devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the October and November reports.

Table of Content

- Niko Partners: Asian Market in 2022 and its future (without mainland China)

- Pokemon Scarlet & Violet are the fastest-selling games in Nintendo's history

- GfK: Pokemon Scarlet & Violet set a record in the UK retail

- data.ai: Talking Tom & Friends is the most popular mobile franchise of the last decade

- StreamElements & Rainmaker.gg: Streaming market in October 2022

- GameRefinery: How Halloween events helped downloads and revenue of mobile titles

- God of War Ragnarok became the best-selling first-party title in PlayStation history

- GameRefinery: IP-collaborations effect on Mobile Games Downloads & Revenue

- AppsFlyer: D30 Retention in games is declining for 3rd year straight

- Apptica: Paid Promotion trends in mobile games in Q3 2022

- GfK: Physical games sales in the UK during the Black Friday 2022 dropped but overall revenue increased

- Games Jobs Live: The number of open positions in gaming companies in the UK continues to decline

- data.ai & Deconstructor of Fun: Mobile Gaming market in 2022 and beyond

- AppMagic: Top Mobile Games by Revenue & Downloads in November 2022

- AppMagic: Goddess of Victory: Nikke earned $100M in a month after the global launch

- Newzoo: UK gaming market in 2022

- Newzoo: German gaming market in 2022

- Sensor Tower: PUBG Mobile earned $9B lifetime

- GSD & GfK: November game sales in the UK dropped compared to 2021

- The NPD Group: The US gaming market got back to growth in November 2022

- Famitsu: Pokemon Scarlet and Violet became the main game of November in Japan

- GSD: European PC & Console game sales dropped in November 2022

- StreamElements & Rainmaker.gg: Game Streaming market in November and 2022

- Sensor Tower: Top Mobile Games by Revenue & Downloads in Southeast Asia in November 2022

- data.ai: Mobile Games Revenue will continue to decline in 2023

- LoopMe: 80% of mobile gamers are not fully engaged while playing

- Azur Games: Hypercasual market analysis in 2022

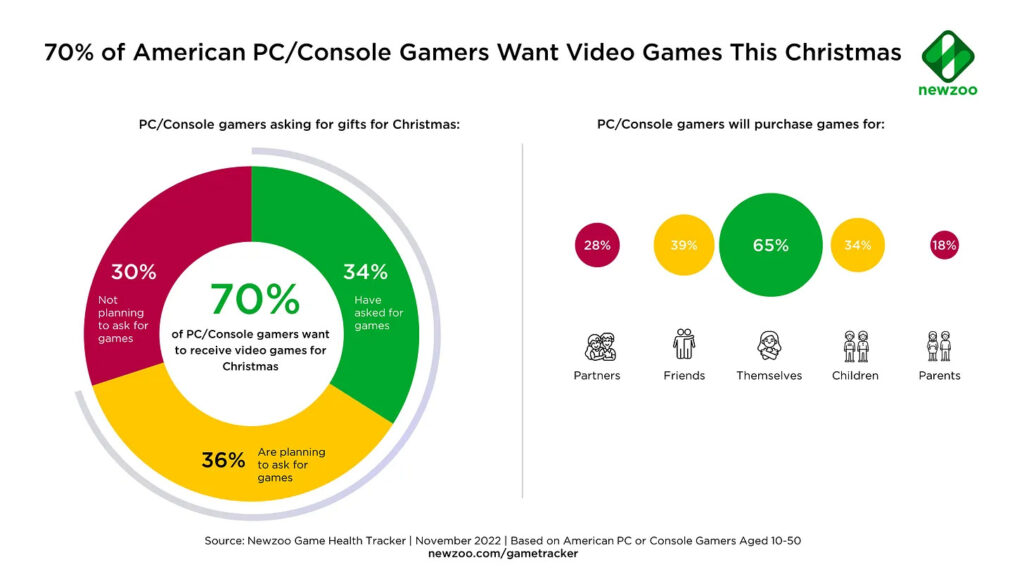

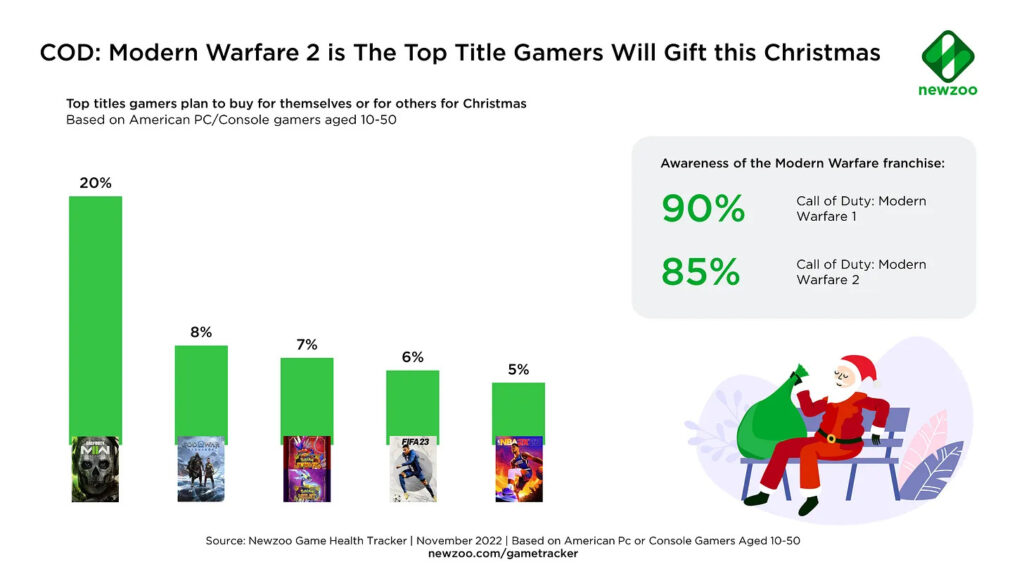

- Newzoo: Call of Duty, God of War, and Pokemon are the most-wanted gifts this Christmas

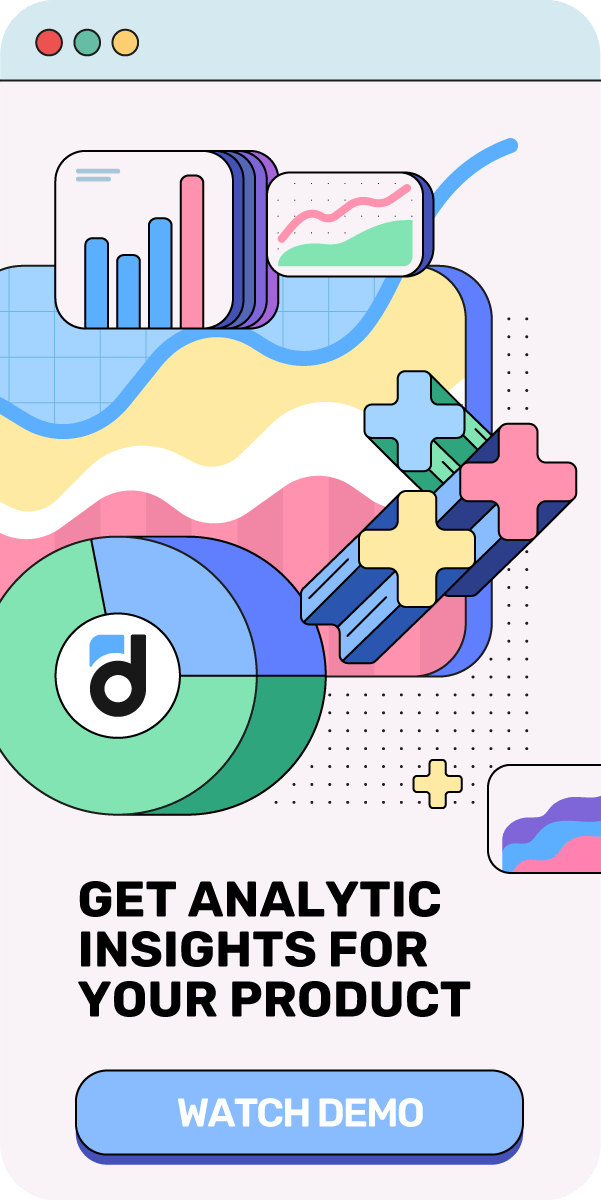

Niko Partners: Asian Market in 2022 and its future (without mainland China)

The research is covering Chinese Taipei, India, Indonesia, Japan, South Korea, Malaysia, Philippines, Singapore, Thailand, and Vietnam.

-

Ten mentioned Asian countries will generate $35.9B in 2022. The revenue will increase to $41.4B in 2026.

-

77% of revenue comes from two countries - Japan and South Korea. In 2022 the revenue of Japan declined by 2.6% YoY, while South Korea's revenue was flat.

-

India (+31.9% YoY), Indonesia (+10.5% YoY), and Thailand (+9.5% YoY) are the fastest-growing countries in the region by revenue.

-

The number of gamers is increasing faster than revenue. In 2022 in mentioned countries there will be 788.7M gamers. In 2026 their amount will reach 1.06B.

-

50.2% of gamers are in India. It’s 396.4M players.

Pokemon Scarlet & Violet are the fastest-selling games in Nintendo's history

-

Two versions of the same game (this is the Nintendo strategy) sold 10M copies in just 3 days both physically and digitally.

-

Just in two days, games earned more in the UK more than any other Pokemon franchise in the country.

-

Despite financial success, Pokemon Scarlet & Violet has its problems. Players are complaining about bugs and graphics.

GfK: Pokemon Scarlet & Violet set a record in the UK retail

-

The game managed to sell in the debut week 4% better than FIFA 23.

-

By retail copies sales, Pokemon Scarlet & Violet is in second place after Pokemon Sun & Moon. But money-wise it’s the first (Scarlet & Violet price is £48 versus £35 for Sun & Moon).

-

Pokemon Violet is responsible for 52% of sales, Scarlet - for 42%, and double-pack has been bought by 6% of users.

-

The successful launch of Pokemon Scarlet & Violet increased the Nintendo Switch sales by 62% compared to the previous week. It’s helped Nintendo to set a new weekly record for console sales.

-

God of War Ragnarok sales dropped by 73% to the previous week. The game is now in the 4th place on the UK chart.

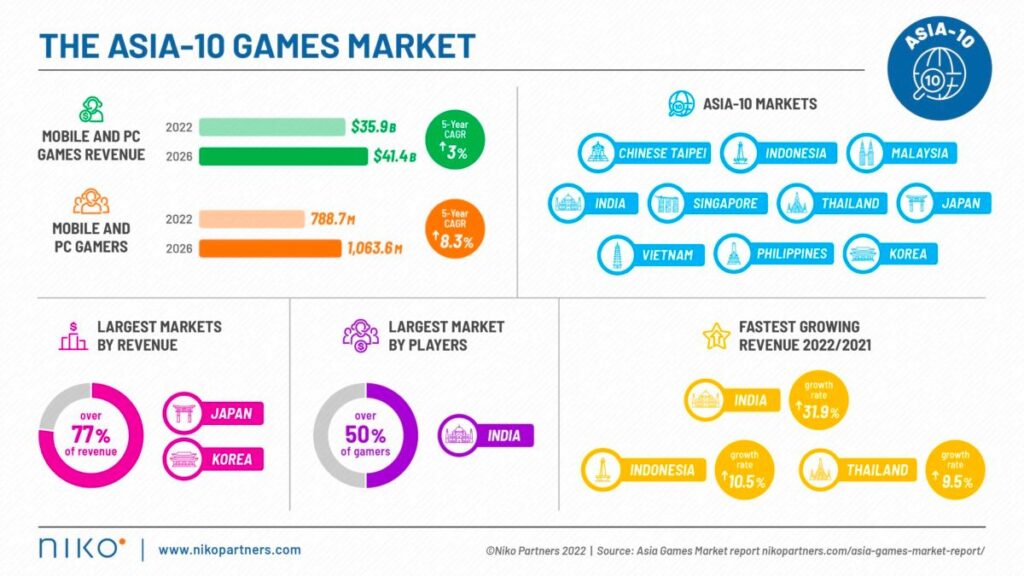

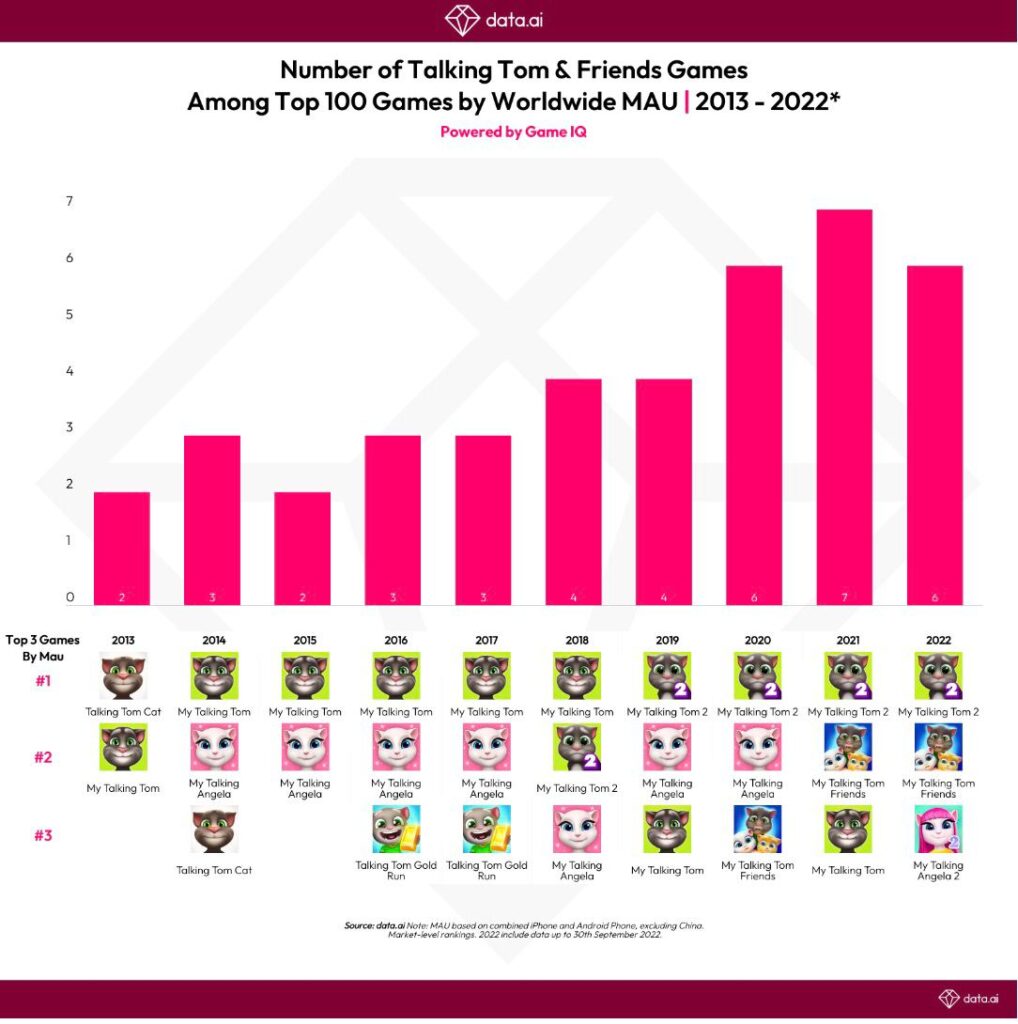

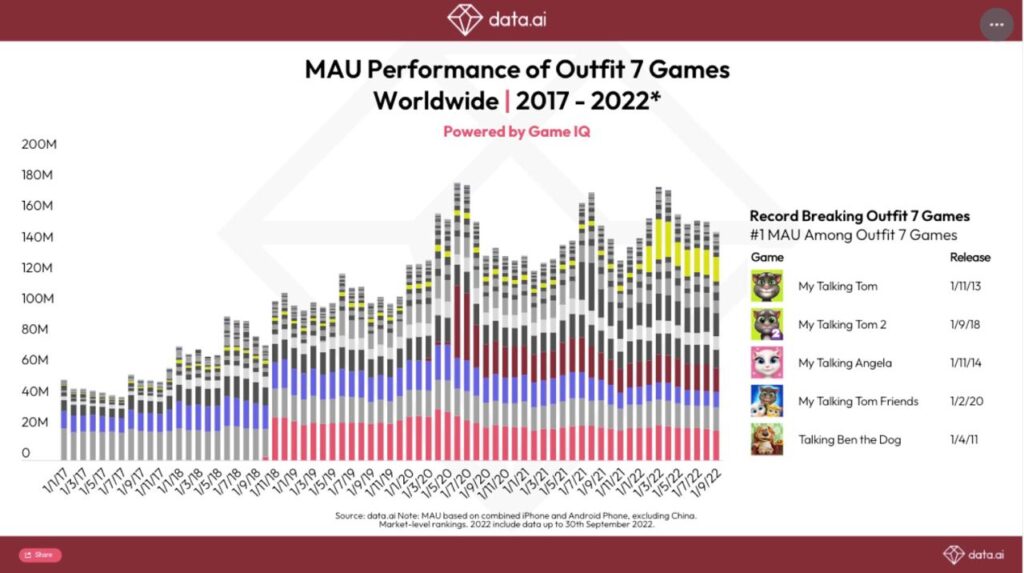

data.ai: Talking Tom & Friends is the most popular mobile franchise of the last decade

-

Talking Tom & Friends games have been downloaded more than 10 billion times from 2013 to 2022. They’ve been leaders every year by downloads.

-

Candy Crush Saga, PUBG, and Angry Birds were other leaders over the years.

-

Outfit7 was the leader in the number of games in the top 100 by MAU in 2021. The company had 7 projects on the list.

-

The company’s MAU is increasing from year to year. Now more than 470M users play Talking Tom & Friends games monthly.

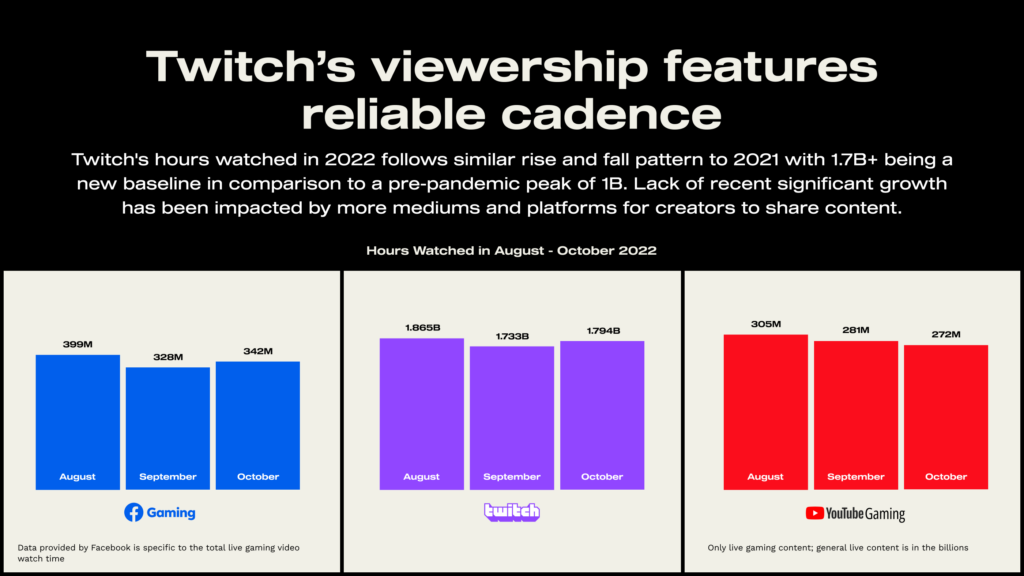

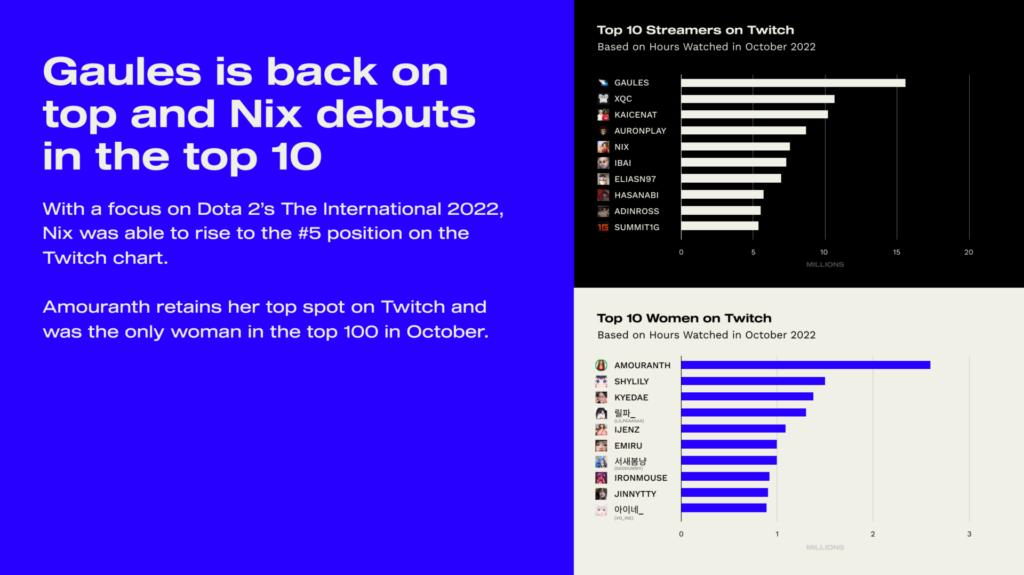

StreamElements & Rainmaker.gg: Streaming market in October 2022

The number of views on Twitch in October 2022 reached 1.79B hours. Two months before the pandemic, Twitch set a record of 1B hours. It seems that even if there is a decline to March 2021 (2.2B hours watched), post-COVID results are much better than in 2019.

Facebook Gaming increased the number of hours watched in September and reached 342M hours. YouTube Gaming is declining for the third consecutive month with 272M hours watched in October.

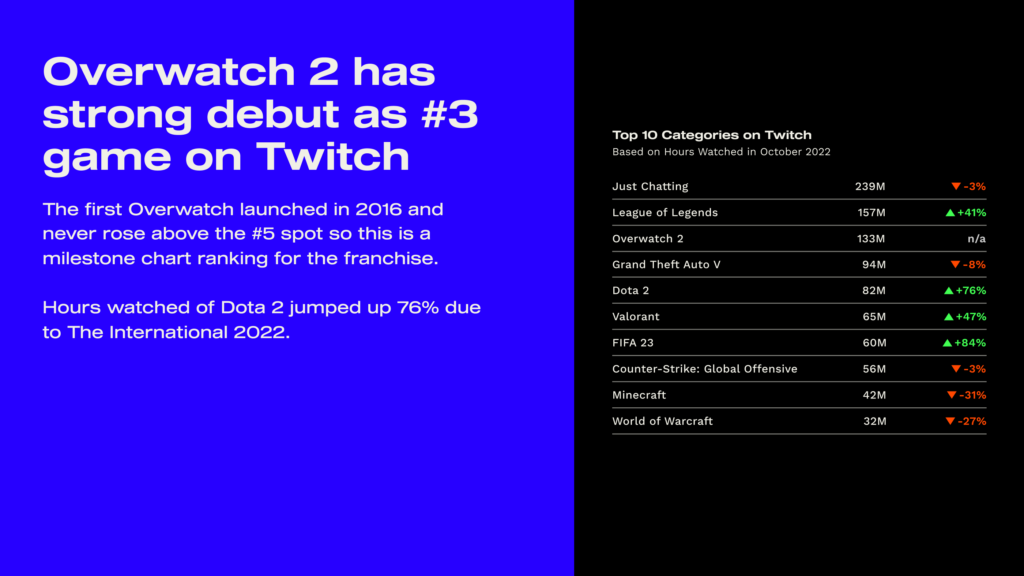

Overwatch 2 made a debut in Twitch charts in 3rd place (133M hours) behind "Just chatting" and League of Legends categories. The best result of the first game was #5 in the rating.

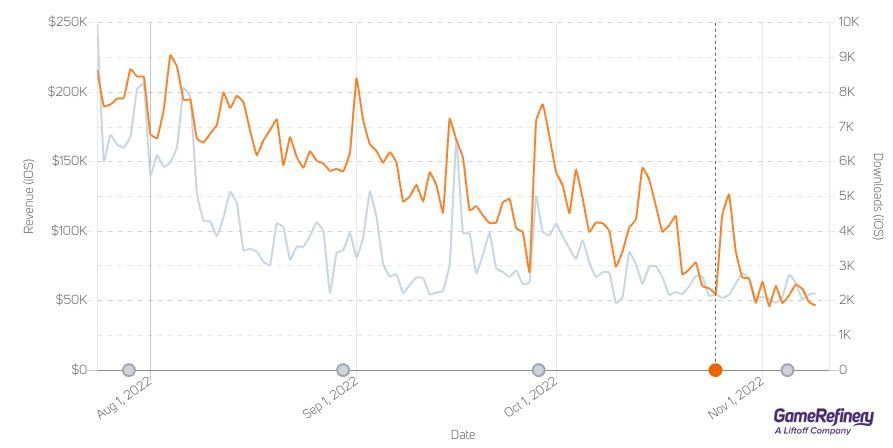

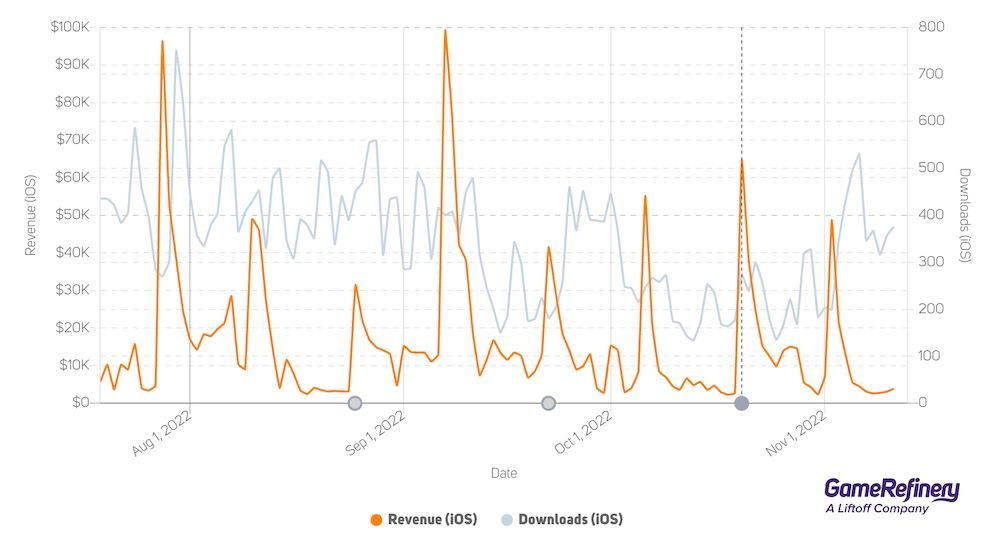

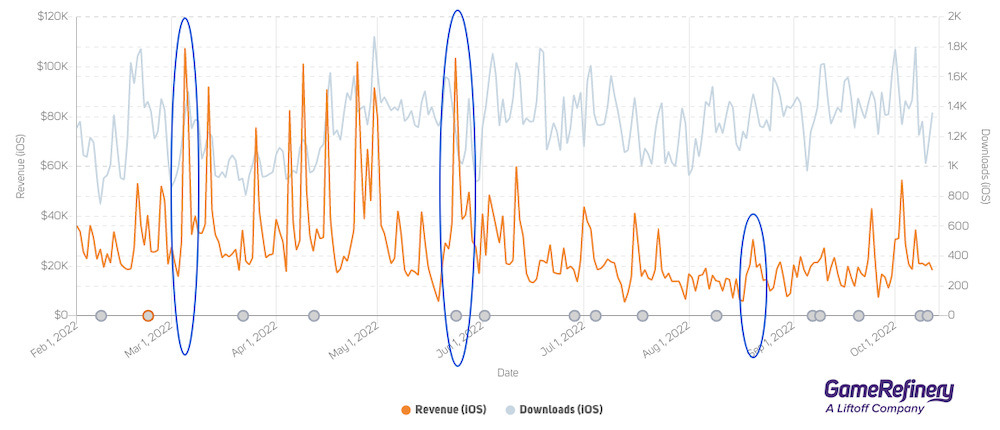

GameRefinery: How Halloween events helped downloads and revenue of mobile titles

-

Hallow’s Wake event helped to spike the revenue at the moment. However, it didn’t help to change the overall trend of declining revenue of the title.

Mario Kart World Tour

-

Halloween Tour helped get 2x more IAP revenue on launch day. Moreover, after the launch, the overall revenue was higher than before the event despite the usual inflation effect.

Gran Saga

-

The Mirage Nightmare event helped the game to get 400%+ revenue at the launch. The trend normalized only in the first days of November, after which an additional event was launched that helped to increase the revenue.

More updates can be found in the GameRefinery material.

God of War Ragnarok became the best-selling first-party title in PlayStation history

-

The game sold 5.1M copies in the first week of sales.

-

It’s the best result in both series history and PlayStation first-party history.

-

The previous record was set by The Last of Us: Part II. Naughty Dog’s game reached 4M copies in the first week.

-

The previous God of War franchise record was set in 2018, by… God of War (2018). 3.1M copies have been sold in 3 days back then.

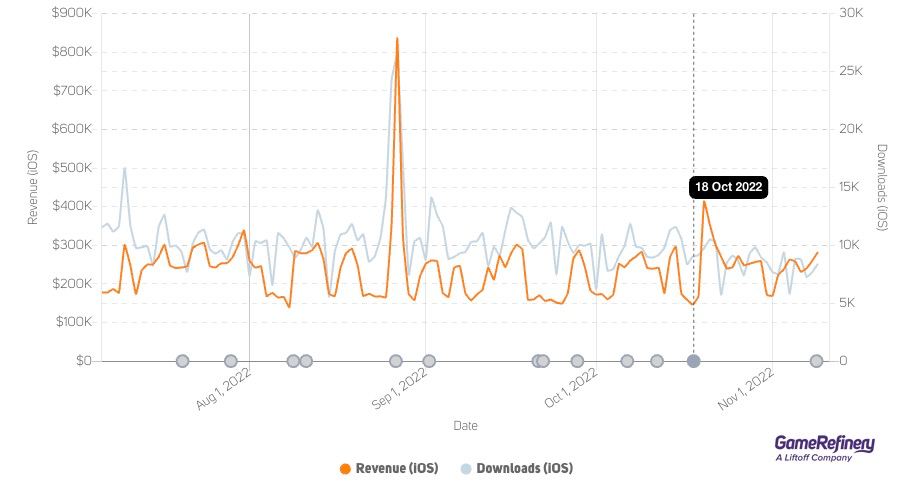

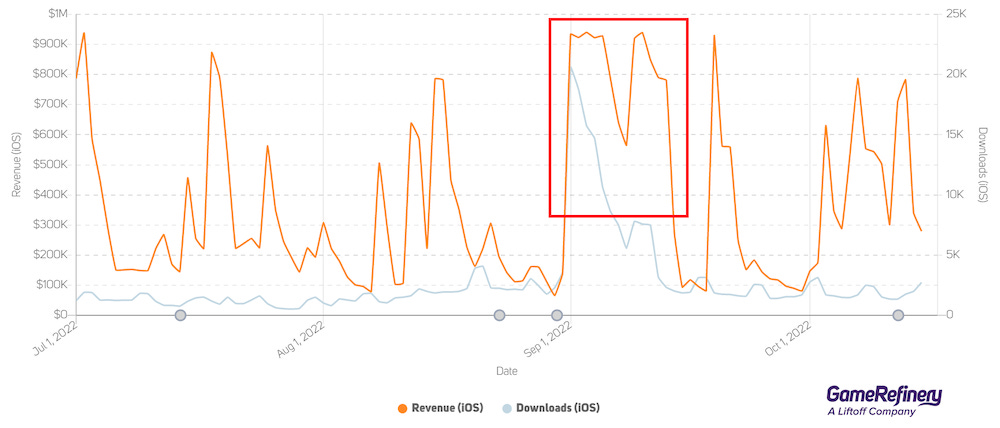

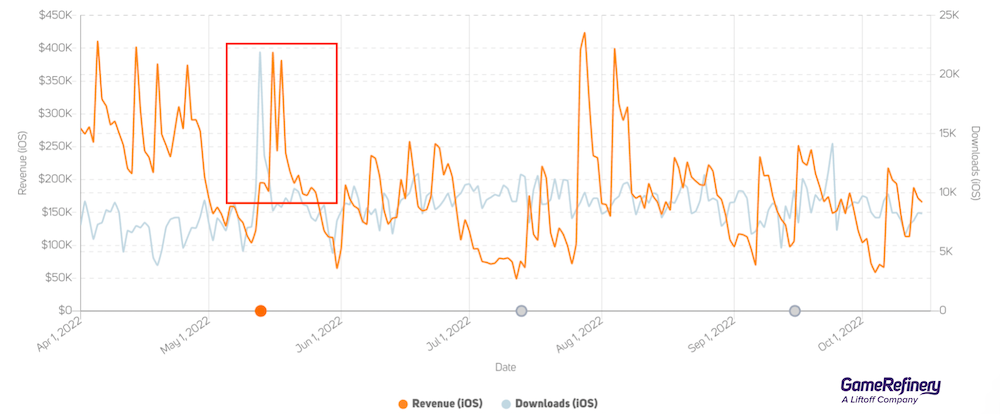

GameRefinery: IP-collaborations effect on Mobile Games Downloads & Revenue

Puzzle & Dragons + One Piece Film Red

-

After the beginning of the event, daily downloads increased by 8x times (from 2.5 thousand to 20 thousand per day).

-

Revenue increased by 11.5x times - from $80k to $920k per day. It’s important to mention that the high revenue was stable during the whole collaboration event.

Mobile Legends Bang Bang + Kung Fu Panda

-

Collaboration results were much worse than with Hello Kitty (March) and Transformers (June). The revenue increase was barely noticeable.

GameRefinery explains it with two critical moments:

-

Kung Fu Panda IP is overall weaker. The last film was released in 2016.

-

The event performance was weaker due to several game design changes.

PUBG Mobile + Evangelion

-

Downloads increased by 2.5x times (from 10 thousand to 25 thousand per day).

-

Daily revenue increased by 2x times (from $200k to $400k) and was high during the event.

Cookie Run: Kingdom + BTS

GameRefinery tracked the collaboration effect in the US market.

-

Collaboration with a boys’ band from Korea helped the game to increase daily downloads by 4x times (from 2.5k to 10k).

-

Revenue increased by 8.3x times (from $18k to $150k).

Analytics are mentioning that IP collaboration can bring significant positive results even in non-target markets.

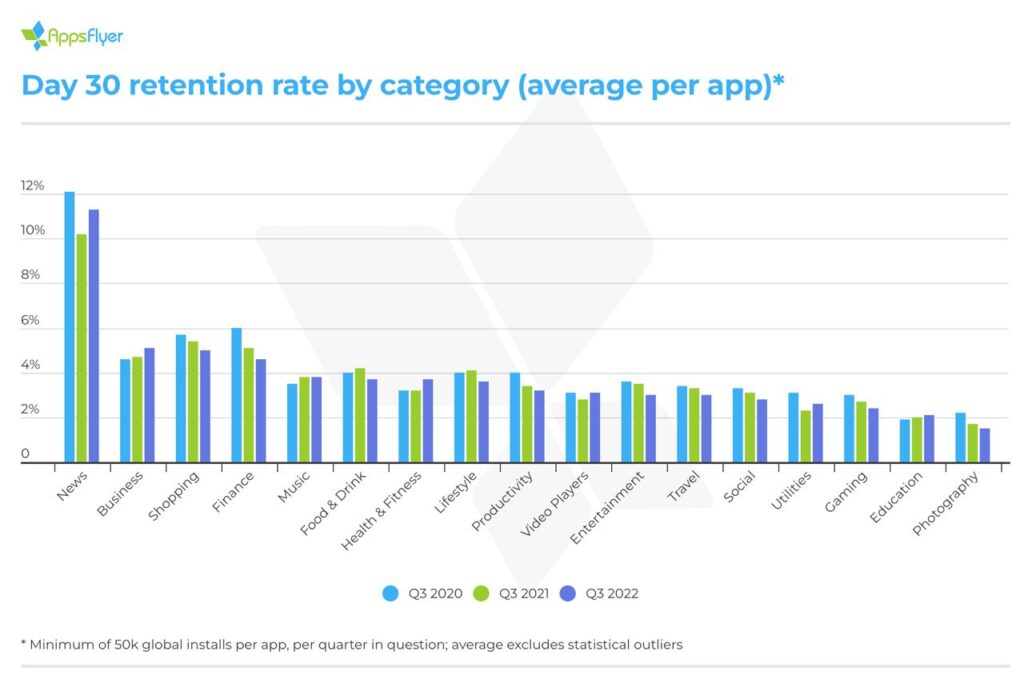

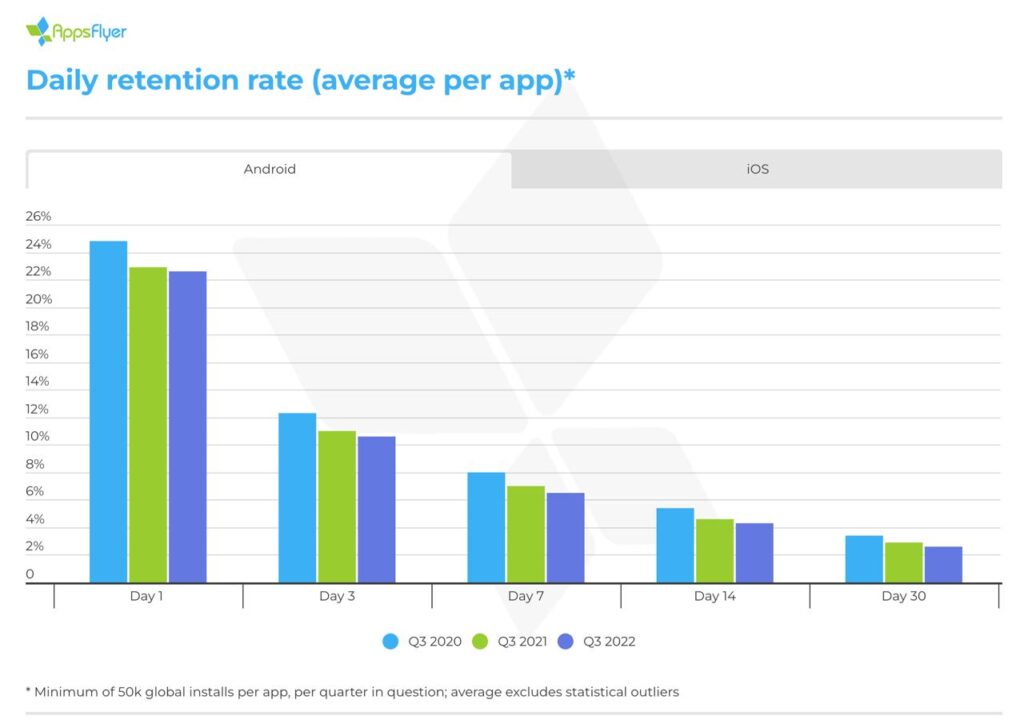

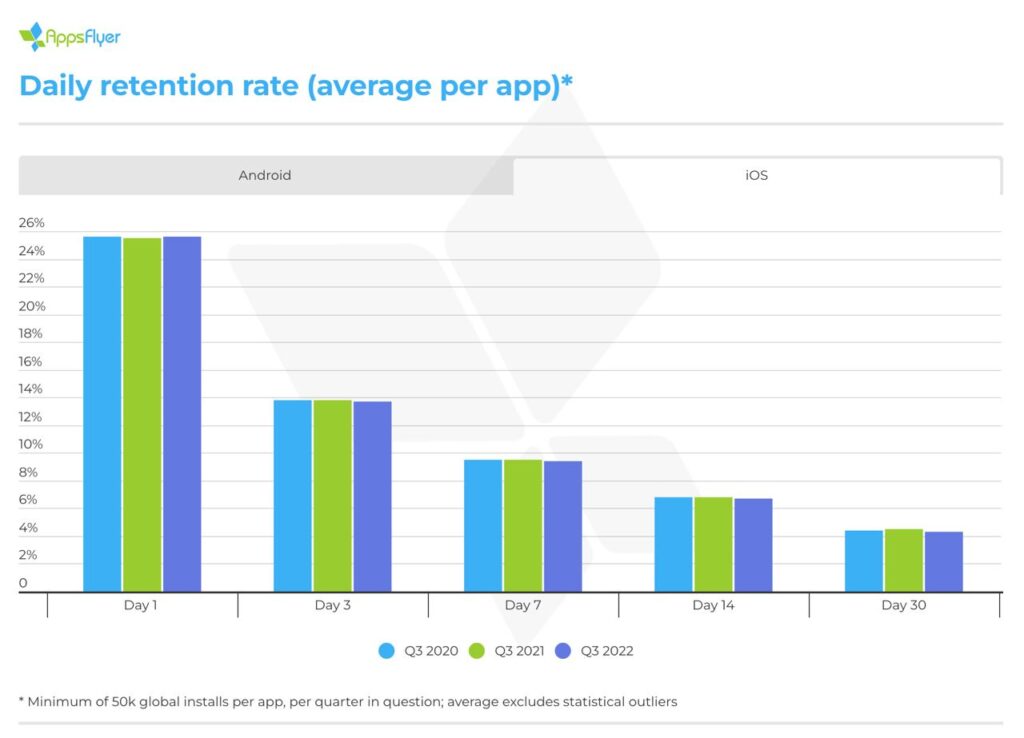

AppsFlyer: D30 Retention in games is declining for 3rd year straight

-

The average D30 Retention in games declined from 3% in Q3 2022 to 2.4% in Q3 2022. It’s a 20% downgrade.

-

Android Retention of all days is decreasing in all categories. iOS is much more stable in these terms.

-

Countries with the highest D30 Retention (not only games) are Japan (5.3%), Canada (3.7%), and South Korea with Australia (3.6%).

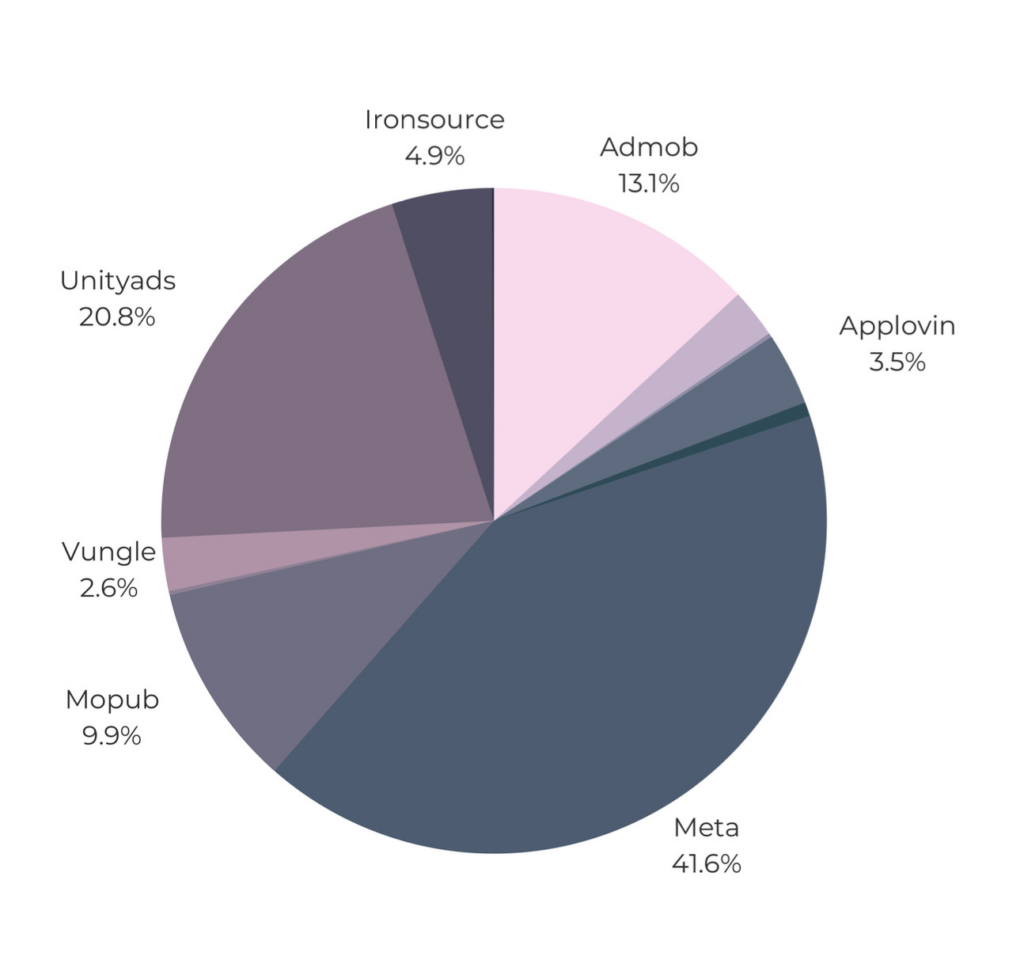

Apptica: Paid Promotion trends in mobile games in Q3 2022

Android

-

26 out of the top 30 games have used paid UA.

-

On average, each advertiser is using from 4 to 6 ad networks.

-

41.6% of ads in the top 30 are using Meta. Unity Ads (20.8%) and Admob (13.1%) are next.

-

7 out of 26 advertisers in the top 30 have used only images as creatives.

-

9 out of 26 advertisers in the top 30 have used all 3 types of creatives - images, videos, and Playable ads.

-

78.1% of all creatives in the top 30 are videos. Playable Ads have a share of only 4.8%.

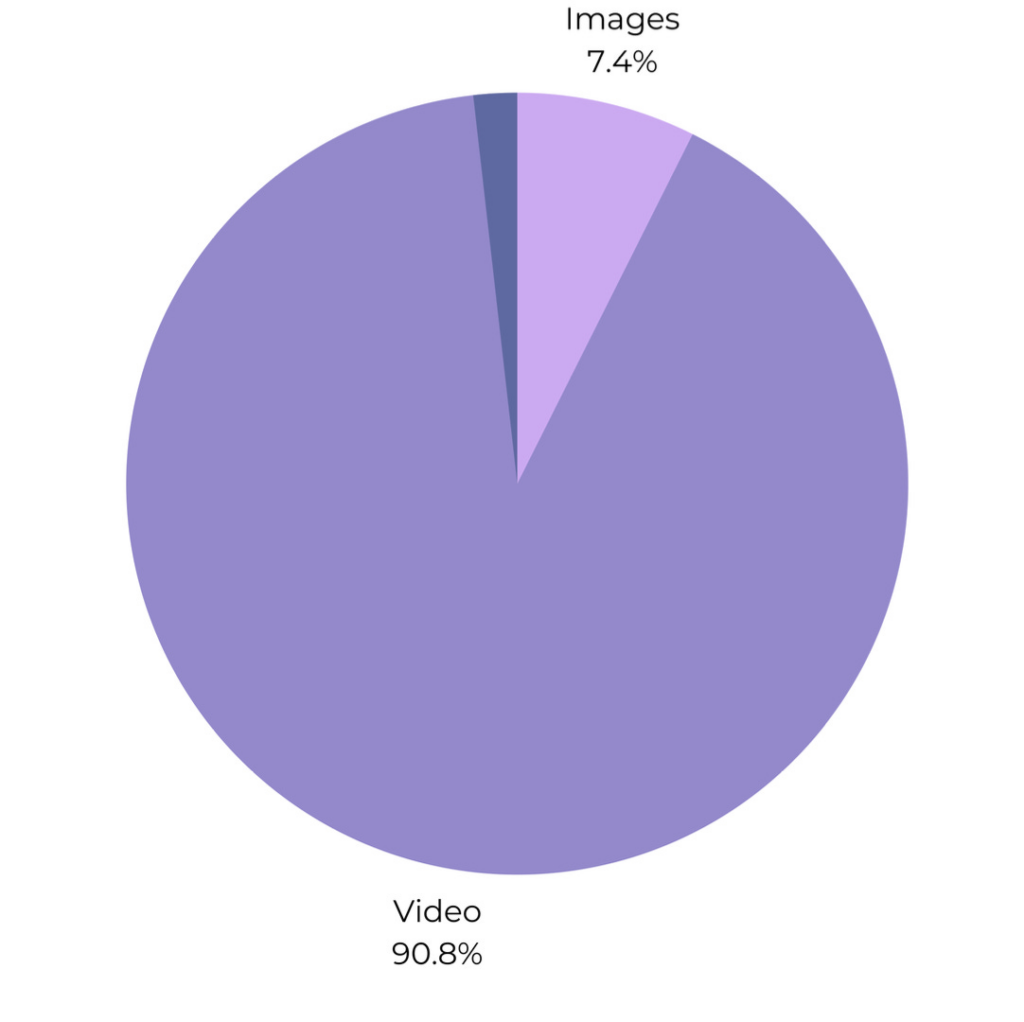

iOS

-

23 out of the top 30 games used the paid UA.

-

86.8% of advertisers in the top 30 have used Meta. It’s the main channel. The second place has Unity Ads (4%), and the third is Chartboost (2.9%).

-

90.8% of all creatives in the top 30 are videos.

-

Only 1.08% of creatives in the top 30 on iOS are Playable Ads.

-

Advertisers on iOS are making about 4.5x more creatives than on Android.

GfK: Physical games sales in the UK during the Black Friday 2022 dropped but overall revenue increased

Games

GfK is recording only physical copies sales, so the decline speaks more about an interest in the digital versions than of a market negative trend.

-

Games’ physical sales last year were better by 15%.

-

The decline is happening for the second consecutive year. In 2021 physical games results were 10% lower than in 2020.

-

The main title of Black Friday 2022 in the UK was FIFA 23 (sales increased by 95%). Call of Duty: Modern Warfare 2 was back in second place (+9% in sales). Pokemon Scarlet went to third place, while Pokemon Violet ended in sixth. Both games lost about 64% in sales.

Consoles

-

Nintendo Switch became the most popular console of Black Friday 2022 in the UK with 42% of console sales.

-

Xbox Series S was about to take the lead. It had 40% of sales thanks to the huge discount.

-

The remaining part of sales was taken by PlayStation 5, the digital version of which received a minor discount.

Overall

-

If we sum up sales of games, consoles, and accessories, Black Friday 2022 financial results in the UK were 4% better than in 2021.

-

41% of revenue has been made by consoles; 39% by accessories, and only 21% by physical games copies.

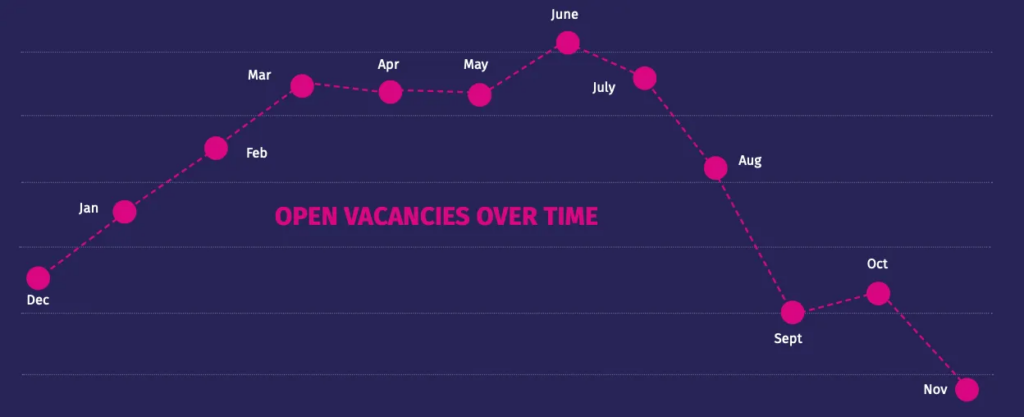

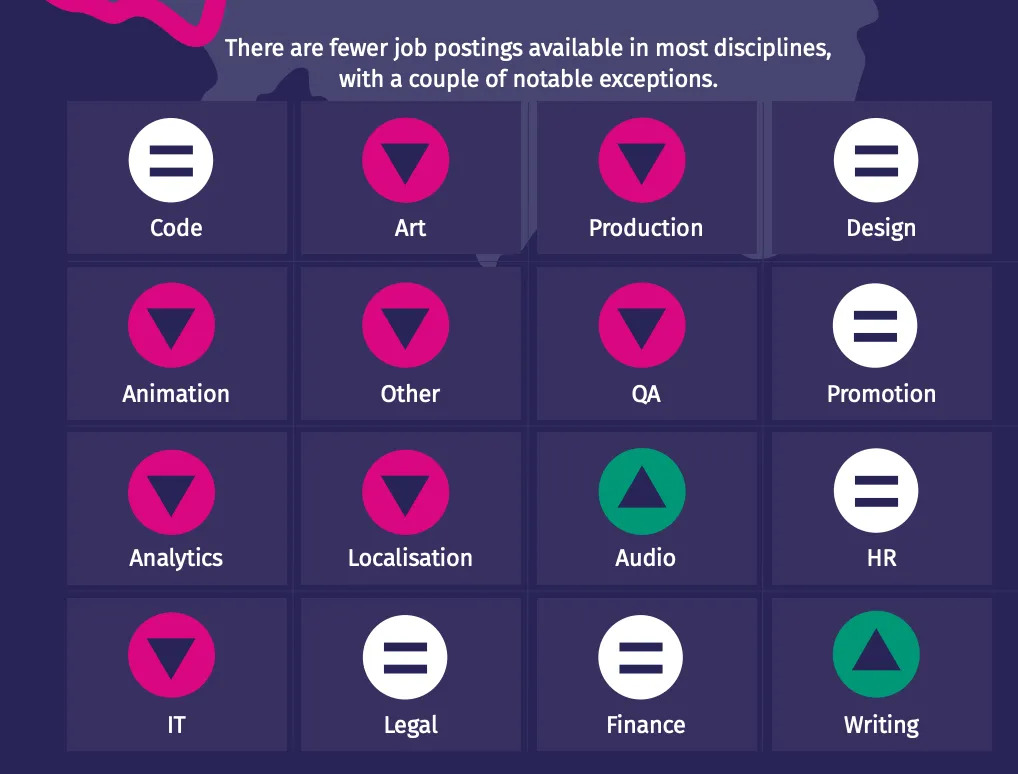

Games Jobs Live: The number of open positions in gaming companies in the UK continues to decline

The information was collected on November 2022

-

The recession struck worse on mobile studios. Big companies in the sector either stopped or paused hiring.

-

One of the few companies actively working in the job market is Jagex.

-

Software Engineer, Senior Producer, Senior Environment Artist, Senior Game Designer, Senior Programmer, Producer, and Technical Artist are the most popular open vacancies in the UK.

-

The number of open positions increased only in two fields - audio and writing.

-

The number of open positions for Junior specialists is about 3-5% of the overall amount.

Games-Jobs-Live-Report-November-2022_summarised

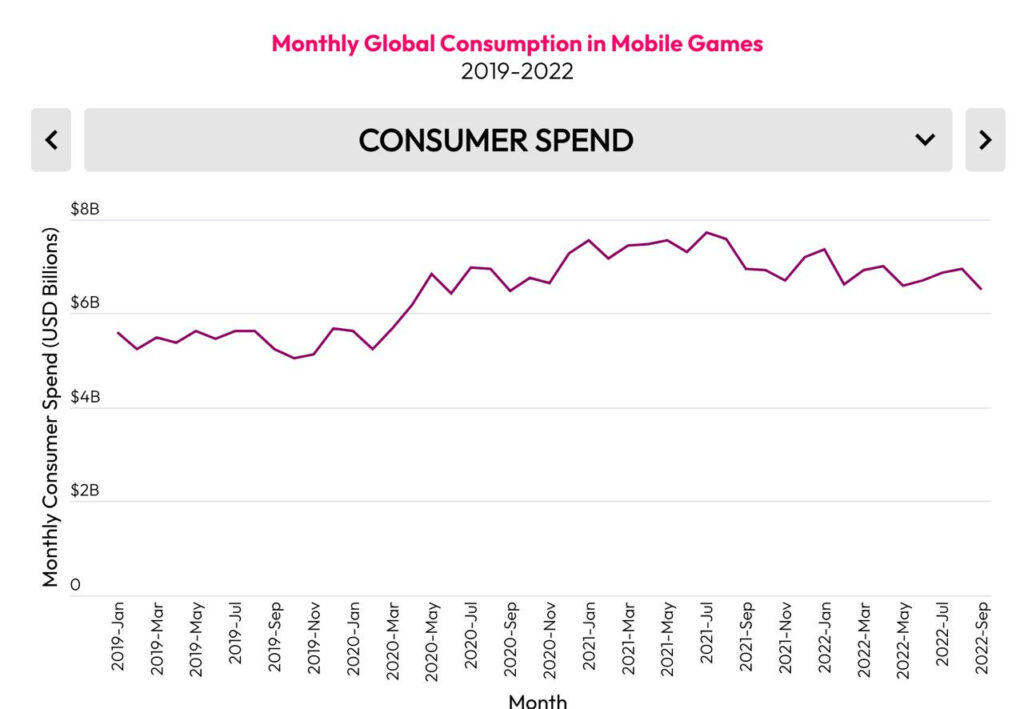

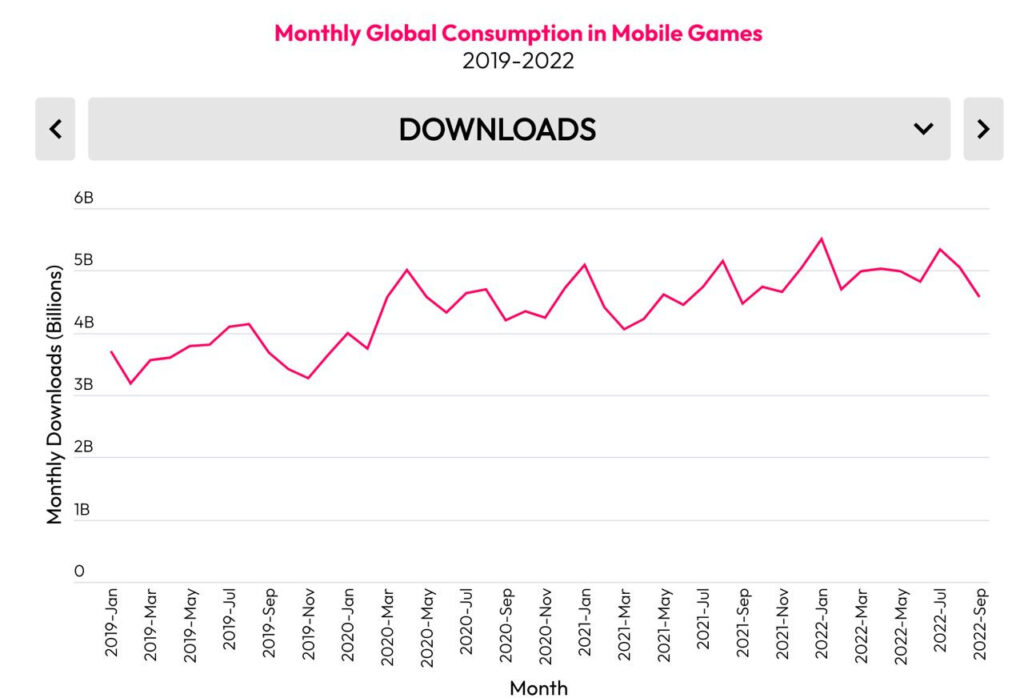

data.ai & Deconstructor of Fun: Mobile Gaming market in 2022 and beyond

-

Games still account for 61% of all users’ spending on apps.

-

In Q3 2022 users spent weekly $1.5B on mobile games and downloaded more than 1.1B games. It’s 25% more than in pre-pandemic Q3 2019.

-

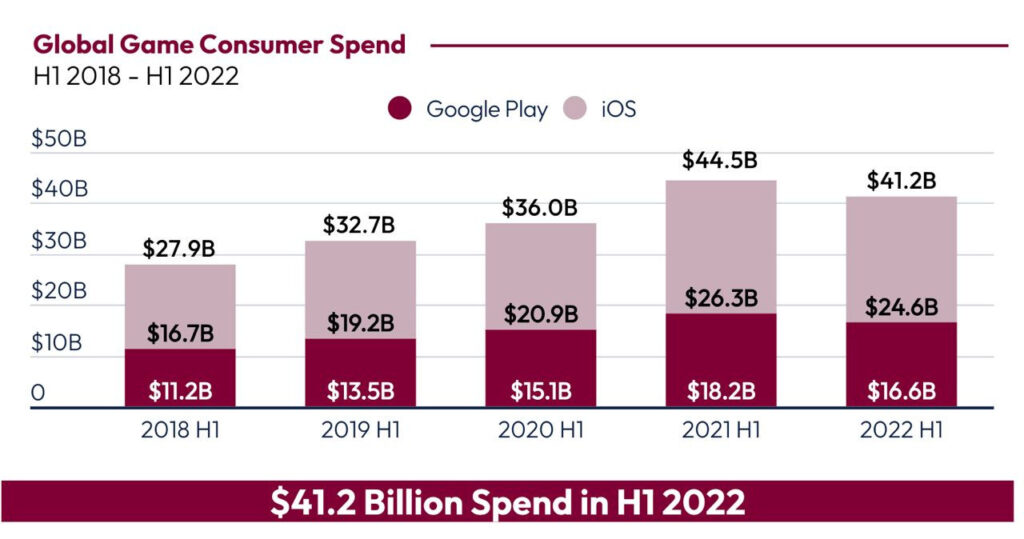

In H1 2022 mobile games in App Store & Google Play earned $41.2B. It’s 7.5% lower than in H1 2021, but 14% more than in H1 2020.

-

Downloads continue to grow. In H1 2022 mobile games were downloaded 30B times. It’s 11.5% more than in H1 2021.

-

The number of games in the App Store has been declining since 2016. The number of new releases is constantly small since 2018.

-

The number of games earning $10M+ per year is growing. In 2021 this amount reached 925 games.

-

63% of all mobile gaming revenue in the US in H1 2022 was generated by games from top-100. In 2020 this percentage was 62%.

-

25 games released in 2021 reached top-100 by revenue (against 19 in 2020). On average it took them 4 months (against 7 in the H1 2020).

The most successful genres of H1 2022 (without Ad Monetization)

-

RPG - $12.8B (31% of all IAP volume). 2% of all downloads. YoY decline by revenue - 9.4%. YoY decline by downloads - 3.5%.

-

Strategy - $6.4B (15% of all IAP volume). 2% of all downloads. YoY decline by revenue - 3.2%. YoY growth by downloads - 16.5%.

-

Match - $4.4B (11% of all IAP volume). 5% of all downloads. YoY decline by revenue - 6.8%. YoY growth by downloads - 15%.

-

Casino - $4.2B (10% of all IAP volume). 2% of all downloads. YoY decline by revenue - 1.9%. YoY growth by downloads - 35.2%.

-

Simulation - $4.2B (10% of all IAP volume). 17% of all downloads. YoY decline by revenue - 13.7%. YoY growth by downloads - 25%.

-

Shooters - $2.5B (6% of all IAP volume). 4% of all downloads. YoY decline by revenue - 7.2%. YoY growth by downloads - 10.8%.

Trends

-

The number of hypercasual games at the top is decreasing. Developers do experiments with hybrid monetization.

-

Casual games managed to reach the growing downloads. However, the revenue is still behind the trail and beyond 2020 and 2021 results.

3 advice from data.ai & Deconstructor of Fun on how to work on the crisis market:

-

Be creative. Test your marketing. Diversify channels.

-

Use IPs.

-

Look outside of iOS and the US. Use different monetization formats.

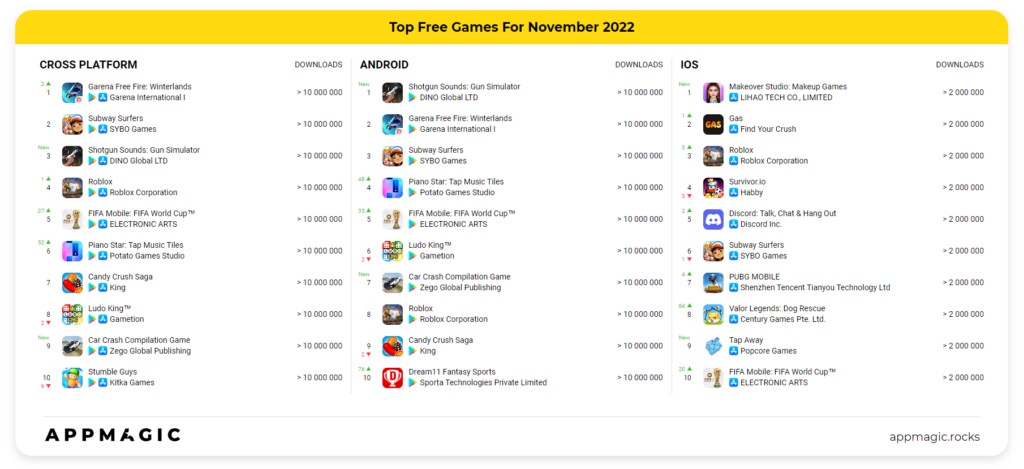

AppMagic: Top Mobile Games by Revenue & Downloads in November 2022

Revenue

-

Goddess of Victory: Nikke reached first place by revenue in Google Play and fifth in App Store last month. The game earned $94M after the release ($50.4M came from Google Play).

-

Honor of Kings is still first by revenue from all platforms; Genshin Impact is second; PUBG Mobile is third.

Downloads

-

Garena Free Fire is first with 17.7M downloads.

-

Interesting that Shotgun Sounds: Gun Simulator made it to third place with 16.5M downloads (from Google Play only). It’s an app that plays the sound of various guns. The majority of revenue came from India (6.2M).

-

Car Crash Compilation Game was a new game in the chart in the 9th place with 11.6M downloads. It’s a hypercasual game that in the marketing refers to FlatOut.

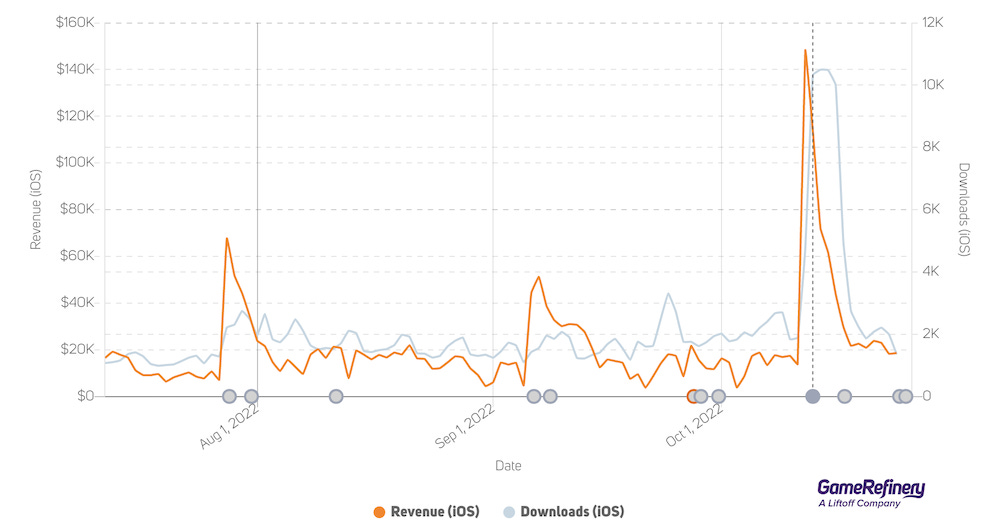

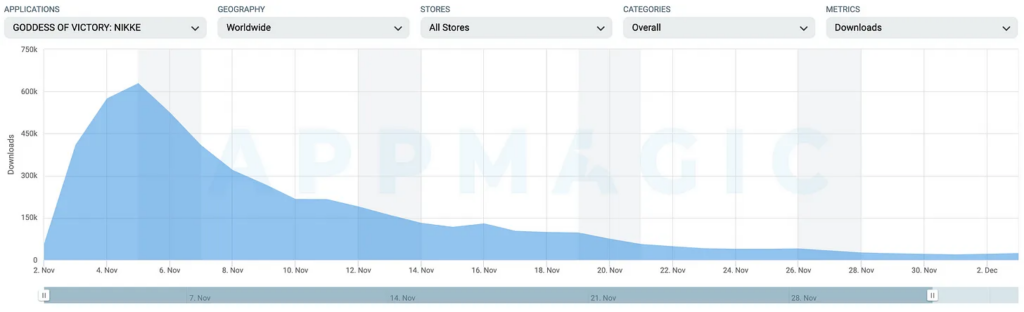

AppMagic: Goddess of Victory: Nikke earned $100M in a month after the global launch

-

53% of game revenue went from Japan; 26% - from South Korea; 14% - from the US.

-

From November 2 to December 3 the game has been downloaded 5.1M times. 21% of downloads were generated Japan; 13% - South Korea; 11% - the US; 10% - Indonesia.

-

The largest revenue the game generated was on November 12. The game earned $5.86M.

-

Now the game revenue stabilized. Last 10 days it’s been on the level of $1.6M-$2M per day.

-

Downloads from the launch dropped significantly. If on launch downloads have been reaching 630 thousand daily, now they’re on a level of 20 thousand.

-

Revenue per Download globally is around $20.24. In tier-1 Asian countries, however, it’s significantly higher - $47.39.

-

The game is launched in 45 countries in the world. It’s not available in Belgium, Israel, Vietnam, or Russia, for example.

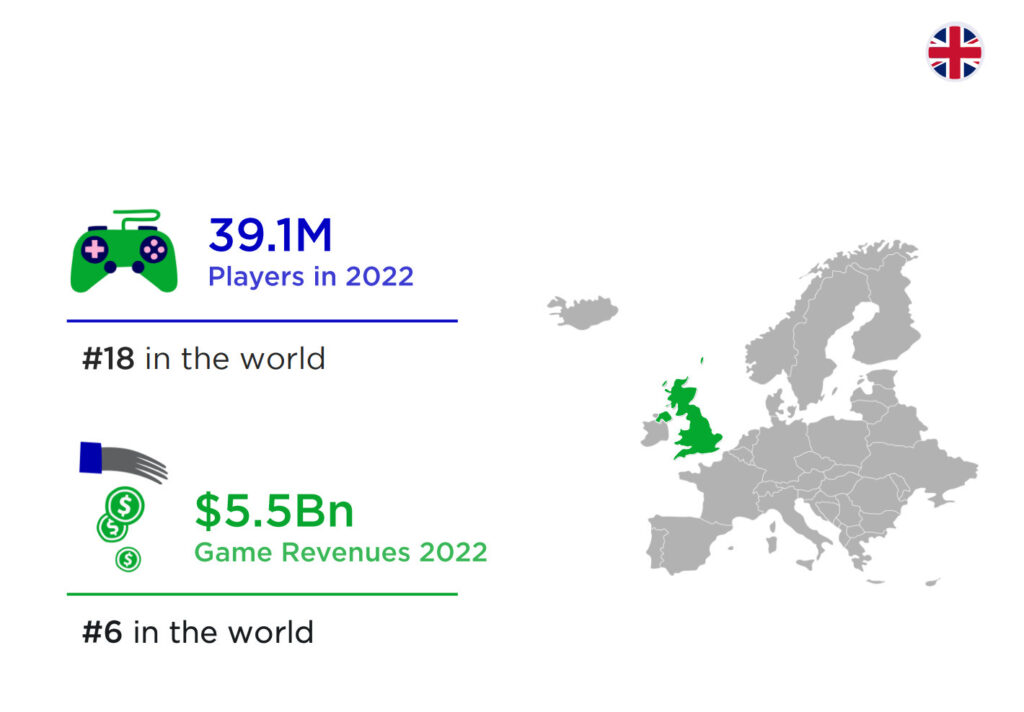

Newzoo: UK gaming market in 2022

-

The UK market will reach $5.5B in 2022. It’s the #6 place in the world.

-

There will be 39.1M players in the UK by the end of 2022. #18 in the world.

-

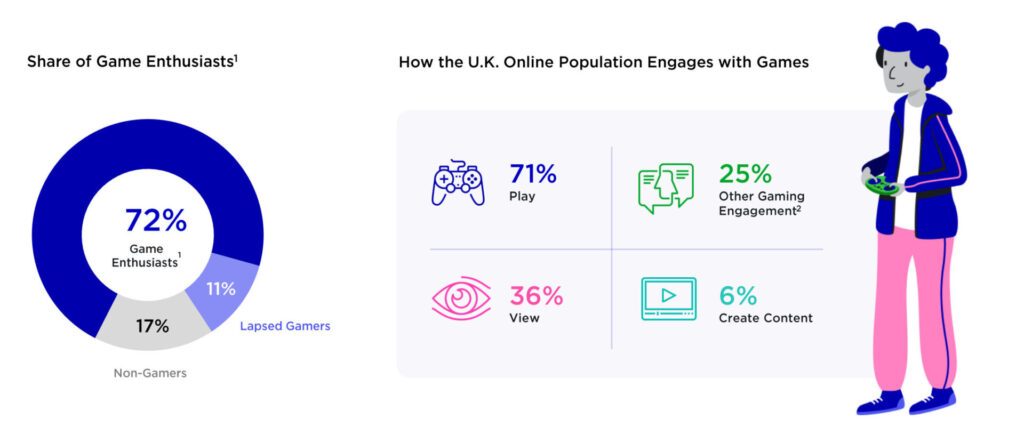

71% of the online population of the UK is playing games.

-

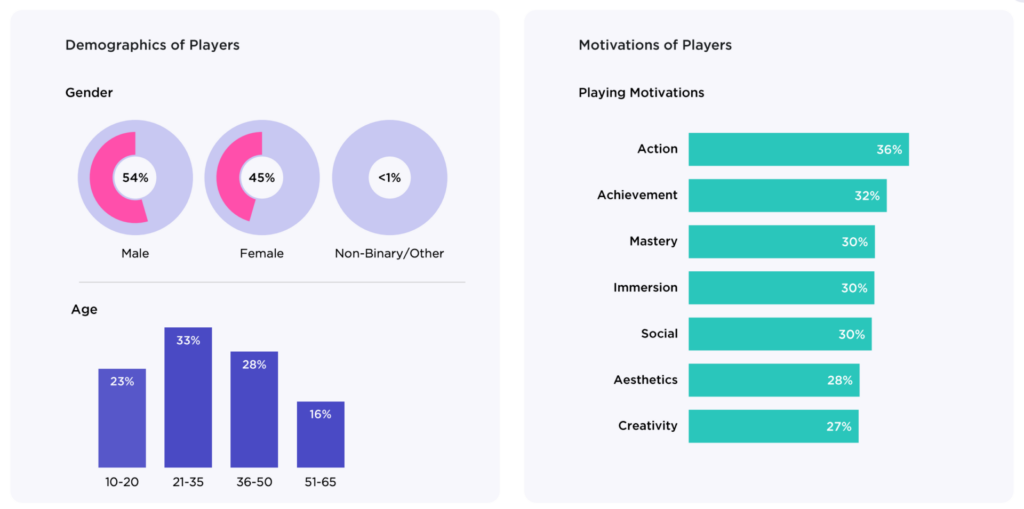

54% of the gaming population of the UK is male. 45% are females, while less than 1% are non-binary persons.

-

Most gamers are between the age of 21 to 35 years (33%). Next are segments of 36-50 years (28%), 10-20 years (23%), and 51-65 years (16%).

-

UK gamers have different motivations for playing. Some want to get new emotions from the action (36%), some do like to achieve something (32%), some enjoy immersion in a gaming world (30%), and some prefer social features (30%).

-

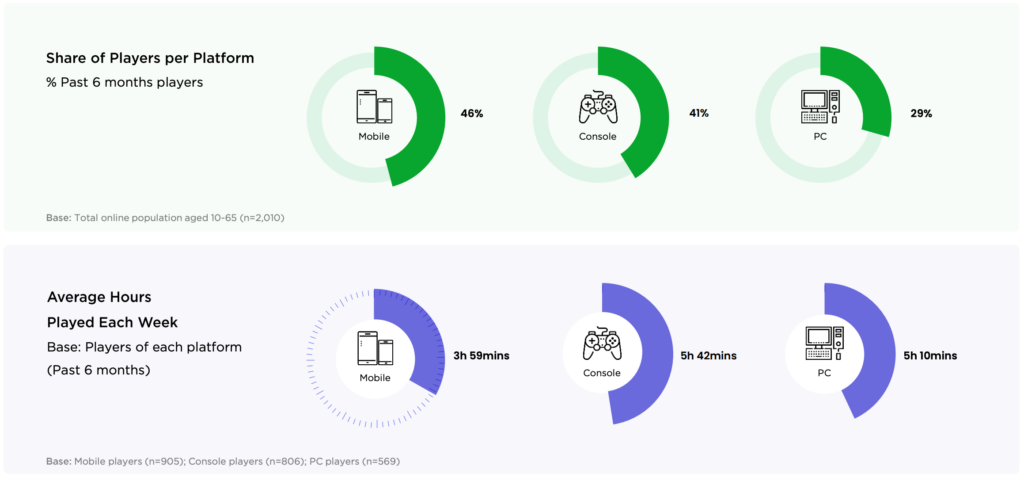

Mobile devices are the largest gaming platform in the UK with 46% of the audience. Consoles (41%) and PC (29%) are the following.

-

Consoles are leading in terms of playtime. On average, console gamer spends 5 hours and 42 minutes per week playing games. PC gamers spend 5 hours and 10 minutes weekly. Mobile gamers spend 3 hours 59 minutes.

-

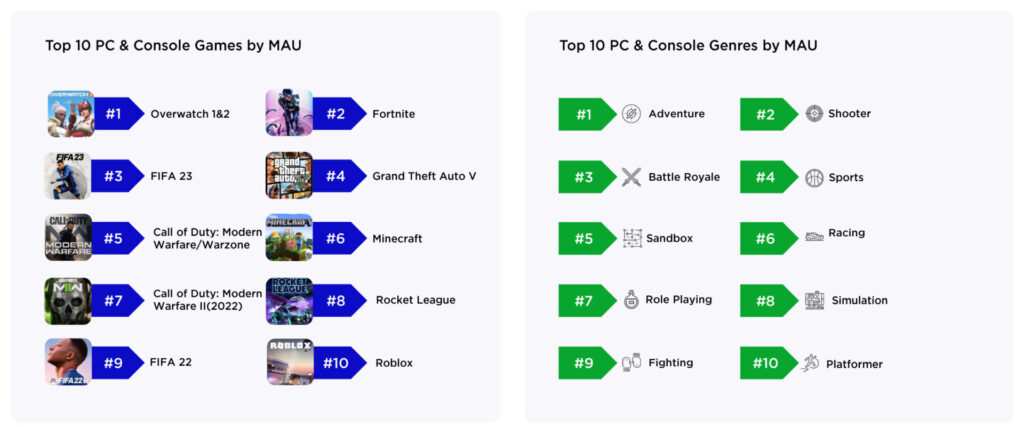

Overwatch 1 & 2, Fortnite, and FIFA 23 are the largest games in the UK by MAU.

-

Adventure games, Shooters, and Battle Royale are the most popular genres in the UK based on MAU.

-

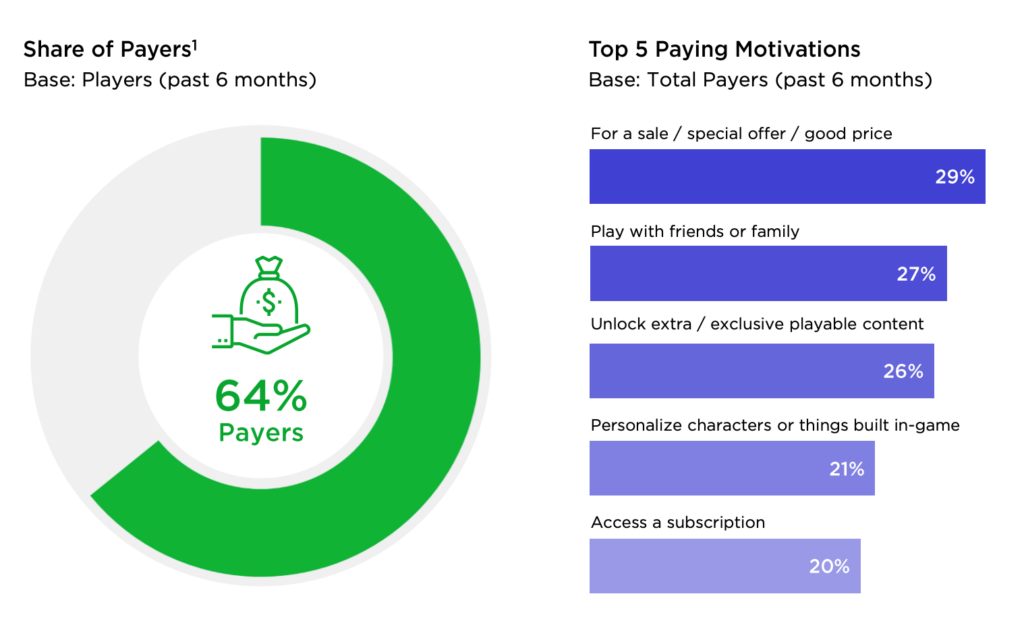

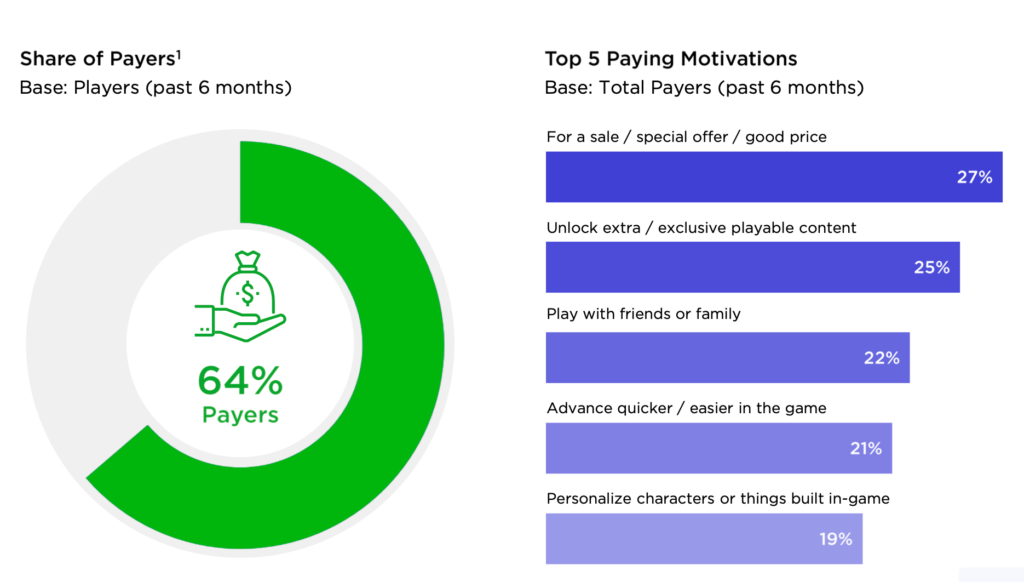

64% of gamers in the UK paid in games in the last 6 months. 29% received a good special offer, 27% wanted to play with friends or family, and 26% wanted to unlock the unique content.

2022_Newzoo_Key_Insights_Into_UK_Gamers_ReportDownload

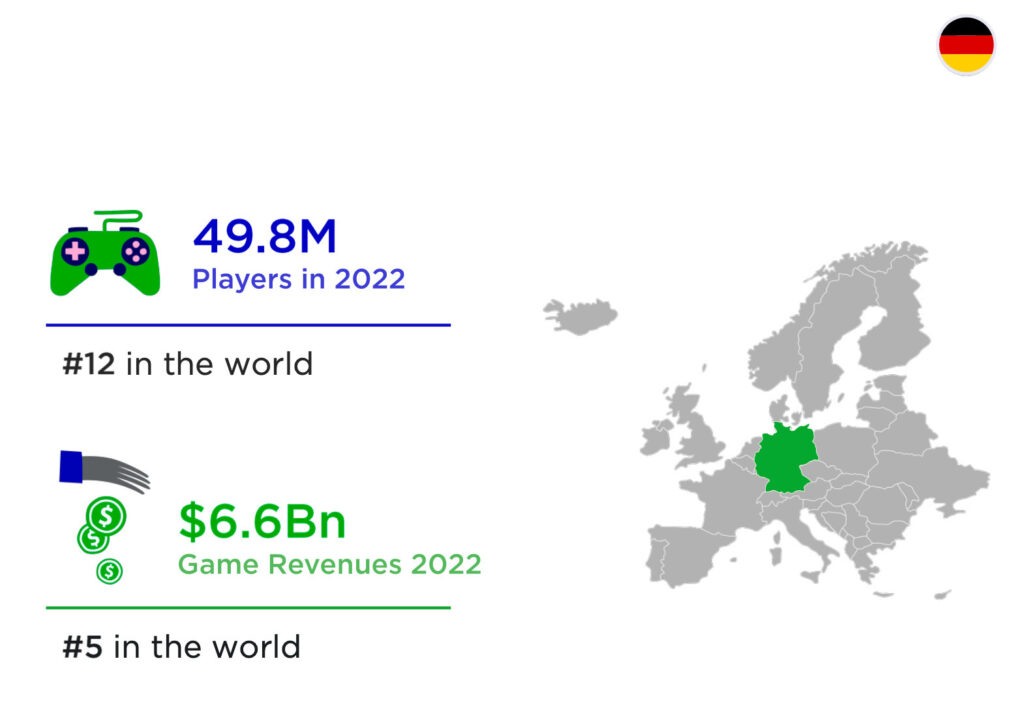

Newzoo: German gaming market in 2022

-

The German gaming market by the end of 2022 will reach $6.6B - it’s the #5 market in the world.

-

There will be 49.8M gamers in Germany in 2022, #12 compared to all other countries.

-

71% of the online population of Germany is playing games.

-

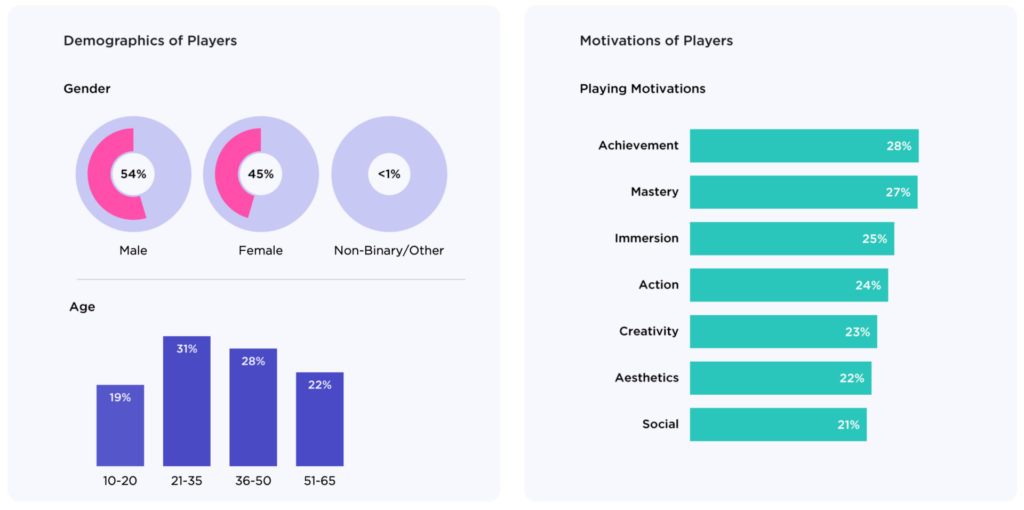

54% of gamers in Germany are male, 45% are female, and less than 1% are non-binary persons.

-

The largest age segments are from 21 to 35 years (31%), and from 36 to 50 years (28%). The segment of 51-65 years (22%) is next; the young audience of 10 to 20 years has the smallest share (19%).

-

The main motivations for the German players are to achieve something (28%), to become a master in a game (27%), to immerse in the gaming world (25%), and to get new emotions from the action (24%).

-

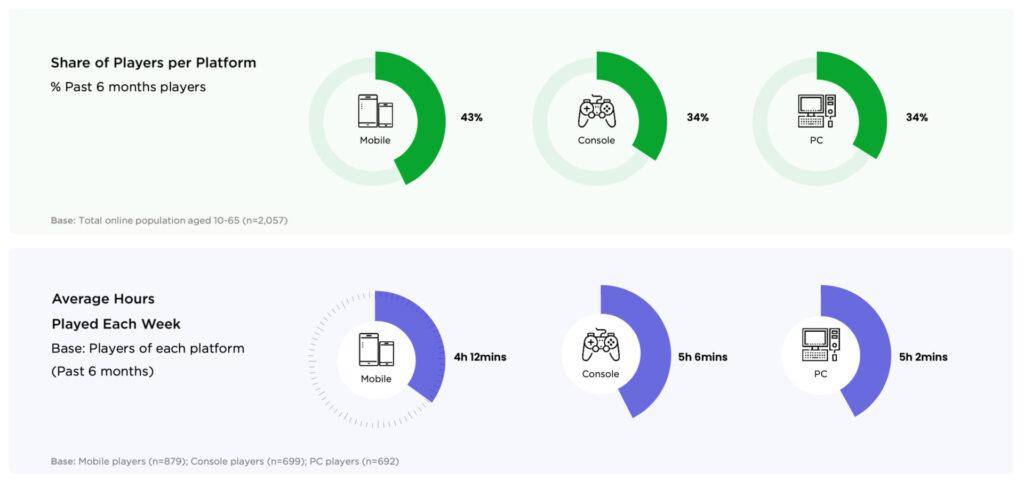

As in many other countries, mobile devices in Germany are leading by the number of users (43%). Consoles and PCs having the same share of the audience - 34%.

-

Gamers are spending around 5 hours and 6 minutes weekly playing on consoles. 5 hours and 2 minutes playing on PC. And mobile devices are taking 4 hours and 12 minutes weekly.

-

Fortnite, Overwatch 1 & 2, and Grand Theft Auto V are leaders in Germany by MAU.

-

German gamers like shooters, adventure games, and sports games. Those genres are leaders by MAU.

-

64% of German gamers have been buying something in games in the last half a year. 27% liked the special price, and 25% wanted to unlock unique content. 22% wanted to spend time with friends and family.

Newzoo: German gaming market in 2022Download

Sensor Tower: PUBG Mobile earned $9B lifetime

Numbers are not covering BattleGrounds Mobile India - the local version of PUBG Mobile.

-

Players in PUBG Mobile are spending around $5.2M daily.

-

From the game launch in March 2018, it reached 1.1B downloads.

-

In the first three quarters of 2022 the game has been downloaded 104.4M times. Users generated $1.6B of revenue. However, both metrics fell by approximately 27% compared to the same period in 2021.

GSD & GfK: November game sales in the UK dropped compared to 2021

Games

-

4.3M games were sold in the UK last month. It’s 7.3% less than in November 2021. However, it is connected to the release of Call of Duty, which last year launched in November 2021.

-

Call of Duty: Modern Warfare 2 nonetheless became the top seller in November 2022.

-

God of War Ragnarok made it second. Compared to the previous installment, sales in three weeks were up by 44%.

-

Pokemon Scarlet and Violet were third in November, and this is without digital sales.

Consoles & accessories

-

Nintendo Switch became the top-selling console in the UK in November 2022 with 372k systems sold (+113% MoM). This is the best result for Nintendo this year.

-

Xbox Series S|X sales jumped by 105%, the console was second last month.

-

PlayStation 5 is third with sales up by 71%. The God of War Ragnarok bundle was responsible for about 38% of all systems sold.

-

1.29M accessories have been sold in November 2022 in the UK. It’s 93% more than in October 2022, and 9.3% more than in November 2021. The most popular accessories were gamepads for PS5 and Xbox Series S|X.

The NPD Group: The US gaming market got back to growth in November 2022

Games

-

The gaming market reached $6.3B in revenue in November 2022. It’s 3% more than last year.

-

However, game sales were $4.7B, down by 5%.

-

Call of Duty: Modern Warfare 2 already became the most successful game of the year by sales.

-

Mobile games revenue dropped by 5% compared to 2021 and by 1% compared to 2020.

-

Candy Crush Saga, Roblox, and Royal Match were the mobile leaders by revenue, according to Sensor Tower.

Consoles & accessories

-

Console sales increased by 45% and reached $1.3B in November 2022.

-

PlayStation 5 is the top platform of November by both systems sold, and revenue generated. Nintendo Switch is second.

-

In November 2022, PlayStation 5 was the best system in the US by revenue. But Nintendo Switch is still leading in unit sales.

-

Accessory sales were up by 10% to $289M.

Famitsu: Pokemon Scarlet and Violet became the main game of November in Japan

Famitsu is tracking only retail sales.

Games

-

4.2M of games’ physical copies were sold this November in Japan. Pokemon Scarlet & Violet is responsible for 73% of all sales.

-

In Japan, retail versions of Pokemon Scarlet & Violet were bought 3.1M times last month. Pokemon: Arceus, when it was launched, generated 2.1M physical sales in the first month.

-

Splatoon 3 was second in November (170k copies), and Tactics Ogre: Reborn was third (48k copies).

-

The only game from Sony in the top 10 is the God of War: Ragnarok - #9 (43k copies).

-

93% of physical game copies have been sold for Nintendo Switch. 6% for the Sony consoles.

Console

-

PlayStation 4 and PlayStation 5 in November have been responsible for a quarter of console sales.

-

Switch Lite sales increased by 2% from October. In November the light version was responsible for 13.6% of all console sales. Nintendo Switch OLED in November was a behemoth with more than 50% of the market share.

GSD: European PC & Console game sales dropped in November 2022

Games

-

18.2M copies were sold in Europe in November 2022. It’s a 17% drop compared to the previous year.

-

Such a decrease is because of the release of Call of Duty: Modern Warfare 2, which happened in October. Last year the release was in November.

-

7.8M game copies have been bought in the digital format (-15% YoY), and 10.4M have been bought in physical format (-18% YoY).

-

God of War Ragnarok became a bestseller in November 2022 in Europe. Sales in the first three weeks were 62% better than the previous installation.

-

However, the reality might have been different if Nintendo will share digital sales. Pokemon Scarlet and Violet combined are in second place by sales with just physical copies, just a little behind God of War Ragnarok.

Consoles & accessories

-

690 thousand consoles were sold in Europe in November 2022. It’s 21% less than a year before.

-

Nintendo Switch sales decreased despite the first position by sales.

-

PlayStation 5 sales were up by 49%, and Xbox Series S|X - by 22%.

-

1.8M accessories have been sold in November - 11% less than in November 2021. DualSense is the best-selling accessory (+60% YoY).

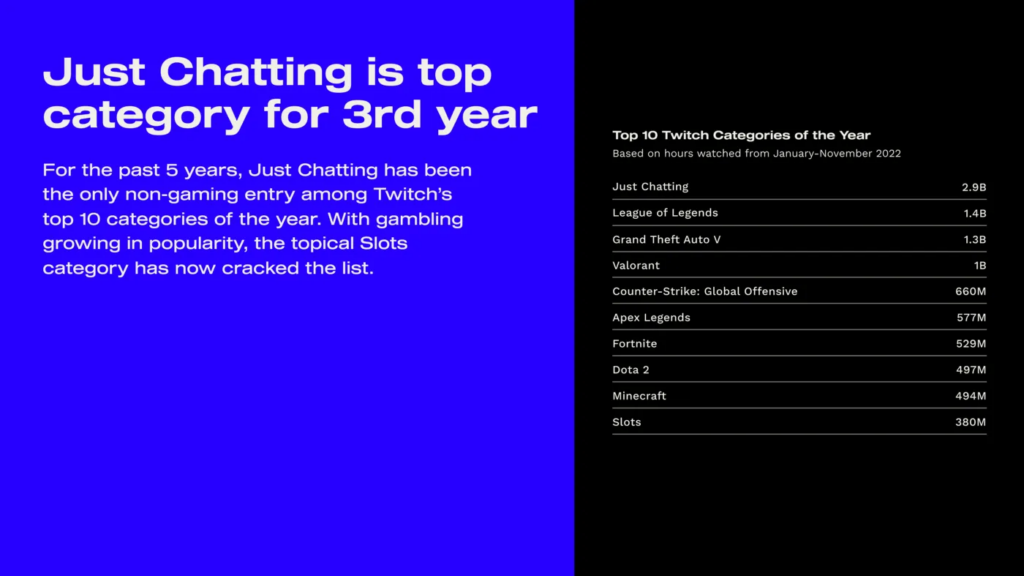

StreamElements & Rainmaker.gg: Game Streaming market in November and 2022

-

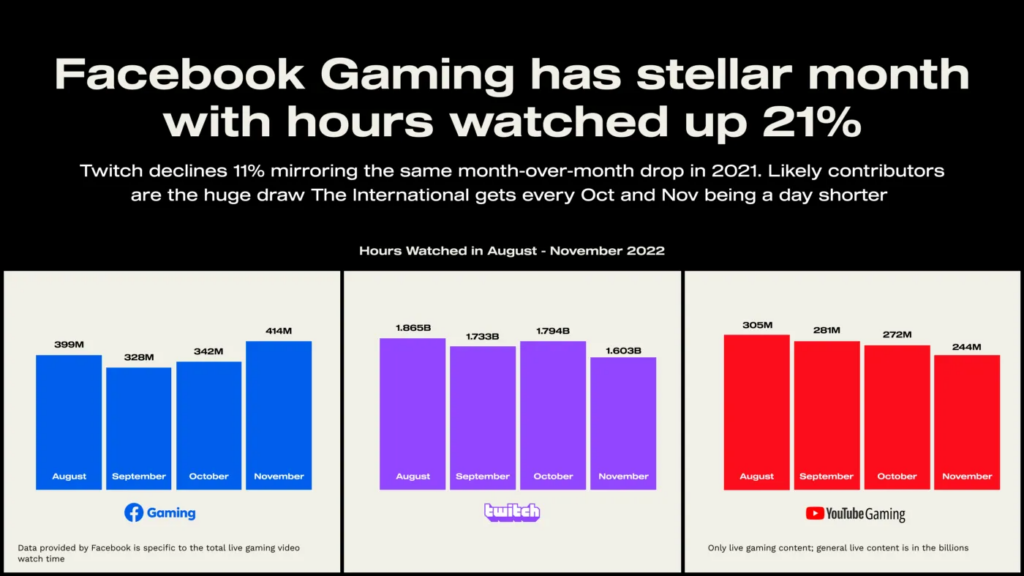

Twitch lost 11% views in November compared to the previous month with 1.6B watched hours.

-

YouTube Gaming continued to drop too with 244M watched hours in November.

-

Facebook Gaming, on the contrary, grew by 21% to 414M hours.

-

God of War Ragnarok made it to the top 10 of most-watched games (in the last place). The first place (if we’ll throw the Just Chatting category) is reserved for Grand Theft Auto V (97M hours watched).

-

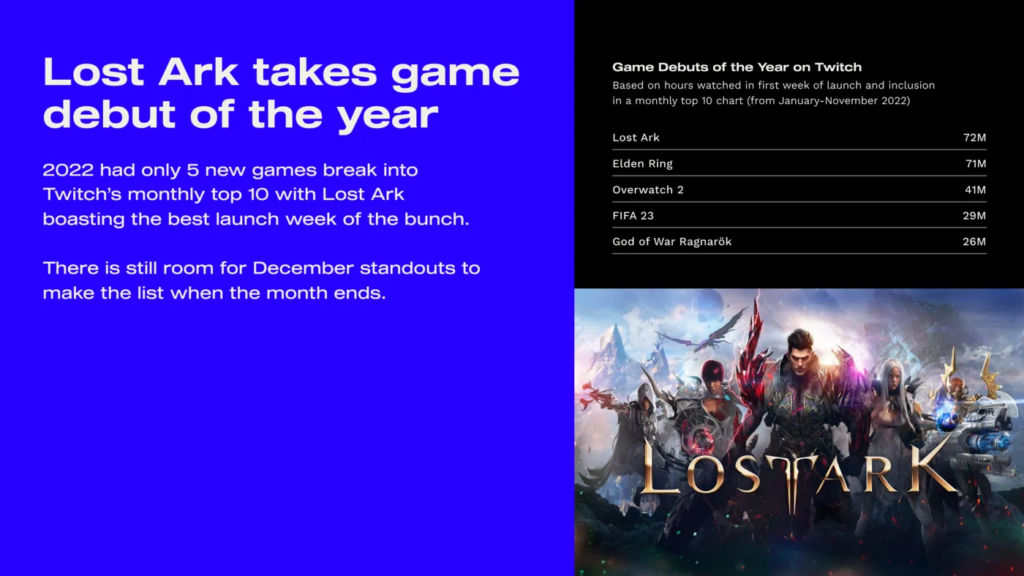

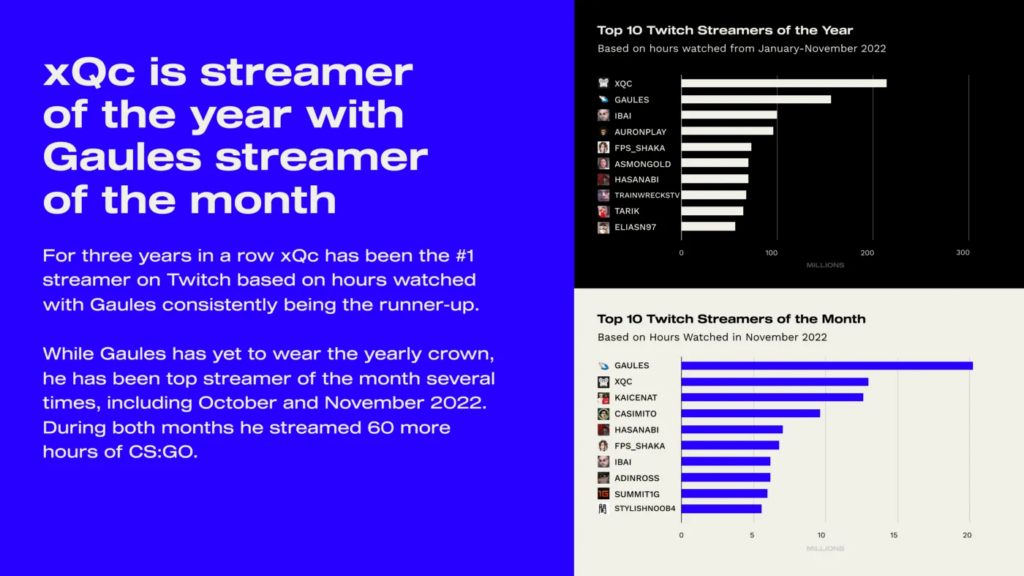

Only five games in 2022 after the release made it to the top by views - Lost Ark (72M hours), Elden Ring (71M hours), Overwatch 2 (41M hours), FIFA 23 (29M hours), and God of War Ragnarok (26M hours).

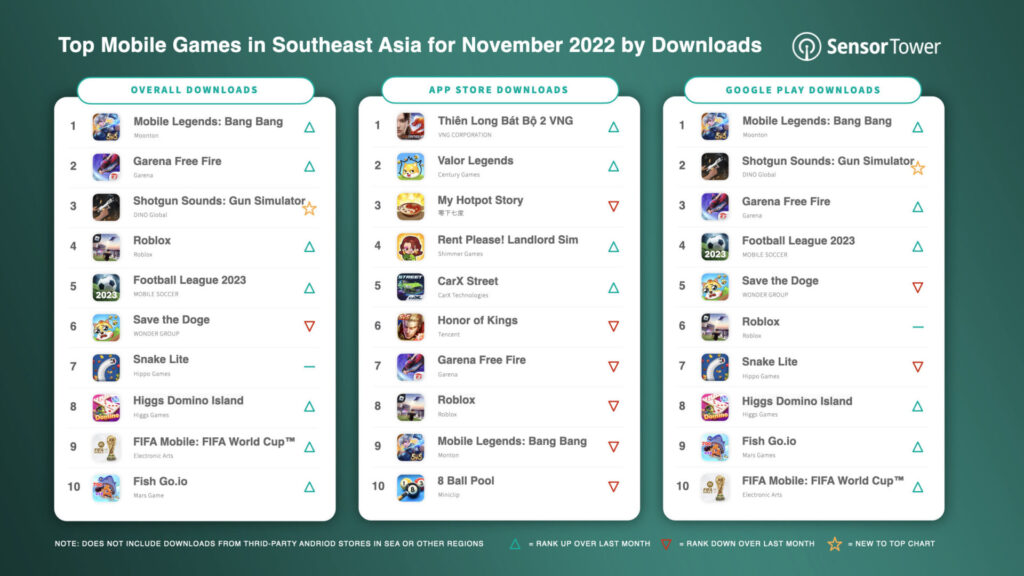

Sensor Tower: Top Mobile Games by Revenue & Downloads in Southeast Asia in November 2022

Revenue

-

Mobile Legends: Bang Bang from Moonton is November’s revenue leader. The game generated $10.6M last month. 36.2% of revenue came from Indonesia, 28.9% - from Malaysia, and 18.8% from the Philippines.

-

Garena Free Fire is second with $7.4M in revenue in the region. 40.6% of this amount came from Thailand, 31.6% - from Indonesia, and 17.1% from Malaysia.

-

Genshin Impact earned more than $6M (+41% MoM). Singapore (26.3% of overall revenue), Malaysia (23.9%), and Vietnam (15.5%) are the leading countries for the game in the region.

-

In November players spent $197M on games in Southeast Asia across App Store & Google Play. It’s a 6.5% decline compared to the previous year.

-

The largest markets of Southeast Asia in terms of revenue are Thailand ($47M; 23.7% of the overall amount), Indonesia (17.9%), and Singapore (17.2%).

Downloads

-

Mobile Legends: Bang Bang is also a leader in downloads. In November it has been downloaded more than 4M times. Leaders are Indonesia (56.9% of the overall amount), the Philippines (22.7%), and Cambodia (6.2%).

-

Garena Free Fire is second with about 3.7M downloads in November. Indonesia generated 40.9% of downloads, Vietnam - 30.6%, and Thailand - 17%.

-

FIFA Mobile showed the second month by downloads in the history in the region, with 2.5M downloads (+92% MoM). 67.8% of them came from Indonesia, Thailand is responsible for 14.9%, and Malaysia brought 11.3% to the table. Thanks to the World Cup.

-

690M games were downloaded in Southeast Asia in November through the App Store & Google Play. It’s 0.9% more than in November last year. The first place in downloads is taken by Indonesia (269M, 39% of the overall amount). Vietnam (20.2%) and the Philippines (18.3%) are next.

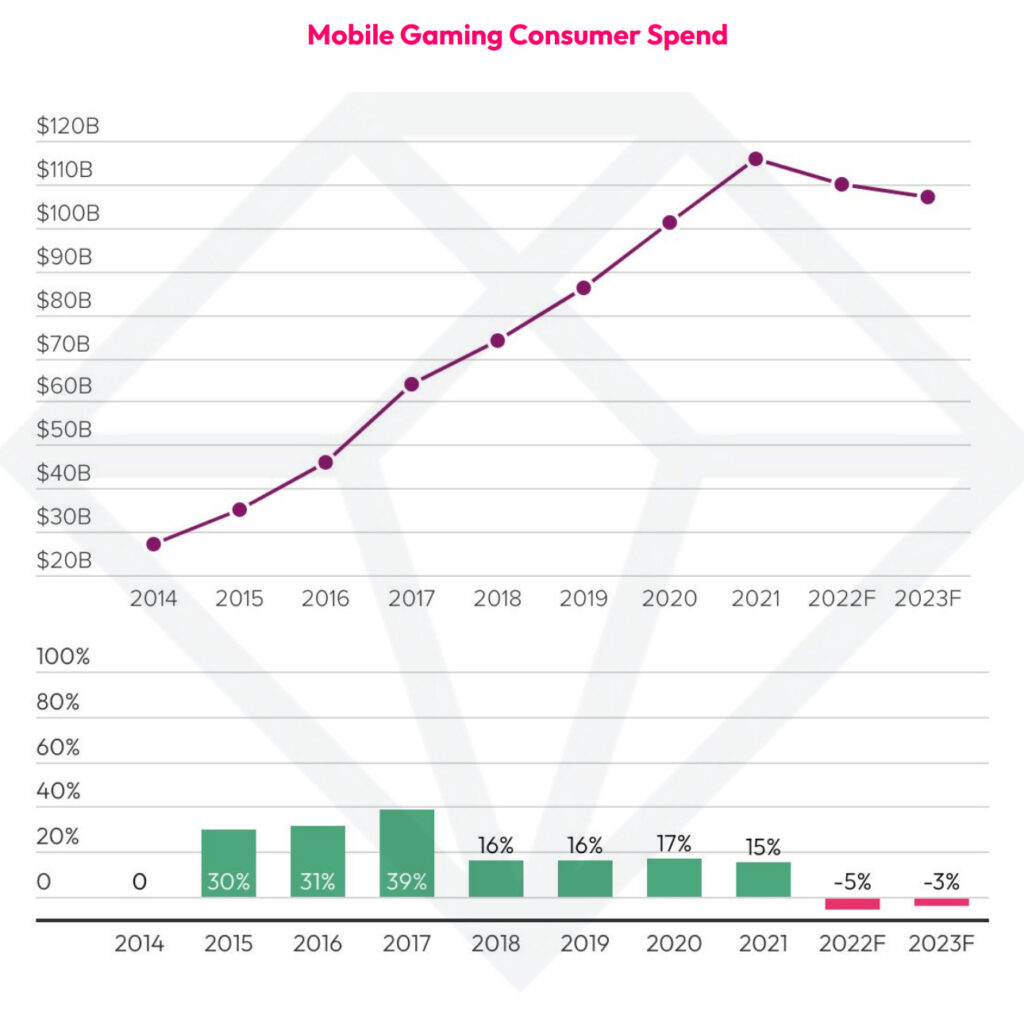

data.ai: Mobile Games Revenue will continue to decline in 2023

-

Analytics is forecasting that the trend of revenue decline in 2023 will continue. Mobile Games will earn $107B, which is 3% lower than in 2022.

-

The only bright thing in this is that the decline speed will change from 5% in 2022 to 3%.

-

The decline will be connected not only with the economic crisis but with new Privacy rules too.

-

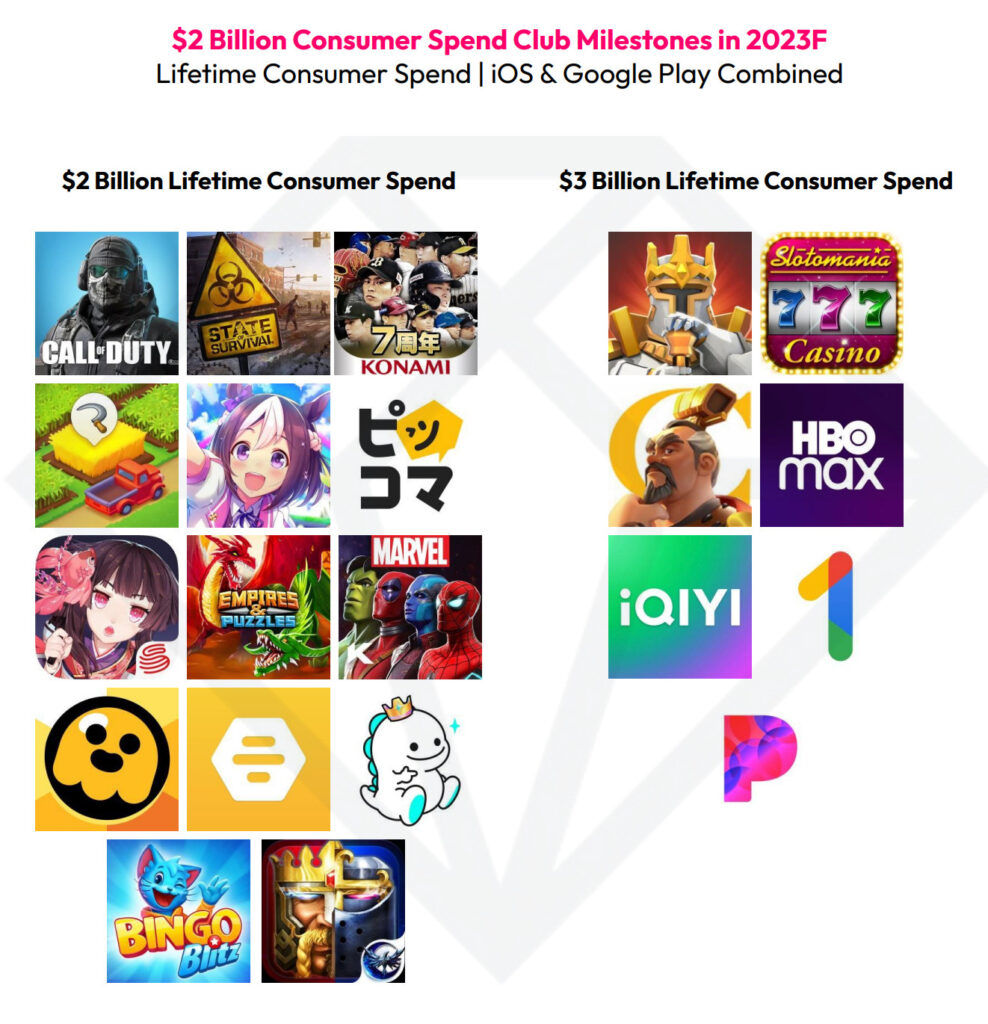

However, data.ai is forecasting that 11 games in 2023 will reach more than $2B in lifetime revenue, Uma Musume Pretty Derby, Call of Duty: Mobile, State of Survival, Brawl Stars, and Empires & Puzzles are among them.

-

3 games will earn more than $3B. Rise of Kingdom, Slotomania will reach this significant result.

2022-12-data-ai-2023-Mobile-Forecasts-EN

LoopMe: 80% of mobile gamers are not fully engaged while playing

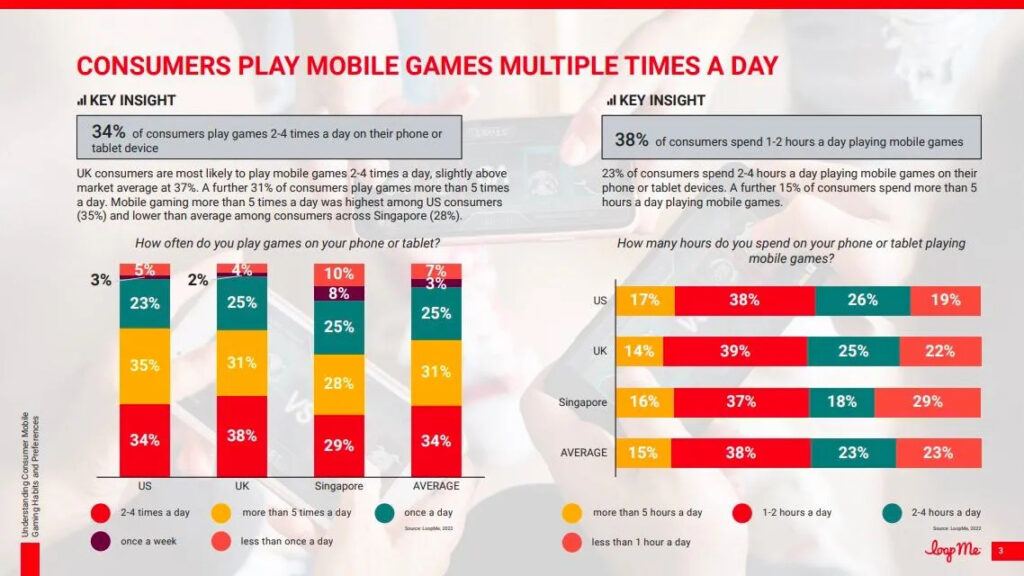

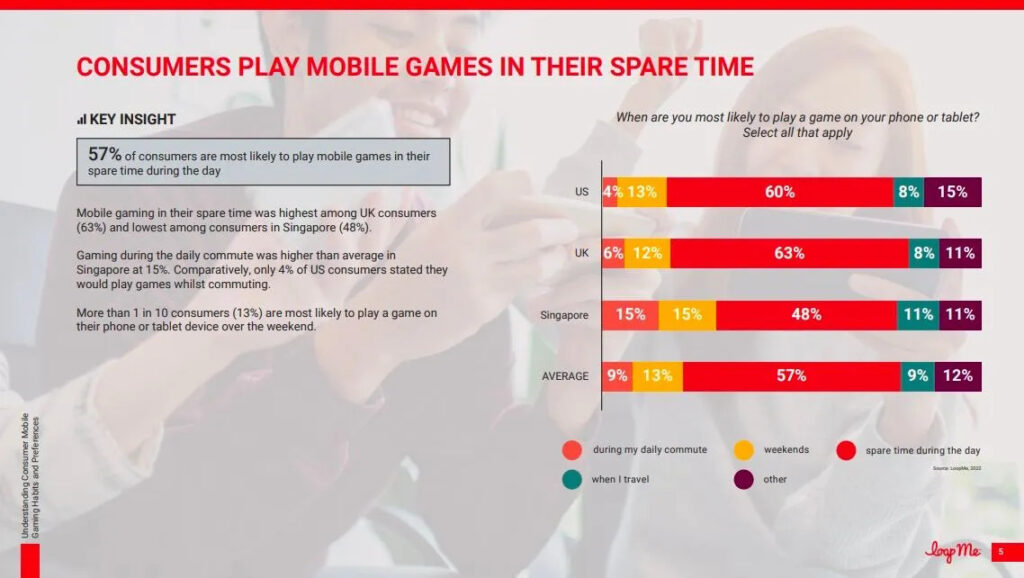

The company surveyed 18 thousand people from the US (6,192), the UK (5,468), and Singapore (6,680) about their gaming habits.

-

On average, 62% of users are playing mobile games.

-

Women, on average, are playing more often. 65% of players in mentioned markets play at least twice daily.

-

38% of gamers spend 1-2 hours per day on games—the other 38% - spend at least 2 hours per day.

-

Only 1 of 5 gamers are fully engaged while playing mobile games. Others are doing different activities.

-

The majority (43%) are watching TV as a secondary activity. 18% are listening to music. 15% are checking social networks. 4% are listening to podcasts.

Azur Games: Hypercasual market analysis in 2022

-

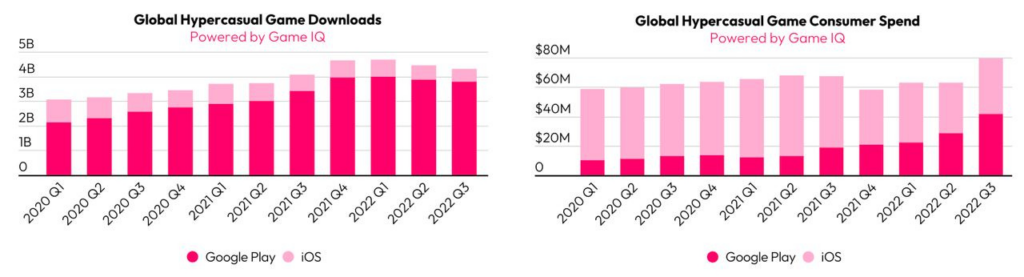

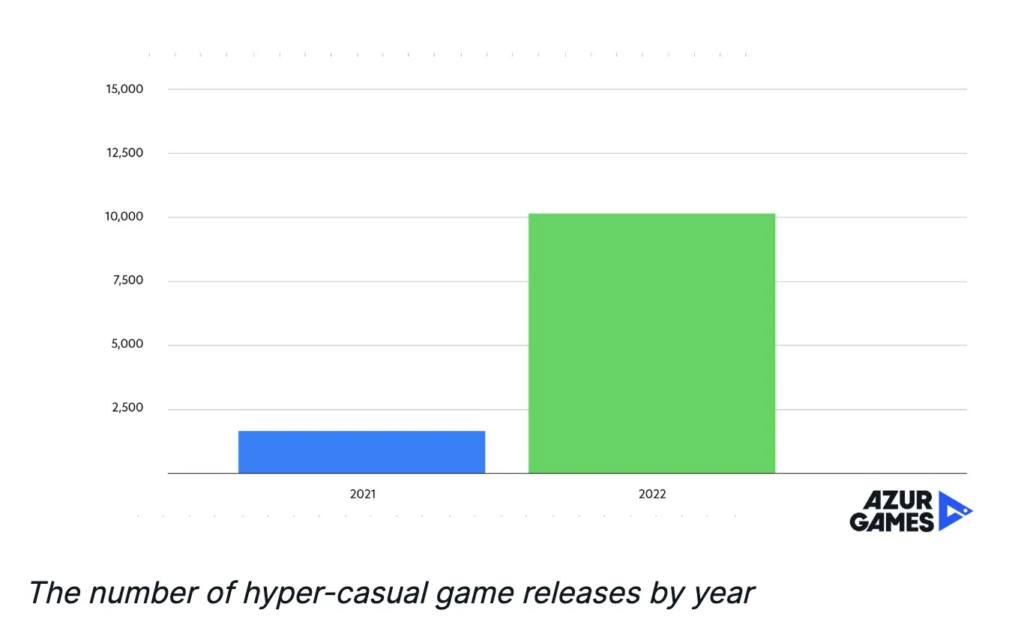

The number of hypercasual releases increased by 5 times compared to 2021.

-

The overall installs for hypercasual games increased from 10B to 13B. This means that the competition increased dramatically.

-

Only 12.3% of games from the top 300 have been released in 2022. The majority (47.7%) have been there since 2021.

-

eCPM has been growing during the whole of 2021. In 2022 the situation normalized and eCPM decreased a little.

-

Idle games continue to grow by both revenue and downloads. Runners are declining heavily by downloads. .io games are also demonstrating good results..

Azur Games experts are positive that developers should focus on creating better products to stay competitive in the current market. They also should think about adding more IAP and making their games more complex.

Newzoo: Call of Duty, God of War, and Pokemon are the most-wanted gifts this Christmas

-

70% of American gamers want to get those titles this holiday.

-

58% of respondents mentioned that they will gift games this Christmas. It’s interesting that 65% of people will gift the game to themselves.

20% of people will gift Call of Duty: Modern Warfare 2. God of War (8%), Pokemon Scarlet and Violet (7%), FIFA 23 (6%), and NBA 2K23 (5%) are next.

Now you have the entire picture of the current game market. If you have any questions, feel free to ask the author using the contact details provided at the beginning of this review.