devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the August and September reports.

Table of Content

- Newzoo: Shooter games in 2022

- NPD Group: The US September 2022 revenue is still dropping compared to the previous year

- Steam set a new record - 30M concurrent users

- Newzoo: PC & Console Markets Revenue will grow to $109.2B in 2025

- CNG: Chinese mobile gaming market dropped by 19% in Q3 2022

- AdQuantum & Social Peta: Mobile Marketing in H1 2022

- Sweden Game Companies earned €5.8B in 2021

- AppMagic: Marvel Snap earned $2.3M+ in a week after release

- Newzoo: French market in 2022

- Bain & Company: The Gaming market will grow by 50% in 5 years

- dentsu: How different generations interact with games in 2022

- GfK & GSD: Console sales surged by 41% in September in the UK

- Stream Hatchet: Mobile Streaming in September 2022

- GSD: European Gaming market in September 2022 is losing to September 2021

- Newzoo: Generations Alpha & Z in Gaming

- Tenjin & GameAnalytics: Hypercasual benchmarks in Q3 2022

- AppMagic: Top Games of September 2022 by Revenue and Downloads

- Sensor Tower: Mobile Games based on Harry Potter IP earned $1B+

- Newzoo: Cloud Gaming in 2022

- AppMagic: Hypercasual market in Q3 2022

- GfK: PS5 reached 2M sales in the UK

- Unity: Multiplayer Games in 2022 Report

- Newzoo: Brazilian gaming market in 2022

- SocialPeta & GameIS: Israel mobile gaming market and worldwide marketing trends in 2022

- GlobalData: The Gaming Market will reach $470B by 2030

- Genshin Impact revenue surpassed $3.6B

- data.ai: Social Casino gaming market in 2022

Newzoo: Shooter games in 2022

-

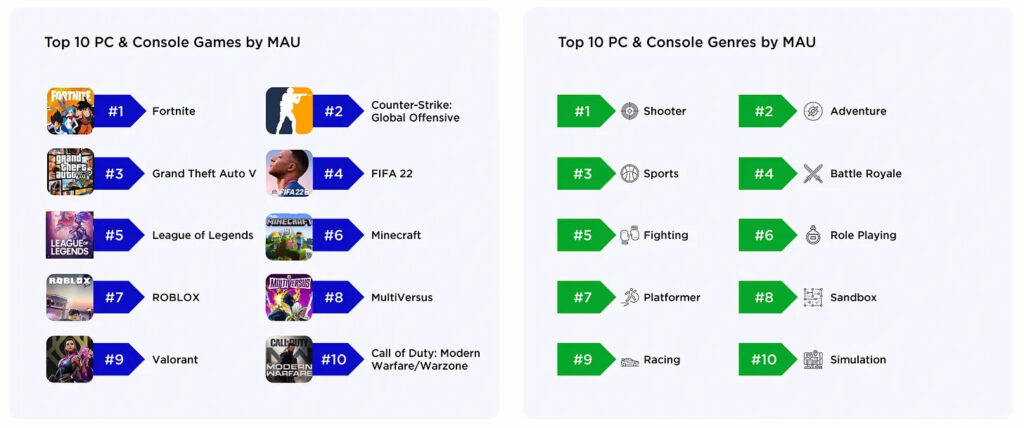

Shooters are the fifth genre by revenue in the gaming industry.

-

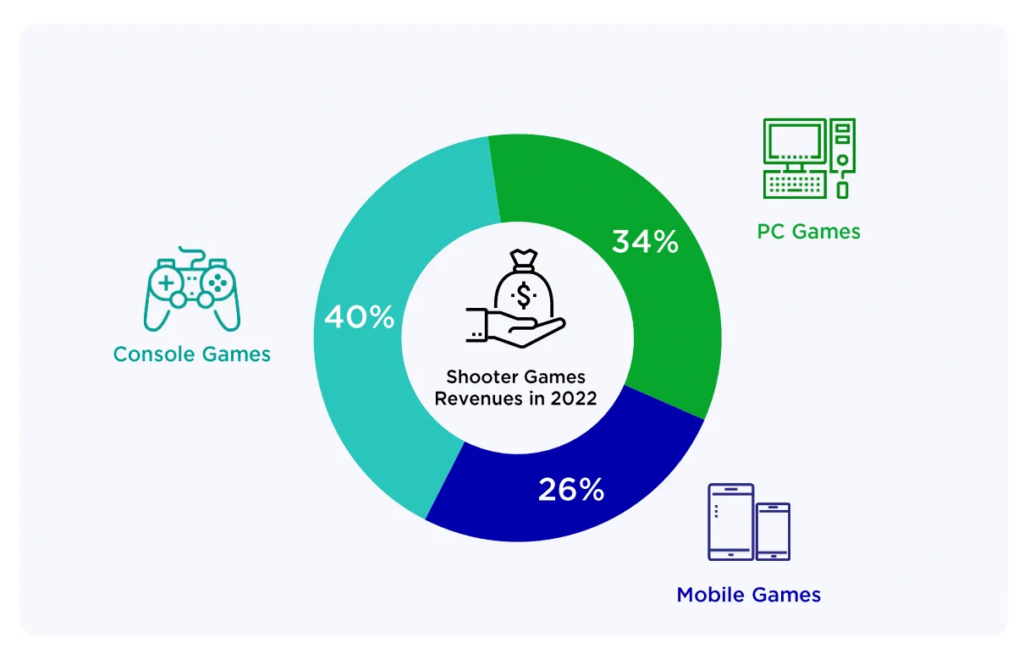

40% of shooters’ revenue comes from consoles; 34% from the PC. 26% from mobile devices.

-

Shooters are the #1 genre by MAU on the PC. On consoles, it holds the #4 place.

-

An average shooter gamer plays 1.7 shooter games per month. He plays 19 hours per week with 1.6 sessions per day.

-

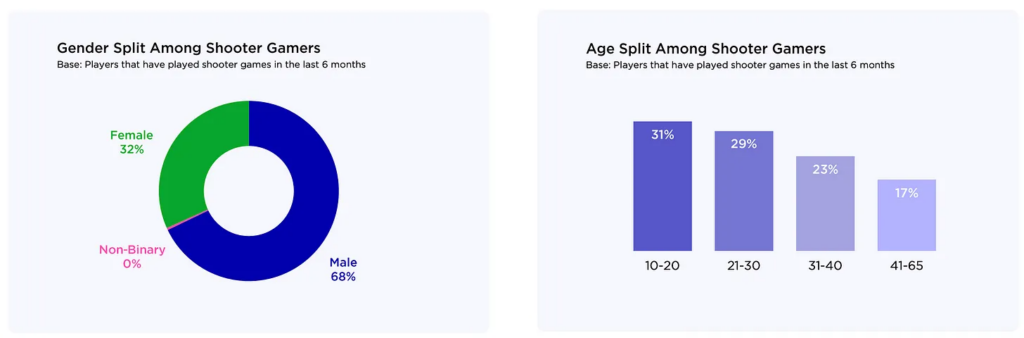

68% of shooter gamers are male. 32% are female.

-

Most shooter lovers are aged 10-20 years (31%). Segments of 21-30 years (29%); 31-40 years (23%), and 41-65 years (17%) are next.

-

The US, the UK, Germany, Brazil, and Russia are the top countries by MAU in shooters in August 2022.

-

The top shooters of August 2022 by MAU on PC are CS:GO, Valorant, and Destiny 2. On consoles: Tom Clancy’s Rainbow Six: Siege; Call of Duty: Black Ops Cold War, and Destiny 2.

-

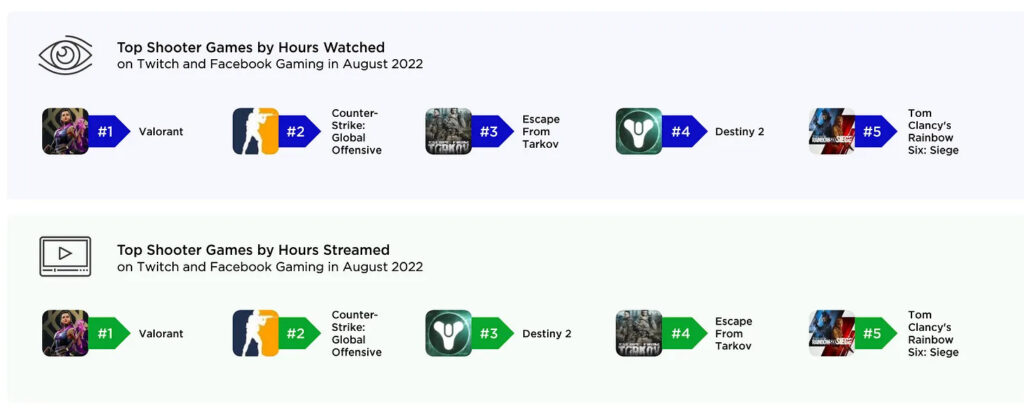

Shooters are the second most popular genre on live streams. In August 2022 streams with shooters were watched for 253M hours. And 12M hours of content were created (it’s the second place too).

-

56% of shooter lovers played adventure games in August 2022. 42% played Battle Royale titles. 31% liked sports games.

-

97% of shooters on PC and Consoles are monetized through in-app purchases. Only 8% are using ads.

Newzoo: Shooter games in 2022 Download

NPD Group: The US September 2022 revenue is still dropping compared to the previous year

-

Users spent $4.07B in September 2022, which is 4% lower than a year before.

-

People spent $490M on hardware (+19% YoY); while games spendings were $3.4B (-7% YoY).

-

FIFA 23 took first place in the September charts (despite it being soccer, not football). Madden NFL 23 is second, and NBA 2K23 was third (but without digital copies).

Steam set a new record - 30M concurrent users

-

It happened on Sunday, October 23.

-

It took 14 years for Steam to reach the first 15M CCU. And another five to reach 30M.

-

In November 2021 the platform reached 27M CCU.

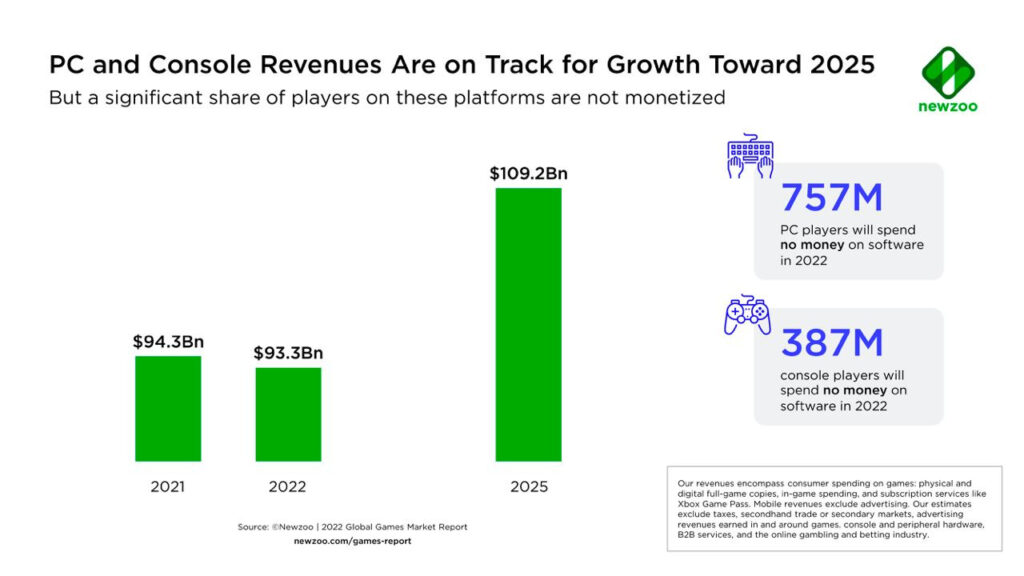

Newzoo: PC & Console Markets Revenue will grow to $109.2B in 2025

-

In 2022 the PC & Console market will reach $93.3B. It’s a billion less than it was in 2021.

-

By the end of 2022, there will be 387M console gamers and 757M PC gamers who haven’t spent money on games in a year.

-

Newzoo analytics are sure that there will be more in-game ads in games on PC & Consoles. It will help monetize non-paying users and open a new revenue stream for both platforms and developers. According to recent reports, Sony and Microsoft are already working on such solutions.

CNG: Chinese mobile gaming market dropped by 19% in Q3 2022

-

The market declined to $8B in Q3 2022 (-19% YoY).

-

The main reason for the dip lies in a decrease in active gamers and hours spent in mobile games.

-

89% more mobile games were closed in Q3 2022 compared to Q2 2022, South China Morning Post reports.

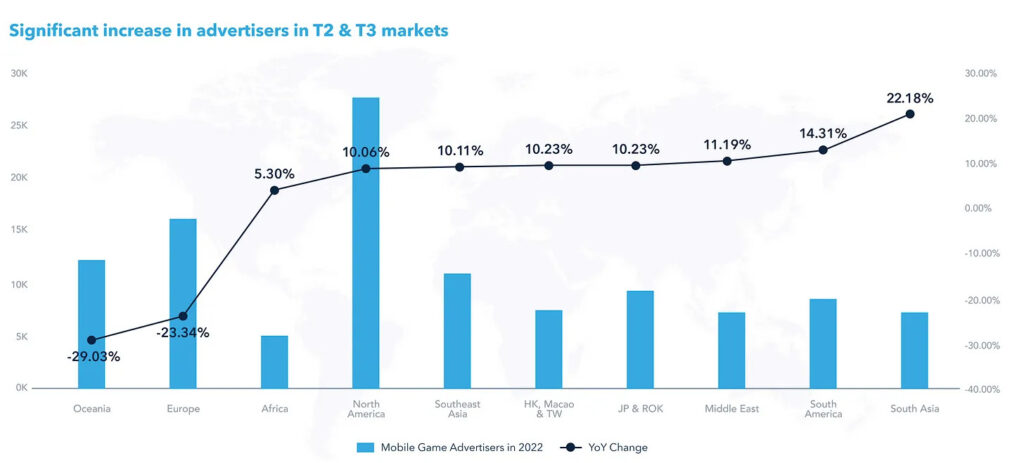

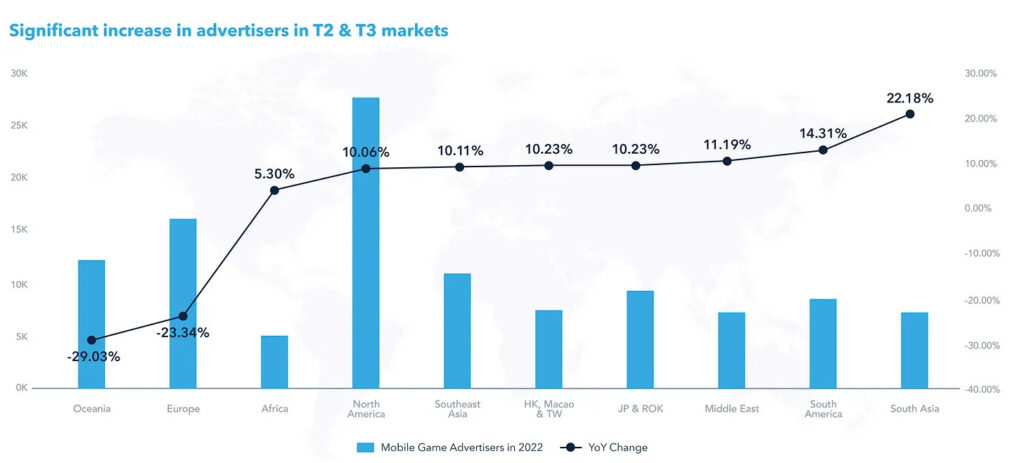

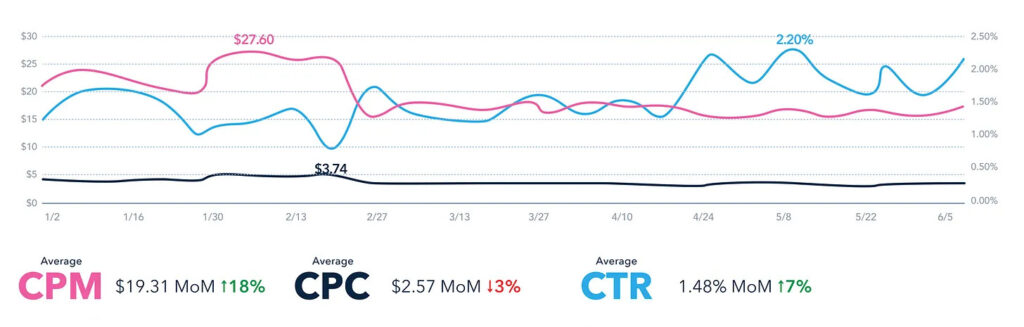

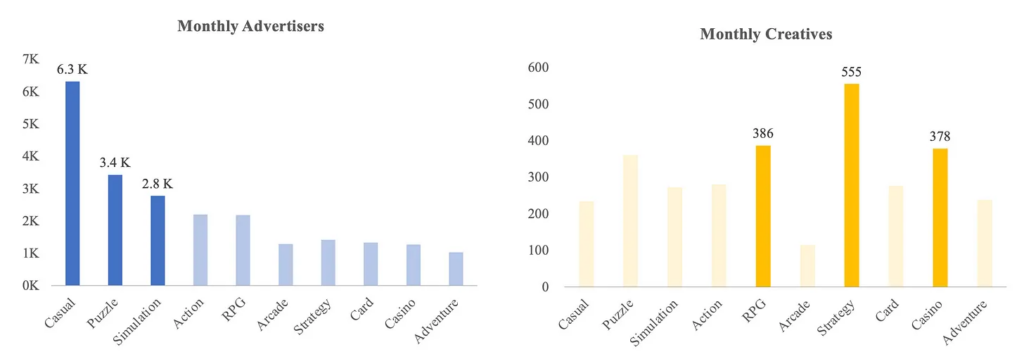

AdQuantum & Social Peta: Mobile Marketing in H1 2022

Companies researched more than 175 thousand mobile games and more than 70 traffic sources in 100 countries.

-

The number of advertisers in Oceania (-29.03%) and Europe (-23.34%) significantly dropped. All other regions are growing - North America (+10.06%), South Asia (+22.18%), and South America (+14.31%).

-

Overall, the number of gaming advertisers in H1 2022 dropped by 2% YoY - to 45.1 thousand. The number of creatives declined by 27.83% YoY to 15.8M.

-

Casual games (18.14% of the overall amount); puzzles (13.67%), and RPGs (12.14%) are leaders by creatives.

-

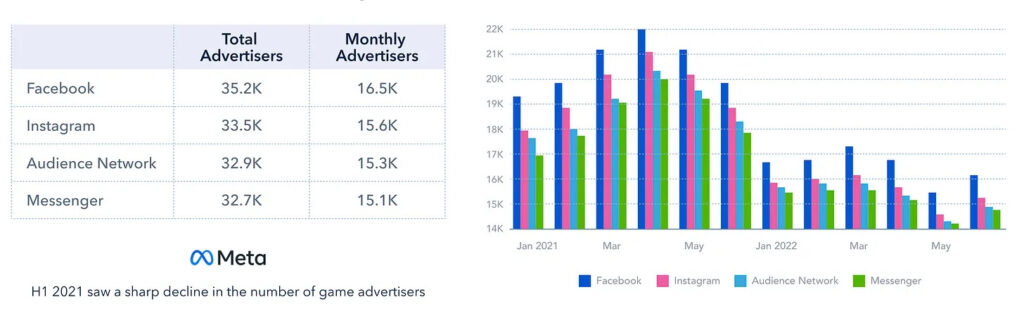

In H1 2022 the number of advertisers on Meta platforms majorly decreased.

-

In all top-10 mobile gaming markets, CPM is higher than $20. The average US CPM is $27.54; CPC - is $4.22; CTR - 1.16%.

-

The average CPM in the world increased compared to H2 2021 by 18% to $19.31.

-

Android now is responsible for about 72.45% of all advertisers and creatives.

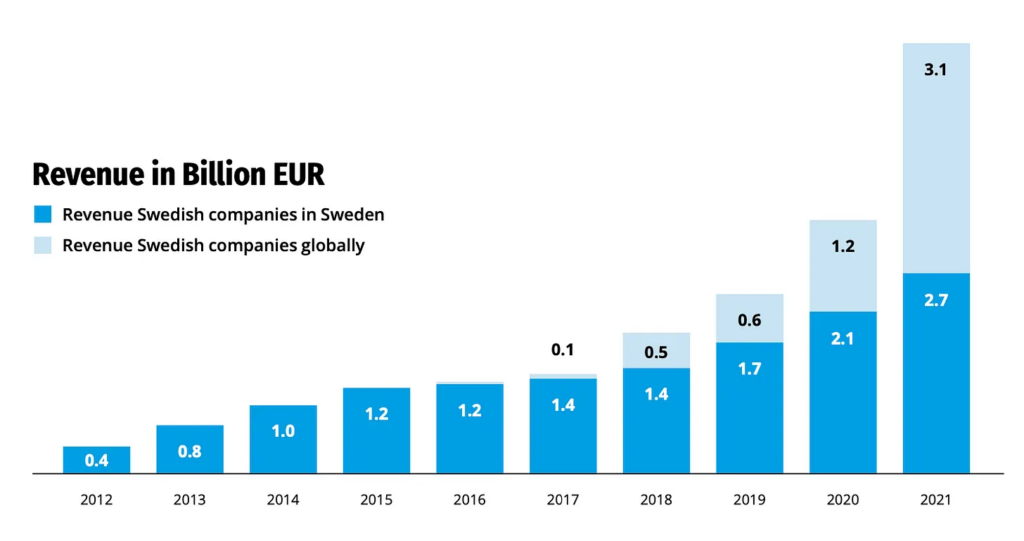

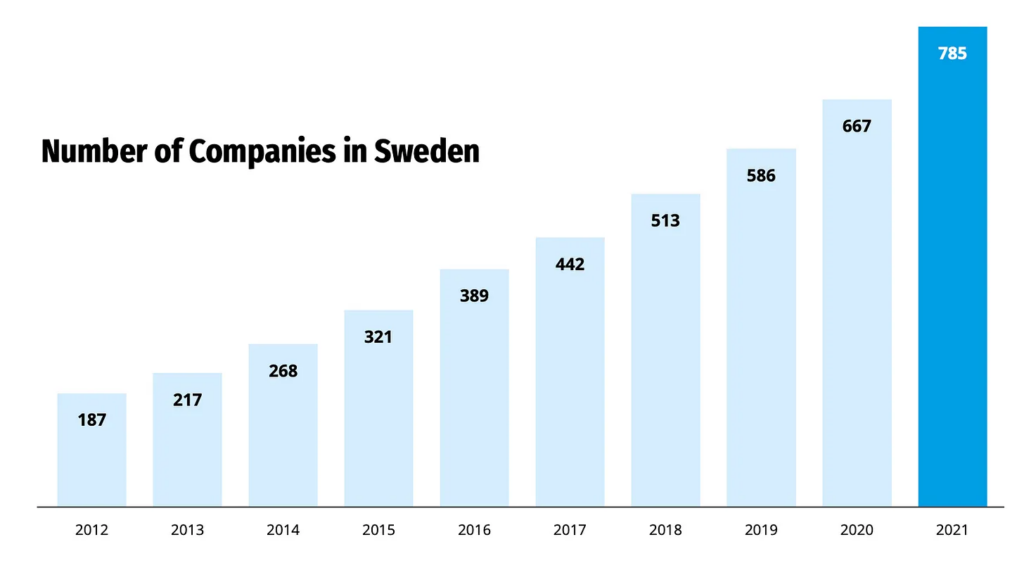

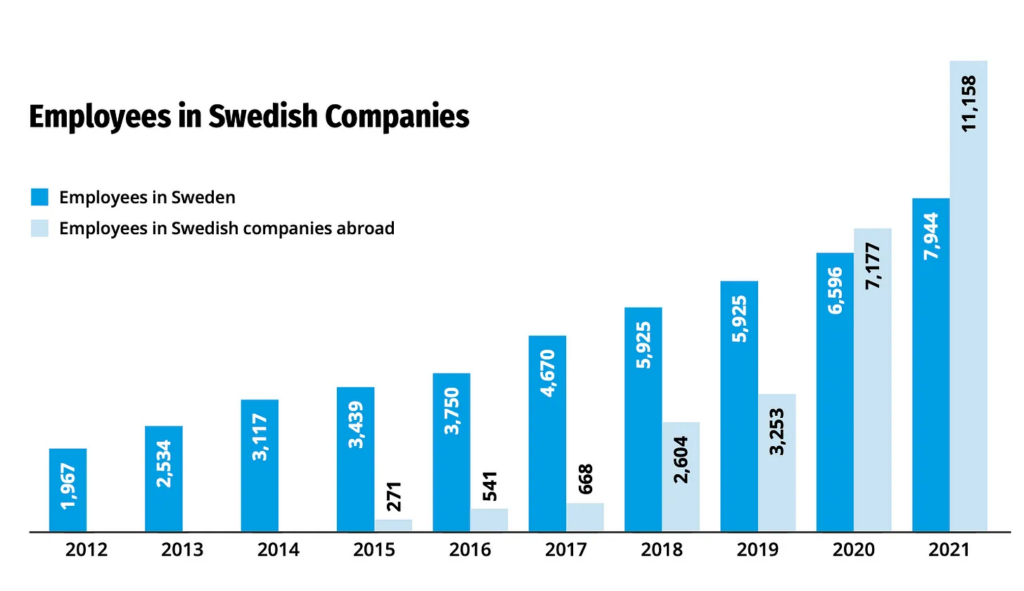

Sweden Game Companies earned €5.8B in 2021

-

It’s 4 times more than the Sweden industry generated in 2017 (€1.4B). The €5.8B revenue includes revenue of subsidiaries of Sweden companies outside of the country.

-

If we’re speaking about the Sweden-based companies, they earned €2.7B in 2021, which is 22% more than last year.

-

785 companies were in Sweden in 2021. It’s 78% more than in 2017. Most companies are either solo-developer studios (49%) or small studios with up to 10 people (40%).

-

7,944 people are working in Sweden in the gaming industry (+17% YoY), and 11,158 people are working in subsidiaries of Swedish companies.

-

21 gaming companies from Sweden are on the local stock exchange. They earned €3.6B in 2021.

-

The largest Sweden studios are Ubisoft Entertainment Sweden (837 employees), EA DICE (730 employees), and King (648 employees).

Sweden Game Companies earned €5.8B in 2021 Download

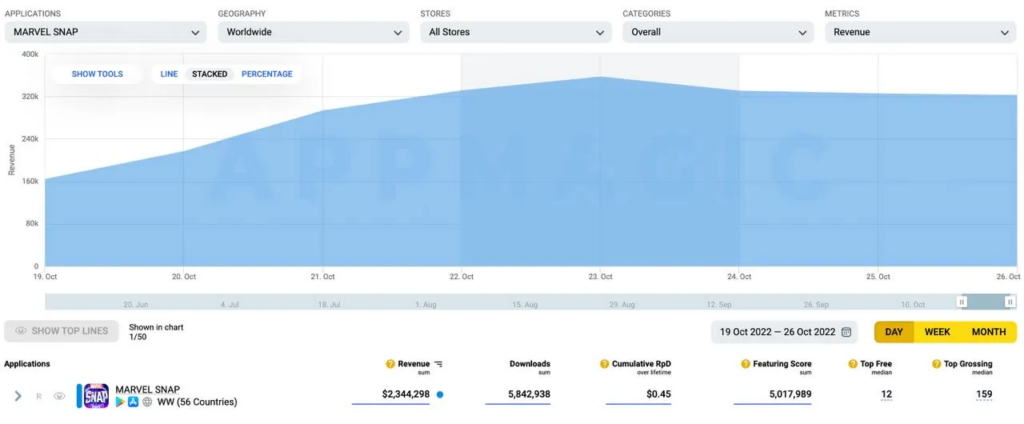

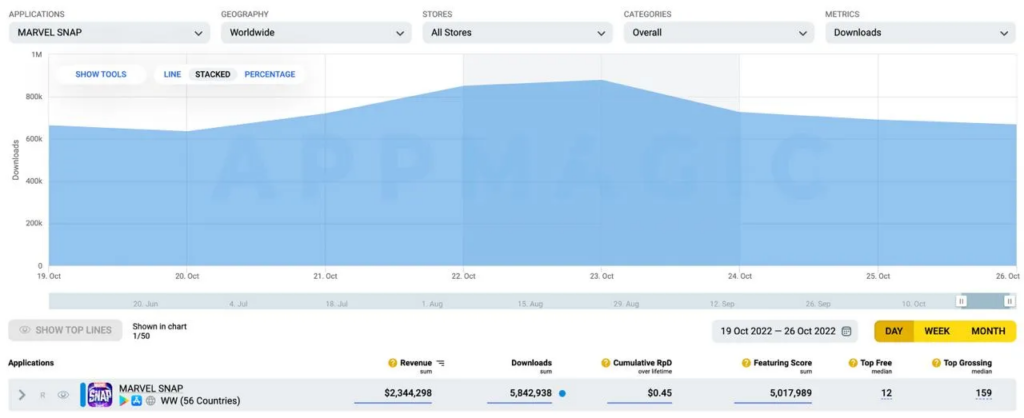

AppMagic: Marvel Snap earned $2.3M+ in a week after release

Marvel Snap is a new card game in the Marvel universe, published by Nuverse, a gaming wing of Bytedance.

-

iOS devices generated $1.5M of revenue. Android is responsible for $0.8M.

-

The game was downloaded 5.3M times in a week. 1.3M downloads came from the US.

-

The majority of revenue came from the US ($1.2M). Philippines ($186k), South Korea ($142k), Australia ($141k), and Japan ($133k), are next.

-

RpD in the first week was $0.45.

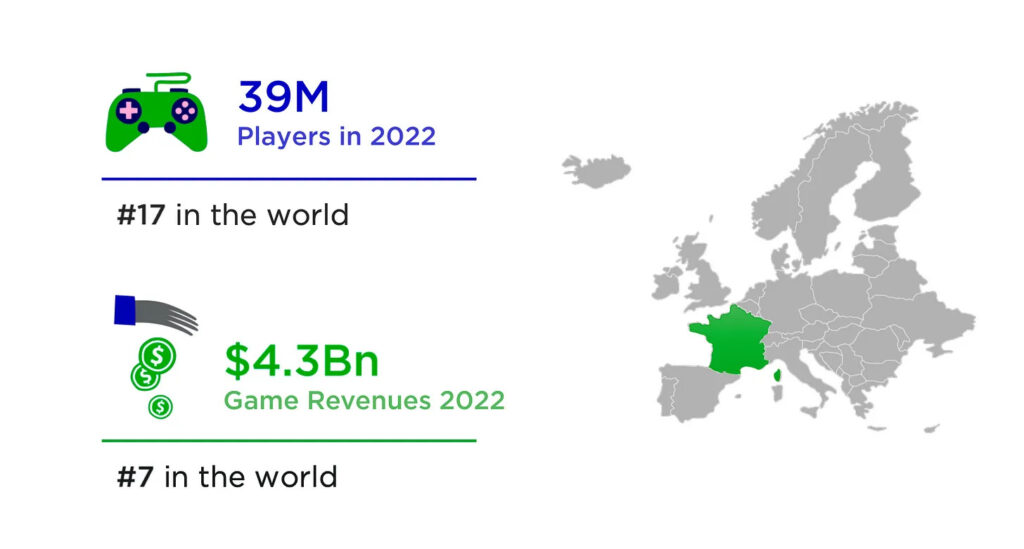

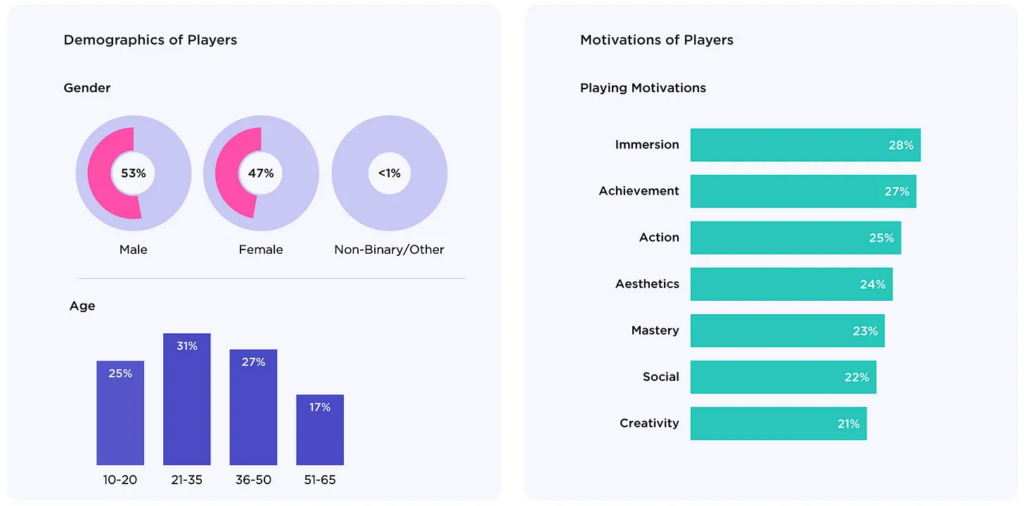

Newzoo: French market in 2022

-

The French market will be #7 worldwide by the end of 2022 with a $4.3B valuation. There are 39M gamers in the country (#17 worldwide).

-

7 out of 10 French people are playing games.

-

53% of gamers are male, and 47% are female.

-

The dominant age segment is from 21 to 35 years (31%). Gamers aged 36 to 50 are next (27%); 25% of gamers from 10 to 20, and 17% from age 51 to 65.

-

44% of French gamers played in the last half a year on mobile devices. 41% played on consoles; 30% on the PC. As often happens, players spend a little bit more time playing games on PC & Console.

-

Fortnite, FIFA 22, and GTA V are the most popular games in France in 2022 by MAU.

-

56% of French users are paying in games.

Newzoo: French market in 2022 Download

Bain & Company: The Gaming market will grow by 50% in 5 years

-

By companies’ assumptions, in 2022 the gaming market will reach $199B. By 2027 it will grow to $307B.

-

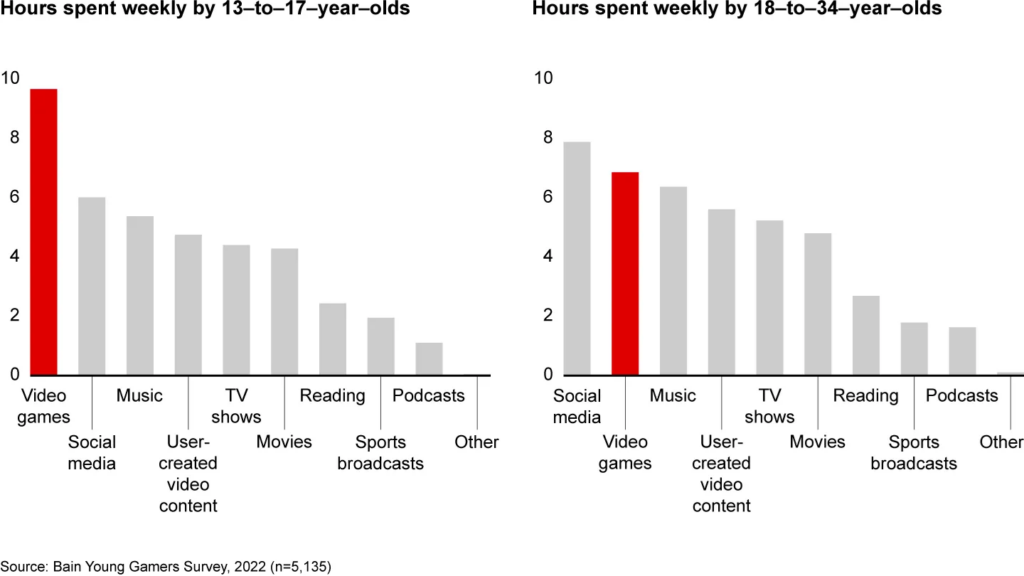

Growth is partly connected to the high engagement of the younger generation (from 13 to 17 years). They spend 40% more free time playing games than older people (from 18 to 34 years).

-

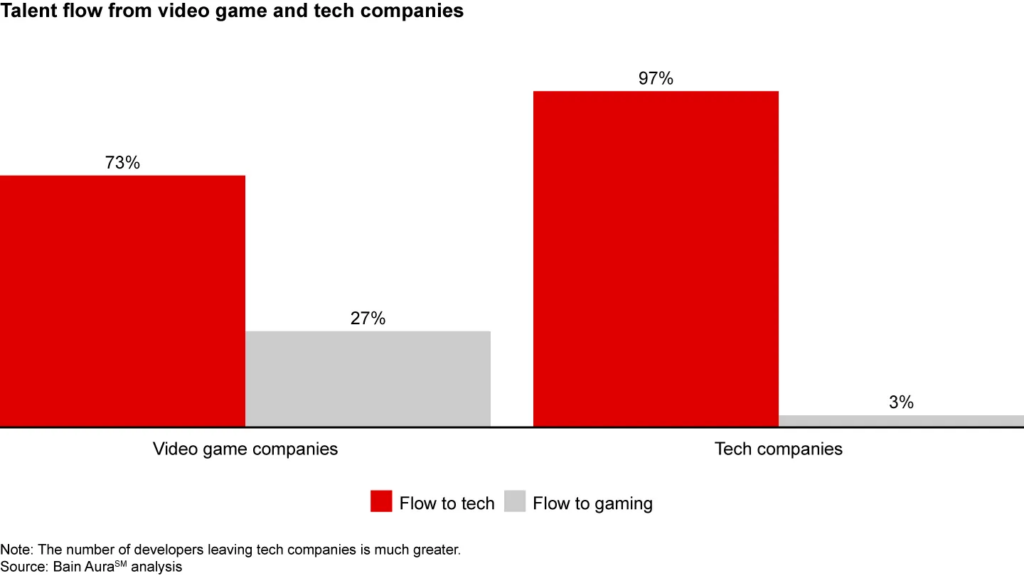

There is an interesting note, that 73% of game developers are moving to Big Tech companies and only 27% are staying in the industry. The flow from Big Tech to gaming stays at the low 3% level.

Bain & Company sees 3 main factors that will help the industry to continue growth:

-

New tech. It’s not only about VR, but about tech progress overall, which helped to launch Genshin Impact on mobile devices.

-

Metaverse experience. Virtual events, E-Sports, and socialization in the virtual world - all of these will help the industry to grow.

-

New monetization models. F2P won’t go anywhere, but subscriptions and blockchain transaction weight will increase.

dentsu: How different generations interact with games in 2022

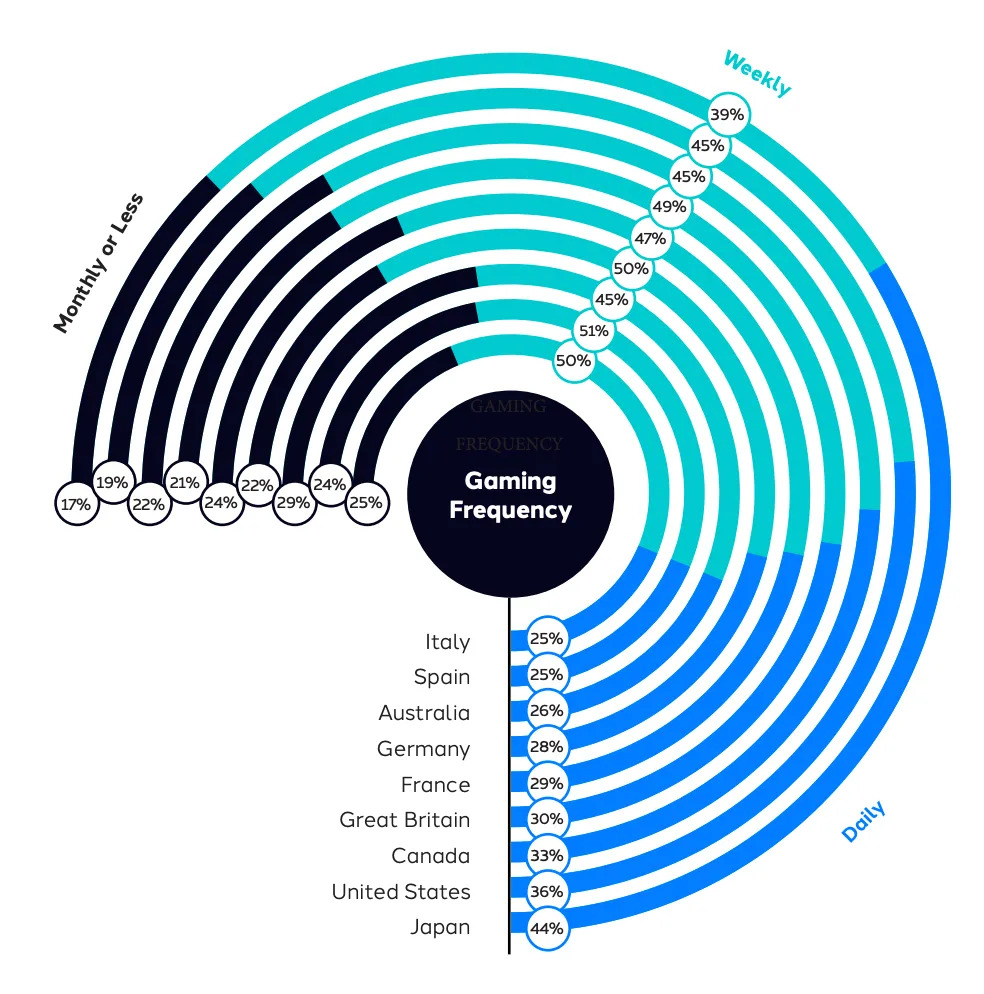

The company researched user behaviors in 9 countries: Italy, Spain, Australia, Germany, France, the UK, Canada, the US, and Japan.

-

34% of gamers play every day. 46% are playing on a weekly basis.

-

People of all generations play games. Generation Z: 37% is playing daily; 47% - weekly. Millennials: 34% are playing daily; 49% - weekly. Generation X: 33% is playing daily; 45% - weekly. 35% of Baby Boomers are playing daily, and 39% - weekly.

-

40% of American gamers perceive themselves as part of the gaming community. 35% are sure that games help them to socialize and spend time with friends & family.

-

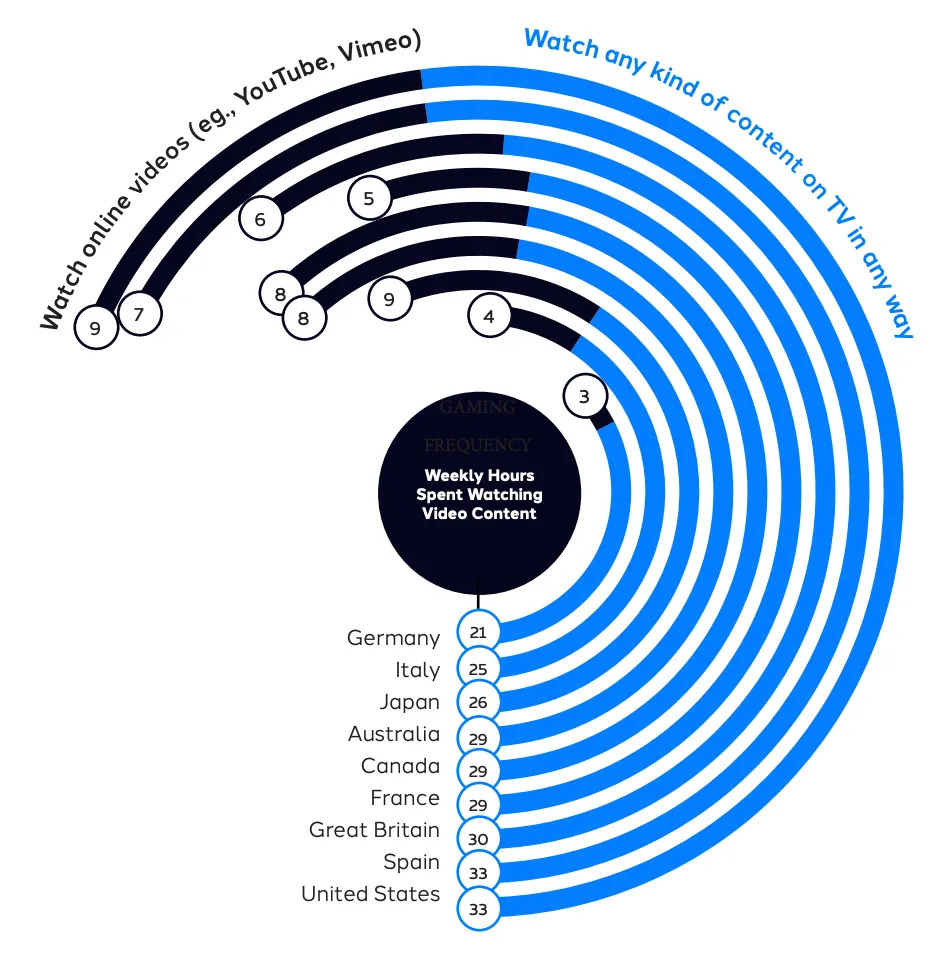

Gamers - aside from games - are actively consuming media products. On average, throughout the week, they’re watching TV for 29 hours; spend 27 hours on Internet surfing; 8 hours on social networks, and 7 hours on videos on the Internet.

dentsu: How different generations interact with games in 2022

GfK & GSD: Console sales surged by 41% in September in the UK

-

3.17M games were sold in the UK in September. It’s 83% more than in August but 6% lower than in September 2021. 69.4% of sales were digital copies.

-

The third of all games sold is FIFA 23. The new installation started 1% better than the previous version.

-

176 thousand consoles were sold in September. It’s 41% more than in August.

-

PlayStation 5 is still the best-selling console (+9% MoM) in the UK. Xbox Series S|X sales increased by 104%. Nintendo Switch sales went up by 44%.

-

Despite excellent results, overall console sales compared to September 2021 dropped by 35.5%.

-

735 thousand accessories were sold in the UK last month. It’s 34% more than in August but still 8% lower than in September 2021. The most popular accessory is a DualSense, controller Xbox Wireless Shock Blue is next.

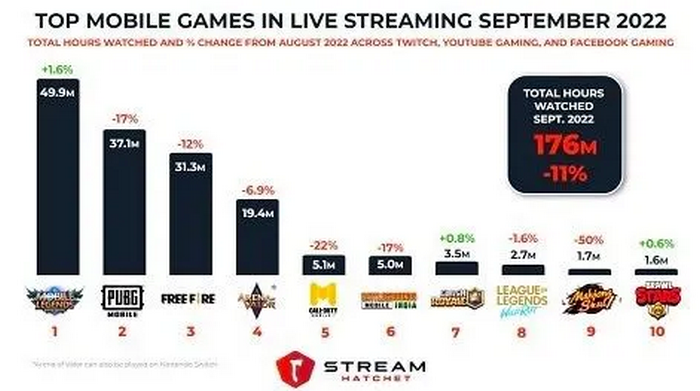

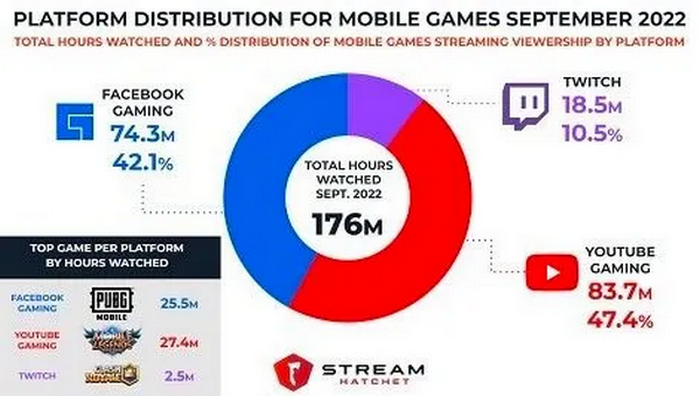

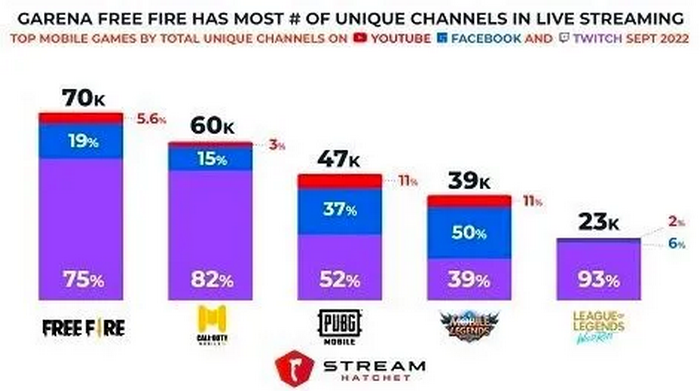

Stream Hatchet: Mobile Streaming in September 2022

-

176M hours of mobile games were watched on different streaming platforms in September. It’s 11% lower than it was in August.

-

YouTube Gaming is a leader, it has 83.7M hours (47.4% of the overall amount). Facebook Gaming generated 74.3M hours (42.1%). Twitch is responsible for 18.5M hours (10.5%).

-

Mobile Legends: Bang Bang is the leader with 49.9M hours watched. PUBG Mobile (37.1M hours; -17% to August) is second, and Garena Free Fire (31.3M; -12% to August) is third.

-

Mobile ESport viewership dropped by 31% to the last year. People watched 40.6M hours in September 2022 with Mobile Legends: Bang Bang’s MPL Indonesia Season 10 being the most popular event.

GSD: European Gaming market in September 2022 is losing to September 2021

-

Numbers are applicable for PC/Console sales only. The research is not covering some countries (more about the methodology is in the source).

-

14.4M PC and console games were sold in Europe in September 2022. It’s 10% less than a year before.

-

FIFA 23 is the main game of the month. Its sales are 6% better than those of FIFA 22. NBA 2K23 started well with a 10.5% increase compared to the previous installation. Splatoon 3 is third by sales in September.

-

394 thousand consoles (excluding Germany & the UK) have been sold in Europe in September 2022. It’s 20% lower than in September 2021; but 29% higher, than in August.

-

Nintendo Switch is the best-selling console in the region in September 2021, and sales increased by 11% compared to August.

-

PlayStation 5 sales increased by 28%; Xbox Series S|X sales almost doubled. All of this - is compared to August 2021.

-

1.44M accessories were sold in September 2022. It’s 22% more than in August, but 7% smaller than in September 2021. DualSense & PS5 Pulse 3D are the best-selling accessories.

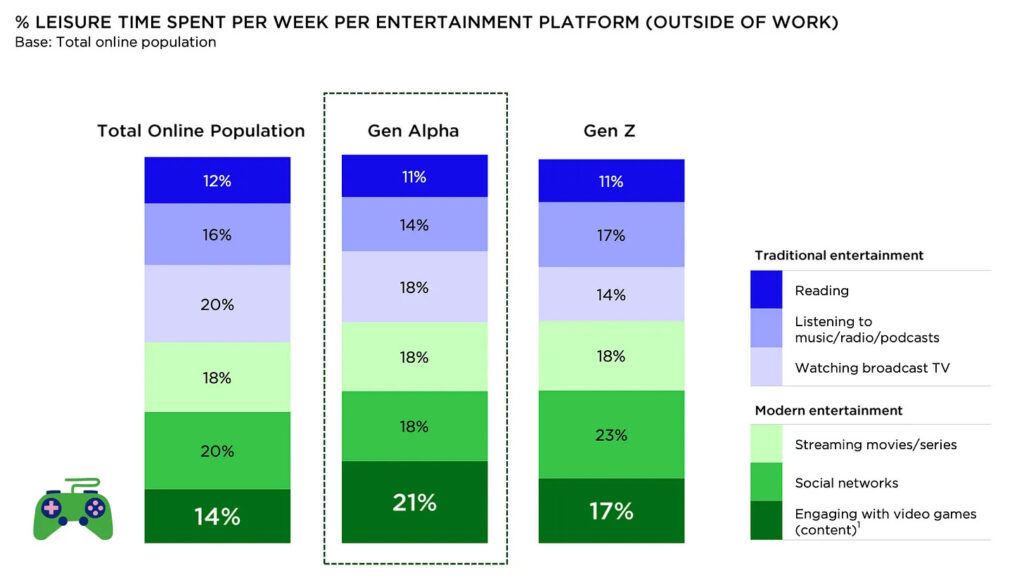

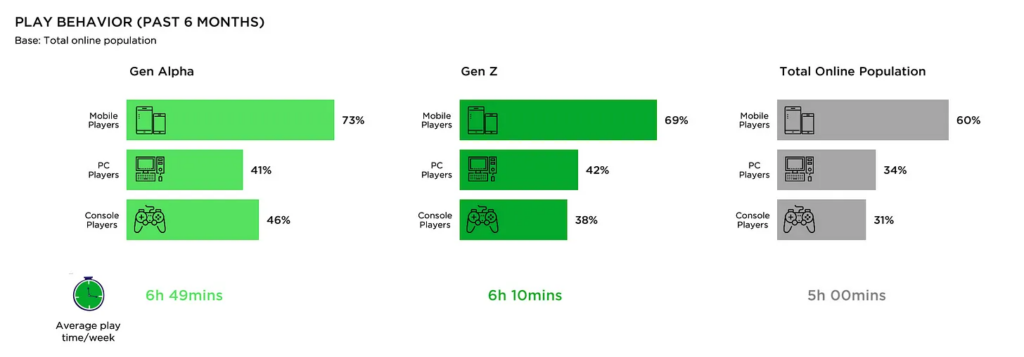

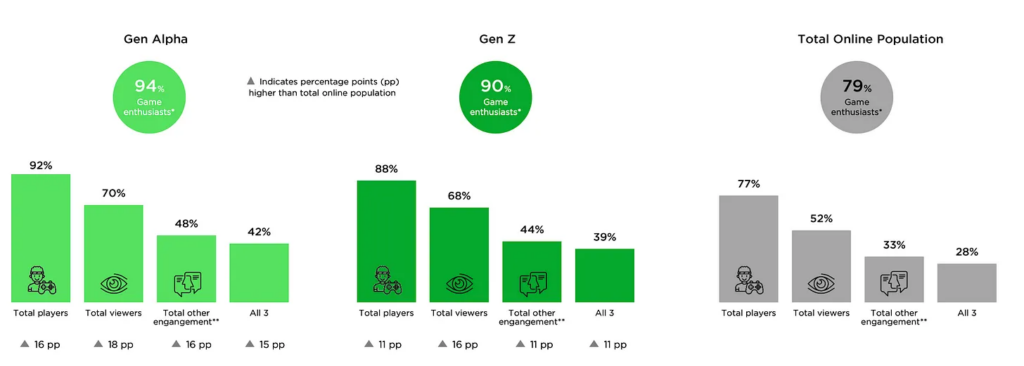

Newzoo: Generations Alpha & Z in Gaming

Generation Alpha is people who were born in 2010 or later. Generation Z are people born between 1995-2009.

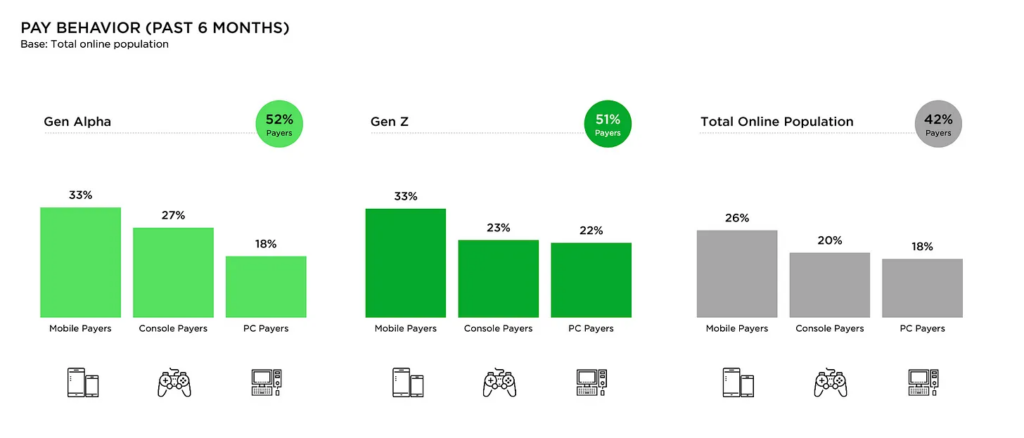

Generation Alpha

-

For Generation Alpha, games are the primary entertainment type. They spend 21% of their free time playing games.

-

73% of generation representatives played mobile games in the last half a year. 41% played on PC, and 46% on consoles. They’re spending 6 hours 49 minutes per week playing games on average.

-

52% of generation Alpha paid in games in the last 6 months. 33% of the payments happened on mobile devices; 27% on consoles, and 18% on PC.

Generation Z

-

Games are one of the leading entertainment options for Generation Z too - they’re spending 17% of their time on them. But social networks (23%), series & films (18%) are a little bit ahead by popularity.

-

69% of Generation Z played mobile games in the last half a year. 42% played on PC; 38% on consoles.

-

There are 51% of payers among Generation Z. 33% spent money on mobile games; 23% on consoles; 22% on PC.

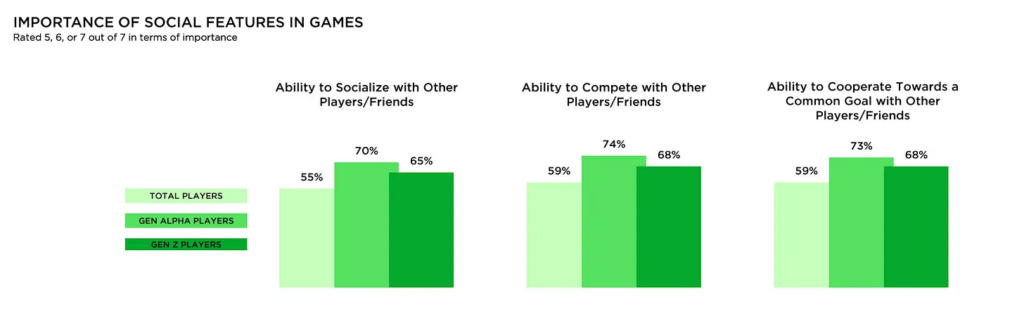

General

-

Socialization, competition, and cooperation are Generation Z's and Alpha's main interest points.

-

Both generations are paying for the same things. Opportunities to unblock unique/additional content and personalization are the dominant things players are buying.

-

93% (Alpha Generation) and 91% (Generation Z) of money are spent on IAP purchases.

Newzoo: Generations Alpha & Z in Gaming Download

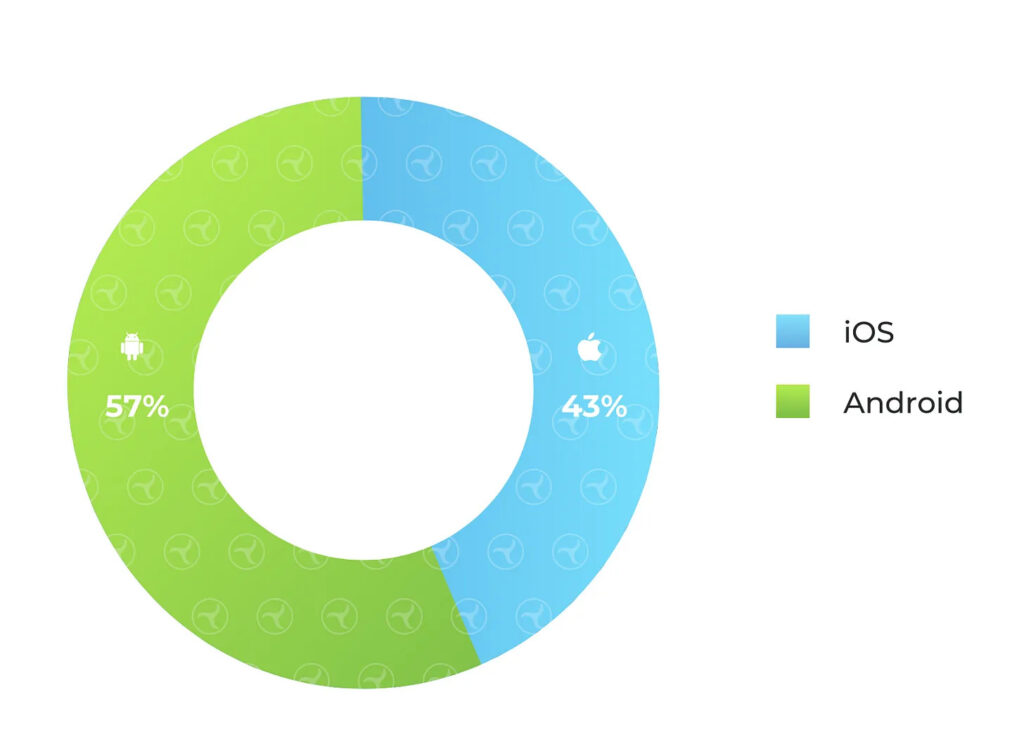

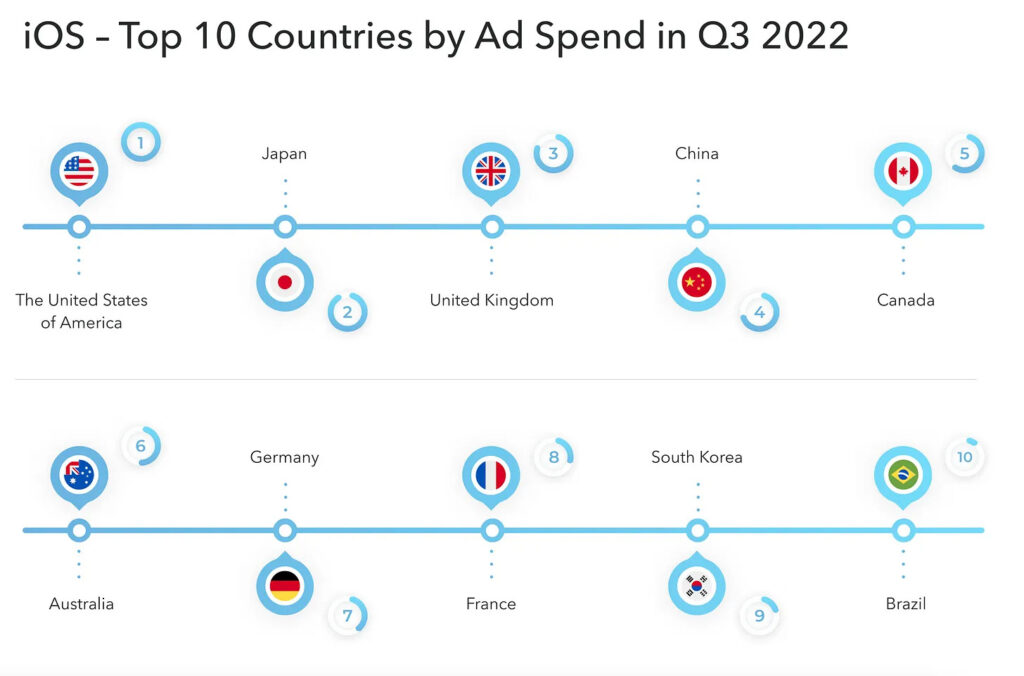

Tenjin & GameAnalytics: Hypercasual benchmarks in Q3 2022

Marketing

-

57% of ad spending is happening on Android. The platform increased its share by 7% compared to the previous quarter.

-

The average CPI on iOS in Q3 2022 was $0.25. On Android - $0.15. It’s a minimal difference in the last couple of years.

-

The US (CPI - $0.56), Japan (CPI - $0.44), and Brazil (CPI - $0.06) are the top countries by ad spending on Android.

-

The US (CPI - $0.71), Japan (CPI - $0.66), and the UK (CPI - $0.39) are the top countries by ad spending on iOS.

Product

-

2% of top hypercasual games had D1 of 51% on iOS and 42% on Android. D7 on iOS was 22%, and on Android - 16%.

-

Top 25% of hypercasual games had following metrics: D1 - 33% (iOS) and 26% (Android); D7 - 9% (iOS) and 5% (Android).

-

The median D1 Retention benchmarks are 25% on iOS and 19% on Android. D7 benchmarks are 6% - iOS, 3% - Android.

Tenjin & GameAnalytics: Hypercasual benchmarks in Q3 2022 Download

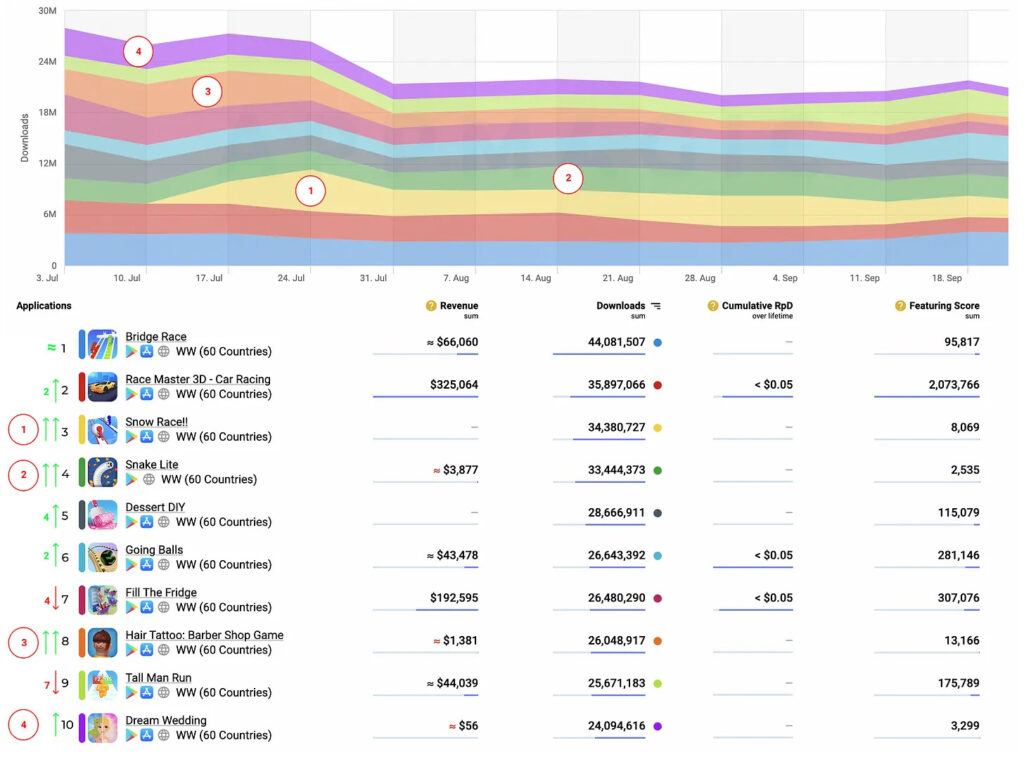

AppMagic: Top Games of September 2022 by Revenue and Downloads

Revenue

-

The first place (oh wow, what a surprise!) is taken by Honor of Kings - $172.19M.

-

Candy Crush Saga became the Android leader with $57.4M. On iOS, the game earned $47.1M.

-

Dragon Ball Z Dokkhan Battle jumped 30 places up with $53.9M in revenue in September 2022.

-

Good results have been shown by Puzzle & Dragons - the game earned $44.1M last month.

Downloads

-

Stumble Guys in September has been downloaded 23.9M times - it’s the first place in the overall list.

-

The most downloaded game on Android was Subway Surfers - 18.7M installs. Plus 3.8M from App Store.

-

X-HERO became the first game on iOS by downloads with 6.8M.

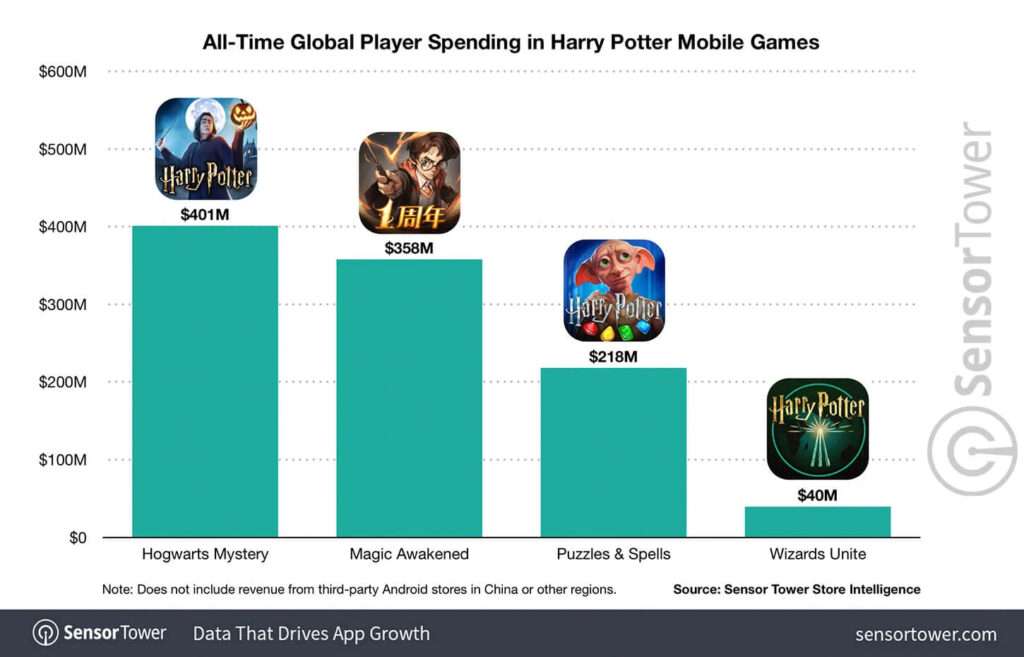

Sensor Tower: Mobile Games based on Harry Potter IP earned $1B+

Games

-

The current leader by revenue is the Harry Potter: Hogwarts Mystery. The game earned $401M since its launch in 2018.

-

Soon the leadership will be taken by Harry Potter: Magic Awakened. The game earned $358M in revenue a year and a month after its launch. 90.6% of the money came from China.

-

Harry Potter: Puzzles & Spells is in third place with $218M. Harry Potter: Wizards Unite from Niantic earned a little - $40M.

-

Harry Potter: Magic Awakened is in 31 places by revenue among all mobile titles based on IP in 2022. From 1 January to 30 September the game earned $85.4M. However, the game is in first place by revenue among games, based on book IP.

Markets

-

The US is the main market for the games based on the Harry Potter IP. It’s responsible for 36.6% of all revenue ($374.8M). China is next - 31.6% ($324.3M), and it’s without taking the third-party stores into account. Germany is third - 5% of the overall amount and $51.6M.

-

App Store is covering 66.6% of revenue - $683M. But if we exclude China, it will be more balanced - 51% of revenue will come from App Store and 49% from Google Play.

-

Harry Potter-based Mobile Games have been downloaded 156M times. The first place is taken by the US (31.8M), China is second, and Brazil is third.

-

A larger chunk of downloads - 54% (84.5M) is coming from Google Play.

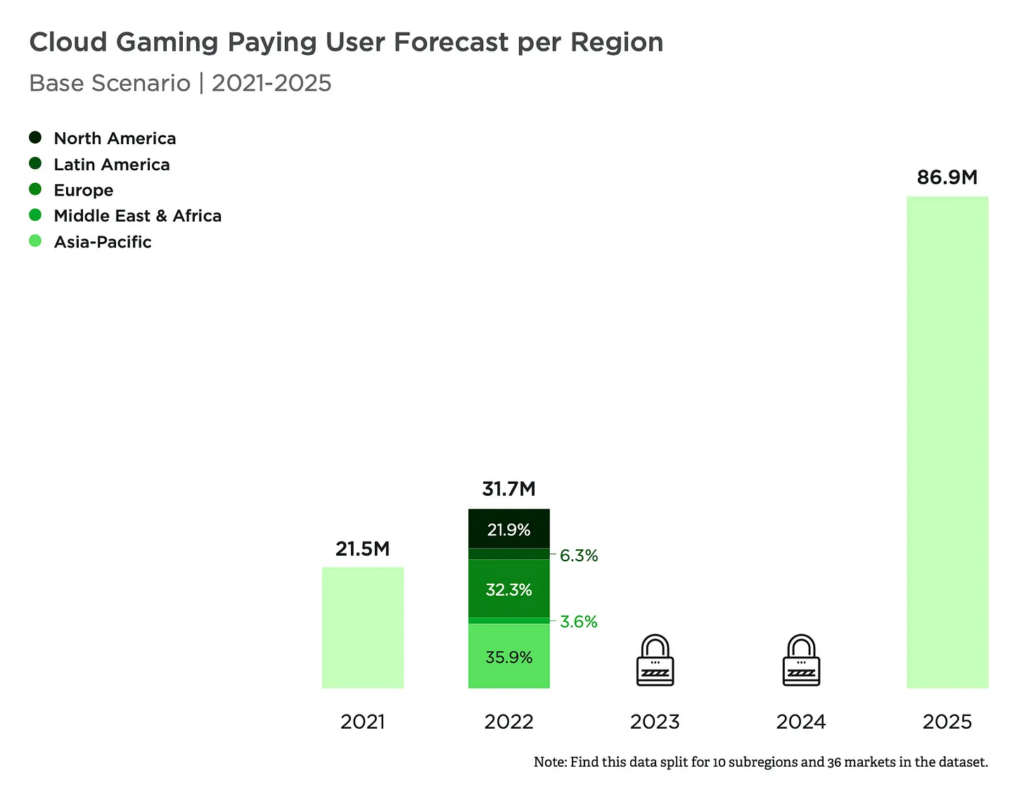

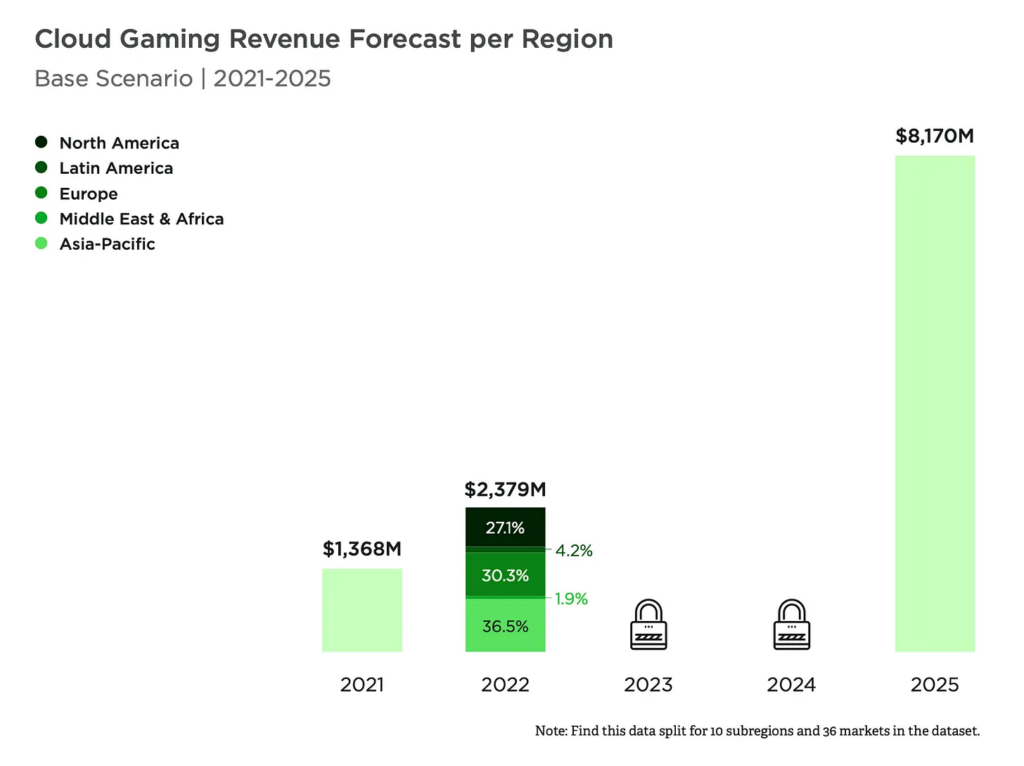

Newzoo: Cloud Gaming in 2022

-

By the end of 2022, the Cloud Gaming market will reach $2.4B. The number of paying users will increase to 31.7M.

-

By 2025 the number of paying users, based on projections, will almost triple to 86.9M.

-

The revenue will jump by almost 4 times by 2025 to $8.1B.

Newzoo is highlighting the following reasons for revenue and audience growth:

-

New Cloud Gaming services are continuing to launch. Old ones are evolving.

-

Cloud Gaming services started to offer the same (or almost the same) experience on all devices.

-

Cloud Gaming services began to provide more budget subscriptions.

-

There are more AAA games in the Cloud than there were before.

-

Issues with hardware availability are pushing users towards Cloud Gaming.

Newzoo: Cloud Gaming in 2022 Download

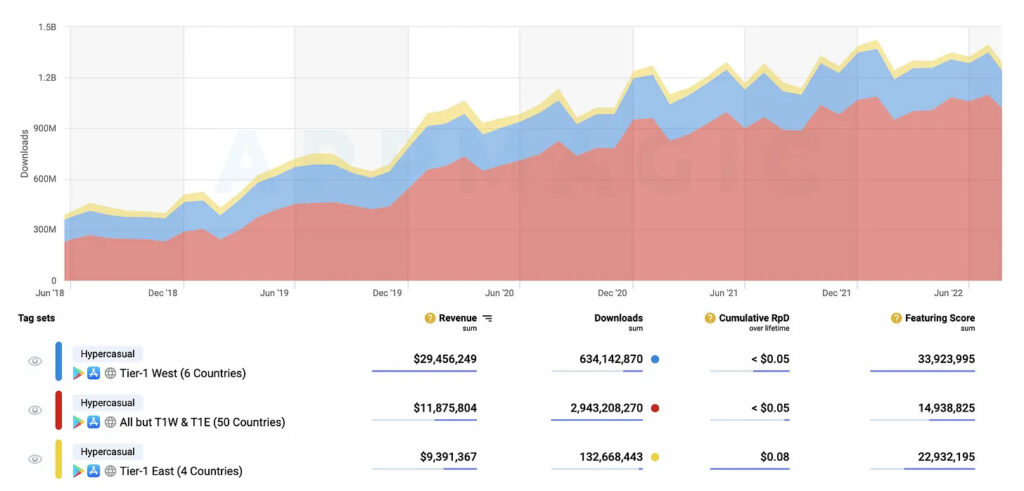

AppMagic: Hypercasual market in Q3 2022

Market

-

Hypercasual downloads in Q3 2022 reached 4B. It’s 10% lower than a quarter before.

-

In 2022 the number of downloads will increase by 5-7%. But emerging markets will be ones responsible for growth, and Tier-1 countries will show a decline.

-

Hypercasual games reached $51M of IAP revenue in Q3 2022. 58% of this amount came from Tier-1 countries.

Games

-

The Bridge Race is keeping first place in Q3 2022 with 44M downloads. Race Master 3D - Car Racing (35.9M) is second; Snow Race!! (34.4M) is third.

-

There are 4 new projects in the top-10 in Q3 2022 - Snow Race!!, Snake Lite, Hair Tattoo: Barber Shop Game, and Dream Wedding.

GfK: PS5 reached 2M sales in the UK

-

It’s the fourth-fastest system to reach this plank in history. Only Nintendo Wii, PS2, and PS4 did it faster.

-

However, PS5 brought the most revenue at the 2M plank - £919M. Wii earned at this milestone £358M, PS4 - £700M, and Xbox One - £726M. But it’s important to take inflation into account.

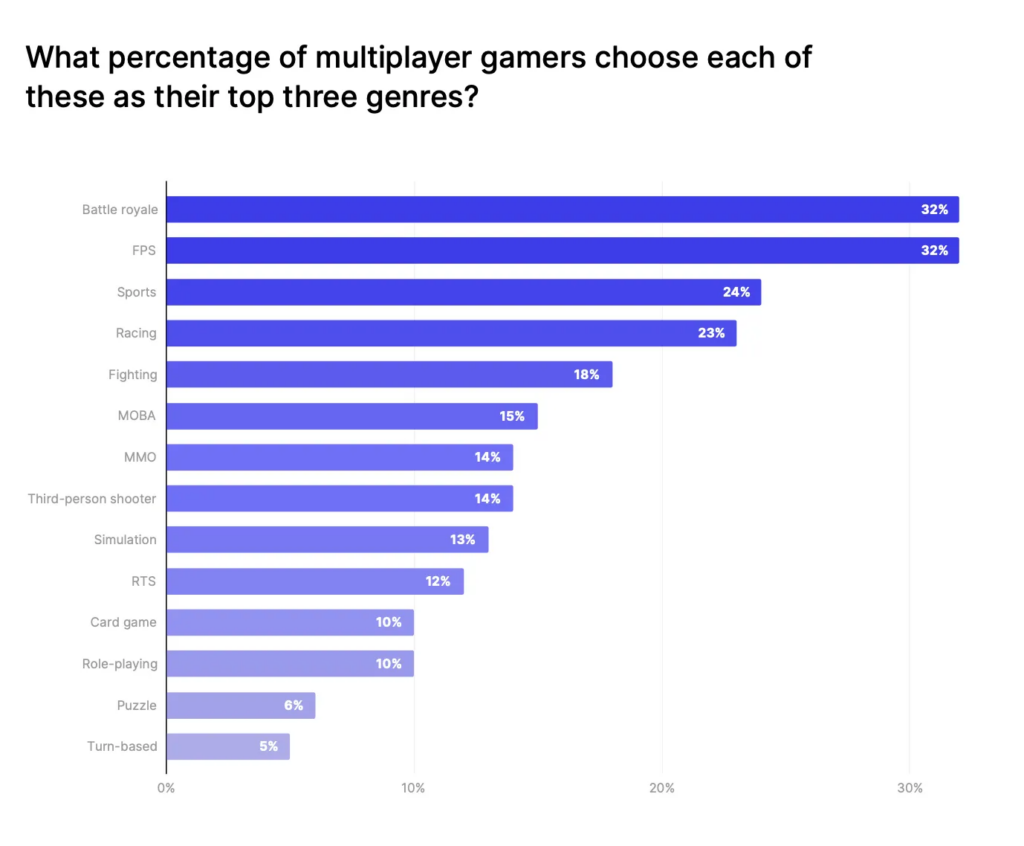

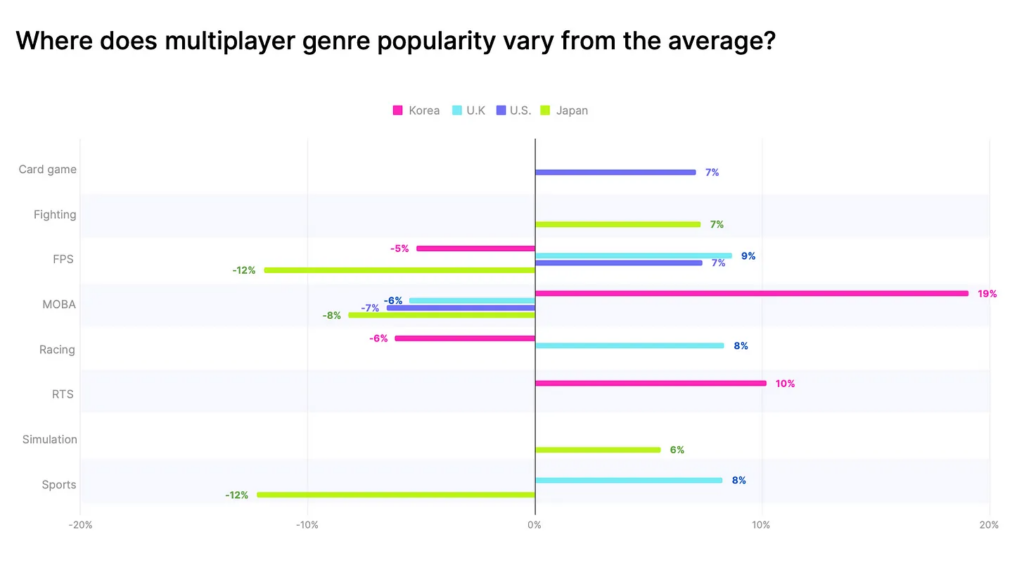

Unity: Multiplayer Games in 2022 Report

-

52% of the planet's population is playing games. 77% of them are playing multiplayer titles.

-

32% of multiplayer gamers prefer Battle Royale and FPS.

-

There is a country factor in the most popular game genres. South Korean top multiplayer genres are MOBA and RTS, not FPS.

-

Sports games showed the highest growth in 2022 compared to the previous year - by 11%. Racing games (+5%) and Battle Royale (+4%) are next.

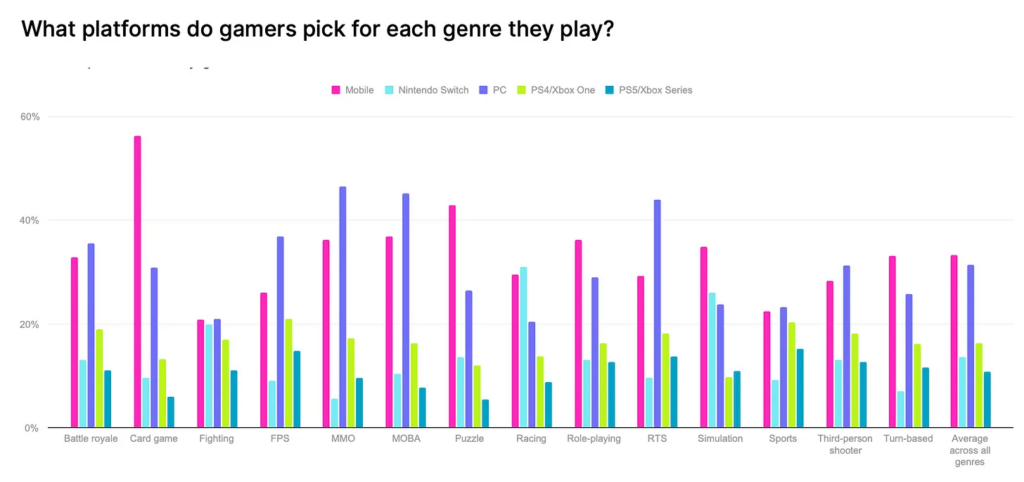

-

MOBA, RTS, MMO, and FPS are the most popular on the PC. Puzzles, card games, simulations, RPGs, and turn-based titles are most popular on mobile devices. Racing games are popular on Nintendo Switch, mobile, and PS4. Third-person shooters, sports games, and fightings are genre-agnostic.

-

35% of multiplayer gamers are worried about the matchmaking system in games. It’s crucial for them.

-

Sport and racing games are one of the few where multiplayer experience happens offline.

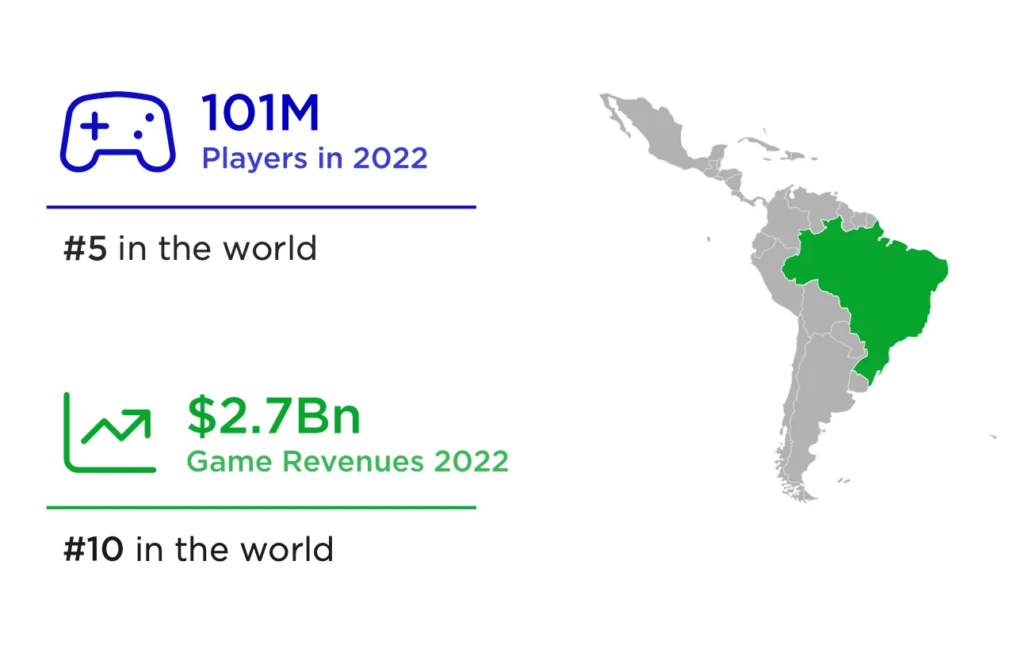

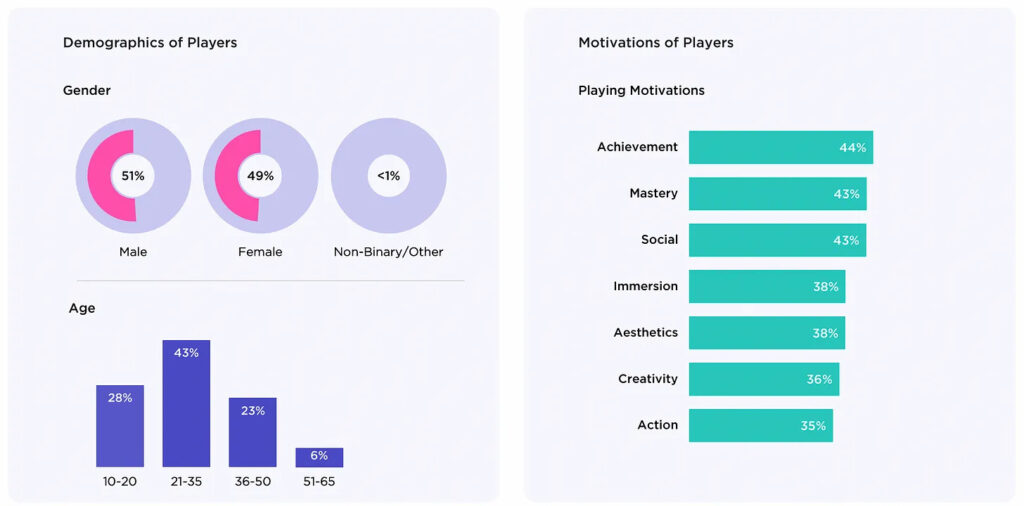

Newzoo: Brazilian gaming market in 2022

-

There will be 101M players in Brazil by the end of 2022. The market will reach $2.7B (#10 globally).

-

52% of Brazilian gamers are both playing games, and watching gaming content.

-

51% of Brazilian gamers are men; 49% are women.

-

Most Brazilian gamers are between the ages of 21 to 35 years (43%). Age segments of 10-20 (28%), 36-50 (23%), and 51-65 (6%) are next.

-

60% of gamers played on mobile in the last 6 months. 31% - on consoles. 30% have played on the PC. PC & Console are also winning in the playtime.

-

Fortnite, Counter-Strike: Global Offensive & GTA V are leaders by MAU in Brazil. Genre-wise, gamers in the country like shooters, adventure games, and sports games.

-

Only 43% of gamers in Brazil made IAP in the last 6 months. The main motivation was a desire to open additional or get access to the exclusive content.

Newzoo: Brazilian gaming market in 2022 Download

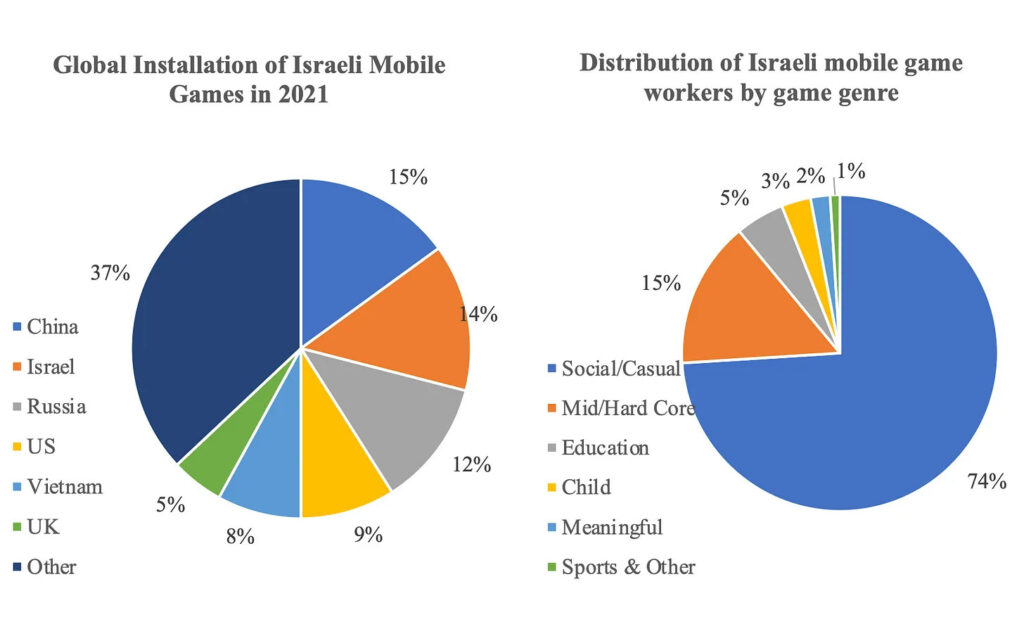

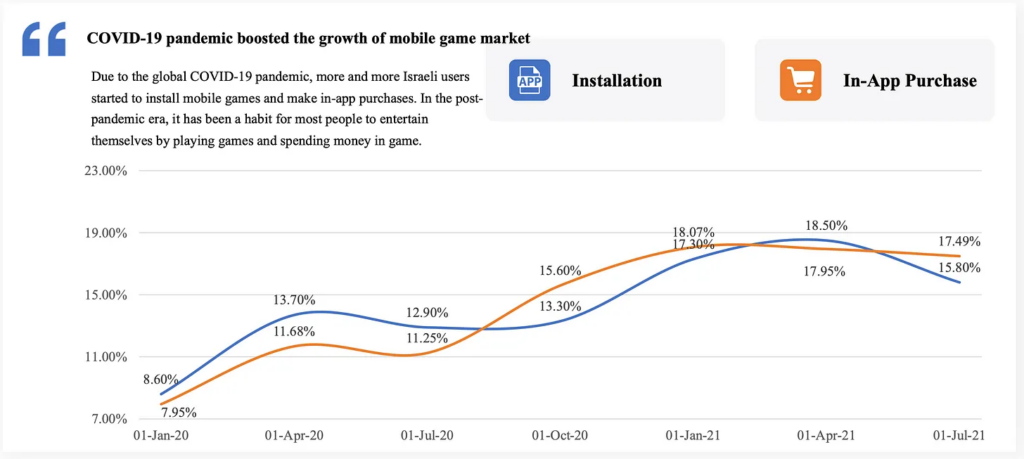

SocialPeta & GameIS: Israel mobile gaming market and worldwide marketing trends in 2022

The report covers the timeline from January to July 2022.

Israeli Market

-

Israeli gaming companies will earn $9B in 2022.

-

There are 200 companies with 14k employees in Israel. The country is the leader in the Social Casino and hypercasual genres.

-

The pandemic boosted the growth of the Israeli market. The number of downloads increased by 1.5x times; the number of IAP by almost 2x times.

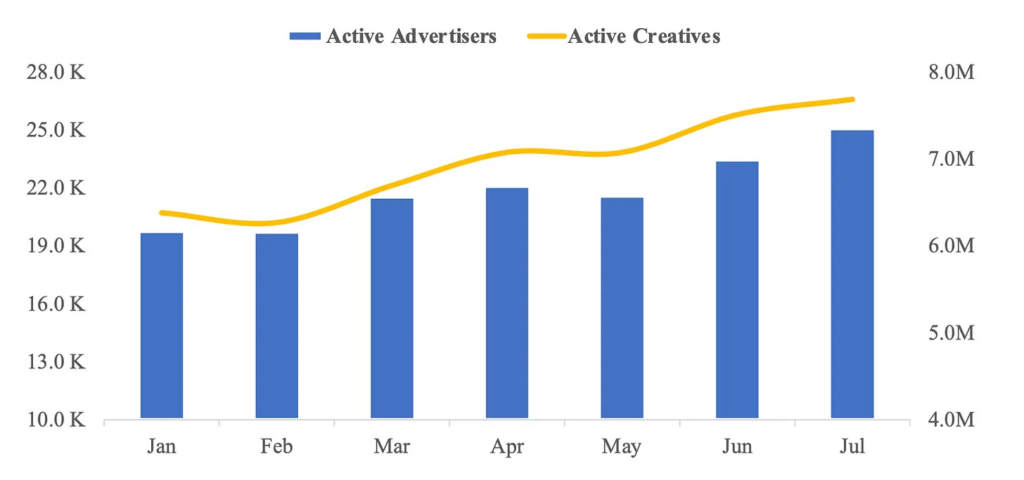

Global Marketing Trends

-

From January to July 2022 the number of gaming advertisers increased by 4.2%. On the contrary, the number of creatives decreased by 17.8%.

-

The majority of advertisers and creatives belong to the casual genre. Puzzles are next.

-

From January to July 2022 the average advertiser released 318 creatives per month.

-

86.4% of all creatives are videos.

-

Android is responsible for 72.5% of all creatives and 70% of advertisers in the reviewed period.

SocialPeta & GameIS: Israel mobile gaming market and worldwide marketing trends in 2022 Download

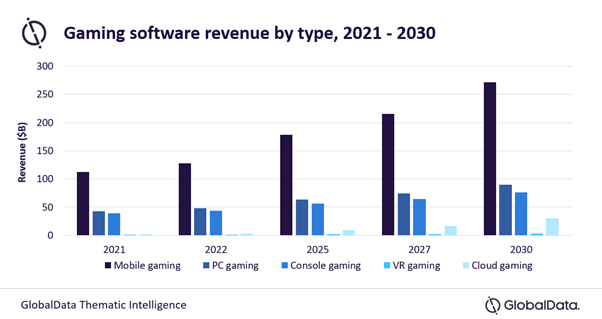

GlobalData: The Gaming Market will reach $470B by 2030

-

Based on research, the gaming industry revenue in 2021 was $197B. By 2030 it should increase by 2.5x times to $470B.

-

In 2030, most of the revenue (more than 50%) will continue to come from mobile. In 2021 Mobile was 57% of the revenue.

-

Cloud Gaming will show the fastest growth rates. From $2B in 2021, it is supposed to grow to $30B in 2030.

Genshin Impact revenue surpassed $3.6B

-

On the day of the Version 3.0 release players spent $12M for the IAP.

-

32% of the Genshin Impact revenue currently comes from China. Japanese users are responsible for 24% of revenue. The US is third with 18%.

-

Genshin Impact now generates more than 110M downloads without third-party stores.

-

21.4% of downloads came from China, and 11.8% from the US. Japan, despite the large share in revenue, is responsible for 4.4% of downloads only.

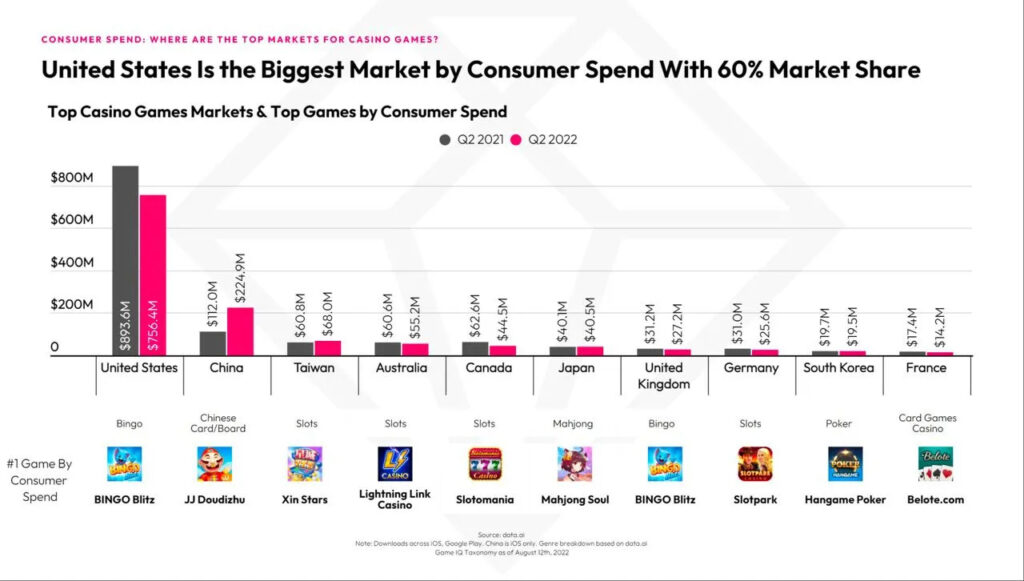

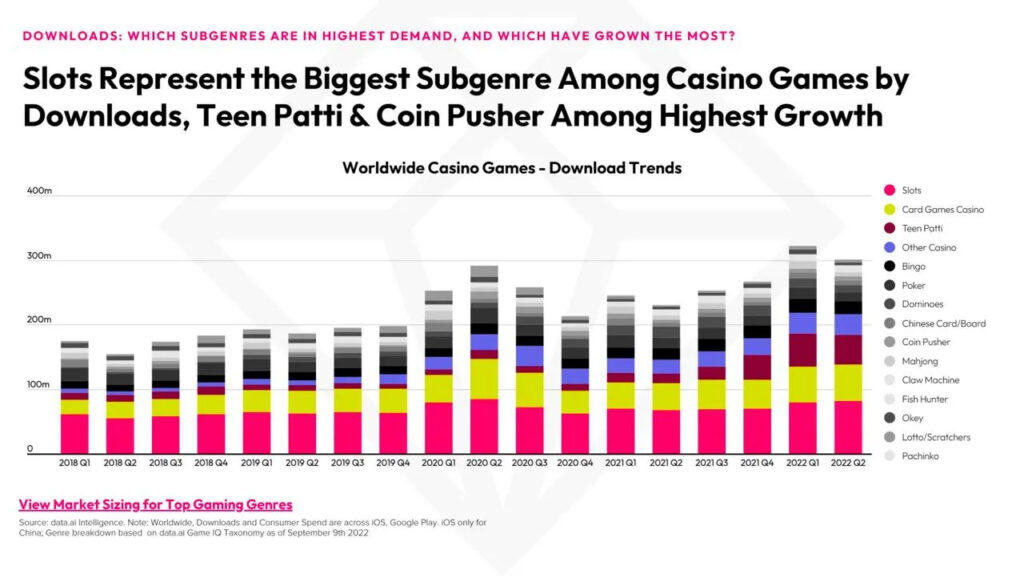

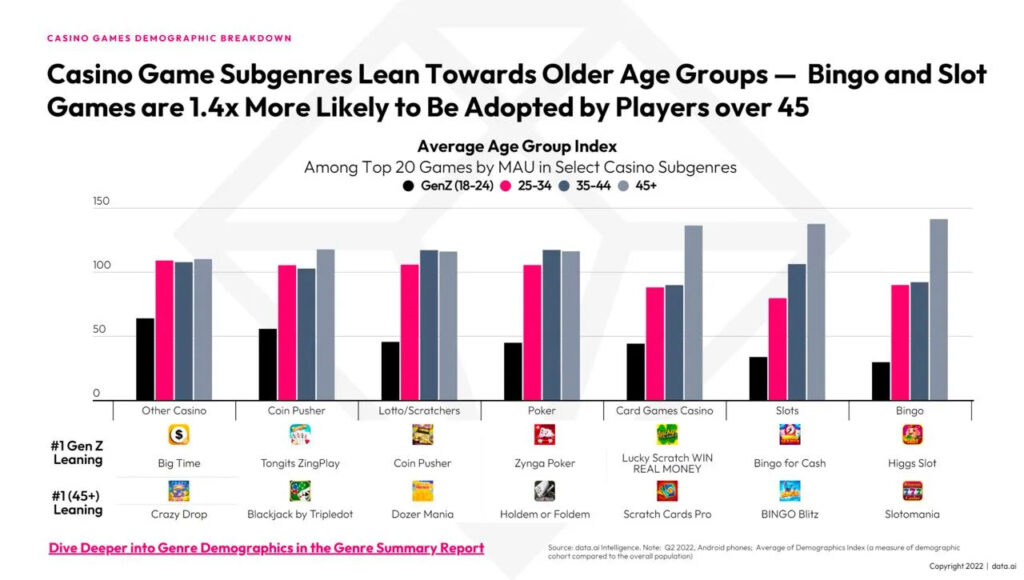

data.ai: Social Casino gaming market in 2022

-

The US is the largest market for social casino games. It’s responsible for 60% of overall revenue despite the small drop in Q2 2022.

-

Chinese gamers’ spending on social casinos increased a lot - from $12M in Q2 2021 to $224.9M in Q2 2022.

-

Slots are still the most popular sub-genre. The largest growth during the last five years showed the Teen Patti game - it’s an Indian card game.

-

The social casino audience is majorly older than 45 years. Slightly younger (from 35 to 44 years) is the audience of poker & scratcher/lotto games.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.