devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the January and February reports.

Table of Content

- inworld.ai: 99% of American gamers do want to see AI NPCs

- China Audiovisual and Digital Publishing Association: Chinese market declined by 10.33% in 2022

- Ampere Analysis: The UK gaming market declined in 2022 for the first time in 10 years

- Microsoft shared the number of Xbox users in the European Union

- Liftoff: Mobile Ad Market Index in 2023

- Warner Bros. Interactive: Hogwarts Legacy sold 12M copies in the first two weeks

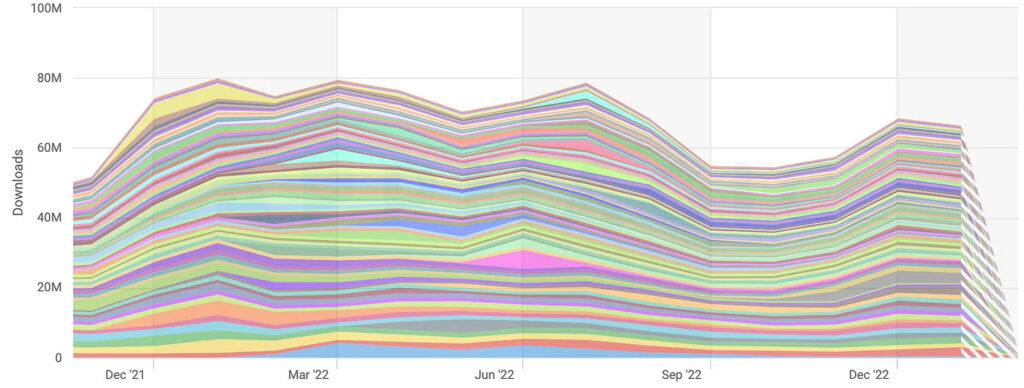

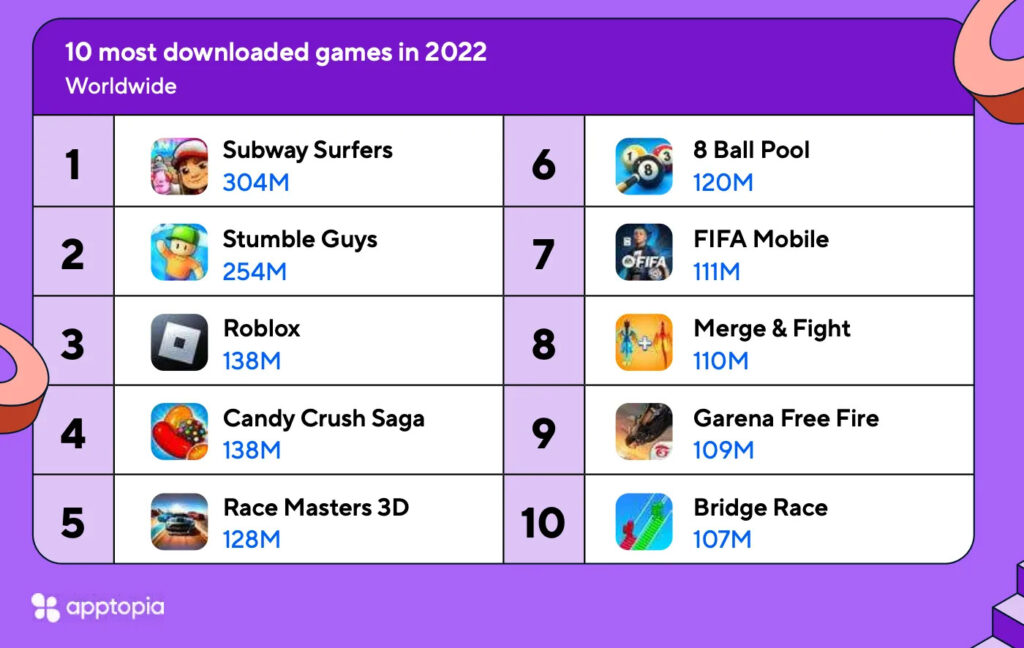

- AppMagic: Mobile Gaming Market in 2022

- Ampere Analysis: The console gaming market dropped in 2022; PlayStation 5 is selling almost twice as better as Xbox Series

- Singular: ROI Index in 2023

- AppMagic: Top Mobile Games of February 2023 by Revenue and Downloads

- GSD & GfK: The UK market came back to growth in February 2023

- ERA: UK 2023 Gaming Report

- GSD: Hogwarts Legacy is the largest European release of the last 6 years (excluding FIFA)

- Appodeal: Yearly eCPM Report (2023 Edition)

- Newzoo: Top-20 on Nintendo Switch by MAU is more diverse than on PlayStation and Xbox

- data.ai: Mobile Gaming Markets of Brazil, Mexico & LATAM, in general, grew in 2022

- Among Us reached 500M downloads on Mobile

- AppsFlyer: State of Mobile Gaming Marketing in 2023

- Unity: Gaming industry in 2023

- Newzoo: PC & Console Markets in 2023

- Epic Games Store: 2022 Results

- Sensor Tower: Mobile Gaming Market in 2023

- Newzoo & MPL: The PCG Games market will grow to $16B in 2024

- SELL: The French gaming market dipped to €5.5B in 2022

- data.ai: Mobile Gamers have been spending $1.6B+ weekly in Q1 2023

- Circana: The Gaming market in the US increased by 6% in February 2023

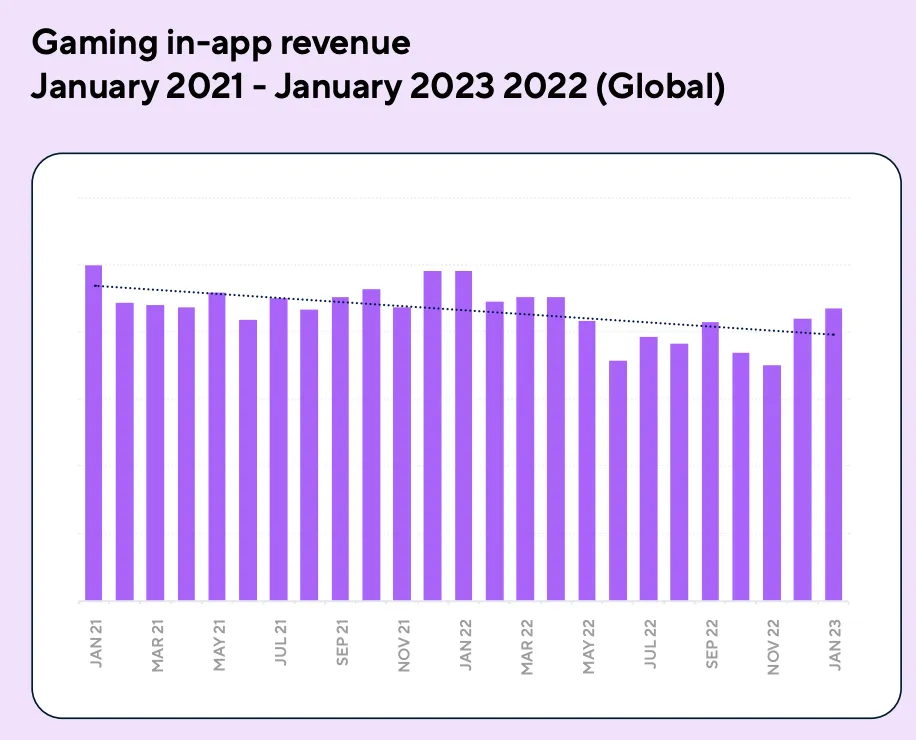

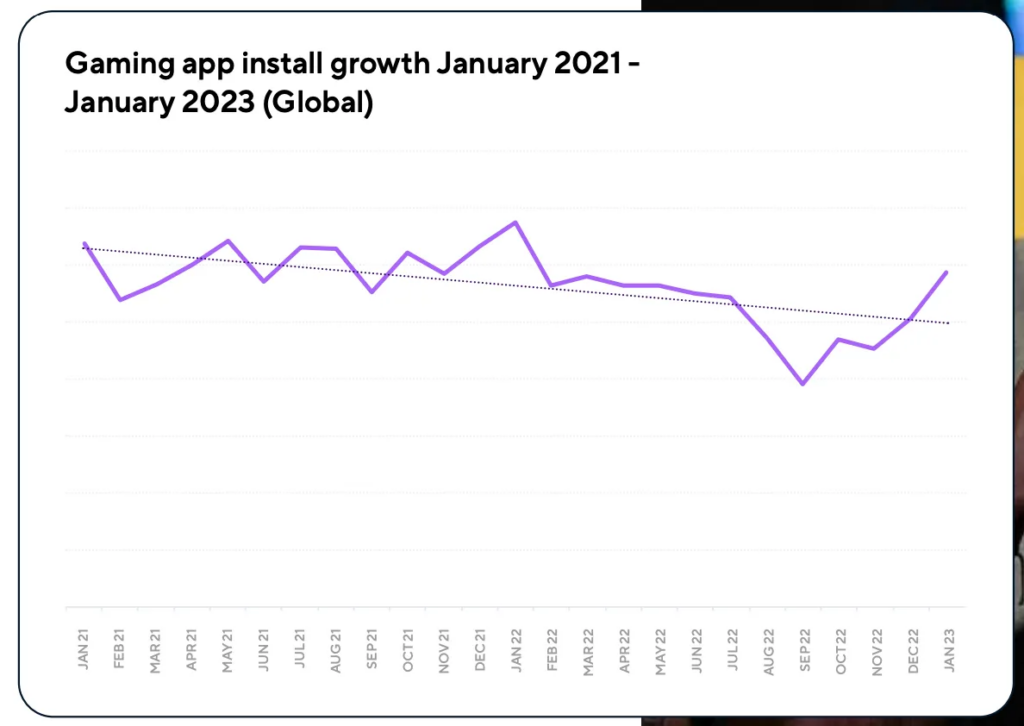

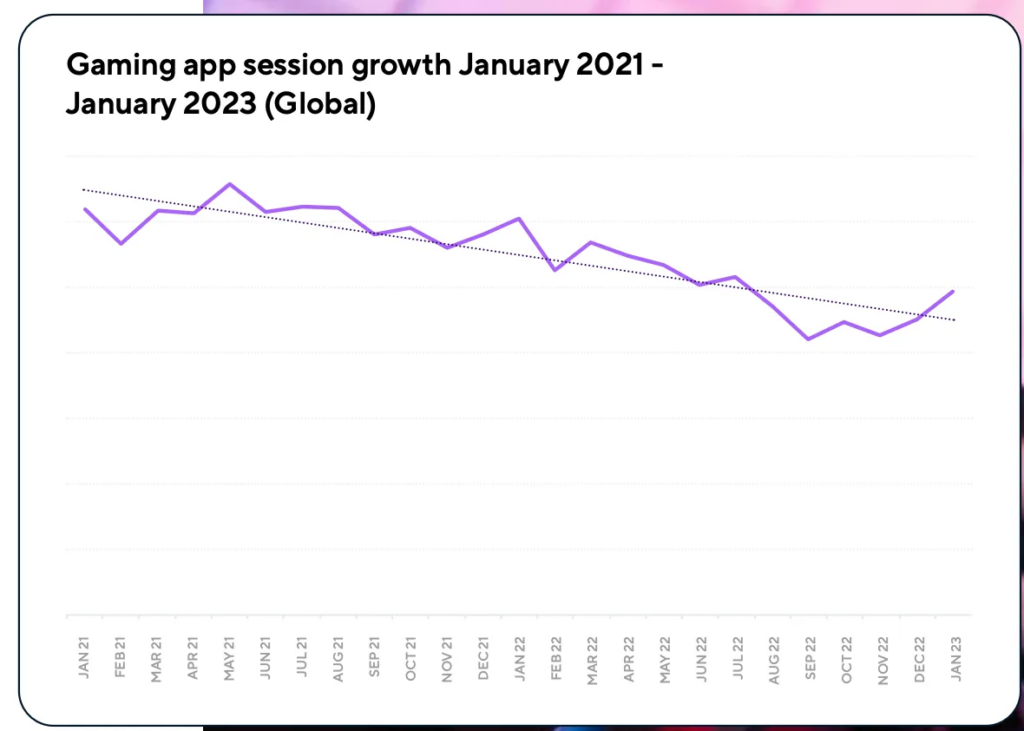

- Adjust: Mobile Gaming Trends 2023

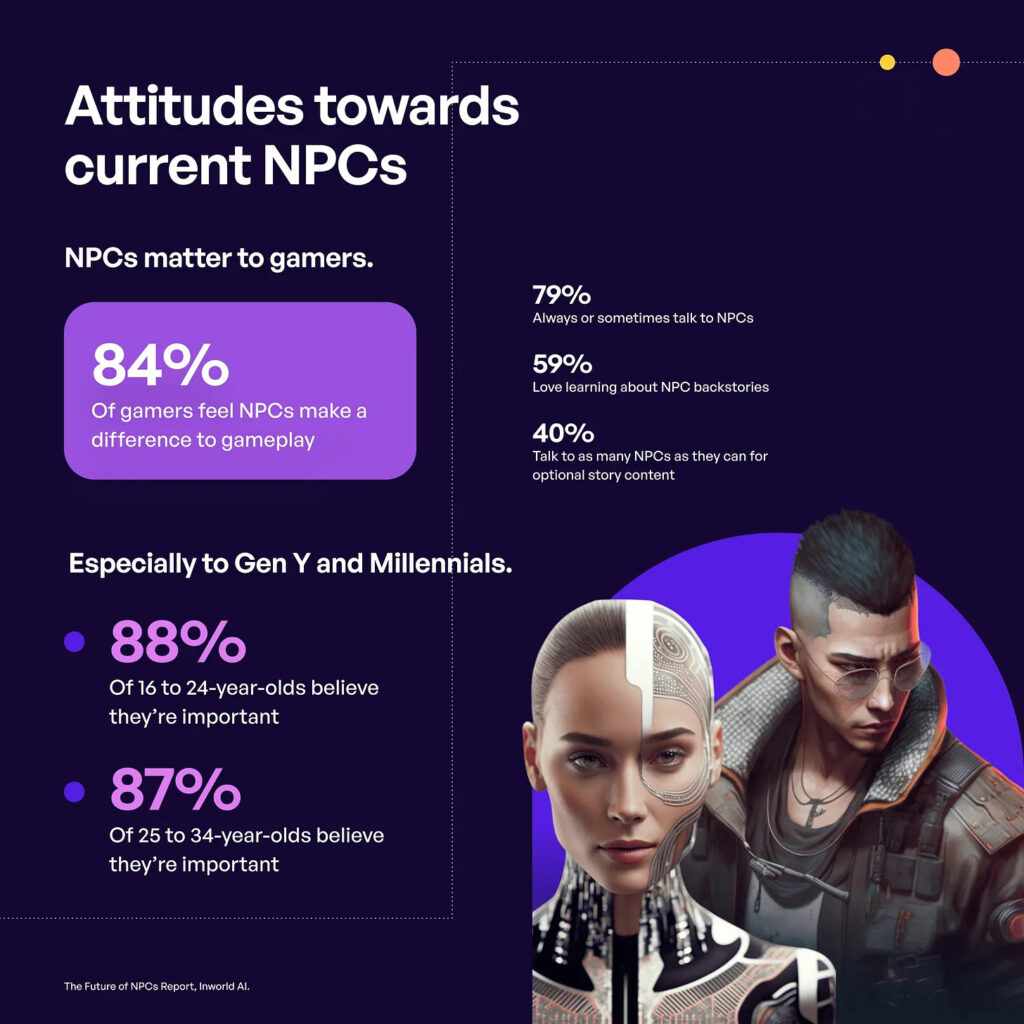

inworld.ai: 99% of American gamers do want to see AI NPCs

1,002 gamers from the US between the age of 16 to 50 years have been surveyed. The company behind the survey has an interest in receiving positive results, so it might be biased.

-

99% of respondents are sure that AI-controlled NPCs will make games better.

-

81% are ready to pay more for the game with such a feature. 79% with a higher probability will buy a game with “smart NPCs”; 78% are sure that such NPCs will make them spend more time in the game.

-

84% of surveyed are sure that NPCs are an important part of the game.

-

79% of respondents are speaking with an NPC. 40% are trying to know the lore in detail and going through all available dialogue options. 24% are skipping this part to do the objective.

-

The majority of those who completed the survey don’t like the following in NPCs: same dialogues (28%); inability to adapt to the in-game changes (22%); lack of variability.

-

50% of users will be glad if NPCs will remember previous actions and will be in context.

inworld.ai: 99% of American gamers do want to see AI NPCs

China Audiovisual and Digital Publishing Association: Chinese market declined by 10.33% in 2022

-

Market valuation dropped to 265.9B yuan (about $39B).

-

The number of users decreased by 0.33% to 664M users.

-

The drop is connected with a pause in issuing new licenses and new restrictions for young players.

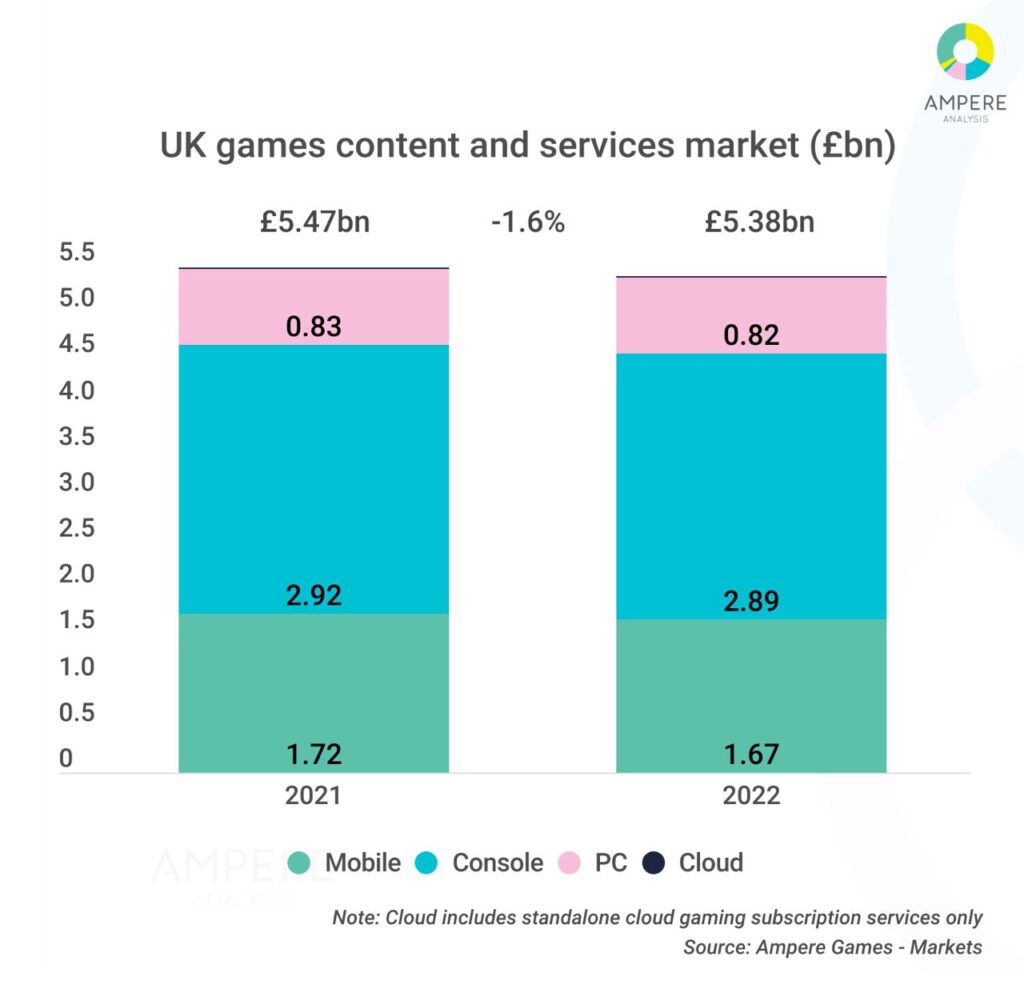

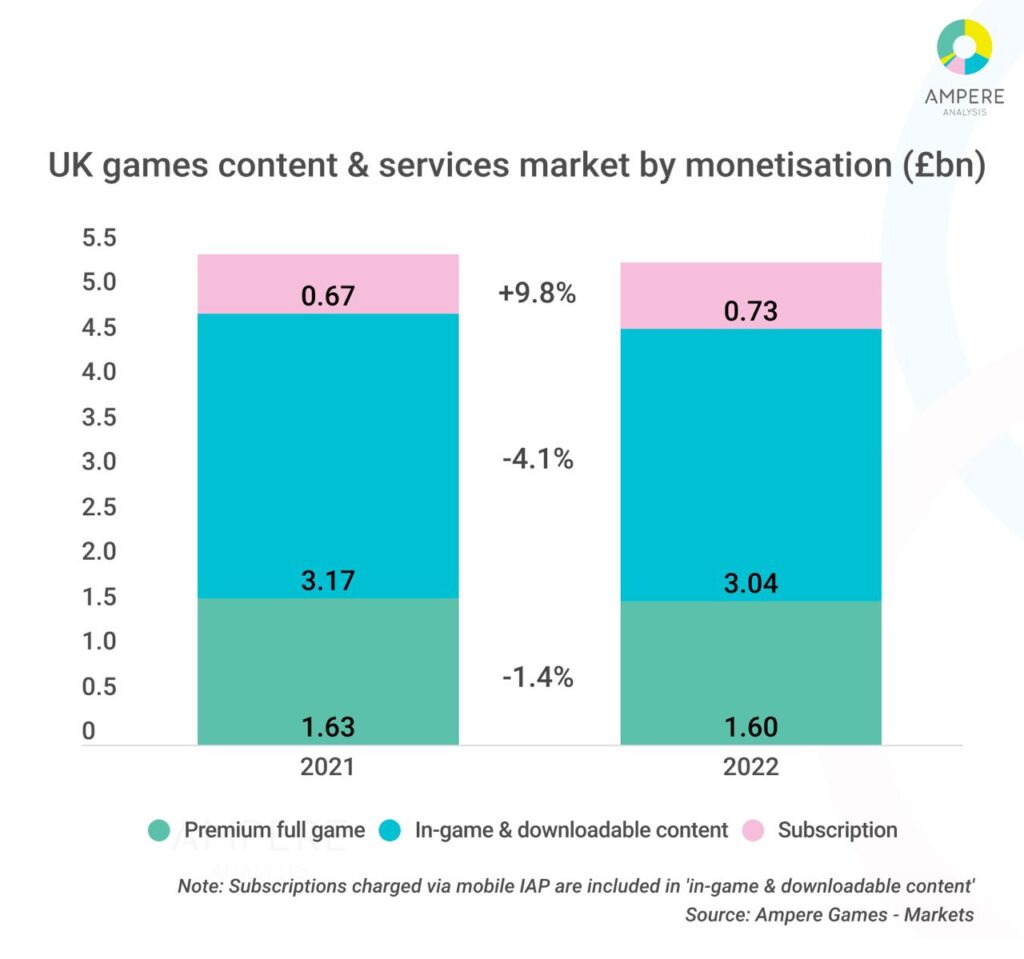

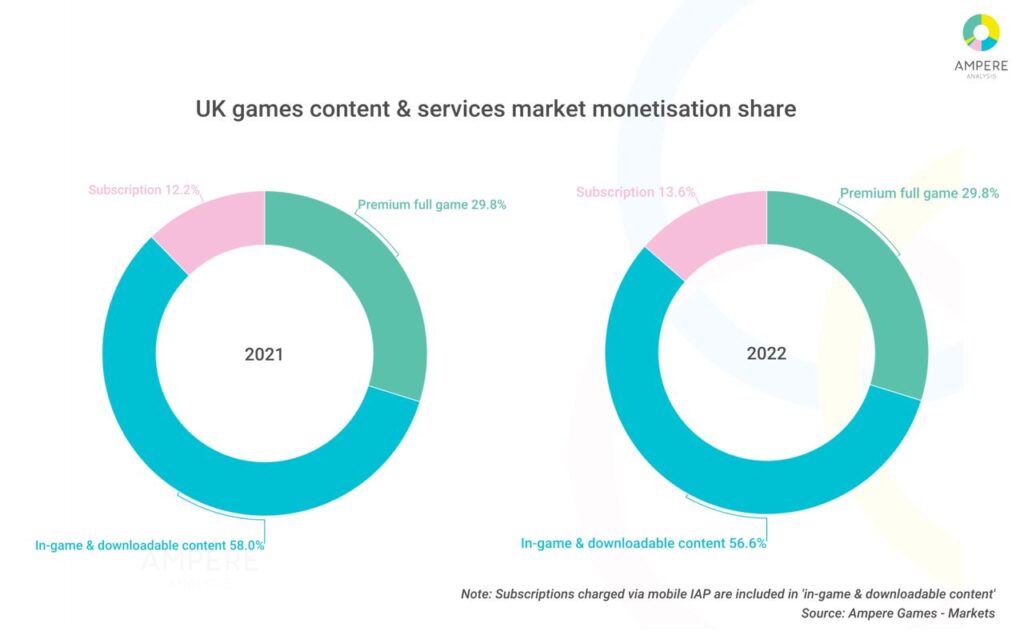

Ampere Analysis: The UK gaming market declined in 2022 for the first time in 10 years

-

The UK market dropped by 1.6% - from £5.47B in 2021 to £5.38B in 2022. The last time decline was registered was in 2012.

-

However, analysts are highlighting that the market size in 2022 is 23% larger than in 2019.

-

Drop in revenue analysts are connecting with the normalization of consumer behaviors; macroeconomic situation; decline in real income.

-

The mobile segment experienced the most significant drop - by 3%. The console market declined by 1%, however, if we exclude subscription services, it will be 3.2%. The PC market fell by 1.2%.

-

Business model-wise, subscriptions showed a 9.8% growth in 2022. But their share in the overall revenue is still small. In-game purchases & DLCs dropped by 4.1%. The decline was in the Premium model too, by 1.4% - it might be connected to the growing usage of subscriptions.

Microsoft shared the number of Xbox users in the European Union

European Union laws are now telling companies to share such information. All user counts are monthly averages in the last 6 months.

-

Xbox.com has about 6M MAU.

-

The PC Games Store has about 3M MAU.

-

The Xbox Store is visited by about 4M users monthly.

-

It’s fair to consider that the overall monthly audience of Xbox in the European Union is from 5 to 7 million.

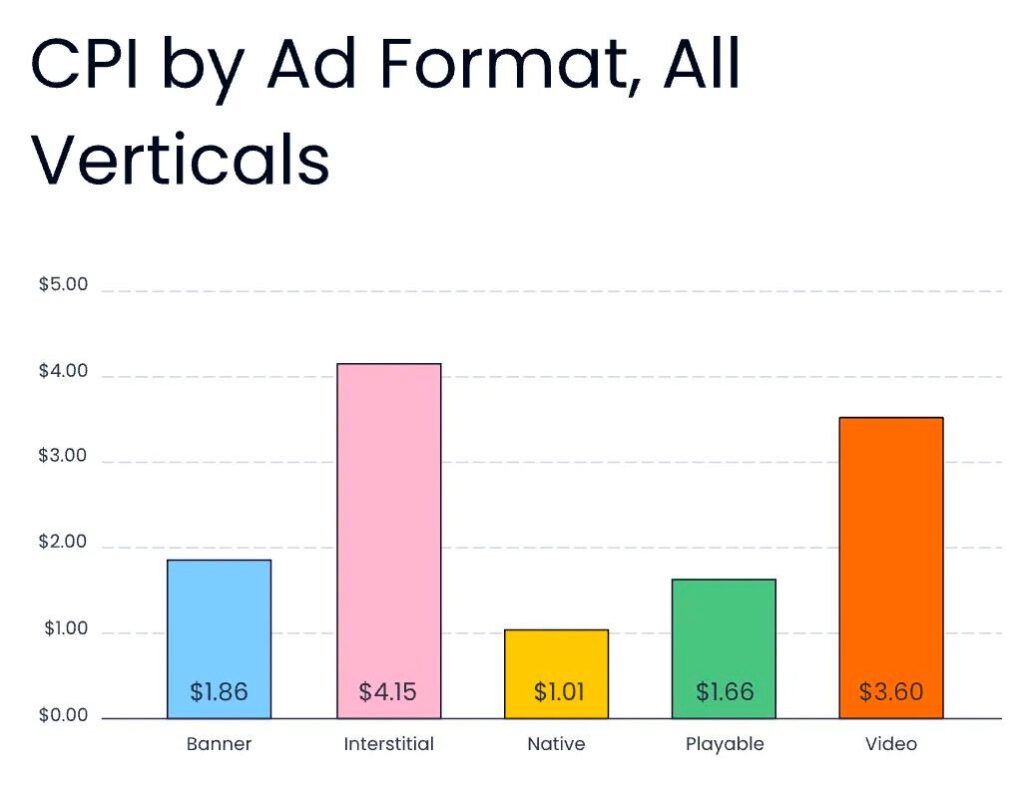

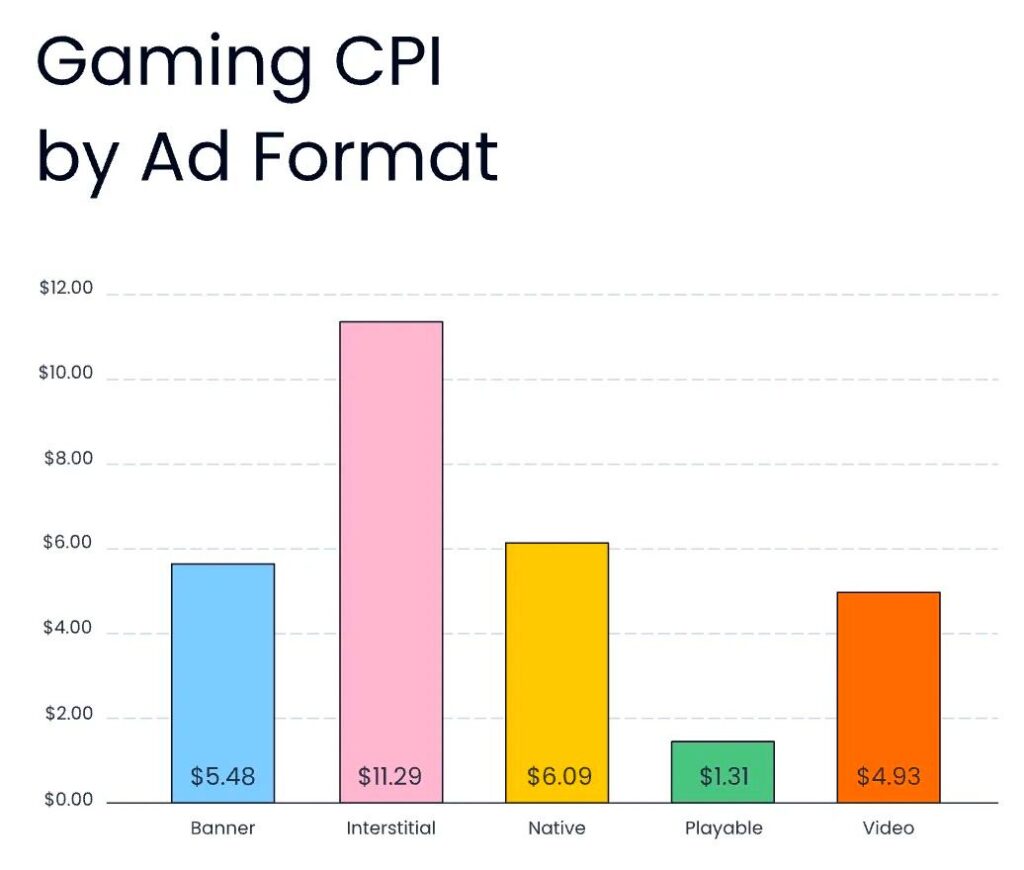

Liftoff: Mobile Ad Market Index in 2023

The data were collected from 1 January 2022 to 1 January 2023. The research is based on trillion impressions; 24.5B clicks, and 240M installs.

CPI by ad formats in games

-

Interstitial - $11,29. That’s the most expensive placement.

-

Native Ads - $6,09.

-

Banners - $5,48.

-

Video - $4,93.

-

Playable - $1,31. That’s the cheapest format according to Liftoff.

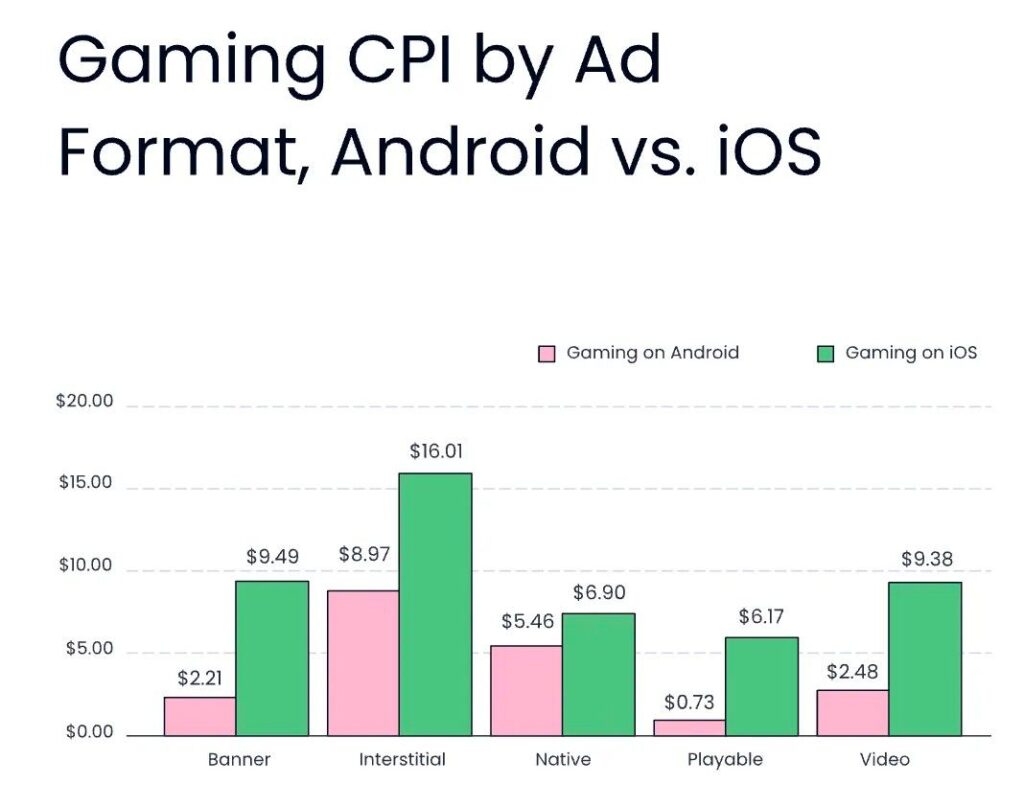

CPI comparison by ad formats, Android vs. iOS

-

Interstitial - $16,01 on iOS and $8,97 on Android.

-

Banners - $9,49 on iOS and $2,21 on Android.

-

Video - $9,38 on iOS and $2,48 on Android.

-

Native Ads - $6,9 on iOS and $5,46 on Android.

-

Playables - $6,17 on iOS and $0,73 on Android.

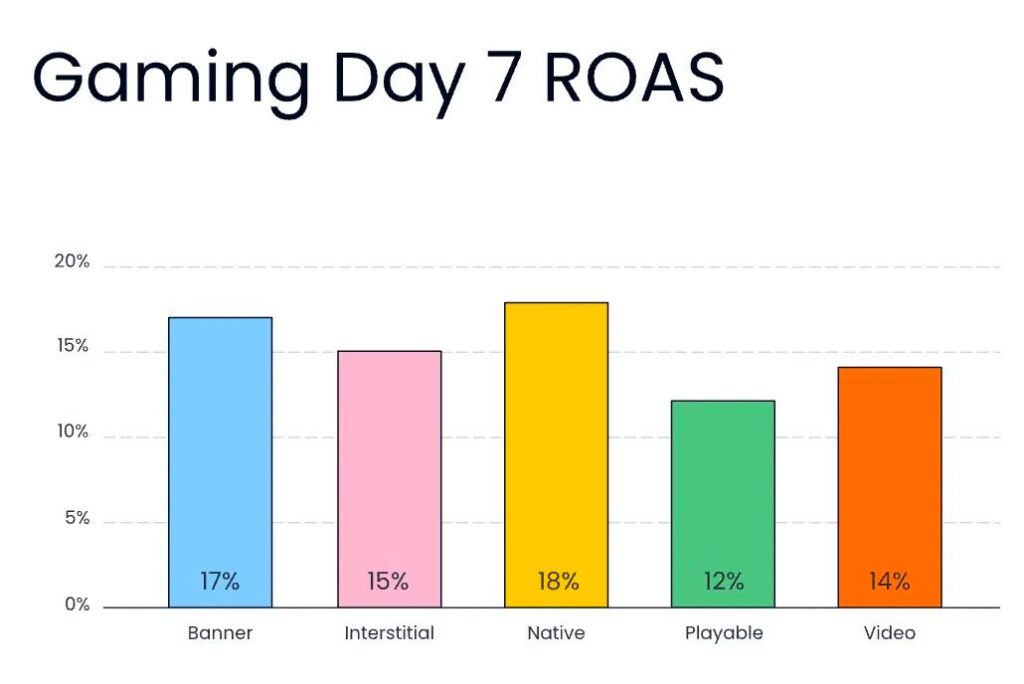

Day 7 ROAS by ad formats

-

Native ad formats - 18% D7 ROAS.

-

Banners - 17% D7 ROAS.

-

Interstitial - 15% D7 ROAS.

-

Video - 14% D7 ROAS.

-

Playables - 12% D7 ROAS.

General recommendations by Liftoff

-

Do not use the art style in ad materials (especially for mid-core titles) that differs from what is used in the game. It will increase churn.

-

Users like to see the progression in ad creatives - customization and level-up.

-

Long video creatives are working better than short ones. In some cases, the difference was up to 50%.

Warner Bros. Interactive: Hogwarts Legacy sold 12M copies in the first two weeks

-

Hogwarts Legacy already earned $850M of revenue.

-

The game had 1.28 concurrent players at peak.

-

Hogwarts Legacy became the most popular single-player game on Twitch on launch.

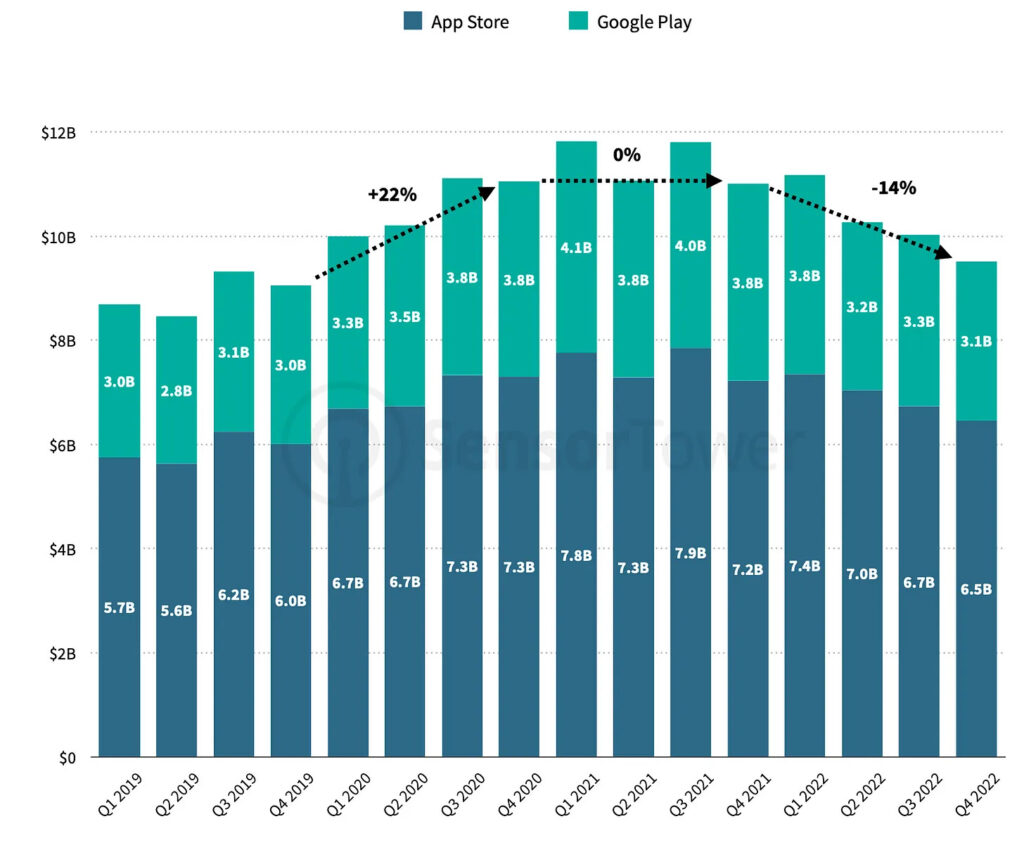

AppMagic: Mobile Gaming Market in 2022

AppMagic shared a report which includes some genres' numbers, stats, and dynamics in 2022. Games with $50k+ monthly revenue are named as a success.

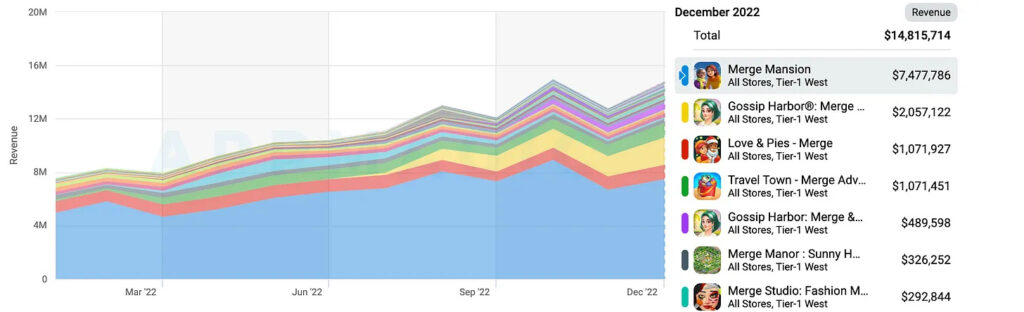

Merge-2

100 games released in 2022; 6 successful. Success Rate - 6%.

-

The genre grew by 102% YoY by revenue.

-

Half of the monthly genre revenue ($14.8m) is generated by one game - Merge Mansion ($7.4M in December 2022).

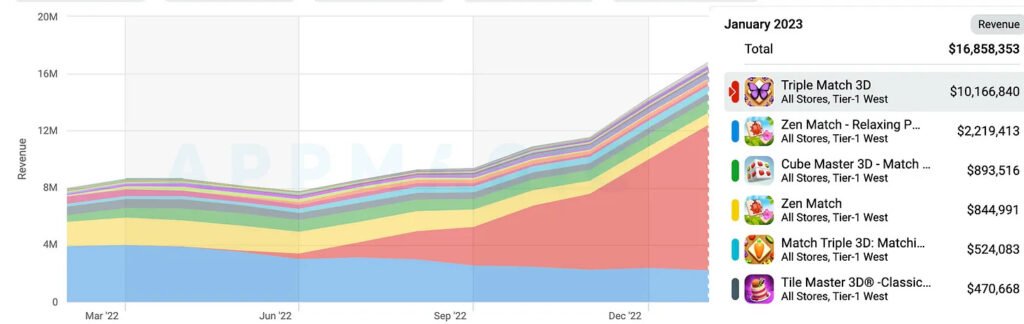

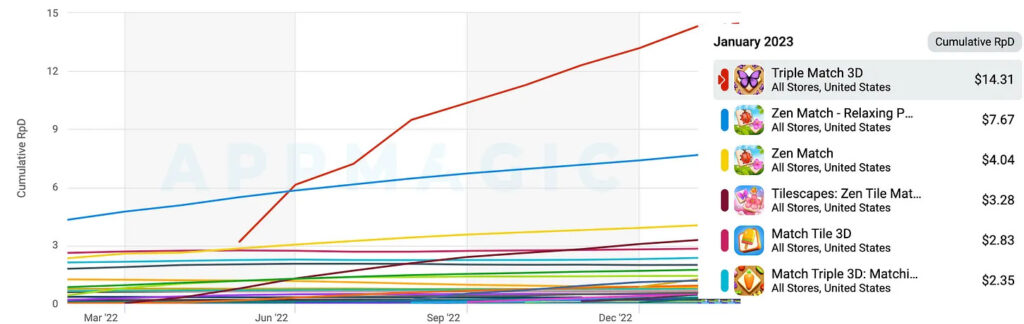

Match-3 Tile

280 games released in 2022; 6 successful. Success Rate - 2.2%.

-

Genre monthly revenue reached $16M (+85% YoY).

-

$10.1M of this amount is generated by one game - Triple Match 3D.

-

Genre downloads fell down by 12% YoY.

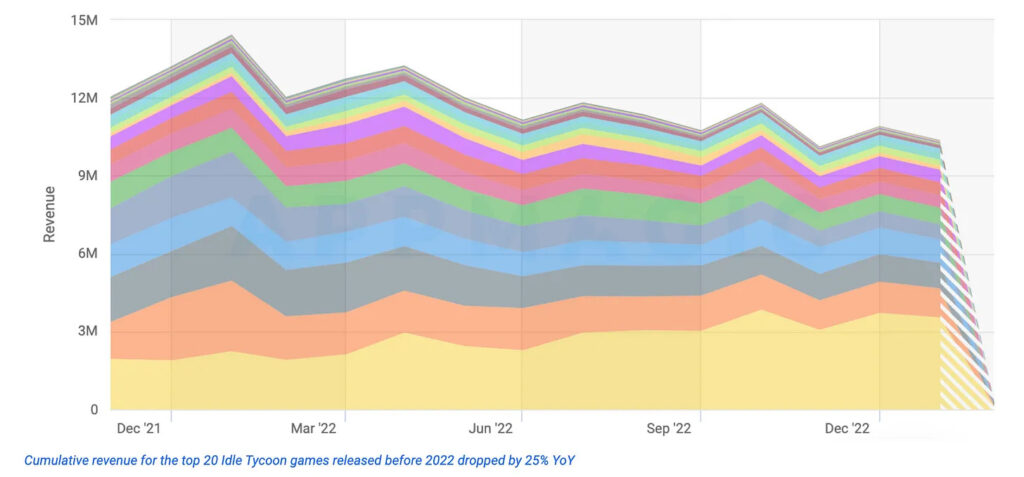

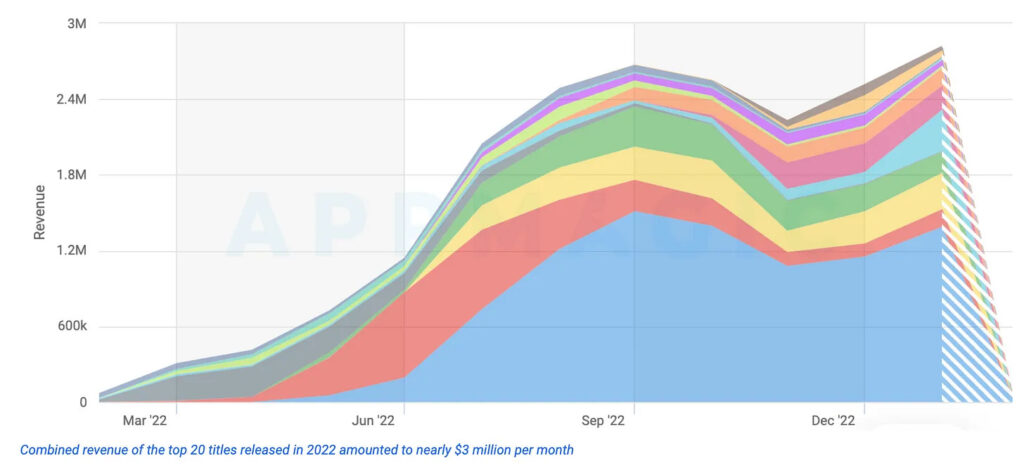

Idle Tycoon

241 games released in 2022; 10 successful. Success Rate - 4.2%

-

Genre revenue increased by 30% YoY.

-

AppMagic analysts consider the genre as a perspective with a notion that new projects are growing by revenue, and old ones are declining. There are no signs of stagnation.

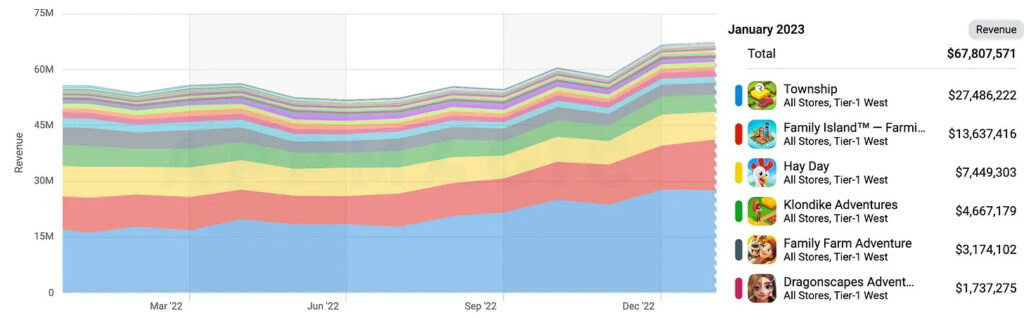

Farming Games

55 games released in 2022; 1 successful. Success Rate - 1.8%.

-

Genre revenue increased by 11%, but old titles generated it.

Survival Arena

134 games released in 2022; 4 successful. Success Rate - 3%.

Shooters

678 games released in 2022; 4 successful. Success Rate - 0.6%.

-

Genre revenue dropped during the year by almost 25%.

Hypercasual games

18,395 games released in 2022; 157 successful (with 500k+ monthly downloads). Success Rate - 0.85%.

-

Overall downloads dropped by 15% YoY.

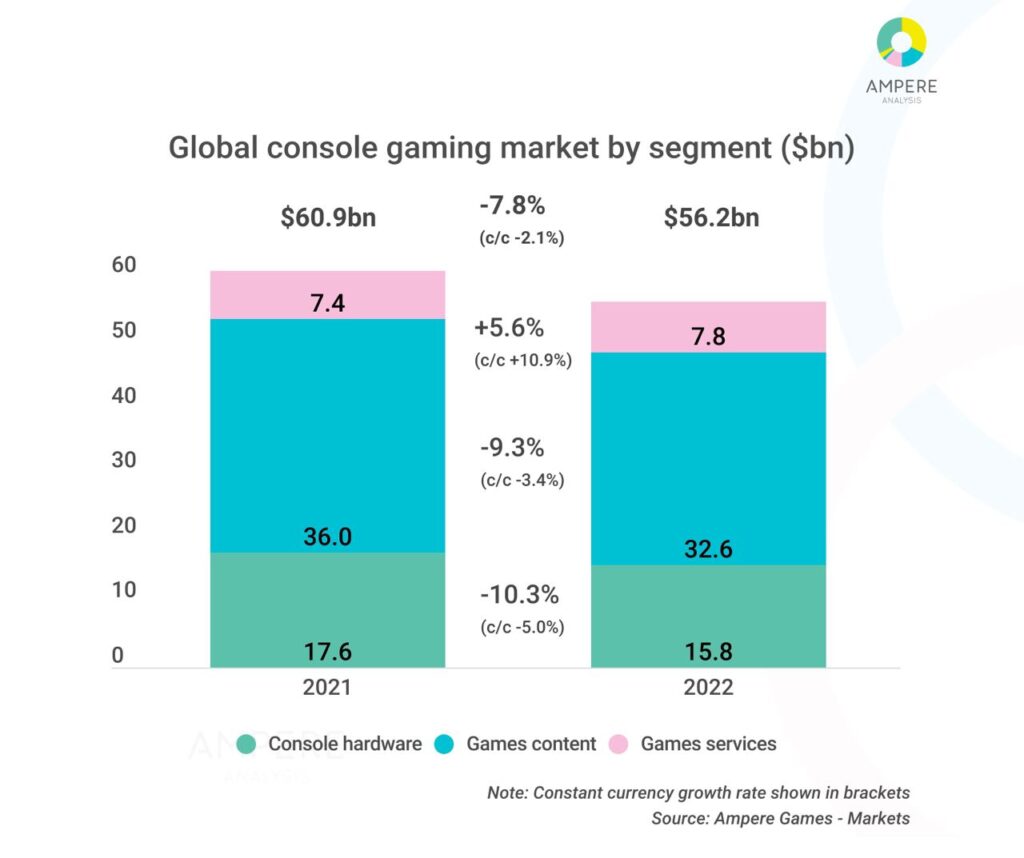

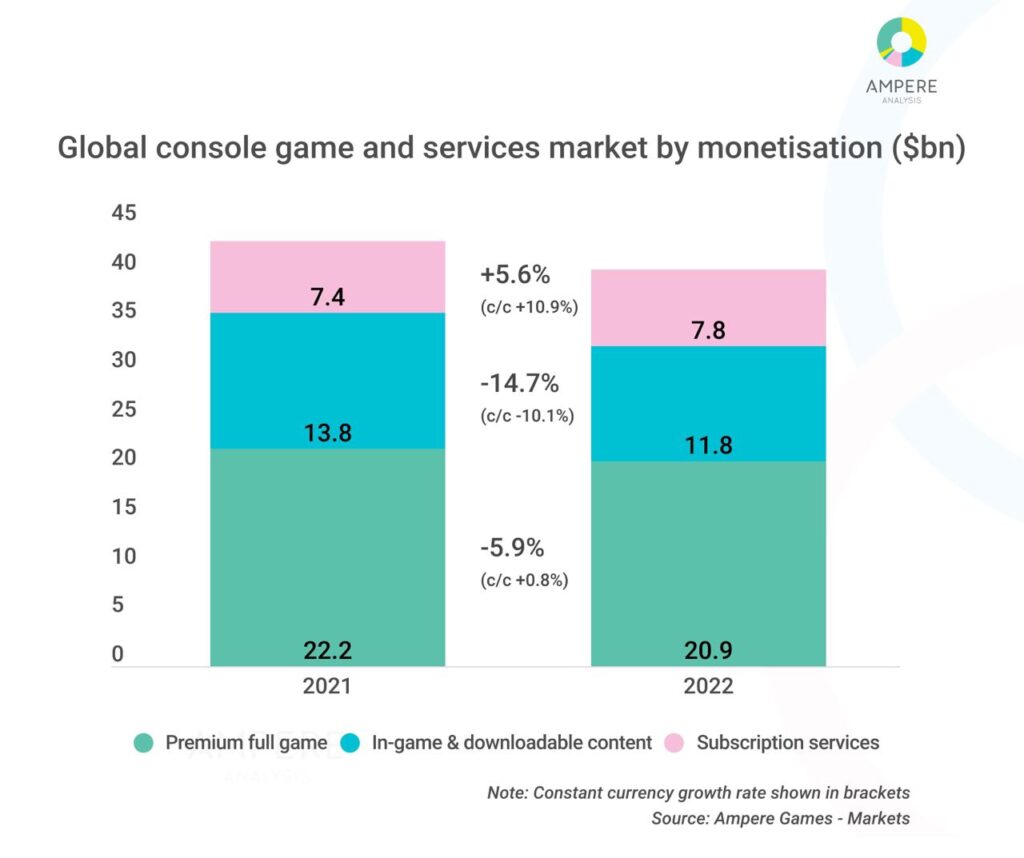

Ampere Analysis: The console gaming market dropped in 2022; PlayStation 5 is selling almost twice as better as Xbox Series

Ampere Analysis due to the instability of the dollar rate in 2022 is using two numbers - traditional and constant currency.

Market

-

The console gaming market declined from $60.9B in 2021 to $56.2B in 2022. The drop is 7.8% (or 2.1% in constant currency).

-

Overall console gaming market size is 18% larger than in pre-pandemic 2019.

-

Gaming services (subscriptions) is the only segment that shows positive dynamics. The growth was by 5.6% (10.9% in constant currency) - from $7.4B to $7.8B.

Content sales declined by 9.3% (3.4% in constant currency) - from $36B to $32.6B.

-

Hardware sales dropped by 10.3% (5% in constant currency) - from $17.6B to $15.8B.

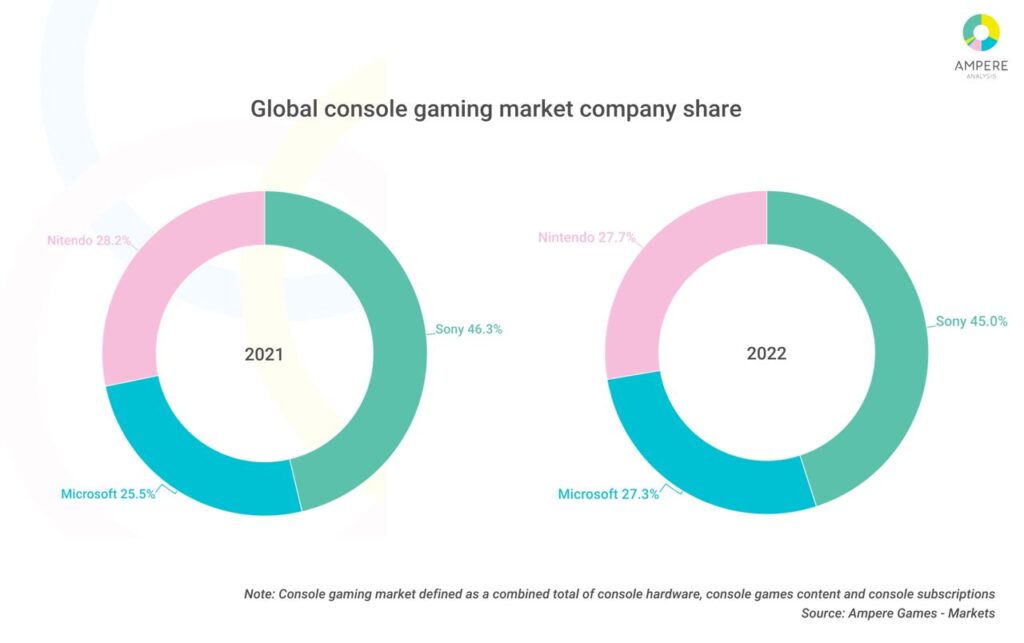

Main console manufacturers

-

Sony's share of the market is 45%; Nintendo is holding 27.7%; Microsoft got 27.3%.

-

Microsoft’s share in 2022 increased by 1.8%. Sony lost 1.3% of the market; Nintendo - 0.5%.

Console sales

-

PlayStation 5 sales in 2022 reached 30M. Xbox Series is far behind with 18.5M consoles sold.

-

Nintendo Switch sales by the end of 2022 reached 119.5M. Analysts are positive that Nintendo will announce a new console in 2024.

Gaming content sales on consoles

-

Subscriptions is the only type of content that grew in 2022 (from $7.4B to $7.8B). Once again, the growth was 5.6% (10.9% in constant currency).

-

In-game purchases and DLC sales dropped by 14.7% (10.1% in constant currency) - from $13.8B in 2021 to $11.8B in 2022.

-

Premium game sales declined by 5.9% (but grew by 0.8% in constant currency) - from $22.2B in 2021 to $20.9B in 2022.

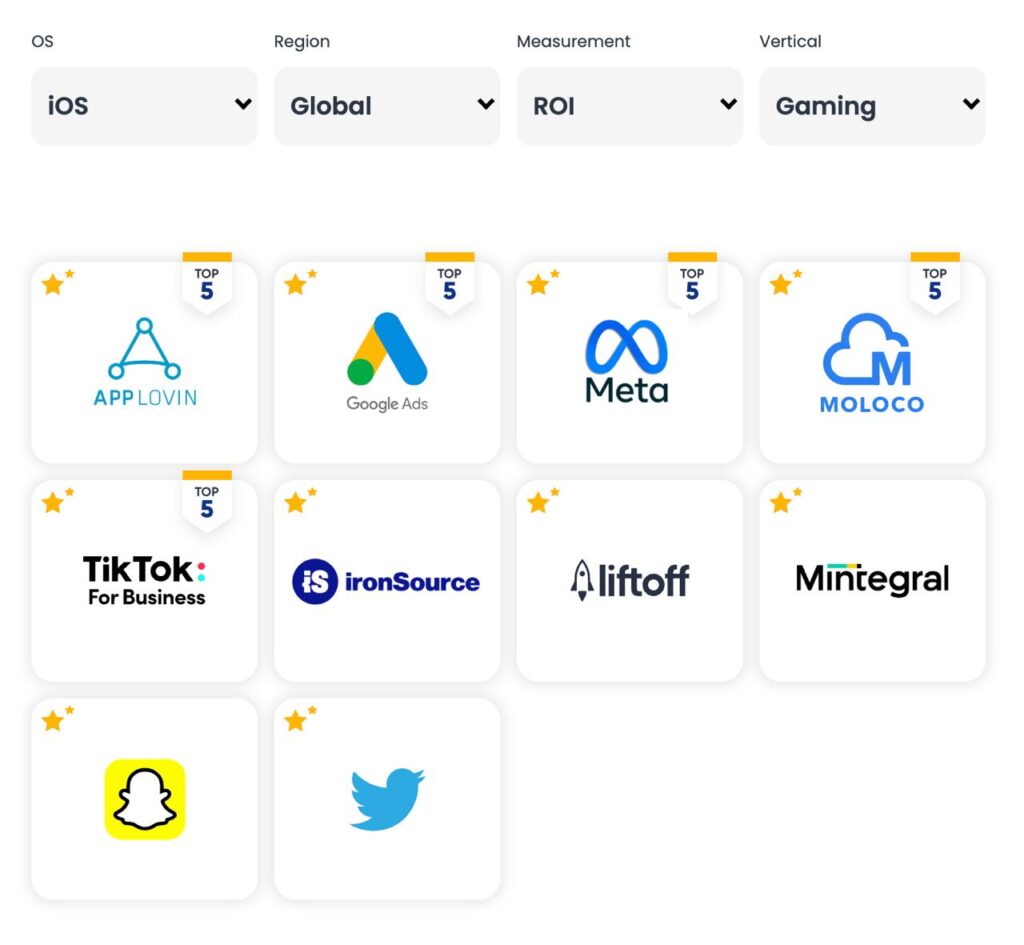

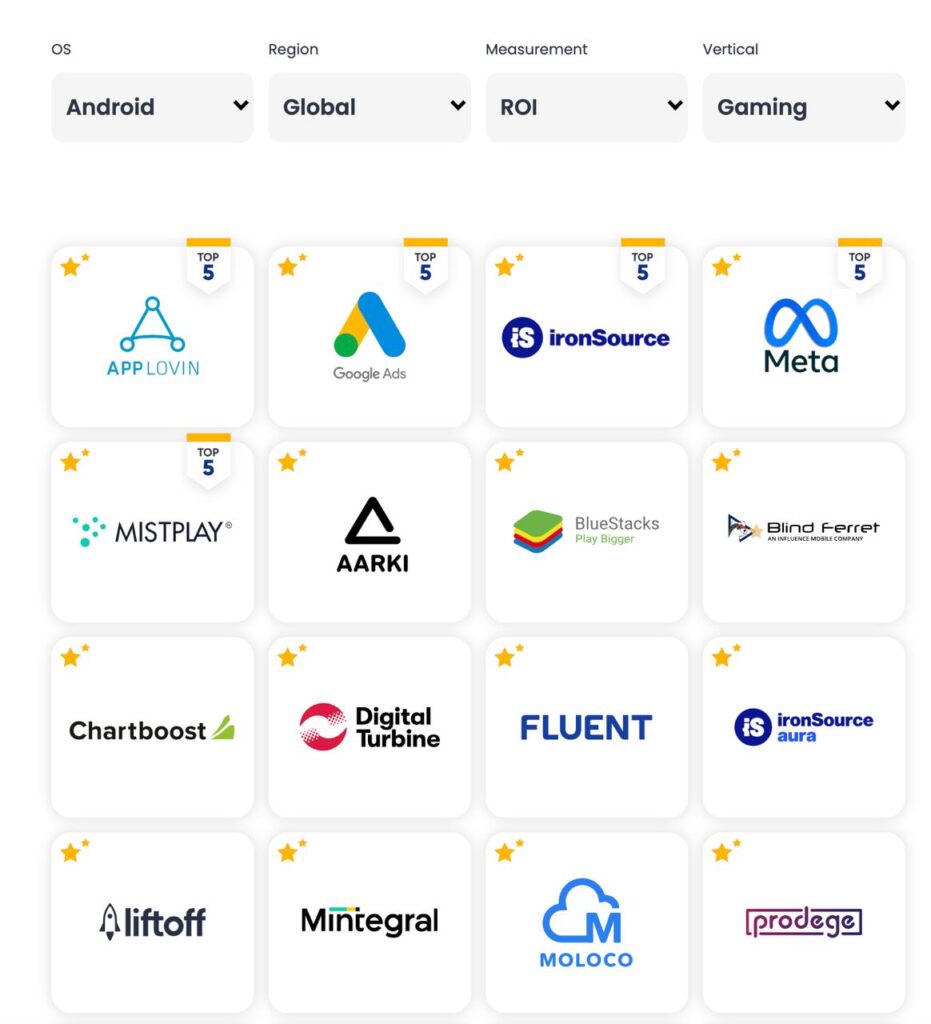

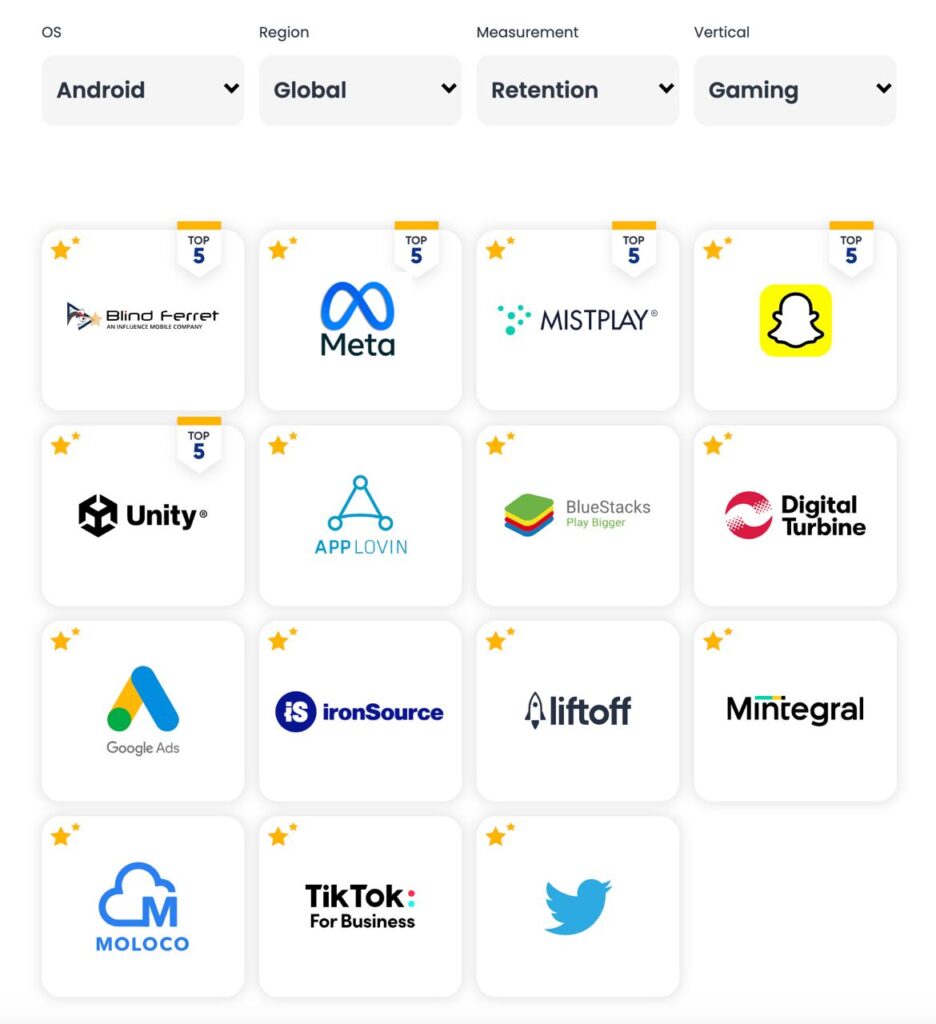

Singular: ROI Index in 2023

The company is basing its research on 100B+ clicks; $10B+ spent, and $10B+ installs.

-

AppLovin, Google Ads, Meta, Moloco, and TikTok are the best ad channels for iOS by ROI.

-

AppLovin, Google Ads, ironSource, Meta, and Mistplay are the best ad channels for Android by ROI.

-

Blind Ferret, Meta, Mistplay, Snapchat, and Unity are the best ad channels for Android by Retention.

-

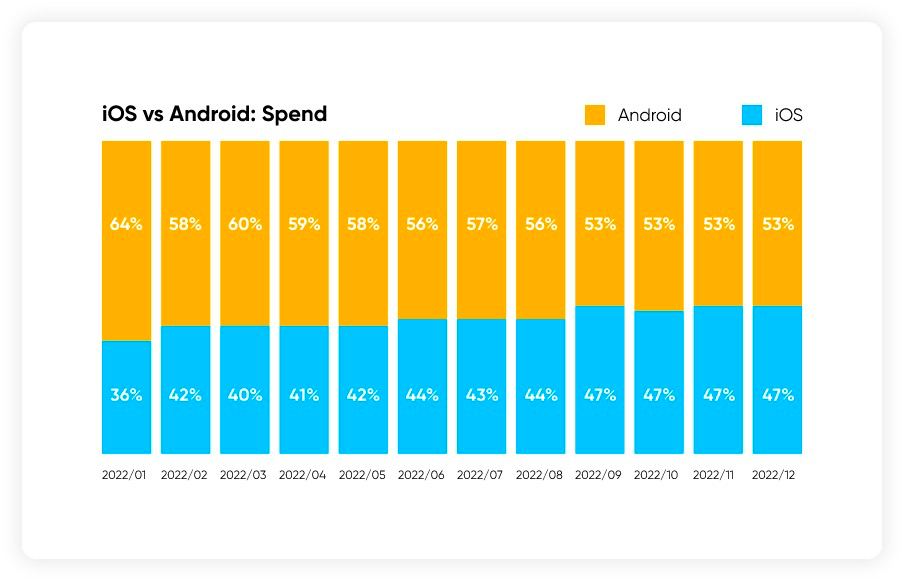

Advertisers’ spending on iOS was recovering throughout 2022. In January 2022 Android was responsible for 64% of spending; 36% was on iOS. At the end of 2022, Android share declined to 53%, iOS grew to 47%.

-

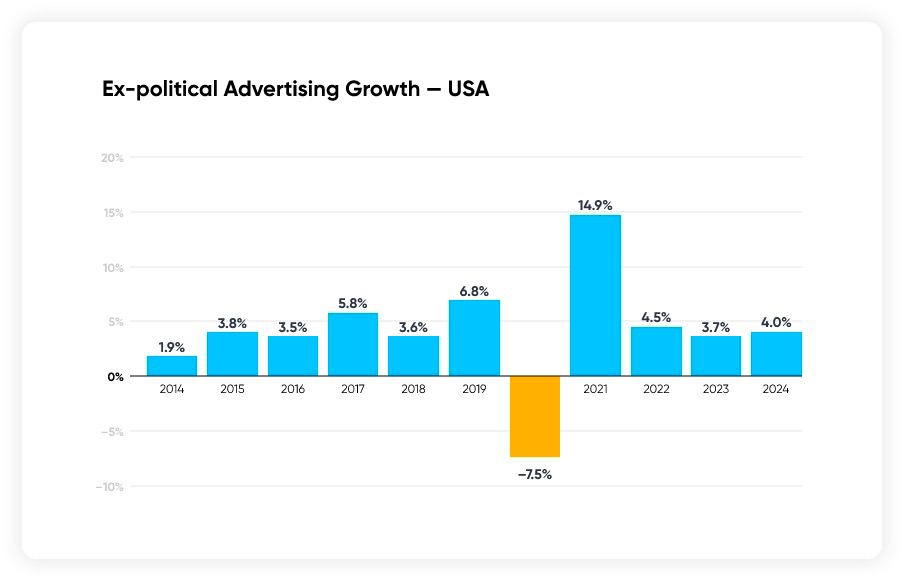

According to Magna, the mobile ads market growth in 2023 in the US will be 3.7%. It’s lower than in 2022 (+4.5%) and significantly differs from 2021 (+14.9%).

-

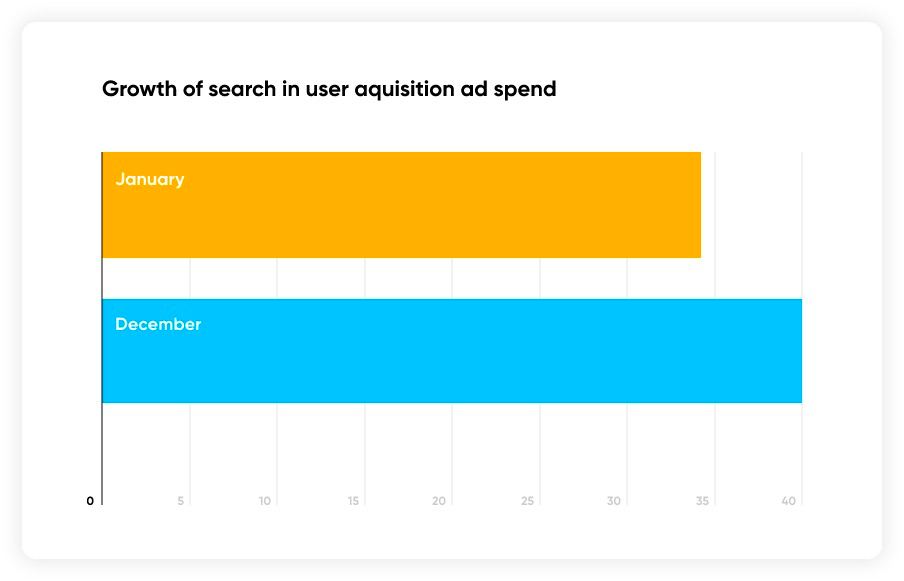

Search UA share increased from 34% at the beginning of 2022 to 40% by the end of 2022.

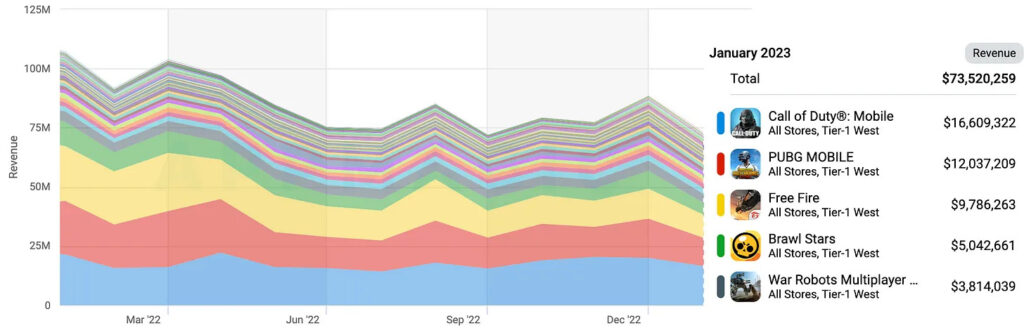

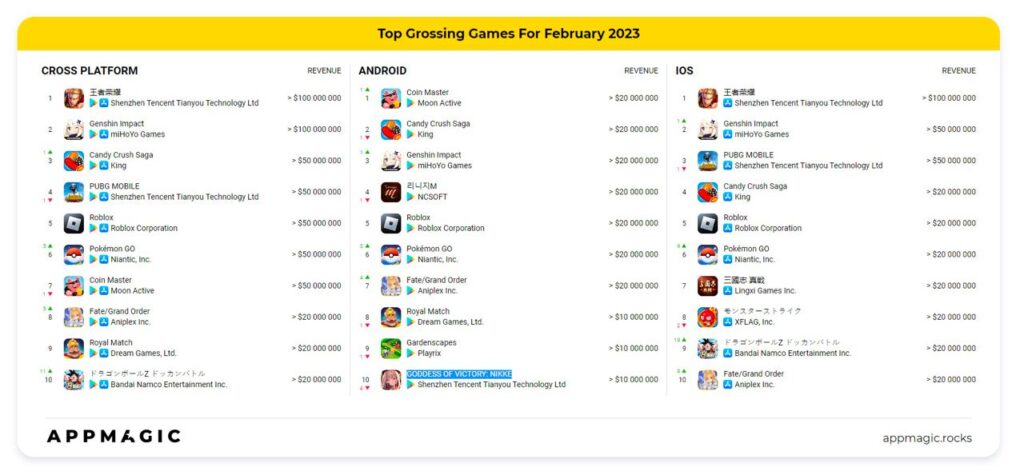

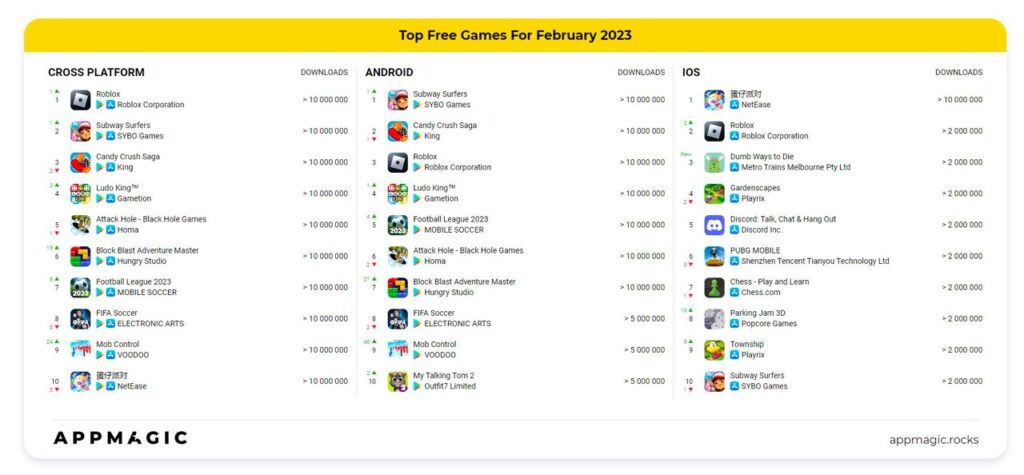

AppMagic: Top Mobile Games of February 2023 by Revenue and Downloads

Revenue

-

Honor of Kings earned $113.5M on IAP in February 2023 which took it to the top.

-

Genshin Impact with 111.7M IAP purchases made great competition to the MOBA from Tencent.

-

Dragon Ball Z Dokkan Battle got back to the top 10 with $40M IAP revenue.

Downloads

-

In February 2023 only one new game appeared in the downloads chart - Dumb Ways to Die. The game was in the charts in 2013, but it was 10 years ago, so we’ll consider it as a new one. Now the game has become viral thanks to TikTok, and developers released a new update. Dumb Ways to Die is a compilation of mini-games that teaches people about the right behavior on roads.

-

ROBLOX became the most downloaded game of February 2023.

GSD & GfK: The UK market came back to growth in February 2023

Games

-

2.8M console and PC games were sold in the UK in February. It’s 11% growth YoY.

-

Hogwarts Legacy is the main game of the month. Its launch week sales were 100% higher than Elden Ring’s - the largest game of February 2022. After 3 weeks of sales, Hogwarts Legacy is close to overcoming overall sales of Elden Ring.

-

The Last of Us: Part II is back in the top-10; sales of The Last of Us Remastered (+50%), and The Last of Us: Part I increased too. Absolute numbers are not so high, but there is a notable effect from the HBO series.

Consoles and accessories

-

143k consoles were sold in the UK in February 2023. It’s 65% higher than last year and 14% more than in January.

-

PlayStation 5 sales skyrocketed by 316% YoY, and 27% to January. The first two months of 2023 sales are 180% higher than in the first two months of 2022.

-

Xbox Series S|X sales increased by 21% YoY, and by 15% MoM.

-

Nintendo Switch sales are declining. In February it showed a drop of 15% in MoM sales. YoY decrease was 29%.

-

511.6k accessories were sold in the UK in February. It’s 17% lower than in January, and 14.4% lower than in February 2022.

-

DualSense remains the leader in sales.

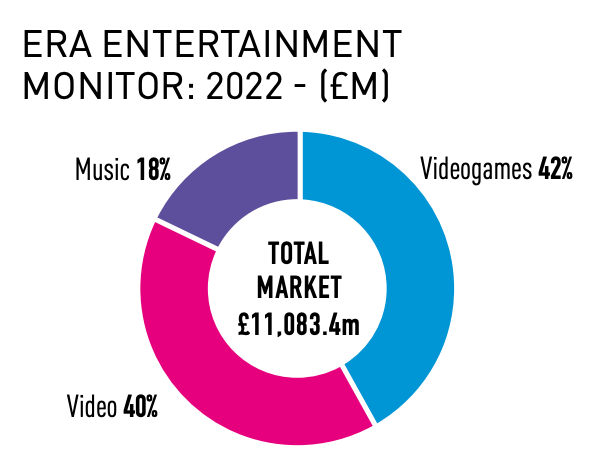

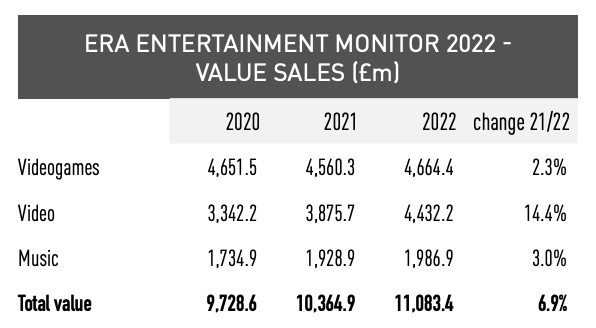

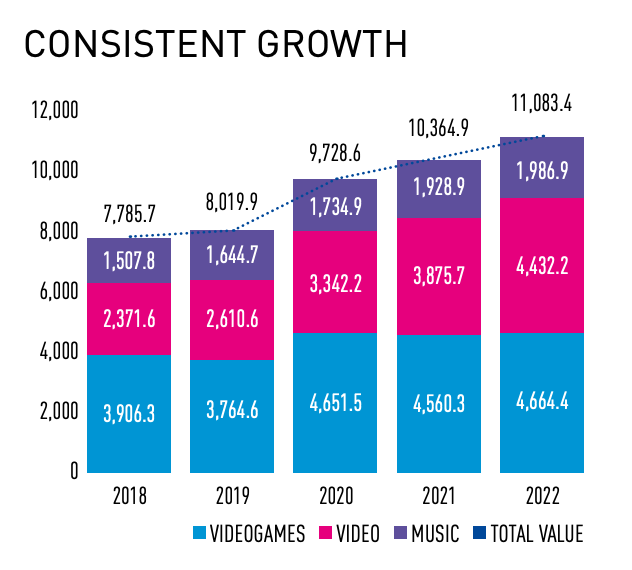

ERA: UK 2023 Gaming Report

ERA released a massive report about the entertainment market in the UK. Despite having many numbers, it allows comparing gaming with other verticals - music, and video.

-

The overall entertainment UK market volume is £11.083B.

-

In 2022 games were responsible for 42% of this amount; video content (movies, TV series, etc.) - for 40%; music - for 18%.

-

Despite the fact that other sources are telling (like GSD, and GfK) about the declining gaming market, ESA analysts found that it grew by 2.3% to £4,66B.

-

You might have heard a lot recently that video games are the largest entertainment market in the world. In 2023 the UK leadership may return to video content. Its growth hasn’t stopped after the pandemic in 2022 it surged by 14.4%. And this is the main entertainment market growth driver.

-

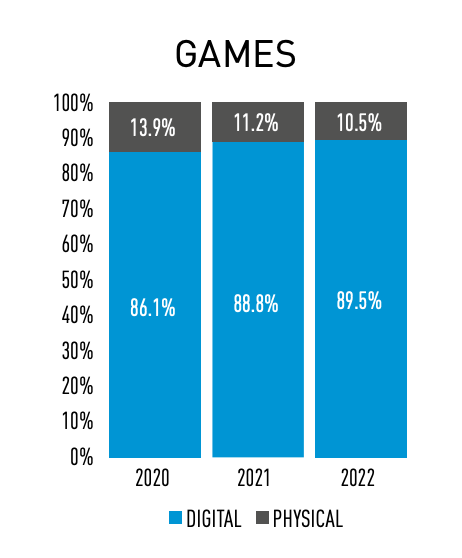

Game sales in digital format in 2022 grew by 3.1; physical sales declined by 4.5%. 89.5% of video game sales in the UK have been made digitally.

-

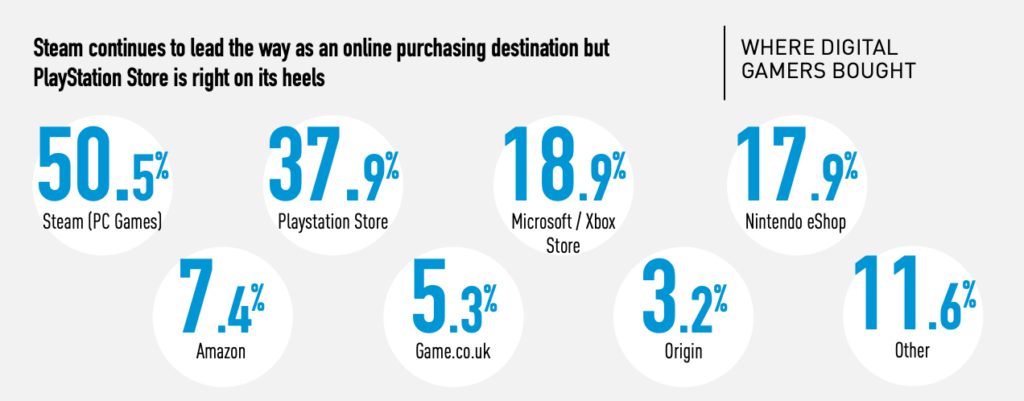

Steam (50.5%) and PlayStation Store (37.9%) are the main platforms for buying digital games in the UK.

-

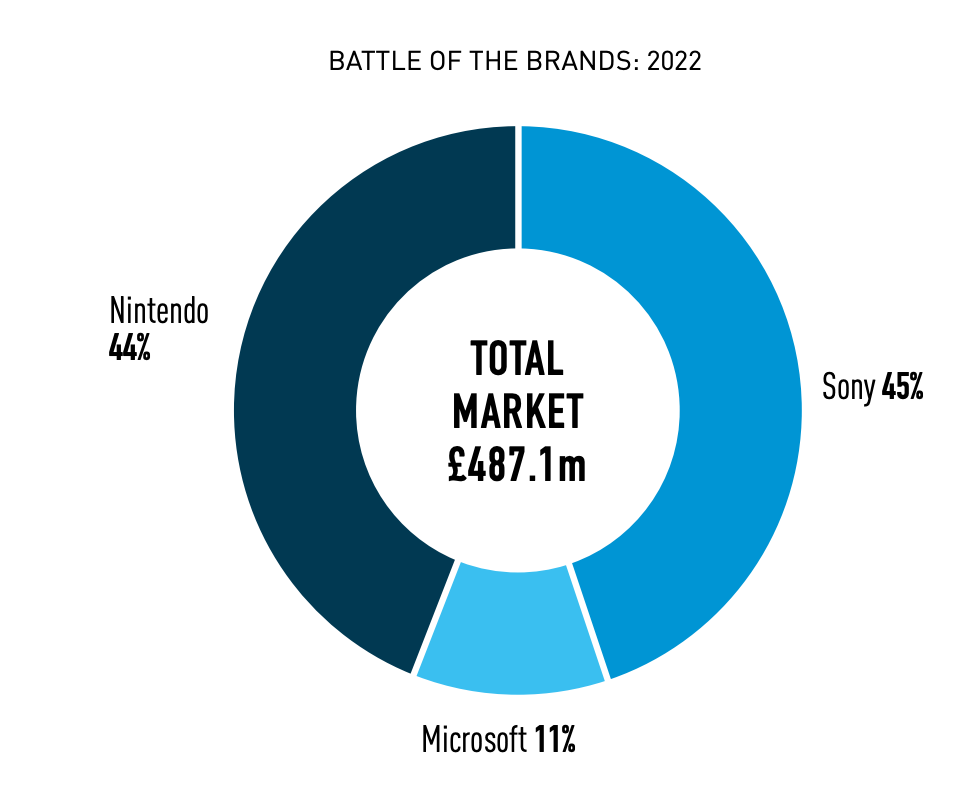

Sony is accountable for 45% of the UK console market; Nintendo - for 44%; Microsoft - for 11%. Only software sales are included here.

-

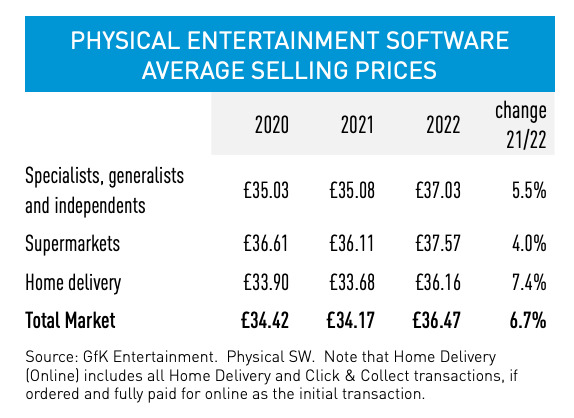

The average price of the physical version of the game in the UK in 2022 increased by 6.7% to £36,47.

-

FIFA 23 sales in the UK in 2022 resulted in 2.5M copies. Call of Duty: Modern Warfare II has been bought 1.68M times. Elden Ring sold 865k copies.

ERA: UK 2023 Gaming ReportDownload

GSD: Hogwarts Legacy is the largest European release of the last 6 years (excluding FIFA)

Games

-

Hogwarts Legacy is #6 in launch sales in the last 6 years with only FIFA games ahead. Hogwarts Legacy starting sales are better than any Call of Duty game; Elden Ring; Red Dead Redemption II, and other hits.

-

After 3 weeks of sales, Hogwarts Legacy is already at #5 in the overall yearly chart. FIFA 23, Call of Duty: Modern Warfare II, Grand Theft Auto V, and Elden Ring are yet to be overcome.

-

Despite Hogwarts Legacy's success, European game sales declined by 10% YoY to 12.9M copies sold.

-

Analysts are connecting it with fewer releases than last year, where Elden Ring, Horizon: Forbidden West, Dying Light 2, and Total War: Warhammer 3 were released in February.

-

Atomic Heart made it to the 9 place by sales in February 2023.

-

The Last of Us: Part II sales increased by 317%, and The Last of Us Remastered sales were up by 285%. Thanks to HBO's TV Series.

Consoles and accessories

Numbers excluding the UK and Germany markets.

-

PlayStation 5 sales in Europe in February 2023 surged by 5 times compared to the previous year.

-

Nintendo Switch sales were down by 28%.

-

PS5 is the strong leader by sales in Europe in February; Nintendo Switch was second; Xbox Series S|X is third with +13% YoY growth.

-

1.27M accessories have been sold in Europe in February 2023 (-0.2% YoY). The leader is the same as all last months - DualSense.

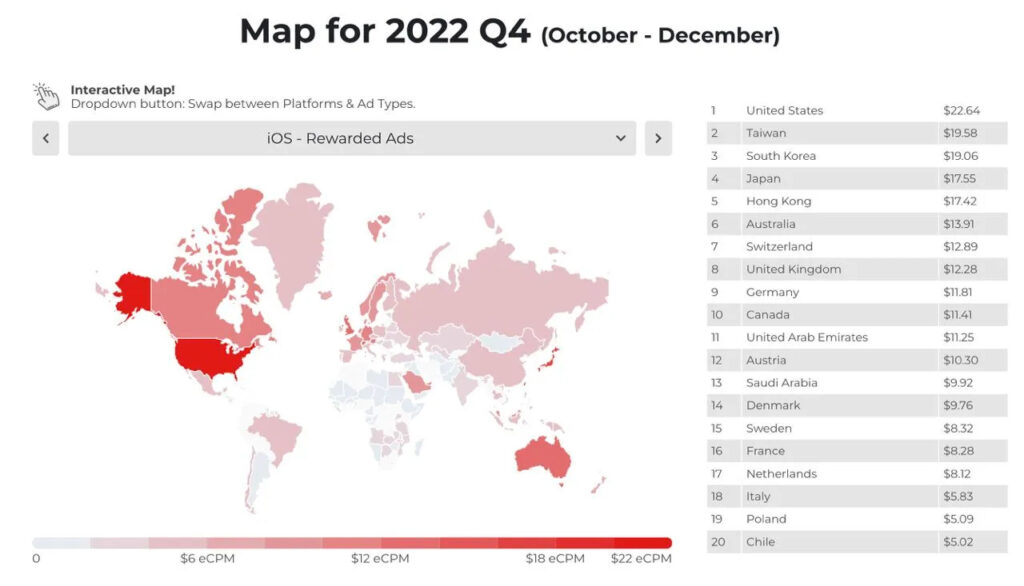

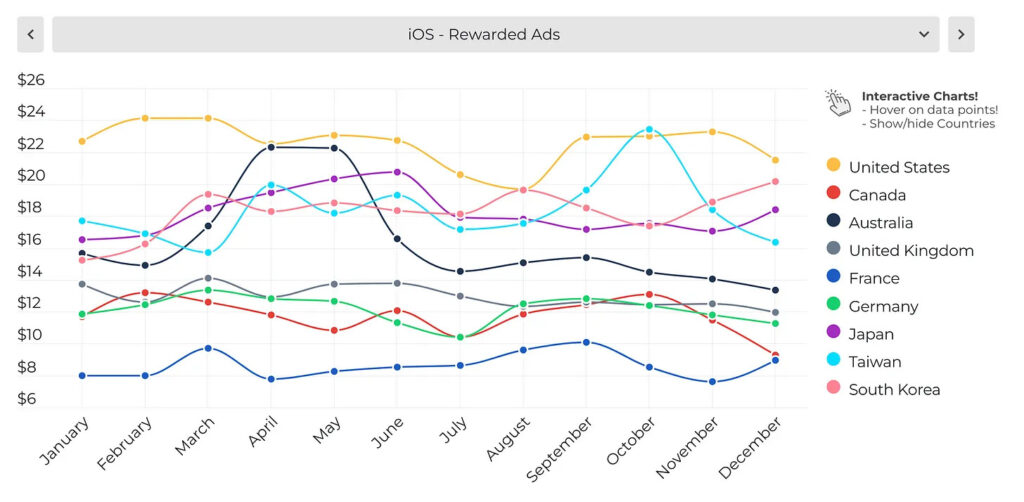

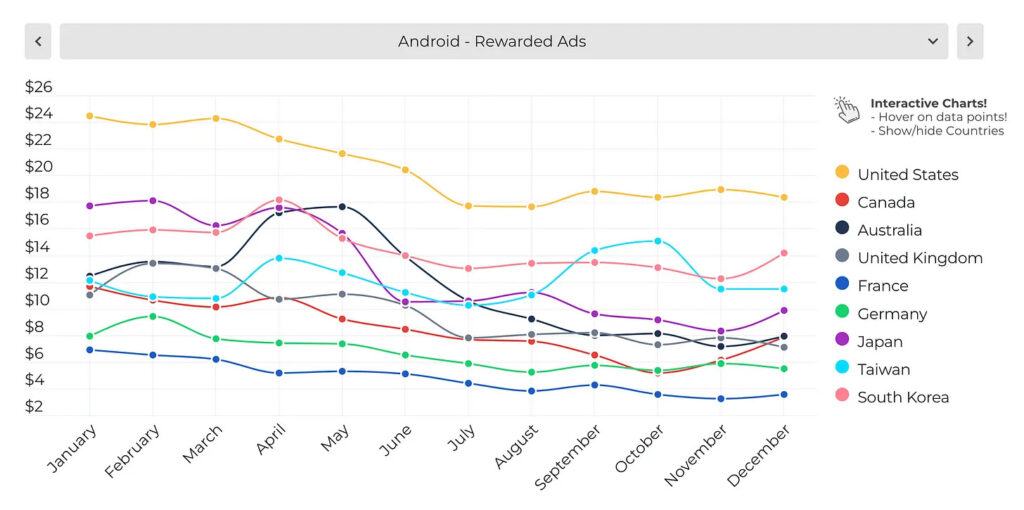

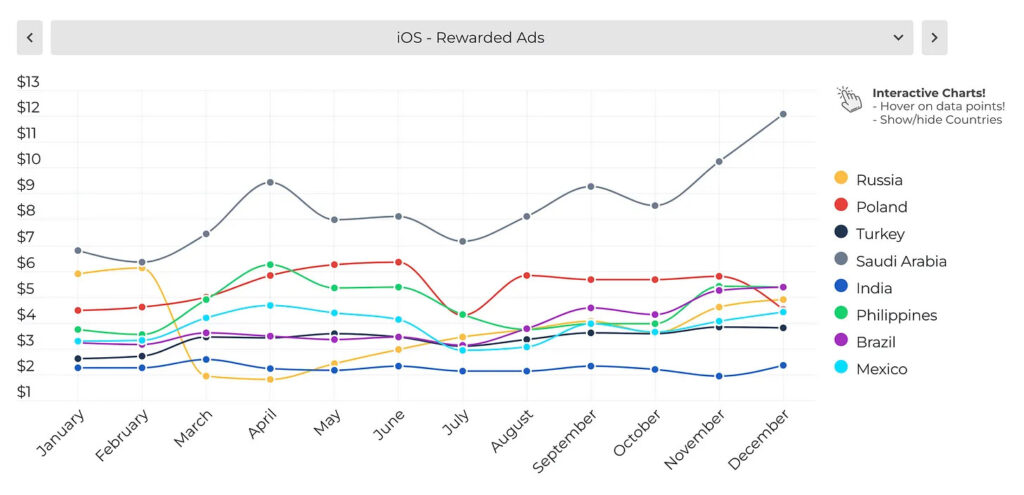

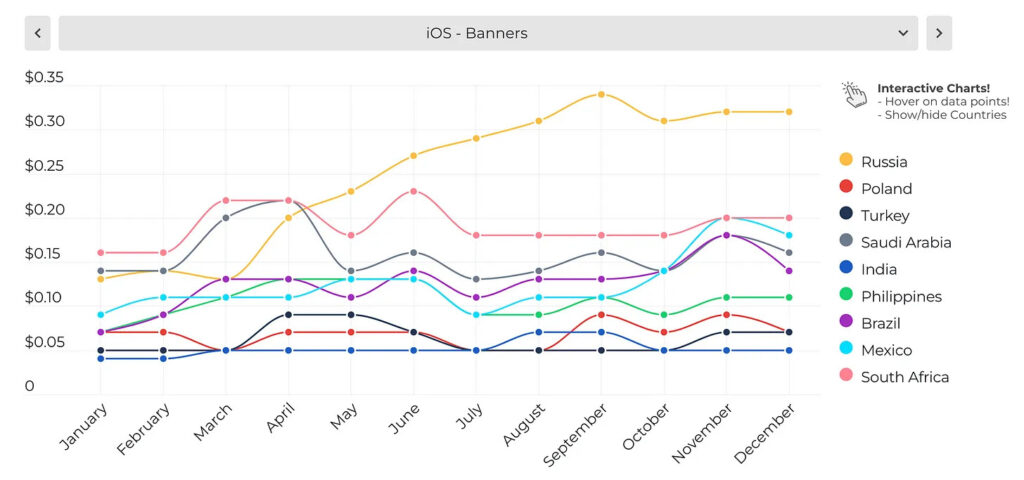

Appodeal: Yearly eCPM Report (2023 Edition)

The research is based on 200B+ views; 70+ ad channels; 100+ thousand apps. Data were collected from January 2022 to December 2022.

Mature markets

-

eCPM on iOS in Rewarded Ads and Interstitials was more or less stable in 2022 in Tier-1 countries.

-

eCPM of banner ads increased in Tier-1 countries on iOS.

-

Rewarded Ads eCPM on Android in the US declined from $24.48 in January 2022 to $18.36 in December 2022. And many Tier-1 countries followed the negative trend.

-

eCPM of Interstitial formats on Android is declining too.

-

eCPM of the banner format on Android is copying the iOS movement - it’s growing, but not as fast as on iOS.

Emerging markets

-

Rewarded Ads eCPM in Saudi Arabia on iOS increased through 2022 almost 2 times - from $6.79 in January 2022 to $12.06 in December. In no other countries, such massive growth was detected.

-

Interstitial format eCPM on iOS in Saudi Arabia grew too - from $4.45 in January 2022 to $7.61 in December 2022.

-

Russia is showing impressive growth in banner format eCPM on iOS - from $0.13 in January 2022 to $0.32 in December 2022. This is on par with Canada ($0.31), and higher than in South Korea ($0.23) or Germany ($0.14).

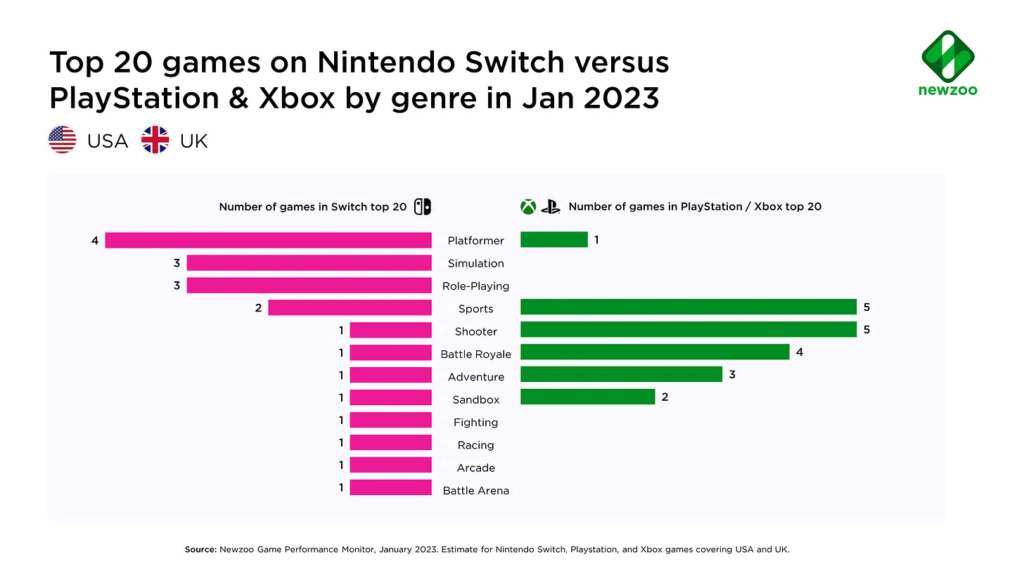

Newzoo: Top-20 on Nintendo Switch by MAU is more diverse than on PlayStation and Xbox

Newzoo tracked the top 20 games on console platforms by MAU in January 2023. Markets are the US and the UK.

-

Fortnite, Pokemon Scarlet / Violet, and Minecraft are the top-3 games by MAU on Nintendo Switch in January 2023.

-

Gamers on Nintendo Switch in general do prefer more genres. In the top 20, there are 12 genres, while on PlayStation and Xbox - there are only 6.

-

The most popular games by MAU on Nintendo Switch are platformers. Simulations, RPGs, and sports games are next. There is only one shooter in the top 20.

-

Among the top 20 games by MAU on PlayStation and Xbox - are 5 shooters and 5 sports games.

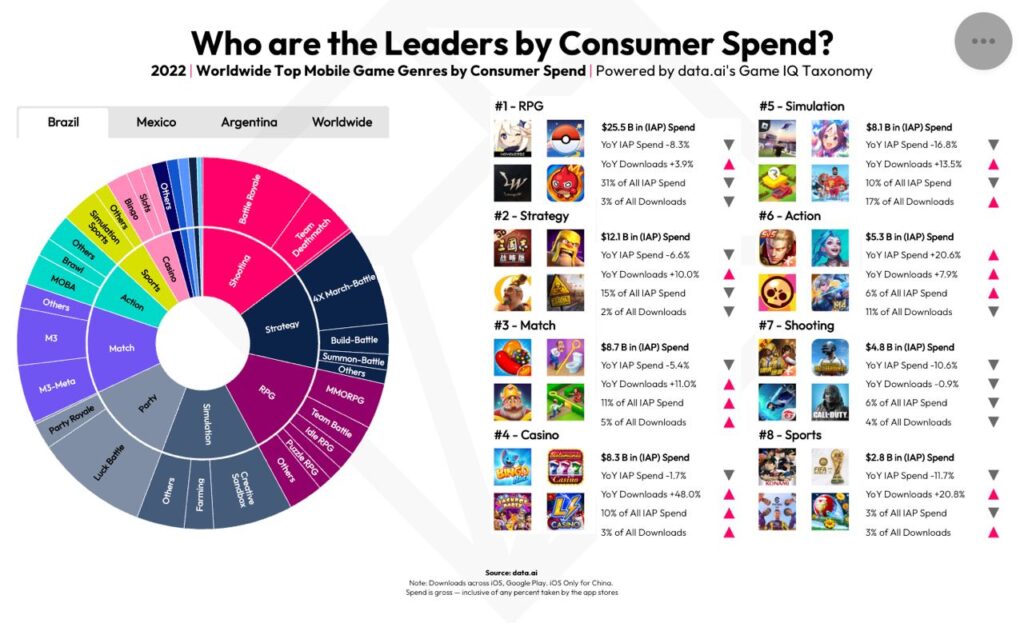

data.ai: Mobile Gaming Markets of Brazil, Mexico & LATAM, in general, grew in 2022

-

Mobile revenue in Brazil grew by 2022 by 20% - from $1.13B in 2021 to $1.37B in 2022.

-

Mexico also showed a growth of almost 20%, and the overall revenue of the mobile market in the country reached $711M.

-

Brazil's mobile gaming market grew by 12.3% YoY - from $570M in 2021 to $640M in 2022.

-

The Mexican mobile gaming market showed good results too with a growth of 9.4% from $320M to $350M.

-

It’s important to note that the global mobile gaming market in 2022 dropped by 5%. This means that Brazil and Mexico are growing despite world downward trends.

-

Countries are growing by downloads too - Brazil reached 4.62B downloads; Mexico - 2.42B downloads.

-

Shooters are the most lucrative genre in Brazil, Argentina, and Mexico. Overall revenue growth of shooter games revenue in those countries reached 24%. This is interesting because shooters are the largest losers of 2022 worldwide.

-

Brazil has also seen an increase in party games revenue by 78%. data.ai tracks Stumble Guys in this category, so it might be an effect of one title.

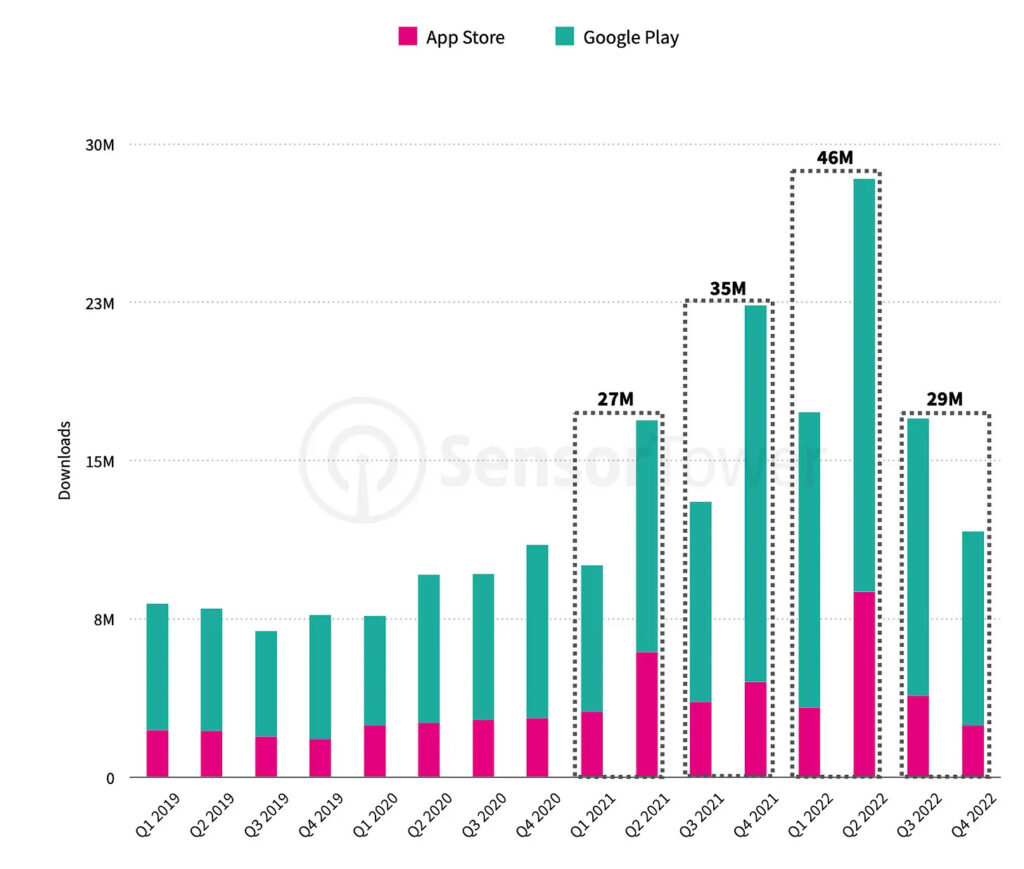

Among Us reached 500M downloads on Mobile

-

Among Us was released on App Store & Google Play in 2018. But before Q3 2020 the game wasn’t popular at all.

-

After the game became viral, in Q4 2020 its downloads reached 230M - only on Mobile.

-

A majority of downloads came from the US, Brazil, and India.

-

Developers earned $91.7M on mobile devices since launch. Which is a great result for a team of 14 people.

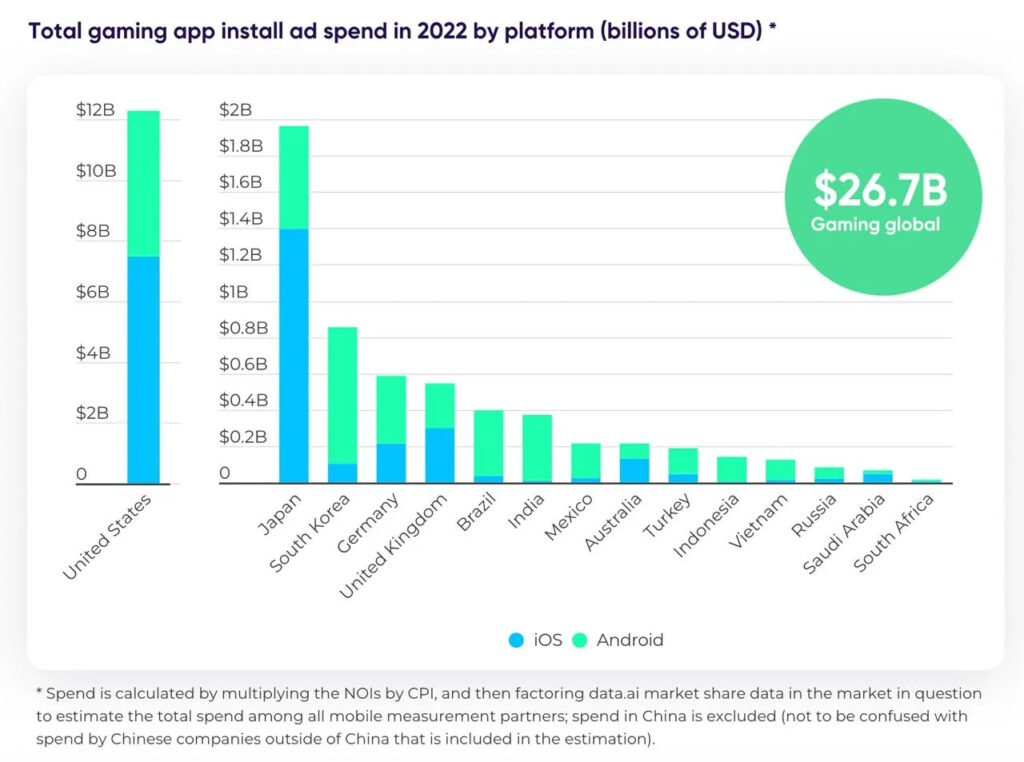

AppsFlyer: State of Mobile Gaming Marketing in 2023

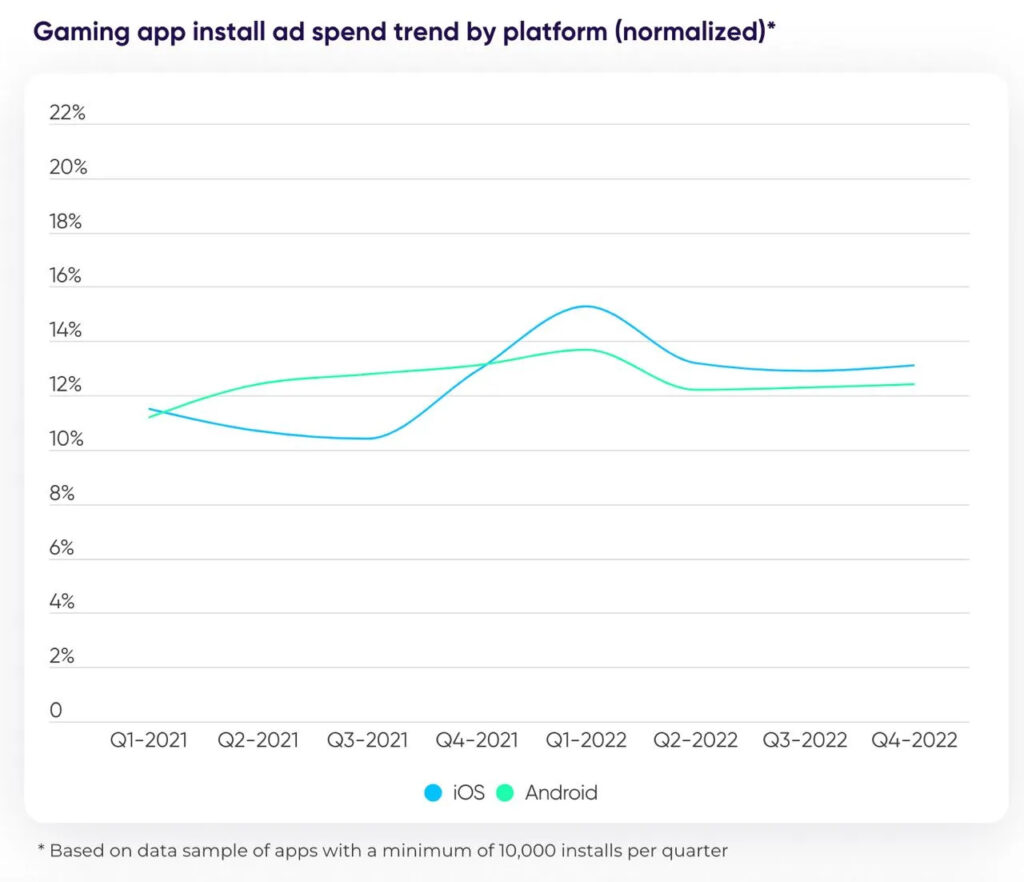

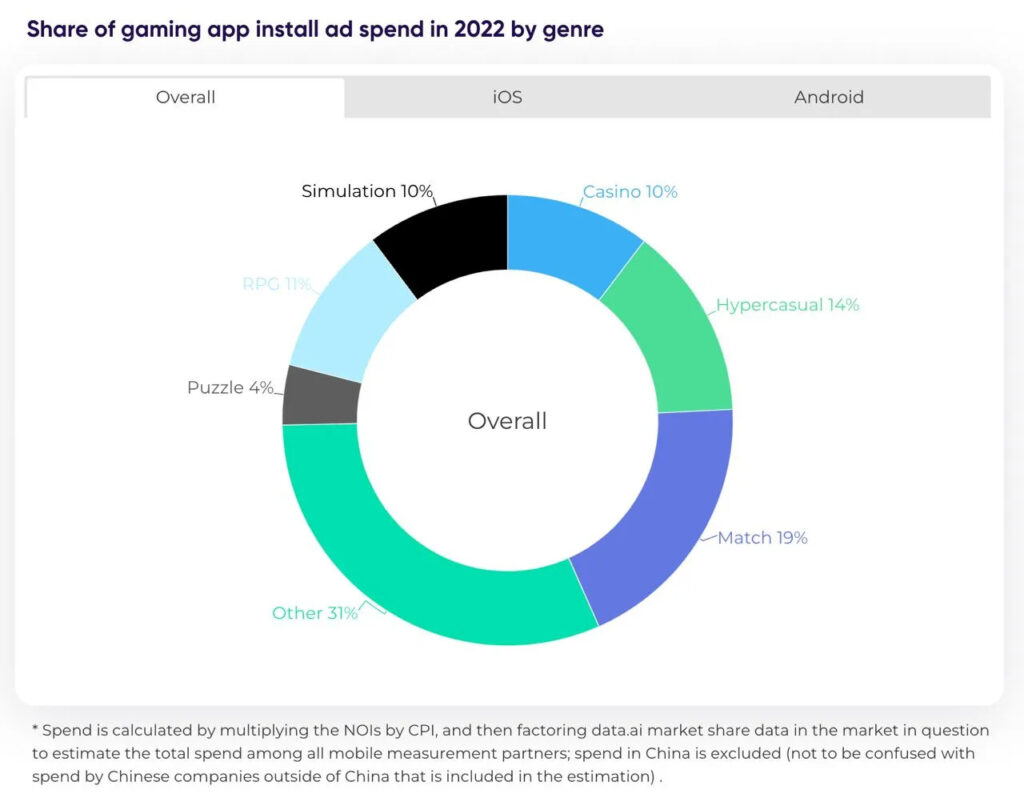

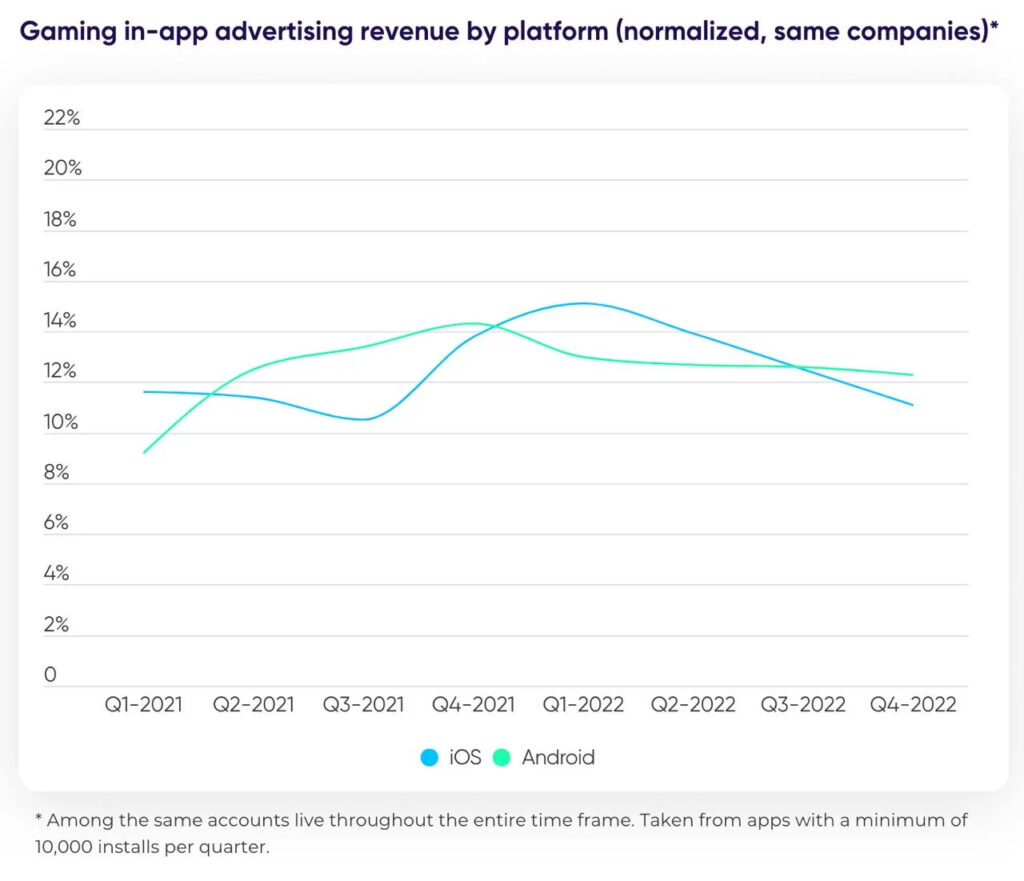

The data was collected from January 2021 to December 2022. 38B installs were counted; 18.6k thousand apps with not less than 10k quarter installs participated; $13.9B of spend was considered.

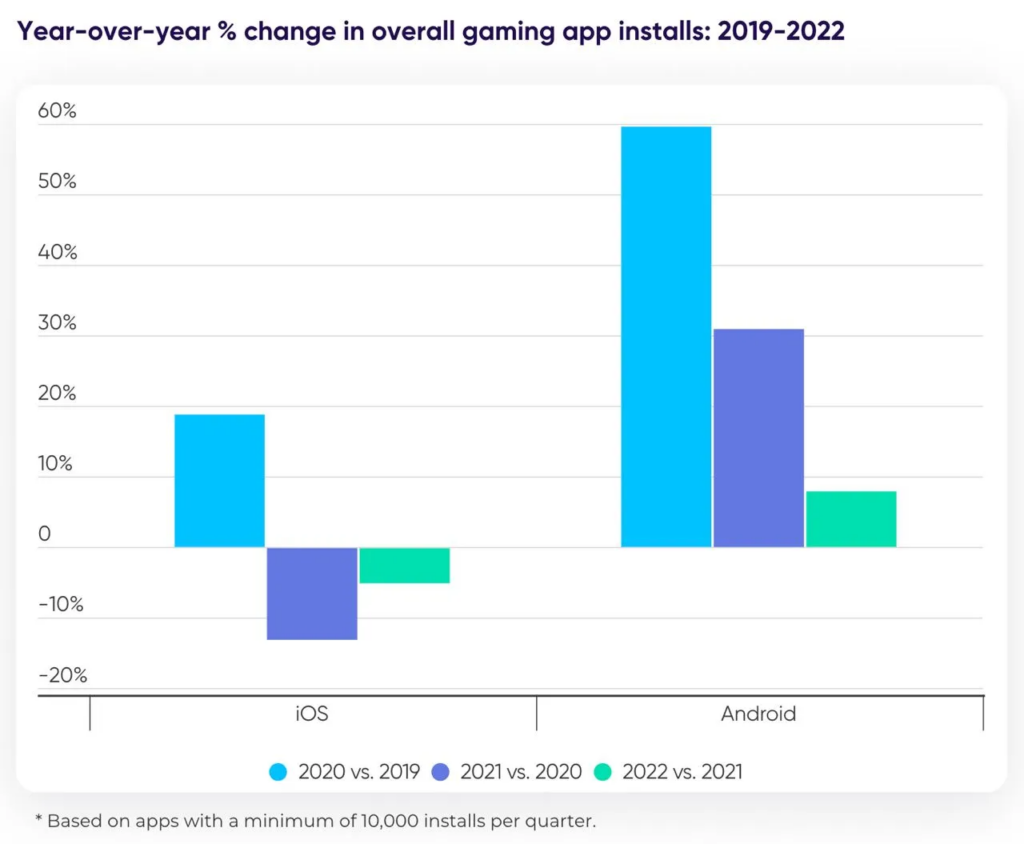

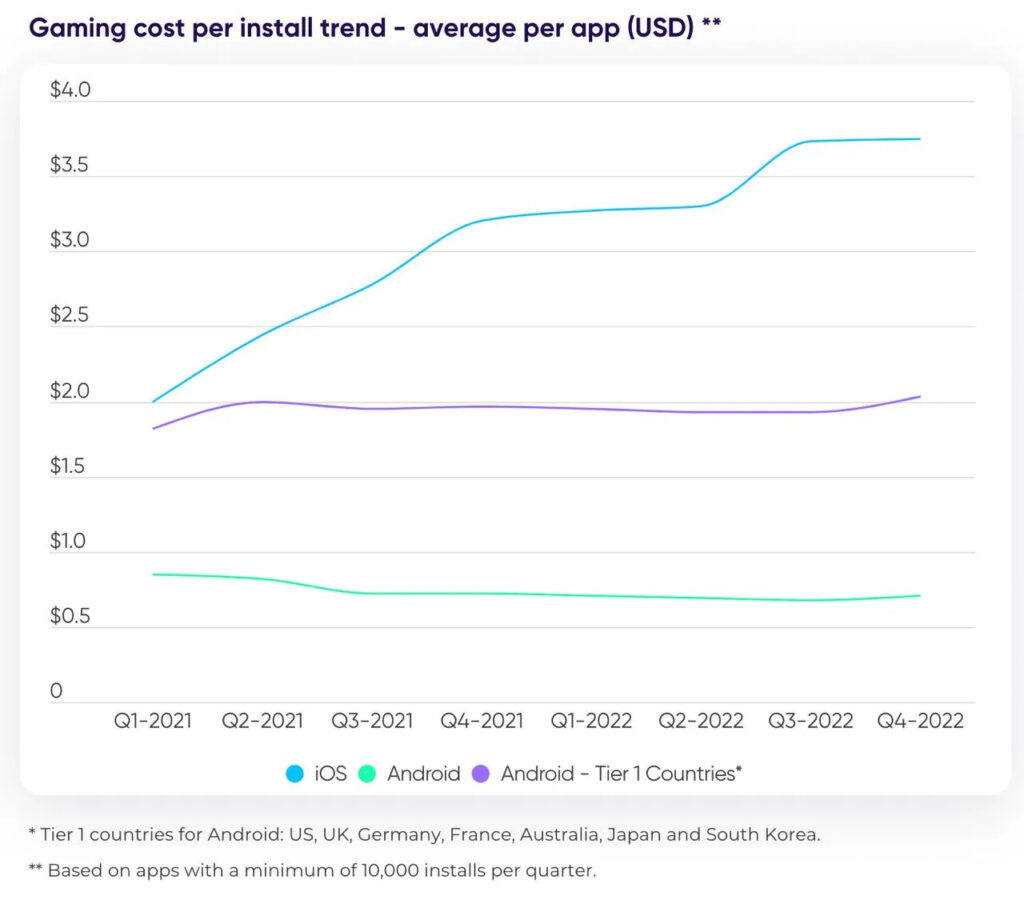

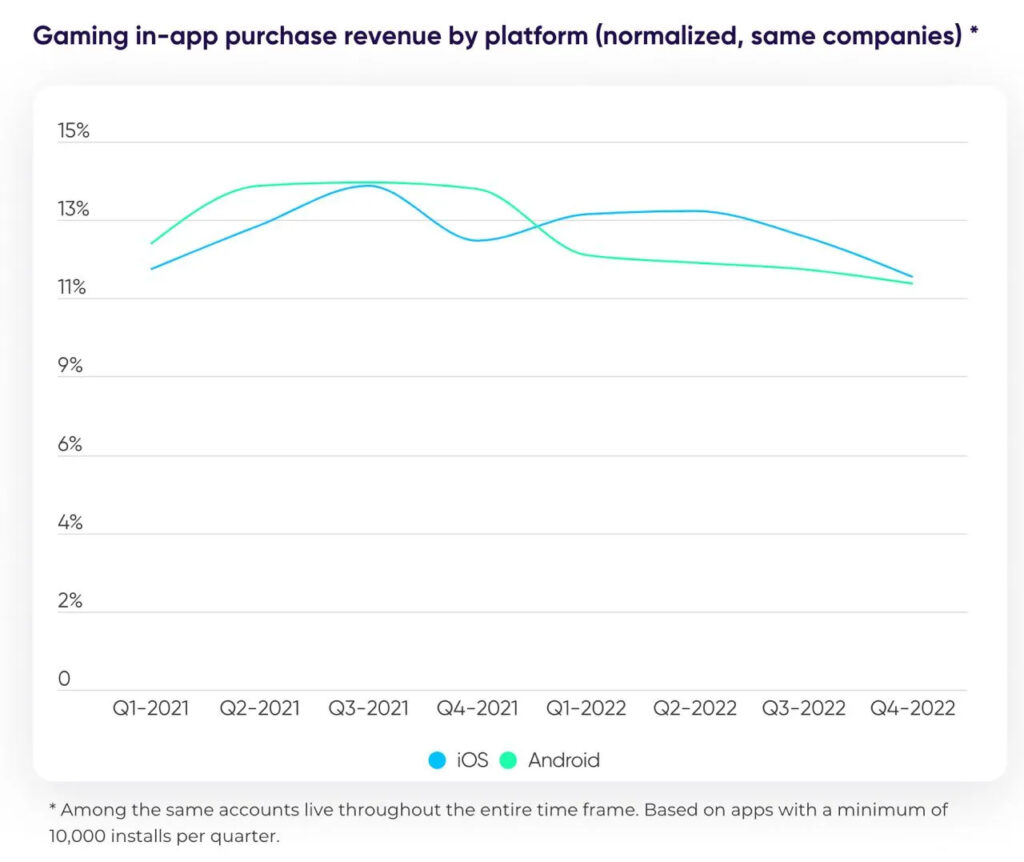

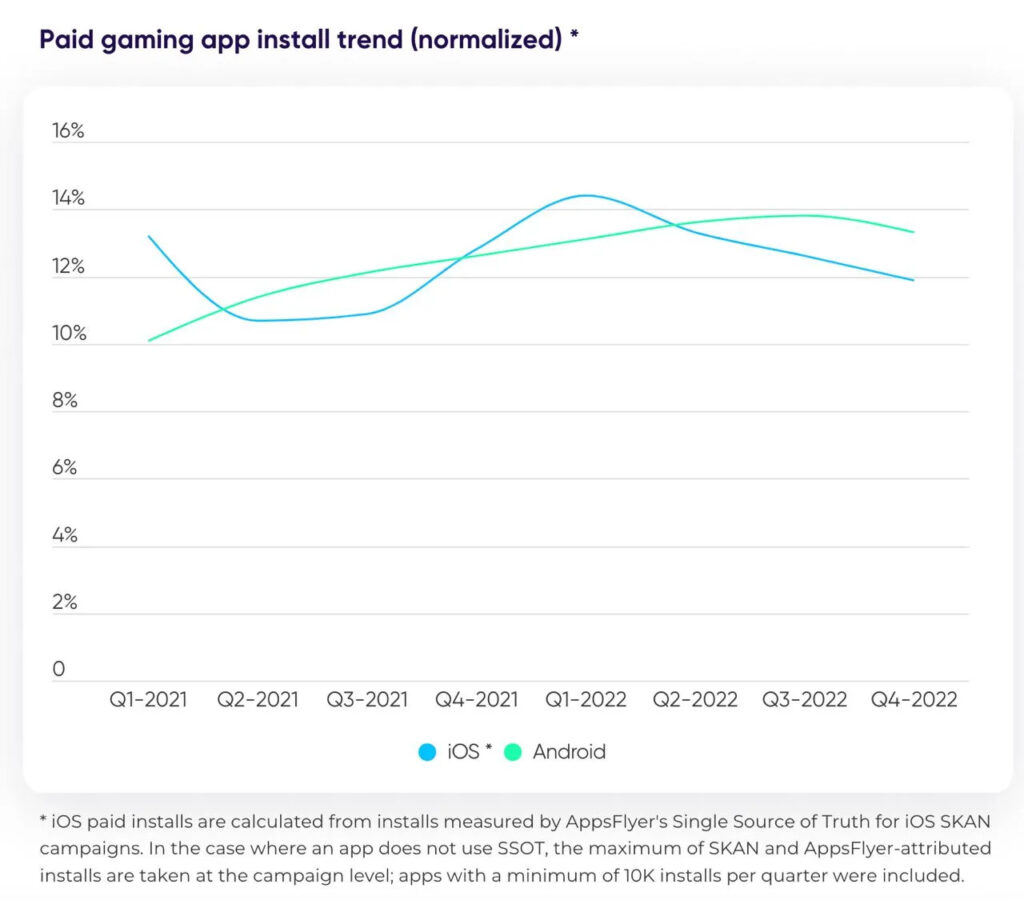

General numbers

-

$26.7B was spent on mobile gaming ads in 2022. The US market is the first with $12.2B of spend. Japan is second with about $2B spent.

-

Android downloads increased by 8% worldwide. iOS downloads dropped by 5%.

-

In the US Android downloads increased by 19%; iOS downloads decreased by 1%.

-

An average CPI on iOS increased by 88% when comparing Q1 2022 with Q4 2022 and reached $3.75.

-

IAP dropped by 7% in H2 2022 compared to H1 2022. iOS payments declined by 13% (-1% YoY); Android - by 6% (-14% YoY). The decline is caused by the revenue drop of RPG and casino games.

World trends

-

The speed of iOS downloads declining in 2022 slowed down, but the trend is still negative. Android downloads growth is slowing too.

-

The number of paid downloads on Android increased by 16% YoY. In spite of difficulties, iOS paid downloads increased by 10%. However, it’s important to note that iOS paid downloads have been declining throughout 2022.

-

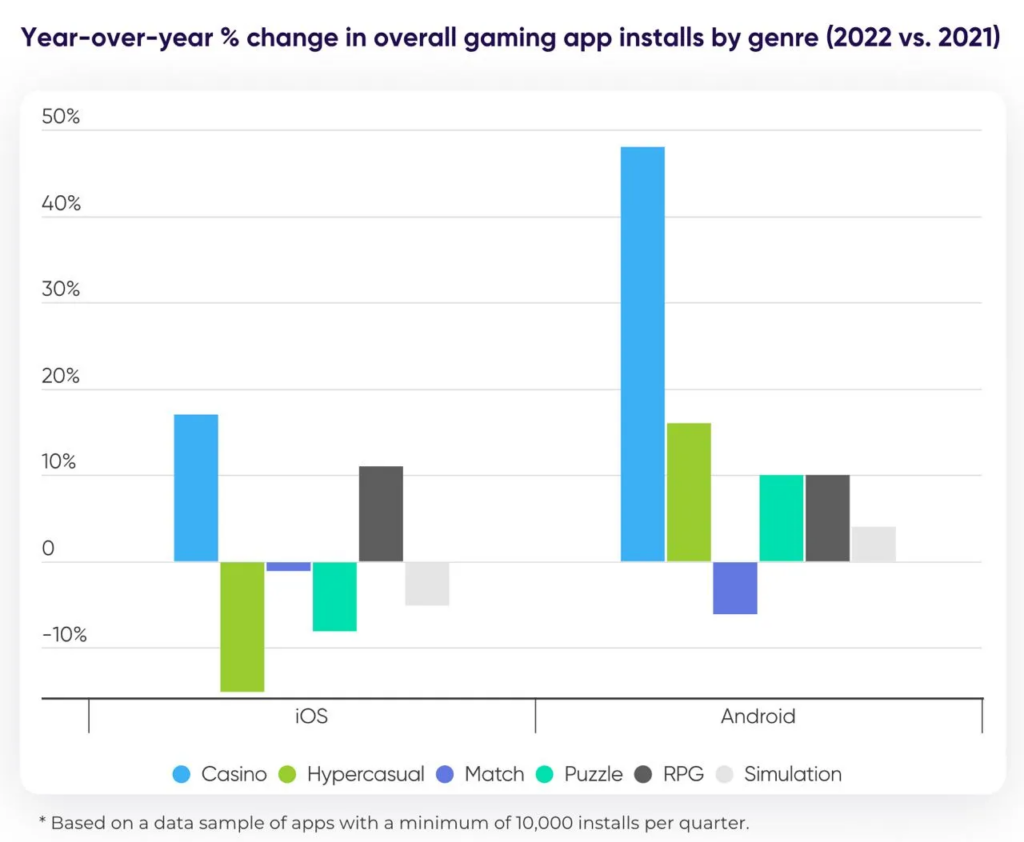

Casino (+17% YoY) and RPG (+11%) downloads grew on iOS in 2022. On Android casino games were 48% more popular - it’s the fastest-growing genre on the platform overcoming the hypercasual games 3x times. Users from India, Brazil, and Turkey drove such dramatic growth.

-

A lot of countries in Southeast Asia showed an overall growth in downloads. China (-30%), Russia (-30%), Mexico (-31%) - are the largest losers by downloads on iOS. Russian Android downloads also decreased by 27%.

-

Match games (19%), hypercasual games (14%), and RPGs (11%) are responsible for almost half of the ad budget worldwide.

-

Ad monetization has been decreasing throughout 2022.

-

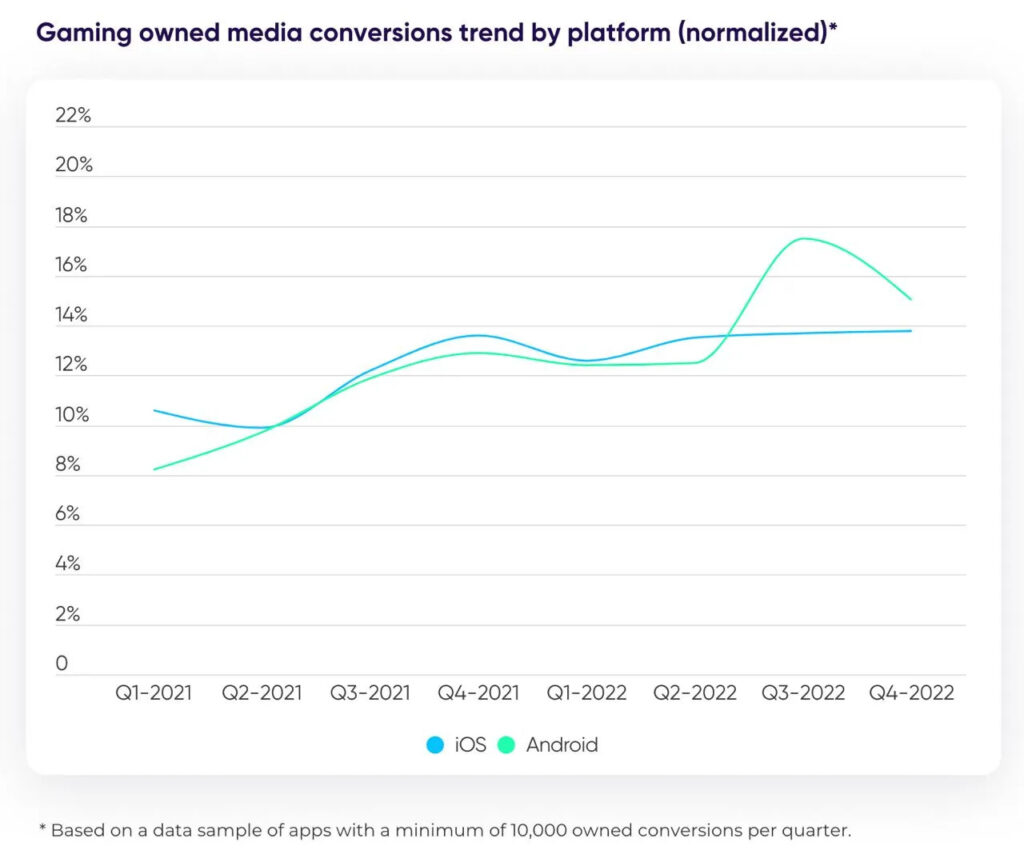

The impact of self-owned marketing instruments (push notifications; in-app messages; cross-promo) increased by 16% on iOS and 34% on Android.

Trends by genre

-

Hypercasual - CPI is decreasing; the number of downloads from India increased by 32% in 2022.

-

Match - CPI is growing on both iOS ($5.74 in Q4 2022) and Android ($1.45 in Q4 2022); China dropped by 41% in downloads on iOS.

-

Casino - CPI on iOS reached $11.45 in Q4 2022; ad revenues declined by 33% on iOS and 29% on Android; downloads in the US are growing.

-

RPG - downloads in the US grew by 90% YoY on iOS and 41% YoY on Android; despite such a growth - IAP and ad monetization declined; however ad spending on games of this genre is increasing.

-

Simulation - paid downloads on Android increased by 33%; IAP revenue is declining on both iOS and Android; in the US downloads dropped by 28% on Android but grew by 1% on iOS.

-

Puzzle - Android ad spending increased by 52% and iOS ad spending increased by 37%; CPI on iOS dropped to $3, on Android - contrary - it grew up to $3; CPI in India is less than $0.1.

General conclusions

-

Hybrid monetization is the key.

-

AppsFlyer is positive that the right usage of SKAN 4.0 will help to work more efficiently on the iOS market.

-

The US is being the main market, but AppsFlyer suggests paying attention to growing markets like Indonesia, India, or Vietnam.

-

Remarketing on Android is still working.

-

The right thing to do is to scale your own marketing channels.

-

Mobile games are turning more to community marketing. Players are reading Twitter, chatting in Discord, watching Twitch. And, of course, discussing their favorite games.

The full version of the report

Unity: Gaming industry in 2023

Trends

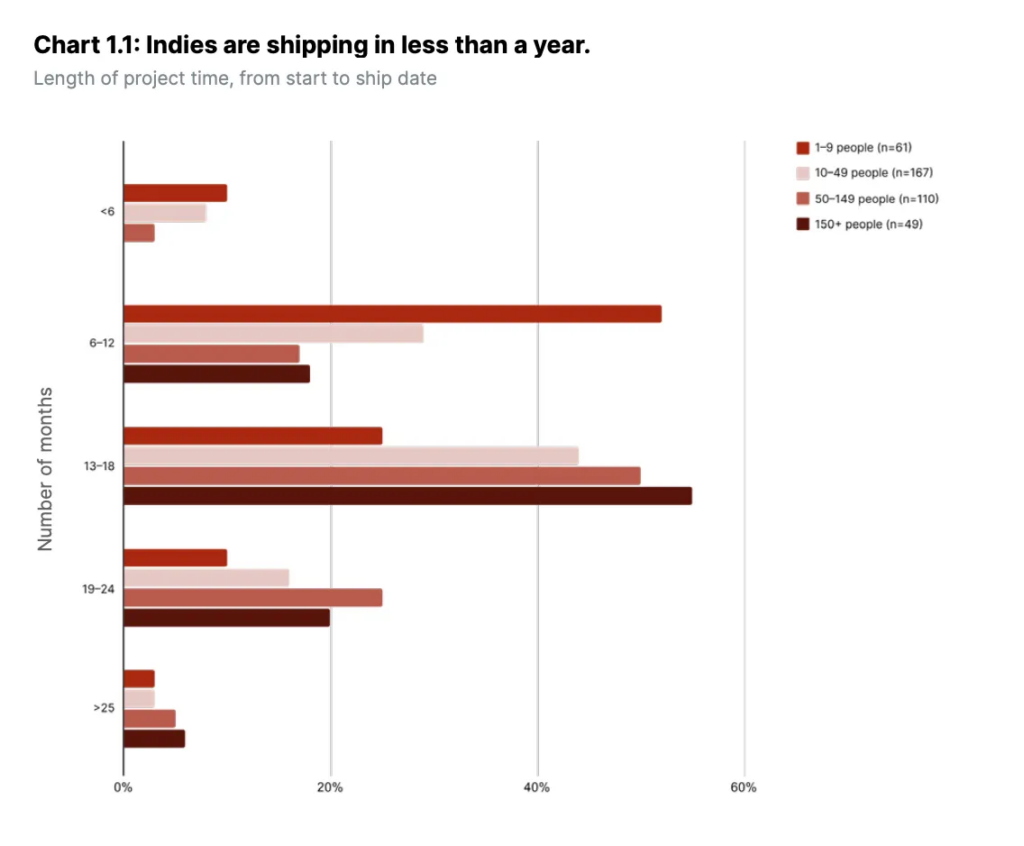

1. Indie developers started to release games faster. 62% of them are releasing a game in less than a year.

-

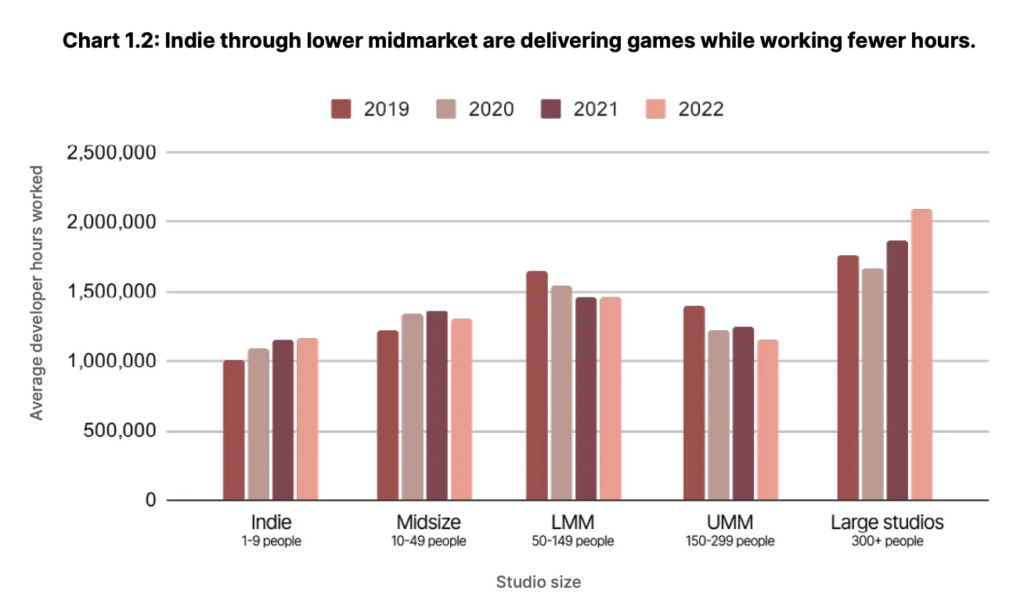

Developers in small (10-49 people) and mid-size (50-299) studios started to spend fewer hours on game development. On the contrary, indie developers and large companies’ hours spent on a game continued to increase.

2. Competition in the mobile market is increasing. The number of mobile games from large studios in 2022 increased by 44%.

-

The only category that started to do fewer mobile games is a studio with a headcount of 10 to 49 people.

-

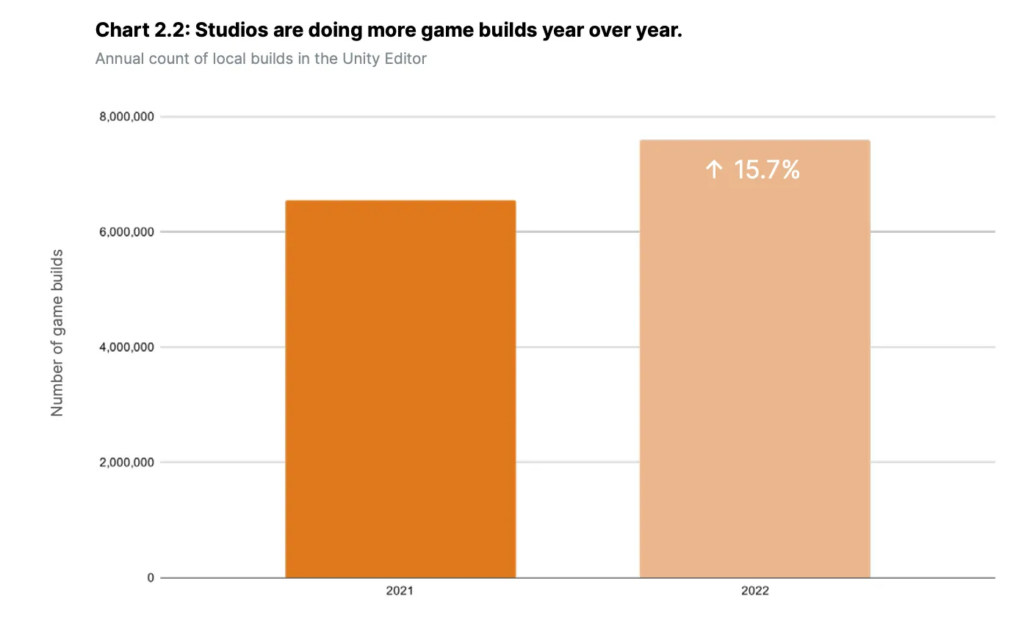

The number of new builds in 2022 increased by 15.7%.

-

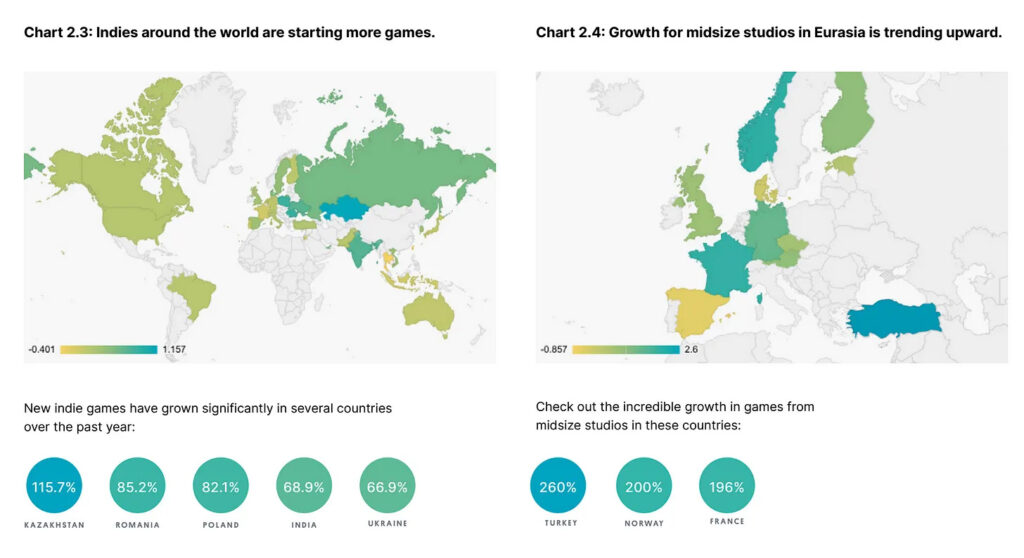

Kazakhstan experienced a surge in indie developers by 115.7%. Romania (+85.2%) and Poland (+82.1%) are among the leaders too.

-

The number of mid-sized studios in Turkey increased by 260%; in Norway by 200%; in France by 196%.

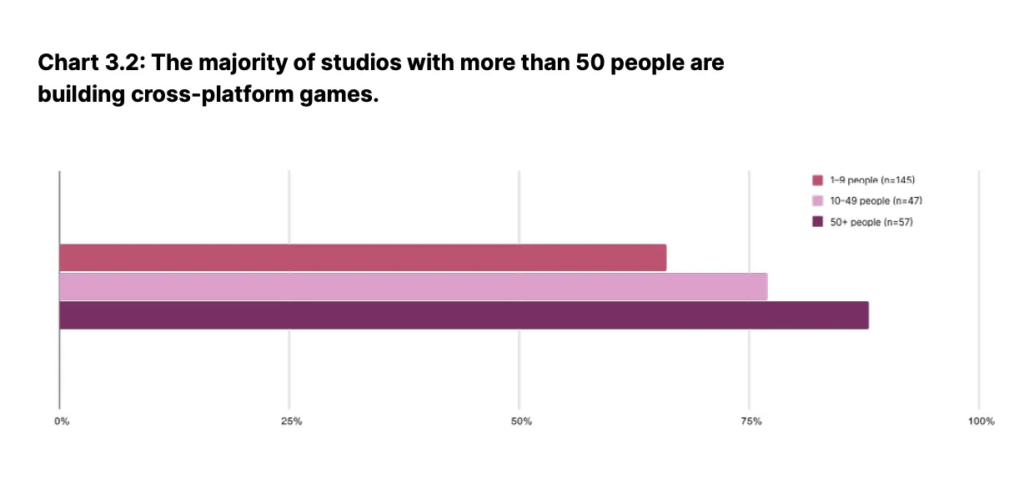

3. Large studios increased the development of multi-platform games. In 2022 the number of cross-platform increased by 16%.

-

85% of studios with a headcount of more than 50 people are working on a cross-platform title.

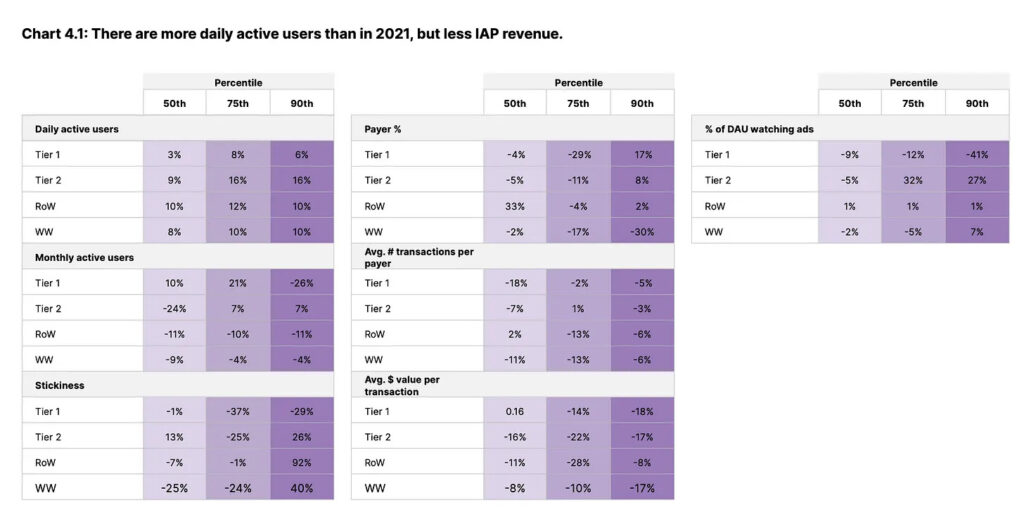

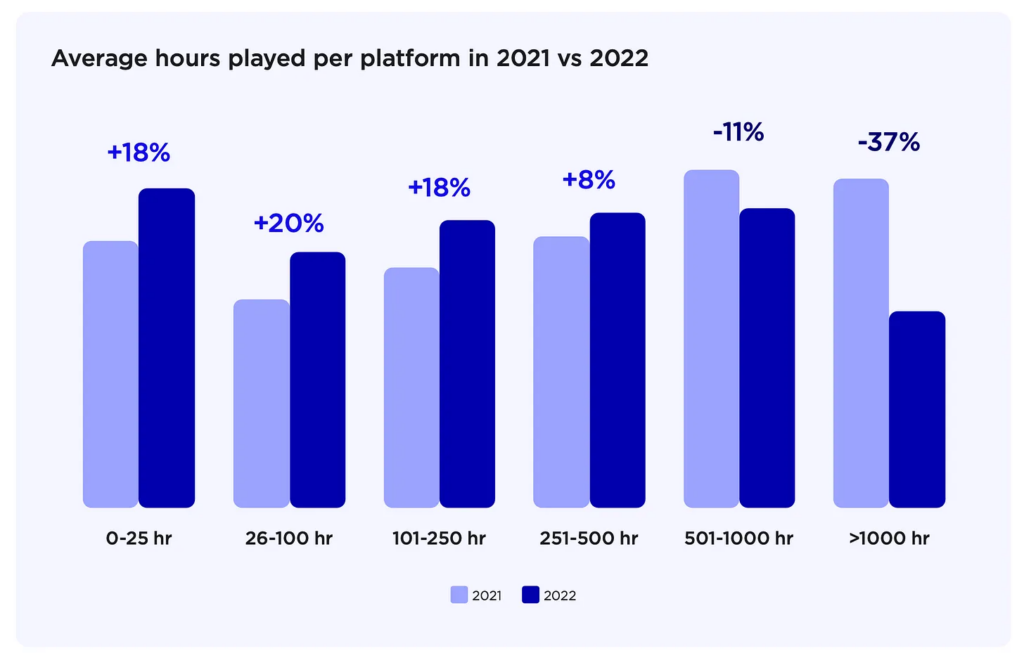

4. Users are playing mobile games more than in 2021. The world DAU in games on average increased by 8%.

-

However, people started to pay less. The number of payers declined by 2%. More people began to prefer ads to IAP.

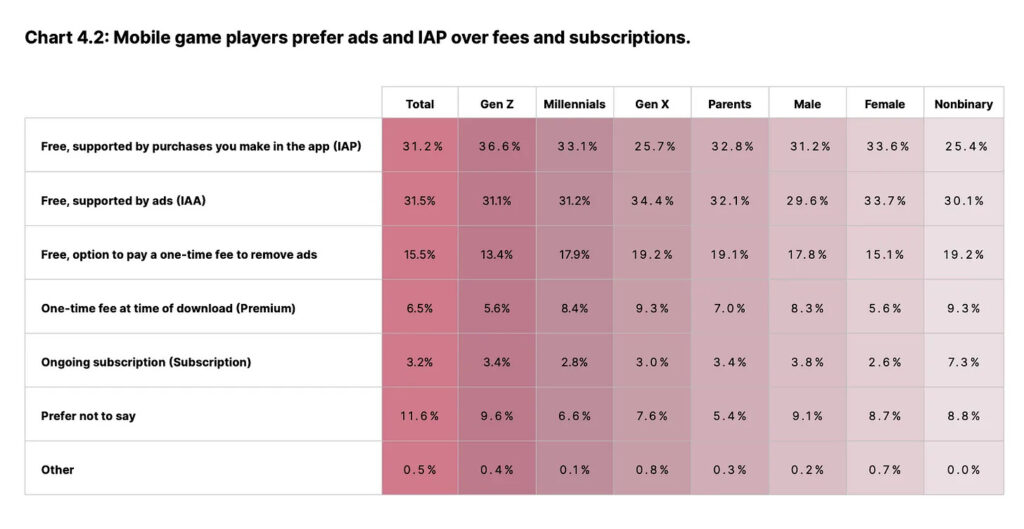

-

The majority of mobile users do prefer IAP and ad monetization. Subscriptions are much less favored.

-

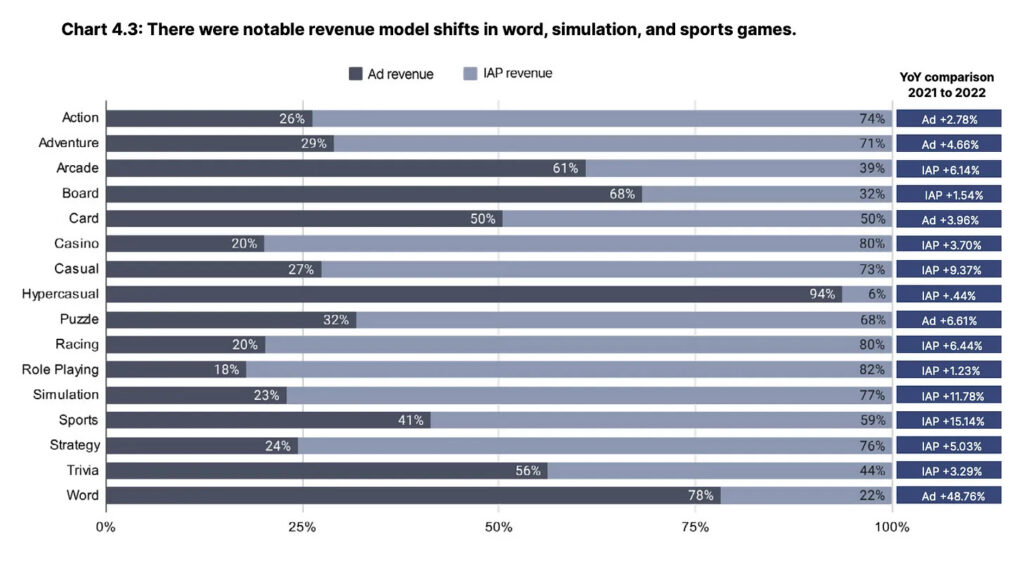

Unity shared the benchmark of IAP/Ad Revenue distribution by genres. Interesting that Word games in 2022 have experienced an increase of ad monetization share by 48.7%; IAP share in sports games increased by 15.14%.

-

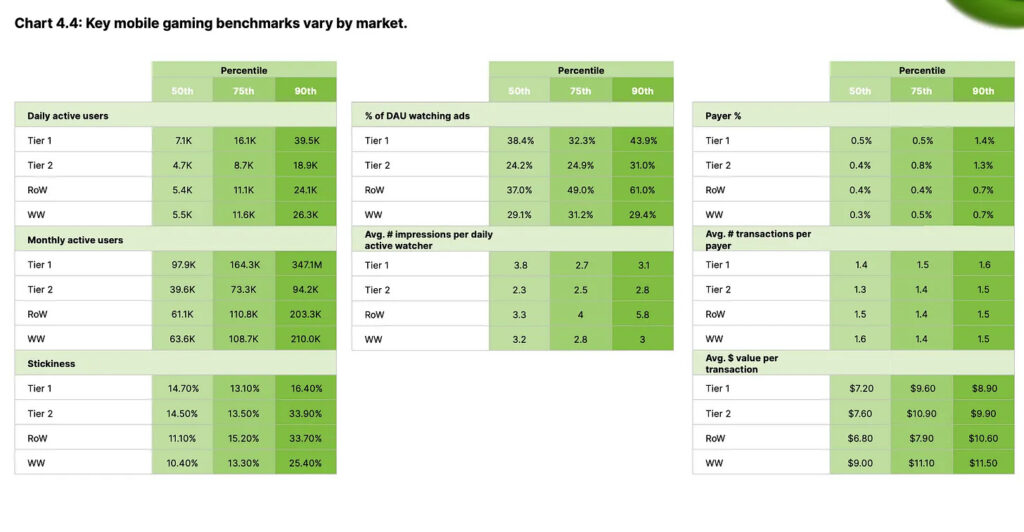

In the current market, only 0.5% of DAU (or less) are making purchases in a day.

-

Games that are in the 90 percentile by revenue (games earning more than 90% of games on the market) are showing the following Retention metrics in Tier-1 countries: D1 Retention - 35.4%; D7 Retention - 14.3%; D30 Retention - 6.1%.

-

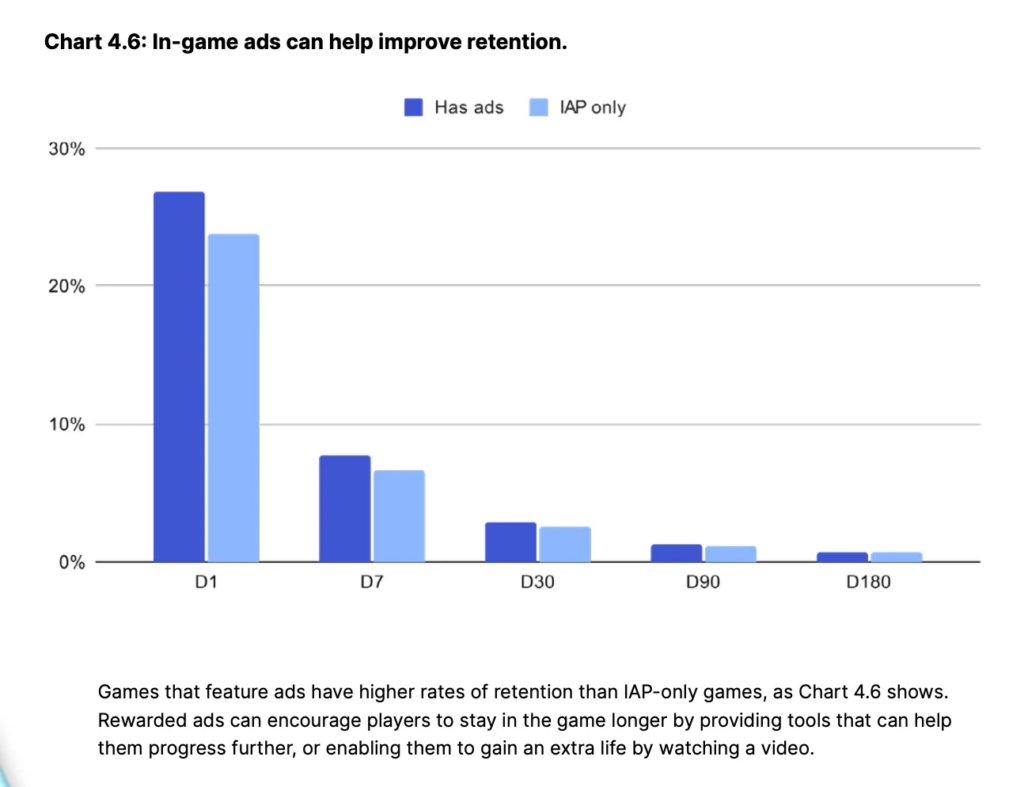

Unity found a correlation between ads (mostly Rewarded Ads) and Retention. It’s higher in games with ads.

-

70% of developers are creating monetization mechanics based on the first 30 days of development.

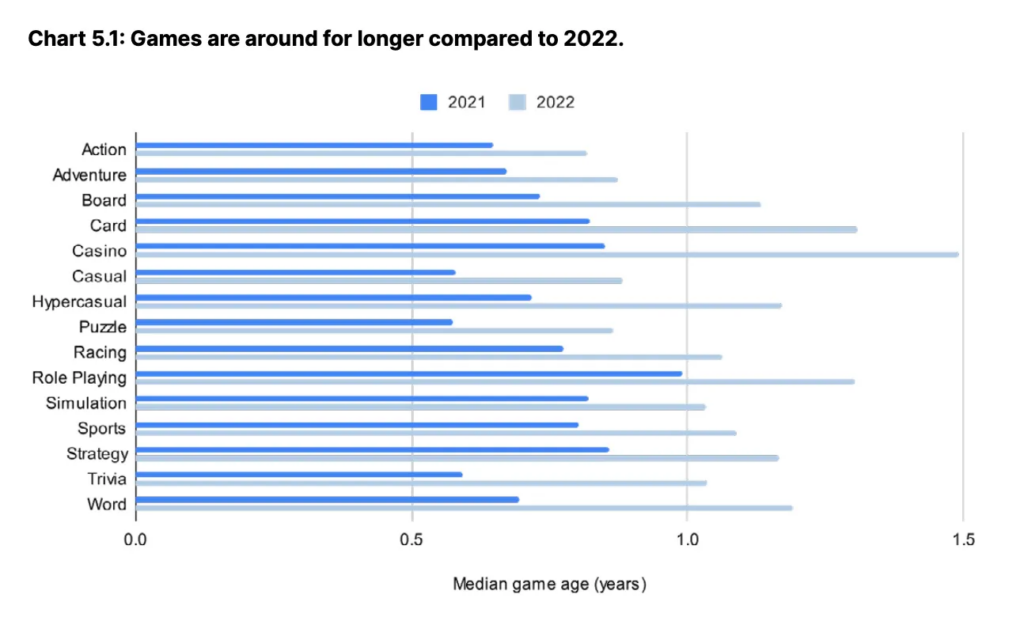

5. Companies started to work more on retention. In 2022 the lifecycle of mobile games increased by 33%.

-

49% of mid-size studios perceive Retention as the main trouble.

-

Battle Pass is the most popular monetization mechanic of 2022. Its usage increased by 27%. Gacha became less popular overall.

Unity: Gaming industry in 2023 Download

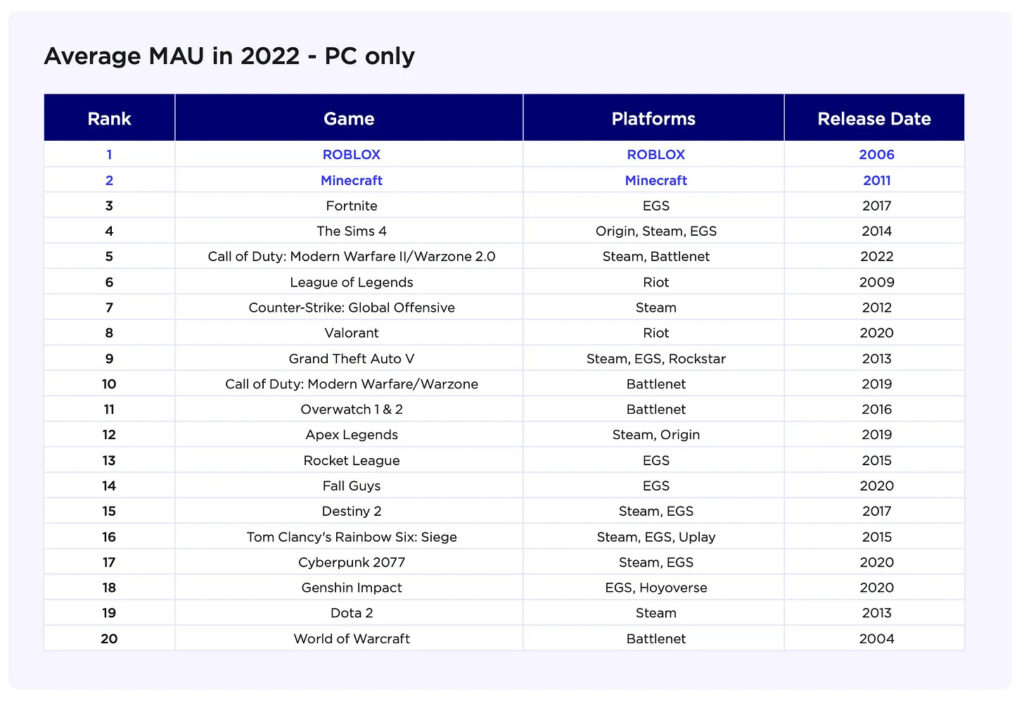

Newzoo: PC & Console Markets in 2023

Main trends

-

The PC & Console market is changing, but its results are higher than Newzoo forecasted before.

-

More AA and AAA games will transform to live-service experiences. This means there will be fewer new games and their lifecycle will be longer.

-

The supply of semiconductors is back, so PlayStation 5 and Xbox Series S|X will actively increase their market share.

-

The in-game advertising will come to PC & Consoles. But it will be designed in a less destructive way than on Mobile.

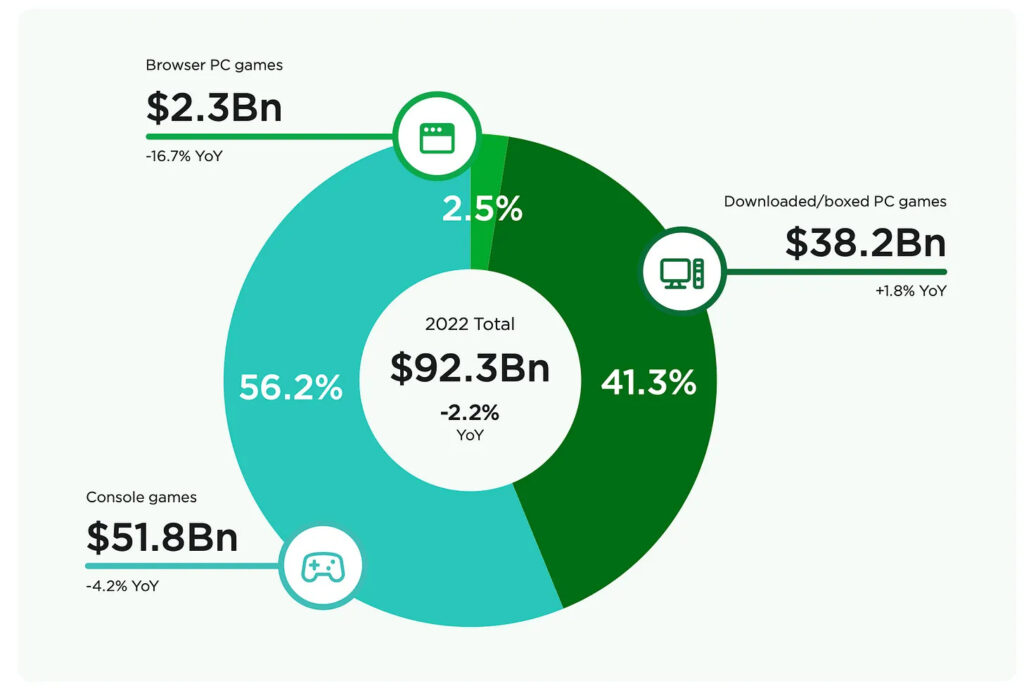

Money

-

$92.3B is the overall revenue of the PC & Consoles market in 2022. The decline is 2.2% compared to the previous year.

-

$51.8B is the size of the Console market (-4.2% YoY); $38.2B is the size of the PC market (+1.8% YoY); browser games got $2.3B in 2022 (-16.7% YoY).

-

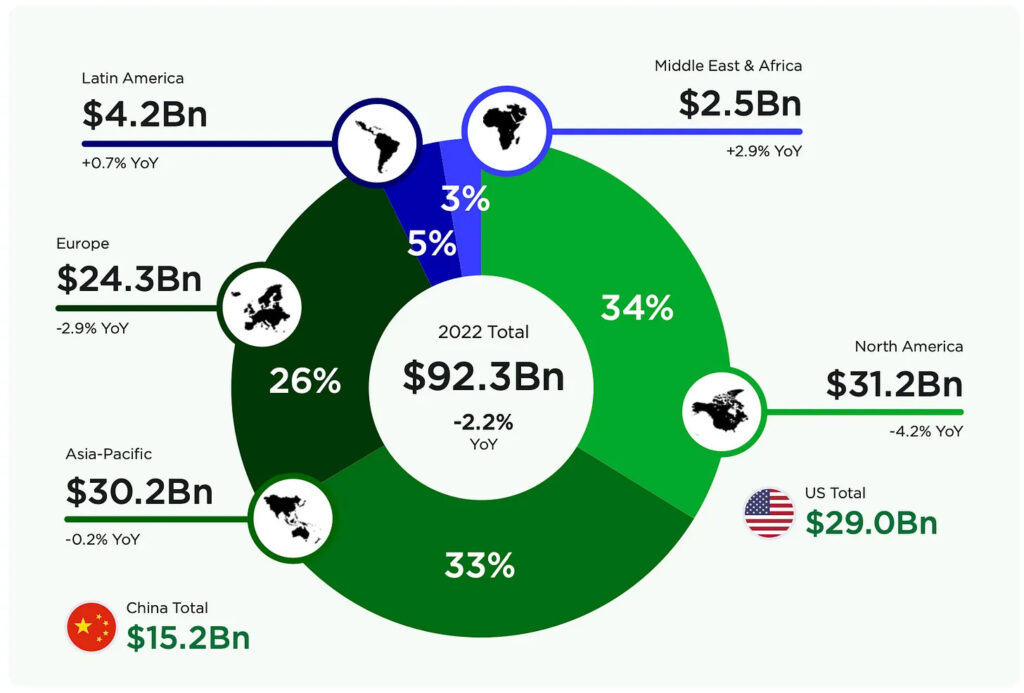

The North American market is the main one for PC and Consoles, its size is $31.2B (-4.2% YoY). The leader of the region (and not only) is the US with a $29B market size.

-

APAC region PC/Console revenue in 2022 was $30.2B (-0.2% YoY). The region behemoth is China with $15.2B.

-

The size of the European PC/Console market is $24.3B (-2.9% YoY); LATAM generated $4.2B (+0.7% YoY); MENA - $2.5B (+2.9% YoY).

-

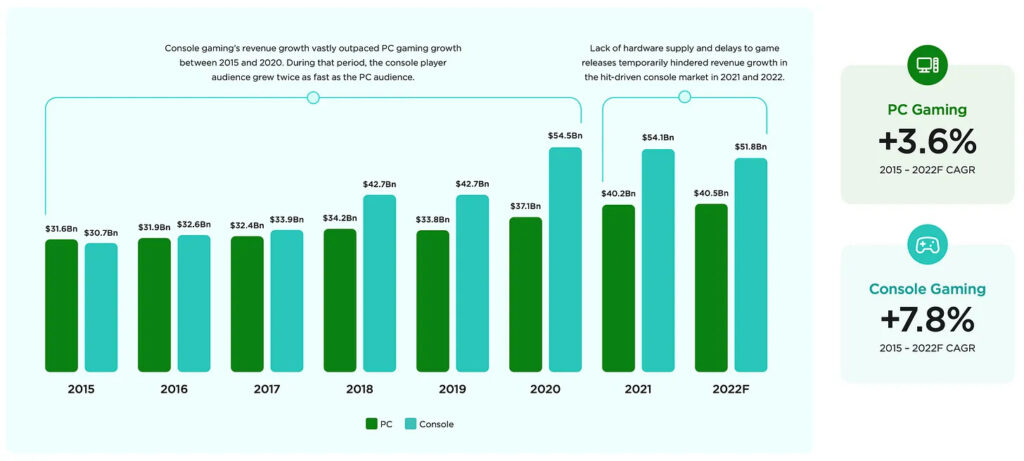

The CAGR of the PC/Console market from 2015 to 2022 was 5.8%. The PC market grew by 3.6% yearly and the console had a growth rate of 7.8% annually.

Consumer habits

-

1.1B users are playing on PC; 611M are playing on consoles.

-

Players spent 20% fewer hours on PC & Console gaming in 2022.

-

Only 1 game released in 2022 on PC was at the overall top by MAU 2022 - Call of Duty: Modern Warfare II (Warzone 2.0). There are no releases from 2021 as well.

-

Shooters, Adventures, and Battle Royale are the most popular genres on PC & Consoles.

-

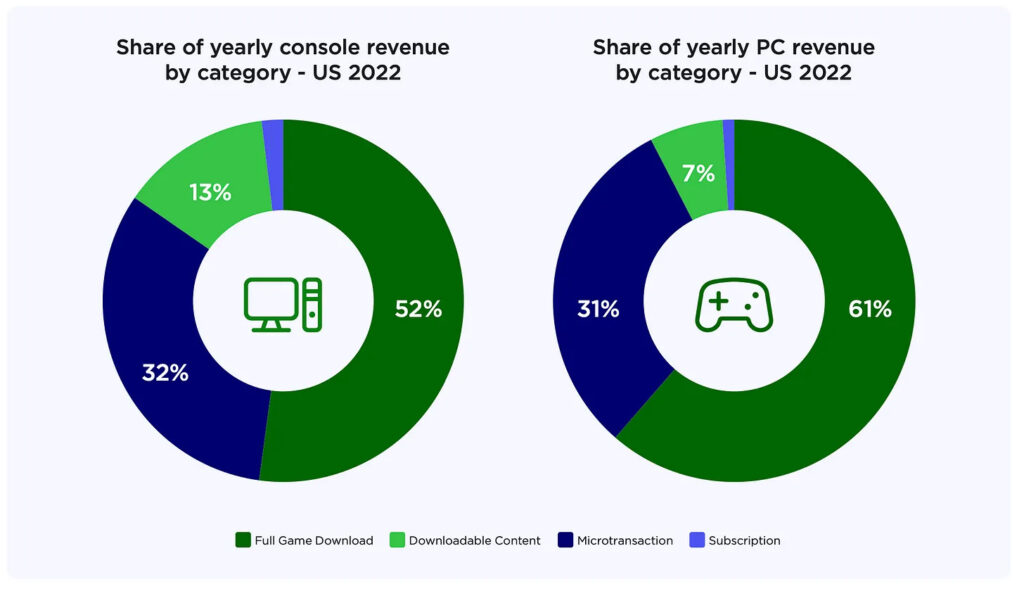

Console players are more likely to make in-app purchases. They’re buying content, doing micropurchases, and using subscriptions. On Consoles 48% of overall revenue are generated through such kind of payments; PC has 39% of revenue on this.

-

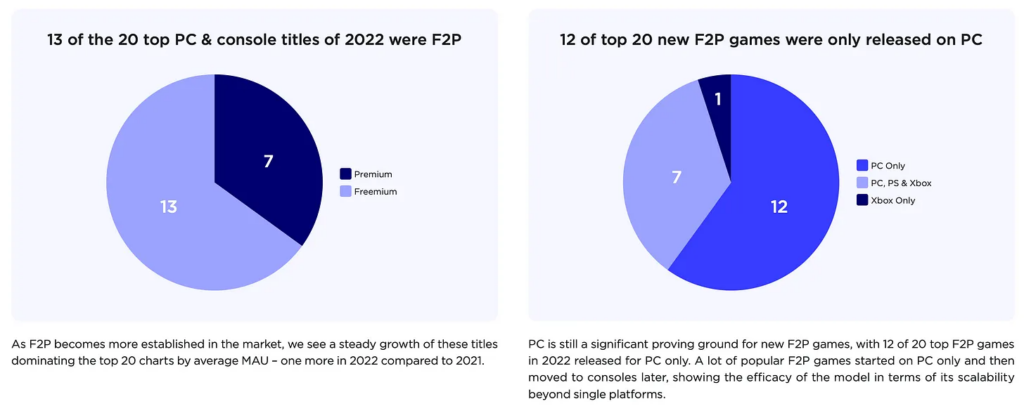

13 out of 20 top games of 2022 on consoles were F2P. On PC there were 12 games out of 20 using the free-to-play model.

-

Three large games in 2022 switched the Premium model to the F2P - Overwatch 2, Fall Guys, and The Sims 4.

-

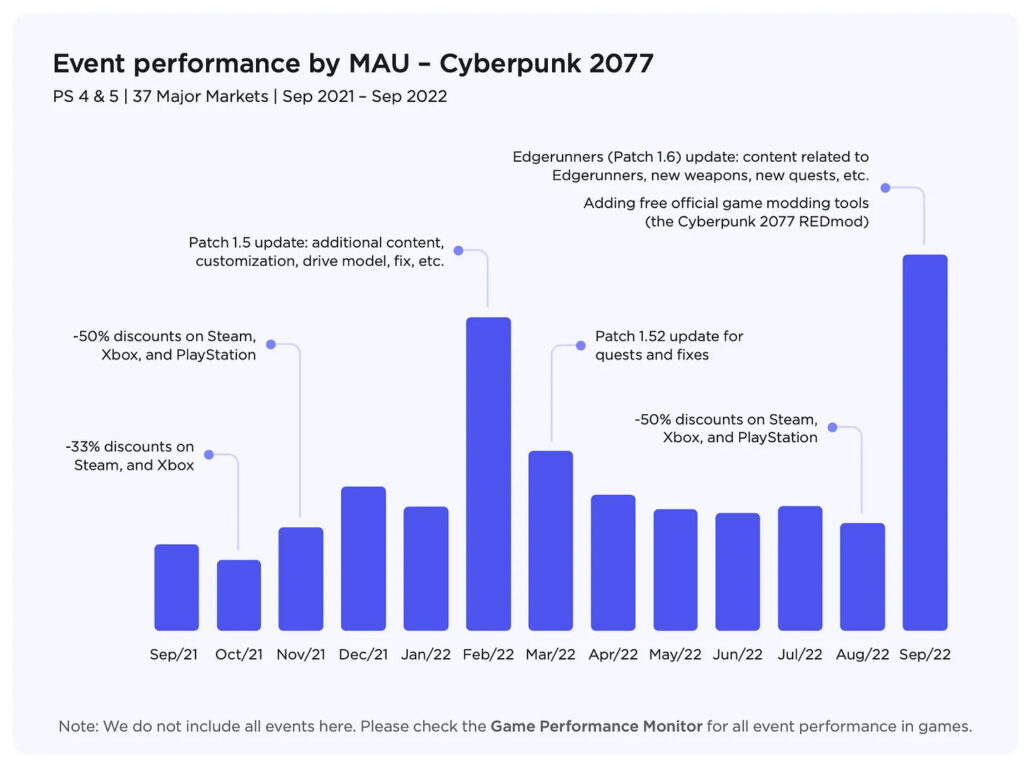

Transmedia marketing strategy works. Cyberpunk’s 2077 MAU increased by 249% after Cyberpunk: Edgerunners release.

-

There is a direct correlation between games’ popularity on streaming platforms and DAU. But it’s working for the AAA releases only.

-

66% of the audience on PC & Console are spending money on games.

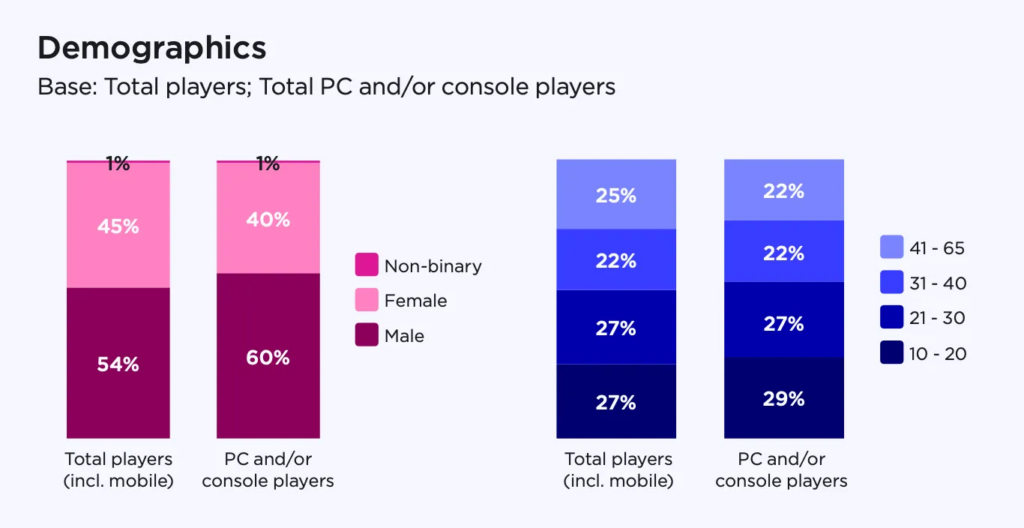

Audience

-

40% of the PC/Console audience are identifying themselves as women.

-

66% of all gamers have been playing on PC or consoles in the last half a year.

-

40% of PC/Console gamers think of themselves as hardcore gamers.

-

75% of PC/Console gamers are not only playing games but watching streams, discussing new releases, etc.

-

7 out of 10 gamers on PC and Consoles have been playing on other devices in the last half a year.

-

66% of gamers are still not very aware of Cloud Gaming.

2023 Forecasts

-

The Console market will grow by 9%; the PC - by 1%.

-

Postponed releases from 2022 will be launched in 2023, which will stimulate the consumer’s spending.

Newzoo: PC & Console Markets in 2023 Download

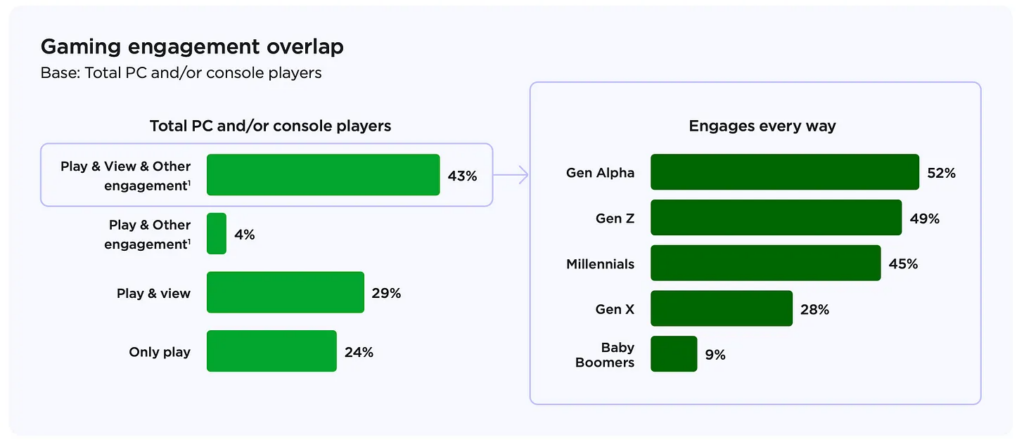

Epic Games Store: 2022 Results

-

The overall number of users reached 230M (there were 194M in 2021).

-

626 new games have been released in 2022 - now 1,548 games are available in Epic Games Store.

-

MAU in December 2022 reached 68M users.

-

Gamers spent $820M on games in Epic Games Store in 2022. It’s a 2% decline compared to the previous year.

-

Third-party games sales on the platform reached $355M. That’s an increase of 18% to 2021.

-

700M free games have been taken in 2022. 99 games with a cumulative price of $2,240 have been given away in 2022. Their average rating was 75 out of 100.

-

Genshin Impact, Rocket League, Tiny Tina Wonderlands, GTA V, and Fortnite are the 2022 leaders by revenue and user engagement.

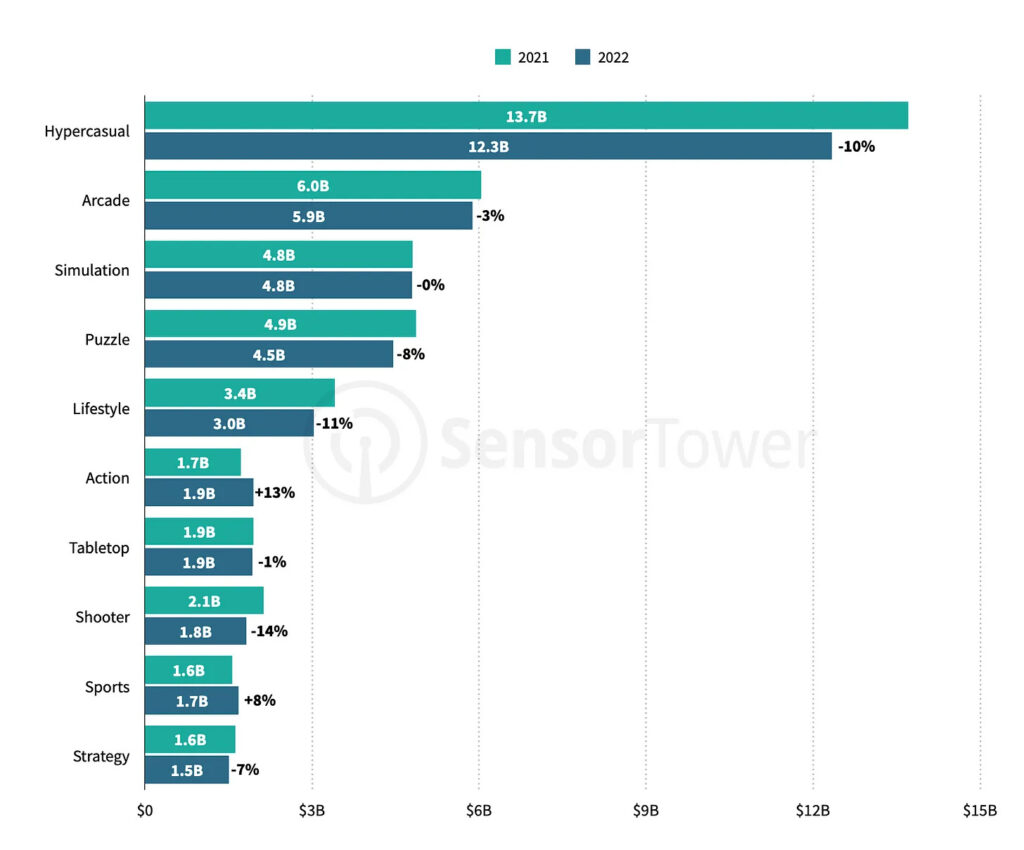

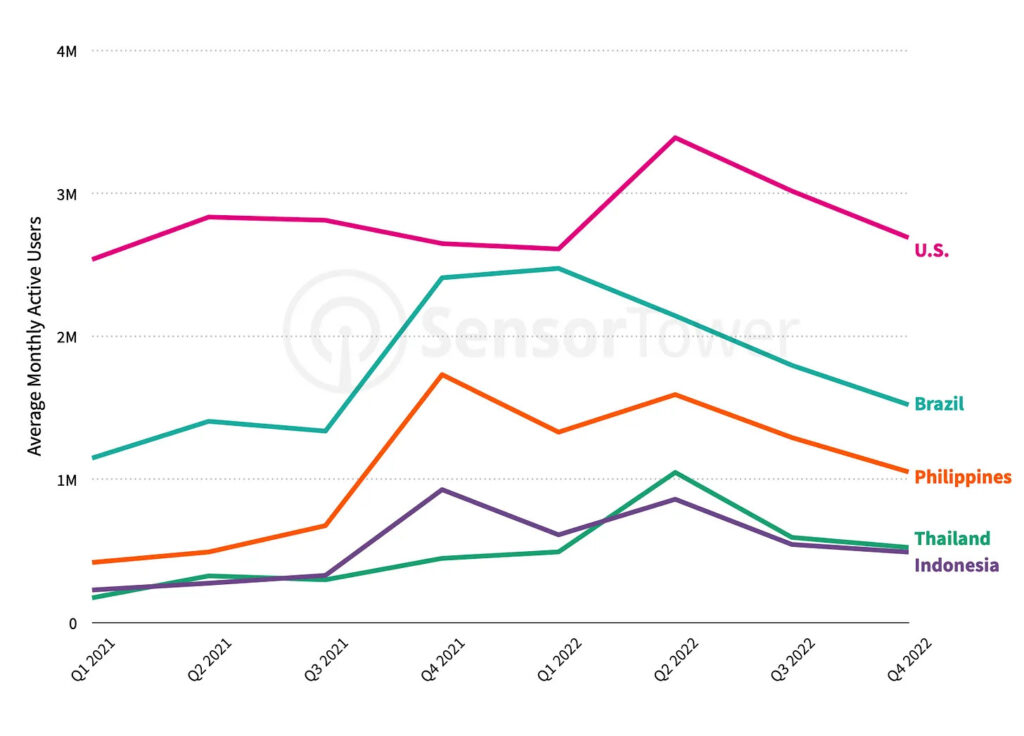

Sensor Tower: Mobile Gaming Market in 2023

Trends

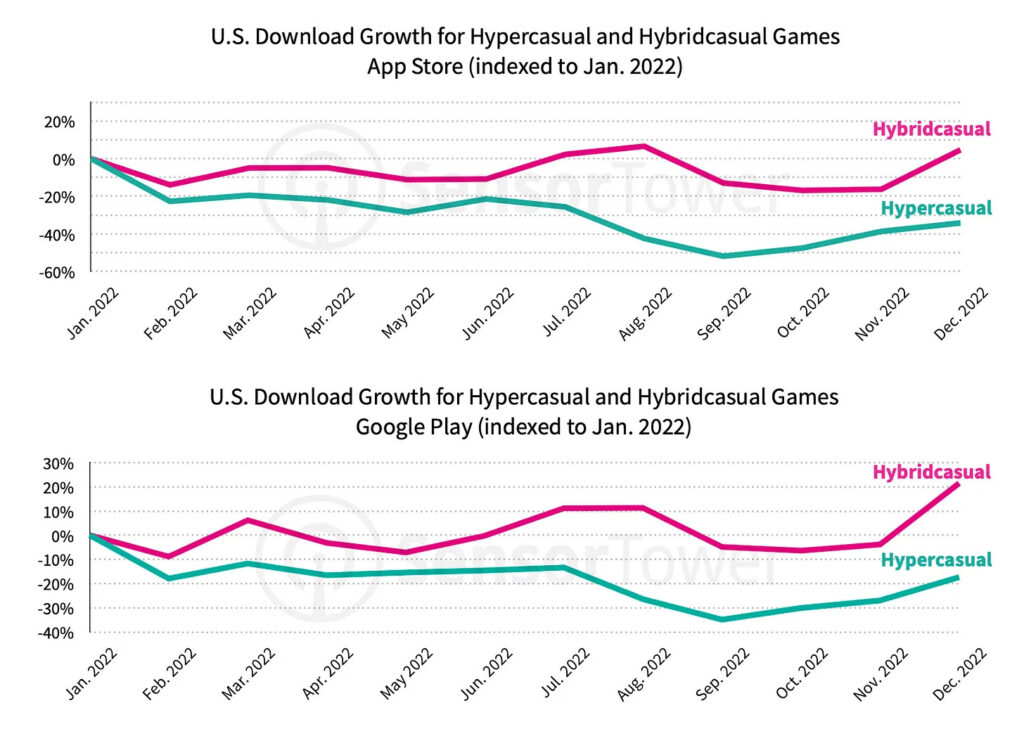

1. The majority of game genres in 2022 fell by downloads. Hypercasual games downloads decreased by 24%. On the contrary, hybrid-casual titles grew by 13% - Sensor Tower forecasts that this genre will replace the traditional hypercasual experience.

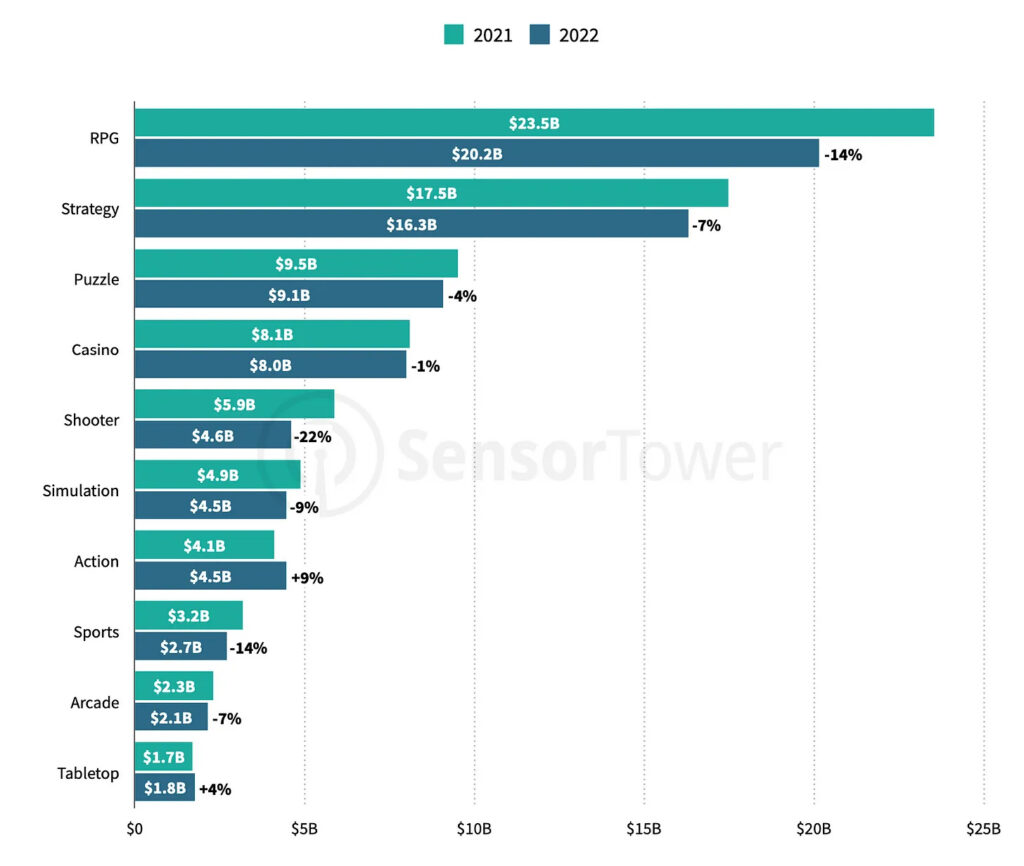

2. All genres’ revenue (despite exclusions like tabletop games or action genres) dropped. Shooters experienced a severe fall of 25%, and RPGs are next with a 20% decline. RPG titles are on a downfall trend for 7 consecutive quarters.

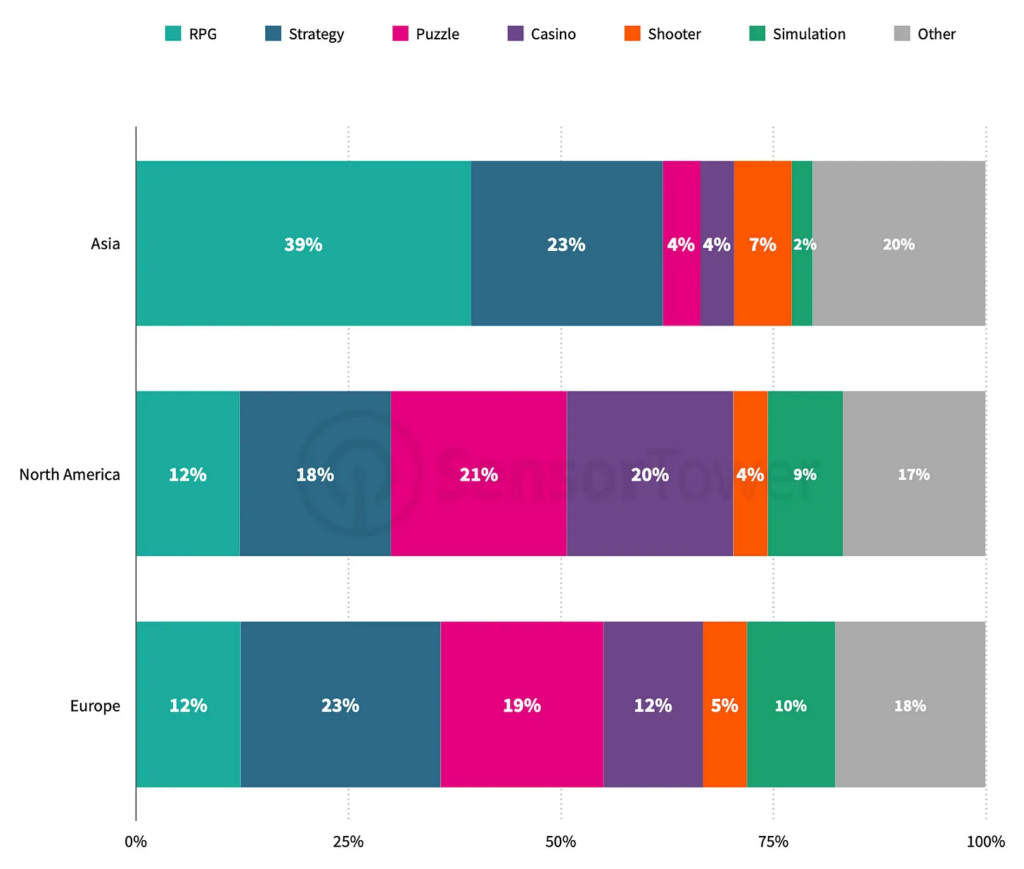

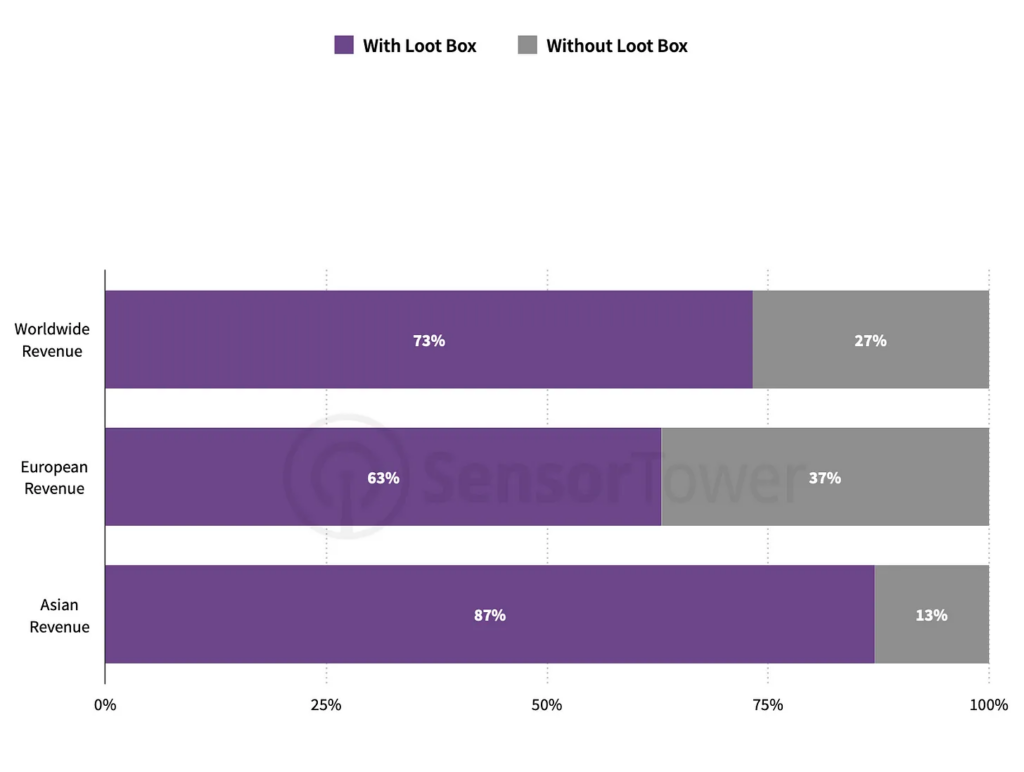

3. Asia is the main market for RPG titles. 39% of all revenue is coming from this region.

Hybrid casual market in 2022

-

$1.4B is the overall hybrid casual revenue in 2022. The subgenre is growing for the 4th year in a row.

- Downloads in 2022 reached 5.1B which is also a growth from the previous year.

-

99 new hybrid casual games have been released in 2022.

-

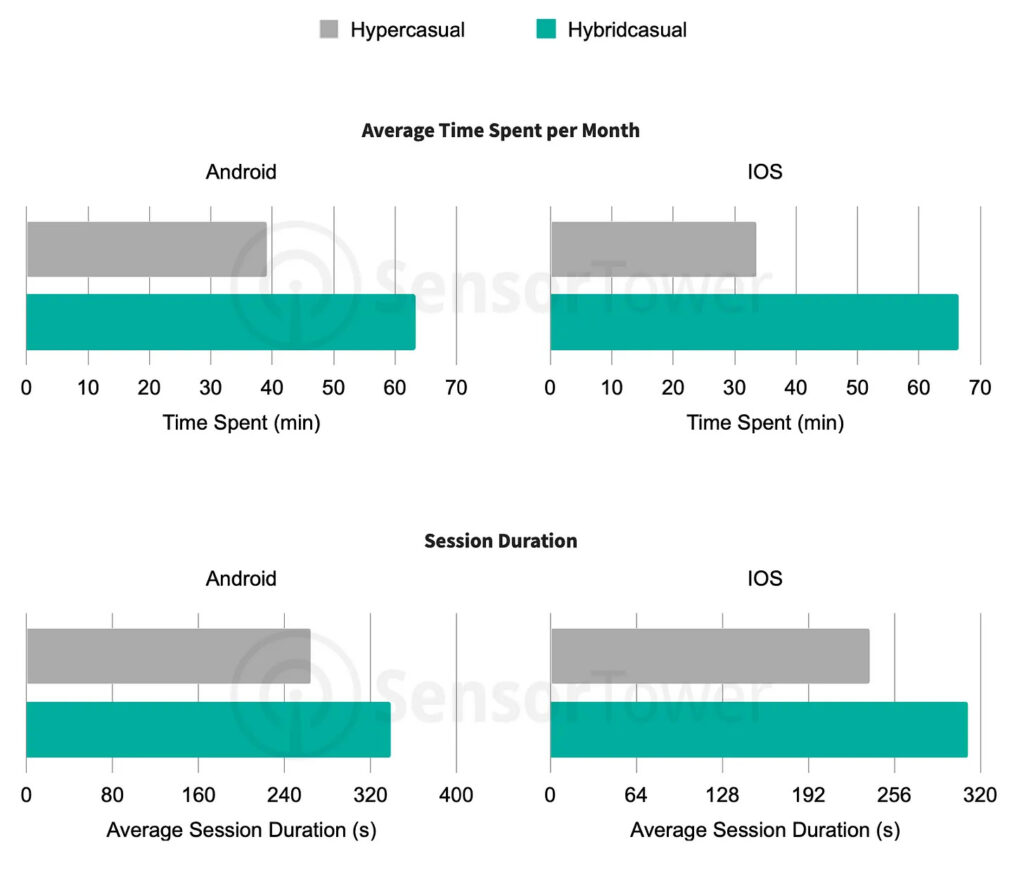

Hybrid casual games do have longer game sessions (especially on iOS) and average monthly playtime compared to classic hypercasual titles.

-

Oceania (+18% YoY), North America (+17% YoY), and Africa (+9% YoY) are leaders in downloads growth for hybrid casual games.

NFT and Web-3 games

-

Mobile Web-3 games are declining in downloads from Q3 2022. In H1 2022 downloads of such games reached 46M, in H2 2022 downloads dropped to 29M.

-

The situation with MAU is similar, the only difference is that the decline started in Q2 2022.

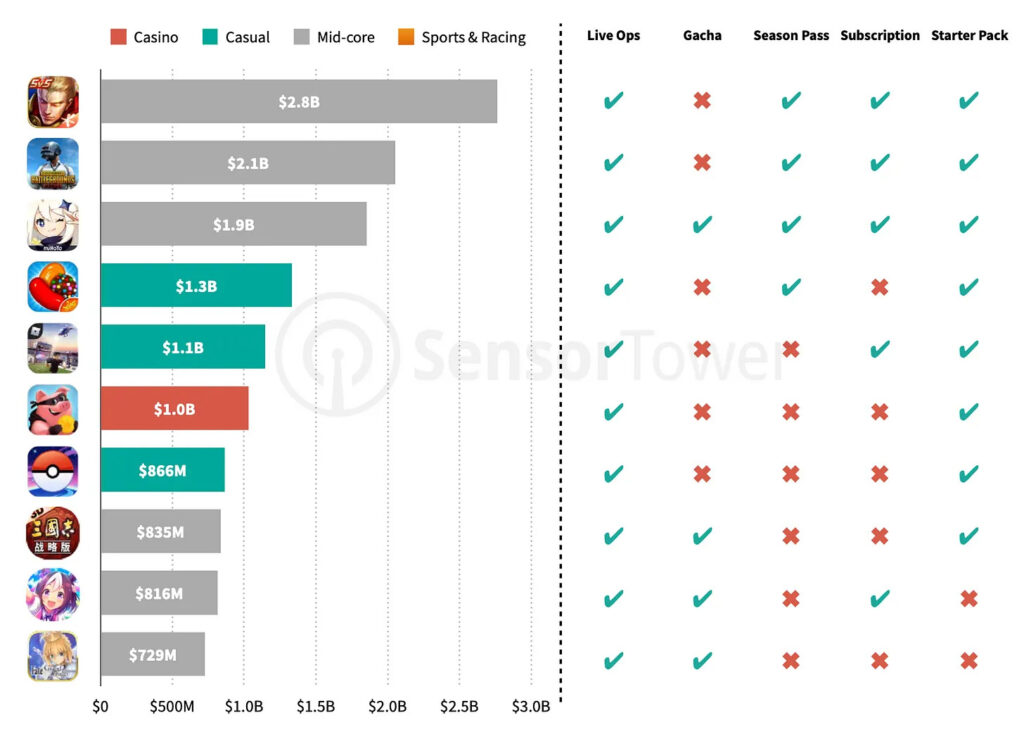

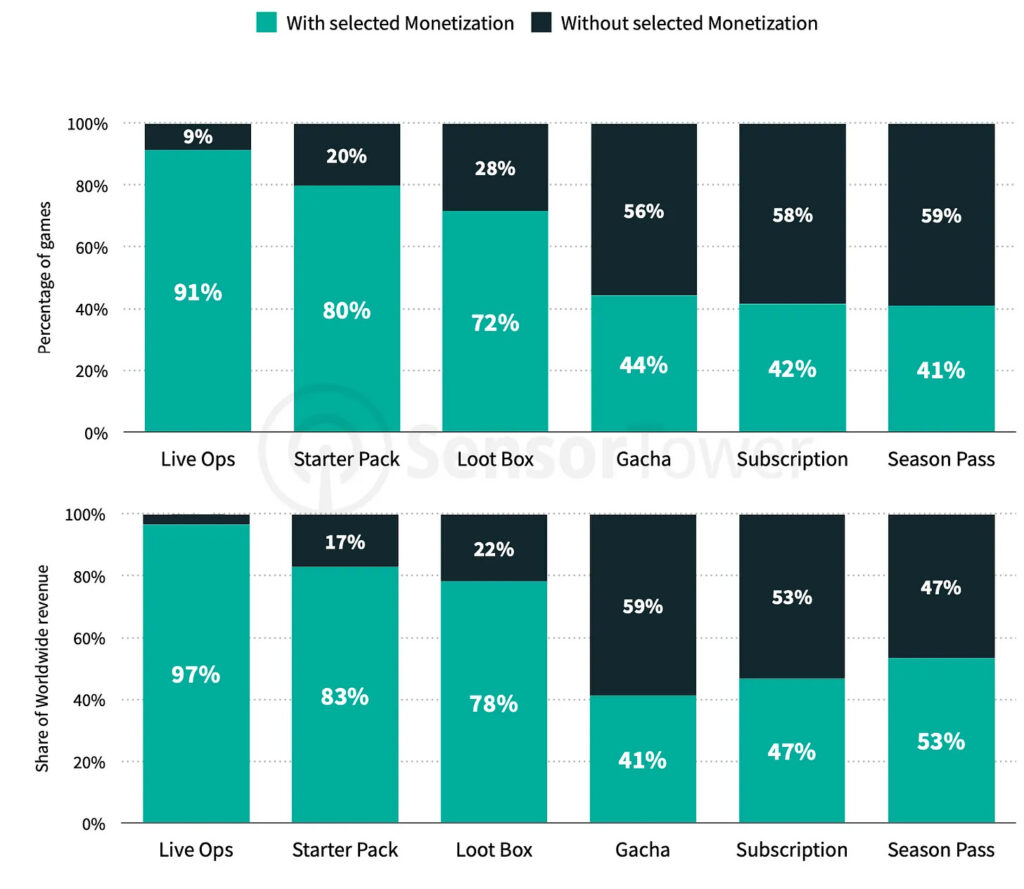

Meta & monetization trends

-

Sensor Tower is positive that we’ve entered the GaaS mobile era.

-

Games that are responsible for 97% of mobile games revenue are using different Live Ops approaches.

-

15% of top titles with loot boxes are generating 73% of worldwide mobile revenue.

-

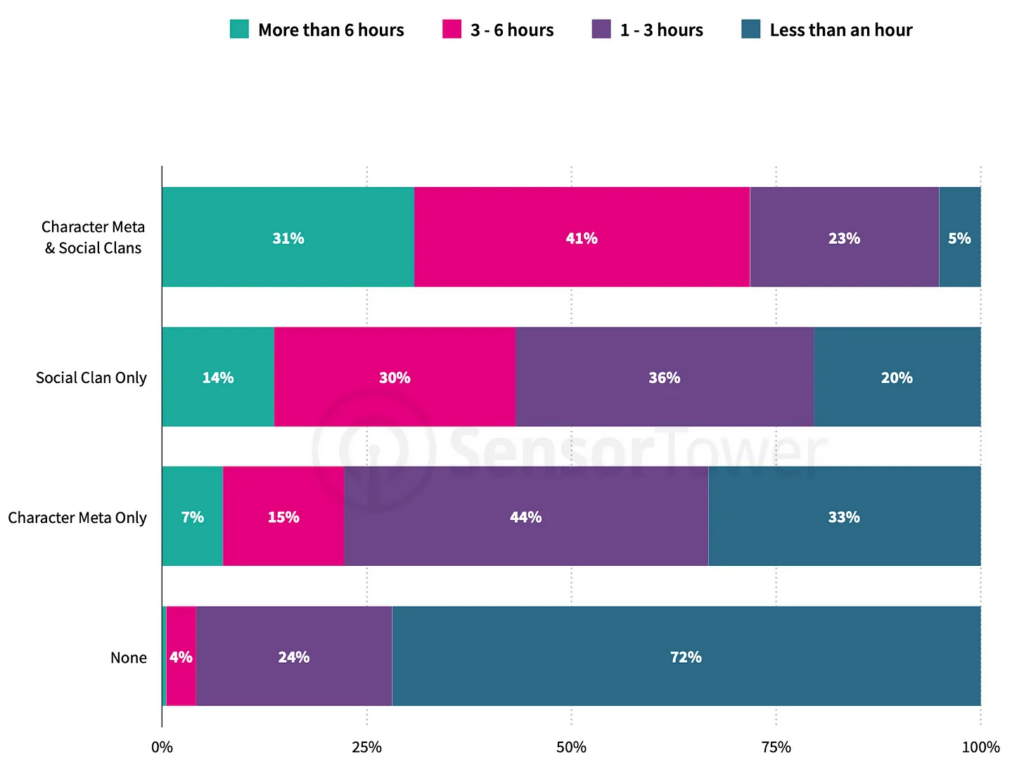

Heroes collection is one of the core pillars of monetization. It can be found in 7 out of 10 top titles by revenue.

-

Games with a combination of heroes collections and social elements (clans)experience have better user engagement compared to games without those features or which have only one of them.

Gaming market numbers in 2022

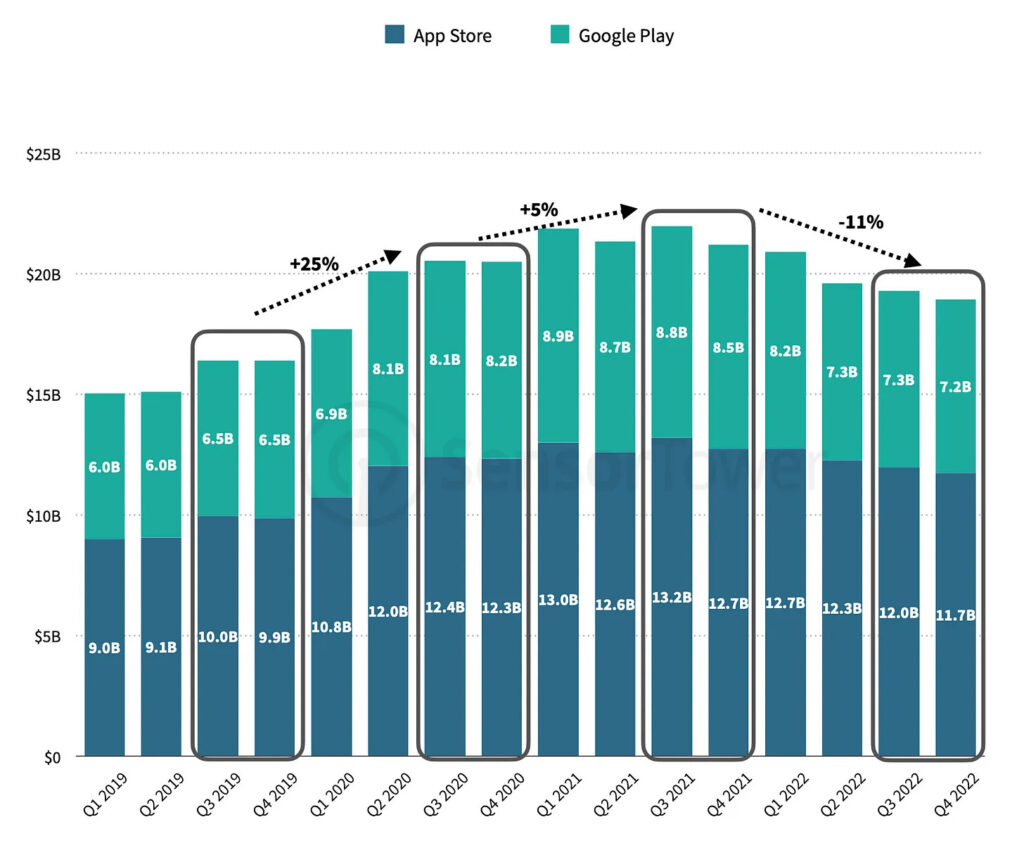

-

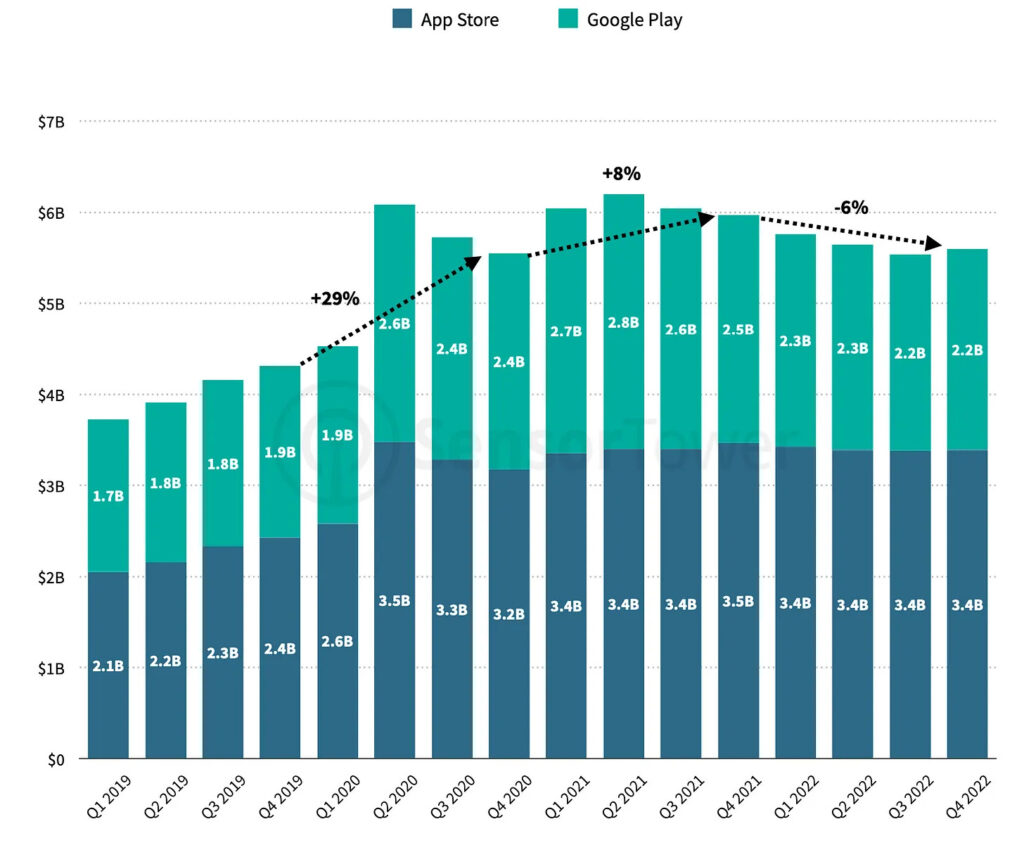

Mobile games revenue is declining for 5 consecutive quarters. It started in Q4 2021.

-

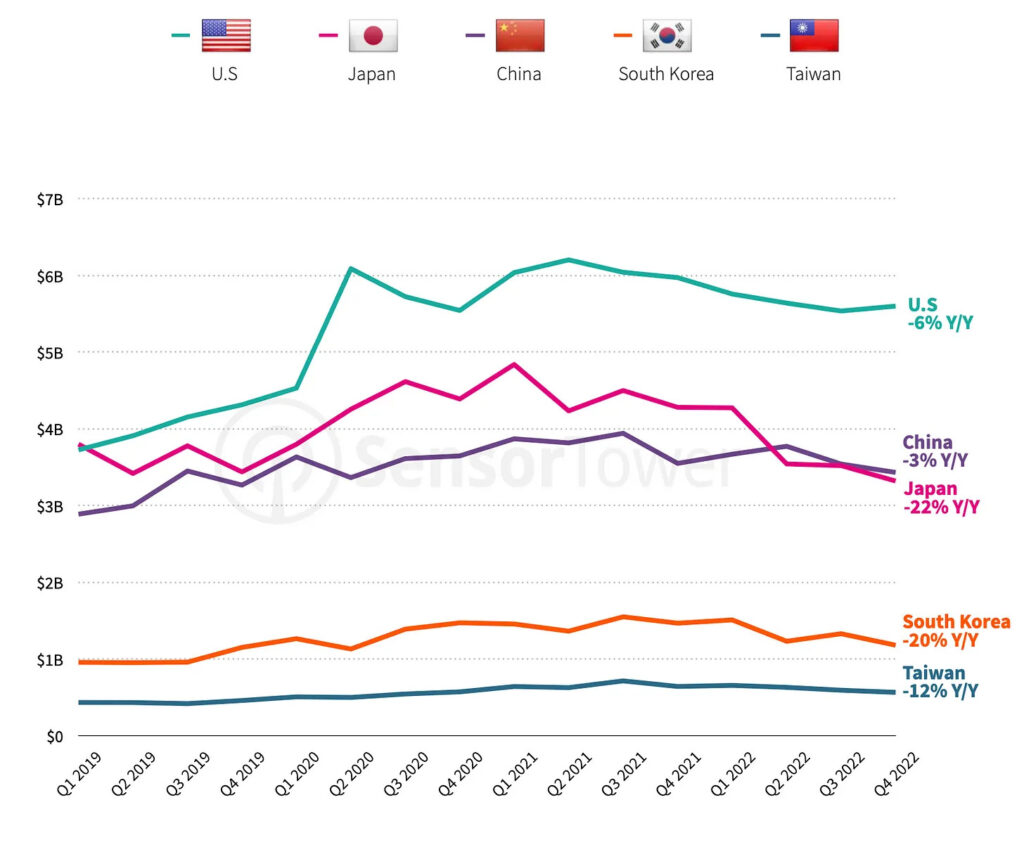

The US remains the largest mobile gaming market with $5.5B+ revenue in each quarter of 2022. But in Q4 2022 the decline to the previous year was 6%.

-

Japanese (-22% YoY), South Korean (-20% YoY), and Taiwanese (-12% YoY) markets experienced the largest declines in 2022.

-

India revenue grew in Q4 2022 by 13% YoY and reached $2.5B annually.

-

Since 2019 the US has increased its mobile gaming market share from 26% to 29%. Japan is losing it. China too, but Sensor Tower is not tracking 3rd-party Android stores.

-

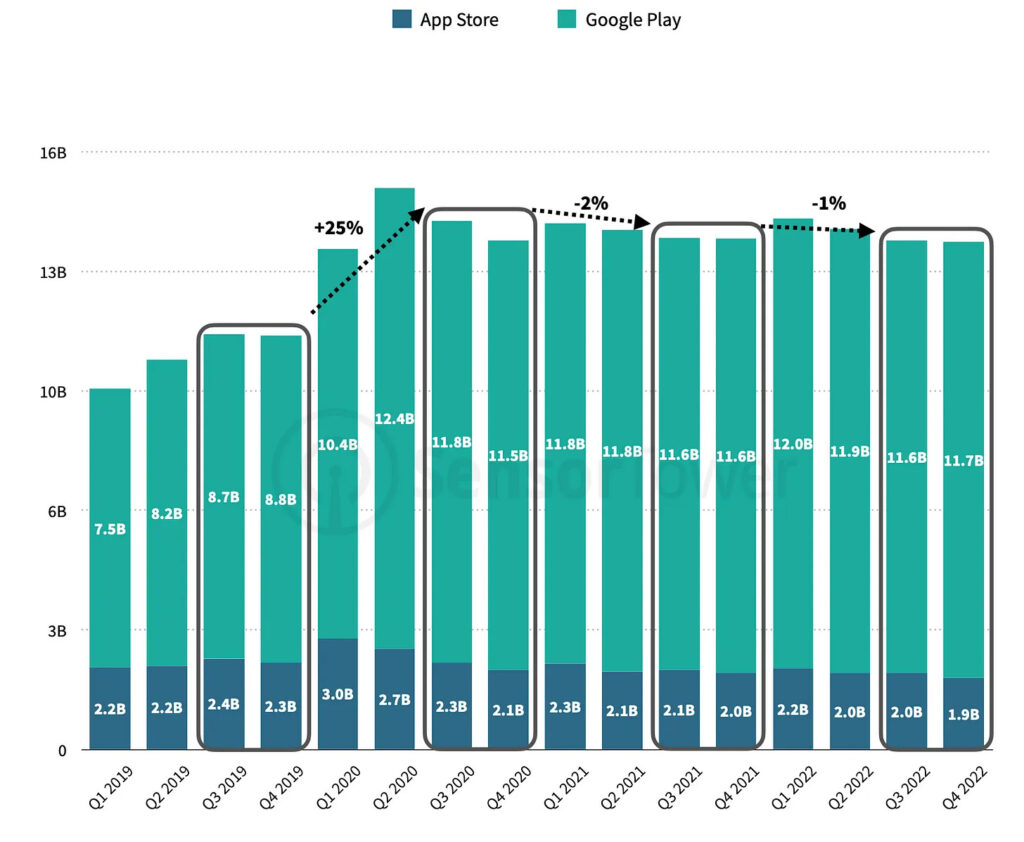

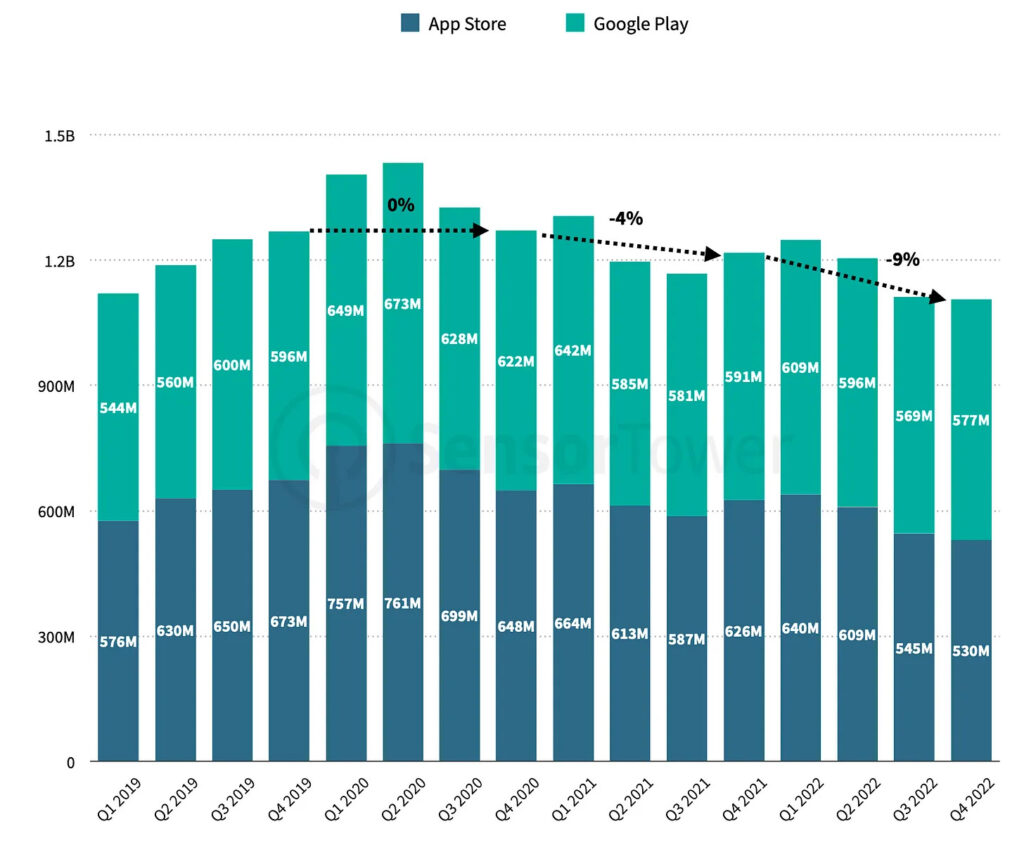

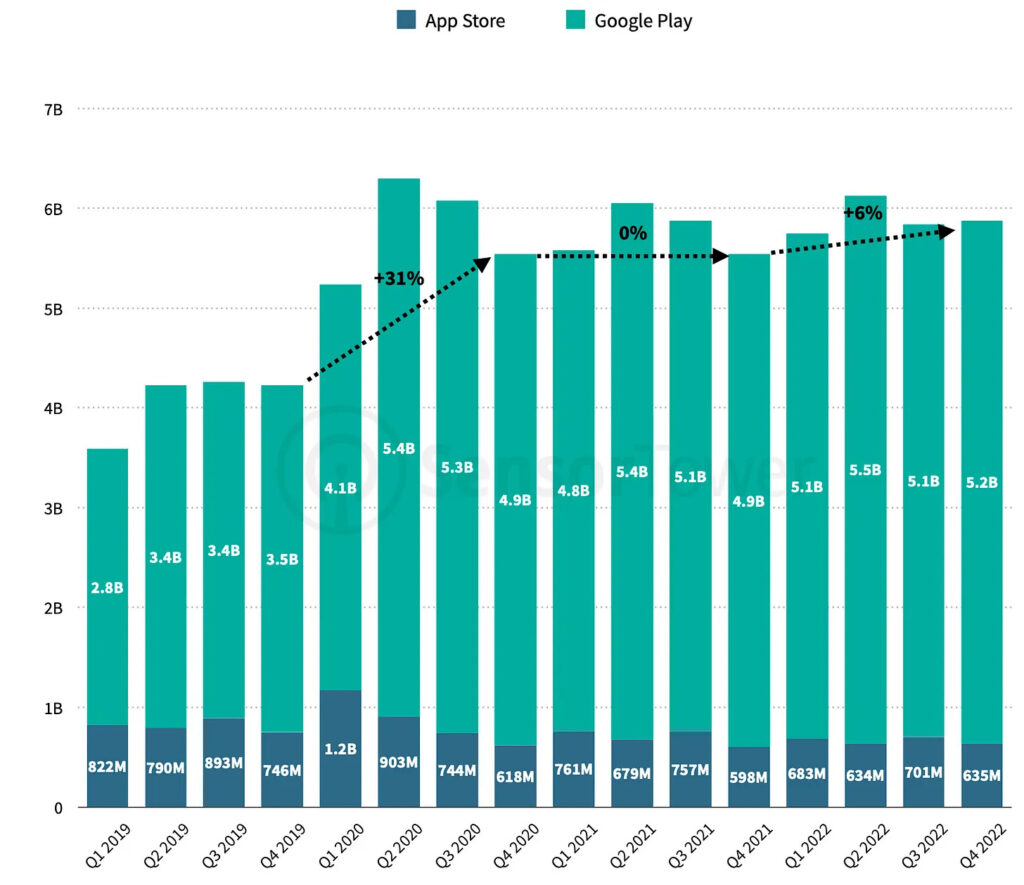

Downloads on the mobile gaming market have been stable for the last couple of years. After the peak in Q1-Q2 2020, they declined by 2% in Q3-Q4 2021, and 1% in Q3-Q4 2022.

-

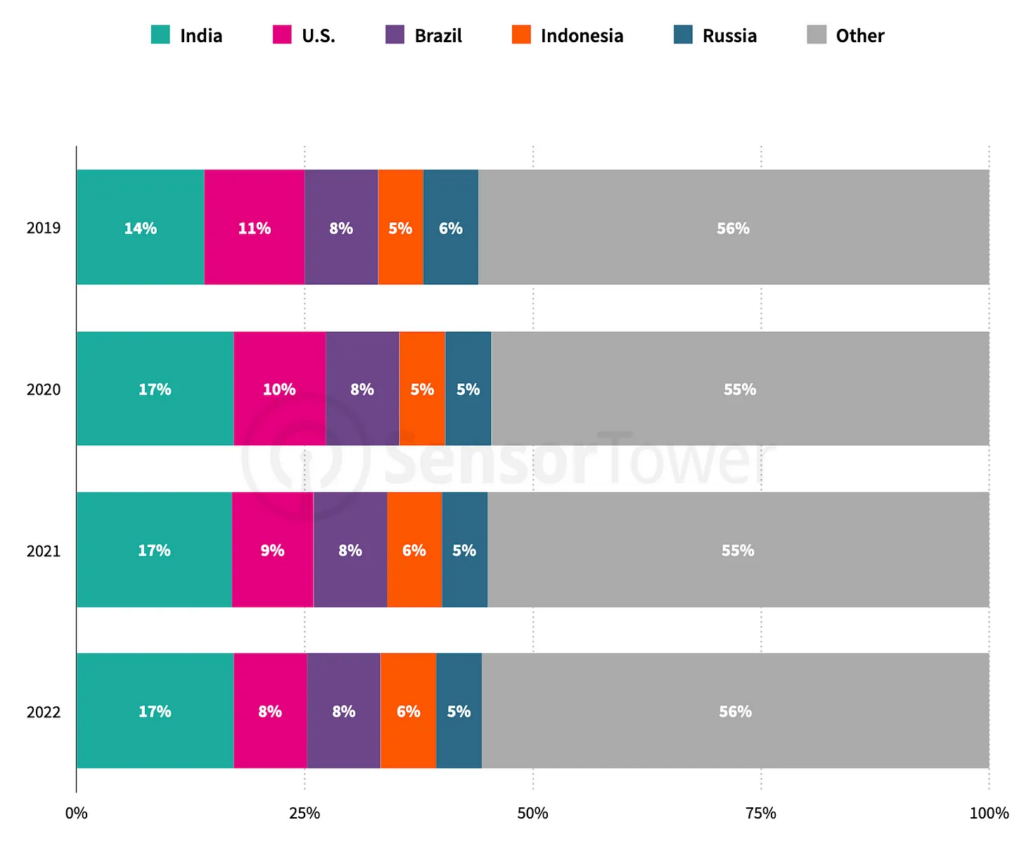

India in 2022 generated 17% of worldwide gaming downloads. The US and Brazil generated 8% each. Indonesia - 6%, Russia - 5%.

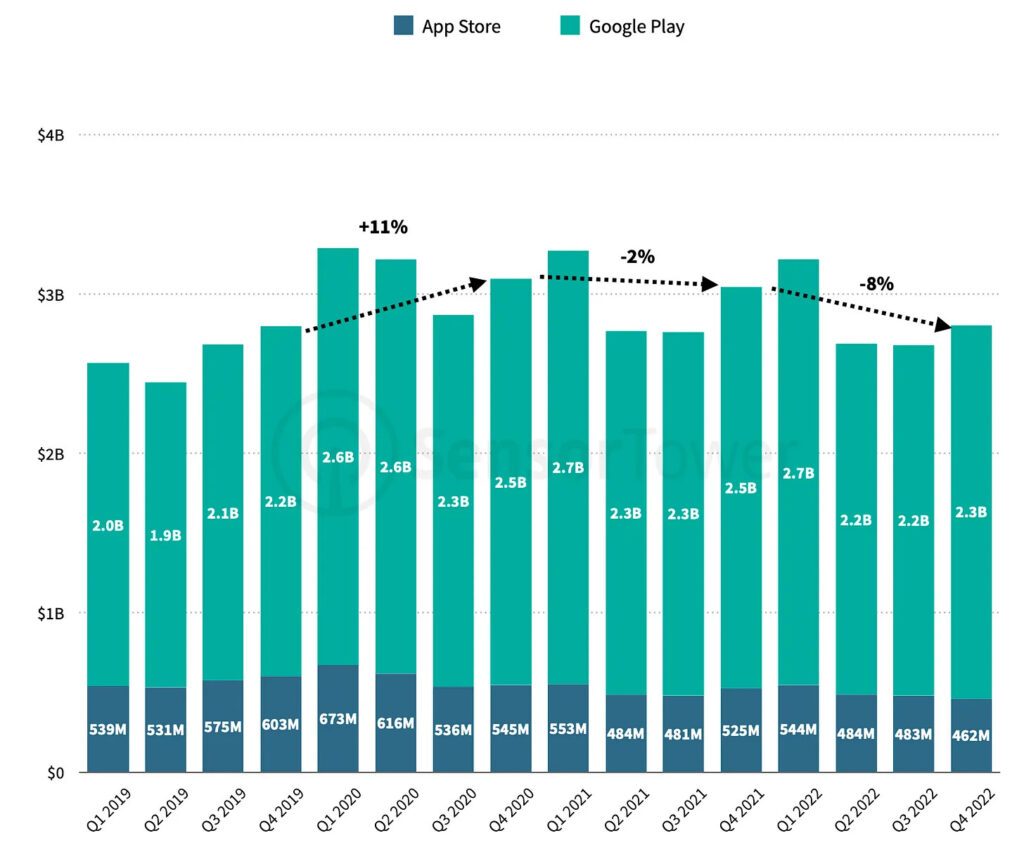

The US mobile gaming market

-

2022 ended with a decline of 6%.

-

Games downloads in the US in 2022 fell lower than pre-pandemic levels. Before COVID-19, in Q4 2019, downloads reached 1,269B. In Q4 2022 they were 1,107B.

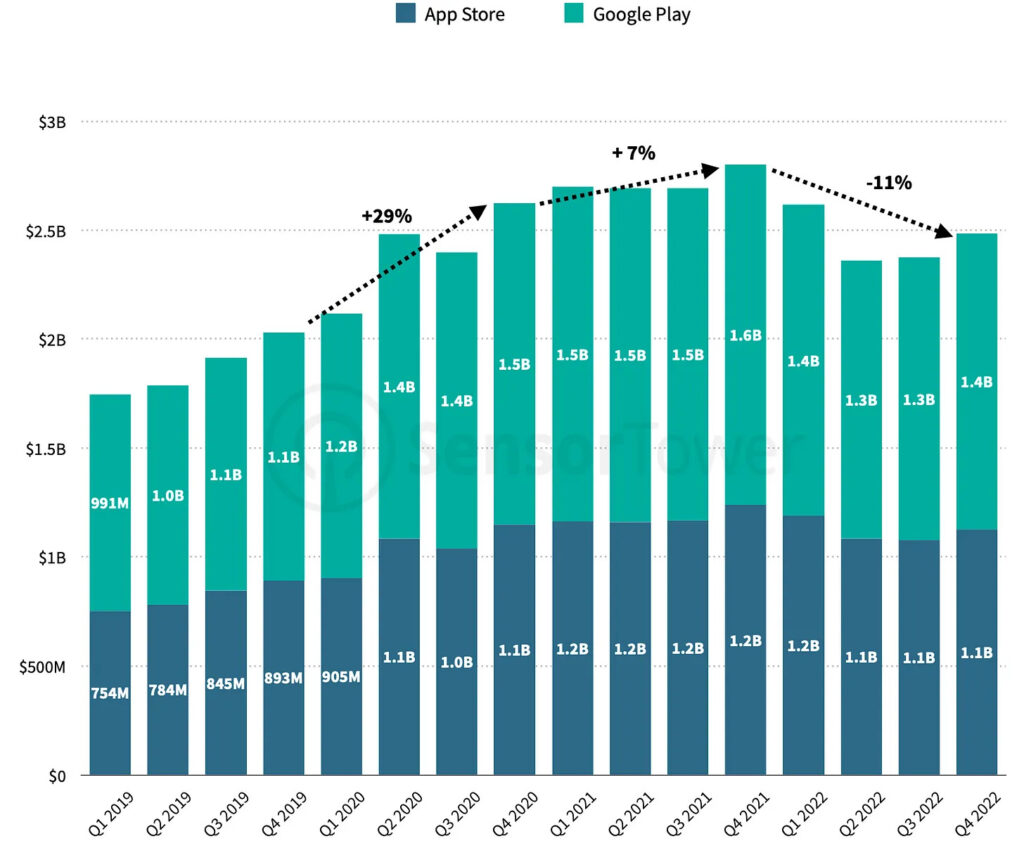

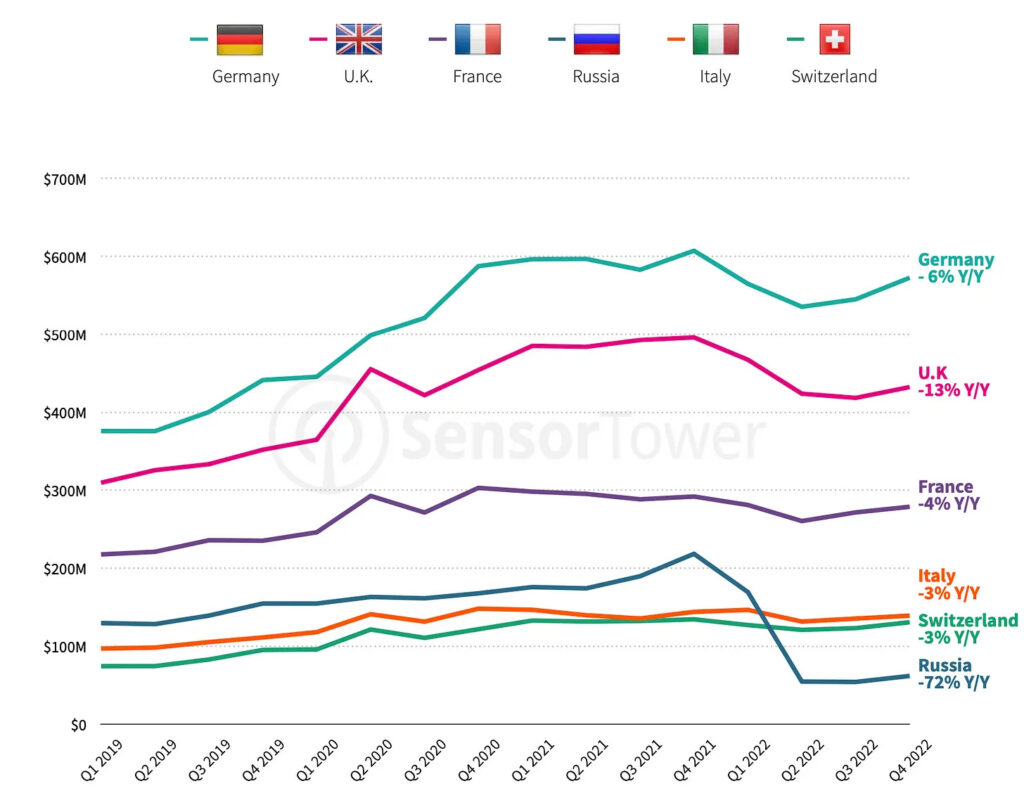

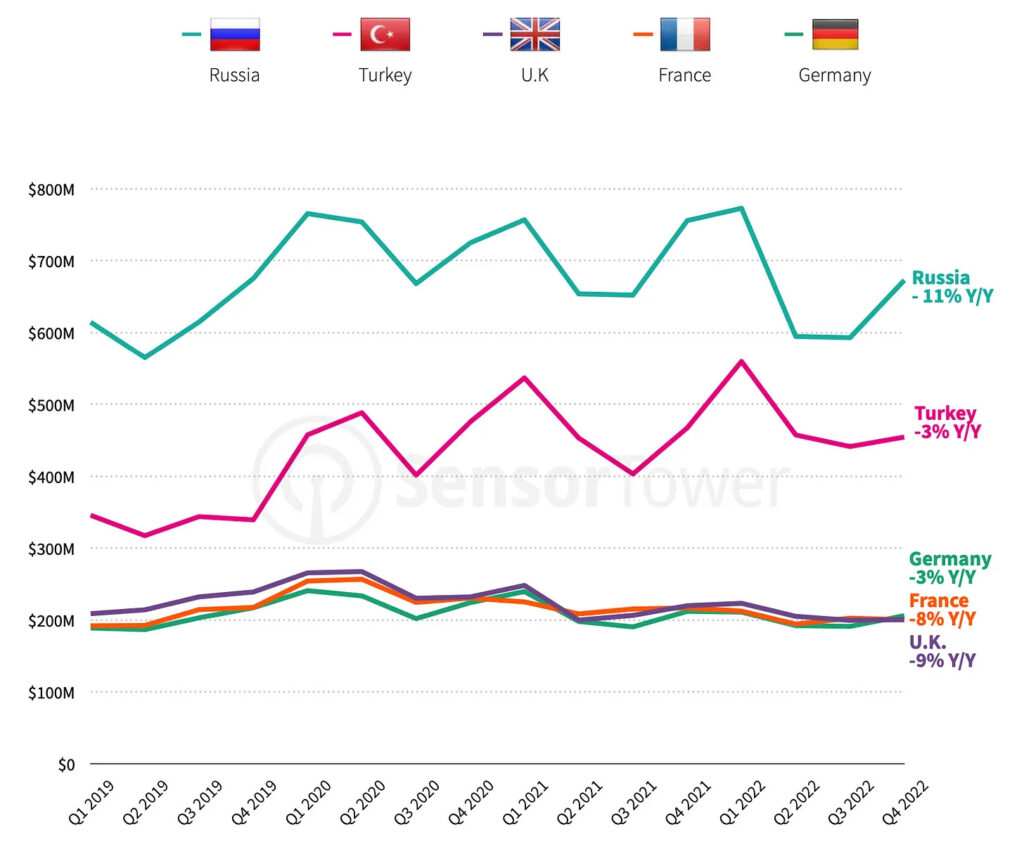

The European mobile gaming market

-

The European market declined by 11% in revenue in 2022. However, results are still significantly better than pre-pandemic levels.

-

Russia's drop in revenue was 72%, which made it out of the top-5 European markets for the first time in history. The UK also had a steep decline of 13% YoY in Q4 2022.

-

Downloads got back to the pre-pandemic levels.

-

Despite monetization issues, Russia is still the largest European market by downloads. The country generated 673M downloads in Q4 2022 - 24% of the overall amount.

The Asian gaming market

-

Revenue declined by 14% in 2022.

-

Downloads in Q4 2022 increased by 6% YoY. It’s the only big region that showed growth - thanks to India.

state-of-mobile-gaming-2023Download

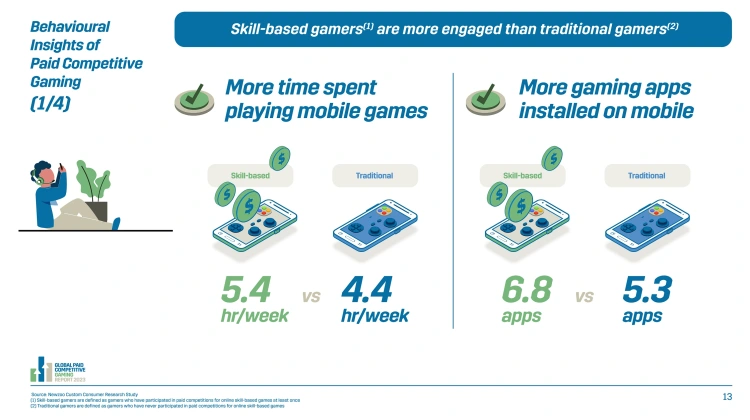

Newzoo & MPL: The PCG Games market will grow to $16B in 2024

PCG (Paid Competitive Games) is a genre of games in which players can earn real money competing with other gamers. This type of game is also called skill-based games.

Market

-

The CAGR of the segment from 2021 to 2024 will reach 31.9%. This is 6 times higher than the CAGR of traditional games (4.9% growth in the same period).

-

The main PCG markets are the US, India, Mexico, the UK, and Germany.

-

The US is the largest market for PCG games. In 2021 it was valued at $3B and in 2024 it will grow to $6.6B.

-

India is second with projected growth to $3.5B in 2024.

Gamers behavior

-

PCG players spend more time in games than traditional gamers (4.6 - 6.2 hours per week against 3.5 - 5.3 hours per week). They also do have more games installed (6 - 7.6 games versus 4.4 - 6.1 games installed on traditional gamers’ devices).

-

PCG gamers are planning to increase their spending in the upcoming years. In India 58% of players have such intention; in the US and Brazil, there are 51%.

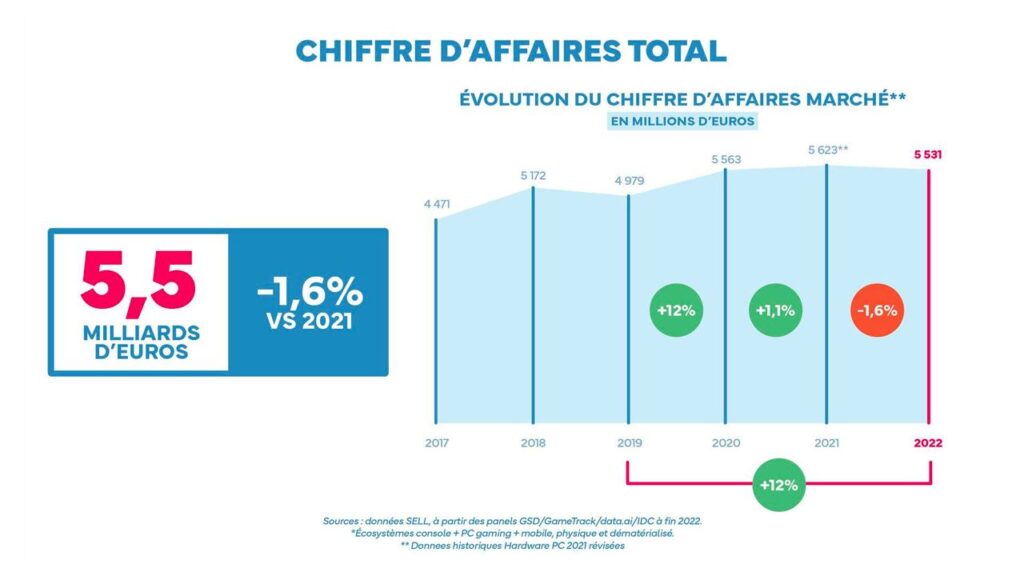

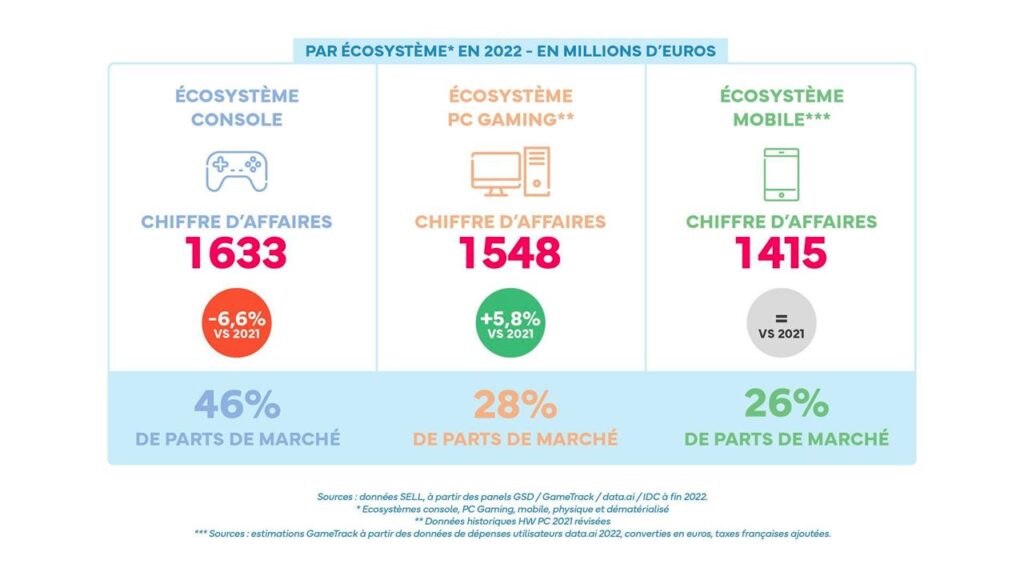

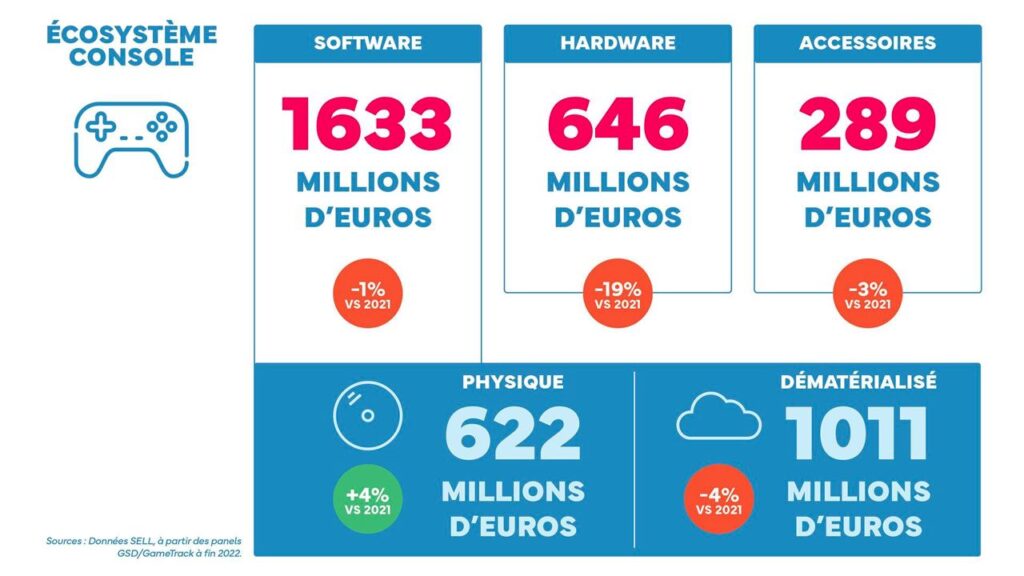

SELL: The French gaming market dipped to €5.5B in 2022

-

The decline to 2021 was 1.6%.

-

The console segment revenue reached €2.56B (-6.6% YoY); the PC segment grew by 5.8% YoY to €1.54B. The mobile gaming market remained flat with €1.41B in revenue.

-

Retail was responsible for 55% of all sales.

-

It’s interesting that physical game copies on consoles grew in 2022 by 4% while digital sales declined by the same percentage. This is different from the world trends.

-

FIFA 23 is the best-selling game of the year in France (1.75M copies). Call of Duty: Modern Warfare (791k copies) and Pokemon Legends: Arceus (589k copies) are next.

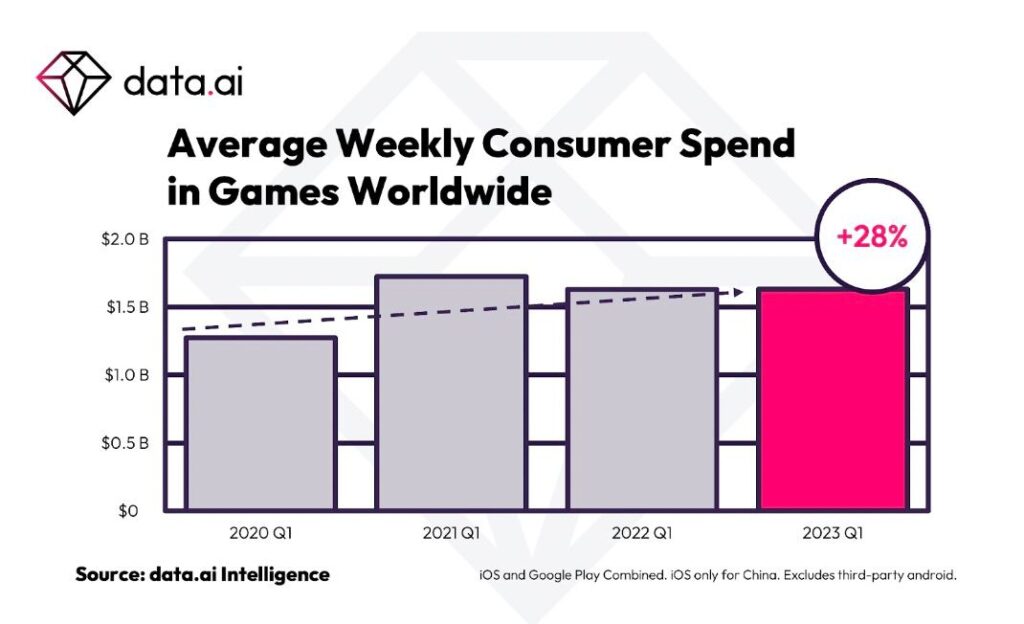

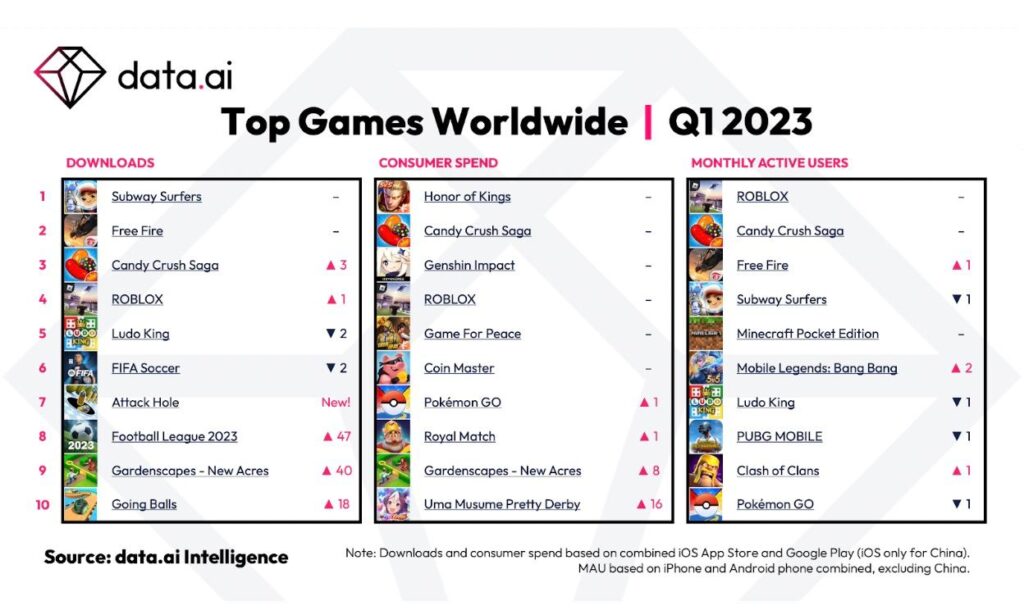

data.ai: Mobile Gamers have been spending $1.6B+ weekly in Q1 2023

-

On average, gamers have been spending $1.63B and have been making 1.2B downloads weekly in Q1 2023.

-

It’s 28% higher than in pre-pandemic Q1 2020. But lower than during the pandemic years.

-

There were some changes in the Q1 2023 downloads charts. Attack Hole, the new game from Homa, reached #7 place. Football League 2023 was up by 47 positions to take #8 place. Gardenscapes experienced a growth of 40 positions which helped it to seat in #9 place.

-

Gardenscapes also grew by revenue and made it to the top-10 chart in #9 place. Uma Musume Pretty Derby had a successful 2 years anniversary which helped it to reach #10 place in the top-grossing chart. Positions from #1 to #6 remain unchanged with an Honor of Kings as the solid leader.

Circana: The Gaming market in the US increased by 6% in February 2023

Market numbers

-

The US players spent $4.6B on gaming products in February 2023 (+6% YoY).

-

Gaming spending reached $3.9B (+1% YoY). Hardware sales increased by 68% YoY and reached $495M. Accessories sales were also good with $212M (+13% YoY).

Games

-

Hogwarts Legacy became the bestseller of the month and the best-selling game of 2023.

-

7 new games appeared in the US PC/Console top-20 chart in February 2023.

-

The HBO TV series helped The Last of Us: Part I jump from #11 to #6 place in the top chart by sales in February. The Last of Us: Part II also changed its position from #41 to #18.

-

The overall revenue of mobile gaming in the US continues to decline. The mid-core genre is struggling the most.

-

Mobile shooters after the severe 2022 are in the stable period, the decline is over.

-

Mobile sports games increased by revenue in February 2023.

Consoles

-

Console sales showed the best result since February 2009.

-

PlayStation 5 is the February’23 leader by both unit sales and revenue.

Adjust: Mobile Gaming Trends 2023

The report includes data collected from January 2021 to January 2023. More than 5 thousand apps were reviewed.

Market numbers

-

Mobile gaming revenue in 2022 was $110B. It’s 5% less than a year before.

-

The Chinese gaming market is $42.4B and is the largest one. The US ($24.02B), Japan ($13.1B), South Korea ($5.28B), and Germany ($2.47B) are next.

-

Mobile games ad spend in 2023 will reach $362B. Growth to 2022 will be 7.5%.

-

The number of users allowing the ATT opt-in has been increasing through 2022. In mobile games, it increased from 30% to 36%.

-

Downloads and the number of sessions in games dropped in 2022. But in January 2023 the trend reversed and analytics have seen an increase of 10% in downloads and 11% in sessions. IAP revenue also increased by 14% compared to the average monthly result of Q4 2022.

-

However, overall IAP Revenue in 2022 declined by 9% compared to the previous year.

Downloads

-

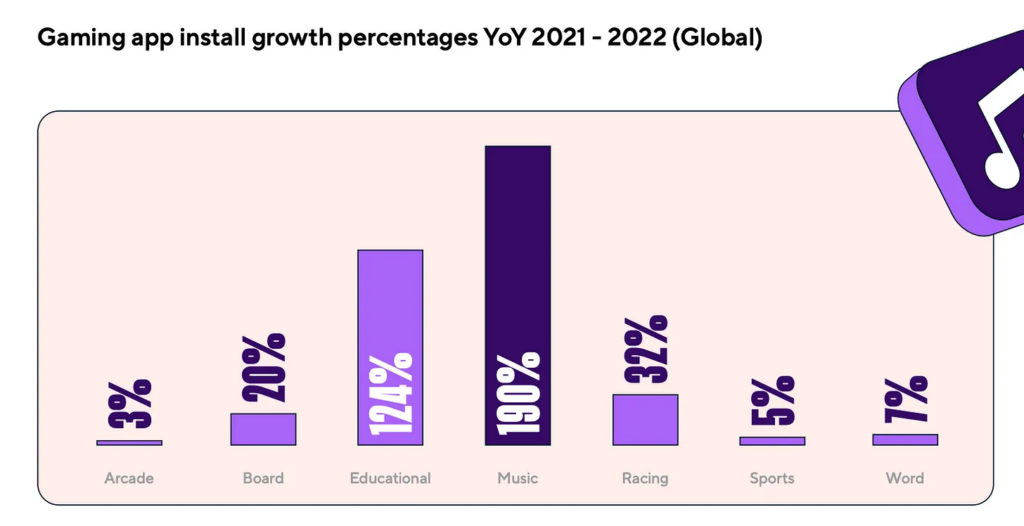

Music games (+190%), educational games (+124%), racing (+32%), board games (+20%) grew by downloads in 2022.

-

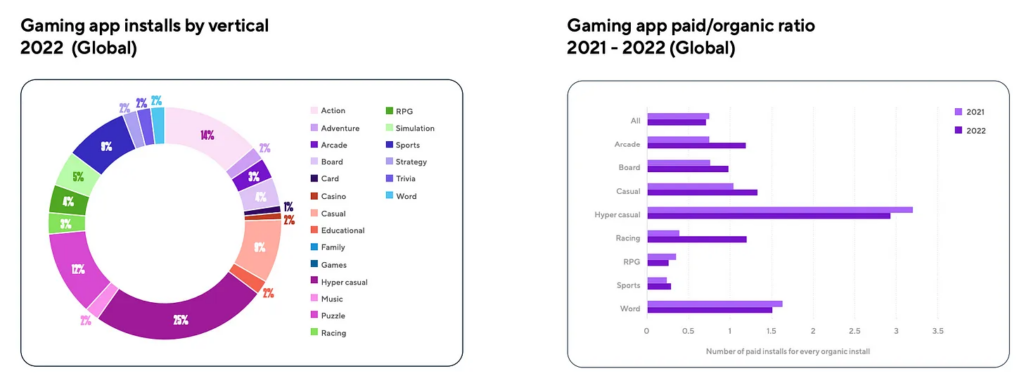

Hypercasual games are responsible for about 25% of overall game mobile downloads.

-

Paid to organic users ratio in 2022 decreased from 0.75 to 0.71. In hypercasual games, the decline was from 3.2 to 2.93.

Product metrics

-

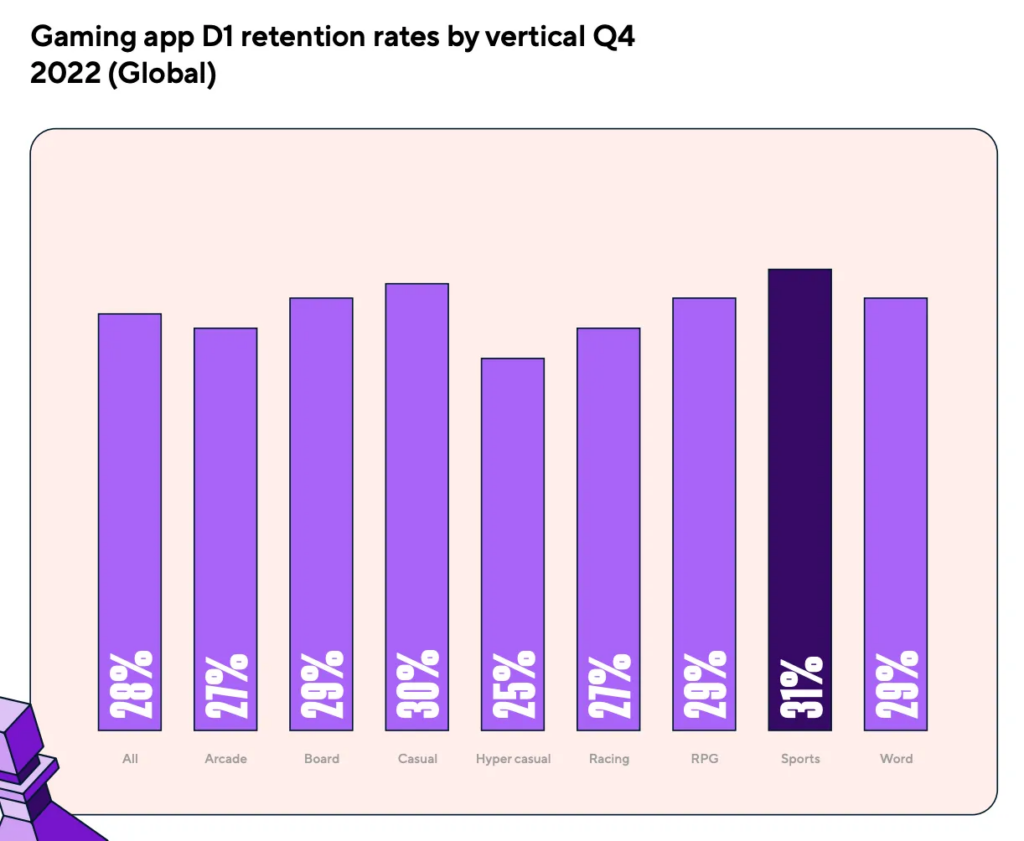

An average D1 Retention is 29% - this number remained unchanged in 2022. D3 Retention declined from 20% to 19%; D30 also dropped from 7% to 6%.

-

The highest average D1 Retention in Q4 2022 was in sports games - 31%.

-

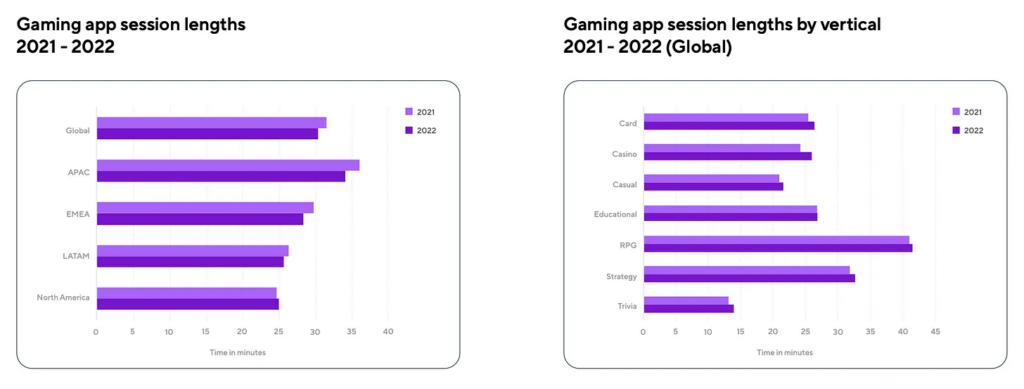

The average session length in January 2023 was 30.96 minutes.

-

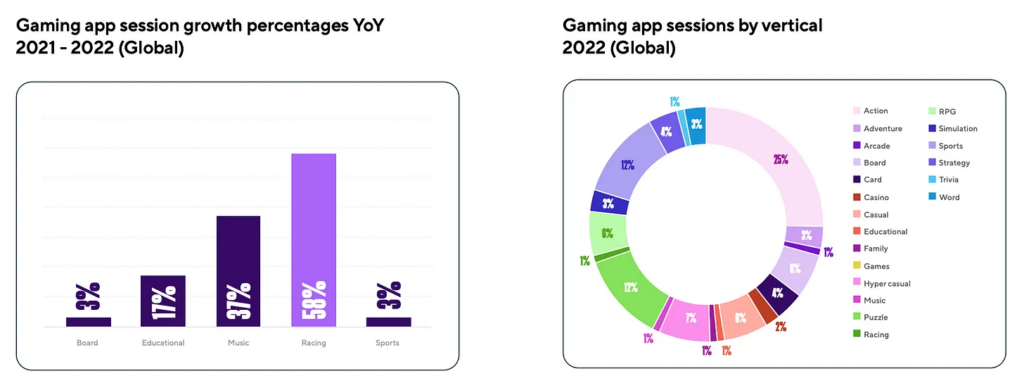

Action games are responsible for 25% of all sessions.

Ebook on mobile app trends 2023