devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the July and August reports.

Table of Content

- AppsFlyer: Games with subscriptions market report (June 2022)

- data.ai: Top mobile games of Q2 2022

- Liftoff: Mobile Casual Games Market Report (2022)

- Niko Partners & Gamescom Asia: Main numbers of the Asian market in 2022

- AppMagic: Top Mobile Games by Revenue and Downloads in August 2022

- Beatstar earned $73M in the first year

- ironSource: App Discovery in 2022

- ironSource: App Monetization in 2022

- GfK & GSD: PlayStation 5 is the best-selling console in the UK so far

- Sensor Tower: Top Grossing Mobile Games of August 2022

- Sensor Tower: 1% of top gaming companies take 93% of mobile revenue

- Appodeal: Performance Index 2022

- Sensor Tower & Homa Games: Arcade Idle Games downloads increased by 2050% in a year

- StreamElements & Rainmaker.gg: Streaming Market State in August 2022

- Newzoo & MAAS: Indian Mobile Gamers Preferences in 2022

- Sensor Tower: Top Mobile Titles by Downloads in August 2022

- Sensor Tower: Mobile Gaming Market will shrink in 2022 by 2.3%

- NPD: The US Gaming Market revenue declined in August 2022

- GSD: European Gaming Market (PC & Consoles) in August 2022

AppsFlyer: Games with subscriptions market report (June 2022)

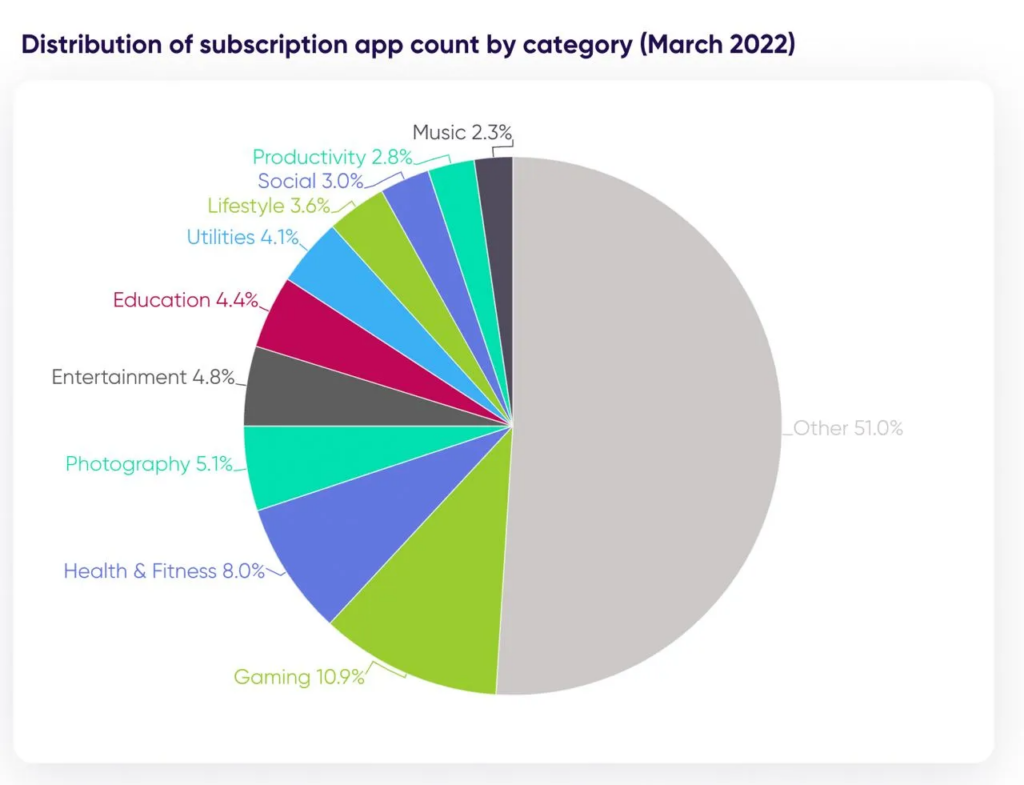

- 10.9% of all apps with subscriptions are games. However, the share of games with subscriptions in the category is much lower than in non-gaming apps.

- Subscriptions are generating 36% of the overall revenue of gaming apps (among those who have subscriptions). In non-gaming titles, this share is much higher - 82%.

-

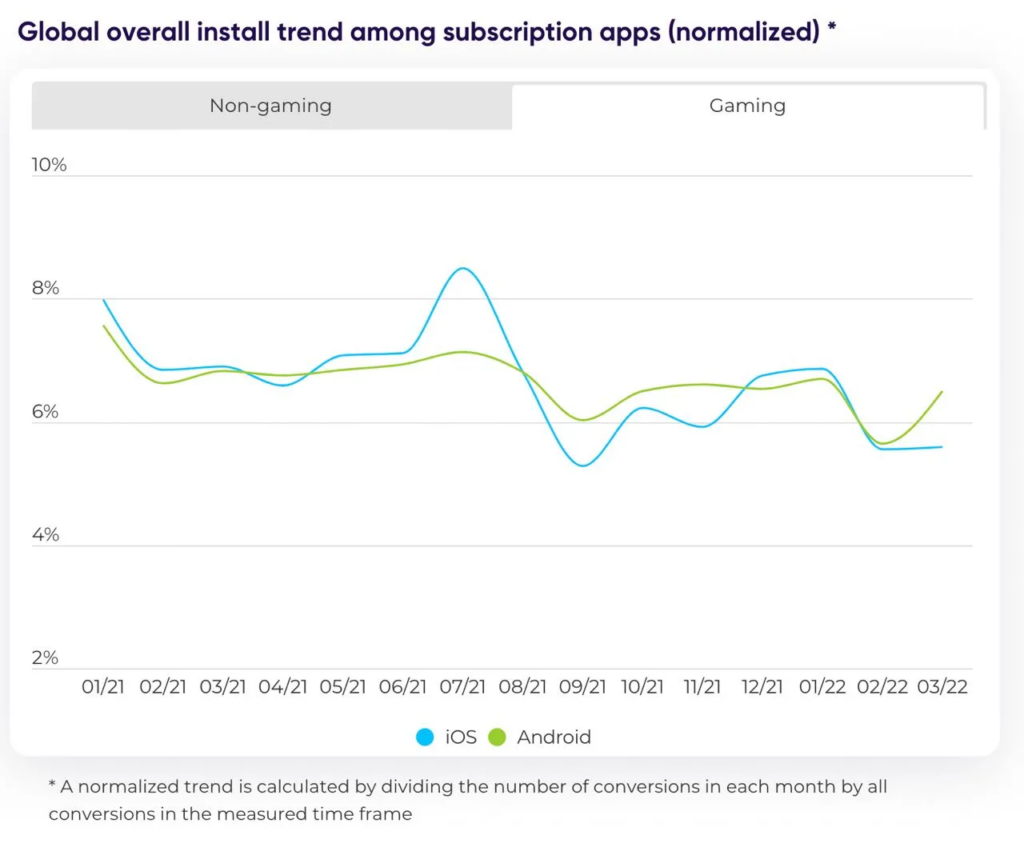

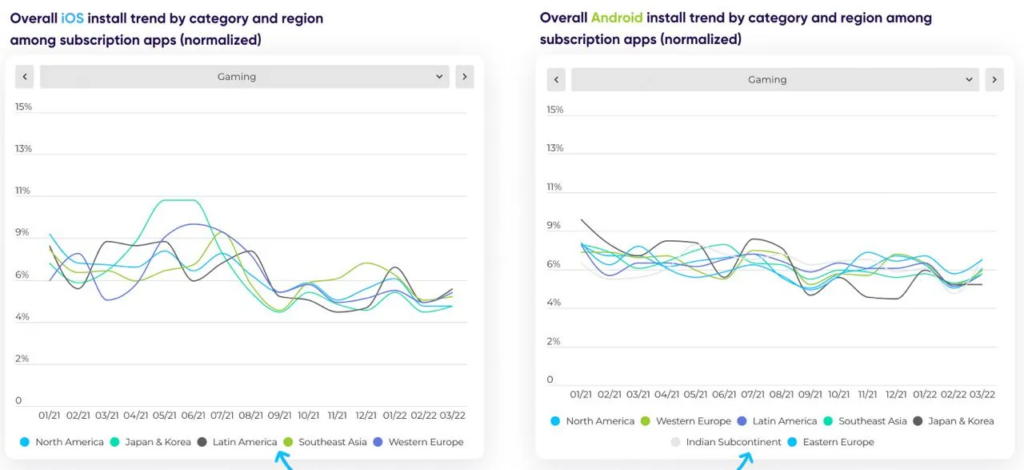

Downloads of games with subscriptions dropped by 18% on iOS and 8% on Android from August 2021 to March 2022.

-

Paid downloads of casual gaming titles with subscriptions grew in January 2022 by 33% YoY. Paid downloads of mid-core games in the same period fell by 40%.

-

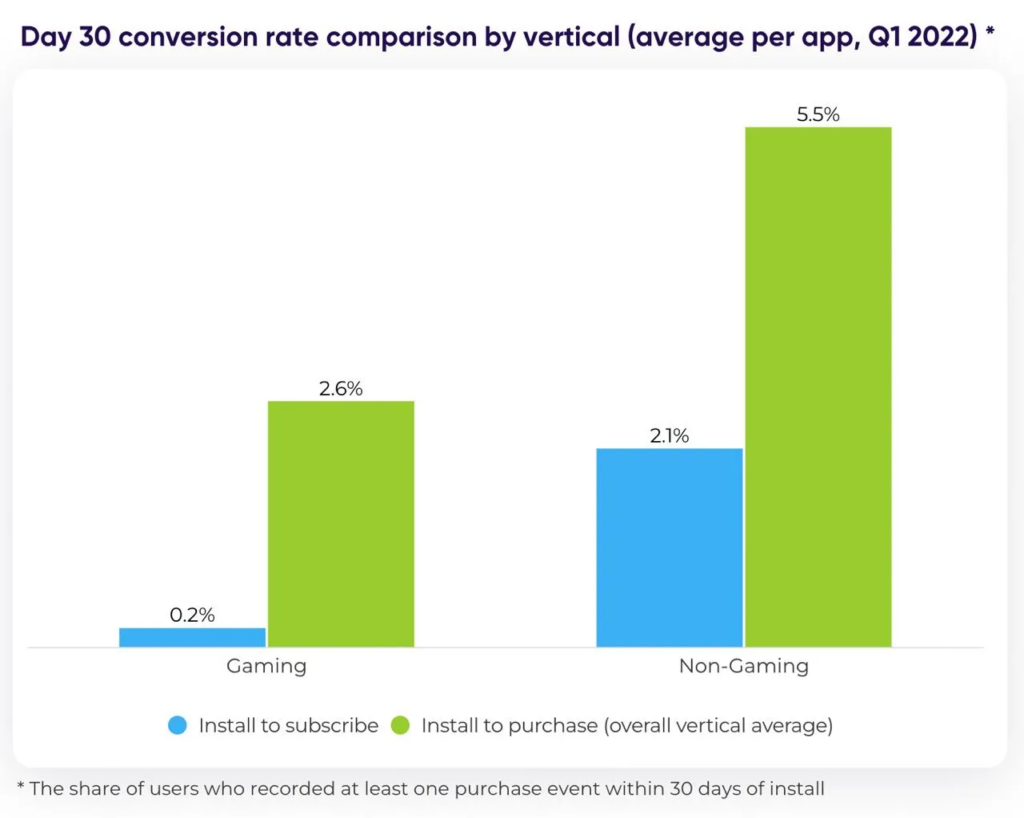

An average conversion from installing to subscription in 30 days in Q1 2022 in games is just 0.2%. Conversion to the purchase is 2.6%. Non-gaming apps are showing much better results in the same period - conversion to subscription is 2.1%; conversion to purchase is 5.5%.

-

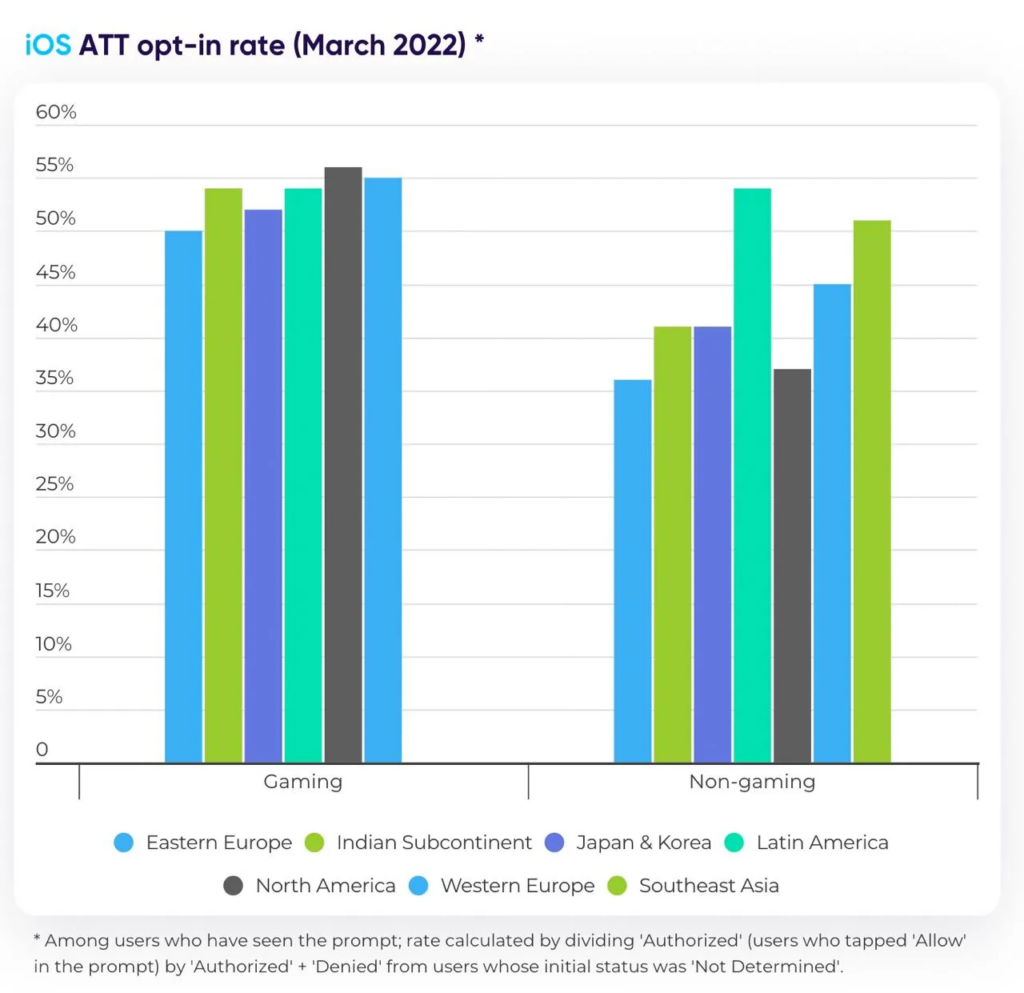

Gaming apps with subscriptions have one of the best ATT Opt-in rates - 54%.

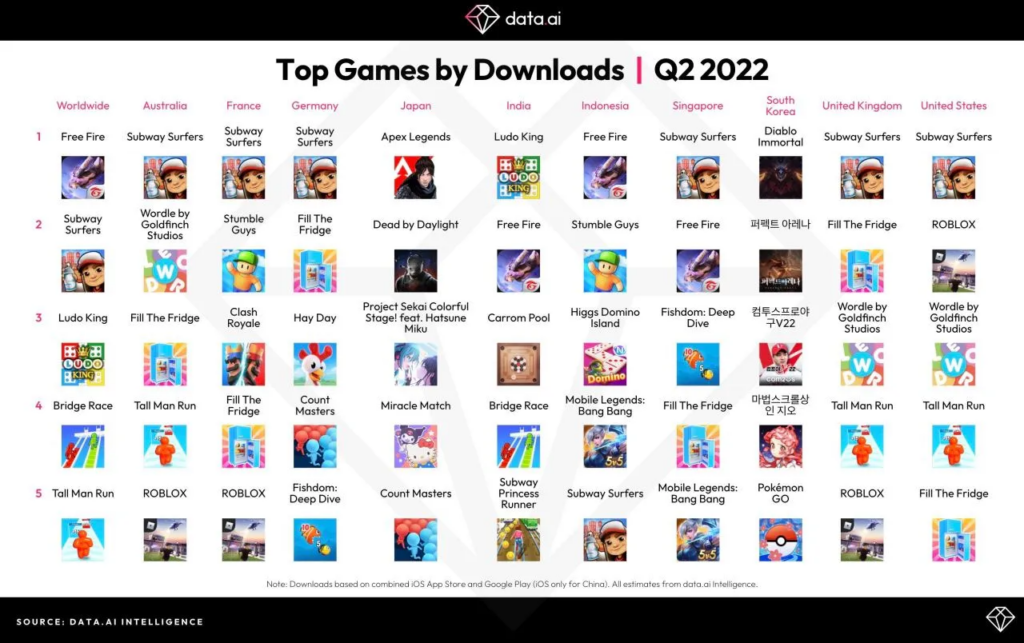

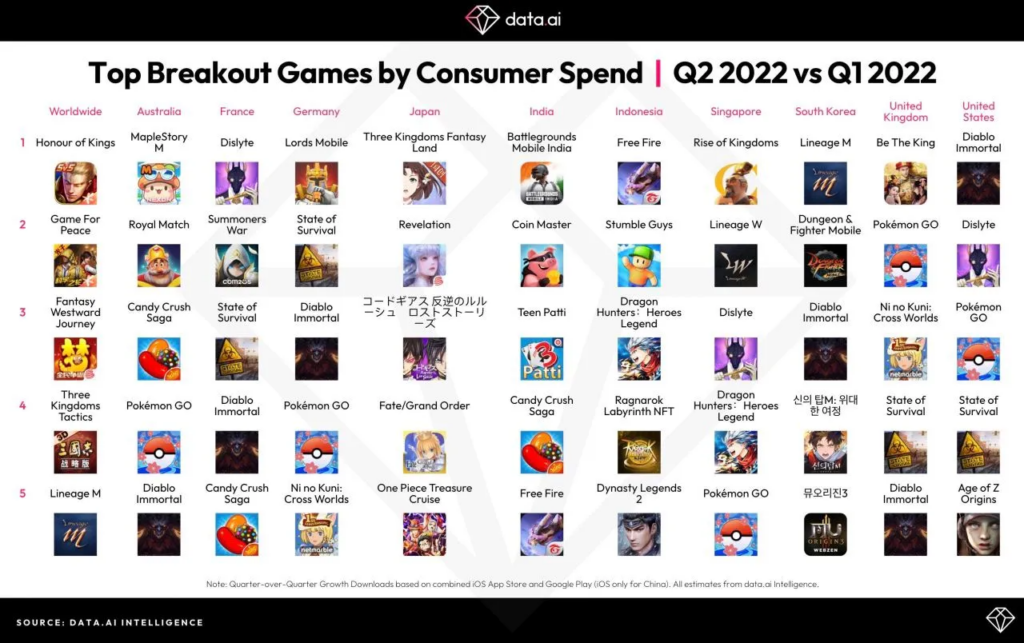

data.ai: Top mobile games of Q2 2022

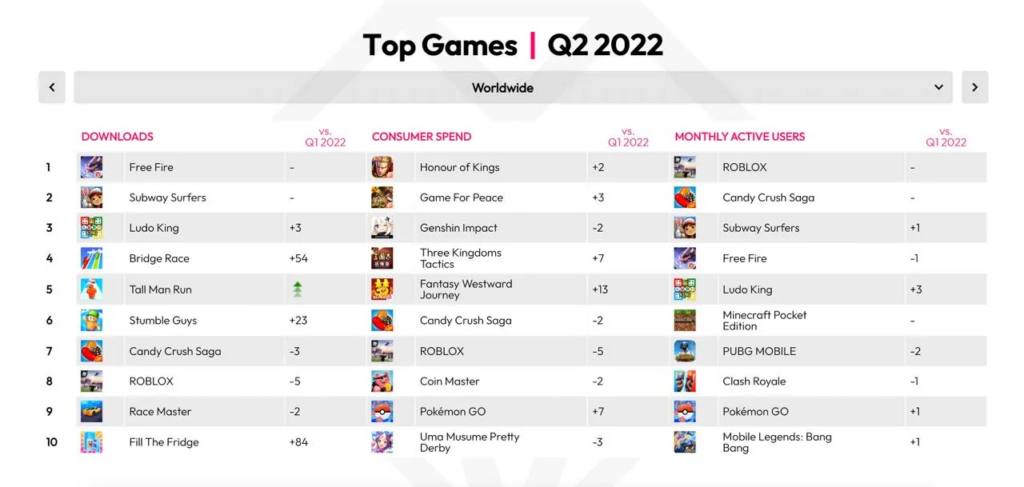

- Garena Free Fire and Subway Surfers remained the leaders by downloads in Q2 2022.

- Leaders by revenue are Honor of Kings, Game for Peace, and Genshin Impact.

- Pokemon GO is showing great results, the game managed to achieve top-5 in many major countries. It’s connected with the start of a new season and Pokemon GO Fest 2022.

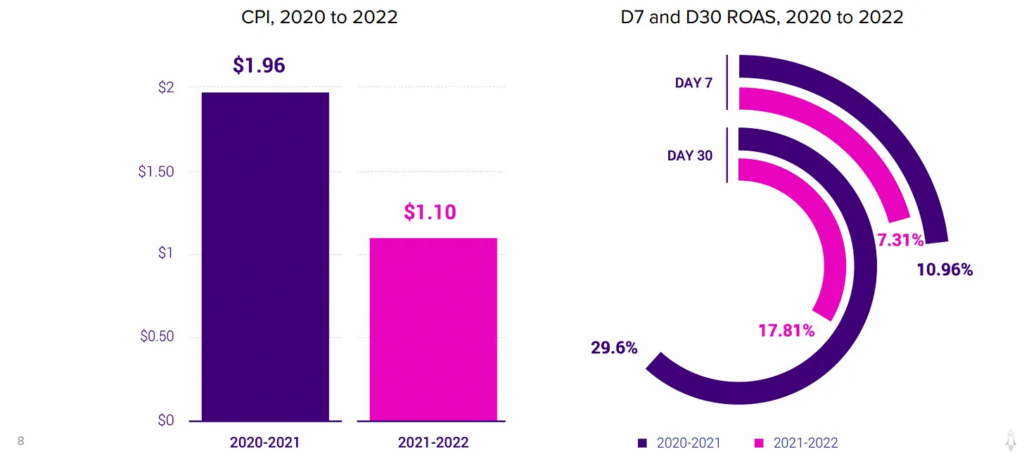

Liftoff: Mobile Casual Games Market Report (2022)

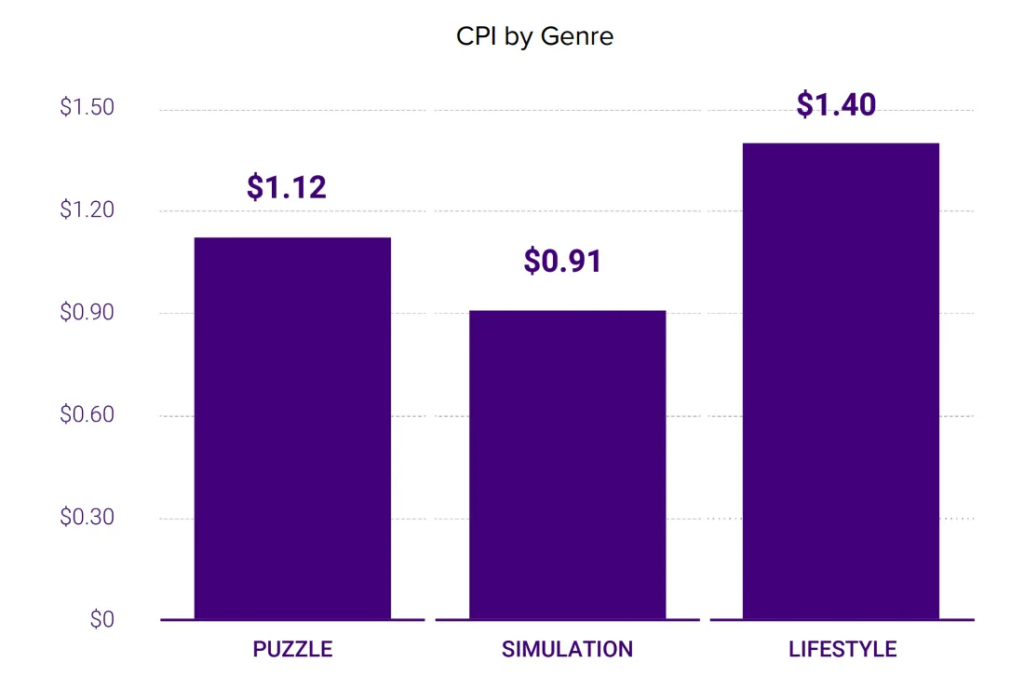

Liftoff refers to casual titles Lifestyle games (interactive stories, decorative games, music & rhythm games e.t.c.), puzzles (Match-3, Hidden Object, Solitaire, Word games, Trivia e.t.c.), and Simulation games (tycoons, city-builders, etc.).

- Liftoff's research is based on 76.1B impressions; 3.4B clicks, and 58.5M installs.

General information

-

The mobile gaming market is about 60% of the overall gaming market. Revenue from mobile games is 3.3x times higher than from the console market, which is second.

-

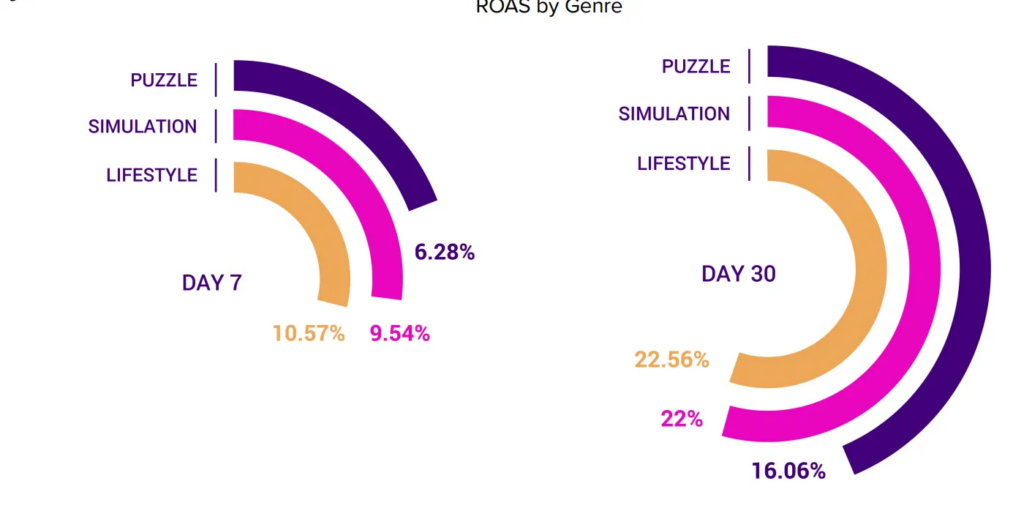

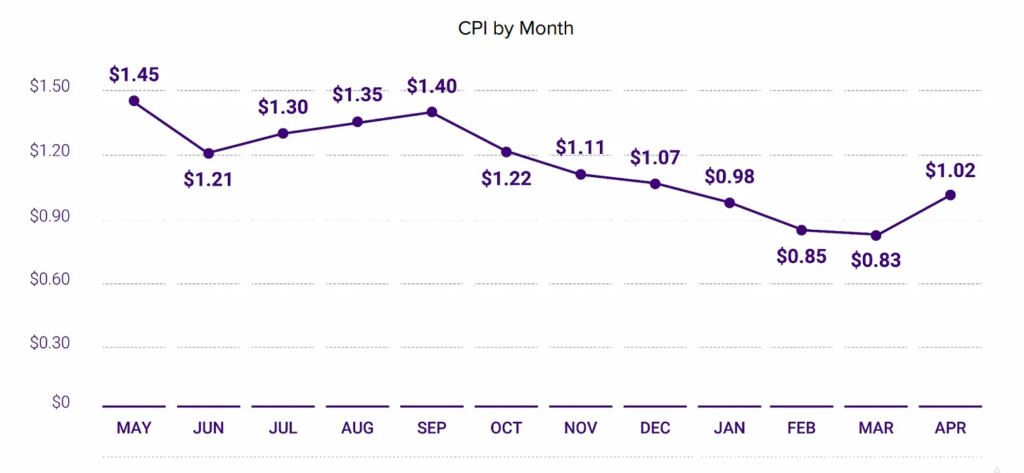

The average CPI decreased from $1.96 (2020-2021) to $1.10 (2021-2022). However, D7 ROAS decreased too - from 10.96% (2020-2021) to 7.31% (2021-2022). D30 ROAS experienced a more dramatic drop - from 29.6% (2020-2021) to 17.81% (2021-2022).

-

Lifestyle games, despite the largest average CPI ($1.4) are showing the best D7 ROAS (10.57%), and D30 ROAS (22.56%).

-

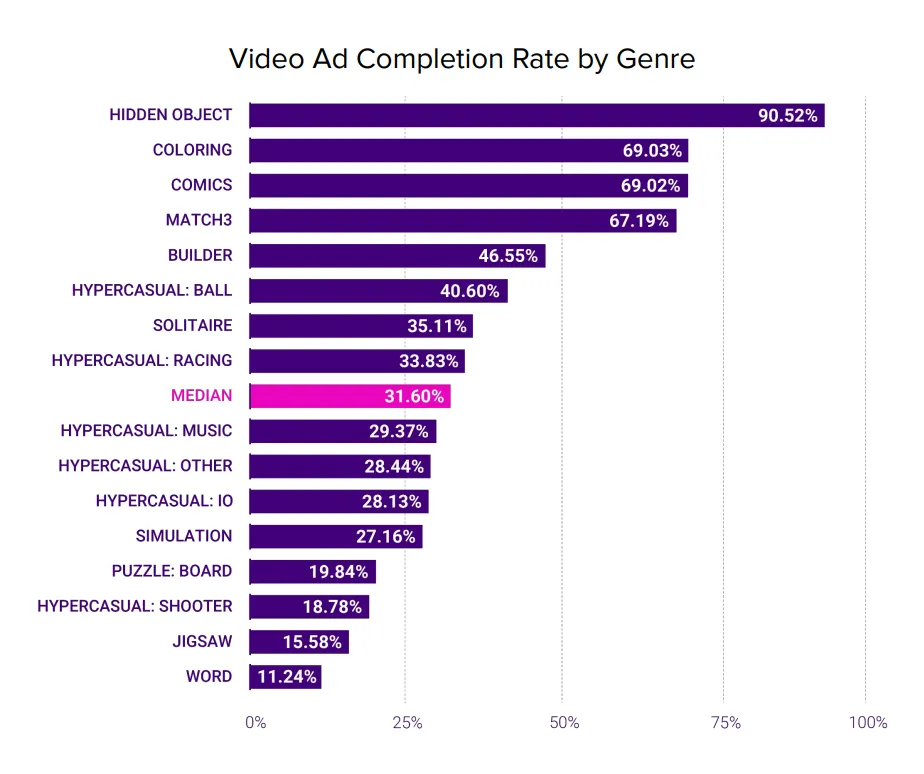

90.52% of Hiddeo Object users are watching video ads by the end. It’s a 60% difference from the median number.

-

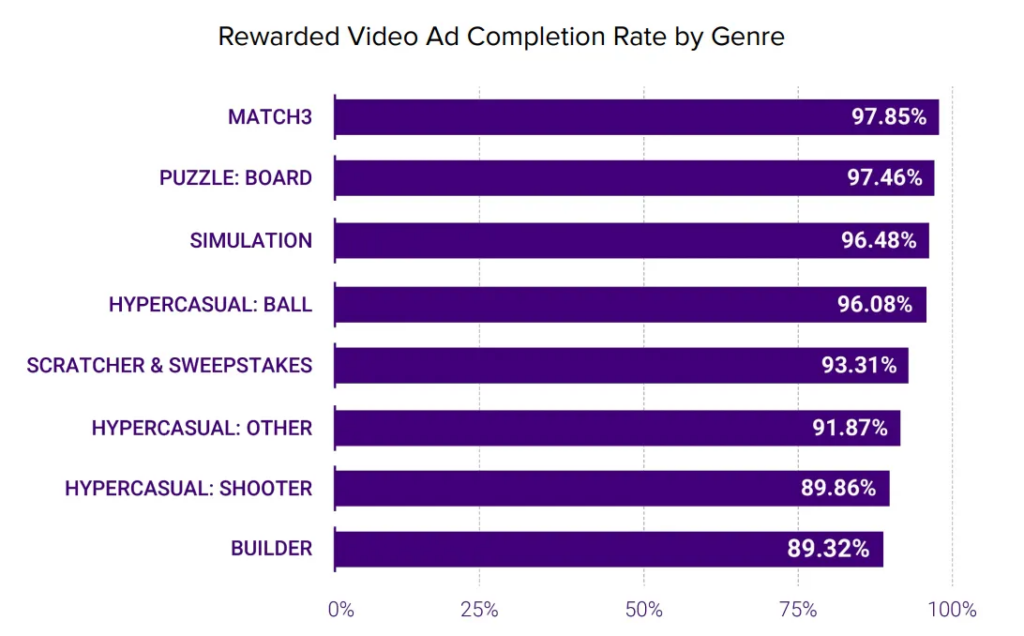

97.85% of Match-3 users are watching Rewarded Videos to the end.

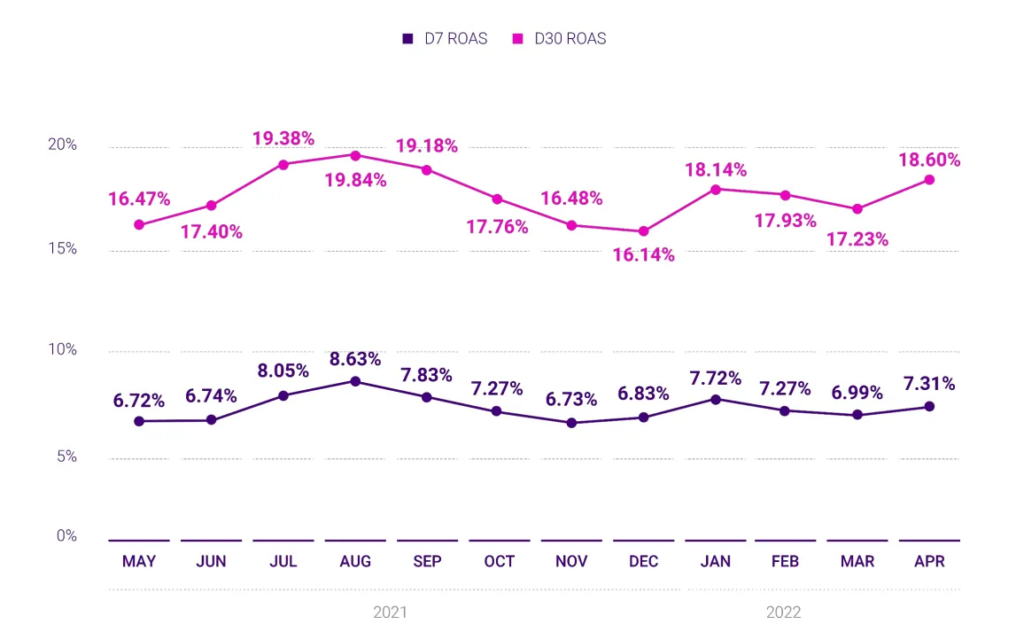

CPI & ROAS trends

-

Average CPI dropped after the IDFA. The peak happened in May 2021 ($1.45), and in April 2022 the average CPI was about $1.02.

-

The average D7 ROAS in the first months of 2022 was about 7%. D30 ROAS was about 17-18%.

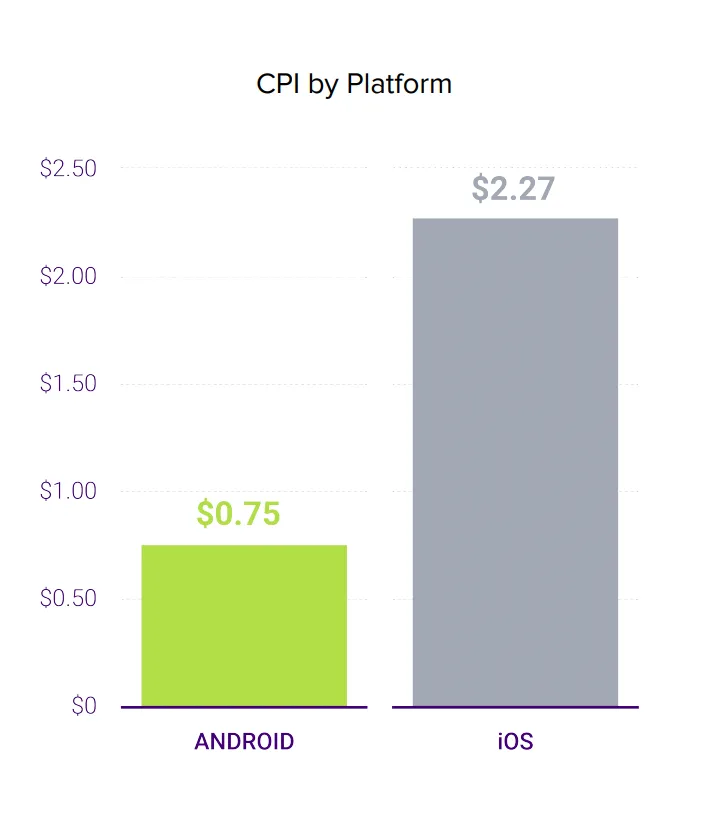

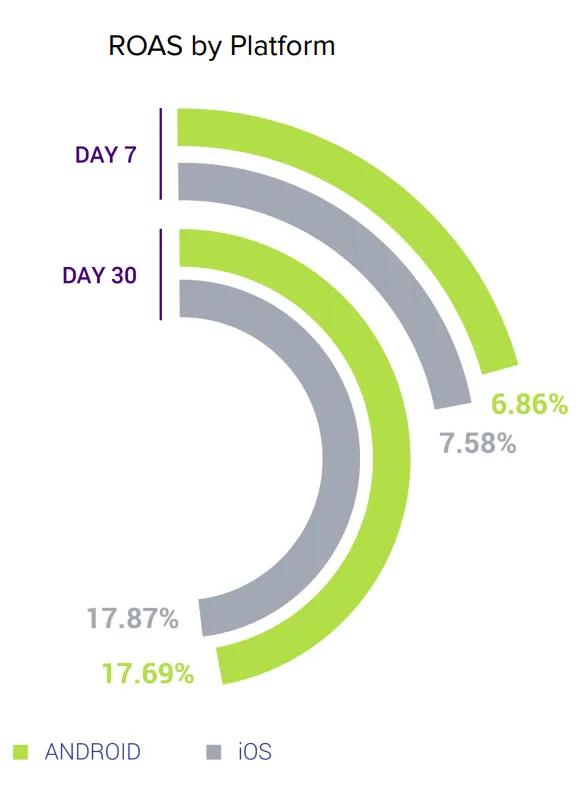

Android vs. iOS

-

After the IDFA, iOS users started to cost about $2.27, and only $0.75 on Android.

-

Both iOS and Android are showing similar numbers in terms of D7 and D30 ROAS. There is less than a one percent difference.

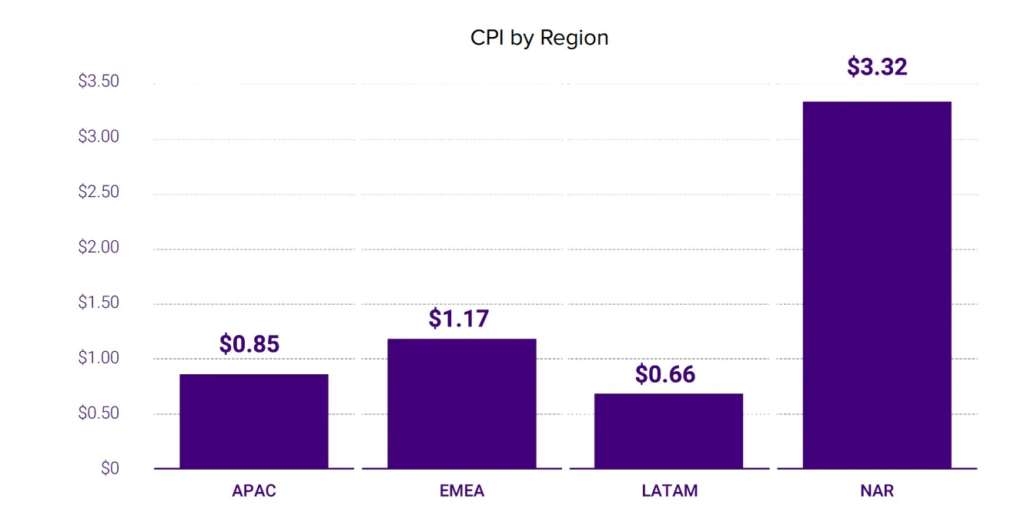

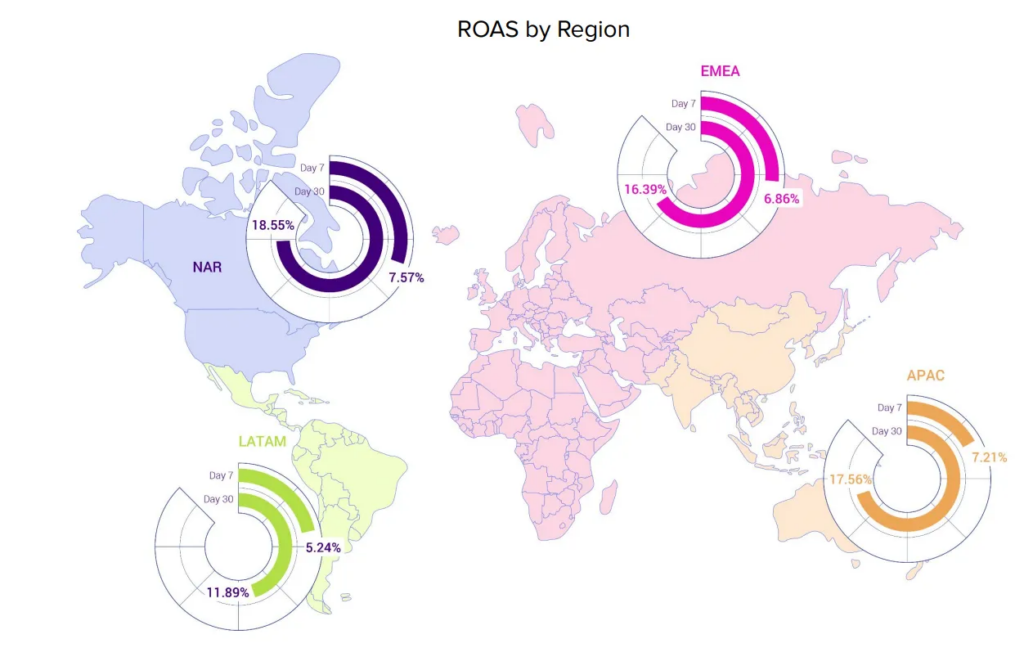

Regional trends

-

The cheapest users are in the LATAM region - $0.66 per install. The most expensive ones - in North America - $3.32.

-

However, Latin American users are showing the worst results with D7 ROAS (5.24%) and D30 ROAS (11.89%) despite low CPIs. The best results are shown by the North American region with a D7 ROAS of 7.57%, and a D30 ROAS of 18.55%. EMEA and APAC regions are having only slightly worse results.

Liftoff: Mobile Casual Games Market Report (2022) Download

Niko Partners & Gamescom Asia: Main numbers of the Asian market in 2022

-

Asian market size by the end of 2022 will be $82B (55% of the overall). There are 1.47B gamers in the region.

-

The six largest countries of Southeast Asia (Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam) are responsible for 6% of Asian gaming revenue & 19% of Asian gamers.

-

Those countries’ revenue in 2022 will reach $5B with 270M gamers in them. It’s important to mention, that from 2020 to 2025 the region will show a CAGR of 8.6% which will make it one of the fastest growing in the world.

-

There are more than 200M E-Sports watchers in Southeast Asia.

-

About 40% of Southeast Asian gamers are female. In some countries (Singapore, Indonesia), female gamers’ audience is similar to the males’.

AppMagic: Top Mobile Games by Revenue and Downloads in August 2022

Revenue:

-

Honor of Kings is still earning more than everyone - $168.5M.

-

Candy Crush Saga with $56.7M revenue became the leader on Android. Additional $47.8M the game earned from App Store.

-

The Chinese version of Diablo Immortal earned $66.1M in August.

Downloads:

-

Stumble Guys, Fall Guys: Ultimate Knockout copycat bought by Scopely yesterday, continues to lead the download charts. The game was downloaded 39.6M times in August.

-

Subway Surfers is second with 35.5M downloads.

-

Survivor!.io, a new game from Archero developers, is showing great numbers. Its global version has been downloaded on iOS 5.9M times; Chinese - 2.87M times.

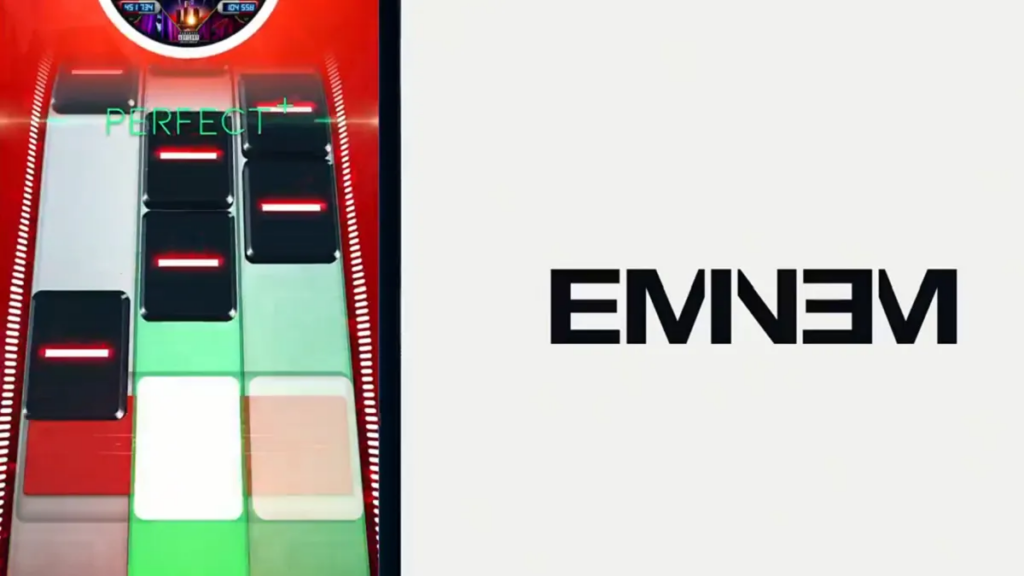

Beatstar earned $73M in the first year

-

The game from Space Ape was downloaded 38M times.

-

Developers paid music labels $16M in the year for the right to use their artists’ songs.

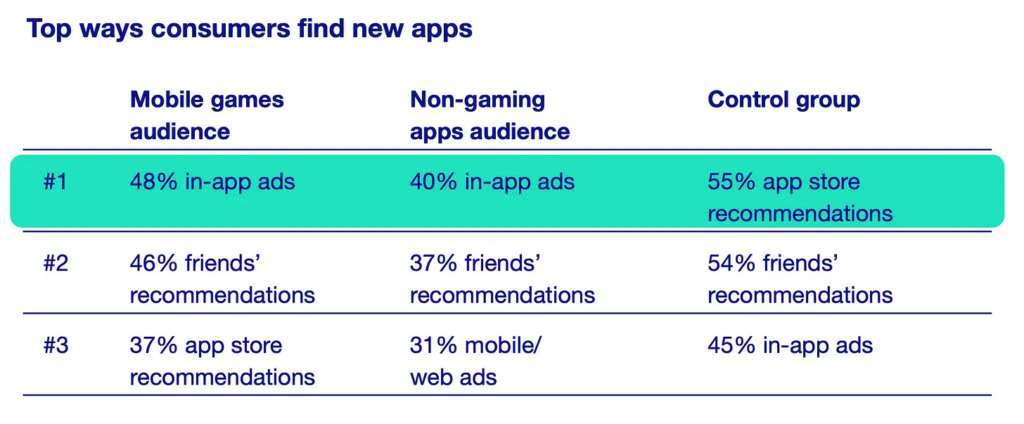

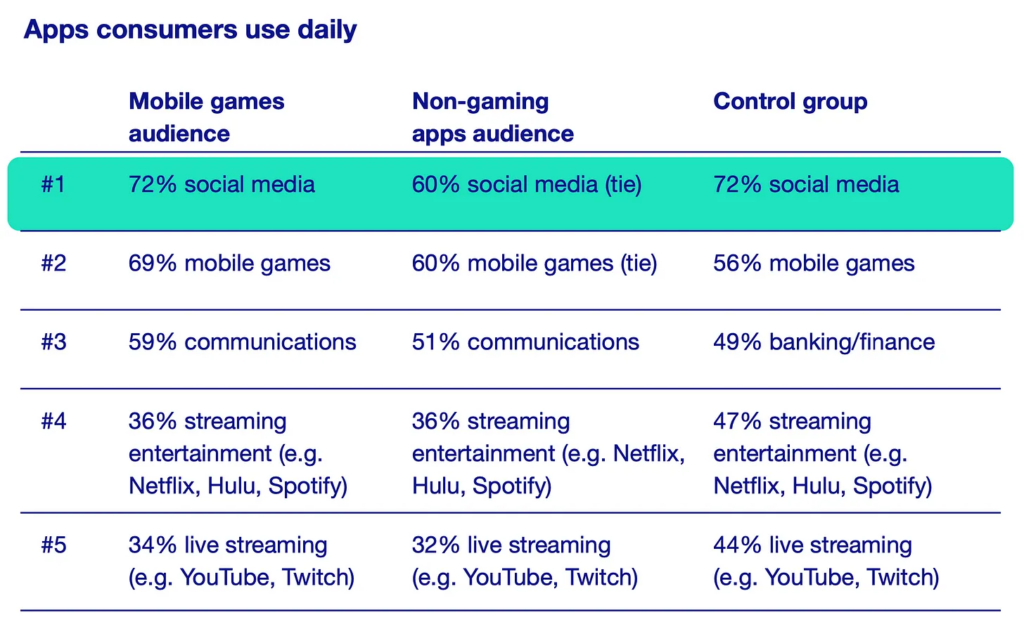

ironSource: App Discovery in 2022

ironSource surveyed 18,894 mobile gamers and 11,563 users of non-gaming apps. On top of that, the company talked with 500 random people to verify the results.

-

70% of gamers and 78% of users of non-gaming apps downloaded apps after watching a mobile ad.

-

48% of users are finding new games through the ads. 46% are relying on friends’ recommendations. 37% find new games in store recommendations.

-

35% of gamers are downloading new apps in their free time, on vacation, or on holidays. 29% are downloading new games when it’s necessary. 23% - when setting up the new device.

-

Users think that video ads, app store ads (like Apple Search Ads), and interactive ads are the most useful formats for finding new apps. 32% of the gaming audience prefers store ads.

-

55% of mobile gamers notice mobile ads if it’s relevant. 37% are attracted to humor. 36% motivates an opportunity to get an in-app reward.

-

60% of non-gaming app users are playing games.

ironSource: App Discovery in 2022 Download

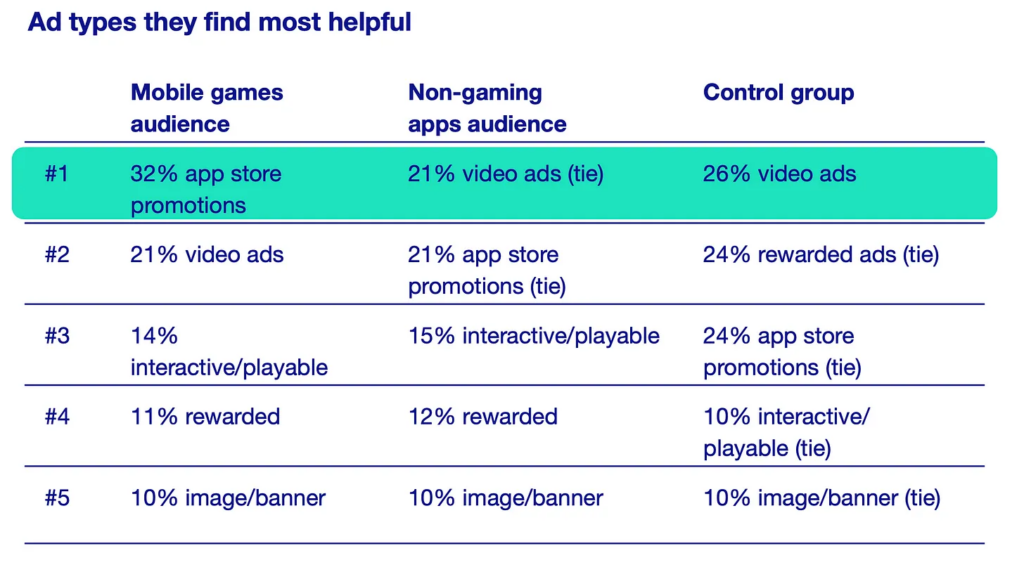

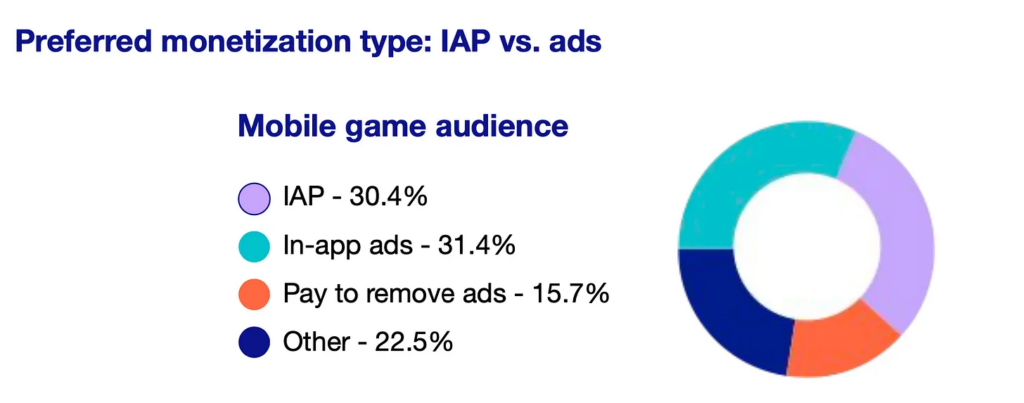

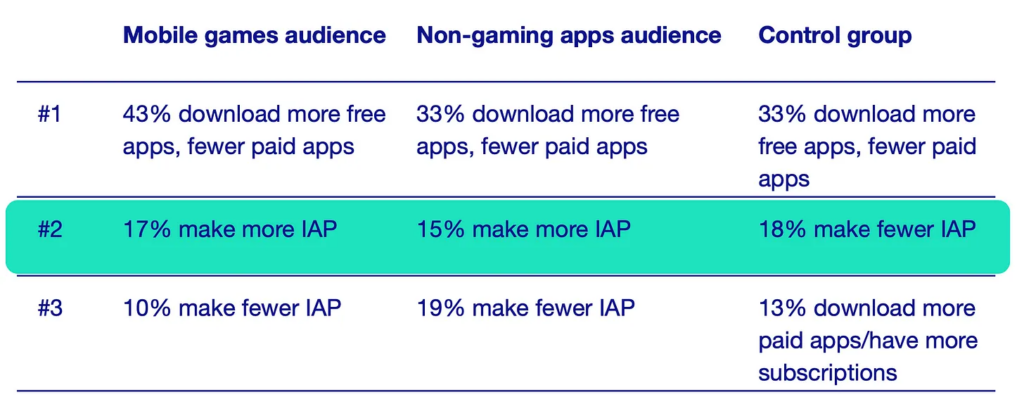

ironSource: App Monetization in 2022

ironSource surveyed 18,894 mobile gamers and 11,563 users of non-gaming apps. On top of that, the company talked with 500 random people to verify the results.

-

30.4% of the gaming audience prefers traditional IAP. 31.4% are ready to watch ads. 15.7% will be happy to pay to turn off ads. The rest 22.5% didn’t define their payment preferences.

-

24% of zoomers can’t stand ads and are ready to pay to turn it off.

-

43% of mobile gamers in the last 5 years started downloading more free apps. 17% started to pay more. 10% started to spend less.

-

35% of mobile gamers never paid in apps. 20% made purchases up to $5. 18% had experience with small payments of around $1.

-

Regarding behavior inside one app, 37% of players can make occasional purchases of a few bucks. 28% never do the IAP. 16% are buying bundles with the price of $10-20.

GfK & GSD: PlayStation 5 is the best-selling console in the UK so far

-

PlayStation 5 sales in August increased by 56% compared to July.

-

The growth allowed PlayStation 5 to become the most selling console in the UK so far. However, Nintendo Switch is feeling good too - the system in August 2022 increased sales by 4%.

-

Xbox Series S|X sales remained on more or less the same levels.

-

About 125k consoles were sold in August 2022, which is a 20% growth MoM. Despite this, console sales are decreasing. In the first 8 months of 2022 about 880k consoles have been sold. It’s 30% less than in January-August 2021.

-

1.67M games were sold in the UK in August 2022. It’s a 10% decrease YoY and a 3% decrease MoM.

-

The new Saints Row became the best-selling game of the month. Lego Star Wars: The Skywalker Saga is second.

-

547,122 accessories have been sold in August 2022. The decrease to the previous month is 0.7%, to the previous year - 14.5%. DualSense is holding the first position with White & Black versions of it being top sellers.

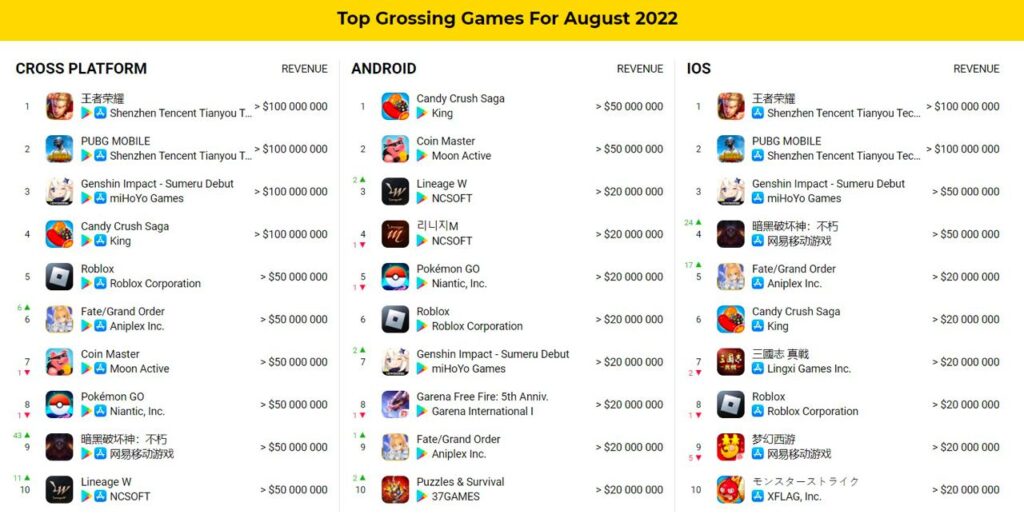

Sensor Tower: Top Grossing Mobile Games of August 2022

-

Honor of Kings is traditionally the first with $222M of revenue. 94% came from China, 2.3% from Taiwan, and 1.8% from Thailand.

-

PUBG Mobile was second - players spent $156.3M in August. 60.7% of revenue came from China, and the US with an 8.8% share is next.

-

Diablo Immortal earned $97M in August - 42% more than in July. The increase is connected with a launch in China, which is responsible for 61% of overall revenue. The US users are responsible for 16% of the money.

-

Overall players spent $6.6B on App Store & Google Play in August 2022. It’s 12.4% lower than it was last year.

-

The US is first in revenue with $1.9B and 28% of the overall market, Japan is next (20%), and China is third (17.4%) - but in the case of China Sensor Tower is not covering third-party stores, so the real share is higher.

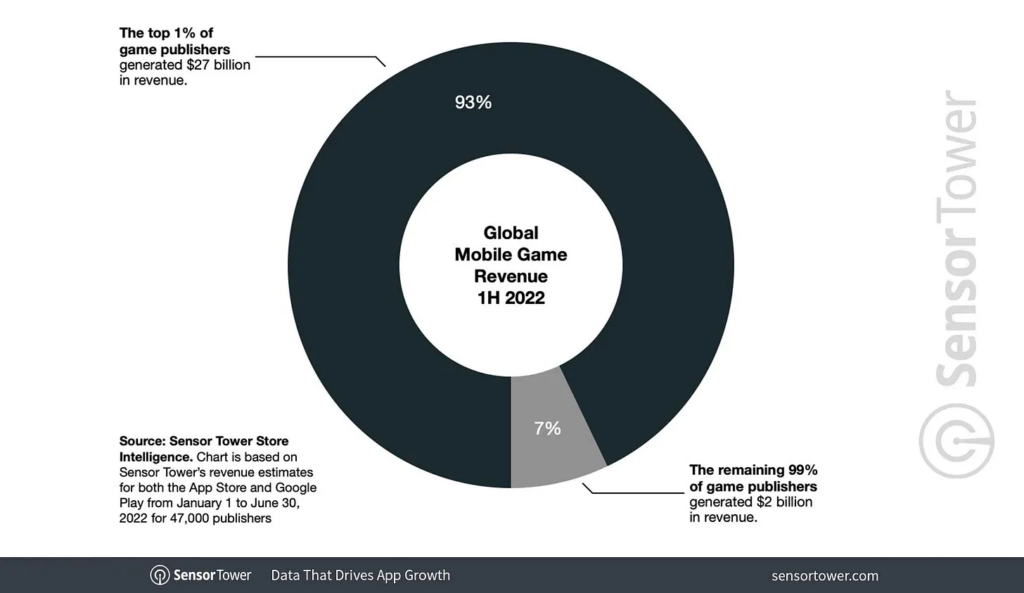

Sensor Tower: 1% of top gaming companies take 93% of mobile revenue

The research covers the first half of 2022.

Revenue

-

In the first half of 2022, there were about 46 thousand mobile publishers with revenue. The First 460 earned $27B which is 93% of the market. The remaining 46 thousand shares the 7% of the market ($2B).

-

Tencent earned $2.6B on mobile in H1 2022 - about 10% of the top-publishers revenue.

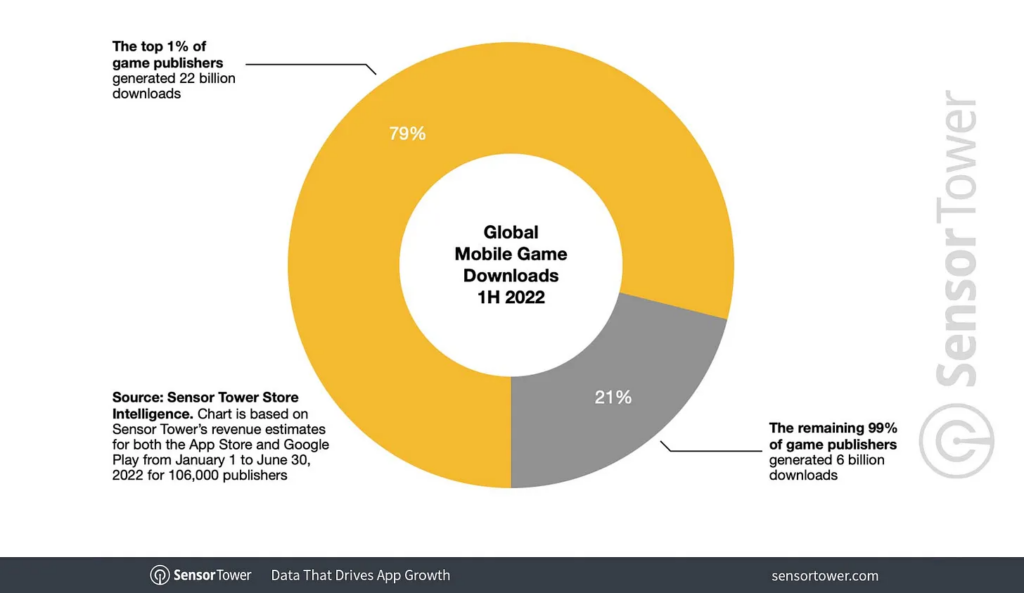

Downloads

-

In H1 2022 about 106 thousand mobile gaming publishers had at least 1 download. 79% of downloads (22B) were taken by the 1% of the most successful companies. Other 99% were forced to be content with the remaining 21% of the market (6B).

-

Ten top gaming companies by downloads (AppLovin, Embracer Group, SuperSonic Studios e.t.c.) were responsible for 22% of downloads (more than 5B).

General situation

-

The share of the top companies in the overall revenue in H1 2022 decreased from 95% to 93%.

-

Share in downloads decreased from 81% to 79%.

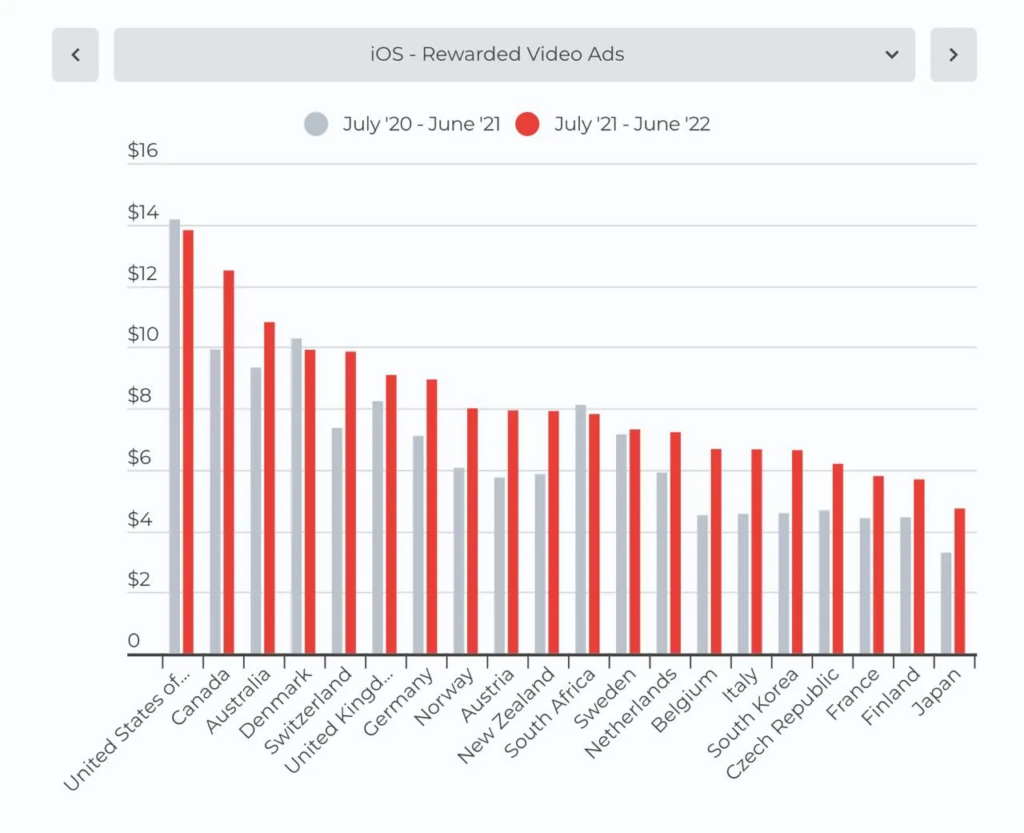

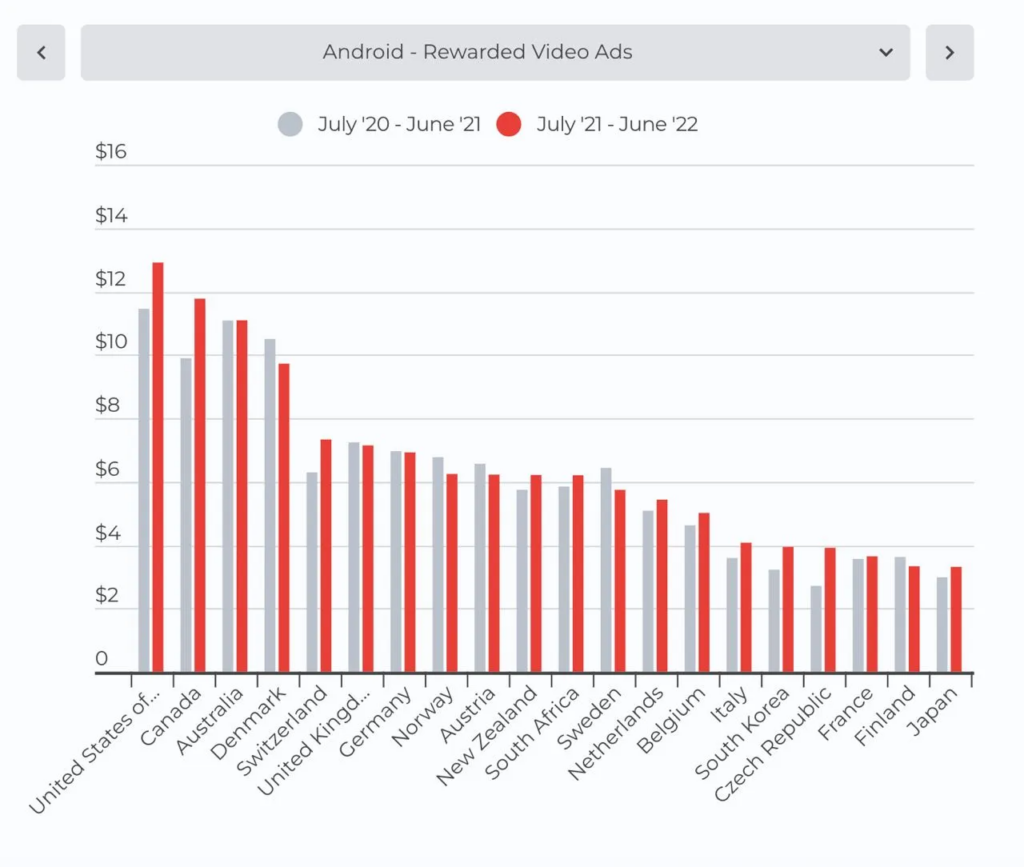

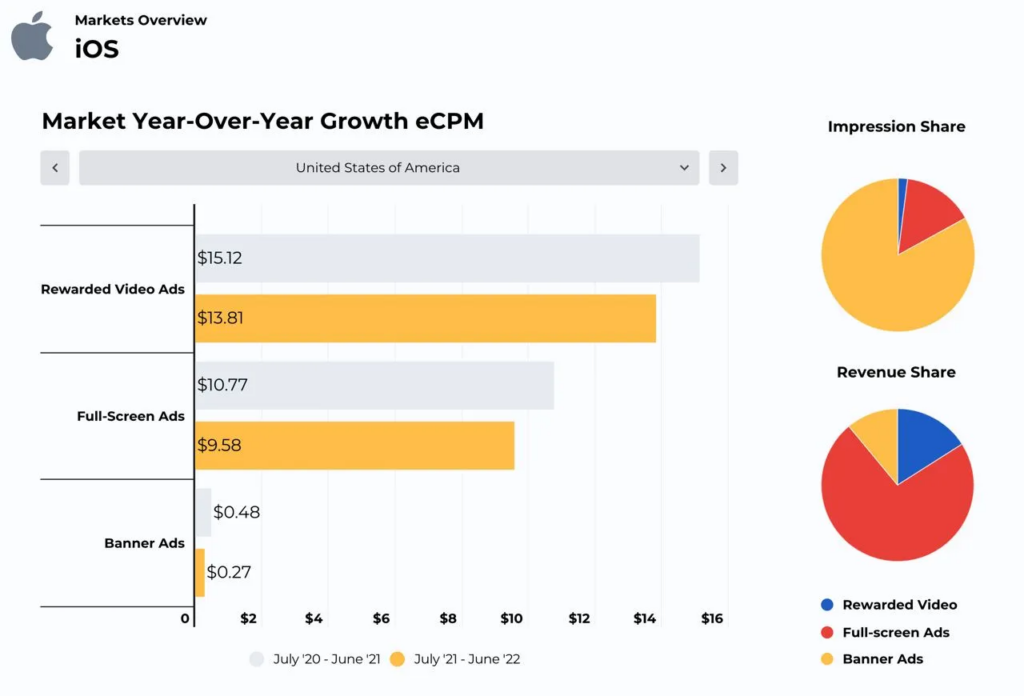

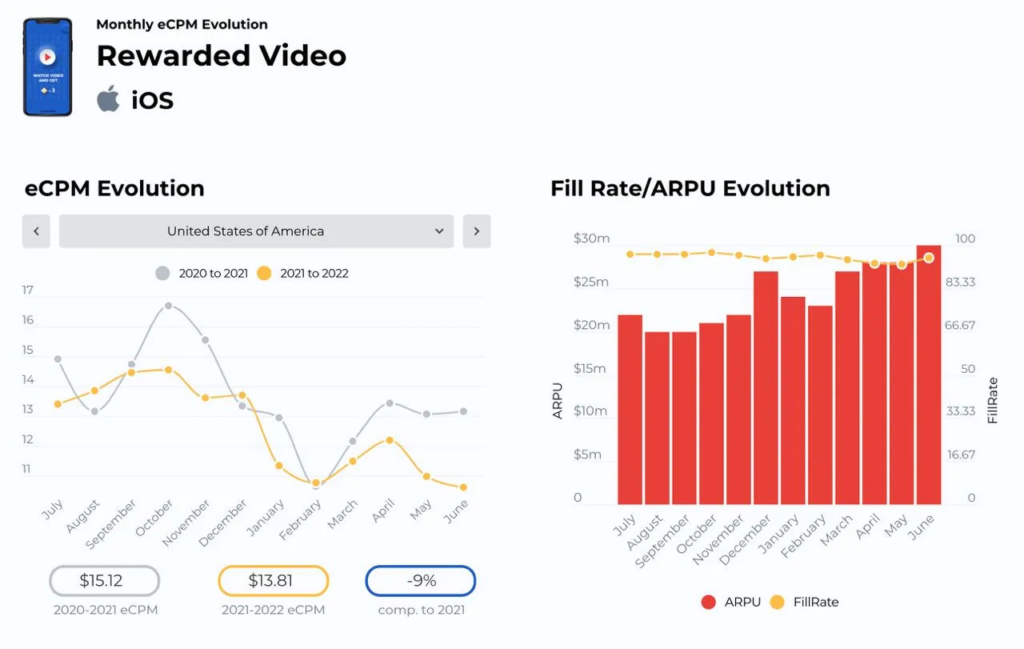

Appodeal: Performance Index 2022

Appodeal studied 100k apps, 70+ ad sources, 2 platforms (iOS + Android), and 3 ad formats - Rewarded Video, Interstitial, and Banners, in 6 key regions from July 2021 to June 2022. The report is based on more than 200B impressions.

eCPM

-

eCPM in the US on iOS dropped (from $15.12 to $13.81 in Rewarded Video ad formats), in other regions it grew or stayed on the same level.

-

eCPM on Android increased or remained the same in all regions.

-

The MENA region is showing growth by eCPM on all platforms and ad formats despite banner ads on iOS.

Fill Rates & ARPU

-

In H1 2022 only the US managed to keep those metrics on the previous level. In all other European countries, those metrics went down.

There is an ad networks rating and a list of ad sources & DSP available in the full version.

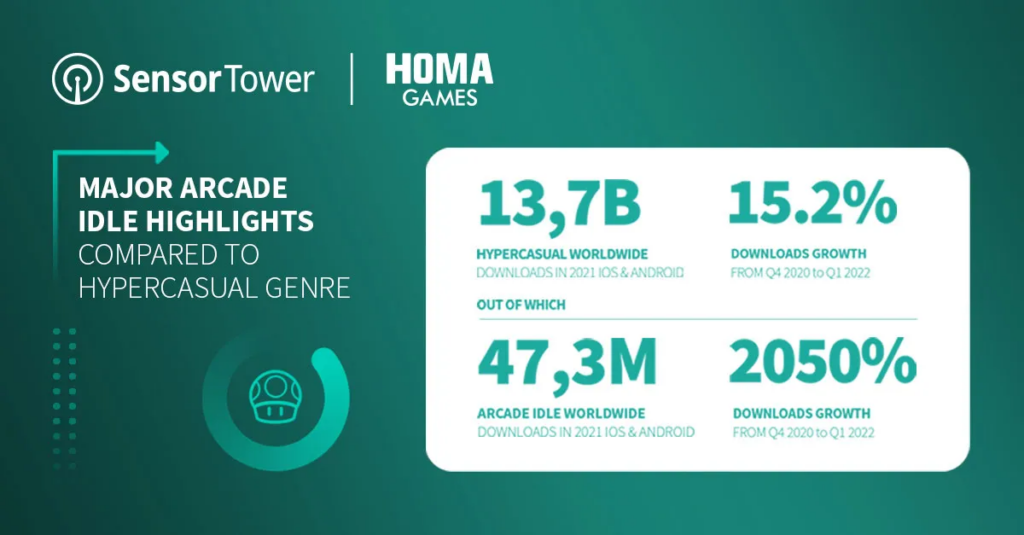

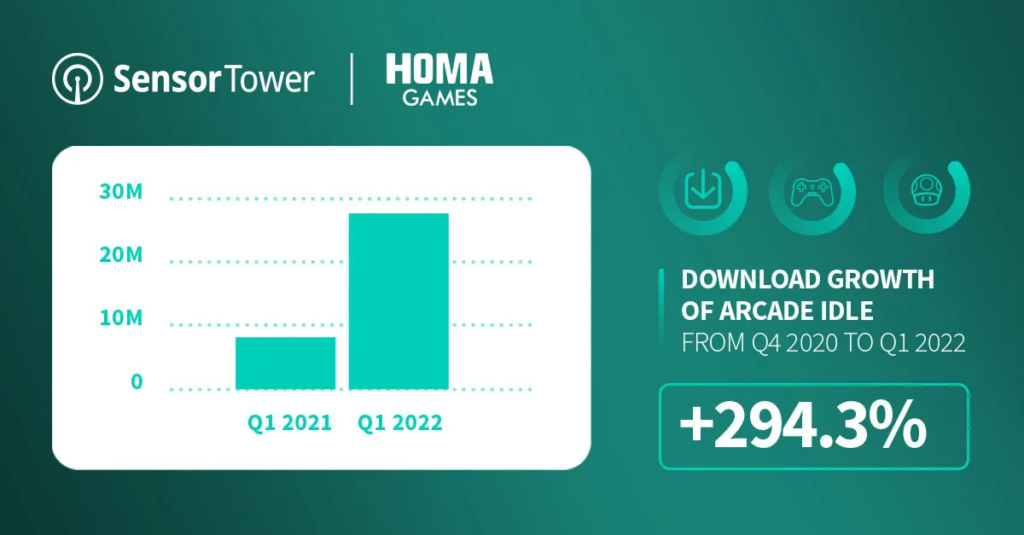

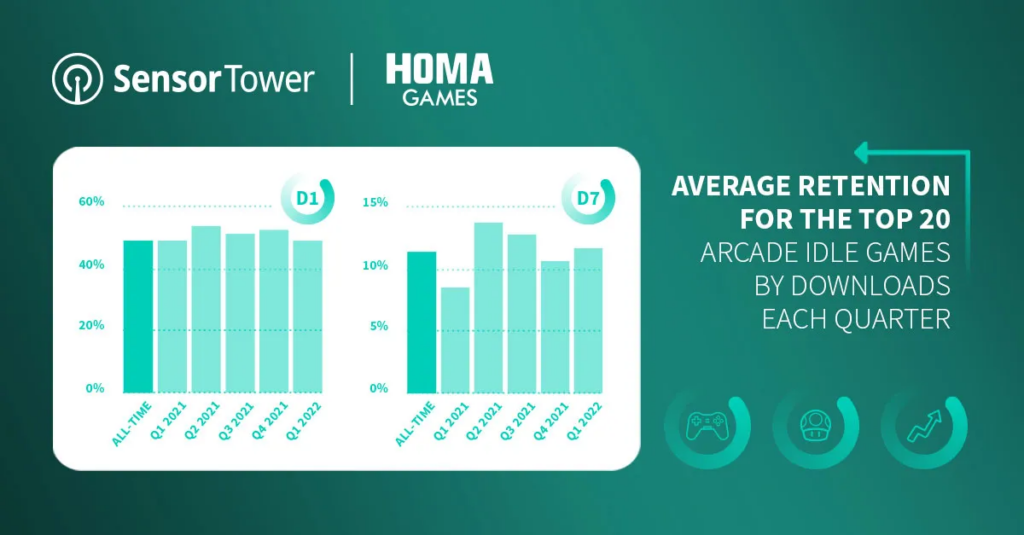

Sensor Tower & Homa Games: Arcade Idle Games downloads increased by 2050% in a year

-

47.3M Arcade Idle games have been downloaded in 2021 on iOS and Android. The number of downloads in Q1 2022 is 2050% more than it was in Q4 2020.

-

However, there must be a low base effect, because the difference in downloads between Q1 2022 and Q1 2021 is “just” 294.3%.

-

Arcade Idle games from the top 20 (WW) are showing D1 Retention between 48% and 52%. Day 7 varies from 7% to 13%.

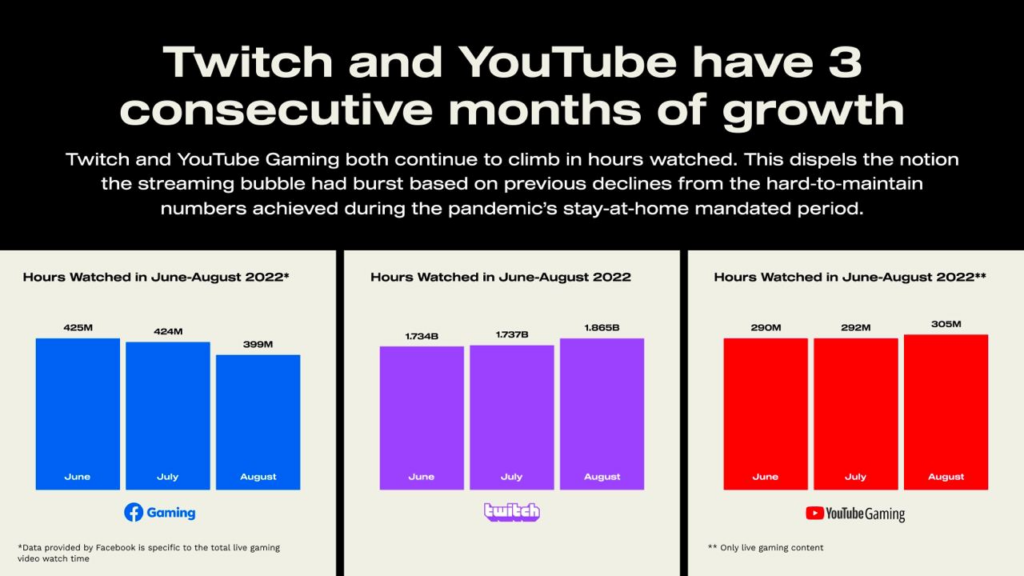

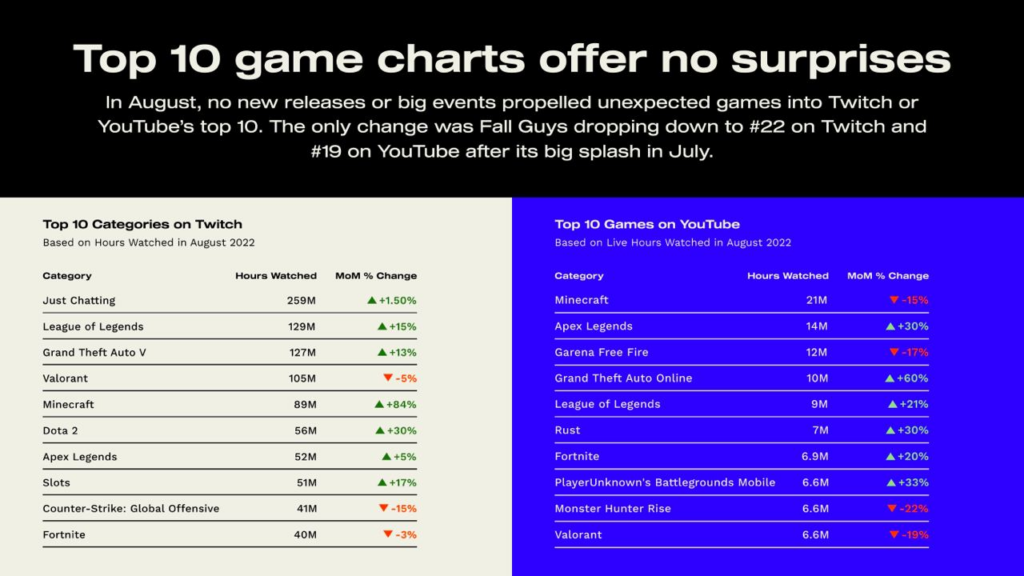

StreamElements & Rainmaker.gg: Streaming Market State in August 2022

-

Twitch & YouTube are growing for the third consecutive month. Twitch reached 1.865B watched hours (+3% MoM); YouTube Gaming shows 4% growth with 305M hours.

-

League of Legends (129M watched hours), GTA V (127M hours), and Valorant (105M hours) are leaders on Twitch. YouTube's first places are Minecraft (21M hours), Apex Legends (14M hours), and Garena Free Fire (12M hours).

-

50% of streamers from Twitch in the top 10 in August 2022 were from Latin America. YouTube’s top 10 had 5 streamers from Japan.

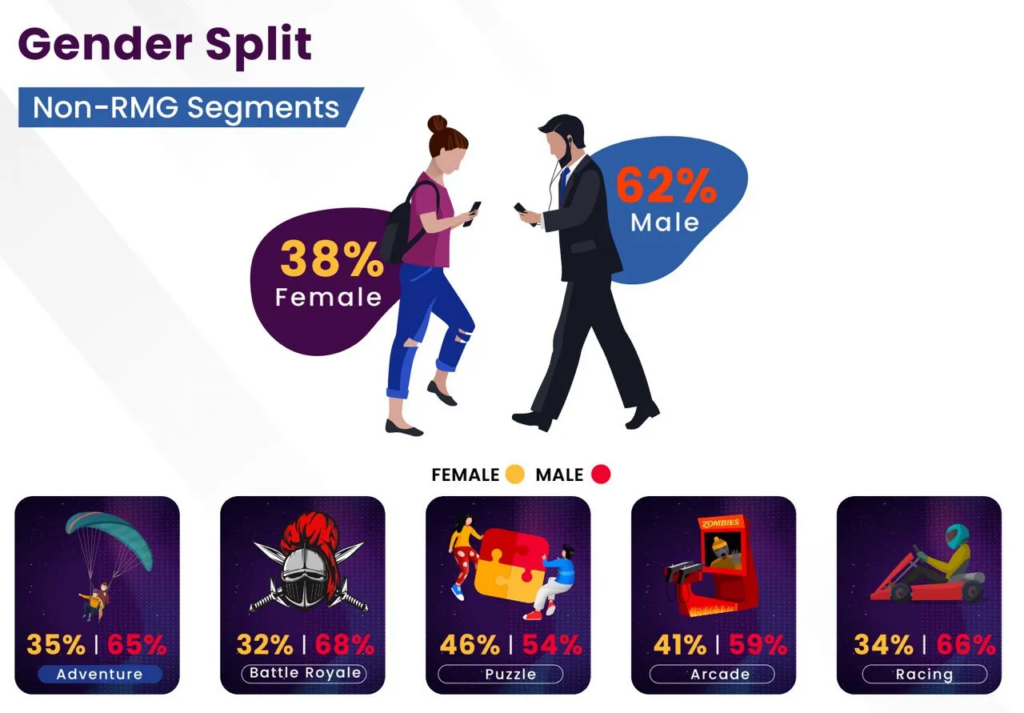

Newzoo & MAAS: Indian Mobile Gamers Preferences in 2022

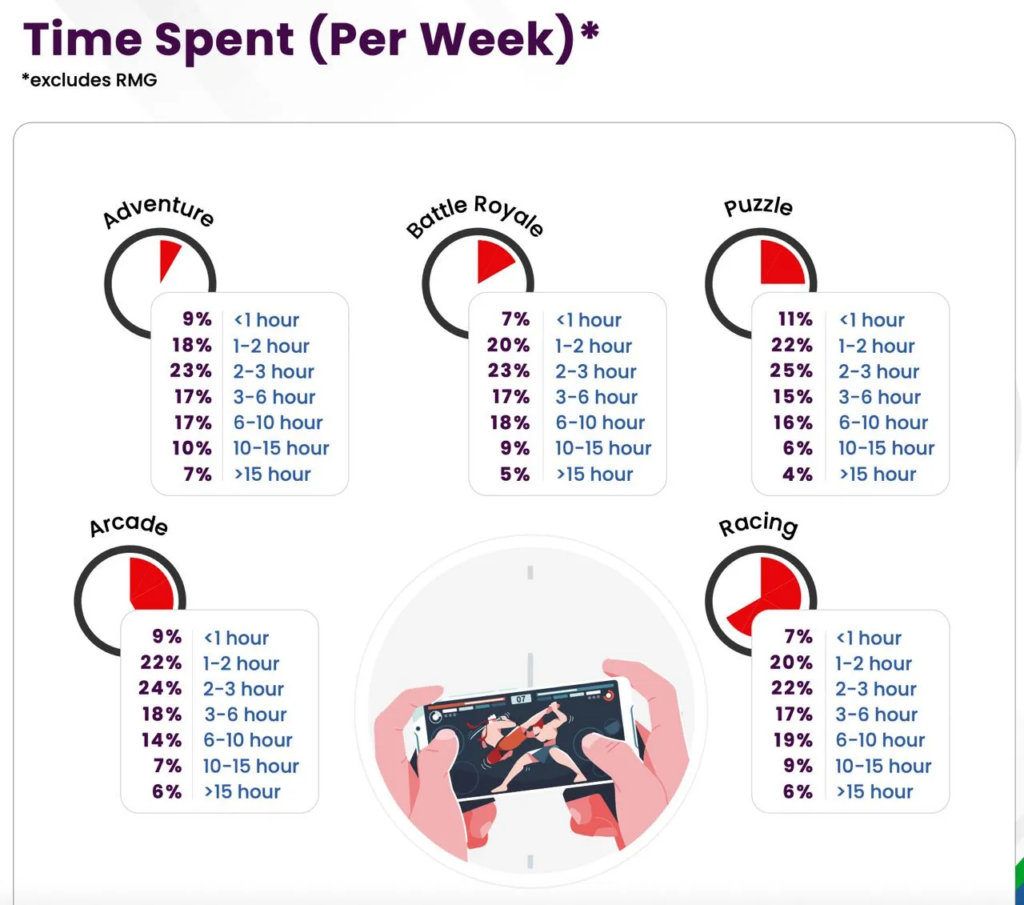

The report is covering only 5 genres from the non-RMG (non-real money gaming) segment. These are Adventure games, Battle Royale, Puzzles, Arcade games, and Racing games. Will cover only them not touching the RMG segment.

-

The Indian gaming market will reach $2.2B in 2022.

-

There will be 373M gamers in India by the end of 2022, 91% of them are playing on mobile devices.

-

62% of Indian mobile gamers are male.

-

Indian gamers do like games: an opportunity to win; role playing; using tactics and strategic moves to win; an opportunity to relax and unwind; an opportunity to build something new; an opportunity to experience adrenalin.

-

In India the average retention in midcore titles is follows: D1 - 25%; D7 - 5%; D30 - 1%. In casual/hypercasual products those numbers are: D1 - 30%; D7 - 7%; D30 - 3%.

Newzoo & MAAS: Indian Mobile Gamers Preferences in 2022

Sensor Tower: Top Mobile Titles by Downloads in August 2022

-

Subway Surfers is first. Again. The game reached 33.5M downloads last month, which is 89.4% more than a year before. Most downloads - 28.5% and 13.3% - came from China and India

-

Stumble Guys (which was recently acquired by Scopely) was second with 26.5M downloads (8.7x times increase from the year before). Indonesian gamers were responsible for 15.2% of downloads, and the US - for 14%.

-

Overall in August 2022 games have been downloaded 4.6B times in App Store & Google Play (-1.6% YoY).

-

India is #1 by downloads (787.5M - 17% worldwide). Brazil is second (8.2%), and the US is third (8.1%). It’s important to mention that Sensor Tower is not covering the alternative stores in China.

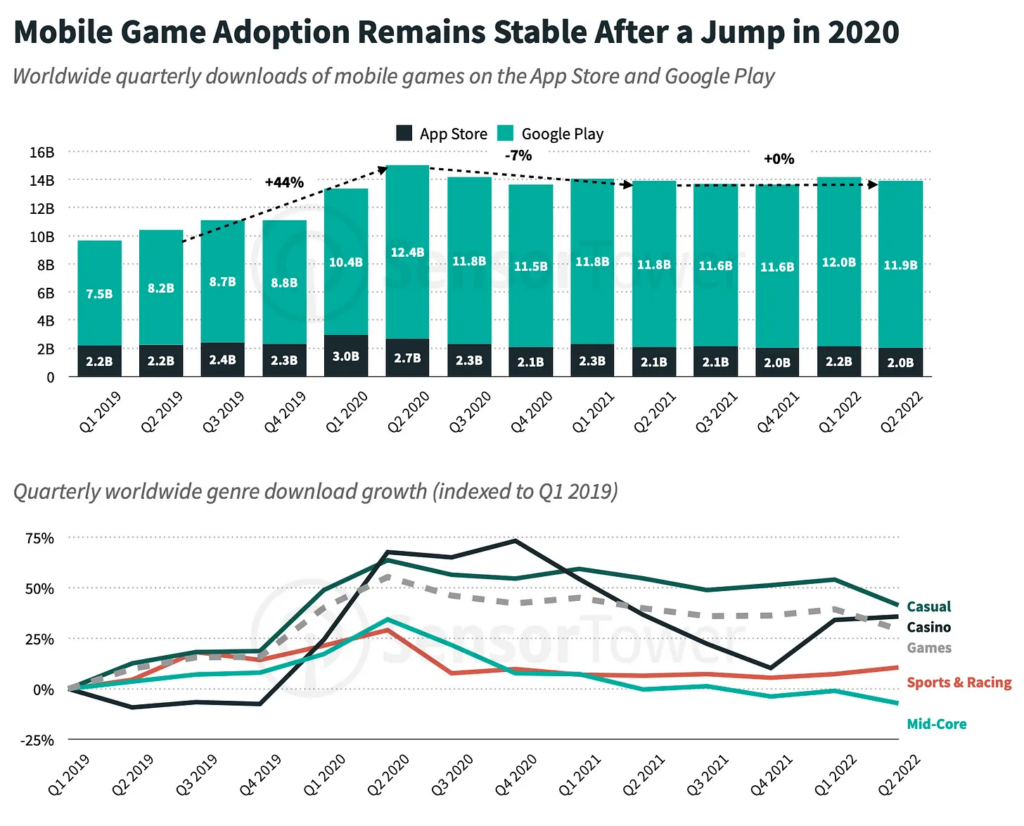

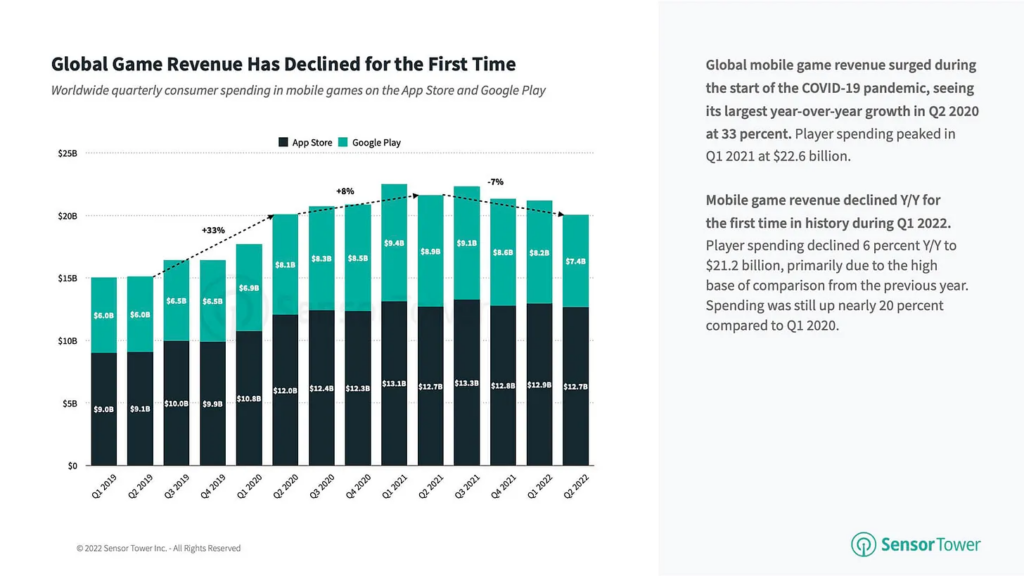

Sensor Tower: Mobile Gaming Market will shrink in 2022 by 2.3%

The market in general

-

The number of mobile game downloads last year (from Q2 2021 to Q2 2022) didn’t change. But it’s still higher than pre-pandemic levels.

-

The mobile gaming market continued its fall in Q2 2022 ($20.1B vs $21.6B in Q1 2021). The first decline in history was tracked in Q1 2022.

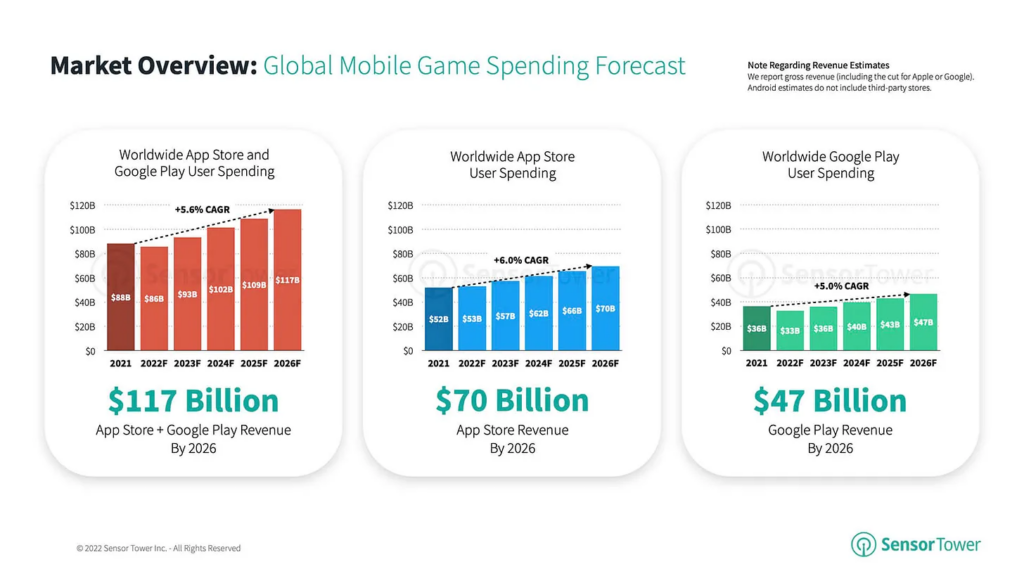

-

Sensor Tower analysts expect an annual revenue drop of 2.3%. The mobile gaming industry will earn $86B.

-

However, the market should get back to growth in 2023. And in 2026 it will reach $117B.

-

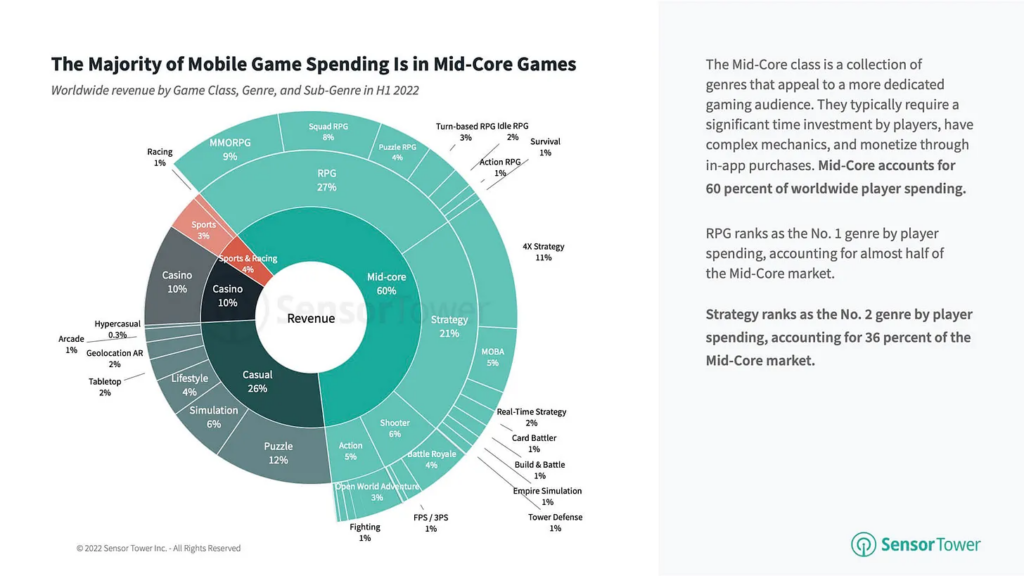

Casual games are responsible for 78% of downloads. Midcore games are generating only 14%. Despite this, mid-core titles are covering 60% of overall mobile games revenue. The most significant genre is an RPG, which is responsible for 27% of overall mobile game industry revenue.

-

The US is the largest mobile market (but Sensor Tower is not tracking Chinese alternative stores). It went down in Q2 2022 by 11%. Taiwan made it to the top 5 with a 4% growth and kicked off Germany

MMORPG insights

-

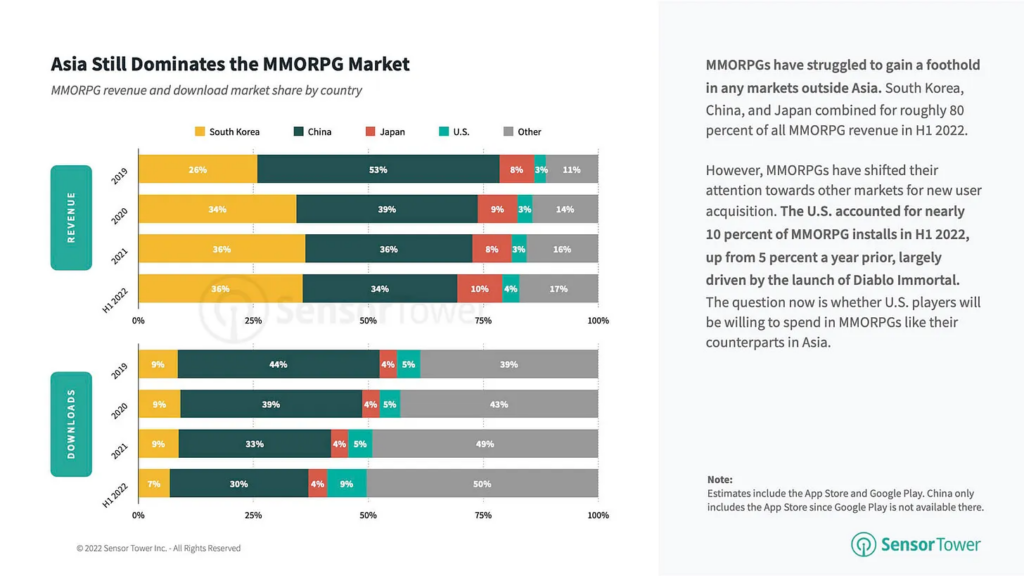

MMORPG is the second after the 4X Strategies genre by revenue. In H1 2022 games of this subgenre earned about $3.6B on mobile.

-

Asian countries are still generating about 80% of the MMORPG revenue. However, the situation changes: the US is responsible for 10% of the subgenre downloads in H1 2022 (it’s a 2x growth from the previous year). But this growth was mostly because of the Diablo Immortal release.

-

Diablo Immortal is one of the most successful MMORPG launches in US mobile history. In the first 6 weeks, the game earned $28M. The closest MMORPG competitor earned $5M.

Sensor Tower: Mobile Gaming Market will shrink in 2022 by 2.3% Download

NPD: The US Gaming Market revenue declined in August 2022

-

The US users spent $4.1B on games in August 2022. It’s 5% lower than a year before. However, there is a slight growth compared to 2020.

-

Software spending dropped by 6% ($3.6B). Contrary, hardware sales are up by 14% ($375M).

-

The hardware sales increase is connected with a better supply situation. PS5 became the best console in August 2022 in the US regarding both unit and dollar sales.

-

Mobile games revenue in August 2022 in the US fell by 10%. iOS was almost okay with a 1.2% drop, but Google Play revenues collapsed by 22%.

-

Accessories sales fell by 18% to $138M.

-

Madden NFL 23 was the top-seller in the US in August 2022; Saints Row was second despite the controversial reviews; the PC version of Marvel’s Spider-Man was third.

GSD: European Gaming Market (PC & Consoles) in August 2022

-

GTA V was first by digital & physical sales. Saints Row didn’t manage to beat the 9-year-old game.

-

7.7M game copies were sold in European countries in August 2022. 3.2M of them were physical.

-

Gran Turismo 7 in August 2022 doubled sales compared to July.

-

About 310k consoles were sold last month in Europe. Nintendo Switch was a leader, and PlayStation 5 is behind. Overall console sales decreased by 19% compared to last year.

-

PlayStation 5 continues to increase its sales.

-

In August 2022 in Europe, 1.18M gaming accessories were sold (-9% to the previous year). DualSense was in the first place by popularity.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.