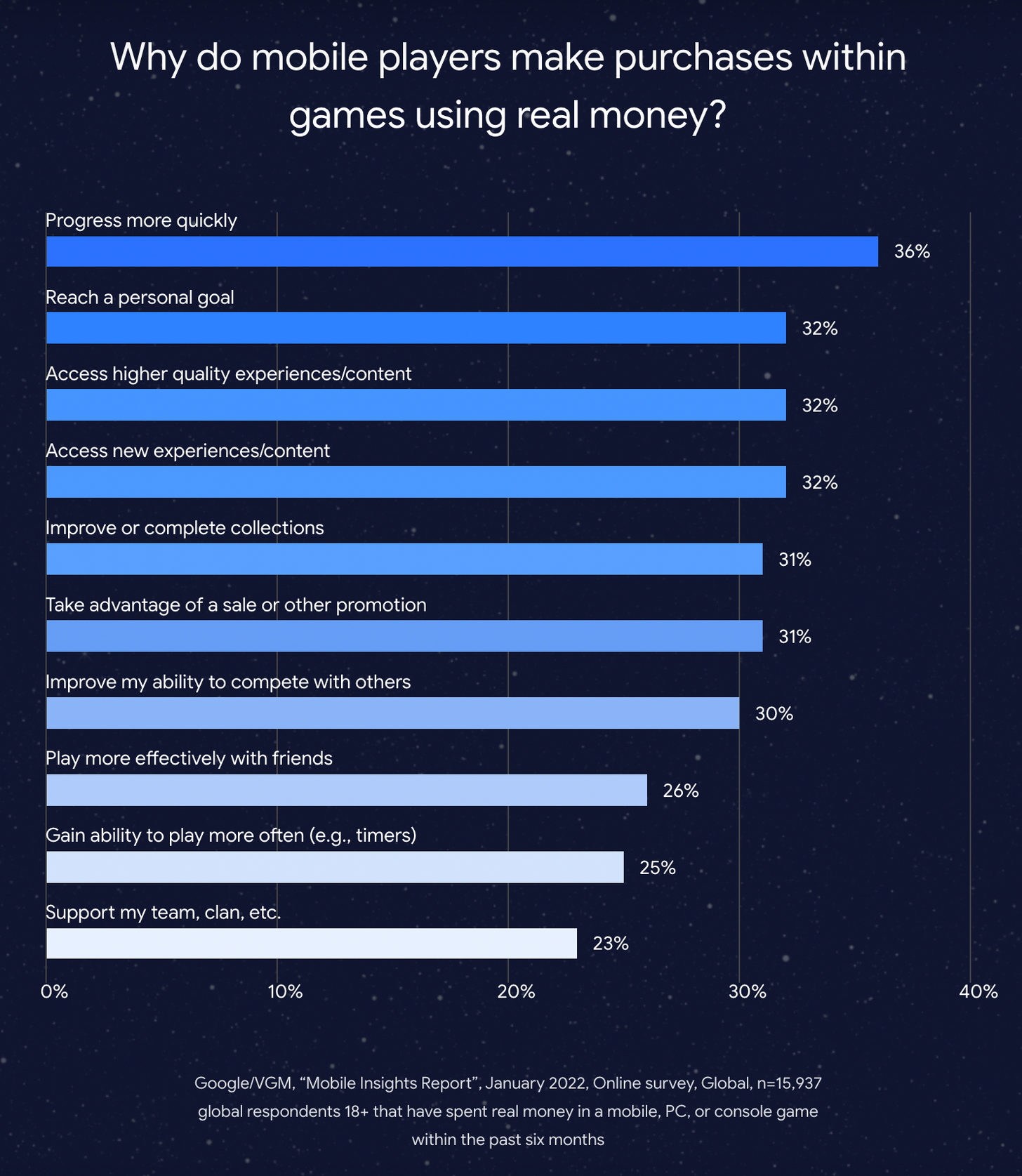

34% of gamers in the last 6 months spent money on in-game currency. 30% have bought characters or/and items. 29% spent their money on unlocking characters or cosmetic items.

-

Different motivations are driving people when buying gaming items. There is a wish to speed up the progress; an opportunity to make the gaming experience better; a desire to make a collection.

-

75% are neutral or positive about in-game ads.

-

Current trends are cross-platform games, cloud gaming, and ESports. Future trends are metaverse, VR, and AR. At least people think so.

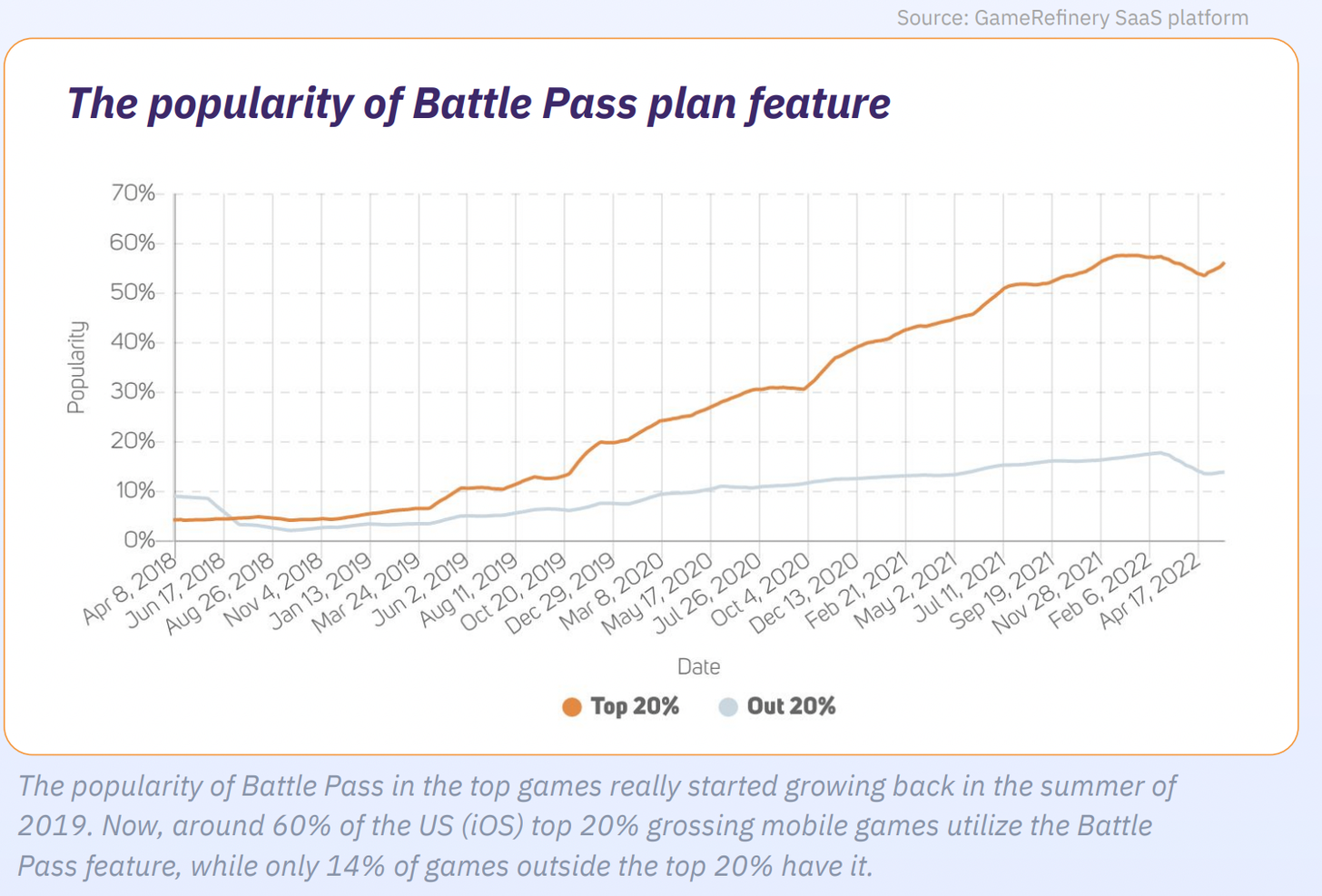

GameRefinery: Mobile Games Monetization trends (June 2022

-

Battle Passes are one of the most popular monetization features in F2P games. It’s used in 60% of top-20% top-grossing mobile titles in the US (iOS).

-

One of the key factors of success is that battle passes can be integrated without interfering with the core gameplay. Battle passes also are improving retention and working fine with other monetization elements.

-

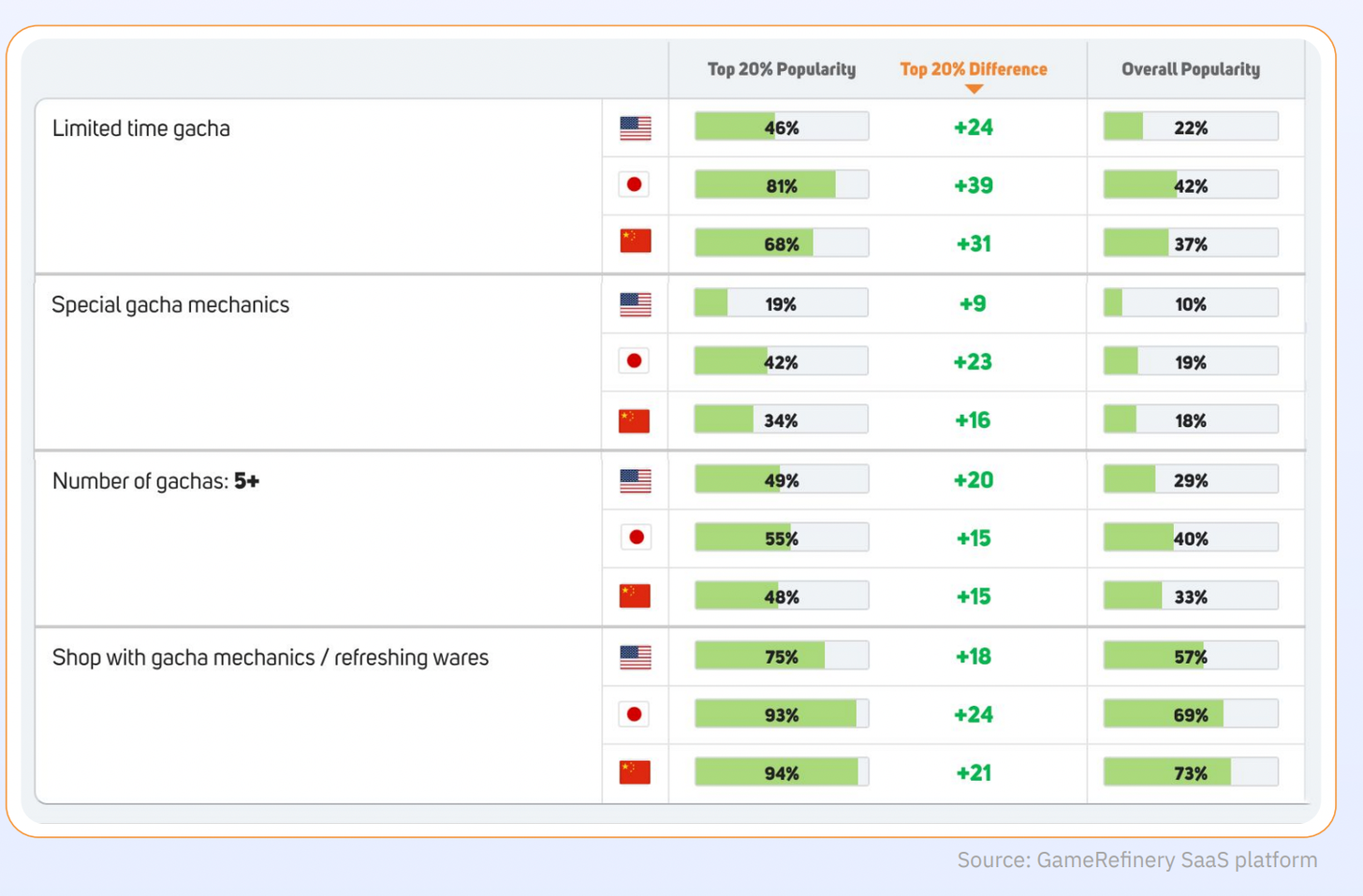

In-game shops with gacha-mechanics are even more popular than battle passes. Especially in Japan, where they are implemented in 93% of mobile games from top-20% by revenue.

-

Gacha-mechanics are evolving consistently. The latest trends are increased transparency of getting the prize conditions & co-op gachas.

-

Traditional IAP are still widely used in games.

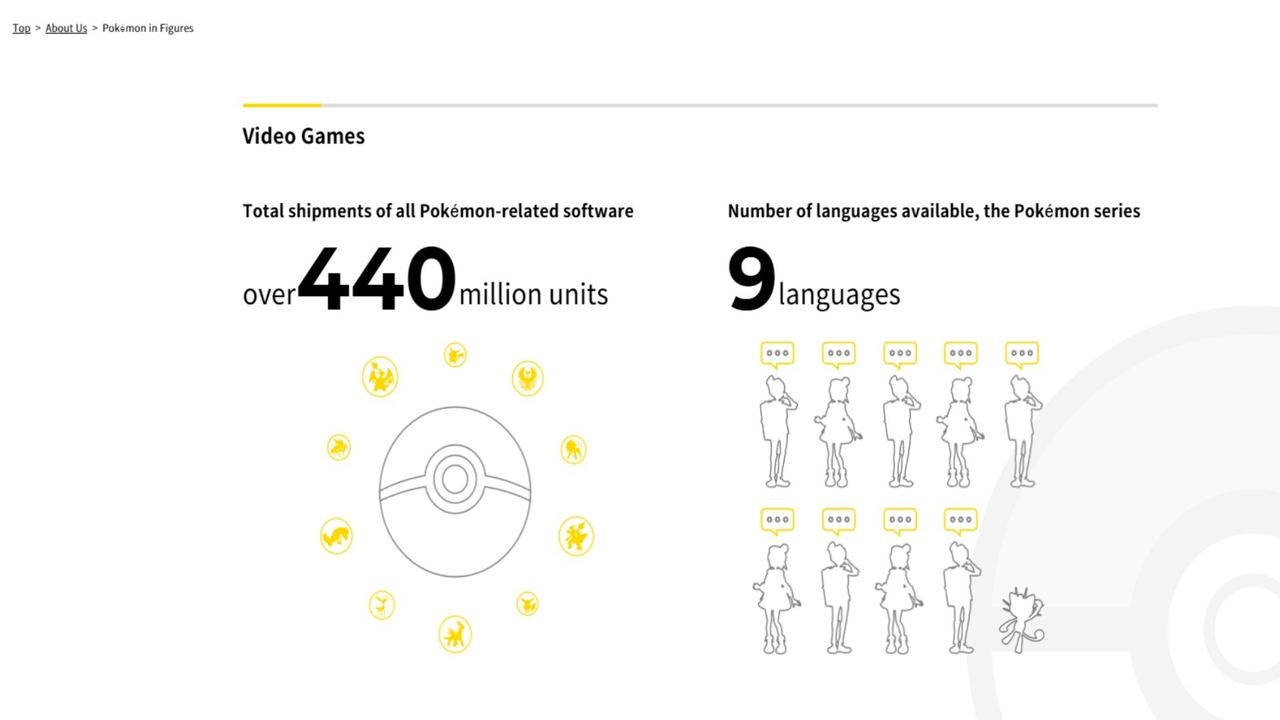

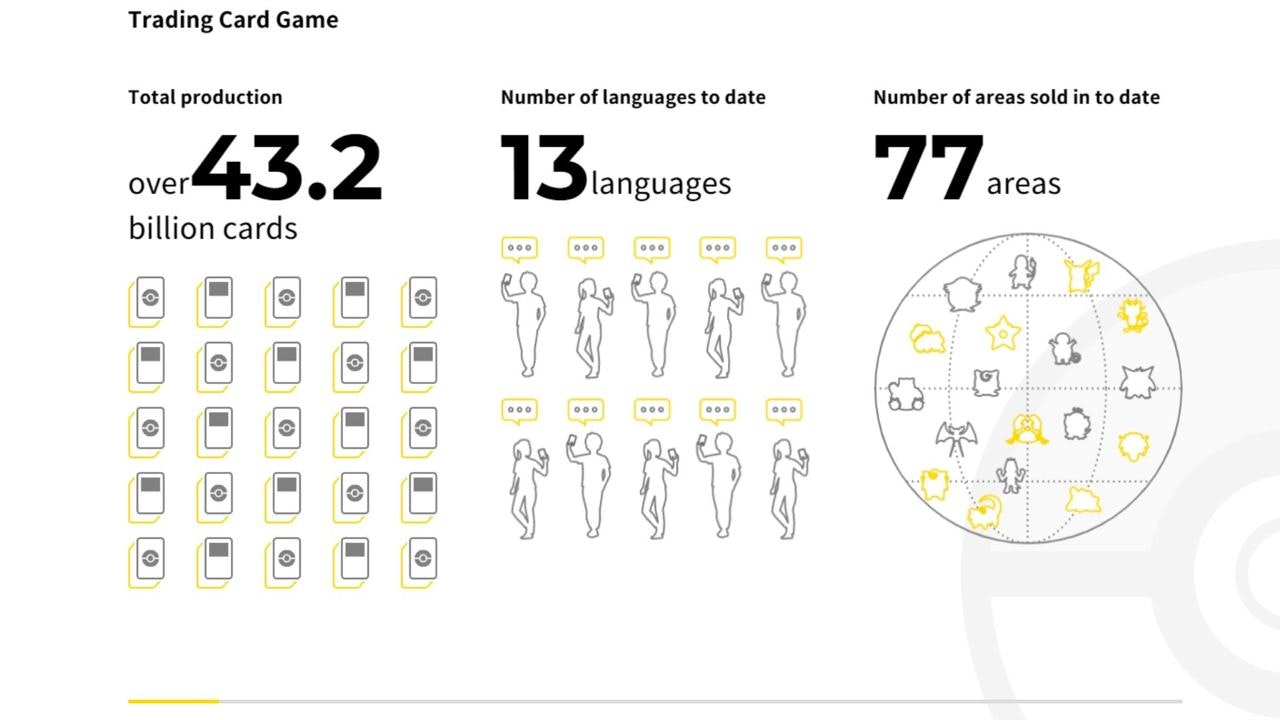

The Pokemon Company: Pokemon-related software was shipped 440M+ times

Numbers are actual for March 2022

-

The majority of shipments are coming from video games.

-

For the CCG time-being, more than 43.2B cards were produced.

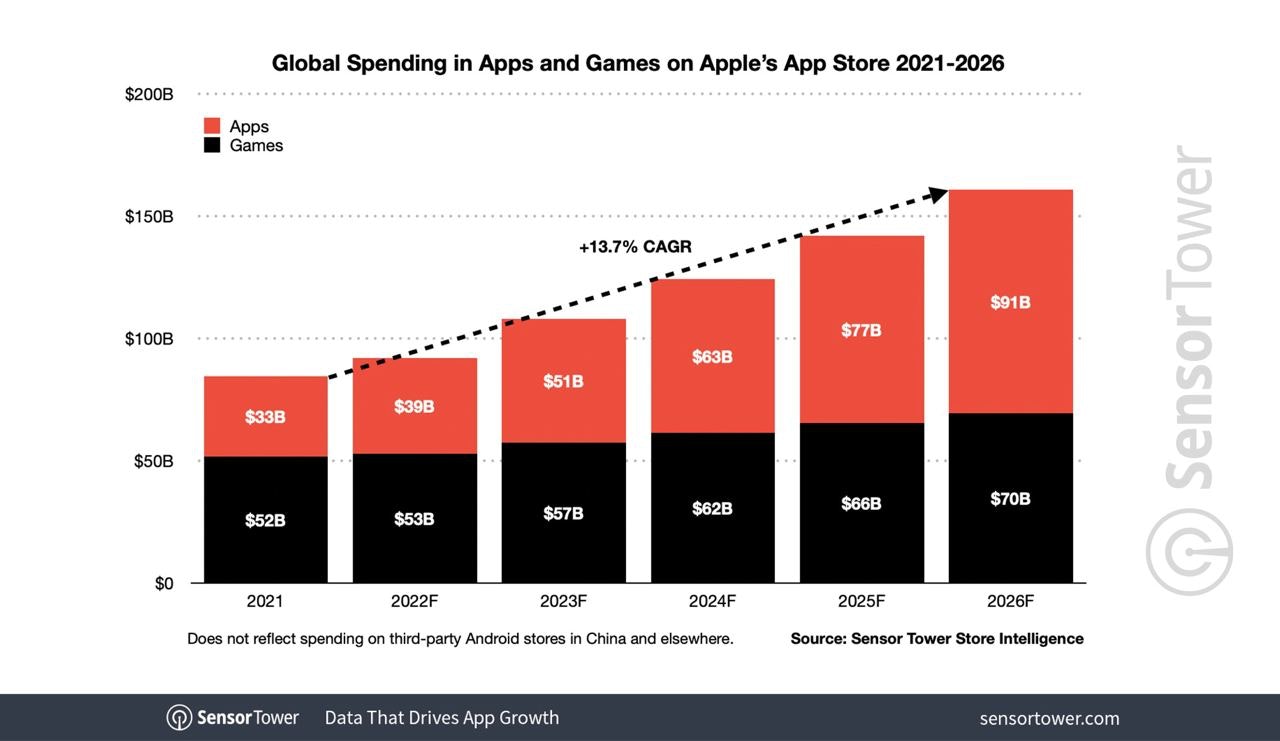

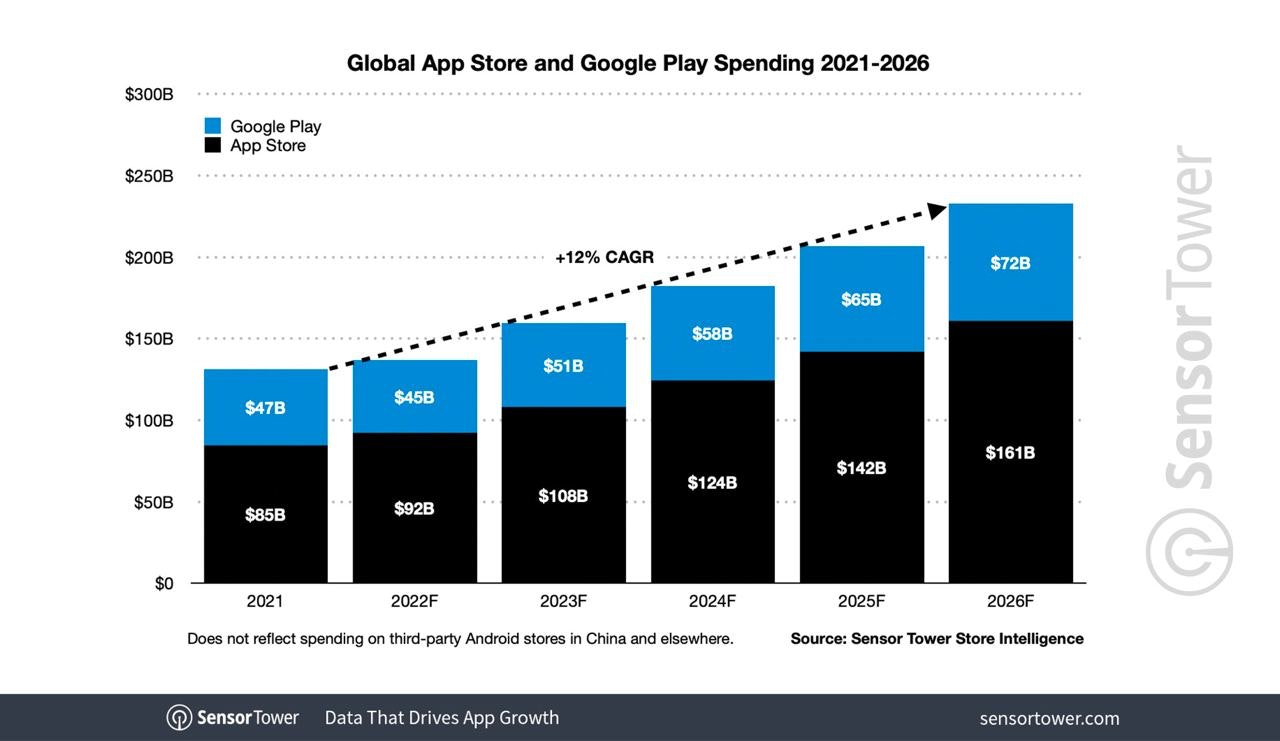

Sensor Tower: Non-Gaming apps will outperform gaming apps in mobile spending

-

By 2026 games will take about 43% of overall iOS revenue. It’s a hard decline compared to the 66% games took in 2020.

-

The situation with Google Play is slightly better, but the trend is the same. By 2026 games will be responsible for 65% of revenue compared with 83% in 2020.

-

However, app spending will also grow and reach $233M by 2026. Sensor Tower analytics are projecting a CAGR of 12%.

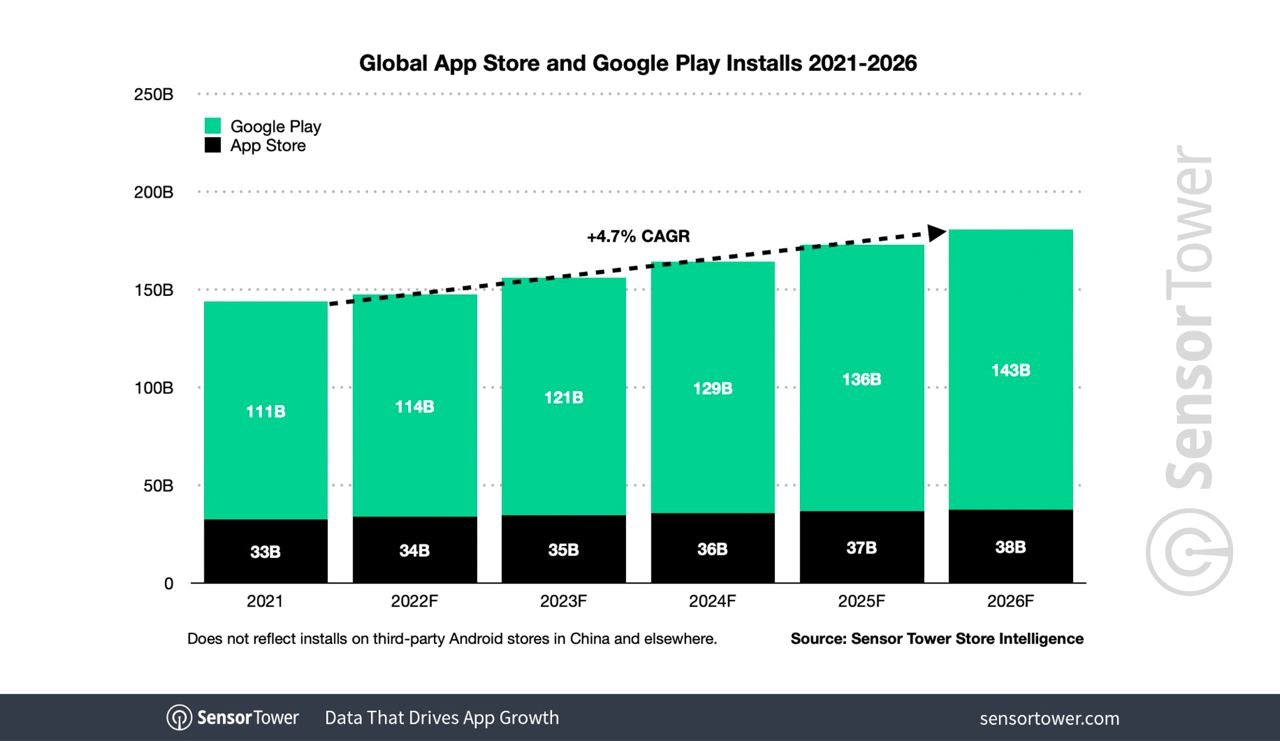

-

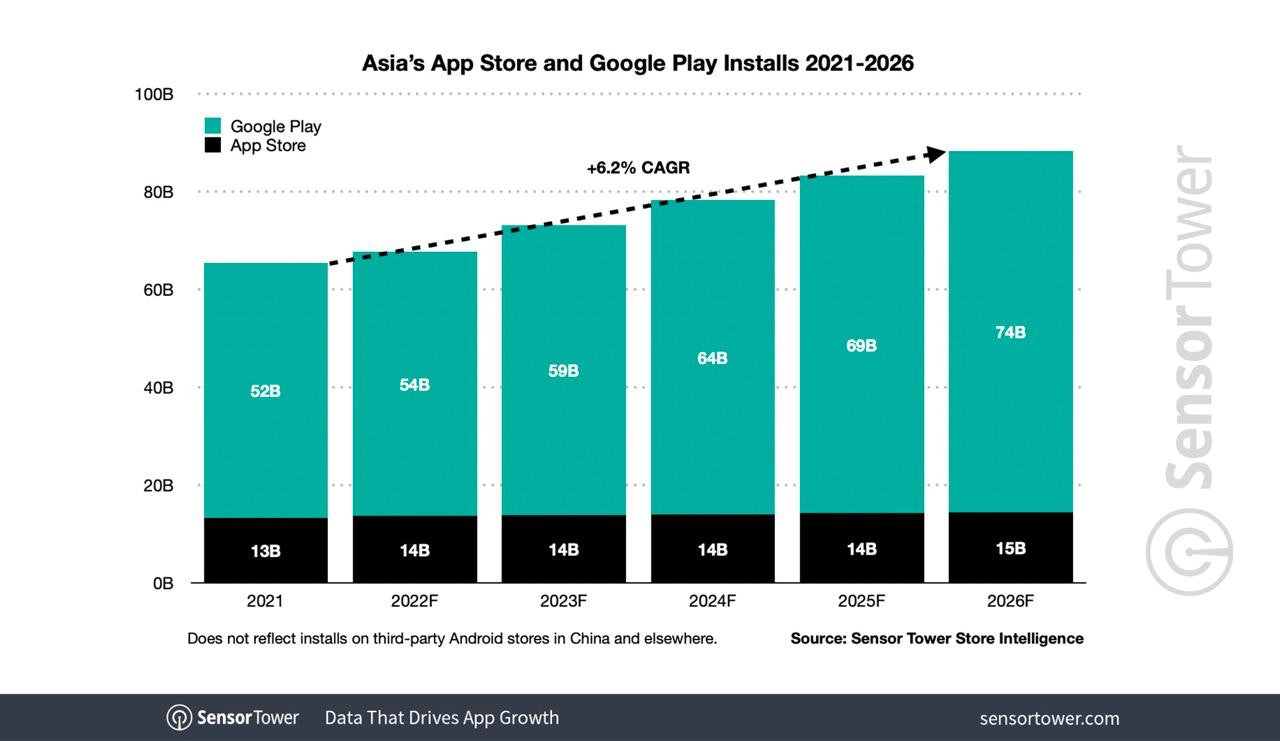

Downloads will grow too but not so fast - with a CAGR of 4.7%.

-

The fastest-growing market by app adoption will be Asia.

NPD Group: May US Gaming sales are the worst since the pandemic

-

$3.68B was spent on games in the US in May. It’s 19% lower than a year before.

-

$3.33B of this sum was spent on the gaming content (games, microtransactions, subscriptions e.t.c.). The decline YoY is 19% too.

-

Elden Ring made it back to the top chart.

-

Google Play sales went down by 23% YoY; App Store is feeling better with only a 2.6% decline.

-

Hardware sales decreased by 11% (to $216M); accessories - by 7% (to $131M). Nintendo Switch LED was first in both unit & dollar terms.

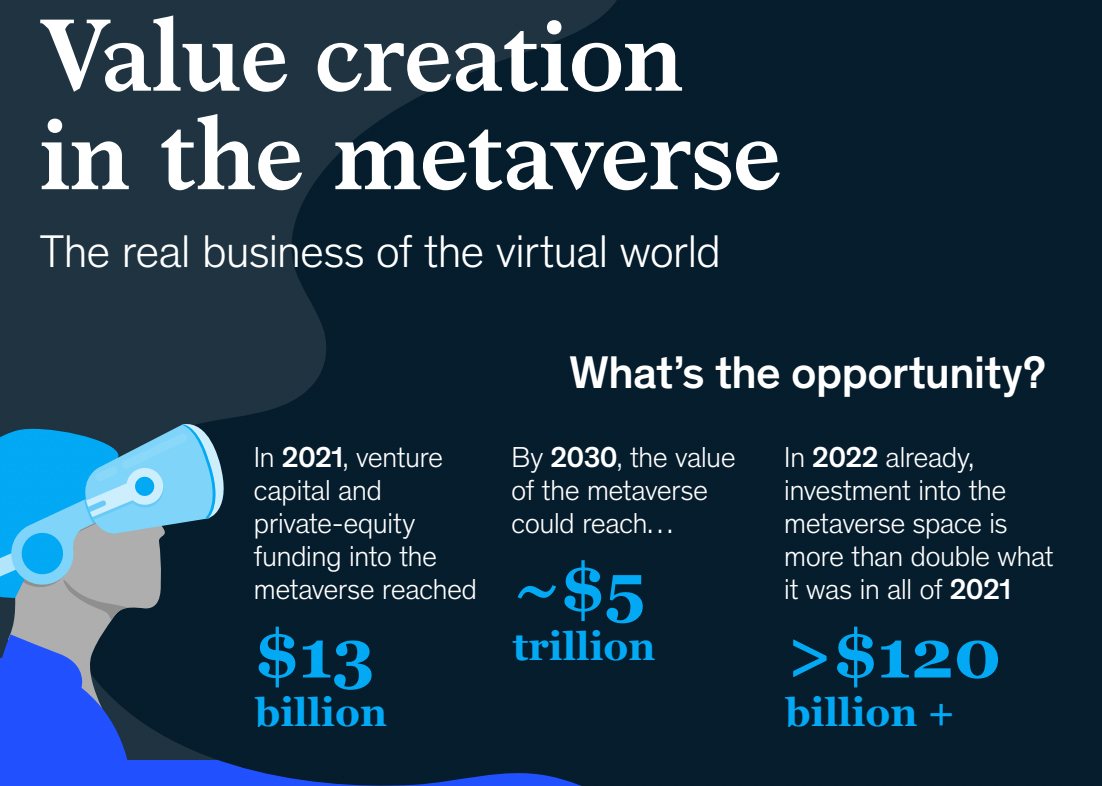

McKinsey & Co.: The Metaverse market will reach $5T by 2030

-

The majority of the volume will come from e-commerce ($2.6T), virtual learning ($270B), ads ($206B), and games ($125B).

-

In 2021 $13B was invested in metaverse of different kinds. During the first half of 2022 (which is not over yet), investors already put more than $120B in metaverse-related companies.

-

There is still no clear understanding of what metaverse is. McKinsey & Co. suggests thinking about it as a multi-layer thing. Yosuke Matsuda, the Square Enix CEO does not want to define the metaverse at all: “We’re trying to not define the metaverse so rigidly that it limits the imagination of creators”.

However, the report is good because of a lot of data & industry leaders’ opinions. You can find it here.

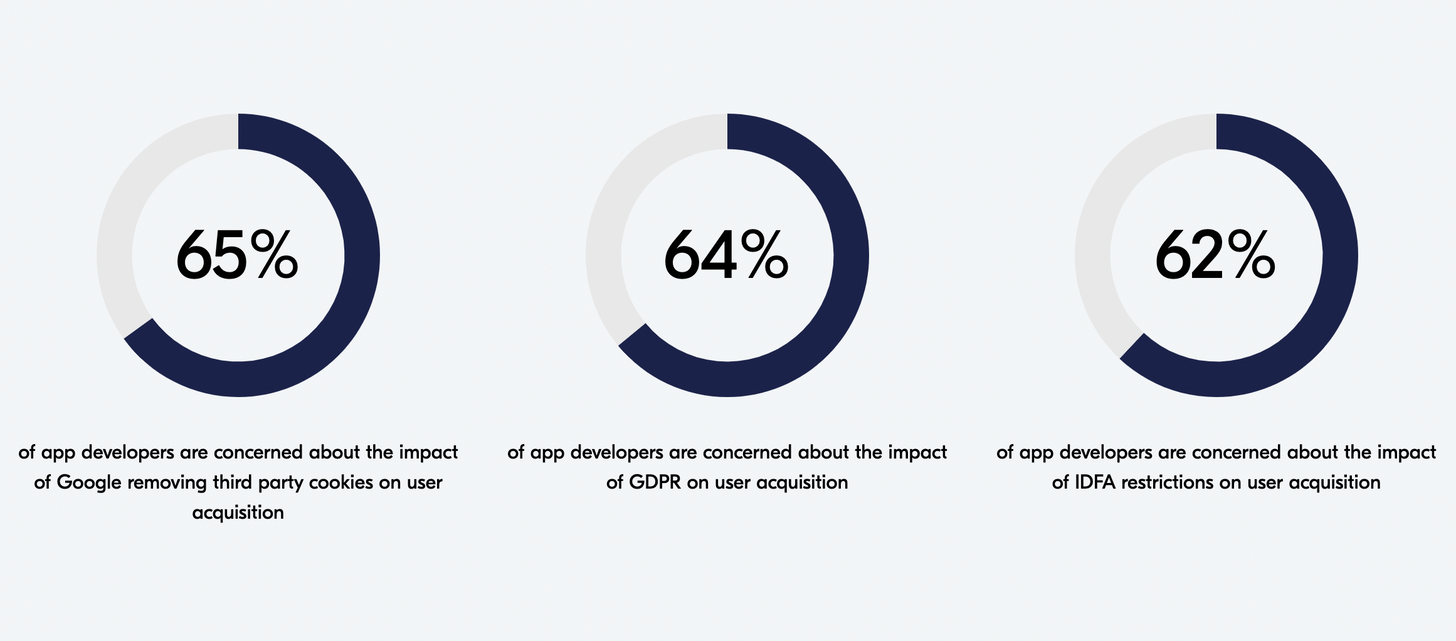

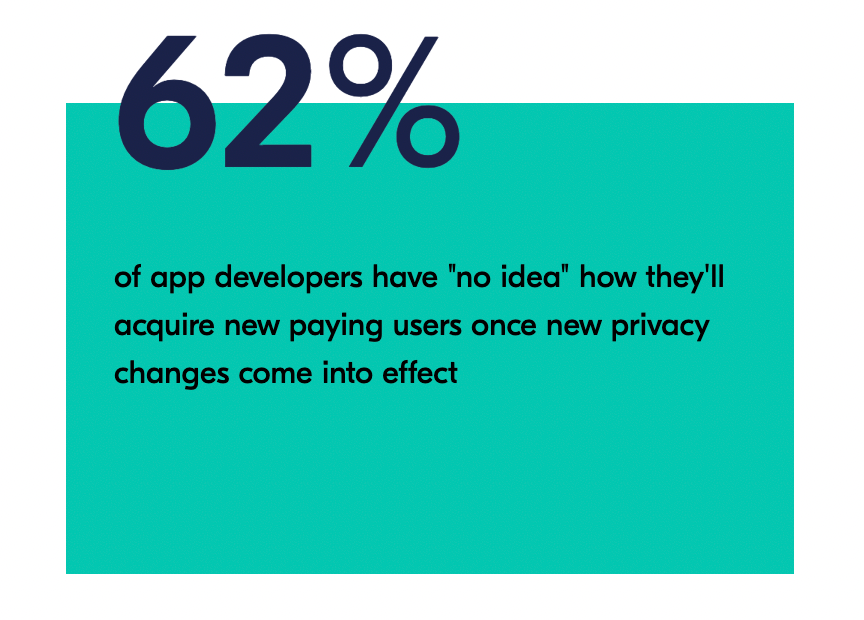

Bango: 31% of game developers from the US & UK will close if ad regulations will strengthen

More than 300 game developers from the US & UK have been surveyed.

-

64% of game developers are sure that acquiring new users has never been so hard as it is now.

-

62% of game developers do not understand how to effectively acquire new users if the ad regulations become harder.

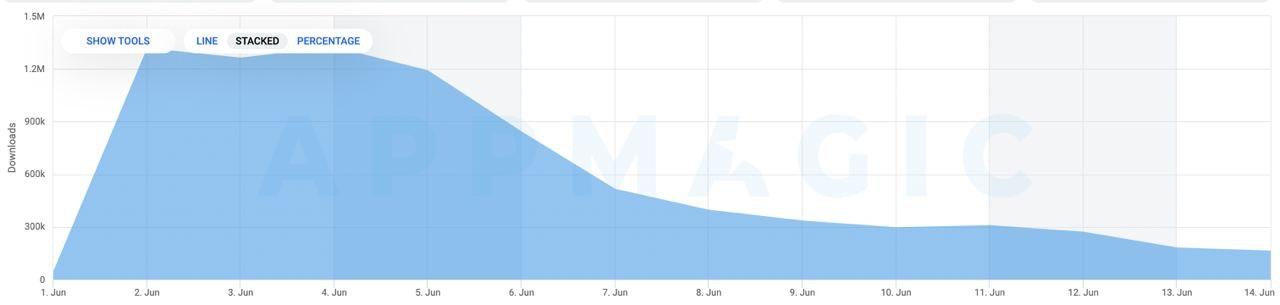

AppMagic: Diablo Immortal earned $24M+ in the first two weeks on mobile

-

According to the service, Diablo Immortal brought developers $24.3M in two weeks after the launch.

-

The revenue split is almost equal. $13M came from the App Store; $11.3M - from Google Play.

-

In the first two weeks, the game was downloaded almost 8.5M times. The peak of downloads happened in the first days after the release.

-

The cumulative ARPU of Diablo Immortal in the first two weeks is $3.12. On iPad, this number is twice as high - $6.67.

These numbers are without the PC version.

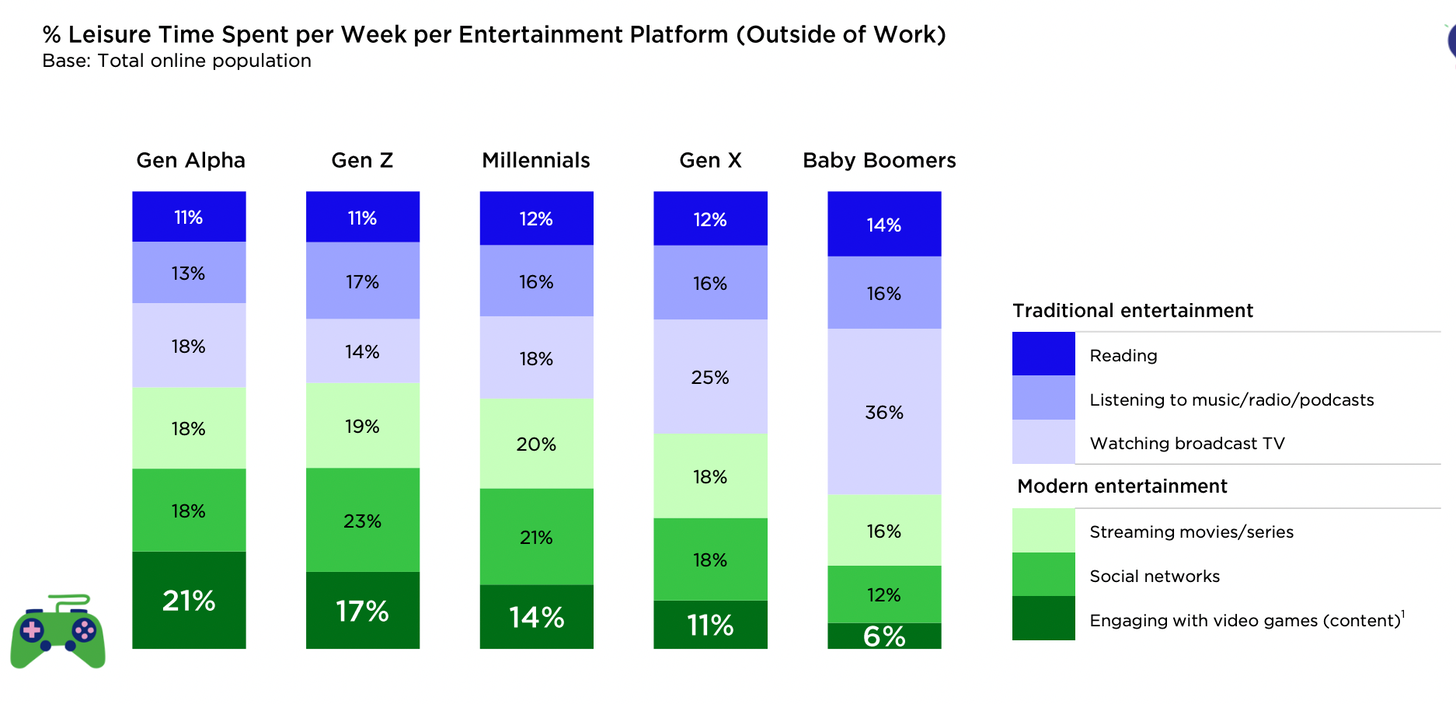

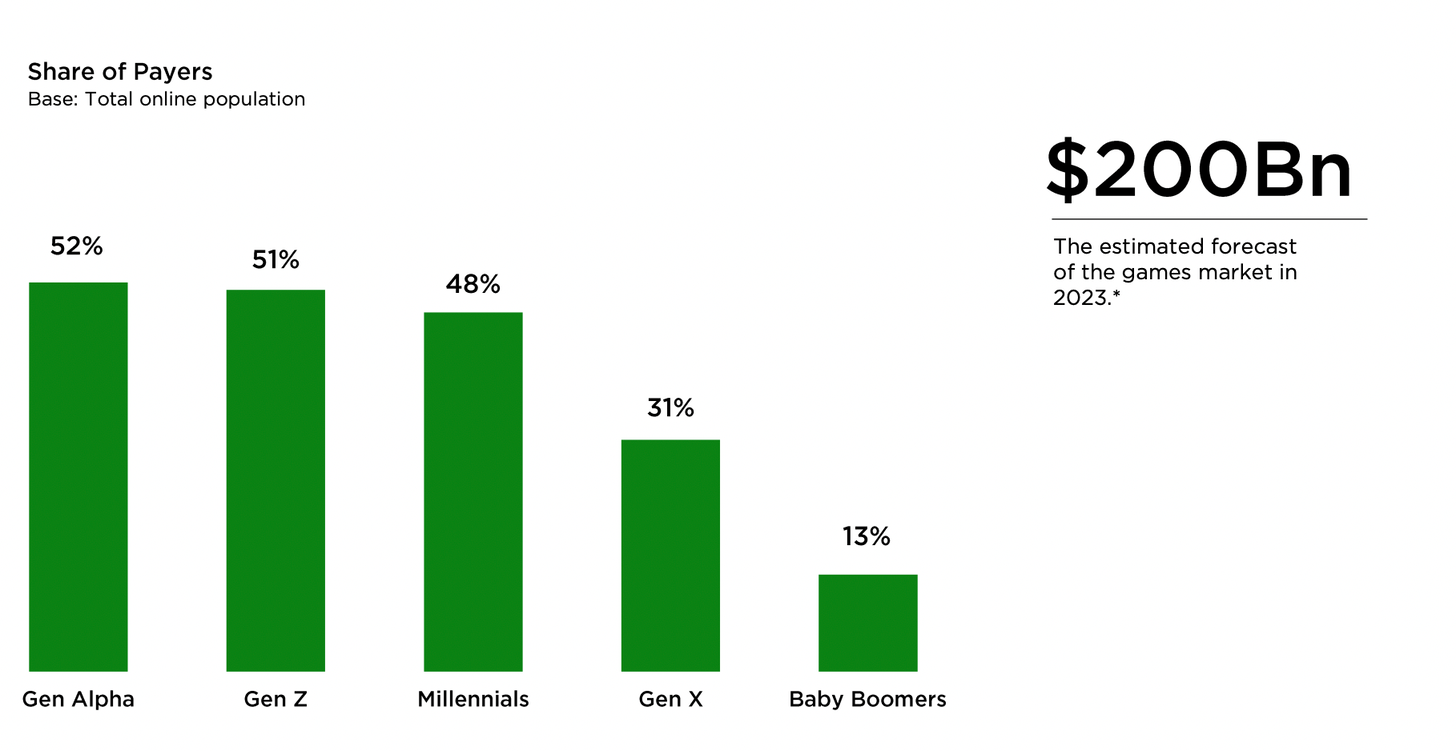

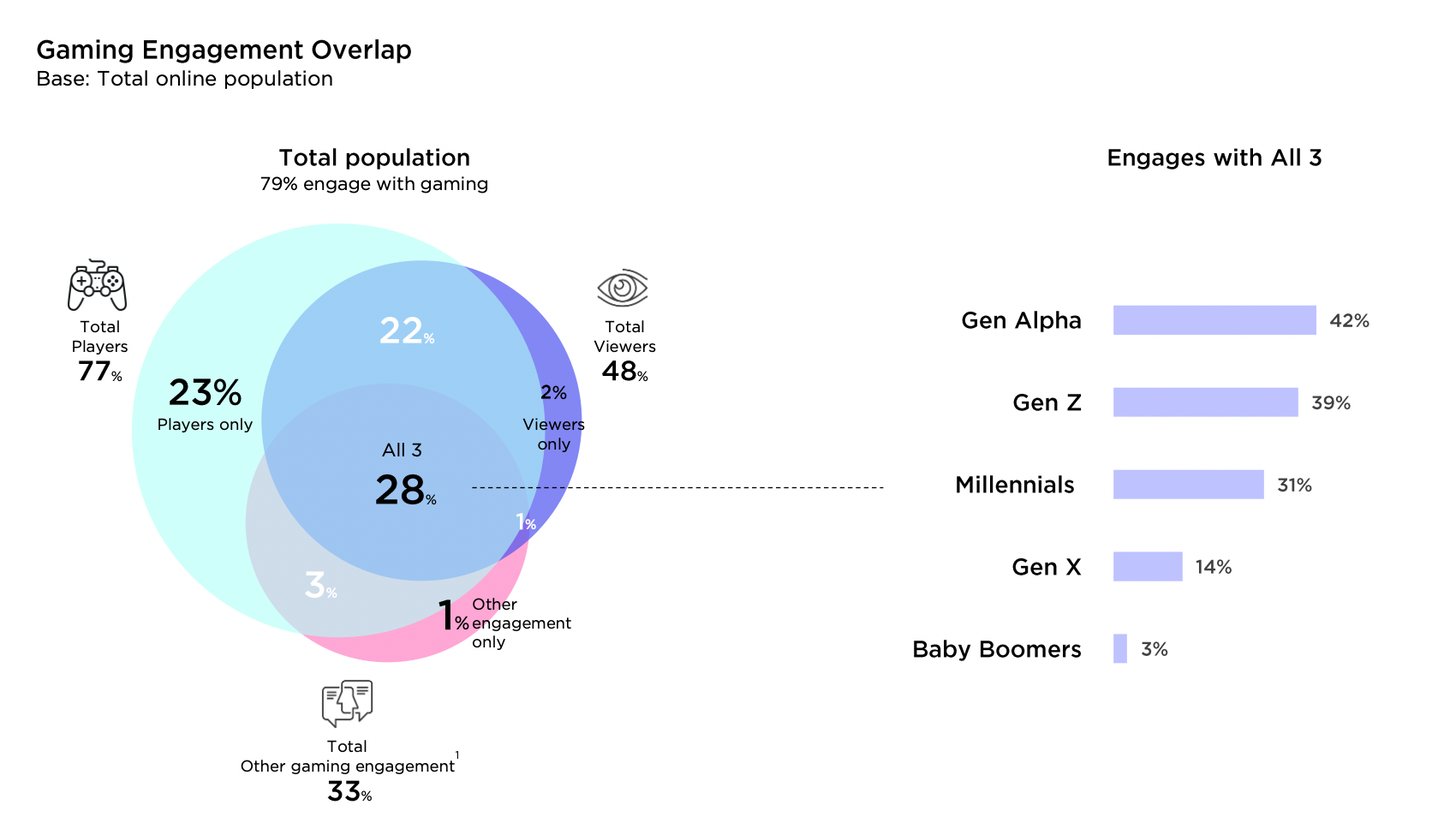

Newzoo: People's reception of games in 2022

Newzoo surveyed 75,930 people in 36 countries.

-

People are choosing Games among other entertainment activities more often. And it’s applicable to all age categories.

-

The younger the person, the higher the chances that he or she is spending money on games. Newzoo analytics are sure that childhood habits will help the gaming market to grow.

-

The majority of gamers are interacting with games outside of just the gaming experience. 42% of generation Alpha gamers watch streams, listen to podcasts, and discuss games on social platforms.

-

In the US only 55% of gamers do know what Play-to-Earn is. The majority of them are optimistic that such a concept will be used in the future.

-

Gamers are more loyal to brands than non-gamers.

Sensor Tower: Top Mobile Games by Downloads in May 2022

-

Subway Surfers from Sybo Games led the chart with 30M downloads in May. It’s 86,5% more than in May 2021. India is responsible for about 15% of downloads, the US is next with 14%.

It’s also the best month for downloads in May for a 10-years lifespan of the title. Anniversary helped Subway Surfers reach $5.9M, a record too. The revenue in May 2021 was 6.3x times lower. -

Garena Free Fire was downloaded 26M times, 50.3% more than a year before.

-

Overall in May 2022 users downloaded games 4.8B times from App Store & Google Play. There is a 1% decline compared to May 2021.

-

India is responsible for 916M of downloads (19.2% of global); the US - for 8.4%; Brazil - for 7.9%.

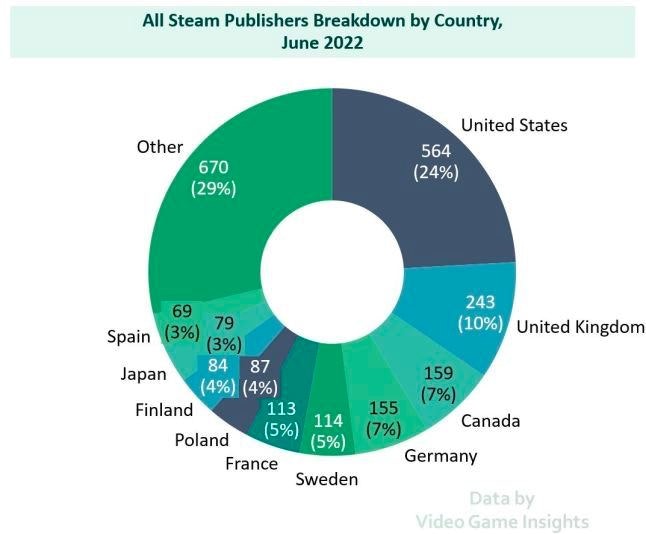

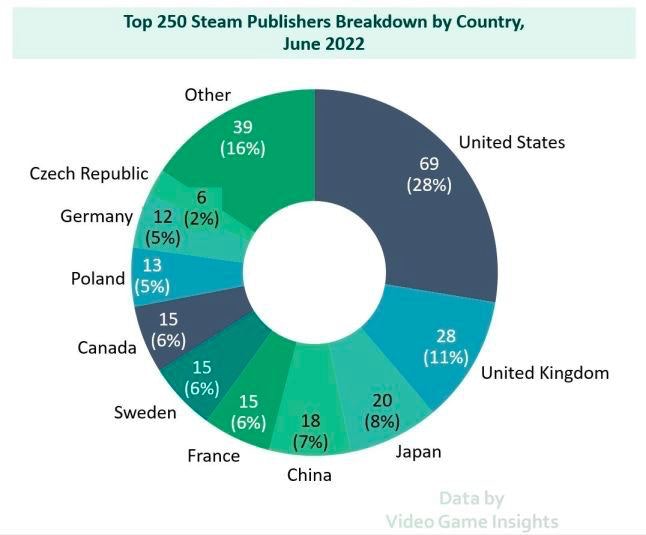

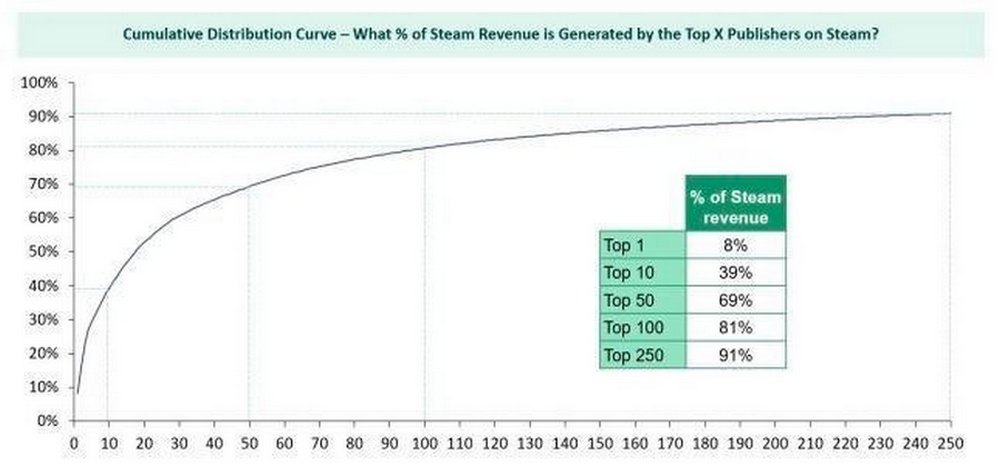

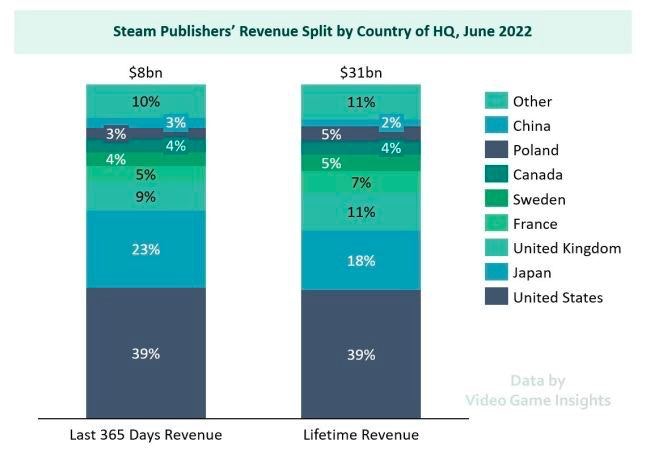

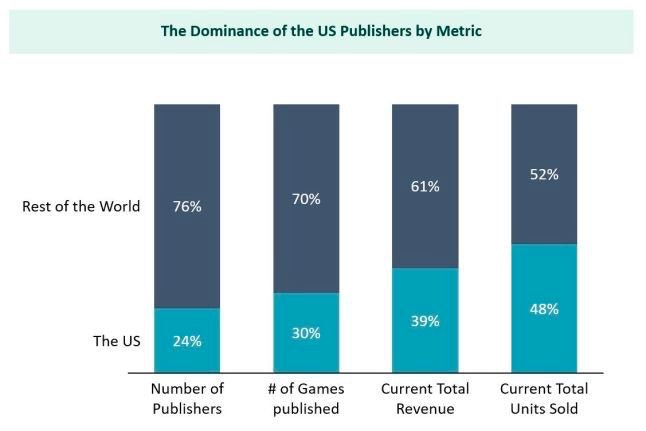

Video Game Insights: Steam Publishers Landscape - US Publishers generating almost 50% of sold copies

-

The research covers 2,337 Steam publishers generating 95% of the revenue. Numbers are relevant as of June 2022.

-

Almost a quarter of publishers are from the US. The only country representing publishers, not from North America or Europe is Japan (3% of publishers).

-

69 out of 250 most grossing publishers are from the US. The UK is next (28 publishers - 11%), Japan is third (20 publishers - 8%), and China (18 publishers - 7%).

-

250 of the largest publishers by revenue in Steam are responsible for 91% of the platform revenue in the last 365 days. The leader is Bandai Namco with more than $800M in revenue per year. The majority of sales made the Elden Ring.

-

Ten top grossing publishers on Steam are generating 40% of revenue.

- 90% of publishers’ revenue in Steam are coming from 8 main markets: the US, Japan, the UK, France, Sweden, Canada, Poland, and China.

-

The US publishers are responsible for 39% of overall Steam revenue, and 48% of all copies sold.

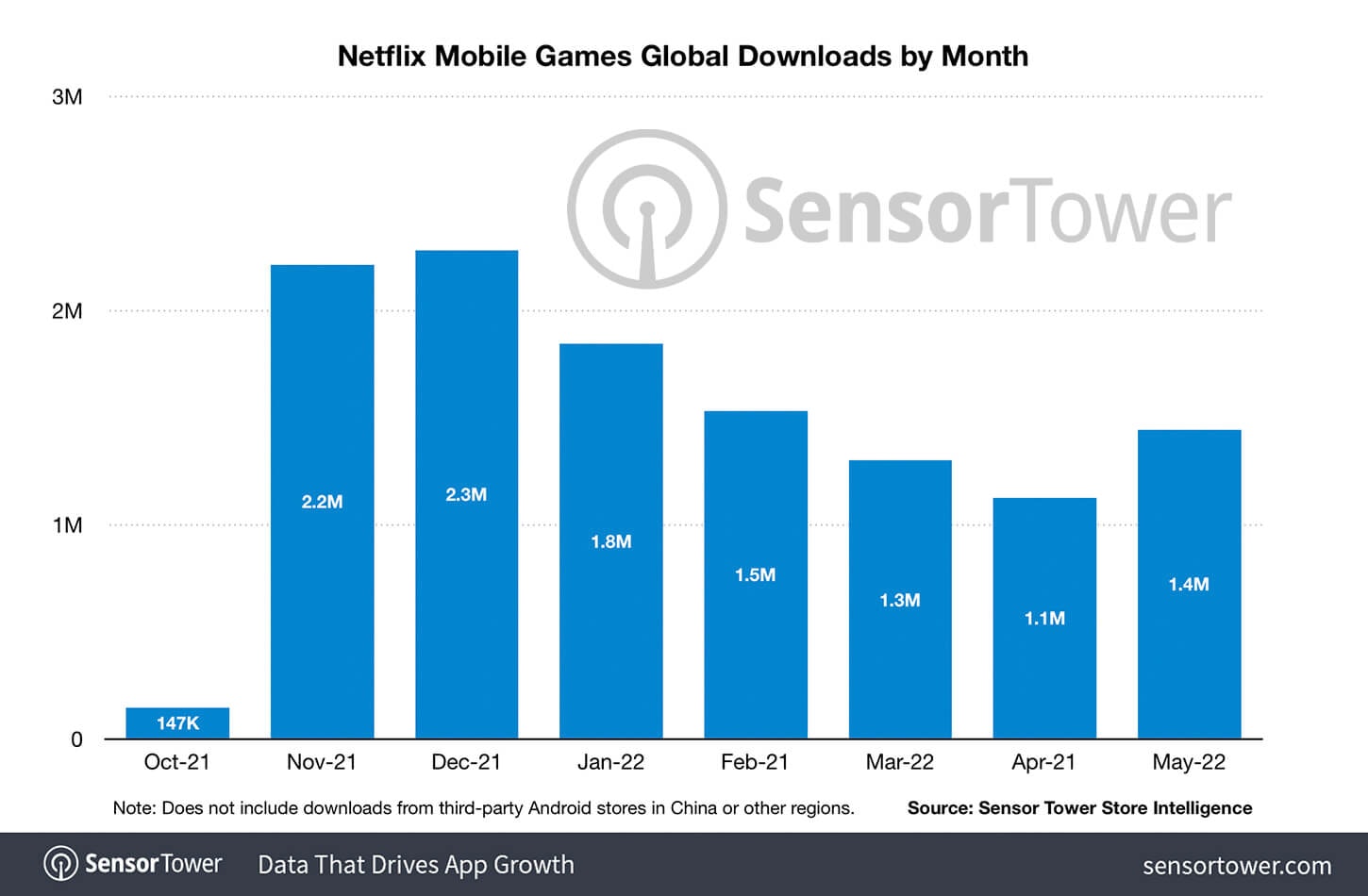

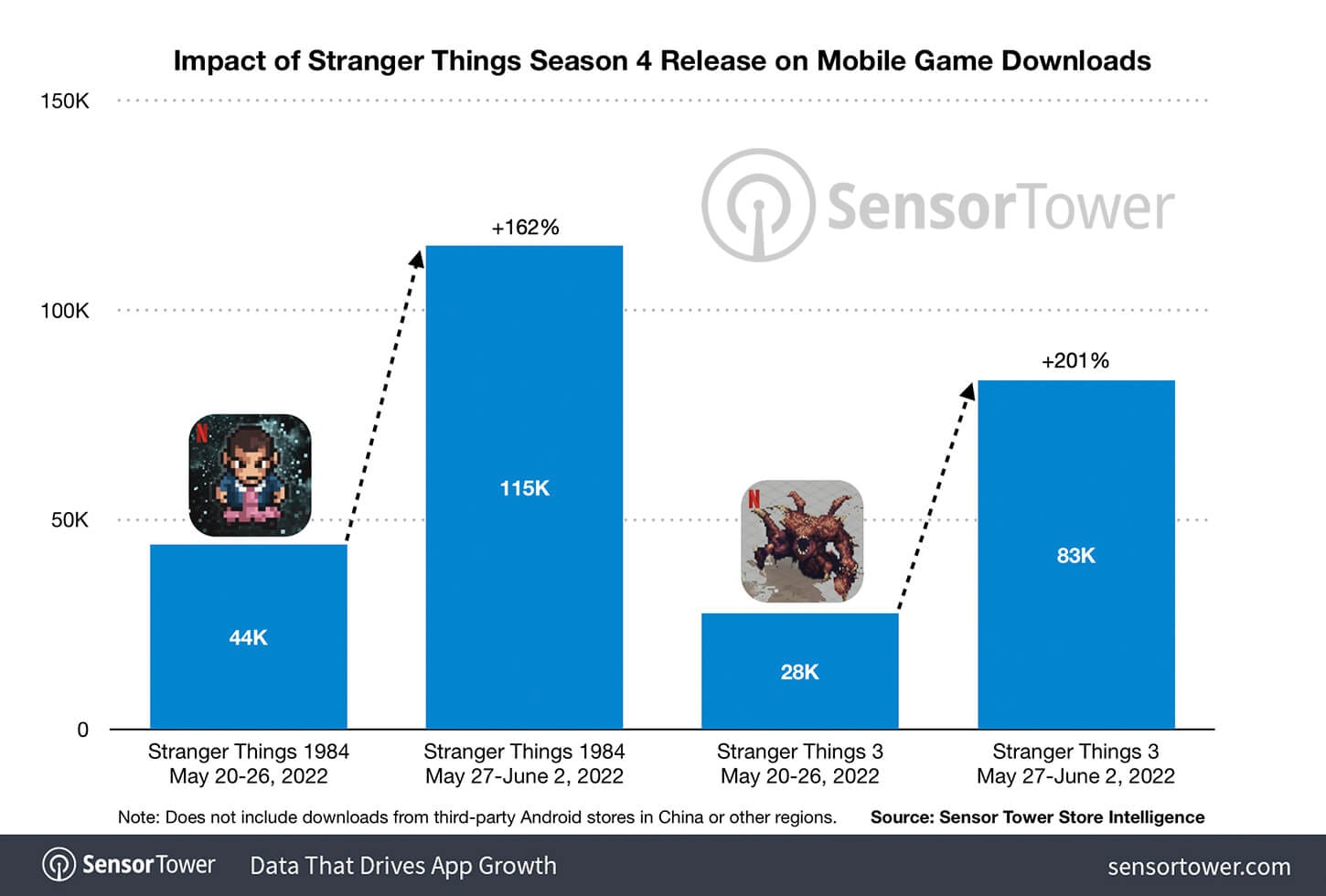

Sensor Tower: Netflix Mobile Games has been downloaded 13M times

-

The platform released 24 Mobile titles to date. The most popular is Stranger Things 1984, which has been downloaded 2M times.

-

The best month for Netflix by downloads was in December 2021, when games published by the streaming giant were downloaded 2.3M times.

-

The Stranger Things remains the strongest Netflix franchise. Downloads of Stranger Things 1984 & Stranger Things 3: The Game increased from the end of May by about 3 times after the 4 seasons of the series release.

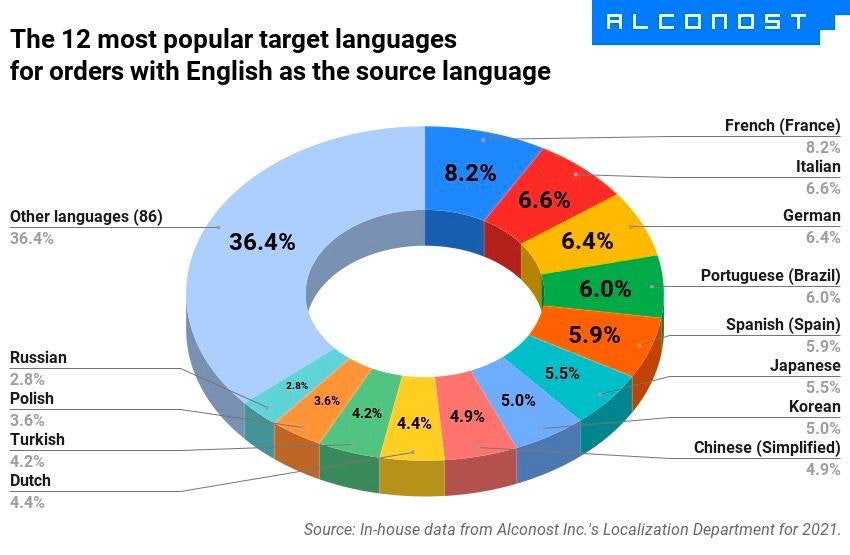

Alconost: The Most Popular Localisation languages

The company shared its structure of orders of translation from English to other languages in 2021.

-

12 most popular languages are: French (8.2%), Italian (6.6%), German (6.4%), Brazilian Portuguese (6%), Spanish (5.9%), Japanese (5.5%), Korean (5%), Chinese (Simplified) (4.9%), Dutch (4.4%), Turkish (4.2%), Polish (3.6%), Russian (2.8%).

-

Alconost highlights the growth of Brazilian Portuguese, which overcame Spanish by popularity.

-

The number of translations to the Asian languages is increasing in the order structure of the company.

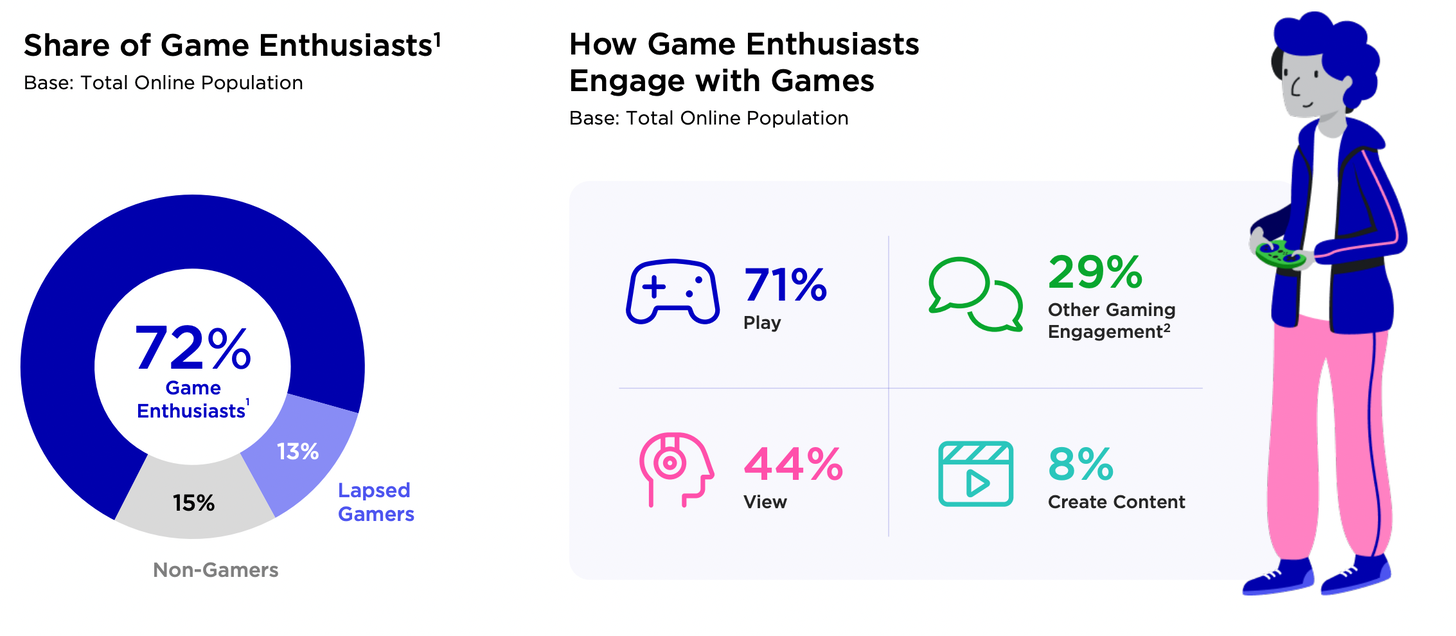

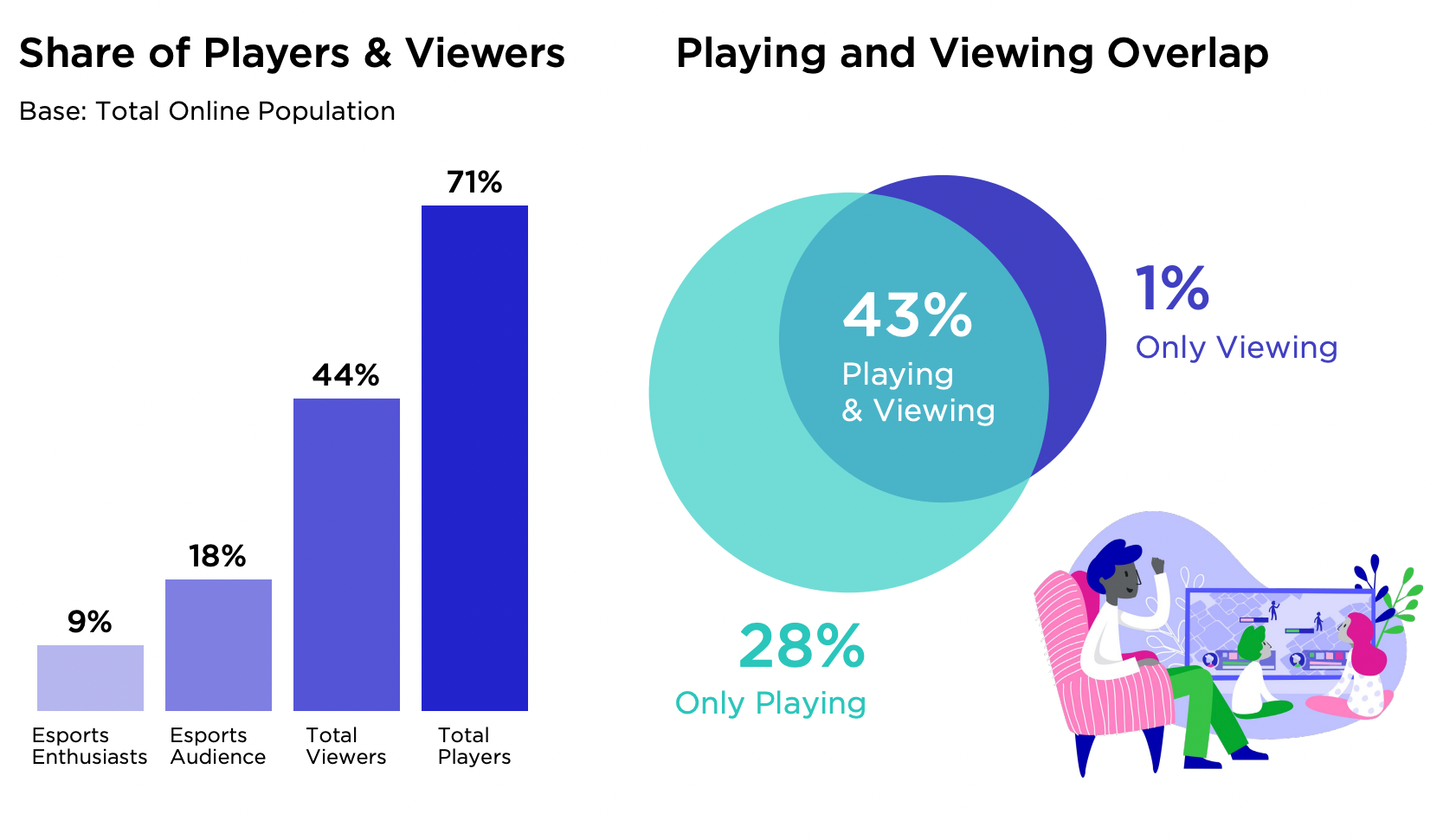

Newzoo: American Player Portrait in 2022

-

72% of the US population is playing games.

-

A lot (44% of the population) are not only playing but also watching gaming content.

-

52% of gamers are men, 47% are women, and 1% are non-binary people (or other).

-

The majority of players are between the ages of 21-35 - there are 35% of them. Next are groups of 10-20 years (26%), 36-50 (25%), and 51-65 (13%).

-

The main players’ motivations to play are to socialize, have fun & action & achieve something.

-

48% of gamers are playing on mobile devices, 39% on consoles, and 27% on the PC. On average, players are spending 5 hours per week gaming on mobile devices and PC, while on consoles - 6 hours per week. This data covers the last 6 months.

-

49% of American players are payers.

-

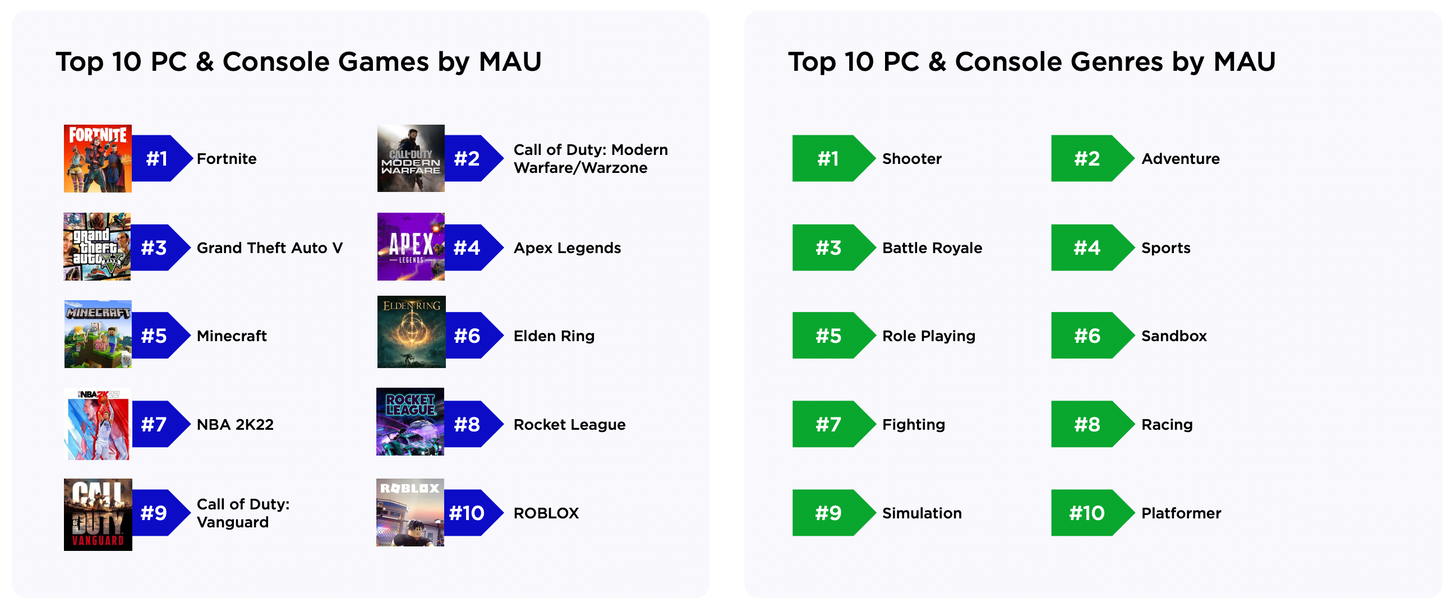

Fortnite, Call of Duty Modern Warfare / Warzone & GTA V are leaders in the US on PC and consoles by MAU.

-

The most popular genres by MAU in the US are Shooters, Adventure games & Battle Royale titles.

Gamma Data: Chinese Gaming Market Revenue is dropping third consecutive month

-

Chinese gaming market revenue in May was $3.4B. The drop to May 2021 was 6.74%.

-

The decrease in the mobile gaming market was 10.85% from the previous year, and 2.15% from the previous month. Overall revenue was $2.48B.

-

Chinese developers and publishers’ revenue in the West in May was $1.44B (-5.8% from the previous month).

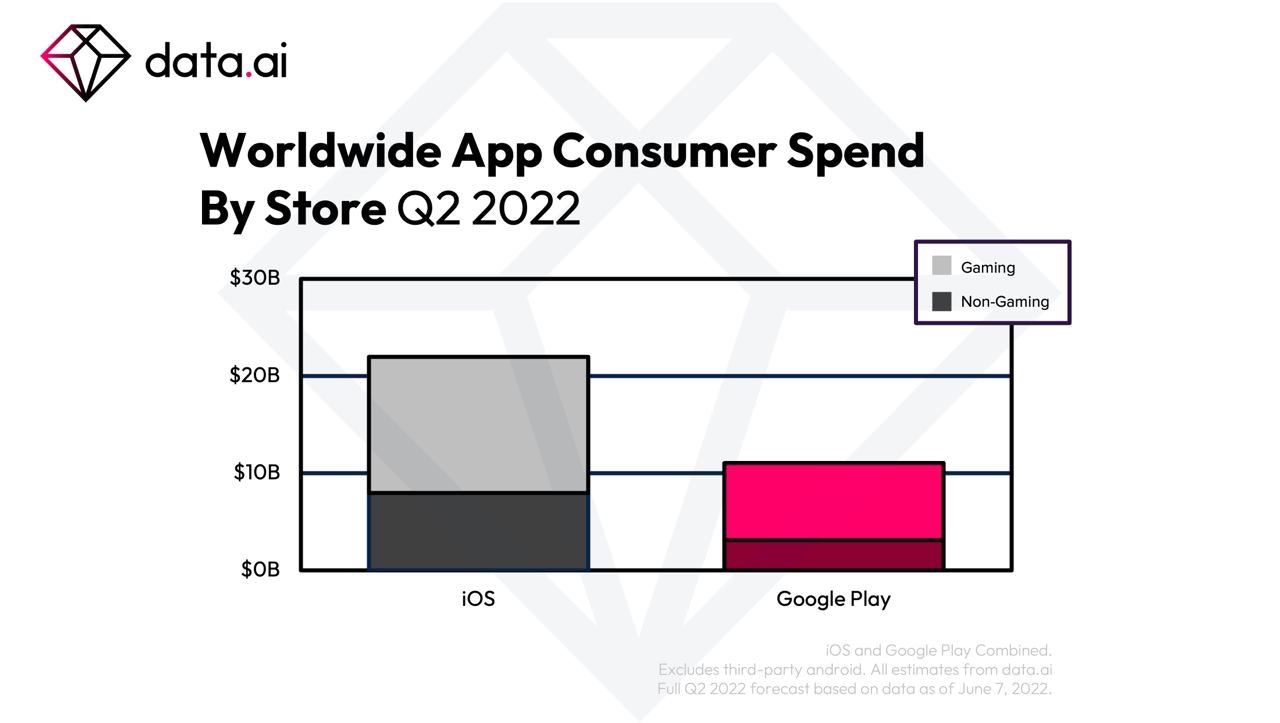

data.ai: Mobile Games will earn $21.4B in Q2 2022

-

There is a 30% increase compared to Q2 2019.

-

Mobile games share will be about 65% of overall mobile revenue in Q2 2022. App Store & Google Play overall revenue will be $33B.

-

The top-grossing genre in Q2 2022 is MMORPG, MOBA, 4X-strategies, Battle Royale, and Action RPG.

-

The top-grossing games of Q2 2022 are Honor of Kings & Genshin Impact.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.