Devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview is prepared by Dmitriy Byshonkov - the author of the GameDev Reports by devtodev Telegram channel. You can read the October and November reports.

Contents

- AppsFlyer: Best sources of advertising traffic on mobile devices (Version 16)

- DDM: Gaming Investment Market in Q3 2023

- The ESA: Most American children want video games connected gifts for the New Year holidays

- Niko Partners: The gaming market in China will grow by 5.2% in 2023

- Shorooq Partners: The MENAP market will grow to $2.8 billion by 2026

- Niko Partners: The markets of South Korea, Japan, and Chinese Taipei will grow to $30.8B by 2027

- Nintendo FY'24 Q1-Q2 Report: Numbers and Insights

- AppMagic: Top Mobile Games of November 2023 by Revenue and Downloads

- Apptica & Gamelight: The Mobile Market in Q3 2023

- Supercell: "We need to make our games f*ing famous, and become part of pop culture."

- Take-Two Interactive Software: Sales of the GTA series have exceeded 410M copies

- Ampere Analysis: Gaming subscription services in the Q3'23

- Maliyo Games: The State of the African game industry (2024)

- Sensor Tower: South Korean Mobile Market Surpasses China and the USA in the Popularity of Football Games

- Story: The first paid mount in WoW earned more than StarCraft II: Wings of Liberty

- Ultra & Atomik Research: How PC Gamers Discover and Purchase Games

- data.ai: What Awaits Mobile Games in 2024

- Sensor Tower: Monster Strike revenue exceeds $10B

- Newzoo: Comparison of Launches of EA Sports FC 24 and FIFA 23

- Google: The most popular games in Search in 2023

- GSD & GfK: Call of Duty was unable to save the British market from decline in November 2023

- Famitsu: Momotaro Dentetsu World: The Earth Spins with Hope - the best-selling game in Japan in November

- Tenjin & ObtainAds: How to make your advertising creatives more effective

- Circana: The American Gaming Market Declined by 7% in November

- Ampere Analysis: Alan Wake II console sales of less than 1M copies

- Lethal Company: The indie success of the year

- GSD: Game sales in Europe declined, but console sales soared by 59% in November

- Ampere Analysis: PlayStation and Xbox players spent almost 1.5 billion hours in Fortnite in November

- The BIG PlayStation leak

- Niko Partners: The volume of payments in the largest gaming markets in Asia and MENA in 2023 will amount to $89.4 billion

- GameRefinery: Trends in casual and midcore games in November 2023

- CGIGC: The Chinese gaming market recovered in 2023

- IGEA: Australian Gaming Industry in 2023

- NZGDA: New Zealand Gaming Industry in 2023

- StreamElements & Rainmaker.gg: State of the Streaming Market in November 2023 and year's results

- The PlayStation 5 has surpassed the 50M sales mark

- 80LV: Culture, Mental Health, and HR Trends in the Gaming Industry in 2023

- Ampere Analysis: PlayStation 5 in 2023 Outpaced Xbox Series S|X Sales by 3 times

- data.ai: In 2023, 19 mobile games surpassed the $1 billion revenue mark

- Omdia: Sales of VR devices will decline until 2026

- Monster Hunter Now has surpassed the $100M revenue mark

- Rush Royale has surpassed the $280M revenue mark

- The total sales of Anthem seem to have exceeded 5M copies

- The Pokemon GO Fest 2023 events brought $323 million to the economies of the countries where they were held

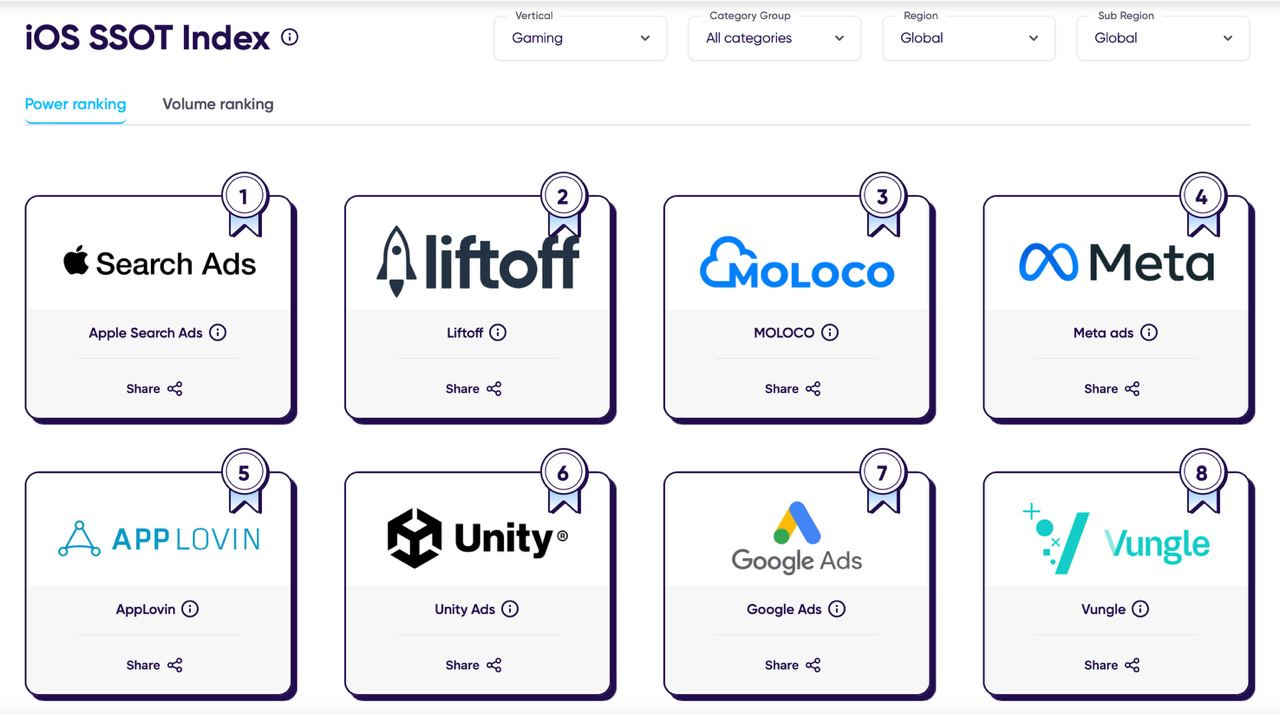

AppsFlyer: Best sources of advertising traffic on mobile devices (Version 16)

To prepare the index, the company analyzed 11.5 billion organic installations from 75 sources from April to September 2023 in more than 30 thousand applications.

iOS

-

Apple Search Ads - the #1 traffic source on iOS. This applies to both the volume and quality of traffic.

-

Liftoff and Moloco - in second and third places, largely due to the quality of traffic.

-

Meta is in fourth position. The channel works especially well for mid-core projects.

-

AppLovin is in fifth place on the chart, performing well for casual and hyper-casual projects.

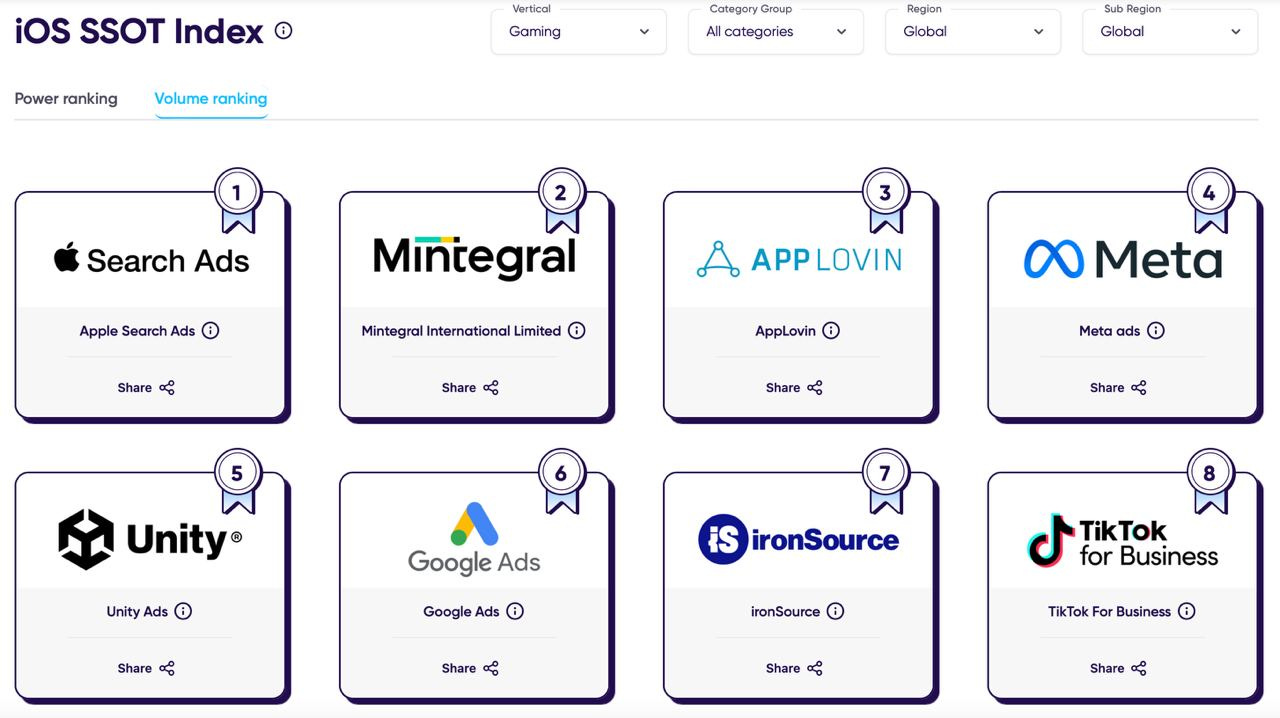

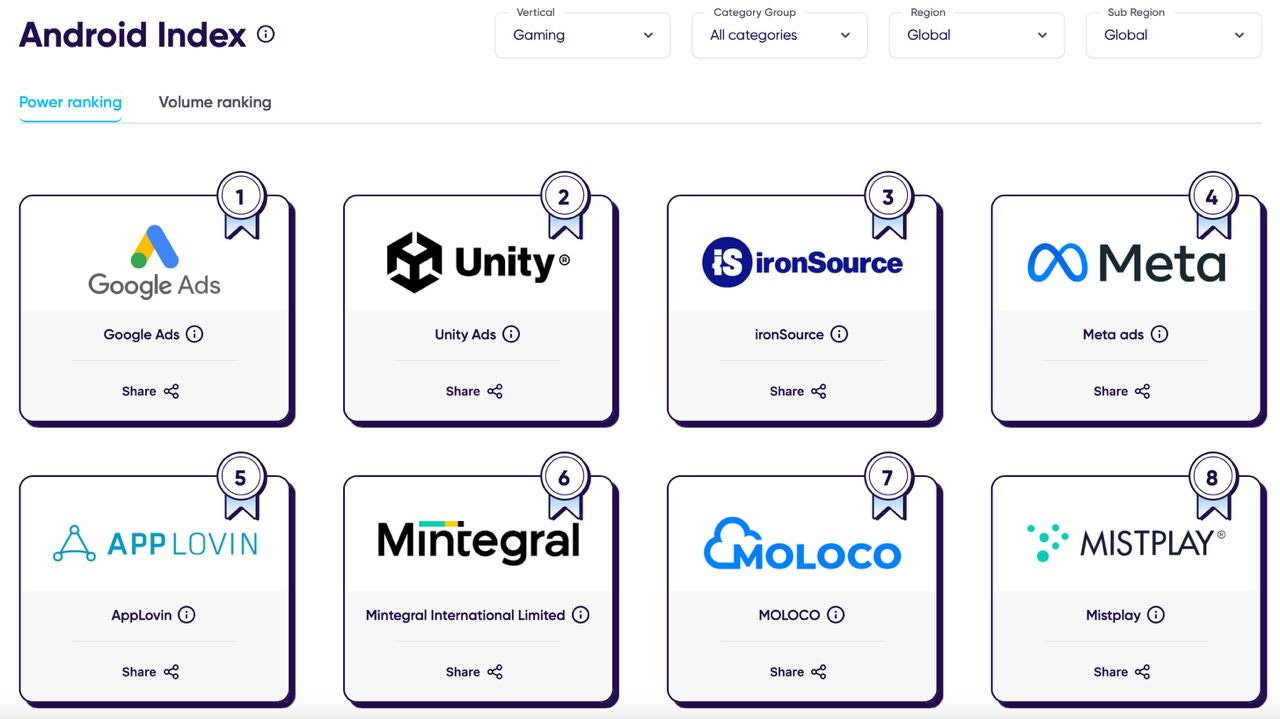

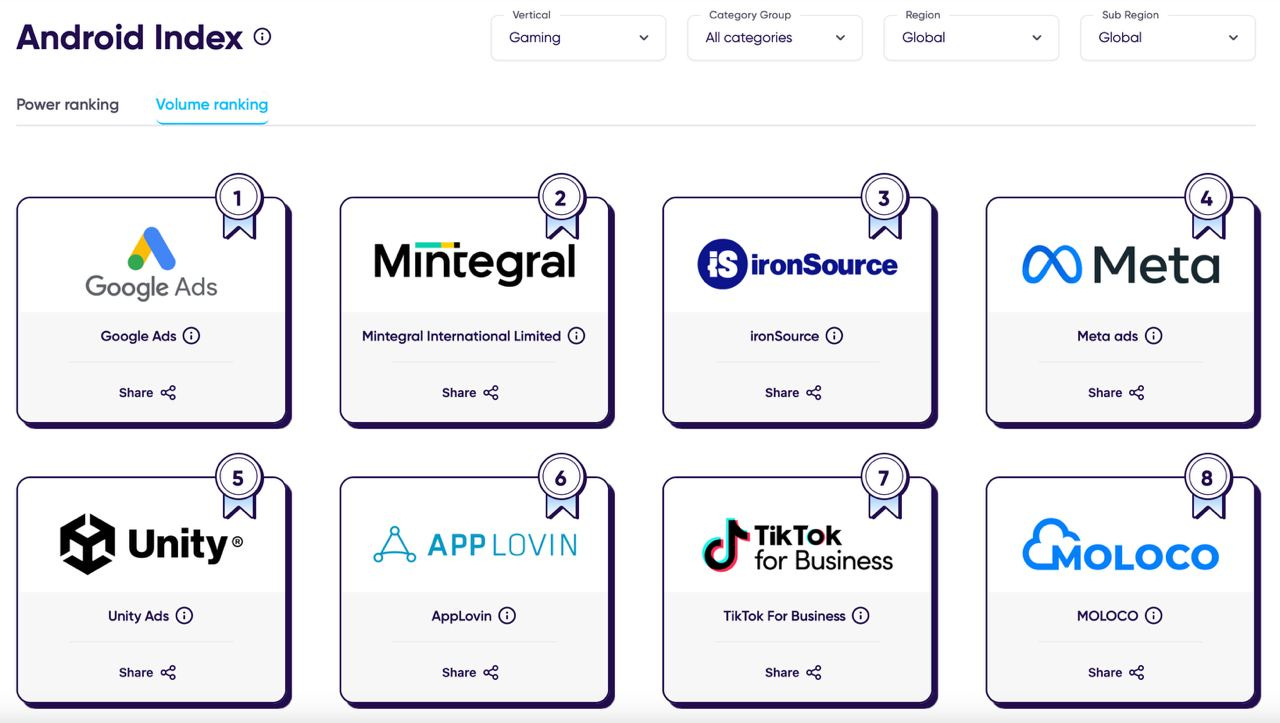

Android

-

Google Ads - the main source of traffic on the platform. It shows the best results in every category except hyper-casual games and casinos - in these categories, Google Ads takes the second position.

-

Unity Ads took second place in the overall chart but lost positions in the volume of traffic. The channel works well for casual and mid-core projects.

-

ironSource significantly improved compared to the previous index, taking the third position (previously sixth). The channel works excellently for hyper-casual projects.

-

Meta took the fourth position. Through this source, it is good to acquire casinos, mid-core games, puzzles, and sports projects.

-

AppLovin lost 1 position in the overall ranking and took 5th place.

The full version of the index, with a breakdown by genres and regions, is available at the link

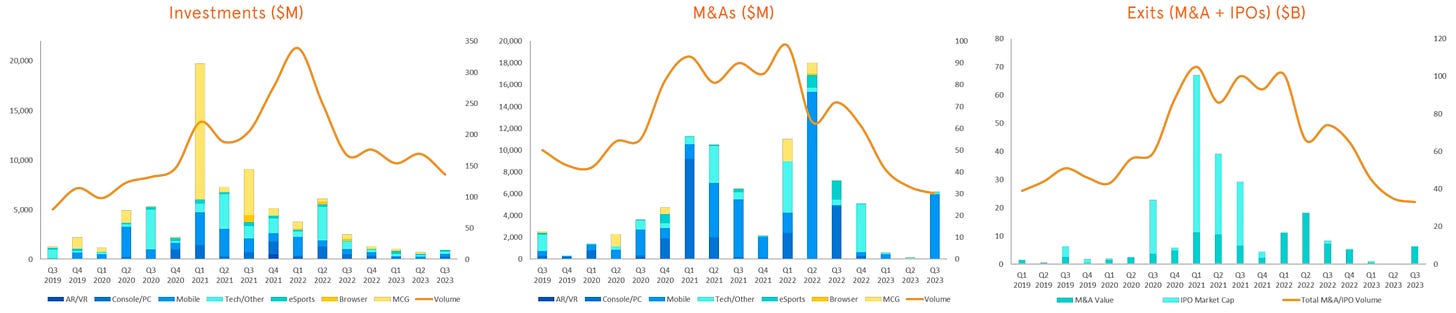

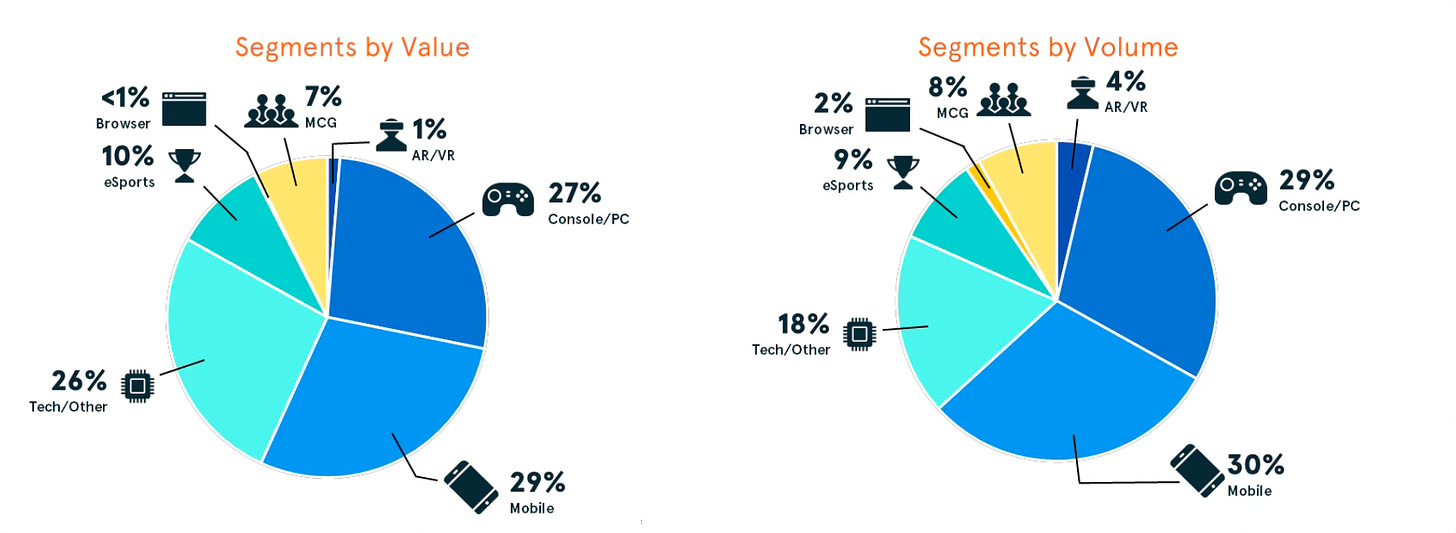

DDM: Gaming Investment Market in Q3 2023

DDM includes blockchain transactions as well as AI startups.

-

The total volume of closed deals in the third quarter amounted to $7.1 billion. There were a total of 166 transactions in the quarter.

-

The volume is 769% higher than in the previous quarter, while the number of transactions decreased by 18%. The third quarter saw deals between Savvy Games Group and Scopyle, as well as SEGA and Rovio, generating the majority of the volume.

Private Investments

-

In the third quarter, 136 deals were made (20% less than the previous quarter) with a total volume of $965.4 million (36% more than the previous quarter). For the first time since the second quarter of 2022, the market has grown.

-

Most investments by volume were made in mobile studios (29%), PC/console studios (27%), and technology (26%).

-

According to DDM estimates, undisclosed transactions totaling $1 billion took place in the quarter.

-

Early-stage investments accounted for approximately 50% of the total volume and 65% of the total number of transactions.

-

Candivore ($100 million), Futureverse ($54 million), and Inworld AI ($50 million) were the largest private deals of the quarter.

-

WeMade, Samsung, Andreessen Horowitz, Polygon, and BITKRAFT Ventures were the most active private investors of the quarter.

M&A

-

In the third quarter, 30 deals were made (9% less than the previous quarter) with a total volume of $6.1 billion (5569% more than the previous quarter).

-

Deals with Scopely and Rovio accounted for 92% of the total volume of the quarter.

The ESA: Most American children want video games connected gifts for the New Year holidays

The association surveyed children and teenagers aged 10 to 17 years.

-

72% of those surveyed would like something related to games as a Christmas and New Year gift. Following games were gift cards (70%), clothing and accessories (66%), and electronics (62%).

-

59% of girls and 86% of boys said they would ask for video game gifts during these holidays.

-

39% want a subscription to a gaming service as a gift; 38% - a console; 32% - accessories; 29% - in-game currency; 22% - a physical copy of the game.

-

32% of adults noted that they plan to buy things related to video games as a gift either for themselves or for acquaintances. Among parents, this percentage increases to 57%.

-

Americans plan to spend $485 on gifts related to video games this year.

-

More than 212 million Americans regularly play games.

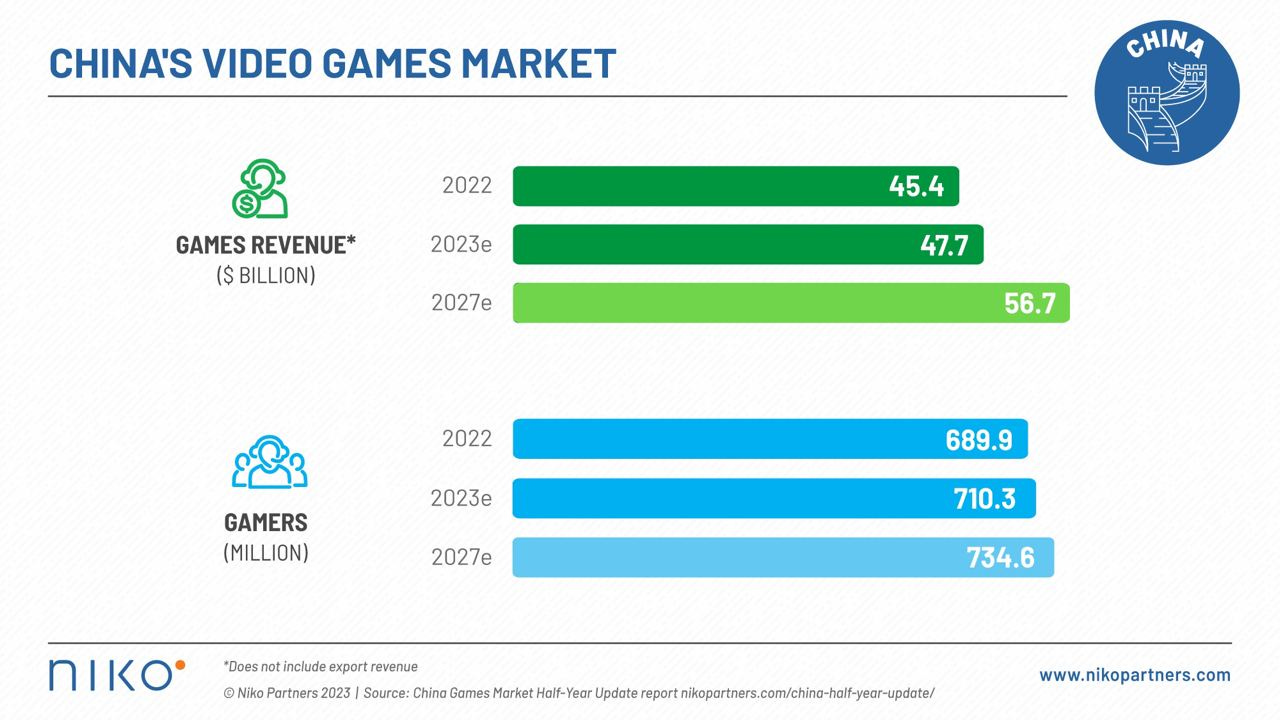

Niko Partners: The gaming market in China will grow by 5.2% in 2023

Preliminary results for 2023

-

The market size will reach $47.76 billion. The 5.2% growth follows a 2.5% decline in 2022.

-

The number of players in the country in 2023 will reach 710.3 million, which is 1.63% more than in 2022.

-

Monthly ARPU (Average Revenue Per User) in China will reach $5.6.

-

Key growth factors this year include active government licensing; large user spending on already released games; and continued access of players to unlicensed games on PC and consoles.

-

As of October 30 this year, the government issued licenses for 844 games. In 2022, 512 licenses were issued, and in 2021 - 755.

-

Chinese companies reduced investments in foreign companies this year, focusing on the local market.

-

China is the world's largest esports market. There are over 400 million esports fans in the country, and the industry's volume is $445 million.

Forecast for 2027

-

It is expected that the Chinese market will grow to $56.7 billion in 2027, with an average annual growth rate of about 4.5%.

-

In 2027, there will be 734.6 million players in China, with an expected 1% growth per year.

-

Growth in the next 4 years, according to Niko Partners' forecasts, will be driven by AI content, the launch of new games, increased spending, and the growing popularity of esports.

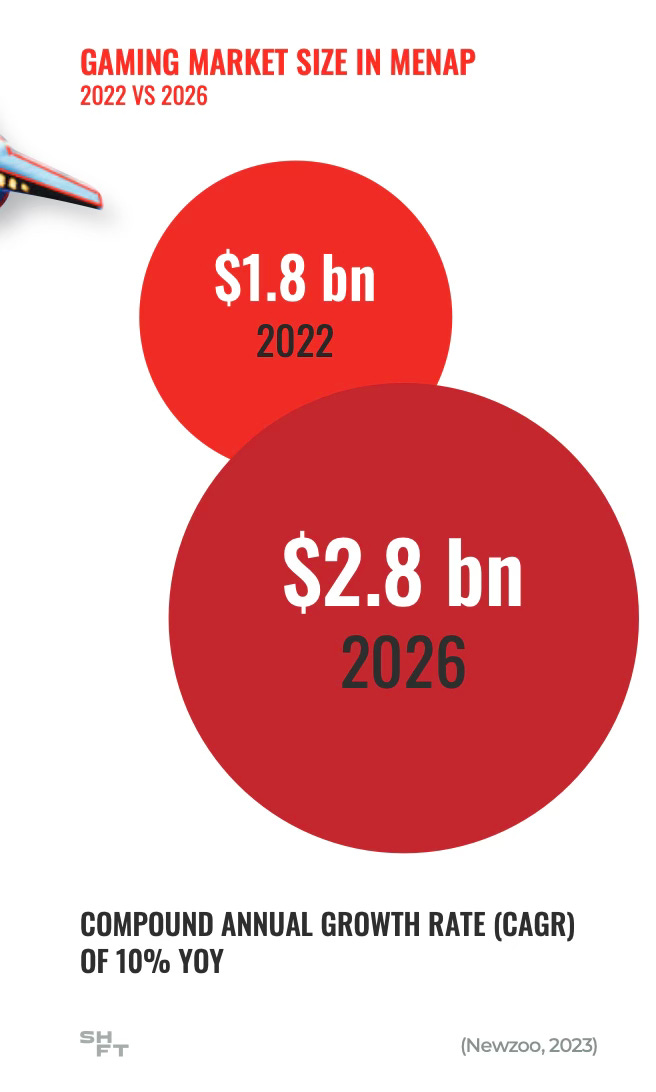

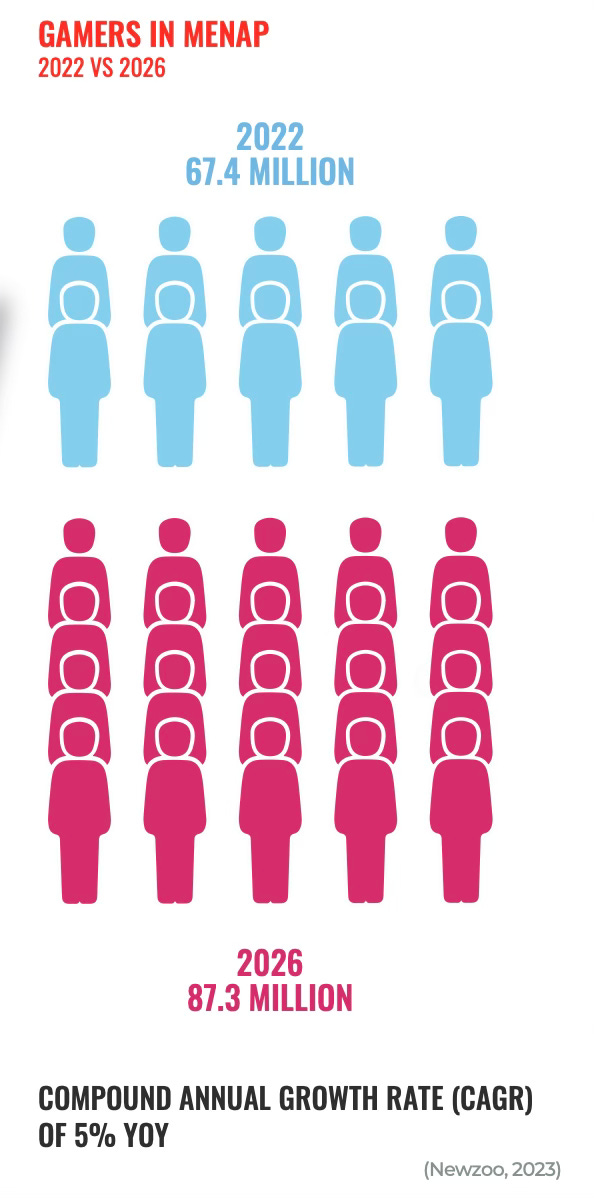

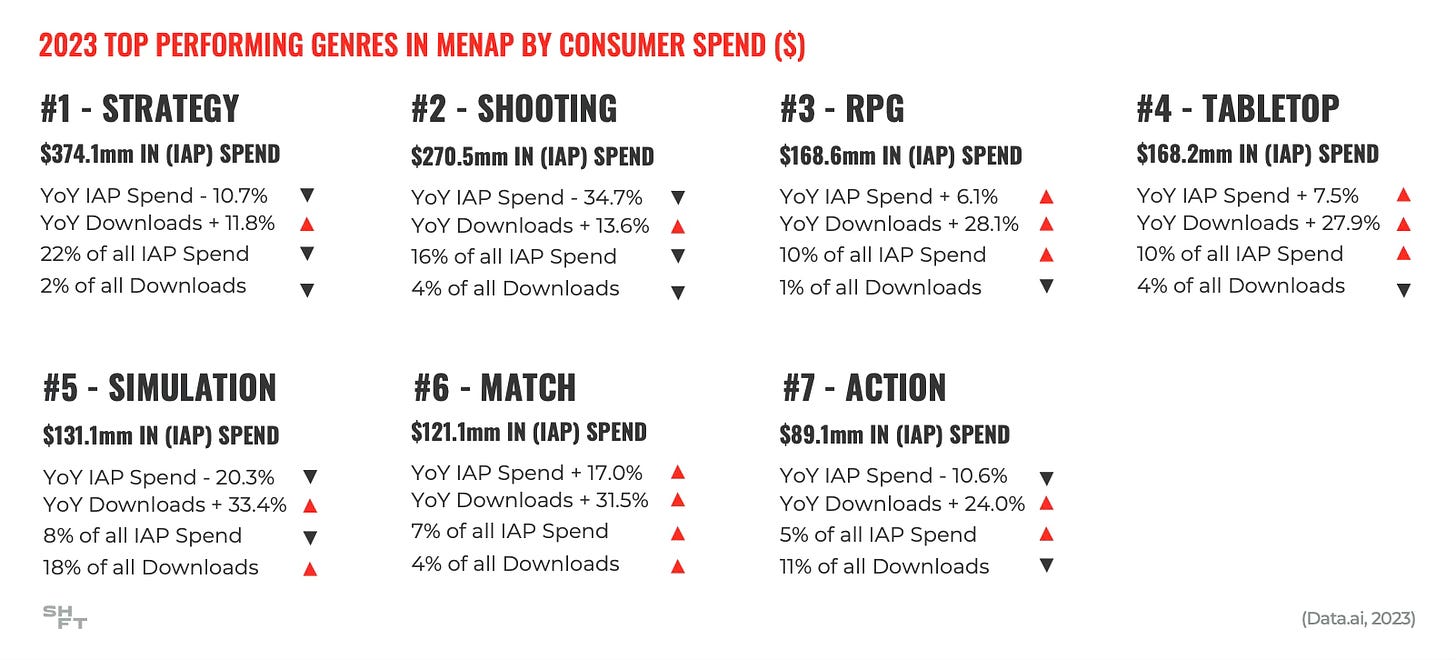

Shorooq Partners: The MENAP market will grow to $2.8 billion by 2026

Newzoo presents market figures; for mobile projects - data.ai. MENAP stands for the Middle East, Africa, and Pakistan markets.

-

As of 2022, the MENAP market was valued at $1.8 billion. By 2026, it is forecasted to reach $2.8 billion. The average annual growth rate is 10%.

-

It is projected that the number of players will also actively increase - from 67.4 million in 2022 to 87.3 million in 2026. This is approximately a 5% annual growth.

-

Strategies ($374.1 million revenue from IAP), shooters ($270.5 million revenue from IAP), and RPGs ($168.6 million revenue from IAP) - are the most popular genres in the MENAP region.

-

In the incubators of the MENAP region over the past year, there were more than 150 gaming companies. They attracted $10 million and earned around $4 million.

-

Out of the 150 startups, 43.2% are gaming studios; 24.8% are developers of Web3 games; 20.8% are creators of gaming software and platforms.

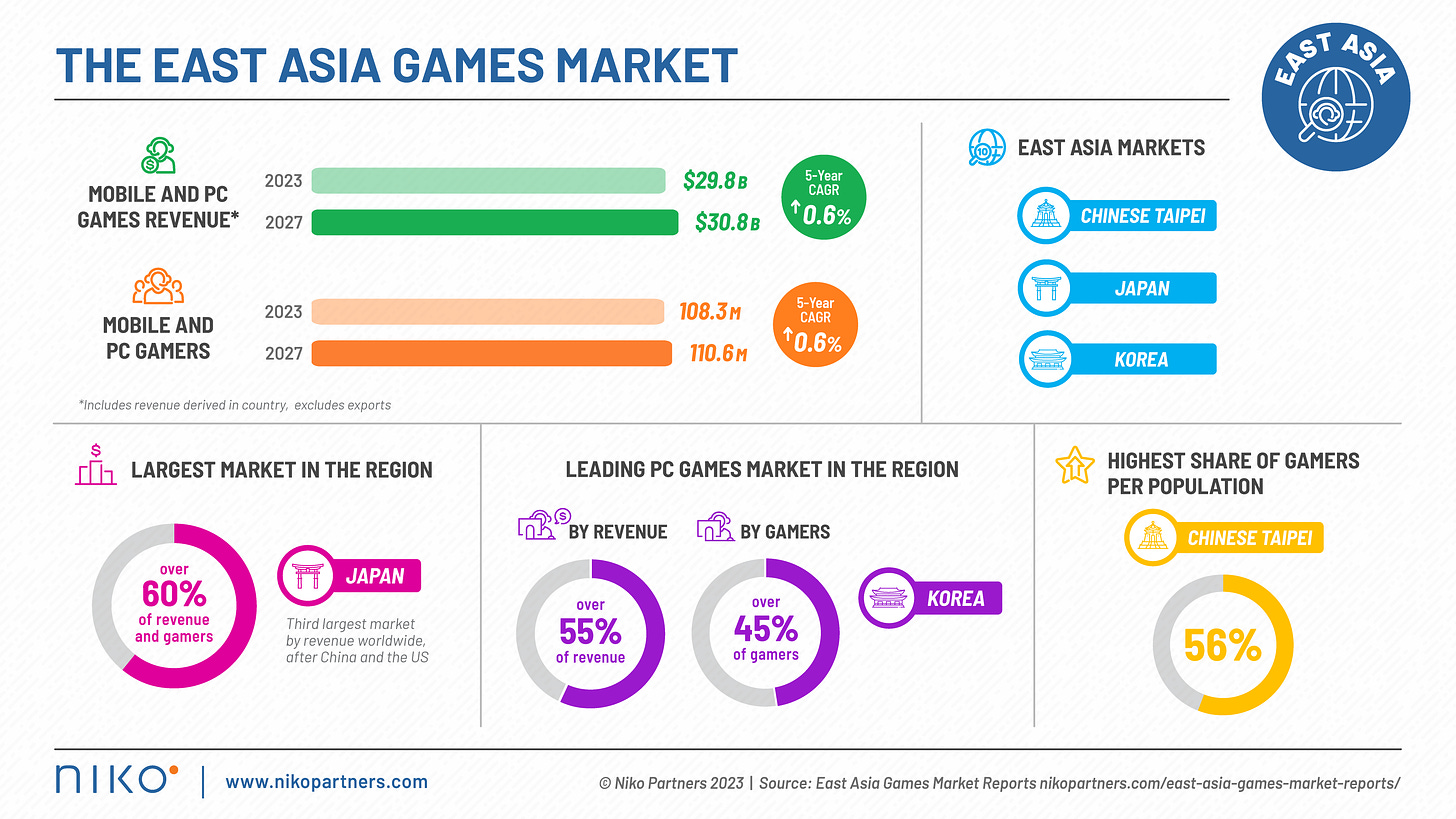

Niko Partners: The markets of South Korea, Japan, and Chinese Taipei will grow to $30.8B by 2027

Current state as of 2023

-

The revenue of the gaming markets in the three countries, referred to as East Asia by Niko Partners, with PC, consoles, and mobile games in 2023 will amount to $29.8B.

-

The number of players this year will reach 108.3 million.

-

Japan is the largest market in the region and the third-largest market in the world after the United States and China. It accounts for 60% of the total revenue and players in the region.

-

Korea is the leader in the PC gaming segment among the three markets. It represents 55% of the total revenue of the segment and 45% of players.

-

42.7% of South Korean PC gamers play in internet cafes.

-

Chinese Taipei has the highest percentage of gamers among the population (compared to Japan and South Korea) - 56%.

Forecasts for 2027

-

In terms of revenue, the markets are expected to grow to $30.8 billion.

-

The audience will increase to 110.6 million people.

-

Both in terms of audience and revenue, growth forecasts are very modest - only 0.6% per year.

-

It is expected that the home console market in Japan will generate more than $3 billion in 2027.

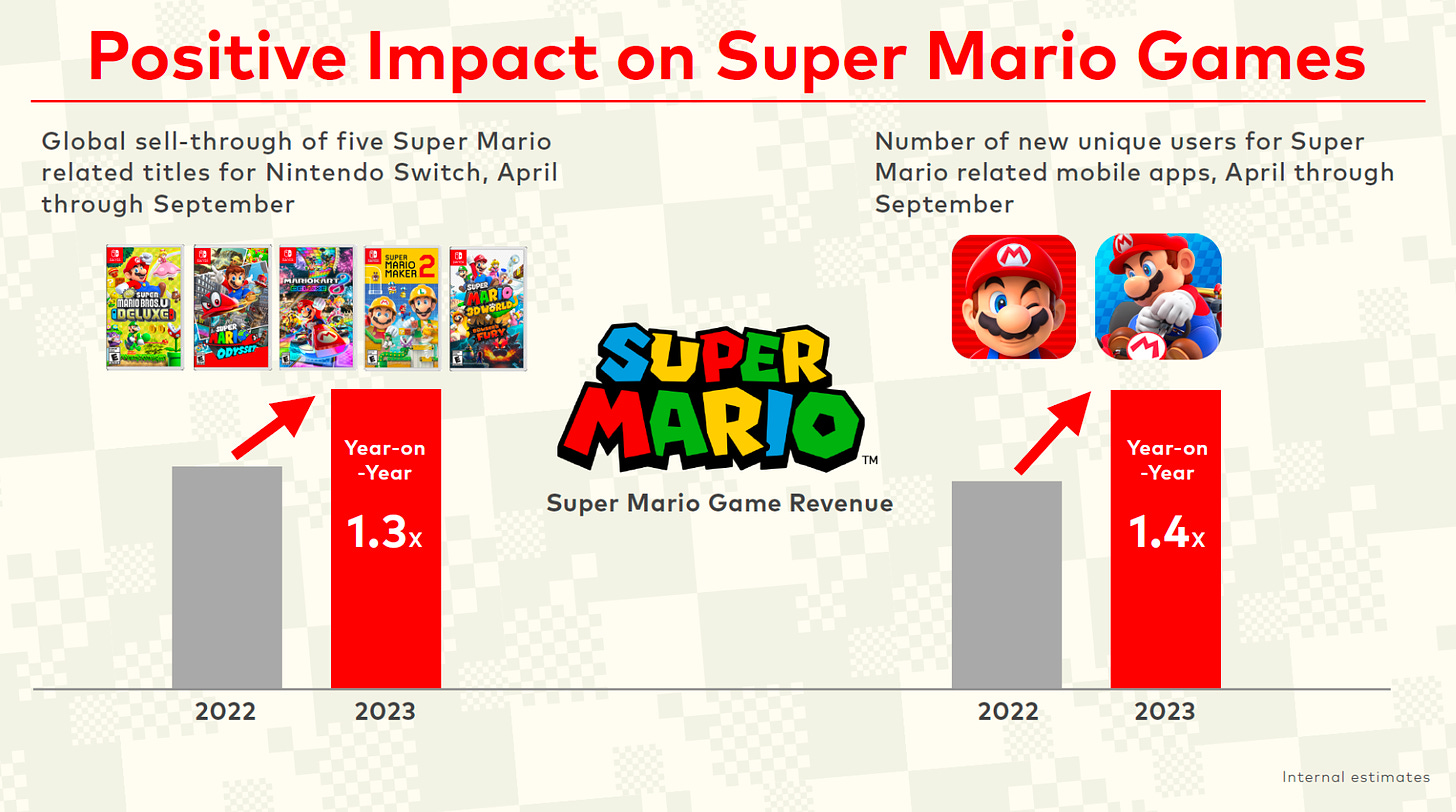

Nintendo FY'24 Q1-Q2 Report: Numbers and Insights

Impact of Intellectual Property (IP)

-

Sales of Mario series games from April to September 2023 increased by 30% compared to the same period in 2022. Mobile device downloads surged by 40%, attributed to the successful release of The Super Mario Bros. Movie.

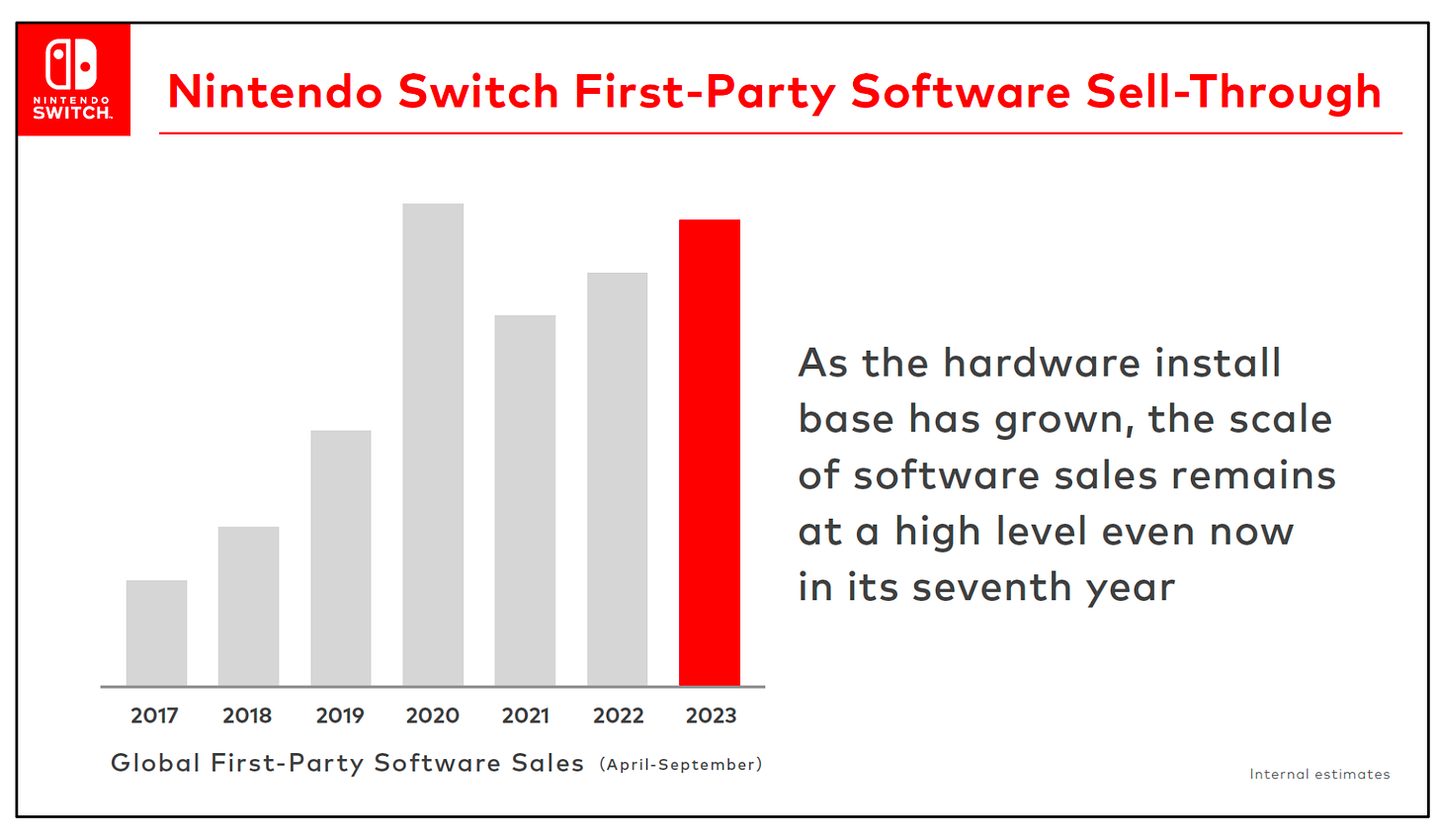

Game Sales

-

Super Mario Bros. Wonder sold 4.3 million copies within two weeks of release, marking the largest launch among all Super Mario games.

-

Pikmin 4, released in July, sold 2.5 million copies as of October 31, 2023, the biggest launch in the series' history in all regions.

-

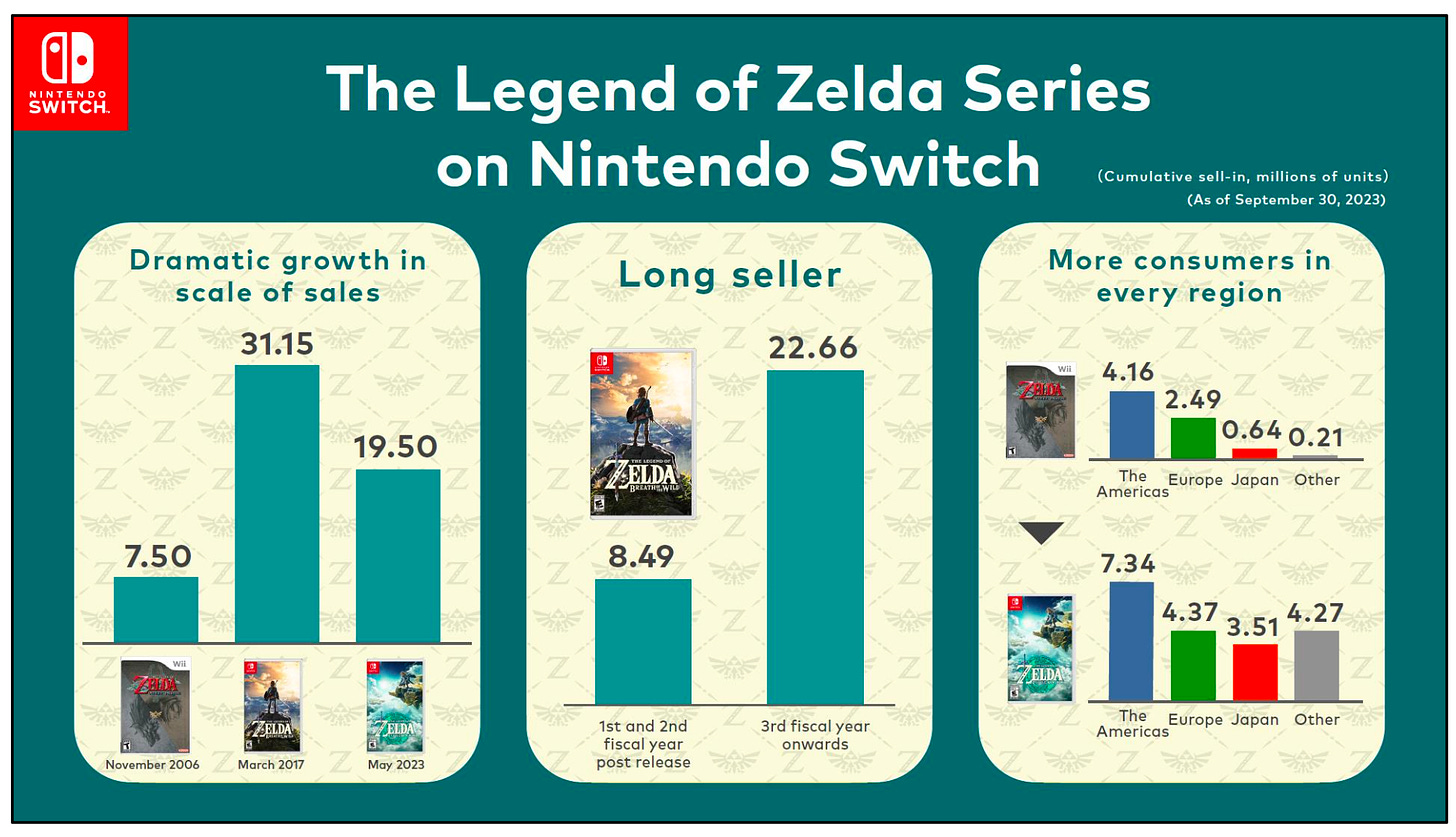

The Legend of Zelda: Tears of the Kingdom exceeded 19.5 million copies in sales.

-

The company sold over 1.133 billion copies of games on the Nintendo Switch.

-

As of September 30, 2023, 132.46 million Nintendo Switch units have been sold.

-

Sales of Nintendo's first-party game lineup have been growing for the third consecutive year and are approaching 2020 levels.

-

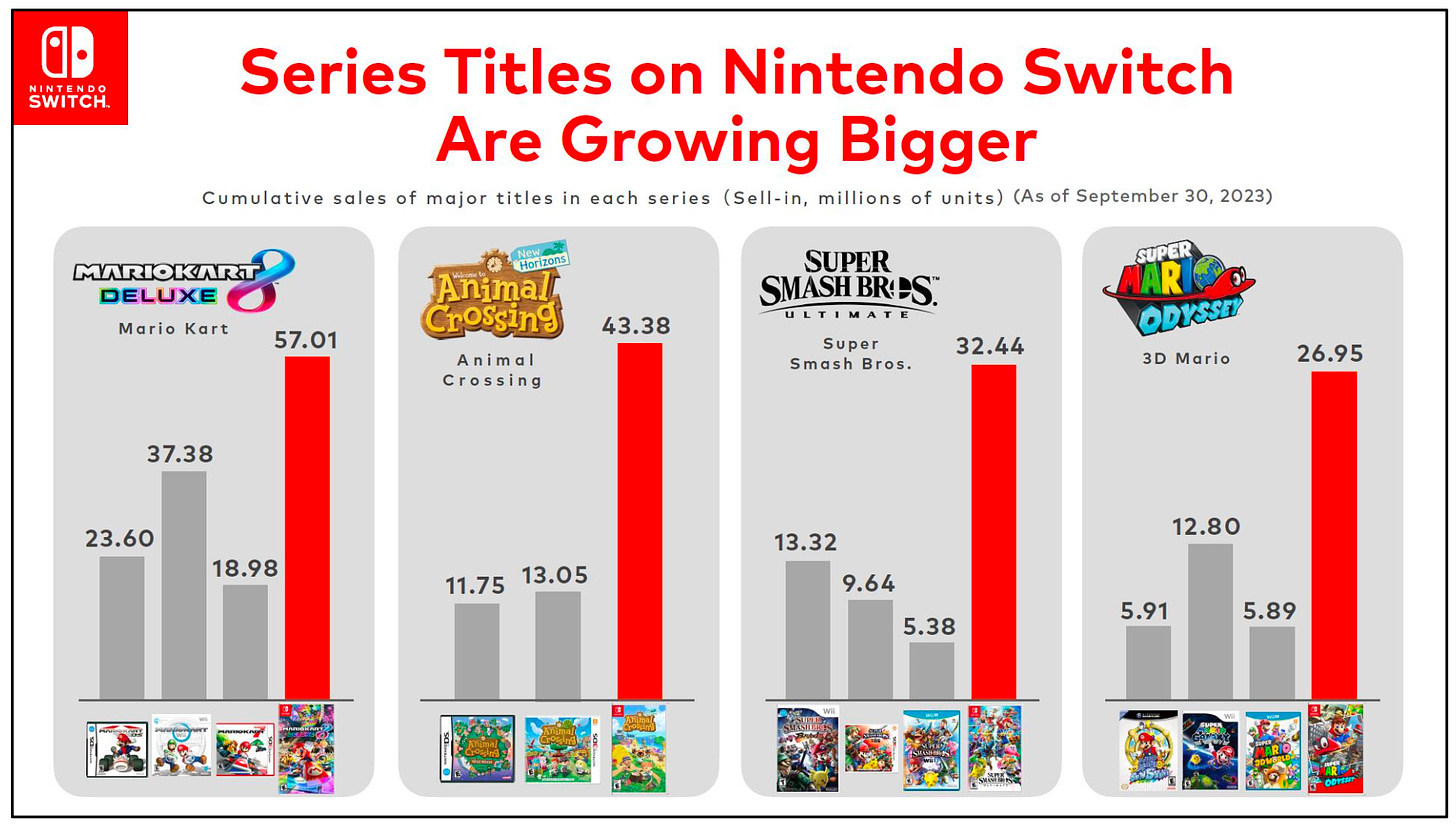

In the Nintendo Switch generation, almost each key Nintendo franchise has seen significant growth in sales.

Long Tail of Sales

-

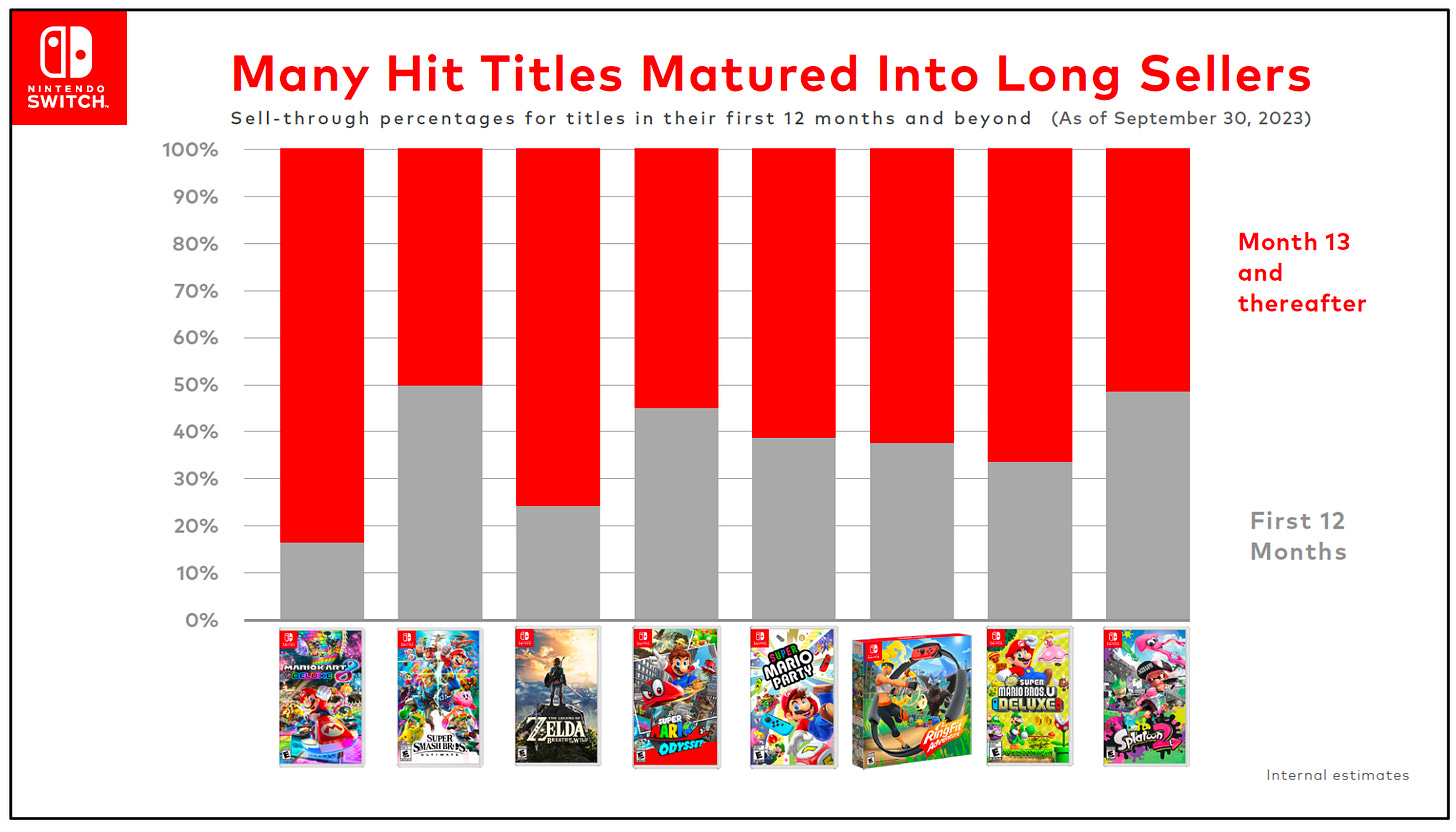

The Legend of Zelda: Breath of the Wild sold 8.49 million copies in the first 2 fiscal years after release. However, total project sales currently stand at 22.66 million, with two-thirds of sales occurring in the third and subsequent years.

-

Most key Nintendo releases earn less than 50% in the first 12 months after launch. All key titles have a very long tail of sales. The best performance among all Nintendo games is Super Mario Kart 8, where only 17% of all sales occurred in the first 12 months.

-

This is a unique situation for the industry, especially for single-player games without a Games as a Service (GAAS) approach. It is commonly believed that the majority of sales occur in the first 3 months after release.

Audience

-

The total number of Nintendo game installations on mobile devices exceeded 860 million.

-

As of September 30, 2023, over 330 million people had a Nintendo Account.

-

Over 38 million people are subscribed to Nintendo Switch Online.

-

The annual audience for Nintendo Switch (from October 2022 to September 2023) is 117 million people.

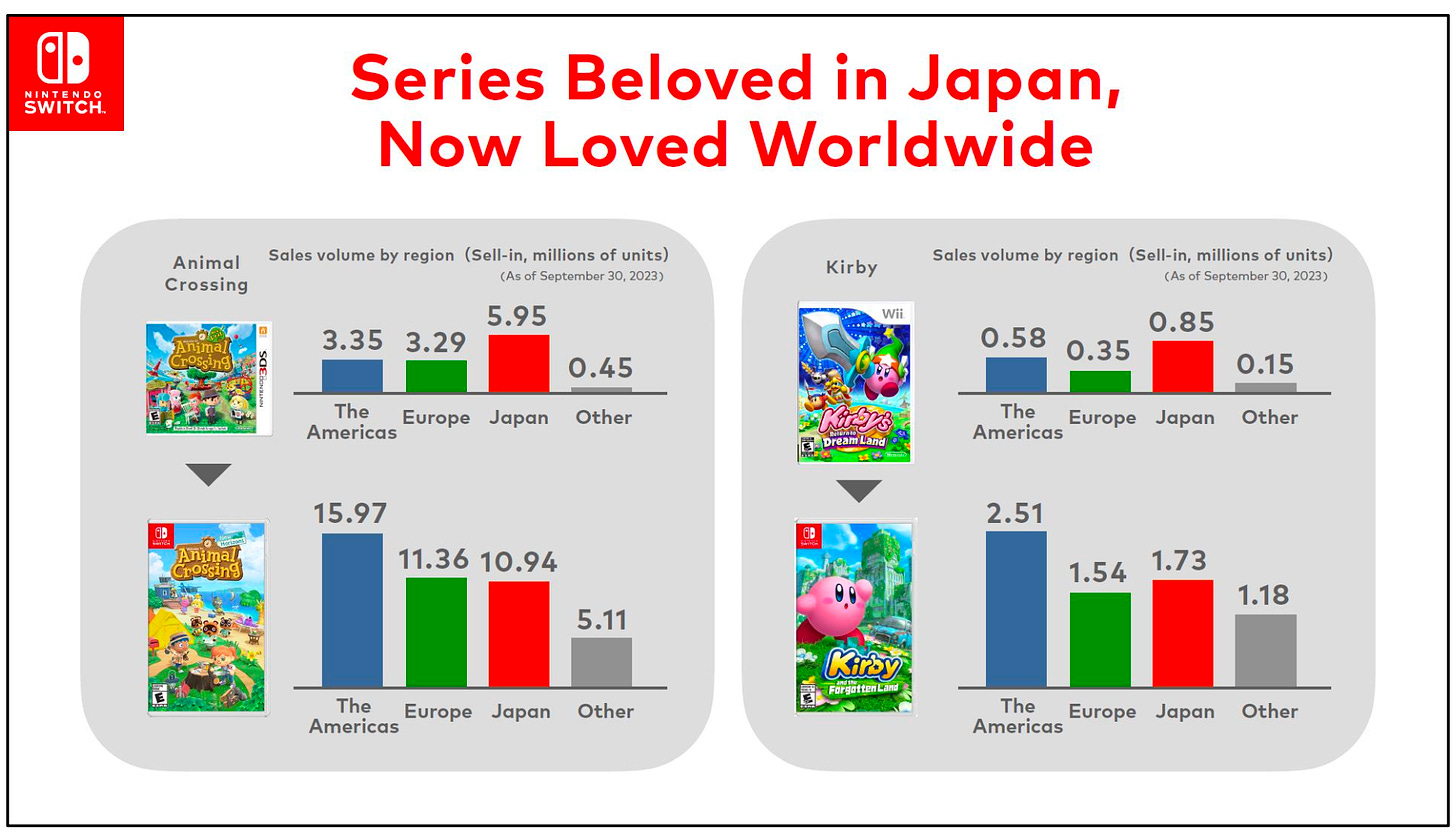

-

Nintendo, with examples like Animal Crossing and Kirby, demonstrates how it has achieved success in the U.S. and Europe. Now, the majority of the audience for Animal Crossing and Kirby and the Forgotten Land is in the West, though a decade ago, the main concentration was in Europe. Sales in the home country have also grown 2-2.5 times.

AppMagic: Top Mobile Games of November 2023 by Revenue and Downloads

AppMagic provides revenue data net of store commissions and taxes.

Revenue

-

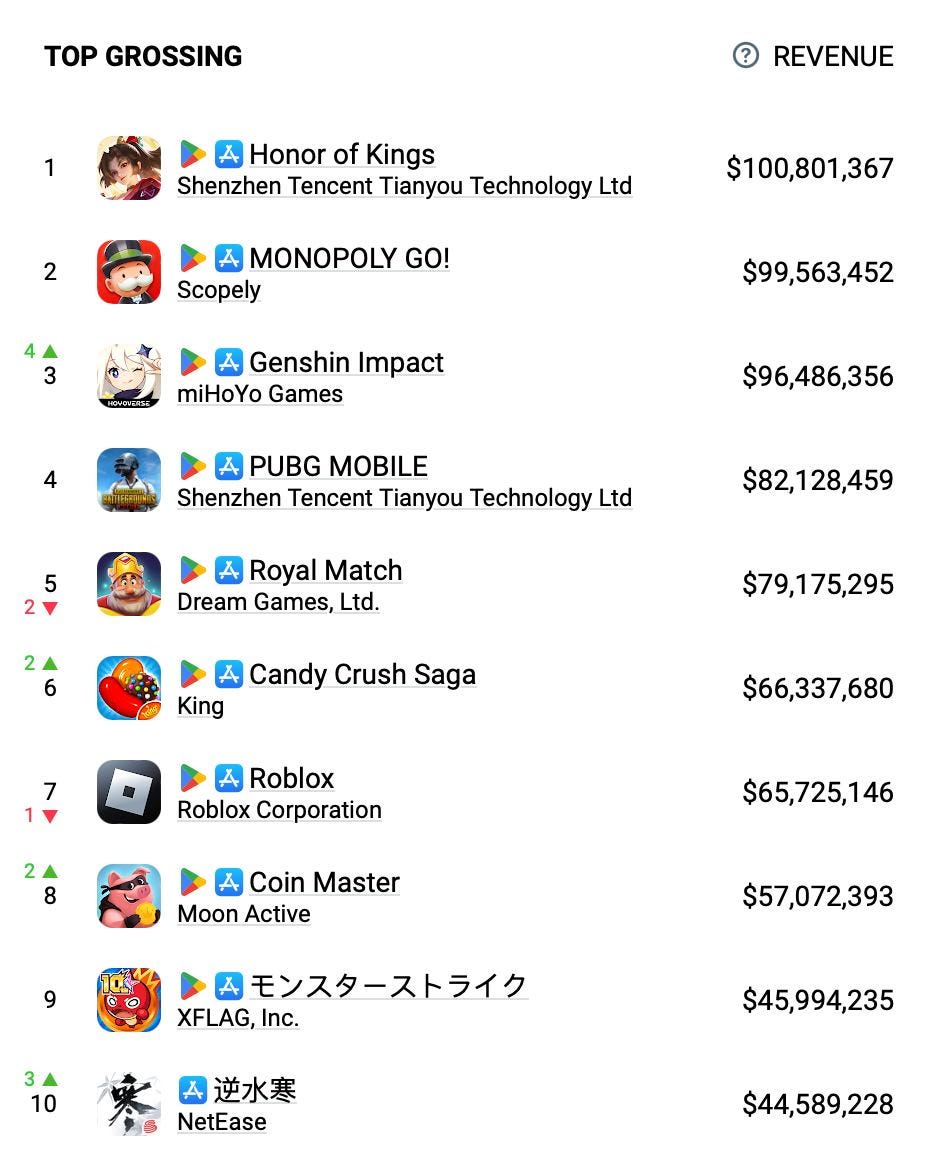

Honor of Kings continues to dominate. In November, the game earned $100.8 million. However, the lead over competitors is not as significant anymore.

-

Monopoly GO! came very close to taking the top spot on the global chart. In November, the game earned $99.5 million. The game continues to set revenue records, and perhaps in December, we may finally see a change in leadership for the first time in a long while.

-

Genshin Impact had an excellent month, climbing 4 positions in the chart, securing the 3rd spot, and earning $96.5 million. The project's revenue has been growing for the fourth consecutive month after a setback in May (related to the release of Honkai: Star Rail).

-

Justice Online returned to the top 10 again. The NetEase MMORPG earned $44.6 million in November.

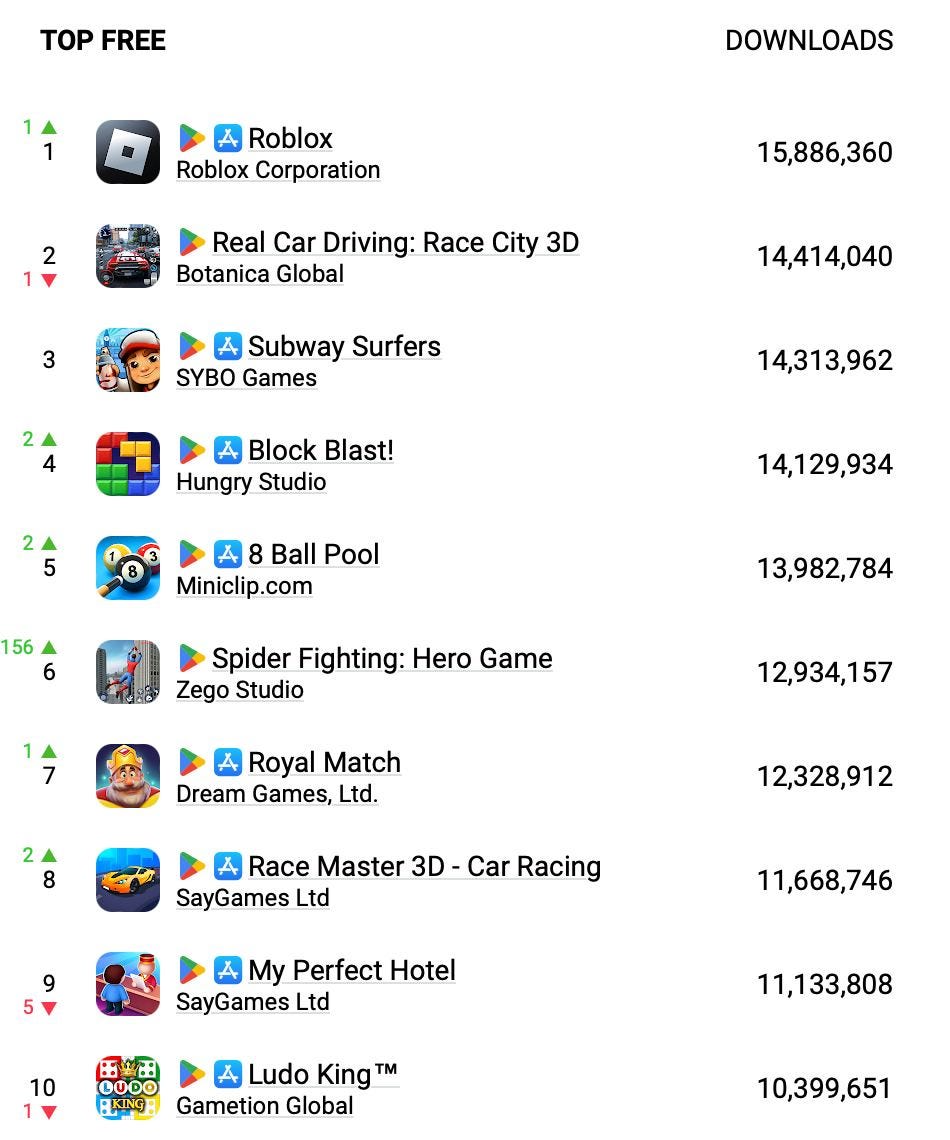

Downloads

-

There are a few changes in the download charts. Roblox is in first place with 15.9 million downloads.

-

Real Car Driving: Race City 3D (14.4 million downloads) is second, and the evergreen Subway Surfers (14.3 million) is in third place.

-

The only new game at the top is Spider Fighting: Hero Game. Inspired by Marvel's Spider-Man 2, developers released a mobile game based on it. You can swing on the web and beat villains. The concept was well-received by people - 12.9 million downloads.

Apptica & Gamelight: The Mobile Market in Q3 2023

The companies also highlighted how much time users spend in games of various genres. Data was collected from 37 countries from July to September 2023.

Downloads - Worldwide

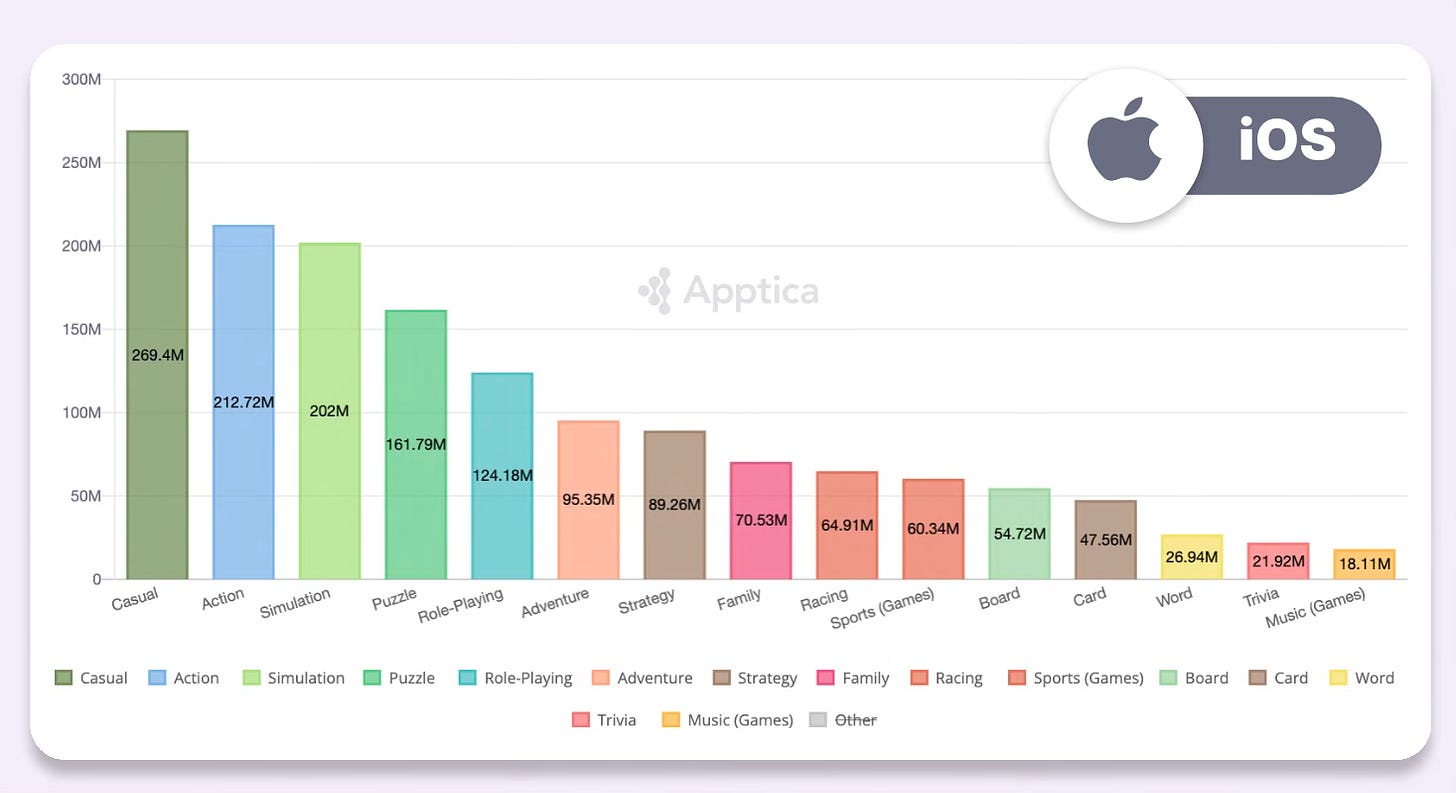

iOS

-

In the third quarter, iOS users downloaded 1.54 billion games in total, constituting 20.4% of all downloads on the platform. This represents a 14.4% decrease from the previous year.

-

The most popular categories for downloads on iOS are casual games (269.4 million), action games (212.72 million), and simulators (202 million).

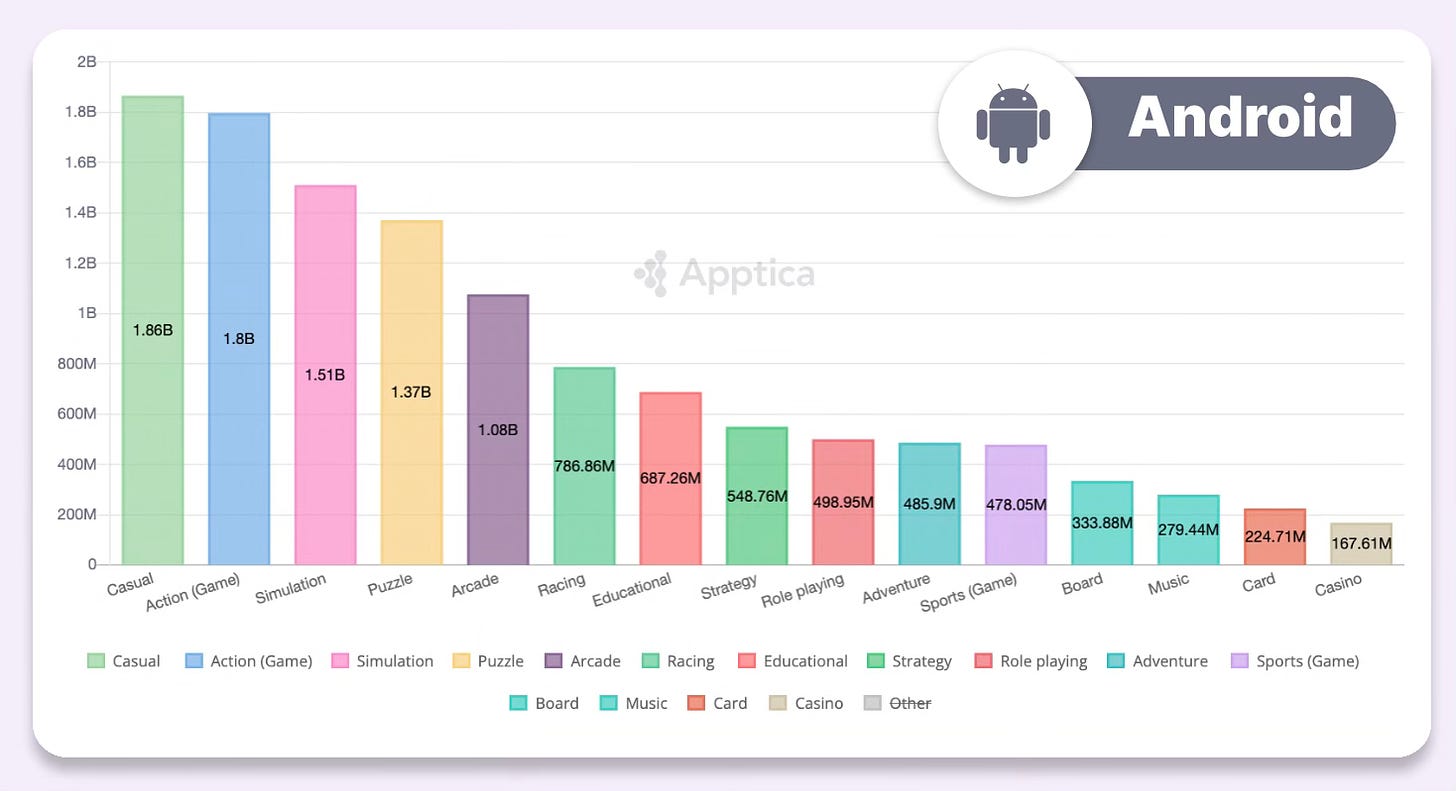

Android

-

In the third quarter, Android users downloaded 12.36 billion games, which is 30.5% of all downloads on the platform. This reflects a 6.8% decrease compared to the third quarter of 2022.

Revenue - Worldwide

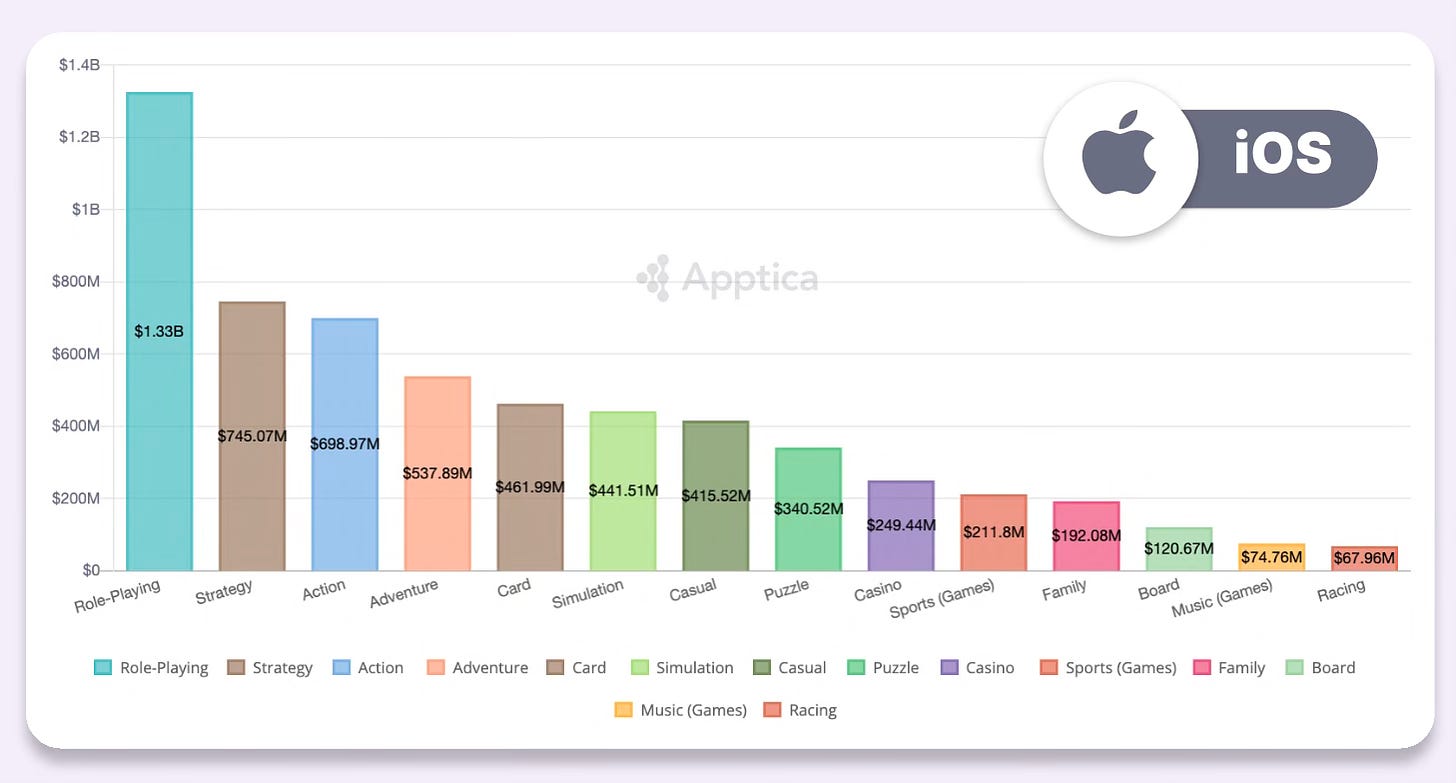

iOS

-

iOS games earned $5.91 billion in the third quarter, excluding advertising.

-

The most profitable genres on iOS are RPG ($1.33 billion), strategy ($745 million), and action ($698.97 million).

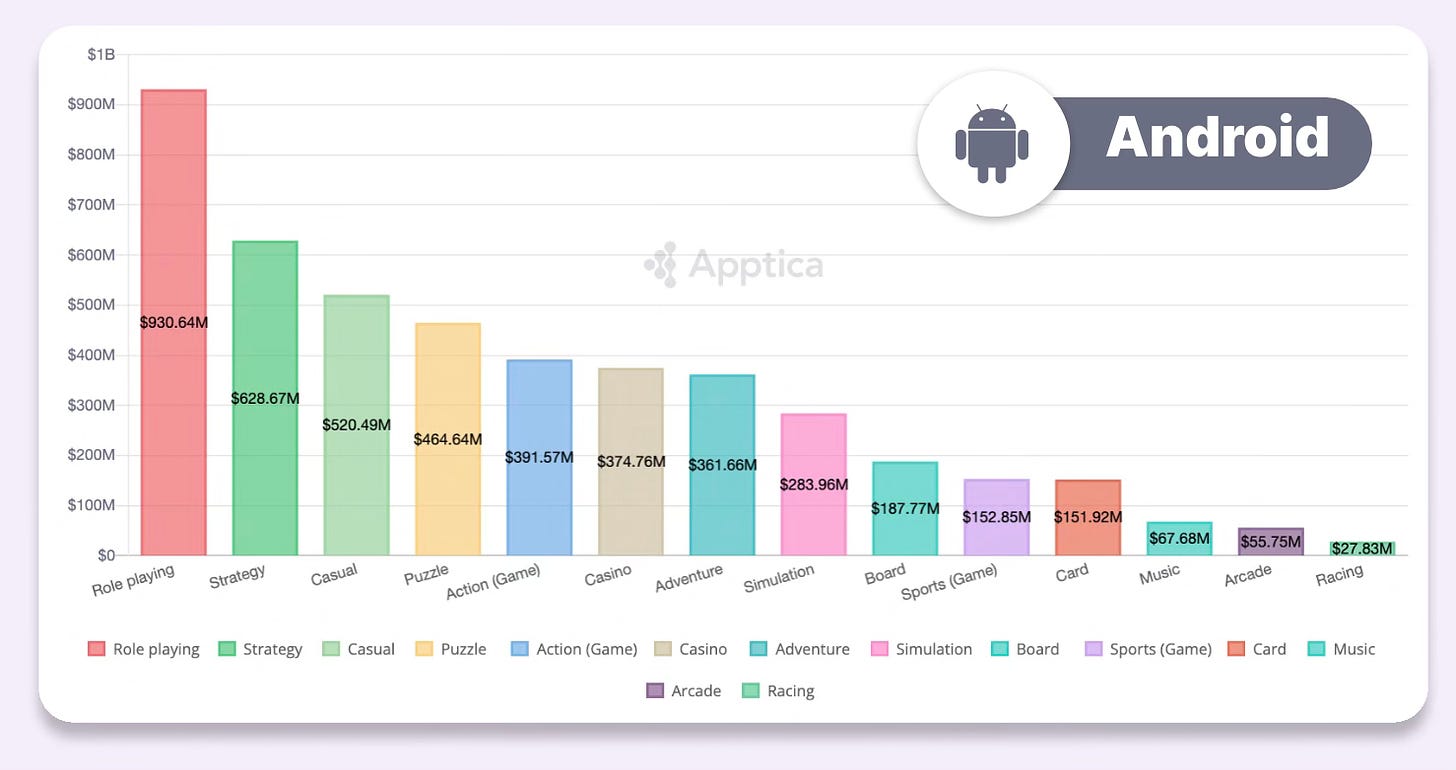

Android

-

Android players spent $4.64 billion on games in the third quarter.

-

They spent the most on RPGs ($930.64 million), followed by strategies ($628.67 million) and casual projects ($520.49 million).

-

Despite significantly fewer users, iOS continues to outpace Android in revenue, with a market share of 56.01% compared to 43.99% for Android.

Engagement Data

-

On average, iOS players spend more time (38.69 minutes per day) than Android users (32.17 minutes per day). This refers only to countries participating in the report: the United States, France, Germany, the United Kingdom, Japan, and South Korea.

-

Candy Crush Saga has the highest playtime in all six countries above.

-

Card, word, and board games have the highest playtime in the United States on Android. On iOS, the leaders are action games, adventure games, and board projects.

-

Interestingly, in Japan, RPGs did not even make it to the top three in terms of how much time users spend on them per day. On iOS, card games, casual games, and word games lead. On Android, instead of card games, adaptations of board games take the lead.

Supercell: "We need to make our games f*ing famous, and become part of pop culture."

At RovioCon'23, Ivo Zakowski, the new marketing director of Supercell, spoke. Ivo previously led global marketing at Burger King. He mentioned the beautiful phrase above and also shared some numbers.

-

In Supercell's games, there are over 200 million Monthly Active Users (MAU). However, Ivo notes that the recognition of characters is low compared to Sonic, Angry Birds, or Mario.

-

68% of Clash of Clans users came through word of mouth. Only 15% learned about the game from ads.

-

The collaboration with Chess.com brought Clash Royale over 1 million Daily Active Users (DAU). In September, this figure increased from 13 million to just over 14 million.

Take-Two Interactive Software: Sales of the GTA series have exceeded 410M copies

The company shared key figures for the GTA series in the November report to investors. Today, Rockstar unveiled the first trailer for GTA VI.

-

Sales of all parts of the GTA series have surpassed 410 million copies. This is one of the most successful series in history, both financially and regarding audience and critic ratings.

-

Sales of GTA V have exceeded 190 million copies. The game became the fastest in industry history to surpass retail's $1 billion revenue mark. It is also the best-selling game in the United States over the past 10 years.

-

The debut trailer for GTA VI was viewed more than 38 million times within the first 6 hours, solely on Rockstar's official channel.

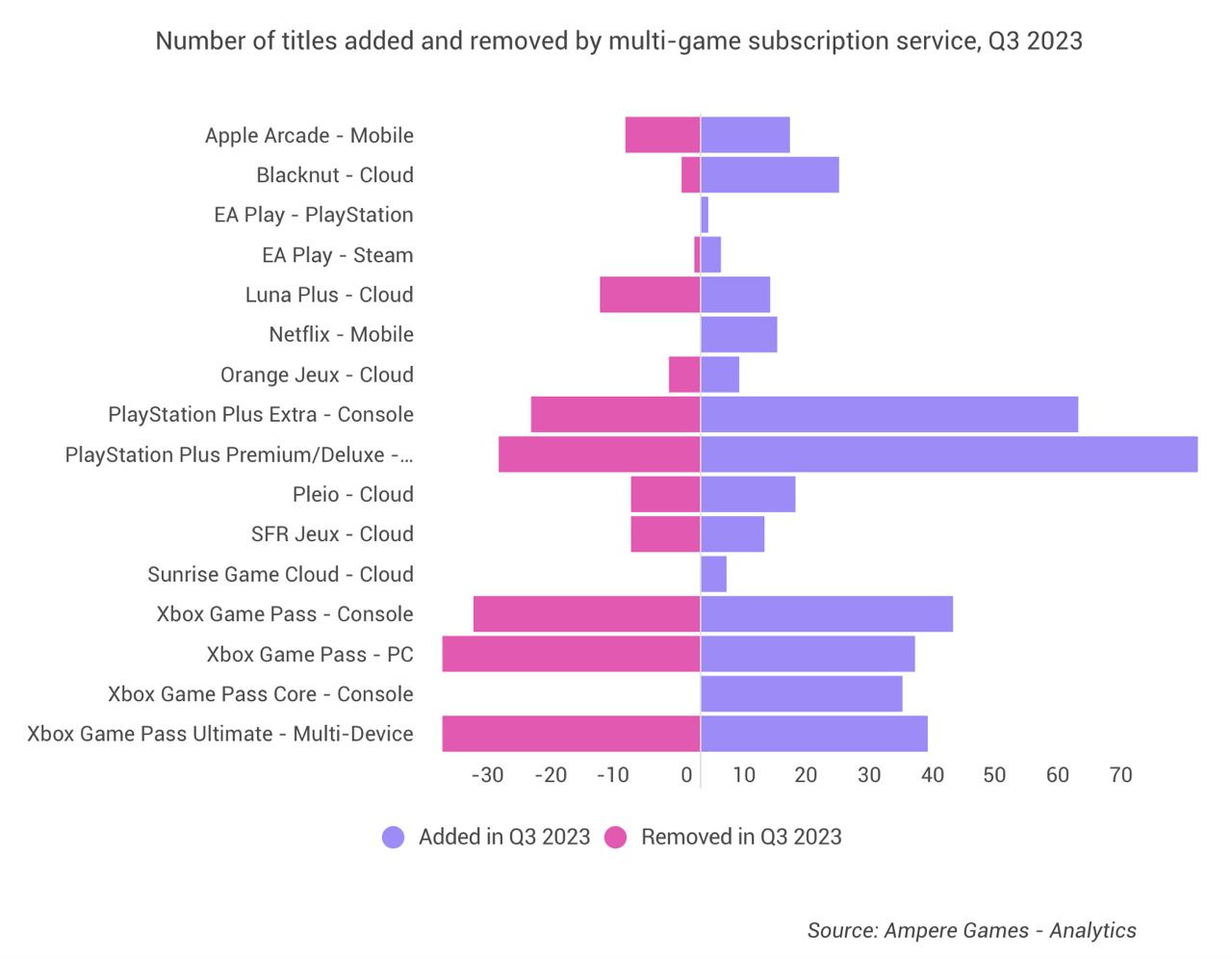

Ampere Analysis: Gaming subscription services in the Q3'23

-

In total, 349 games were added to gaming services in the third quarter of 2023, while 236 projects from subscription services were removed.

-

Microsoft introduced the Xbox Game Pass Core subscription, replacing Xbox Live Gold.

-

The launch of Starfield had a positive impact on Xbox Game Pass sales. On the release day, the highest daily number of initial subscription purchases since 2020 was recorded.

-

The highest number of games in the third quarter was added to PlayStation Plus Premium/Deluxe - 79 projects. For Xbox Game Pass, depending on the subscription version, there were between 32 and 40 games.

-

Netflix added 12 new games from July to September. During the same period, Apple Arcade saw the introduction of 14 new projects.

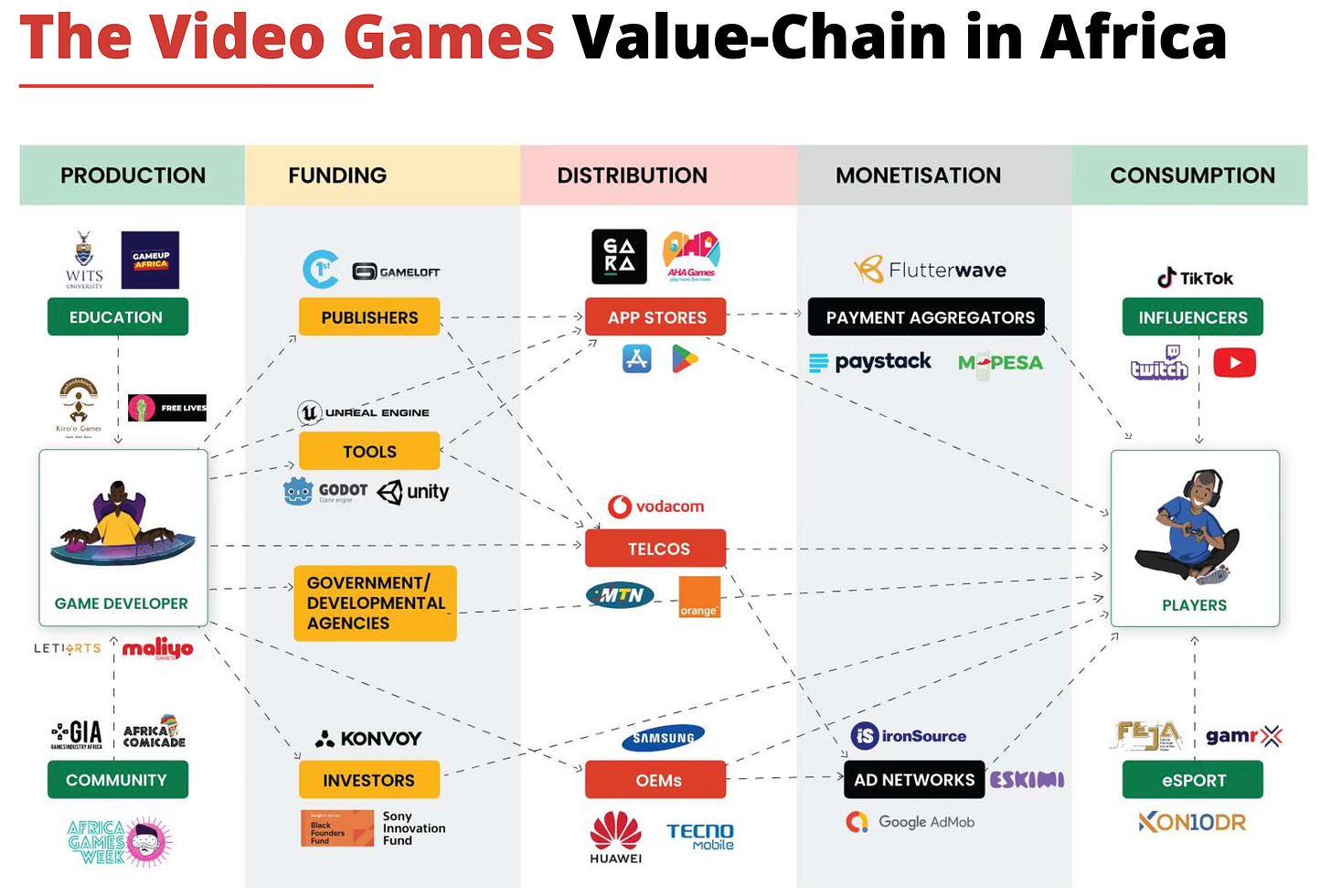

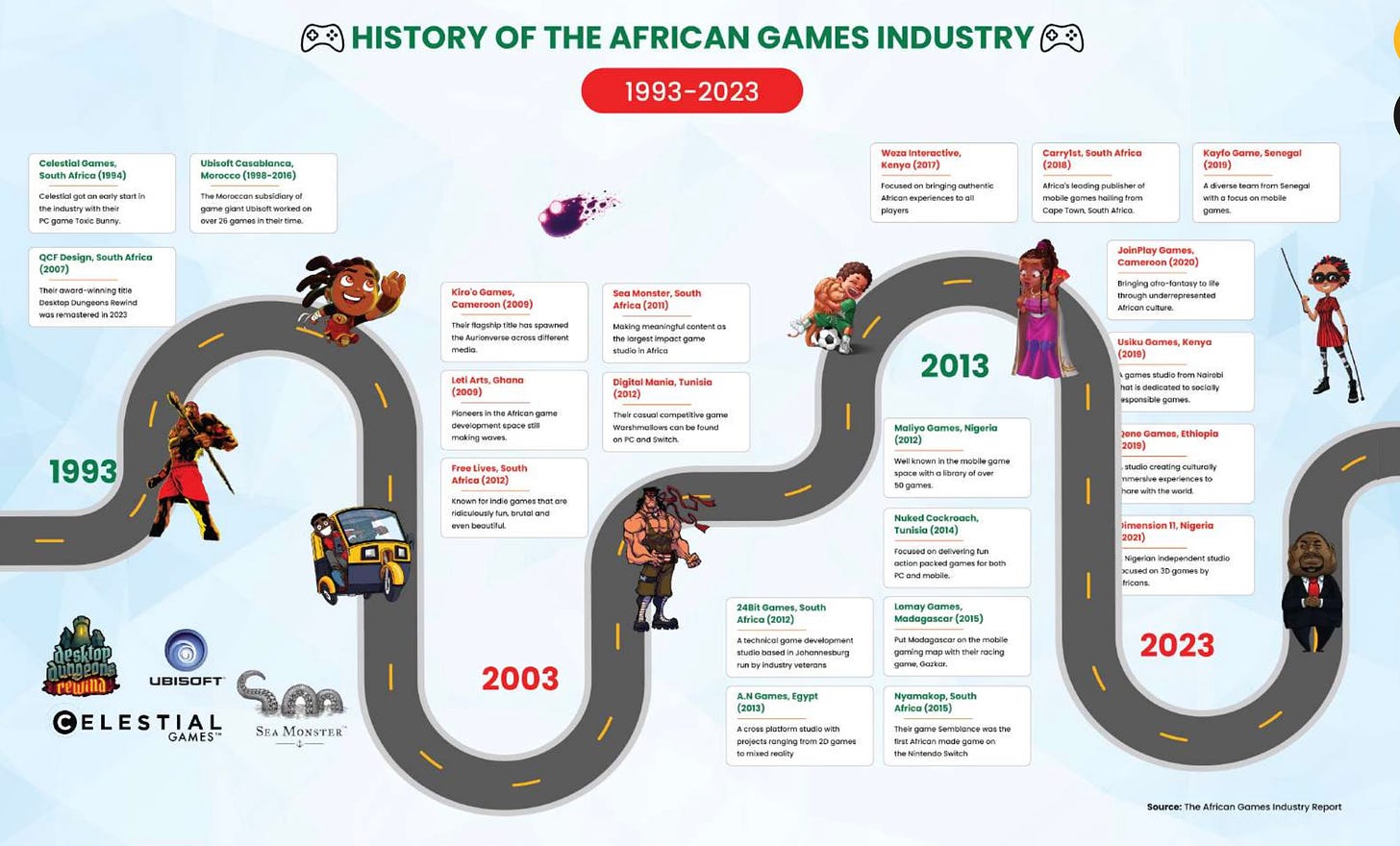

Maliyo Games: The State of the African game industry (2024)

-

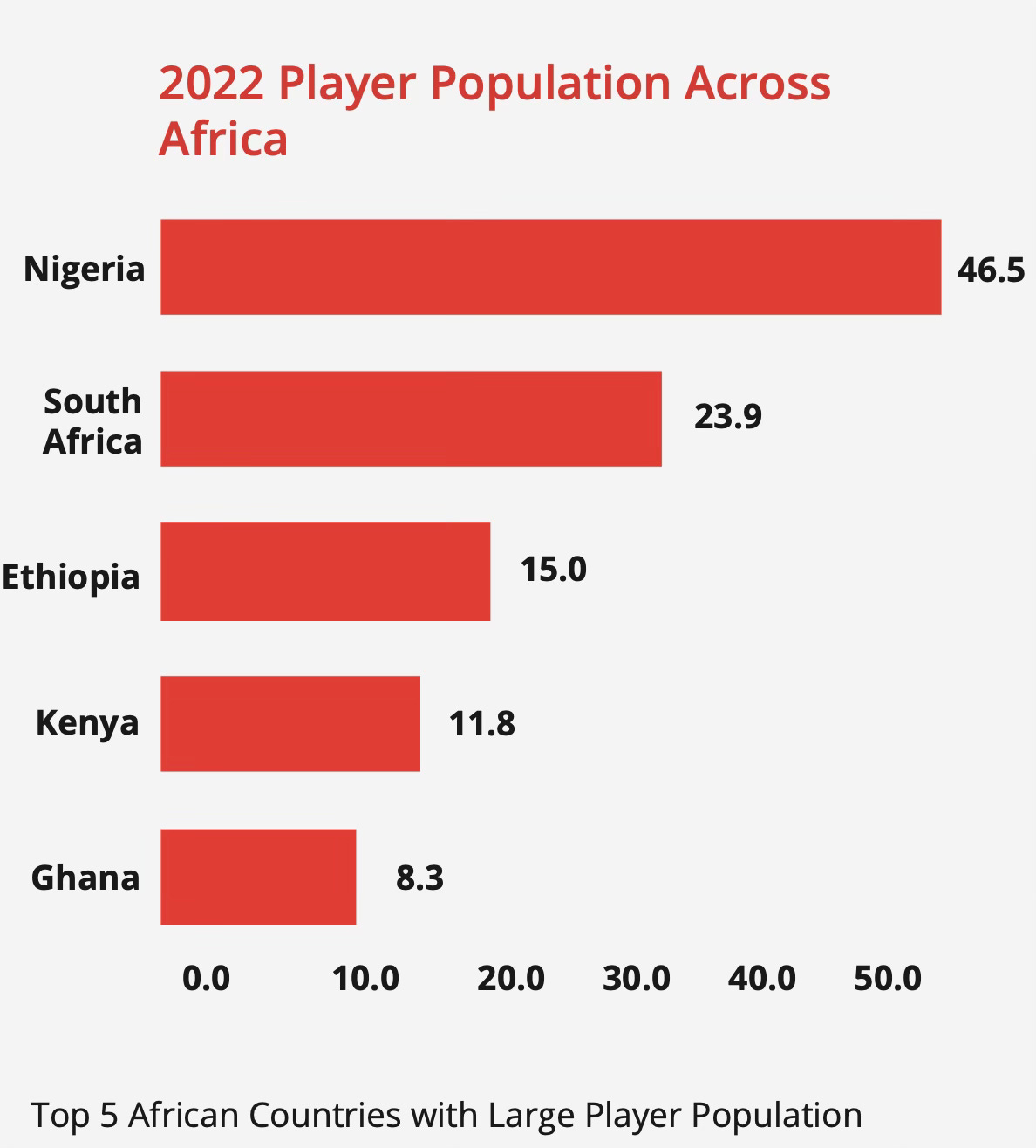

As of the end of 2022, Africa had over 287 million internet users. By 2030, this number is expected to grow to 438 million (with mobile device penetration reaching 32%).

-

The median age of the population in African countries is 19.7 years, compared to the global median age of 30.4 years. Africa is one of the "youngest" regions in the world.

-

On average, African gamers spend $6 per year on games. The spending leader is South Africa (around $12 per person per year), while residents of Nigeria, Ghana, Kenya, and Ethiopia spend between $2 and $5 per year.

-

The South African gaming market had a volume of $289.5 million in 2022, followed by Nigeria ($184.6 million), Ghana ($41.7 million), Kenya ($38.1 million), and Ethiopia ($35.2 million).

-

Africa is a mobile-centric region, with all revenue coming from this platform. Digital Virgo predicts an average annual growth of 13.11% from 2022 to 2025.

-

Carry1st is the largest African gaming company, having raised $27 million in a pre-Series B round to develop and publish games in the country. Bitkraft Ventures, a16z, Konvoy, and other well-known companies have invested in it.

-

In Africa, Sony Ventures, Google, and Xbox GameCamp operate, along with smaller hubs supporting developers. The main focus of major players in the market is not to miss the active growth of the market (if it occurs) or a new promising company.

African Developers

-

64% of developers in Africa work with Unity, 14% with Unreal Engine, and 8% choose Godot. 3% develop games using their own engines.

-

78% of African developers create games for mobile devices, and 70% for PC, mainly focusing on cross-platform releases. Only 17% of developers plan to release games on consoles.

-

Only 36% of African developers make money from creating games; others do it as a hobby.

-

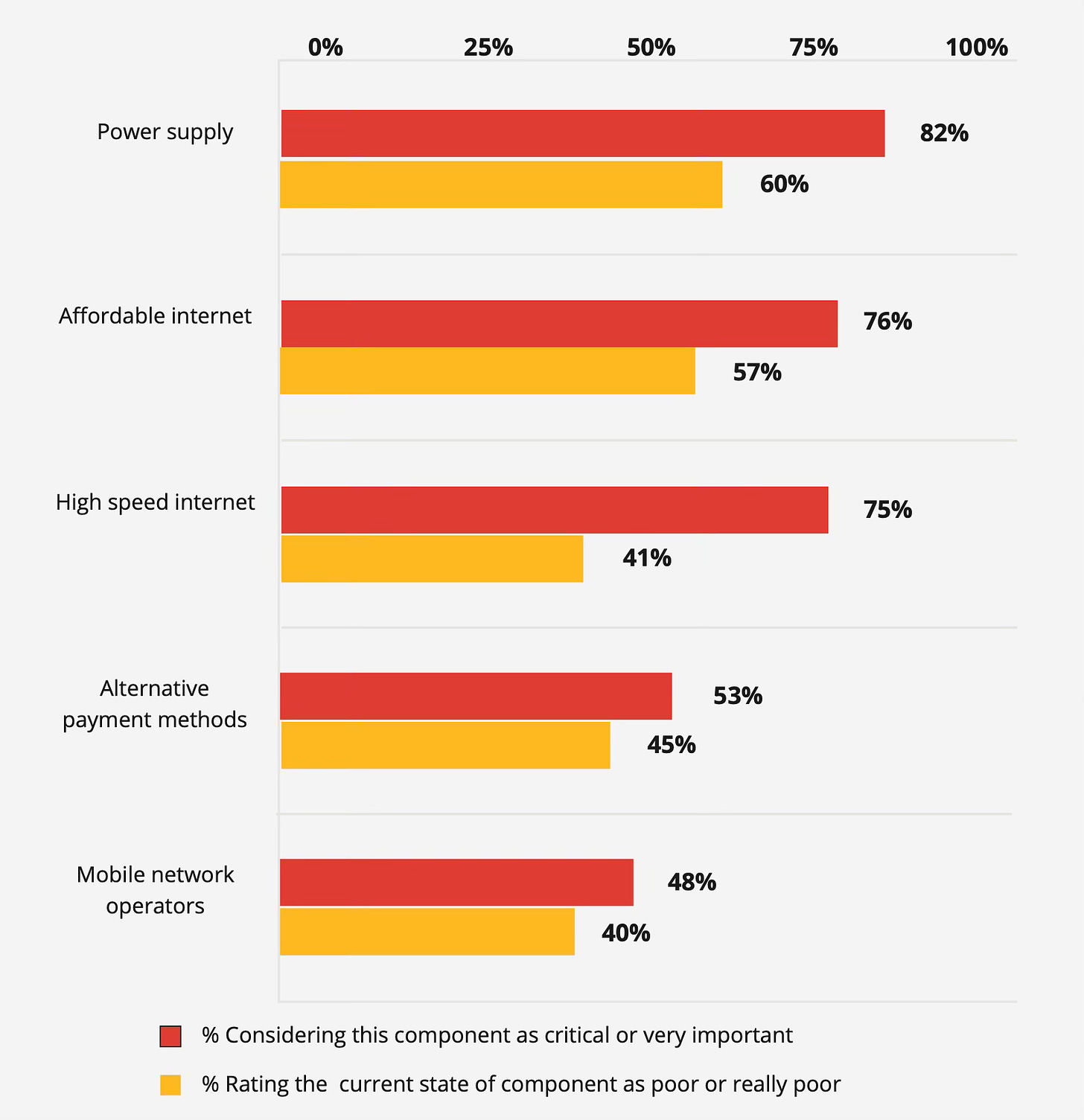

For 82% of African developers, an uninterrupted power supply is critically important. 76% noted that they need fast and accessible internet. What about your complaints?

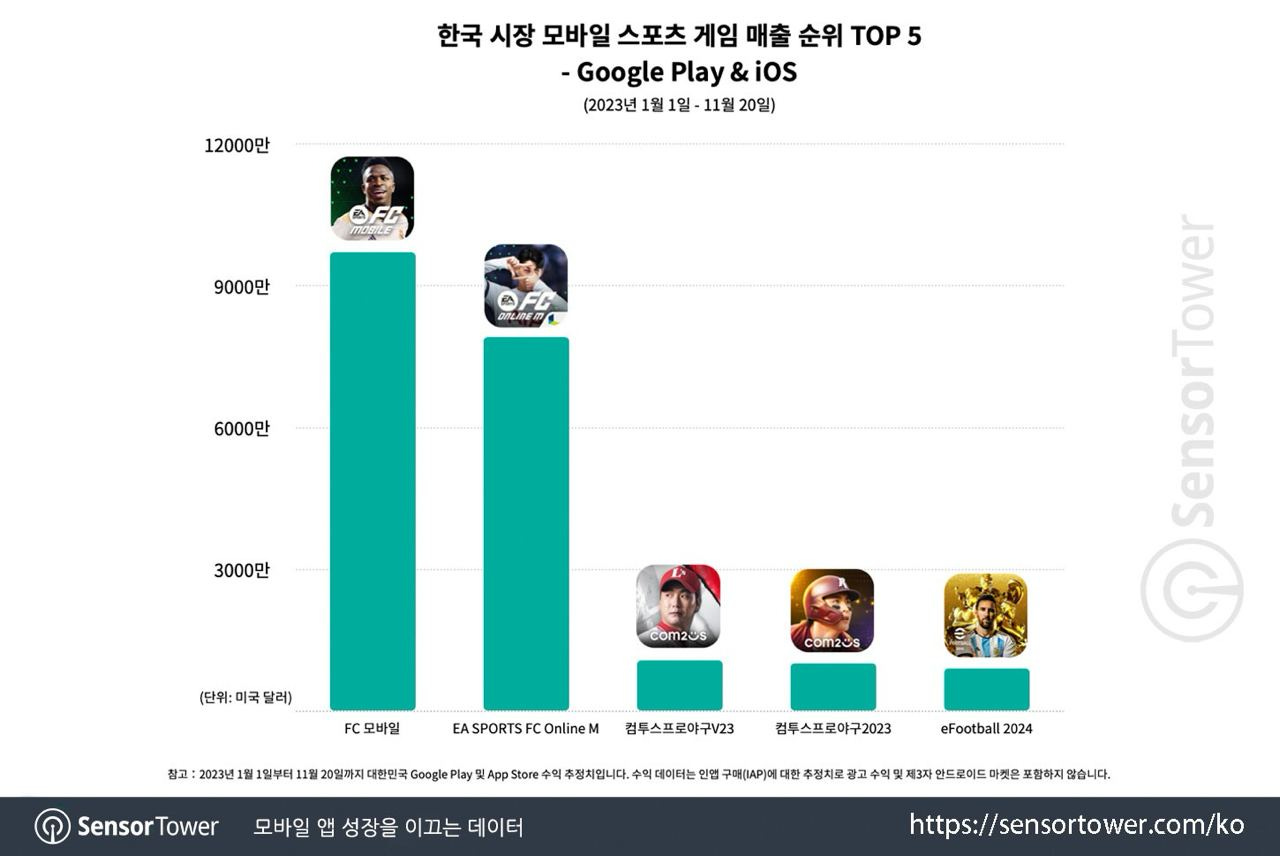

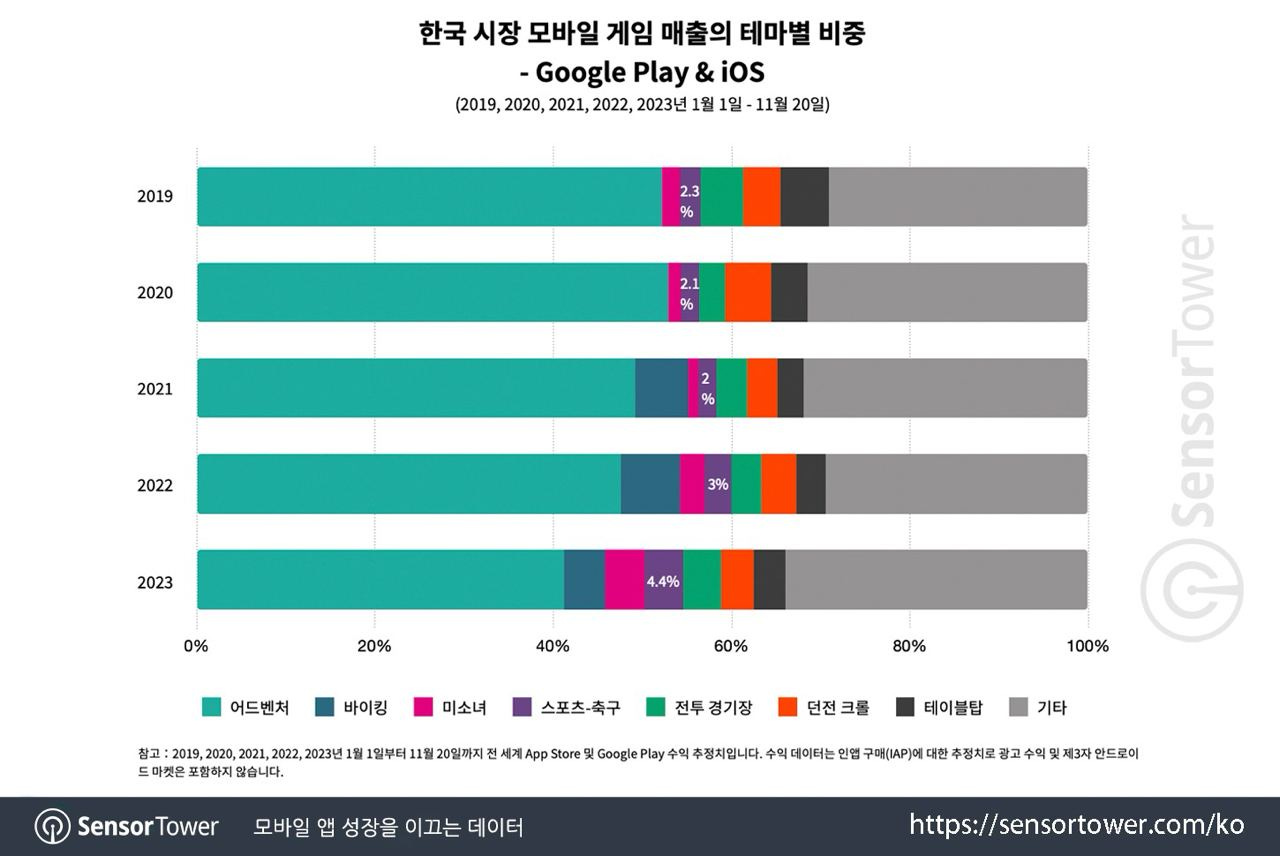

Sensor Tower: South Korean Mobile Market Surpasses China and the USA in the Popularity of Football Games

-

Mobile football games in South Korea account for 4.4% of the total revenue. Over the past year, their share has increased by 50%.

-

EA Sports FC Online M earned $440 million worldwide, with 91.7% of this revenue coming from South Korea. It is worth noting that EA Sports initially positioned the game for Asian countries.

-

As for the global EA Sports FC Mobile (formerly FIFA Mobile), which earned $1.3 billion, as of April 2023, it had 15.9% of its revenue from South Korea. China accounted for 24.7%, and the USA accounted for 15.1%.

-

The total revenue of EA Sports' mobile games in South Korea reached $94 million this year. This surpasses the market figures for China (considering only iOS) and the USA.

Story: The first paid mount in WoW earned more than StarCraft II: Wings of Liberty

-

The information was shared by Jason Thor Hall, the founder of Pirate Software Studio. At Blizzard Entertainment, he worked on the project's infrastructure security.

-

The first paid mount in WoW was called Celestial Steed and was initially sold for $25. Later, the price was reduced to $15.

-

In 2010, Blizzard Entertainment reported that a queue of 140,000 people had formed to purchase Celestial Steed. The amount brought the company $3.5 million in the first three hours of sales. The limited number of mounts at the start (codes were not generated automatically) contributed to this.

-

In 2010, World of Warcraft had 12 million active subscribers.

-

The total sales of StarCraft II: Wings of Liberty exceeded 6 million.

If we do a rough calculation and estimate that the average price of StarCraft II: Wings of Liberty was around $25 (taking into account sales), the game earned about $150 million. For the WoW mount to surpass the game in sales, it would need to be sold in a quantity of 8.5 million at an average price of $17.5 (which in reality will be lower due to the various discounts).

The story is certainly interesting but seems a little unrealistic. Perhaps Jason embellished the picture a bit to get a viral headline.

Ultra & Atomik Research: How PC Gamers Discover and Purchase Games

Сompanies surveyed 2,000 PC gamers from the United States and the United Kingdom.

Impact of Prices

-

75% of PC gamers consider prices for AAA projects to be too expensive.

-

87% of respondents note that discounts play a significant role in their decision to make a purchase.

-

Only 36% of players buy digital versions of PC games at full price. The rest prefer to wait for discounts, bundles, or get the game for free.

Indie Games

-

75% of PC gamers purchase indie projects. The main reason people choose them is the creativity of such games.

-

Among the popular reasons users avoid such games are a lack of confidence in their interestingness (41%), lack of time (32%), a preference for large franchises (17%), or simply an inability to find good projects (17%).

How users discover new games

-

36% of respondents find it difficult to discover new games.

-

YouTube (38%), recommendations from friends (34%), and features on Steam (18%) are among the main channels for informing players about new releases.

data.ai: What awaits mobile games in 2024

-

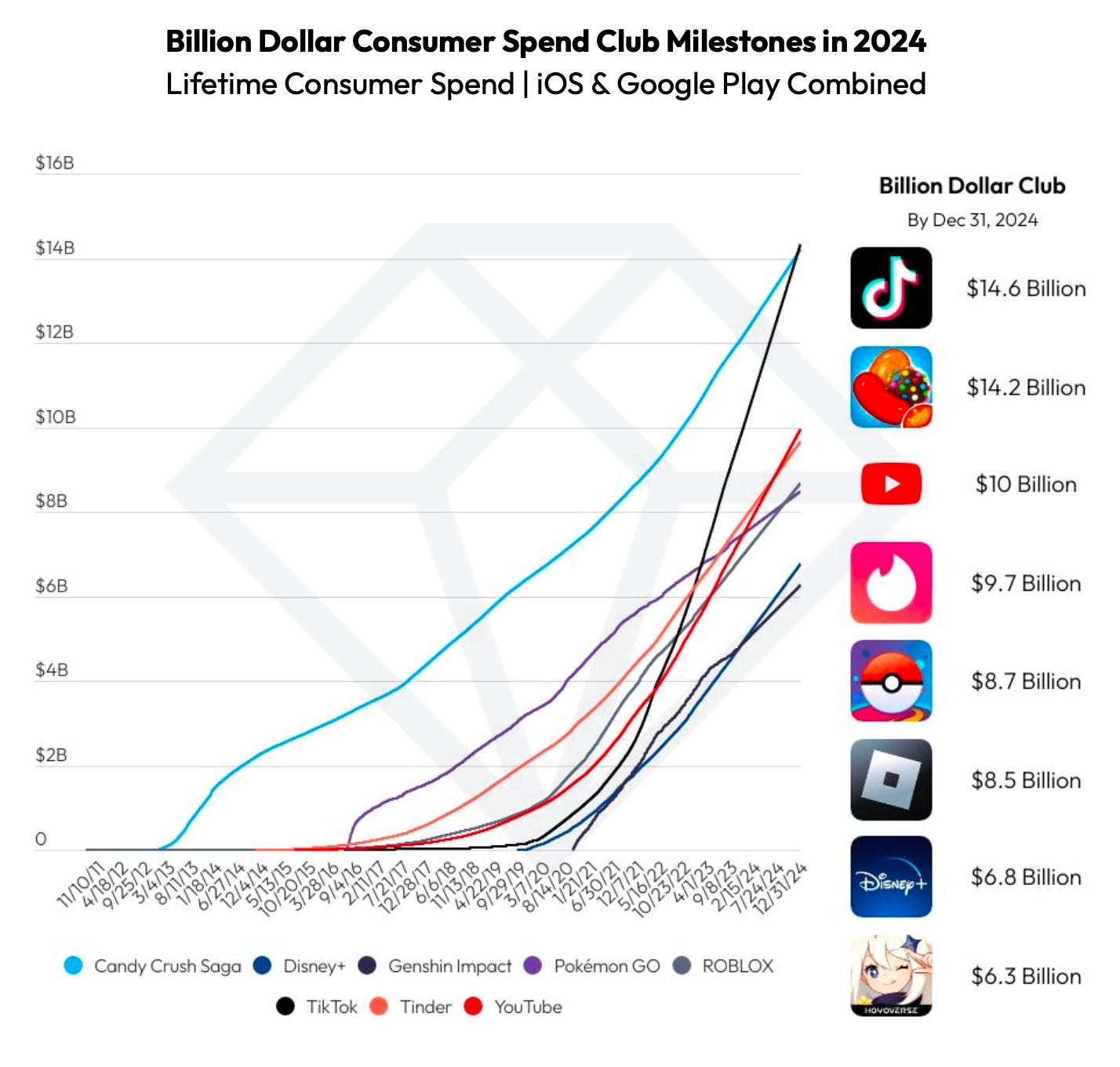

TikTok will become the highest-earning application in history by the end of 2024. According to data.ai forecasts, the app will earn more than $14.6 billion. In second place will be Candy Crush Saga ($14.2 billion).

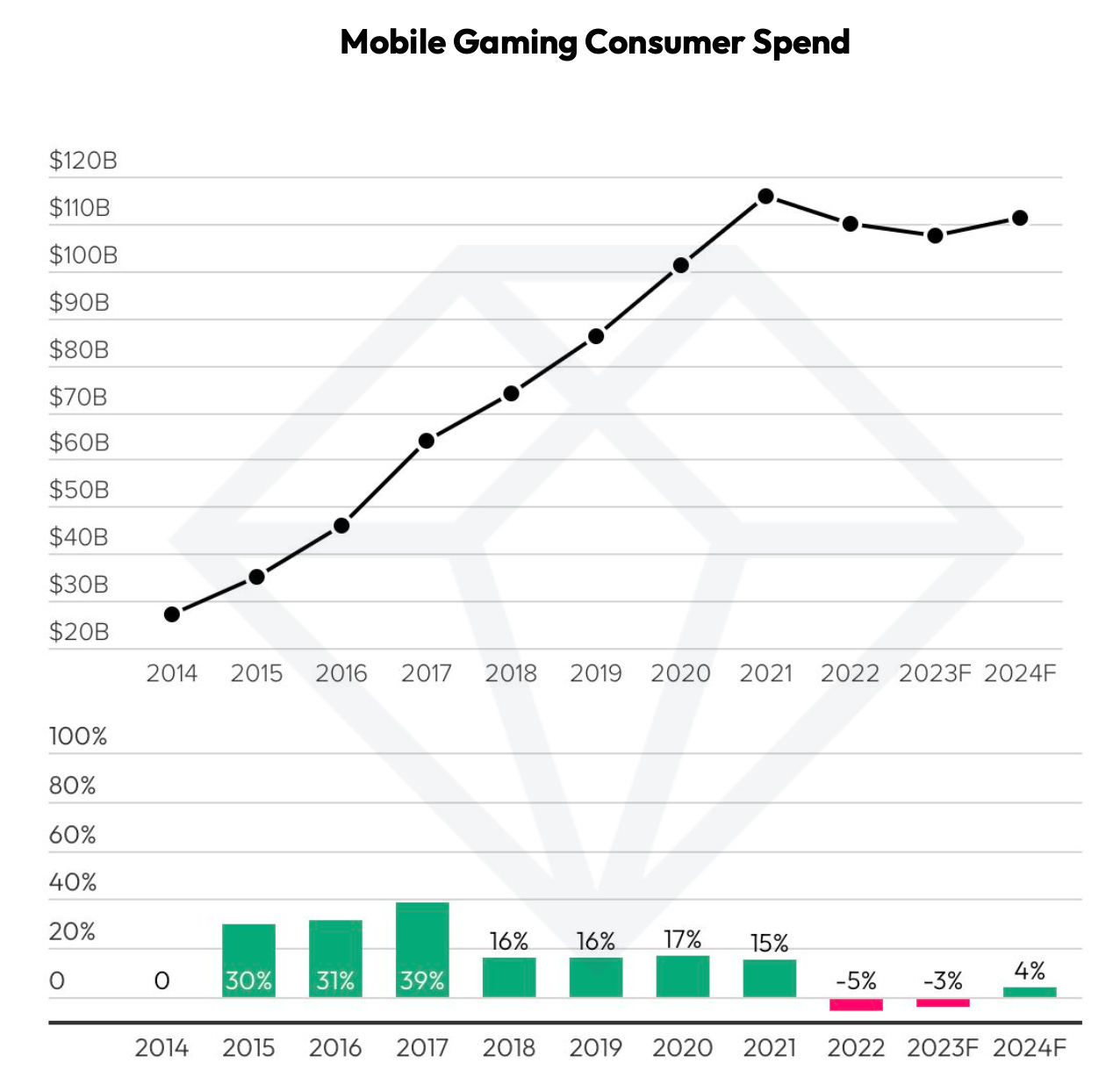

-

By the end of 2023, mobile revenue will decline by 3% to $107.5 billion. However, in 2024, data.ai predicts a 4% growth to $111.4 billion. This is slightly less than the peak in 2021 ($115.8 billion).

-

The United States will be the main driver of mobile market growth, accounting for 40% of the total revenue growth. Following will be Japan (16%), South Korea, Taiwan, Germany, and the United Kingdom. It is worth noting that data.ai does not take into account the Android store in China.

-

China is the largest gaming market in the world. However, data.ai cannot provide an accurate estimate due to calculation complexities.

-

As for genres, RPGs, Match games, casinos, and corporate games will generate the most revenue in 2024. RPG and Match will account for 20% of the total global revenue each.

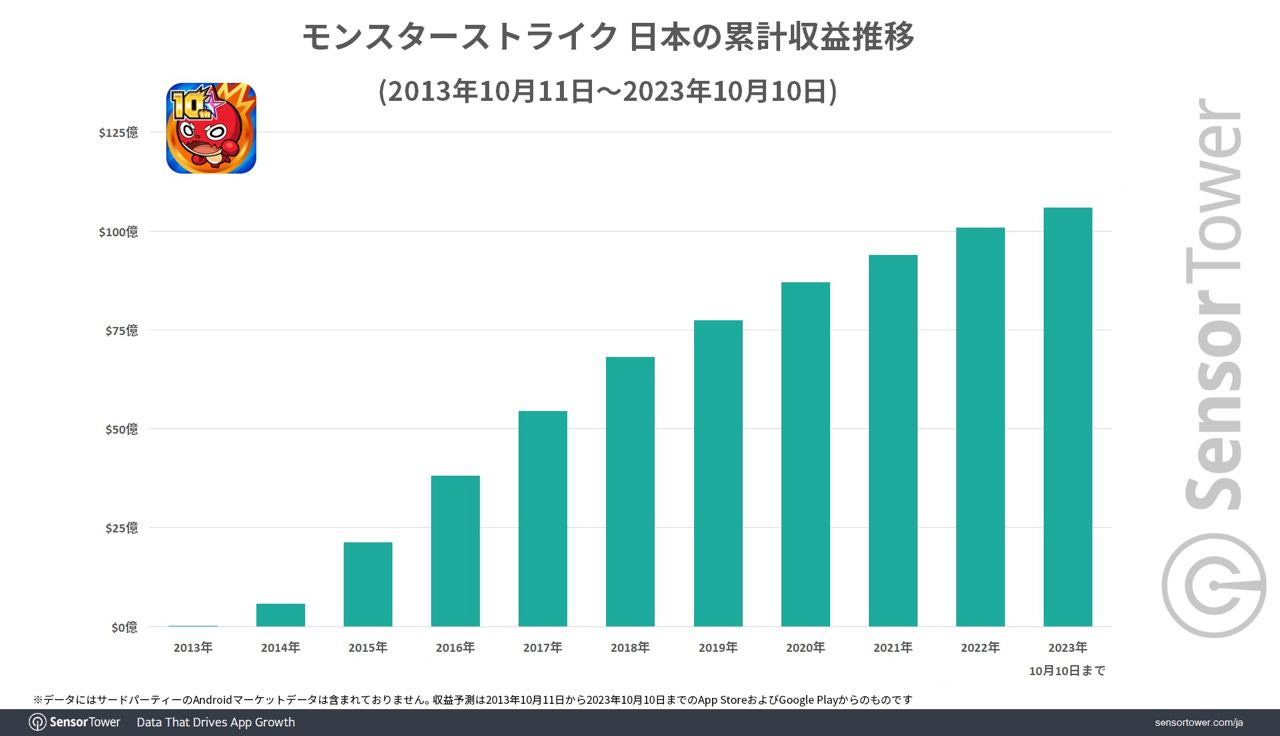

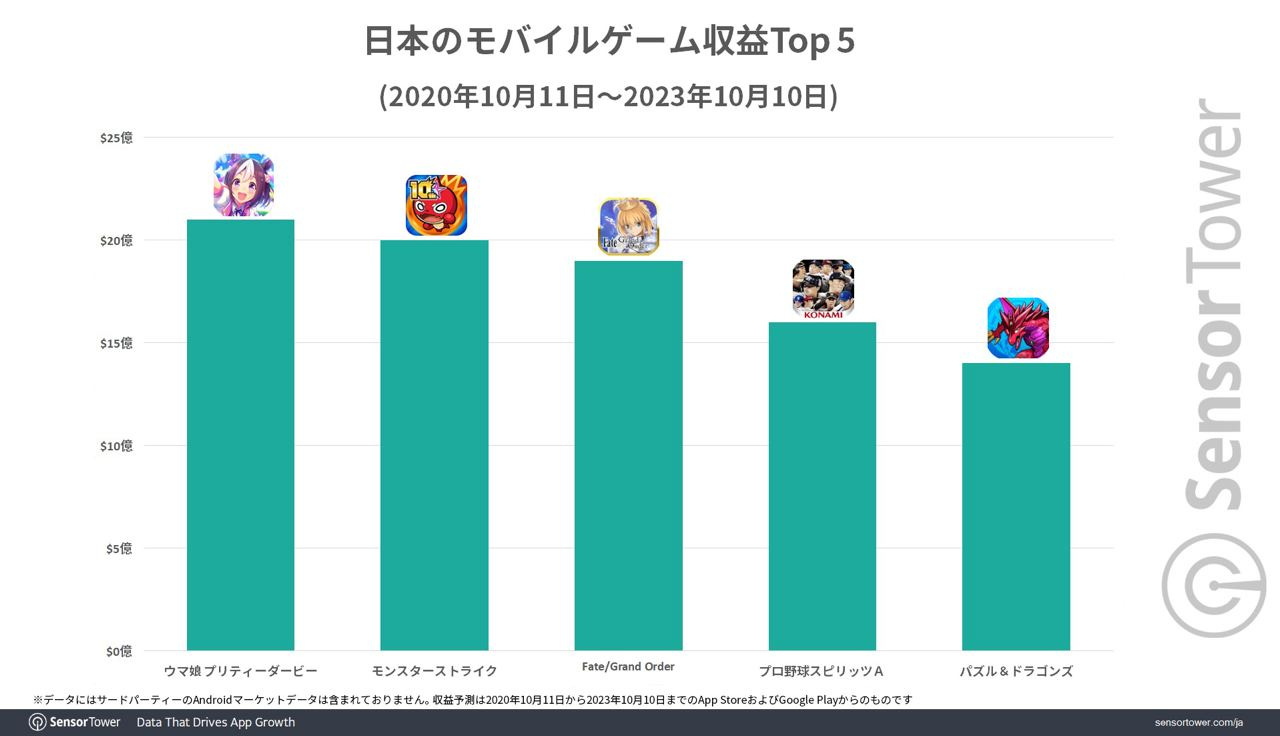

Sensor Tower: Monster Strike revenue exceeds $10B

-

To be more precise, over the course of 10 years in operation, from October 2013 to October 2023, the game has earned $10.5 billion.

-

97% of the game's revenue and 84% of downloads (according to AppMagic data) come from Japan.

-

Despite the game's age, Monster Strike has consistently ranked in the Japanese charts for the last 3 years. It has been in the top 10 for 962 days, in the top 3 for 563 days, and in the first place for 245 days.

-

The average Monthly Active Users (MAU) for the game over the last 3 years is 5.8 million users. Only Uma Musume Pretty Derby has more on the Japanese market.

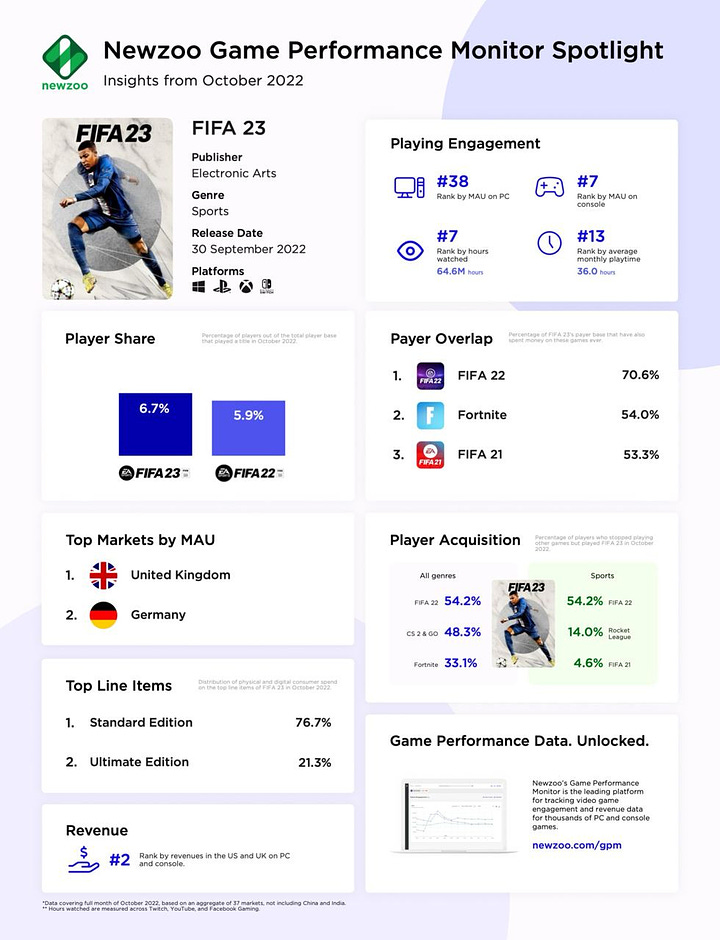

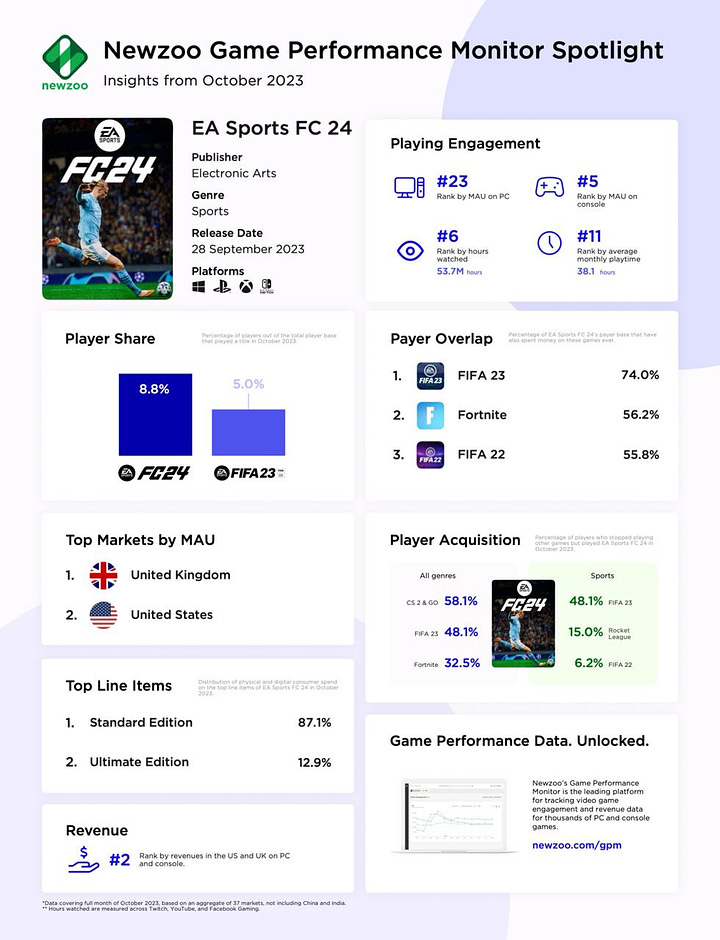

Newzoo: Comparison of Launches of EA Sports FC 24 and FIFA 23

FIFA 23 was released on September 30, 2022; for comparison, Newzoo took October 2022. EA Sports FC 24 started on September 28, 2023; for comparison, October 2023 was considered.

-

In the month following the release, FIFA 23 ranked 38th in MAU on PC and 7th on consoles. EA Sports FC 24 performed better - 23rd place on PC and 5th place on consoles.

-

Both games took the second position in MAU among sports games on PC and consoles in the first full month after release. They were only surpassed by Rocket League.

-

8.8% of all players on PC and consoles played EA Sports FC 24 in October 2023 - they spent an average of 38.1 hours (per month) in the game. In October 2022, 6.7% of the monthly audience played FIFA 23, and they played for 36 hours. Newzoo does not provide absolute MAU figures, but the engagement in hours for EA Sports FC 24 is higher.

-

In October 2023, EA Sports FC 24 accumulated 53.7 million hours on streaming platforms. In October 2022, FIFA 23 had 64.6 million hours.

-

Both EA Sports FC 24 and FIFA 23, in the first full month after release, became the second best-selling games in the USA and the UK on PC and consoles.

-

Over half of the players in EA Sports FC 24 (and FIFA 23) also play Fortnite.

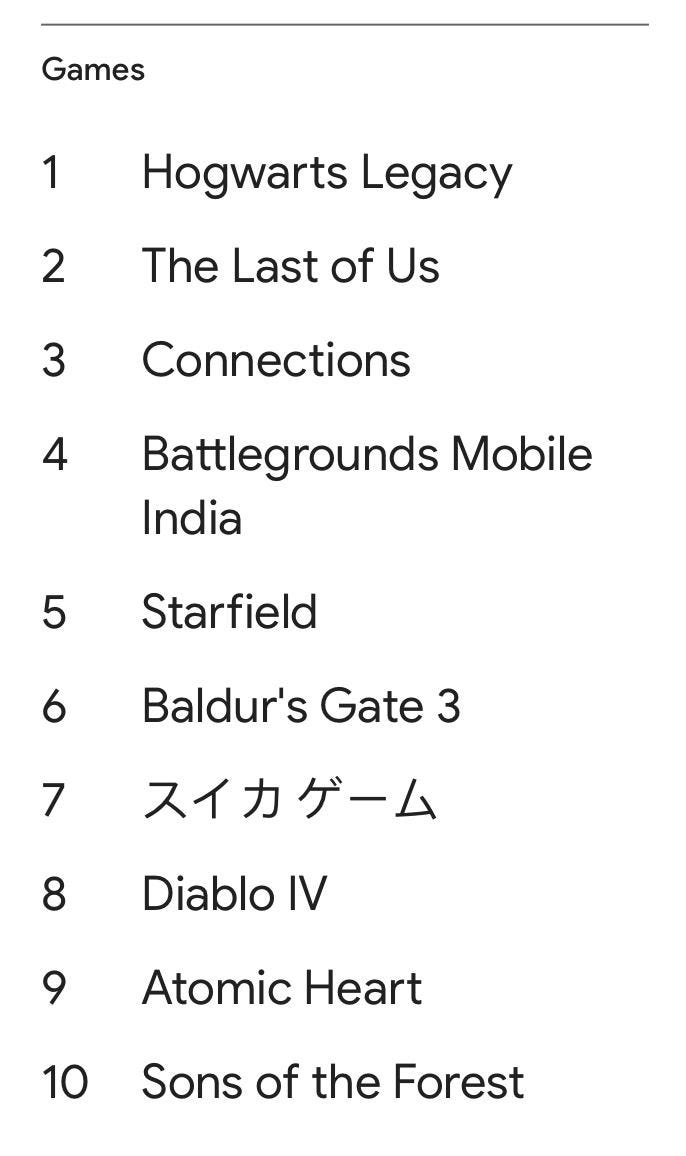

Google: The most popular games in Search in 2023

-

Hogwarts Legacy - the leader in the number of Google search queries among games this year.

-

In second place is The Last of Us. However, people were likely searching for the series rather than the game.

-

The third place in popularity goes to Connections - a word game from The New York Times.

-

Battlegrounds Mobile India - through the efforts of one country - took fourth place.

-

Baldur’s Gate 3 entered the top (6th position), surpassing Diablo IV (8th place).

-

One of the most interesting search trends is スイカ ゲーム (Google translates it as "Watermelon Game"). A game with this name ranked seventh in searches (higher than Diablo IV, Atomic Heart, and Sons of the Forest). In terms of mechanics, it's like Tetris blended with 2048, but instead of geometric shapes, there are round fruits. There is also a simple physics model. You can play it here: https://suika-game.app

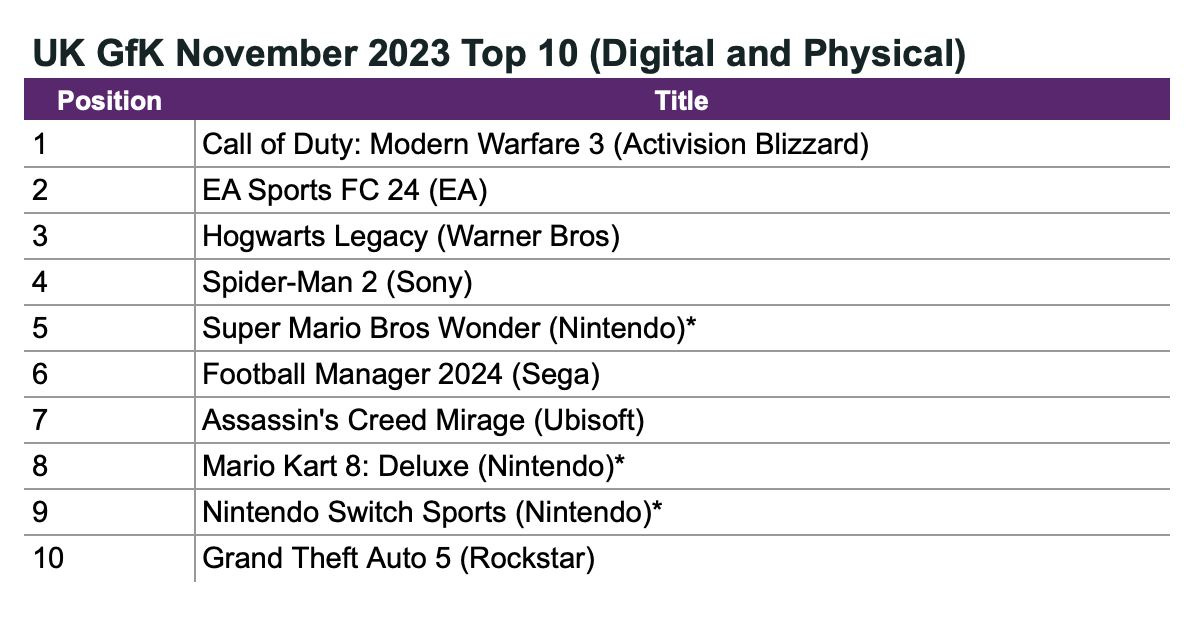

GSD & GfK: Call of Duty was unable to save the British market from decline in November 2023

Analytical platforms report only the actual sales figures obtained directly from partners. Large publishers, such as Nintendo, do not share information on the sales of digital copies.

Game Sales

-

In the UK, 4.55 million games were sold in November, which is 3% less than the previous year. In November 2022, God of War: Ragnarok and Pokemon Scarlet and Violet were released.

-

Call of Duty: Modern Warfare 3 led sales in November. However, the game started 38% worse than the previous installment.

-

Hogwarts Legacy was released on Nintendo Switch, allowing it to grow sales in the British market by 100%.

-

EA Sports FC 24 sold slightly worse than FIFA 23 in November of the previous year, but the difference is insignificant.

Black Friday Results

-

During Black Friday in the UK, 1.66 million copies of games were sold, which is 0.8% more than the previous year.

-

EA Sports FC 24 became the best-selling game in the UK on this Black Friday.

Console Sales

-

Over 486 thousand consoles were sold in November in the UK, showing a 176% increase compared to the previous month and a 32% increase compared to the previous November. This was due to console discounts.

-

As of the end of November, console sales in the UK increased by 12% compared to the same period the previous year.

-

PlayStation 5 sales soared by 149% in comparison to October and by 126% compared to November of the previous year. In fact, it was the first real Black Friday for the console, as previous ones were hindered by shortages.

-

Xbox Series S|X also had successful sales. The consoles sold 231% better than the previous month and 4% better than the previous year.

-

Nintendo Switch sold 175% better than in October, but by November 2022, there was a 19% decline.

-

In November, 1.275 million accessories were sold, which is 118% more than in October and 3.5% less than the previous year.

-

PlayStation Portal debuted at 5th place in the chart. In the UK, the accessory is sold out.

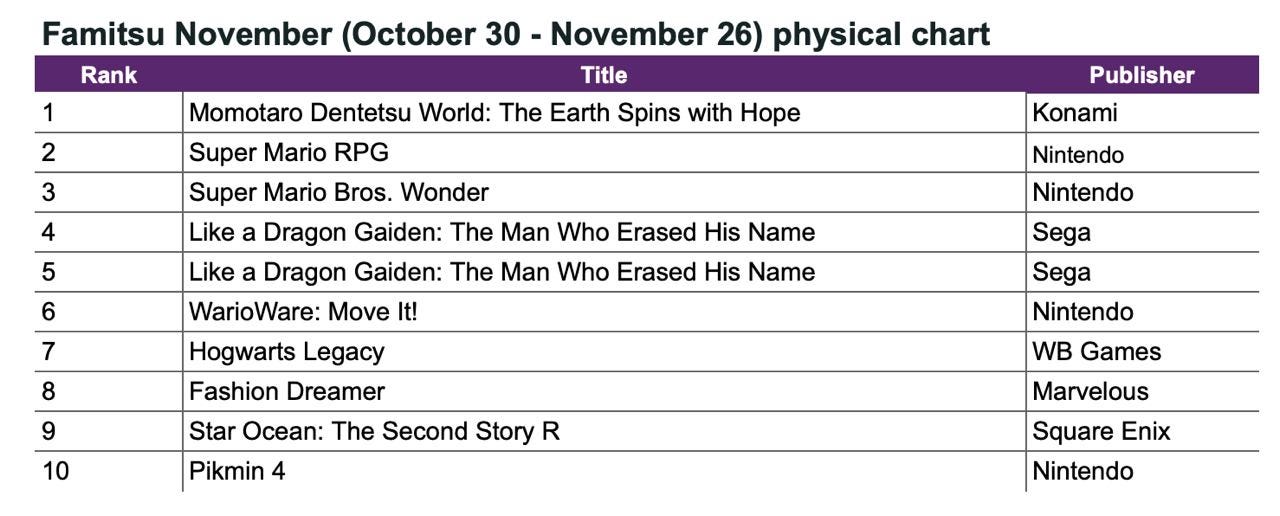

Famitsu: Momotaro Dentetsu World: The Earth Spins with Hope - the best-selling game in Japan in November

Famitsu only shares physical sales data.

-

Momotaro Dentetsu World: The Earth Spins with Hope - a new game from Konami, reminiscent of Monopoly, topped the sales charts. The game was released on November 16th and sold 413 thousand (physical) copies in just a couple of weeks.

-

In second place for sales was Super Mario RPG (356 thousand copies); in third place was Super Mario Bros. Wonder (287 thousand copies).

-

Nintendo sold 964 thousand copies of games in Japan in November. This is twice as much as Konami (438.5 thousand) and SEGA (178 thousand).

-

In November, 296 thousand Nintendo Switch units and 231 thousand PlayStation 5 units were sold. The sales of the latter increased by 80% compared to the previous year.

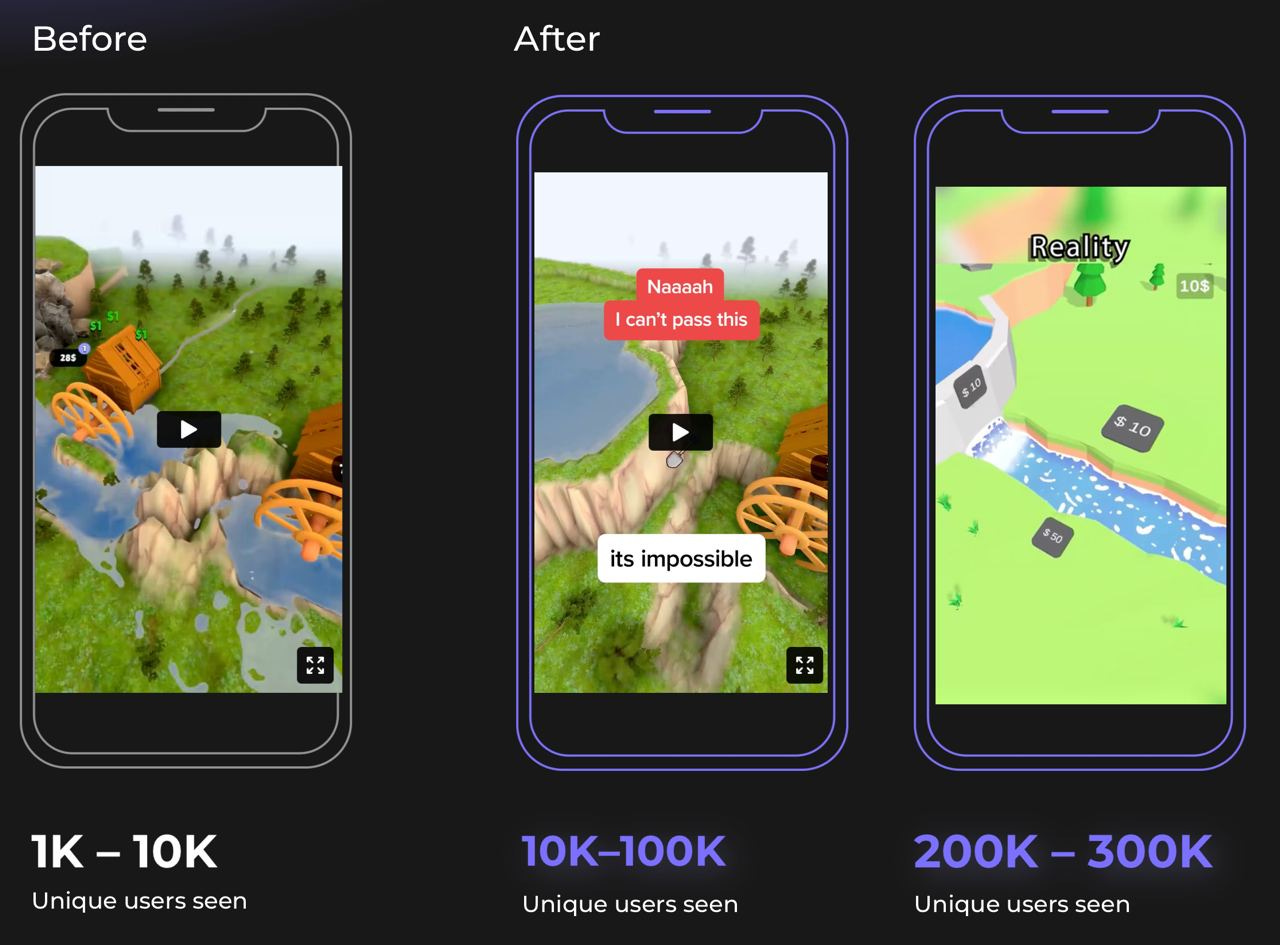

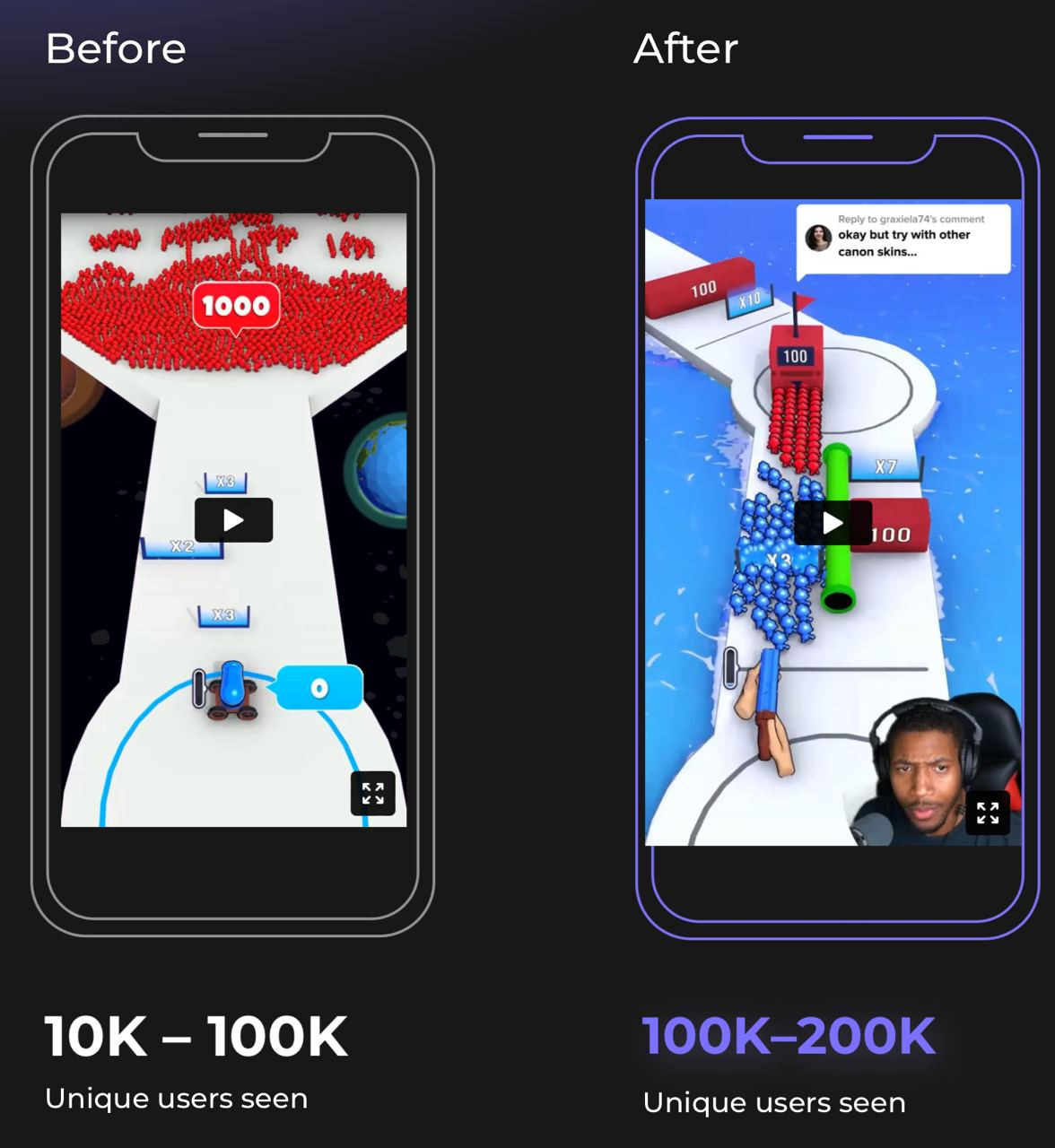

Tenjin & ObtainAds: How to make your advertising creatives more effective

This report is based on the analysis of 7 million creatives.

The state of the gaming advertising market in 2023

-

The number of ad impressions increased by 17%.

-

The number of clicks decreased by 7%.

-

The average CTR decreased by 3%.

-

The number of installations from paid advertising channels decreased by 6%.

Methods to improve advertising creative performance

1. Styling Creatives for Holidays. This allows extending the life of successful creatives and giving a new lease of life to those who have shown weak results.

2. Static Content in Videos. Tenjin & ObtainAds recommend transforming static ad creatives into videos - watched by 79% of users. Just add simple animations and a soundtrack.

3. Captions. Voodoo, Lion Studios, and Rollic Games use subtitles in their creatives. They either provide additional context or comment on what is happening on the screen.

4. Hooks. Tenjin and ObtainAds recommend starting ads with an engaging action, a video designed to keep the player on the screen.

5. Overlays. Companies believe that the most effective method is to use CTA buttons, progress bars, and timers.

6. User-Generated Content (UGC). According to Tenjin and ObtainAds, ads with UGC outperform by up to 4 times in CTR and have half the CPC. One of the most popular formats is the player or blogger's reaction to what is happening on the screen.

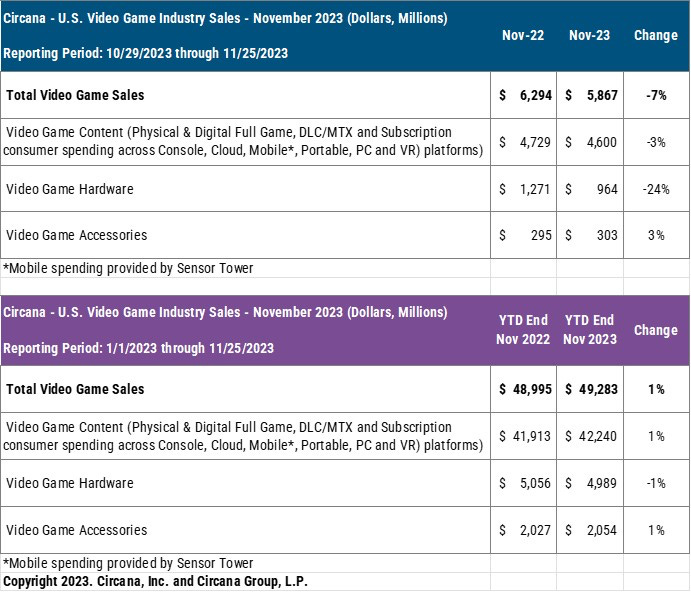

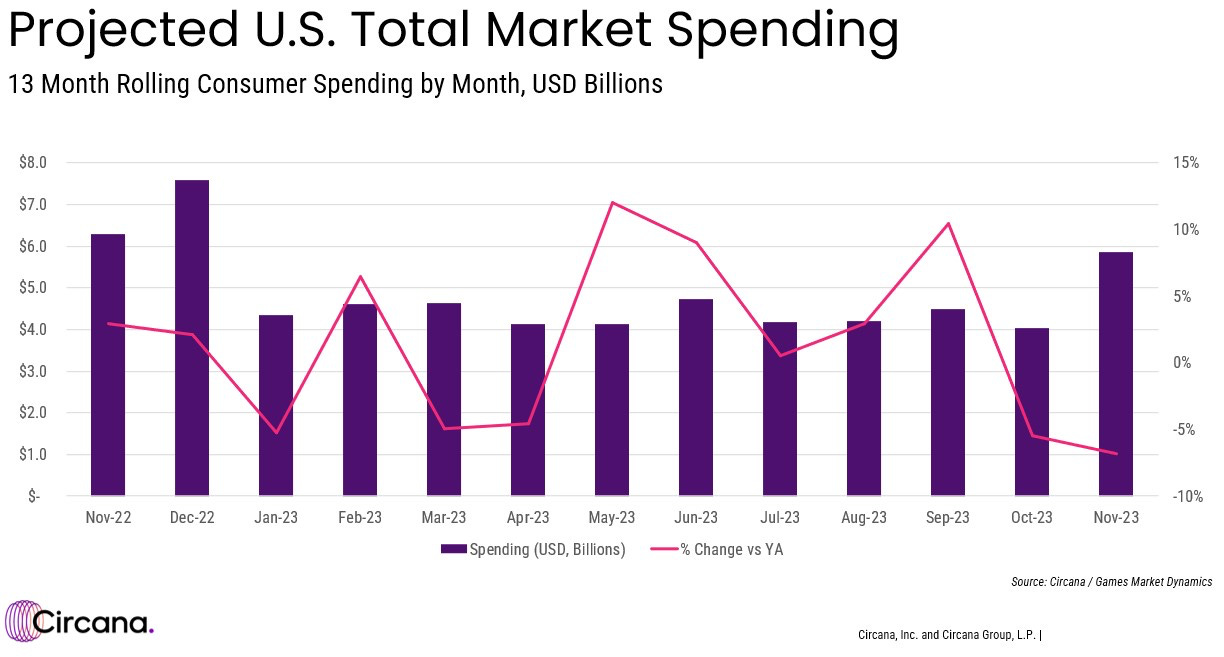

Circana: The American Gaming Market Declined by 7% in November

Market Overview

-

In November 2023, the American gaming market earned $5.9 billion, which is 7% less than the previous year.

-

The decline is attributed to a 3% drop in-game sales and a 24% decrease in console sales (down to $964 million).

-

Despite the decline, the PlayStation 5 remains the best-selling console of the month, followed by the Xbox Series.

-

PlayStation Portal debuted at the 4th position in console sales charts, with limited availability.

-

Cumulative Nintendo Switch sales in the USA surpassed Xbox 360. The console now trails only Nintendo DS and PlayStation 2 in sales.

-

Overall console sales decreased by 1% compared to the same period in 2022 (January - November).

-

Console game sales and portable system sales dropped by 11%, but revenue from mobile platforms, subscriptions, and PC content increased by 3%.

-

Mobile revenue in the USA grew by 2.6% in November compared to the previous year. The leaders are Monopoly GO!, Royal Match, and Roblox.

-

As of the end of November, the American gaming market is 1% ahead of the 2022 figures.

Game Sales

-

Call of Duty: Modern Warfare III (as expected) became the best-selling game on PC and consoles in the USA. Marvel’s Spider-Man 2 secured the second spot, followed by Hogwarts Legacy.

-

Hogwarts Legacy retained its position as the top-selling game in the USA in 2023. Call of Duty: Modern Warfare III took the second spot, while The Legend of Zelda: Tears of the Kingdom dropped to third place. Note that there is no data on digital sales for the latter.

-

Call of Duty: Modern Warfare III marks the fifth consecutive installment in the series to top the charts in November. The last time the series was surpassed was by Red Dead Redemption II in November 2018.

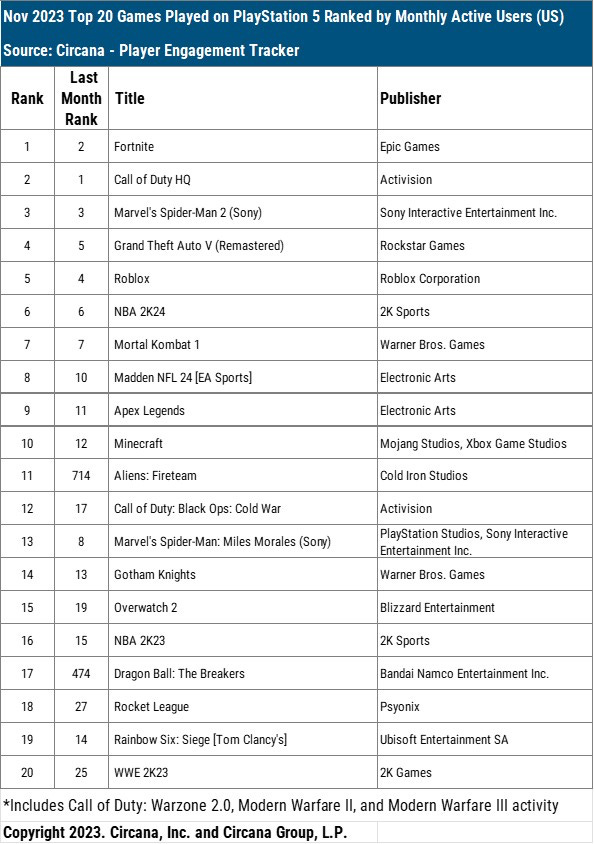

MAU Charts

-

Fortnite, Call of Duty (all parts), and Marvel’s Spider-Man are the most popular games on PlayStation by MAU.

-

Fortnite, Call of Duty (all parts), and Grand Theft Auto V lead in MAU on Xbox in November.

-

Counter-Strike 2, Lethal Company, and Baldur’s Gate III are the top three in MAU on Steam.

Accessories

-

Accessory sales in November 2023 grew by 3% compared to the previous year, reaching $303 million. Spending on gamepads increased by 8%, with the DualSense (in Midnight Black) leading in sales.

Ampere Analysis: Alan Wake II console sales of less than 1M copies

-

Pierce Harding-Rolls' Estimate (Ampere Analysis analyst) mentioned that 850 thousand copies of the game were sold as of the end of November. This figure represents only console sales.

-

However, Pierce notes that sales of Alan Wake: Remastered significantly increased in October-November of this year.

-

Circana indirectly confirms Ampere Analysis' data. According to their information, Alan Wake II did not make it into the top 100 for active players in the USA in November on either PlayStation or Xbox.

-

Matt Piscatella from Circana believes that two things could have helped the game: physical releases and more advertising. Although, according to estimates from Finnish media, they could have spent around $70 million on the project's advertising.

-

Nevertheless, labeling it a failure is at least premature. Analytical companies do not have access to sales figures on EGS, where a significant number of purchases could have occurred. Moreover, according to Remedy's standards, the initial sales are good. The same applies to Control, which sold 3 million copies in three years.

-

In 2015, it was reported that the first part of Alan Wake sold 3.2 million copies on all platforms, five years after its release.

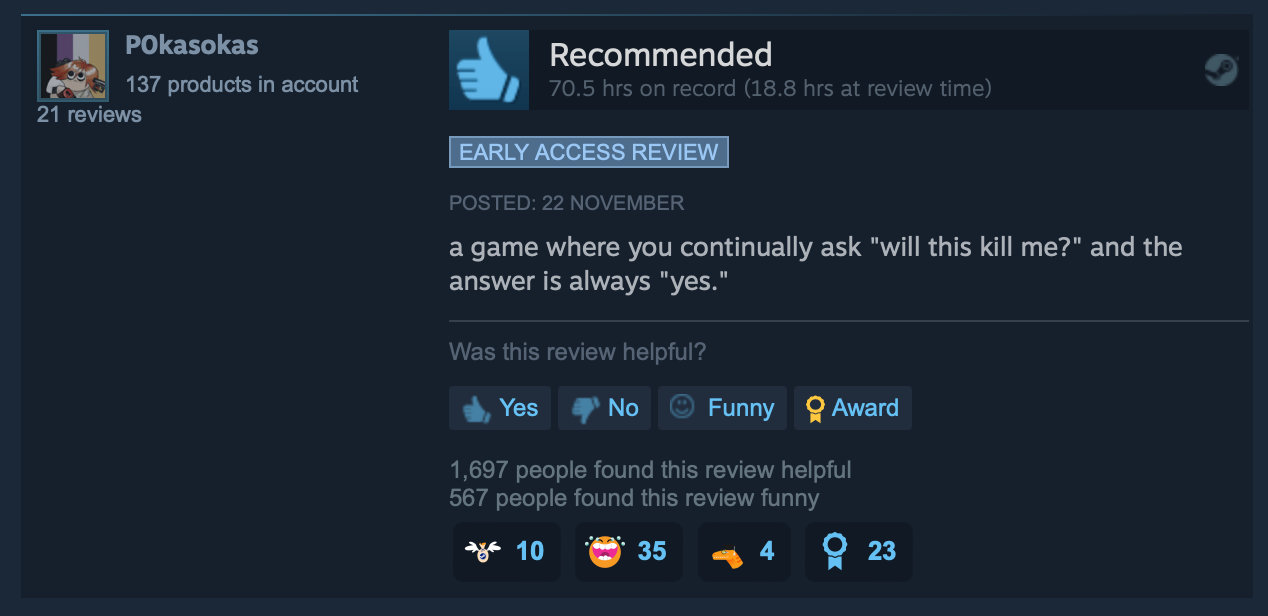

Lethal Company: The indie success of the year

Indie developer Zeekerss surpassed Baldur's Gate 3 in Steam ratings; his game sold 4.5 million copies. Let's delve into the game, who made it, and the results it achieved.

What is Lethal Company

-

Lethal Company is a cooperative horror game where teams of 4 people must gather loot while simultaneously trying to avoid monsters and traps. The earned money can be spent on various upgrades, as well as the opportunity to travel to other planets with better loot.

-

The success of the game is largely explained by the abundance of viral (often scary and simultaneously funny) moments. "The game continually has an answer to the question - 'Will this thing kill me?' The answer is positive," - tells one of the reviews on Steam.

-

In Lethal Company, the rooms are randomly generated (and with a recent update, not only them), making each gaming session unique.

Who made Lethal Company?

-

The game was made by one person - Zeekerss. This is not his first game.

-

In July 2020, Zeekerss released It Steals - a pixelated single-player horror game (98% positive reviews); in April 2021 - the horror game Dead Seater (92% positive reviews); in March 2022 - the horror game The Upturned (99% positive reviews).

-

Although none of the games came close to the success of Lethal Company (It Steals sold the best - around 35-40 thousand copies), Zeekerss built a player base familiar with his work over the years. The released games laid the foundation; Lethal Company is not a random "overnight success."

-

Zeekerss came into game development from Roblox. He joined the platform in November 2011; over 11 million people have played his cards. Now, at 21, Zeekerss has been making games since he was around 10, as the first videos on his YouTube channel date back to 2012.

Game success

-

Lethal Company currently has a 98% positive review rating on Steam, based on 149.6 thousand reviews. People love the game - the approval level is higher than Baldur's Gate III (95.82% positive reviews).

-

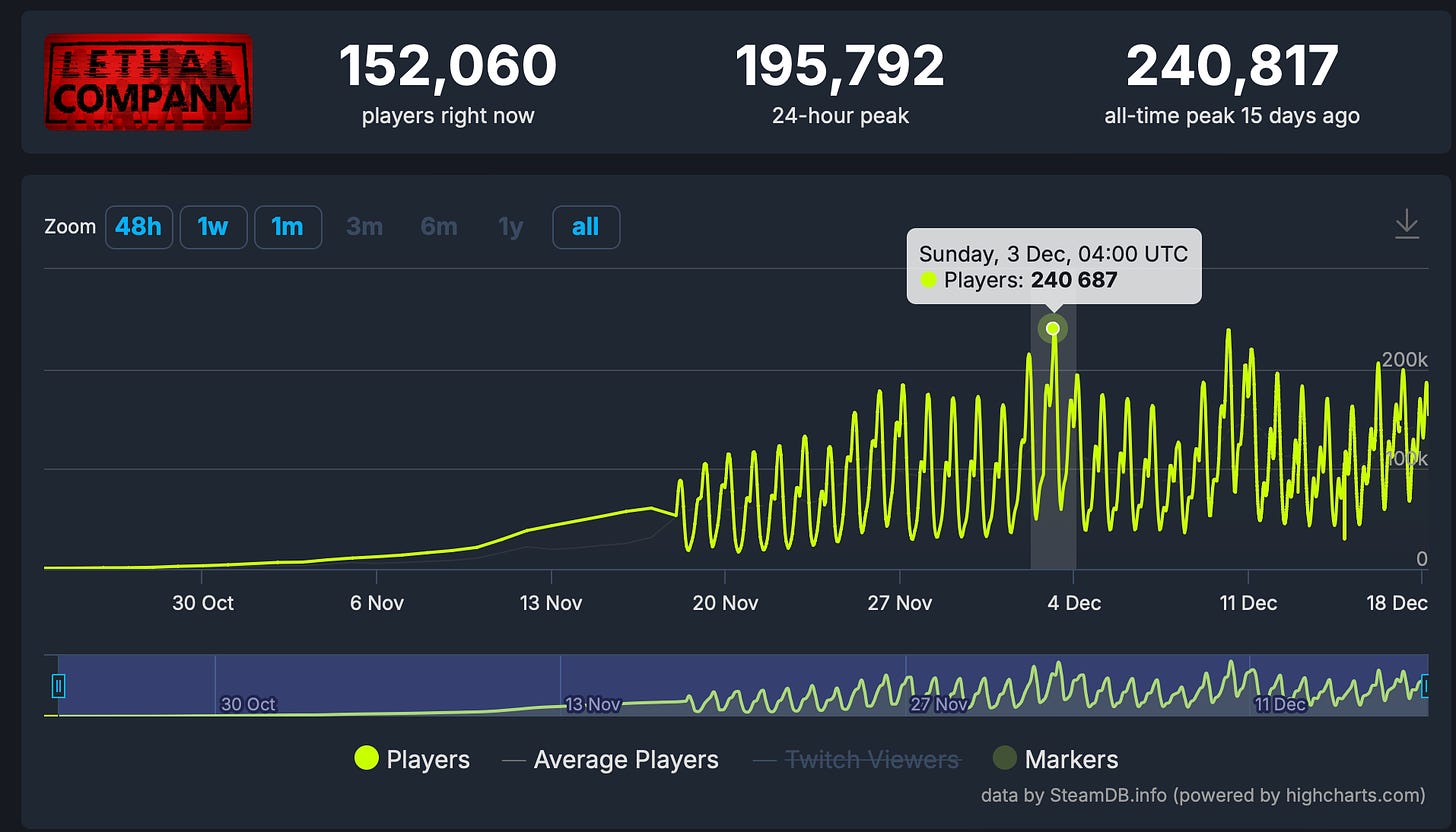

The game's peak CCU is 240k people (more than The Finals, for example). The average peak CCU per day is around 180k users, and the minimum is 45k users.

-

Lethal Company was released on October 24 this year - since then, the game has gradually gained popularity. The peak came on December 3, but attention to the game has not waned since.

-

As of now, Lethal Company is in fourth place on Steam. The game is positioned after Counter-Strike 2; DOTA 2; PUBG: Battlegrounds. It has surpassed the popularity of GTA V; Apex Legends; The Finals; Baldur's Gate III; and Call of Duty: Modern Warfare II/III (Warzone).

-

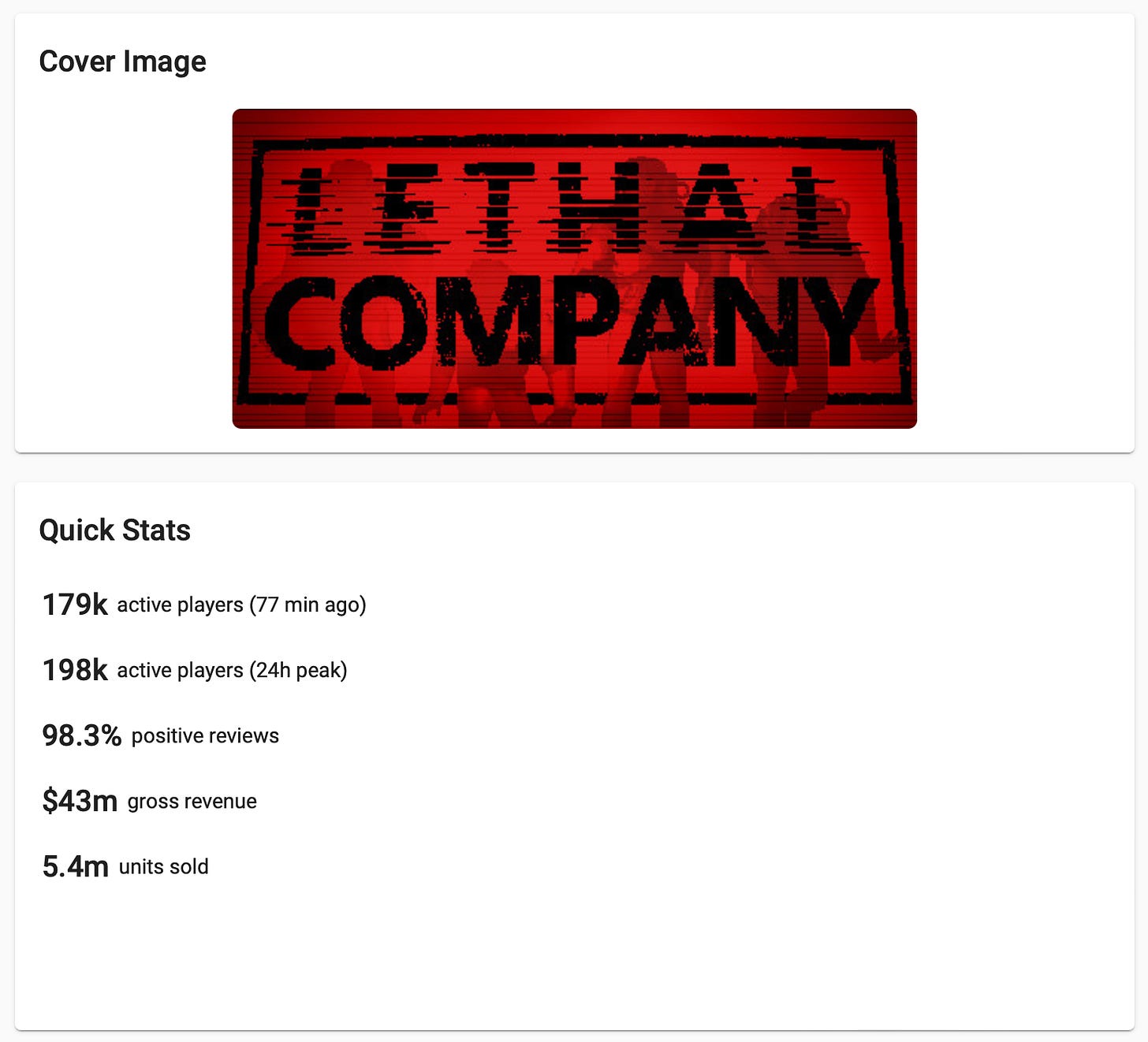

According to VG Insights, the game has already sold 5.4 million copies. This translates to $43 million in revenue (excluding Steam commissions and taxes).

-

The game has excellent potential for streaming platforms. Top streamers choose the game, and the peak number of viewers since the release has reached 190 thousand. The average daily peak viewership for Lethal Company streams is around 70-80 thousand people.

-

An active community is forming around Lethal Company - on Reddit, for example, in the r/lethalcompany subreddit, there are over 51 thousand members. They create videos about the game, discuss lore, and share creativity - all of which work to the game's advantage.

-

Zeekerss is actively working on project updates - two major patches have been released since the game's launch.

What explains the success?

To attribute success solely to luck - considering the developer's experience - is not appropriate. To make Lethal Company what it is, Zeekerss needed tens of thousands of hours spent developing various games for Roblox and Steam. Therefore, first and foremost, we must acknowledge persistent hard work and dedication.

An important factor in the game's success was the existing audience on Steam, which was able to "pick up" the project in its early stages. Most indie developers lack access to marketing tools or the skills to use them, so it is critically important for your audience to become your marketing agents.

With Lethal Company, this happened, in part, because the game incorporates many components of other viral projects. Firstly, the game is cooperative, prompting users to share it with friends. Secondly, Lethal Company is scary, funny, and absurd all at once. This appeals to both players and streamers. Thirdly, the game's locations are randomly generated, making playing the game interesting the first time as well as the hundredth.

Zeekerss spent a whole 11 years working for his "luck." And this is a good lesson for all indie developers. Sometimes success comes quickly, but it is more of an exception than a rule.

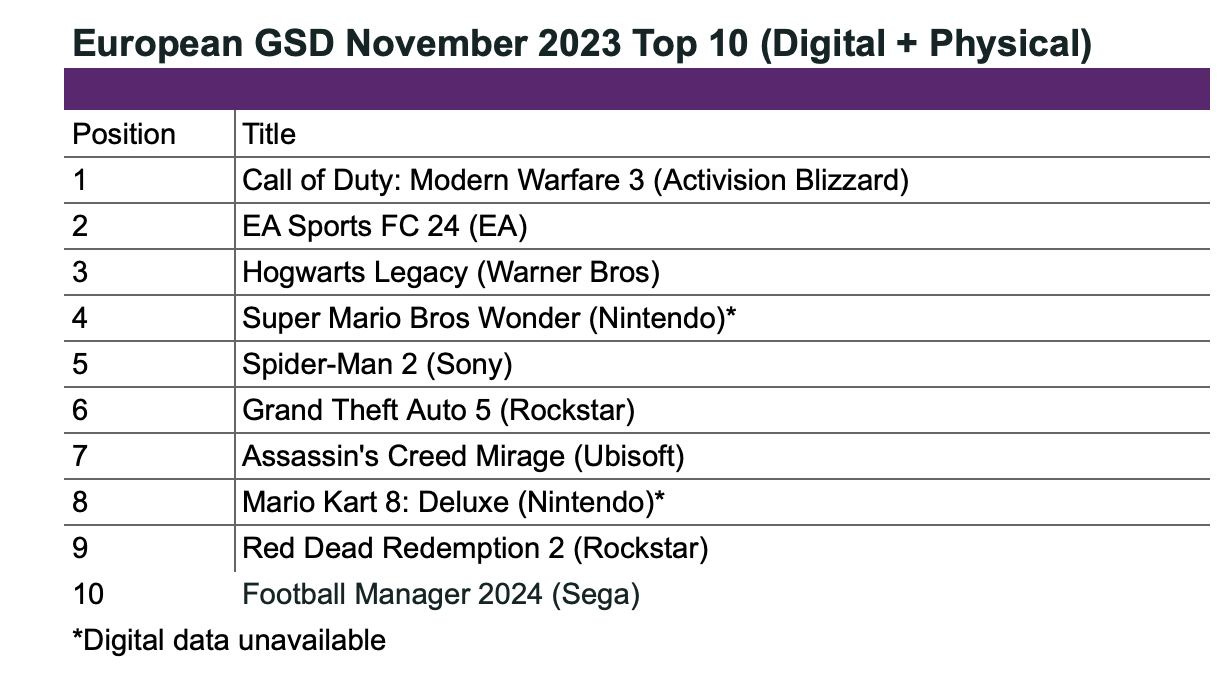

GSD: Game sales in Europe declined, but console sales soared by 59% in November

GSD reports only the actual sales figures obtained directly from partners. Major publishers, such as Nintendo, do not share information on sales of digital copies, for example.

Game Sales

-

In November, 24.6 million copies of games were sold in Europe. This is 20% more than the previous year, but only because November accounted for 5 weeks instead of 4. When comparing 4 weeks, sales declined by 2%.

-

Call of Duty: Modern Warfare III debuted as the top-selling game. However, the initial sales (for the first month) of the new installment were 33% worse than those of Call of Duty: Modern Warfare II.

-

EA Sports FC 24 sold 3% better than FIFA 23 during the same period the previous year. The game received significant discounts during Black Friday.

-

Sales of Hogwarts Legacy during Black Friday soared by 509%—two reasons: the release on Nintendo Switch and discounts. Most likely, by the end of the year, Hogwarts Legacy will only be surpassed by EA Sports FC 24 in Europe.

-

During Black Friday, 7.8 million games were sold. This is 1% less than the previous year.

Console Sales

-

1.3 million consoles were sold in Europe in November. This is 59% more than the previous year.

-

All the growth came from the PlayStation 5. Console sales in November grew by 376% compared to the previous year. Nintendo Switch declined by 35% compared to 2022, and Xbox Series S|X fell by 26%.

-

2.56 million accessories were sold in November. This is 13.8% more than the previous year. DualSense, as always recently, is the sales leader.

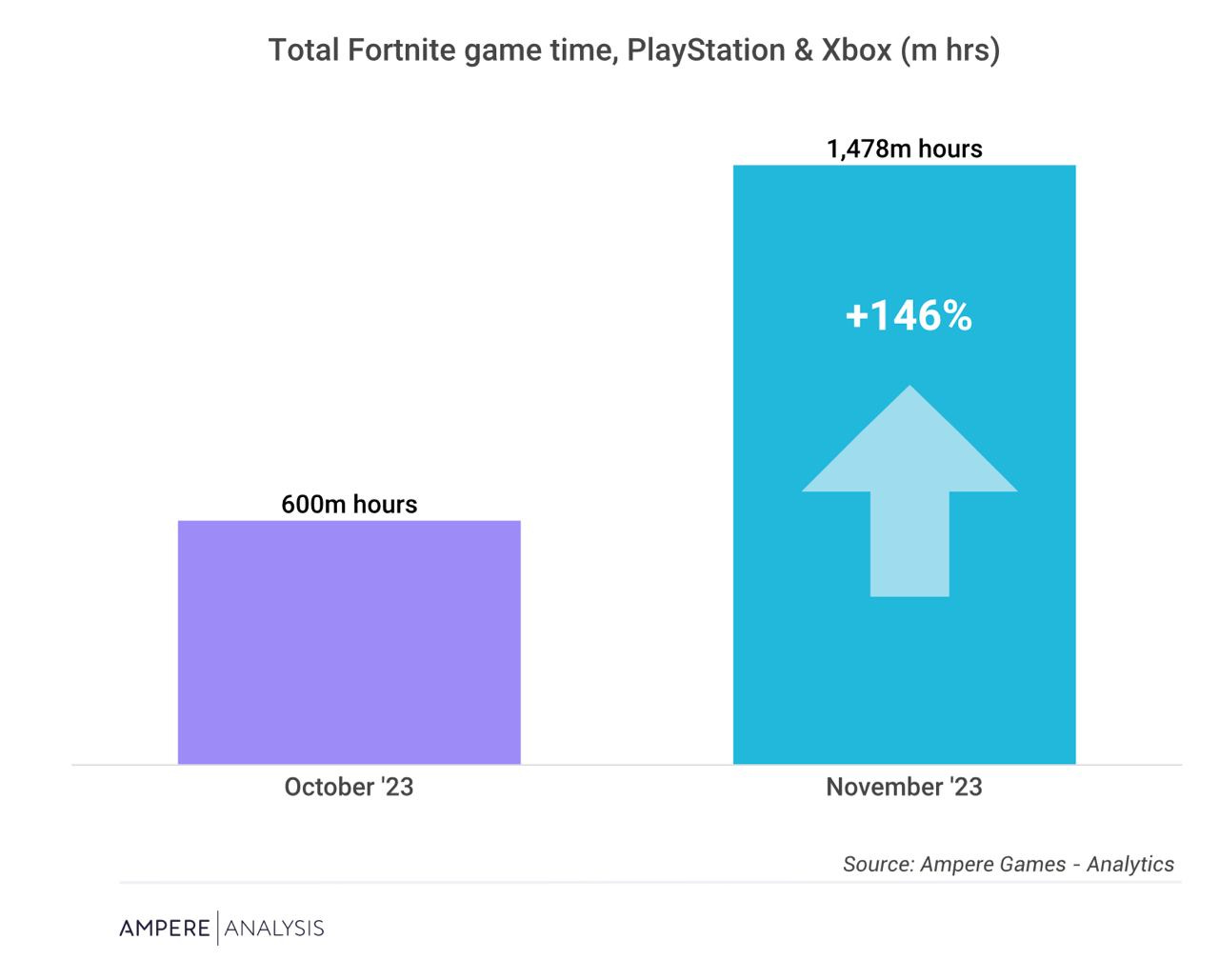

Ampere Analysis: PlayStation and Xbox players spent almost 1.5 billion hours in Fortnite in November

-

Growth by October was 146%, from 600 million hours to 1.478 billion hours.

-

Such rapid growth is attributed to an update that brought back the original Fortnite map from the first season.

-

45% of all Fortnite users in November did not play the game in October. This means that Epic Games managed to bring back a significant number of players even before the release of the Big Bang update.

-

The closest competitor in November on consoles in terms of hours played is Call of Duty: Modern Warfare III (Warzone 2.0) with just under 600 million hours in total.

-

Interestingly, the most popular Netflix series, The Night Agent, had 133 million hours of viewing per month in the last half a year. Fortnite had 630 million hours on consoles alone.

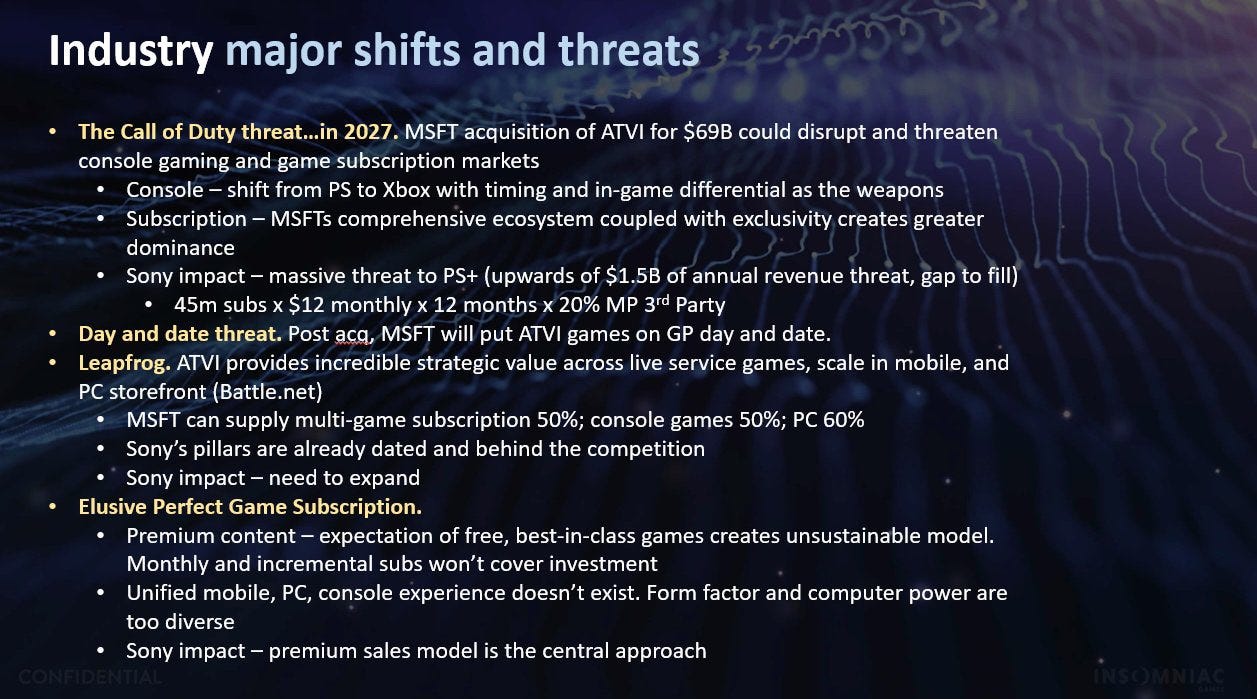

The BIG PlayStation leak

Disclaimer: I do not support what hackers did. The guilty party must face its punishment.

However, the information went public. Want it or not, hide it or not, it’s there. And the leak is massive; every gaming website is writing about it. Unfortunately.

My take is that as far as it leaked, we can try to learn from it. The industry learned a lot from the Epic vs. platforms case and the Microsoft x Activision Blizzard process. Numbers here might be helpful for game industry peers from the evaluation, benchmarking, and general business understanding perspectives.

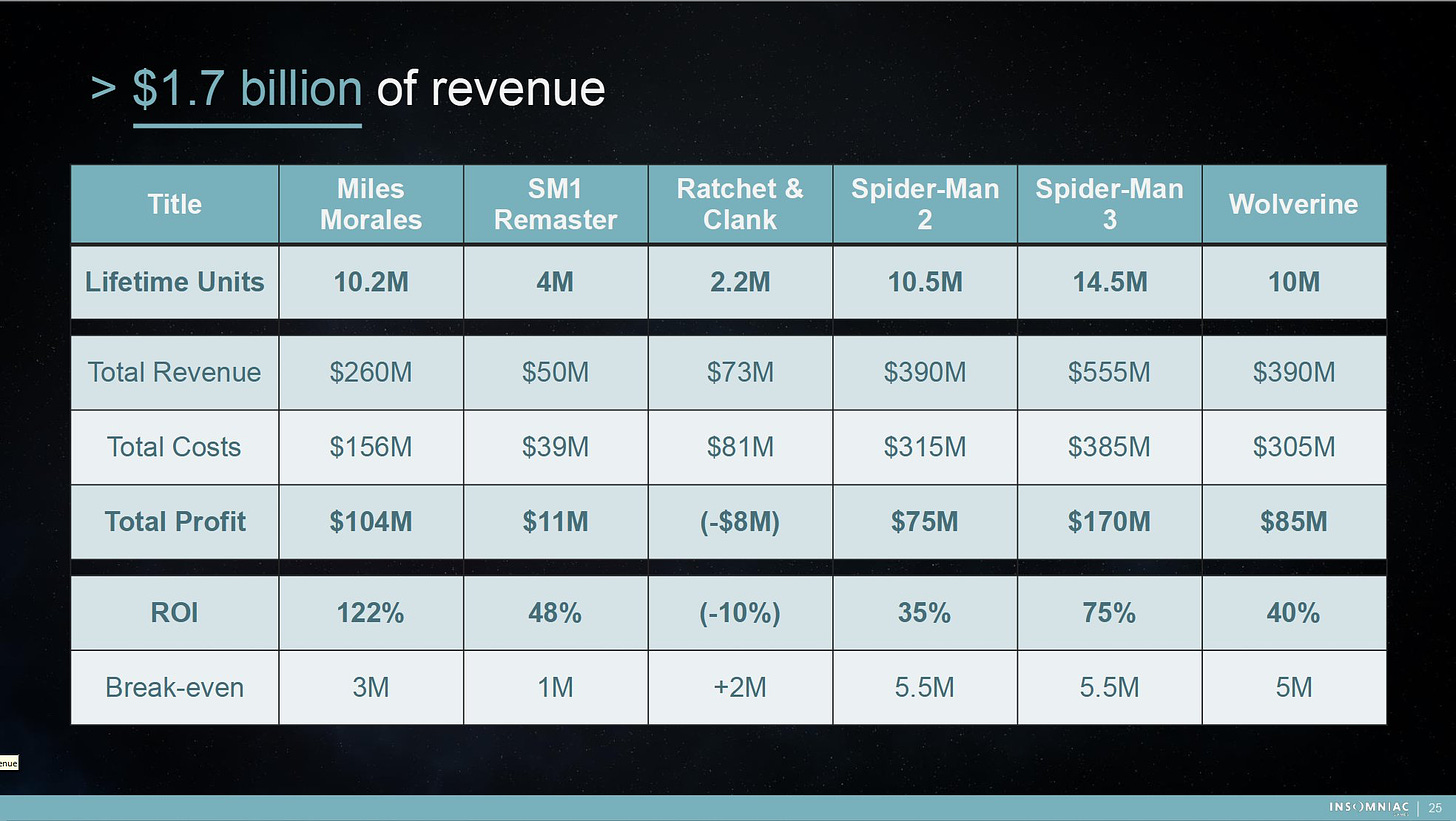

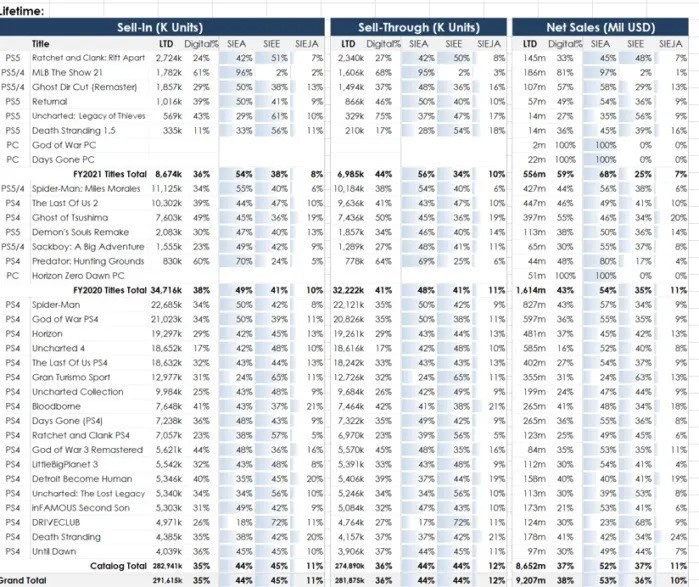

Insomniac Games Financial Results

-

Throughout its existence, the studio has earned over $1.7 billion. Ratchet & Clank is the only (new) game from Insomniac Games that hasn't yet turned a profit. It sold 2.2 million copies, costing $81 million to develop. Revenue from the project so far is $73 million, with $8 million needed to break even.

-

The development of Marvel’s Spider-Man 2 cost the studio $315 million (likely including marketing). The company expects to sell 10.5 million copies (a quarter of the plan is already complete) and earn $390 million.

-

The remaster of Marvel’s Spider-Man cost the studio significantly less - $39 million. The studio sold 4 million copies and made $50 million.

-

The development of Marvel’s Wolverine will cost the studio $305 million, with plans to release the game in 2026.

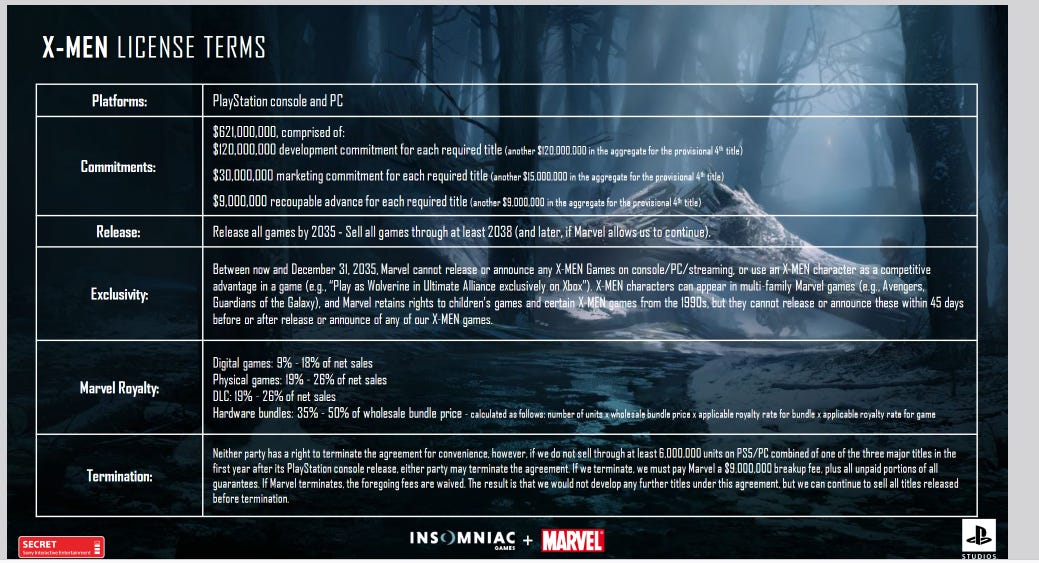

Marvel License Terms (X-Men)

-

Insomniac Games commits to spending at least $120 million on developing each licensed game, with an additional $30 million for marketing.

-

All projects must be released by 2035. Until December 2035, Marvel cannot release separate X-Men universe games, but characters can appear in Marvel games, children's projects, and some games from the 1990s.

-

Marvel will receive 9 to 18% of net sales from digital versions of IP games; 19-26% of net sales of physical copies and DLC; 35-50% of the wholesale cost of the physical bundle.

-

If PlayStation doesn't sell a total of 6 million copies of the IP game on PC and consoles in the first year, the contract may be terminated. If termination is initiated by PlayStation, it must pay a $9 million penalty and all unpaid guarantees. If termination is initiated by Marvel, PlayStation retains the right to operate games released before termination.

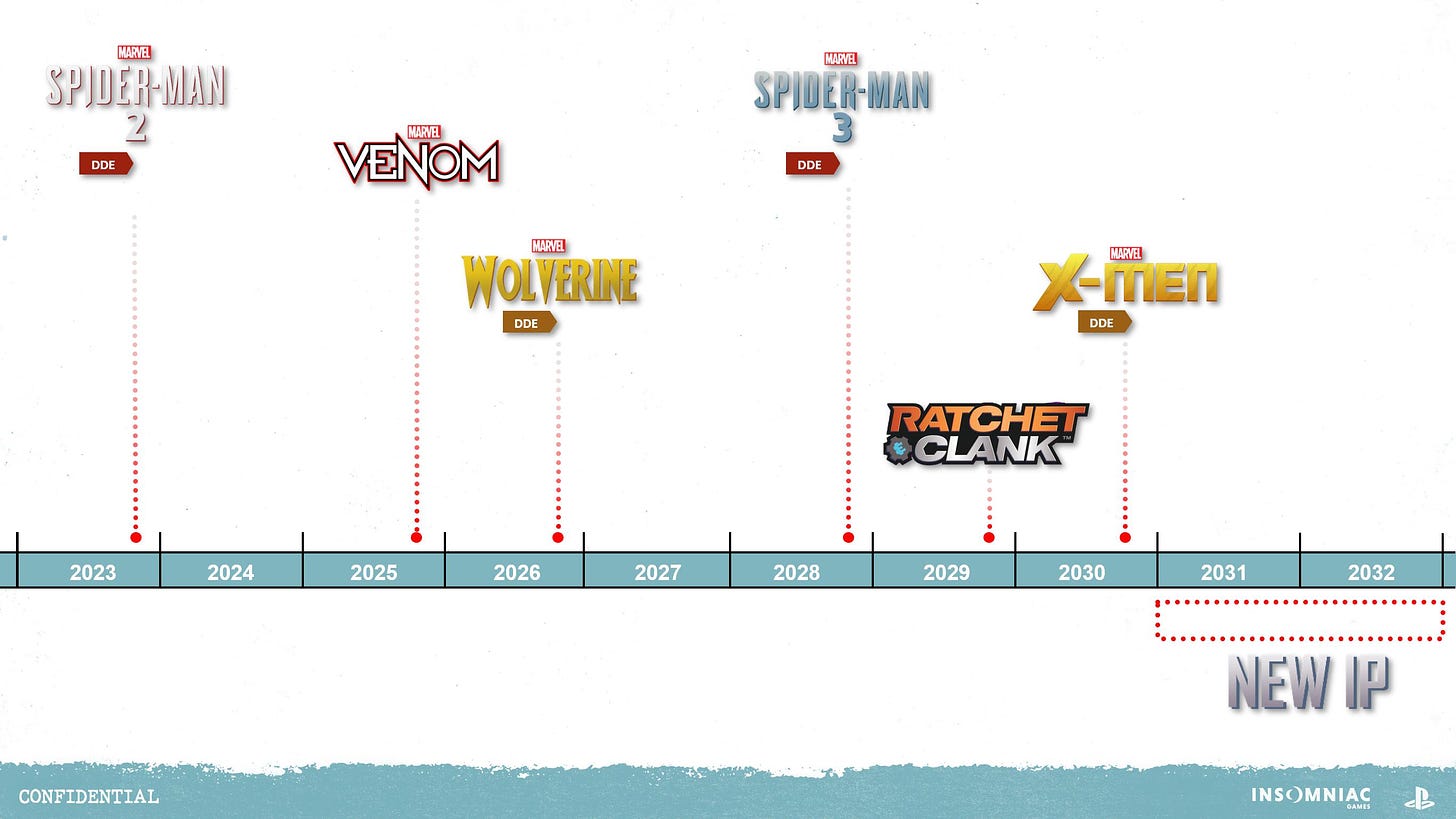

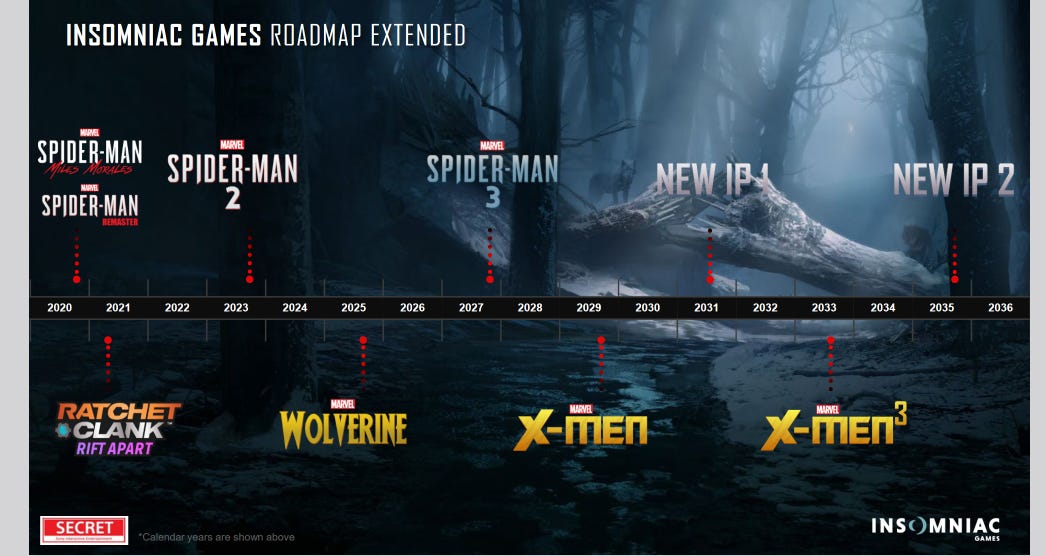

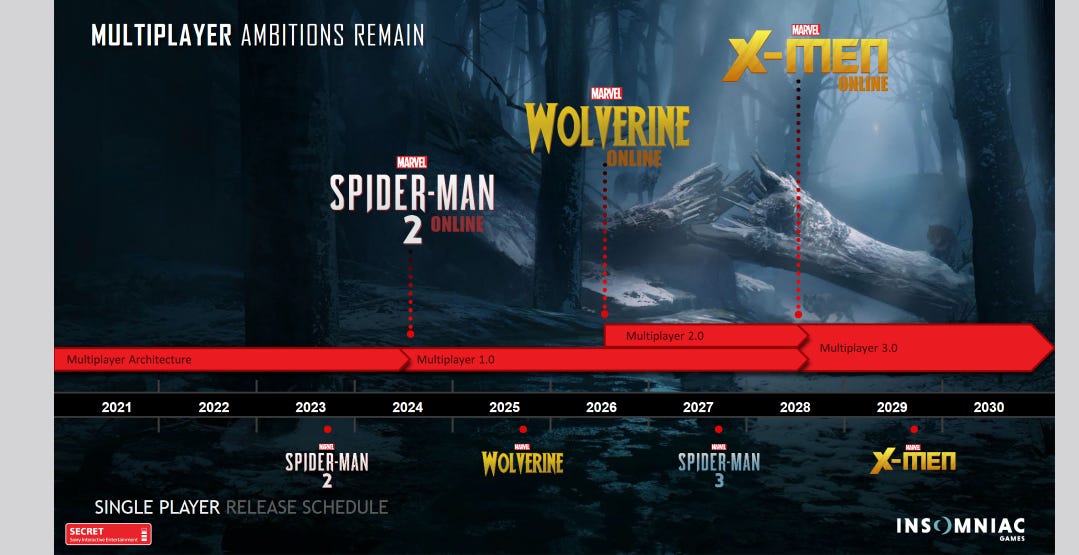

Insomniac Games Plans

-

The company plans to release a Venom spin-off in 2025.

-

Marvel’s Wolverine is set to release in 2026, with 173 people working on the game and resources from friendly studios being utilized.

-

The studio is already prepared to develop Marvel’s Spider-Man 3, scheduled for the end of 2028.

-

Despite the previous part's unsuccessful sales, there are plans to release Ratchet & Clank in 2029.

-

Marvel’s X-Men is planned for release in 2030. Although several roadmaps have leaked online, one of which includes a release in 2029 - and without a new Ratchet & Clank.

-

The company plans to release several new IPs.

-

Marvel’s Spider-Man: A Great Web, a multiplayer project in the universe, was in development, described by developers as “Marvel’s Spider-Man meets GTA Online.” The project's development seems to be on hold.

-

However, the company is not abandoning multiplayer ambitions. Multiplayer modes are expected in Marvel's Spider-Man 2, Marvel's Wolverine, and Marvel's X-Men.

PlayStation Game Sales

FY’21 ended in late March 2022; FY’20 ended in late March 2021.

-

Cumulative sales of Bloodborne exceeded 7.4 million copies, with 41% of sales coming from digital versions.

-

The Last of Us: Part II sold 10.3 million copies in FY’21, worse than Marvel’s Spider-Man: Miles Morales. 39% of the game's sales were digital, bringing in $447 million.

-

Ghost of Tsushima sold 7.6 million copies in FY’21, with 49% being digital, earning the company $397 million.

-

Marvel’s Spider-Man at the end of FY’20 was Sony's best-selling game, with almost 22.7 million copies sold and $827 million in revenue.

-

Close behind were the first God of War (21 million copies - $597 million revenue), Horizon: Zero Dawn (19.3 million copies - $481 million revenue), and Uncharted 4: A Thief’s End (18.6 million copies - $585 million revenue).

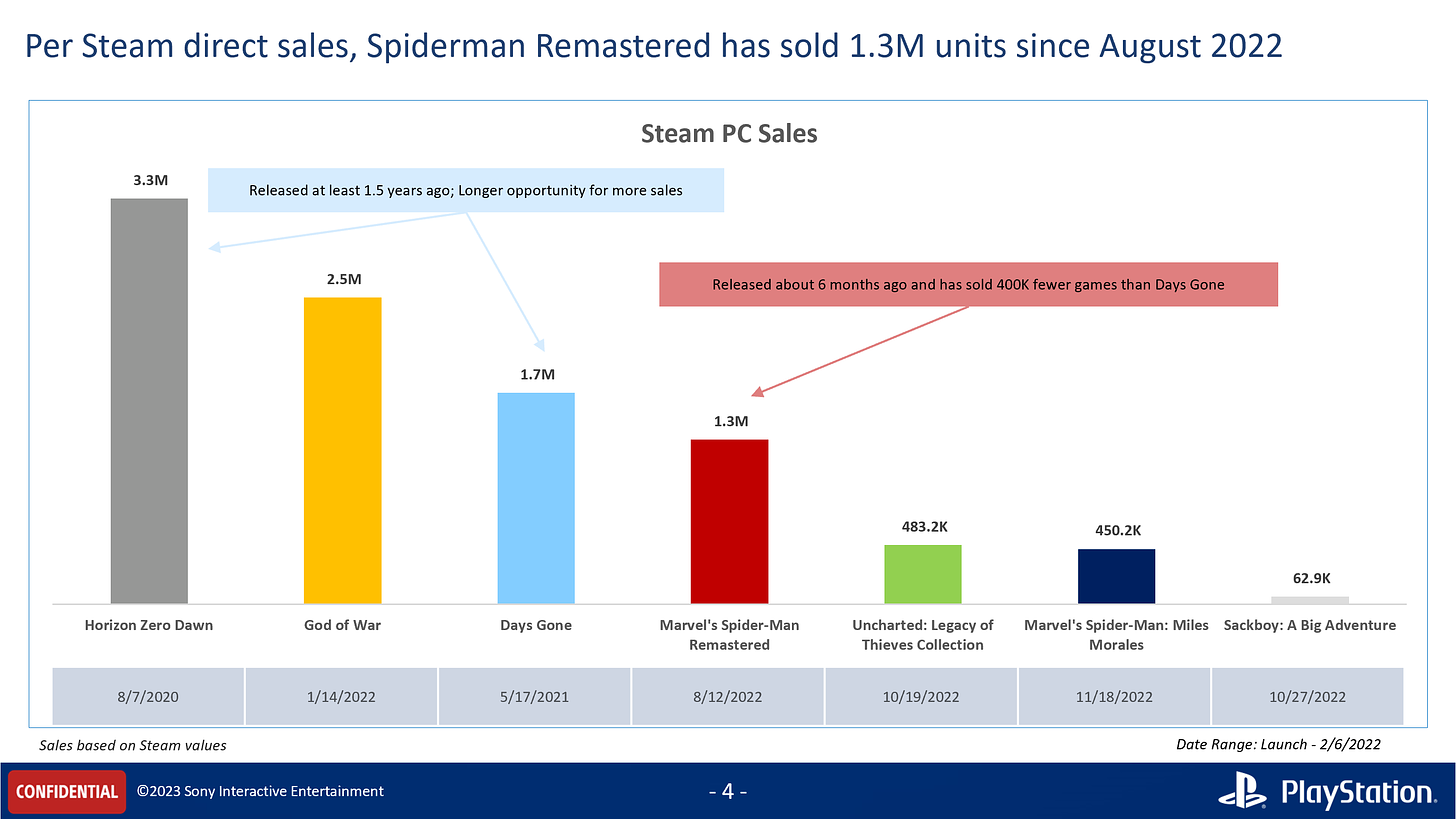

PlayStation Game Sales on Steam

Data is current as of February 2023.

-

Horizon: Zero Dawn is the top-selling game on PC, with over 3.3 million sales.

-

God of War performed well (2.5 million), along with Days Gone (1.7 million) and Marvel’s Spider-Man Remastered (1.3 million - but in just six months).

-

Sackboy: A Big Adventure is the main disappointment among all PlayStation games on PC, with only 62.9 thousand copies sold.

-

The leak claims that Sony approves PC ports via email, with the condition that porting should cost less than $30 million.

PlayStation and the Industry Vision

-

The company sees significant risks in the deal between Microsoft and Activision Blizzard. They believe the deal will help Microsoft grow its influence in the GAAS segment on PC and console, mobile devices, and compete with Apple and Google in the mobile store market.

-

Sony is seriously considering the threats posed by the Microsoft and Activision Blizzard deal. The key concern is losing Call of Duty and impacting the PS+ audience, which brings in approximately $1.5 billion annually.

-

Sony acknowledges that Microsoft is far ahead in mobile and PC directions, with the Japanese company having nothing to counter competitors.

-

Sony doesn't believe that AAA games in a subscription model can cover development costs and considers this business model unsustainable.

-

Sony believes there is no unified approach to development on PCs, consoles, and mobile devices. Differences in form factor and computer power prevent using the same approaches.

-

The company plans to continue focusing on the development of paid AAA games, considering it the main factor in its strategy.

Also

-

It appears that 40% of the budget for Horizon: Forbidden West went to outsourcing. In the case of Horizon: The Burning Shores, this is 21%, assuming the slide is read correctly.

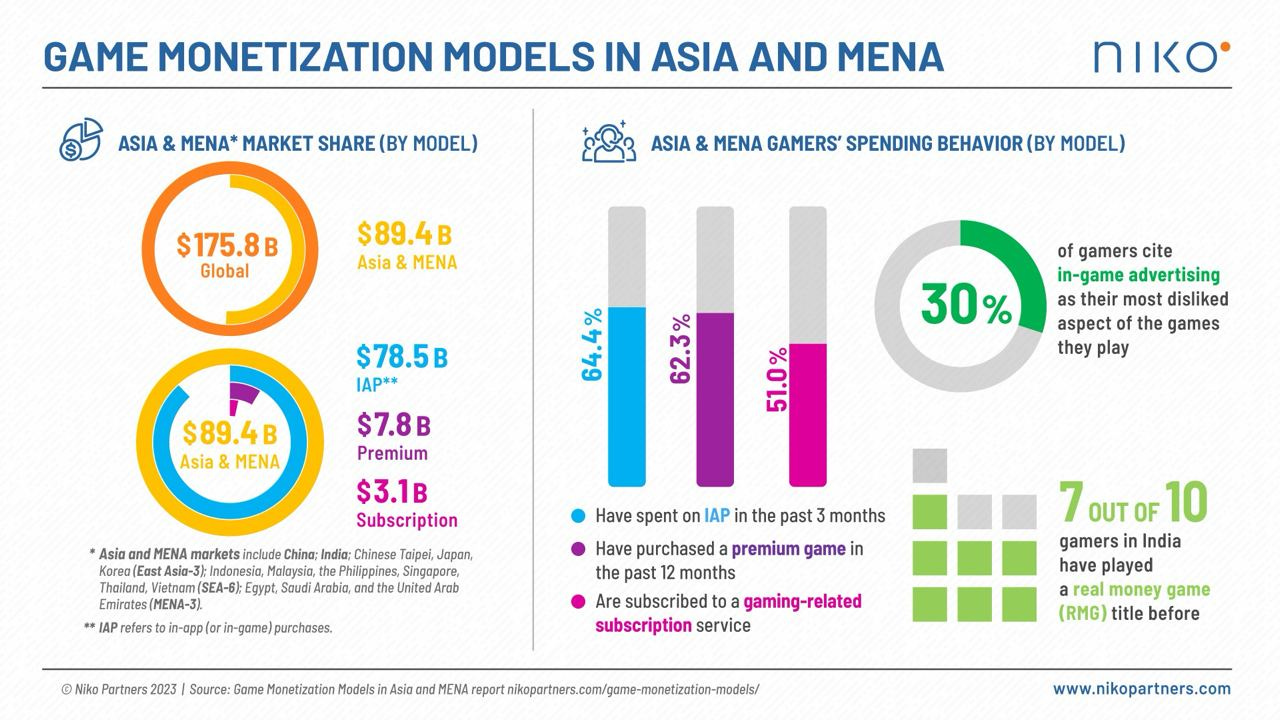

Niko Partners: The volume of payments in the largest gaming markets in Asia and MENA in 2023 will amount to $89.4 billion

The company considers the markets of China, India, Chinese Taipei, Japan, South Korea, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam (Asia); Egypt, Saudi Arabia, and the UAE (MENA-3).

-

$78.5 billion in revenue in the mentioned regions comes from in-app purchases (IAP payments). This accounts for 87.8% of the total volume.

-

Sales of games distributed through the Premium model brought in $7.8 billion in 2023. Subscriptions contributed an additional $3.1 billion.

❗️ Niko Partners does not account for advertising in the overall revenue.

-

Price is the biggest barrier for players from Asian and Middle Eastern countries. 39.3% of non-paying users on mobile devices and 44.3% of non-paying PC users identified this factor as key.

-

62.3% of players from the considered countries bought a game on one of the platforms in the last 12 months.

-

30% of users in Asia and the Middle East purchased a monthly subscription to the game. If considering offers within other services (such as Twitch Prime), the percentage of users increases to 51%.

-

30% of mobile gamers in Asian and MENA countries named in-game advertising as the worst aspect of the games they spend time on.

-

In India, 7 out of 10 people play Real Money Gaming (RMG) projects. These are games where you can play for real money.

GameRefinery: Trends in casual and midcore games in November 2023

Casual Game Trends

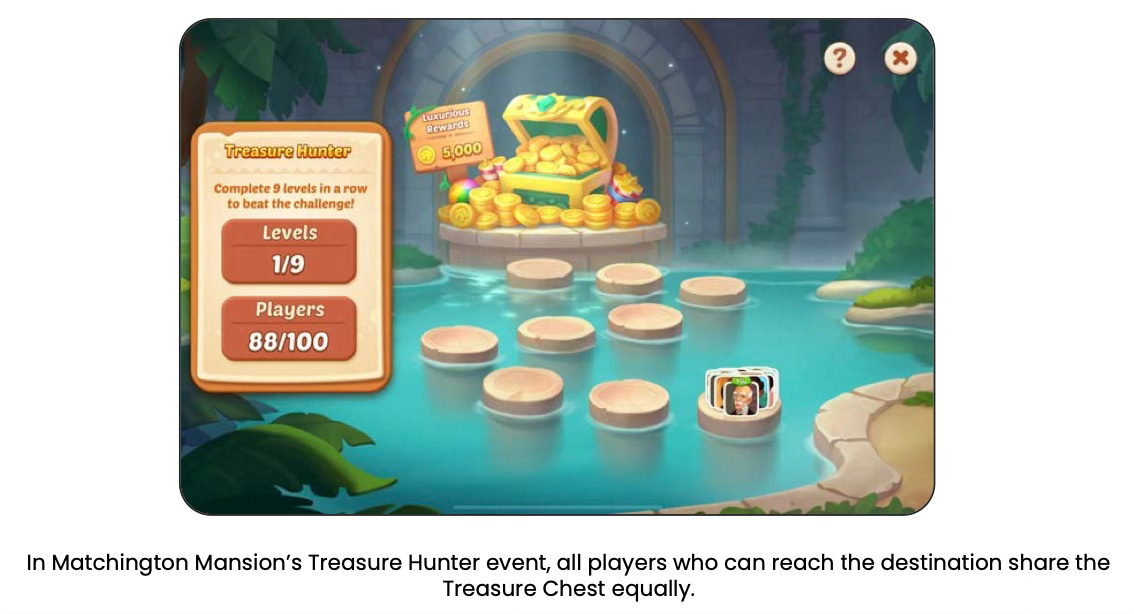

-

GameRefinery notes the growing popularity of the Social Win Streak mechanic. Users are grouped into large teams (usually around 100 people) and given several tasks to be completed consecutively. If a task is not completed, the player is eliminated from the competition (but can return after some time). This is a casual interpretation of the Battle Royale concept.

-

The second popular mechanic is the Digging Minigame. Through the main game, the user gains access to a pickaxe (or equivalent) to dig up the game field. The minigame first appeared in June in Royal Match; in November, the mechanic was borrowed by Monopoly GO! (Egyptian Treasures) and Chrome Valley Customs (Crusher Carnage).

Midcore Game Trends

-

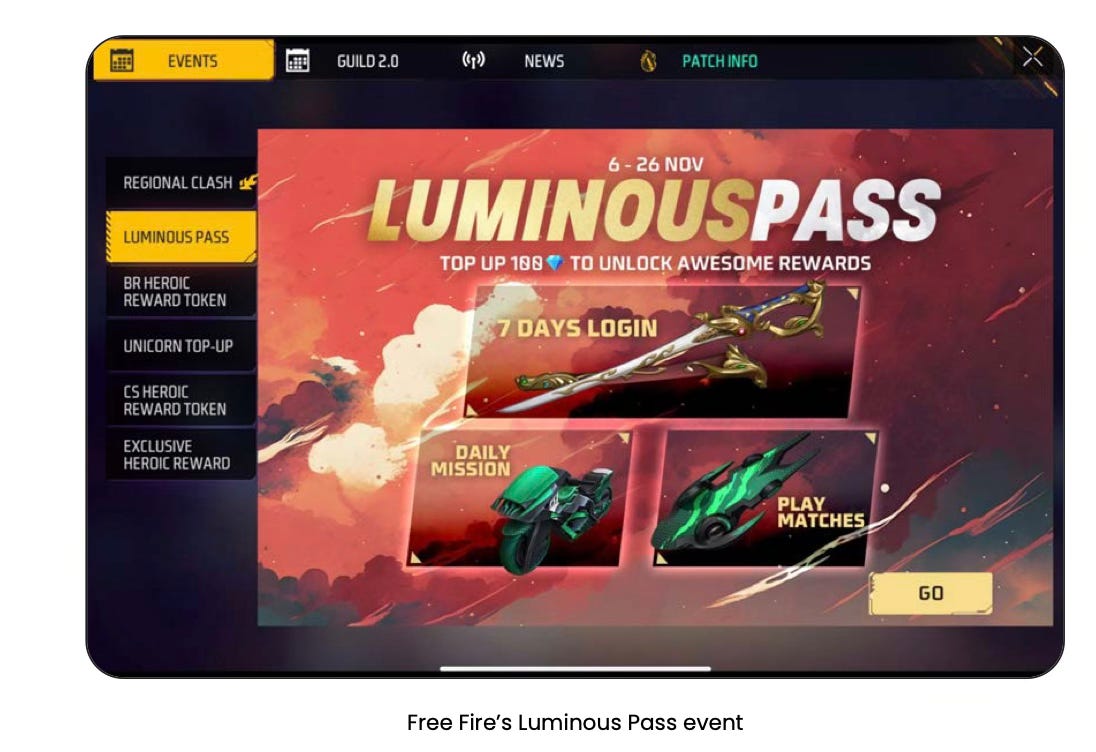

Paywall events. In Garena Free Fire, the Luminous Pass has been launched. Its concept is to take hard currency from the user (100 diamonds), in exchange for which the player receives 7 days of login rewards, exclusive daily tasks, and the opportunity to spin the wheel of fortune after each match.

-

A similar mechanic was applied by the State of Survival in collaboration with Resident Evil. To access new content, players need to unlock Chris Redfield through the gacha system. One attempt per day is free, but the balance is set up in a way that you won't get anything for free. You need to purchase hard currency.

-

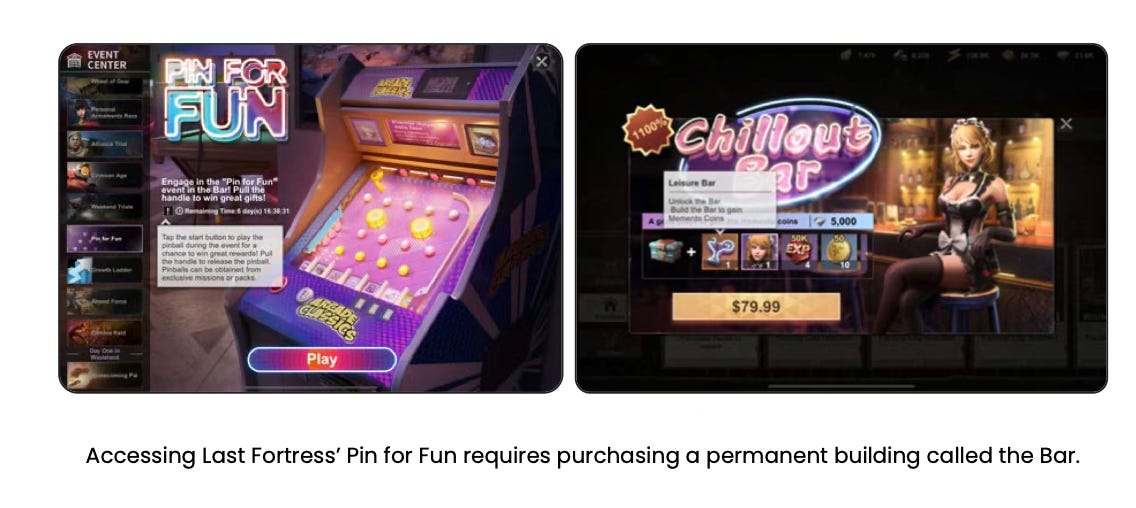

The latest example of locking part of the content in F2P is in Last Fortress: Underground. The Pin for Fun event is only available to those who have purchased the Chillout Bar building (which is sold in a bundle for $79.99).

-

Not a trend but a noteworthy event: in League of Legends: Wild Rift, a new 2v2 mode has been released. Four teams of two compete on the field, each with a limited number of respawns. The roster is also limited.

CGIGC: The Chinese gaming market recovered in 2023

-

The revenue of the Chinese gaming market for the year 2023 is expected to reach 303 billion yuan ($42.6 billion). This is 13% higher than the previous year, as reported by the CGIGC association.

-

This marks the first year in China's history where the revenue exceeded 300 billion yuan.

-

The number of gamers in China increased by 0.61% to reach 668 million people.

-

Local developers earned 256 billion yuan in China, which is 15% more than the previous year. And 84.4% of the entire gaming market is covered by local companies, which makes it challenging for projects from other countries to compete, not only due to licensing difficulties.

-

However, the revenue of Chinese companies abroad fell by 5.65% to $16.3 billion. One of the reasons is the increased regulatory measures in countries like India.

IGEA: Australian Gaming Industry in 2023

-

By the end of 2023, the gaming industry in Australia earned AU$345 million ($234.8 million US dollars). This is 21% more than the previous year.

-

Overall, Australian studios have positive expectations for the future. 68% predict an increase in profits in 2024; 21% expect stable profits at the current level.

-

At the end of the year, more than 2458 people work in Australian studios - 17% more than the previous year.

-

The Australian industry aims to expand. 63% of studios plan to hire new people in 2024 - expecting more than 200 new jobs.

-

69% of employees in Australia are male; 26% are female; 5% are transgender or non-binary individuals.

-

89% of Australian studios work on games based on their intellectual property (IP).

-

87% of studio revenue comes from countries outside of Australia.

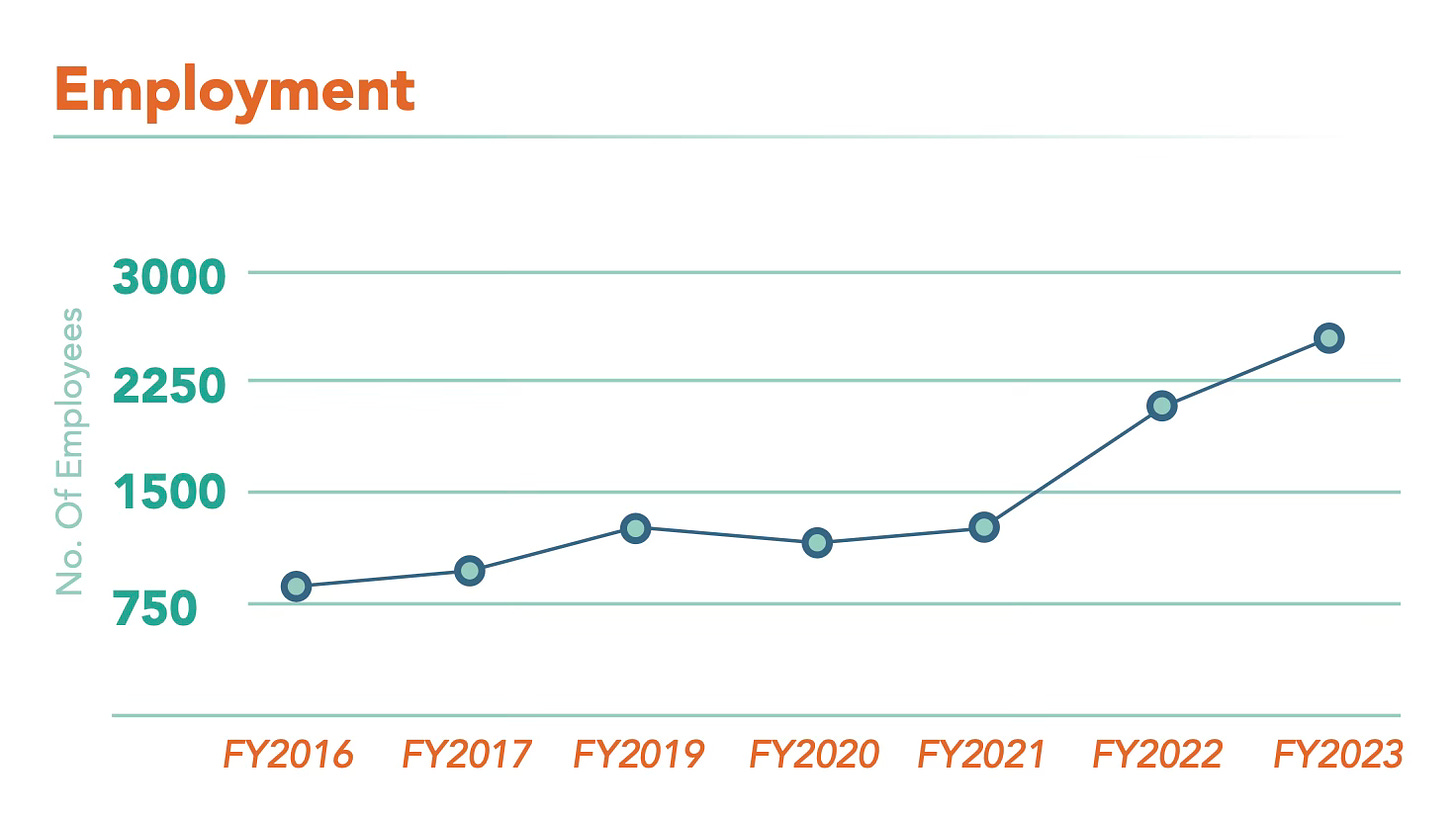

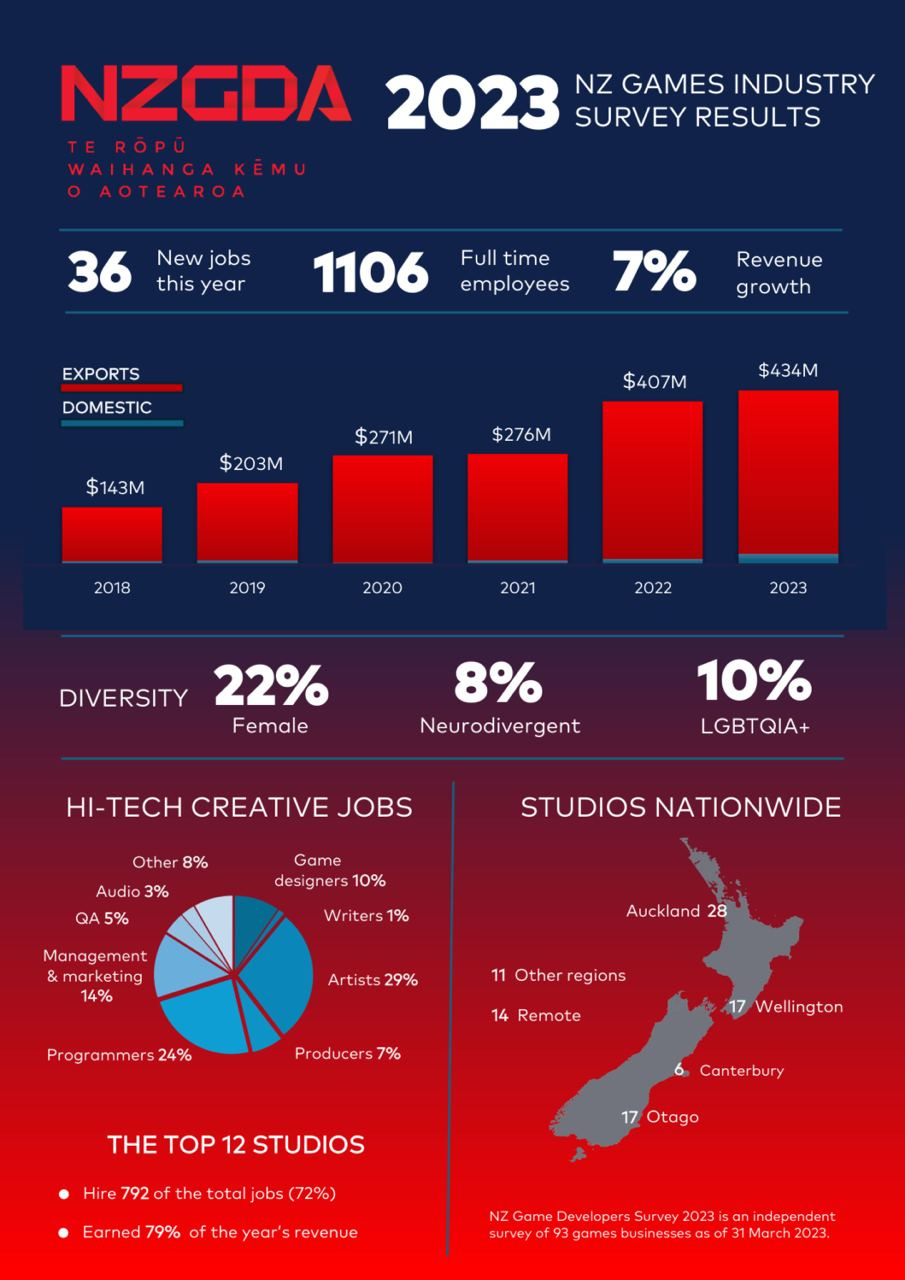

NZGDA: New Zealand Gaming Industry in 2023

-

New Zealand studios earned NZ $434 million ($273.5 million US dollars) in 2023. 95% of the revenue comes from other countries.

-

In the New Zealand industry by the end of 2023, 1106 people were employed. 22% of them are women, and 10% identify as LGBTQIA+.

-

New Zealand studios complain that their Australian colleagues are poaching talents, limiting the industry's growth in the country.

-

43% of New Zealand studios were founded in the last 3 years.

-

Business sentiments are optimistic. 59% of studios expect revenue growth; 30% are confident they can maintain the current revenue level.

-

54% of studios work on PC projects; 31% are on mobile projects.

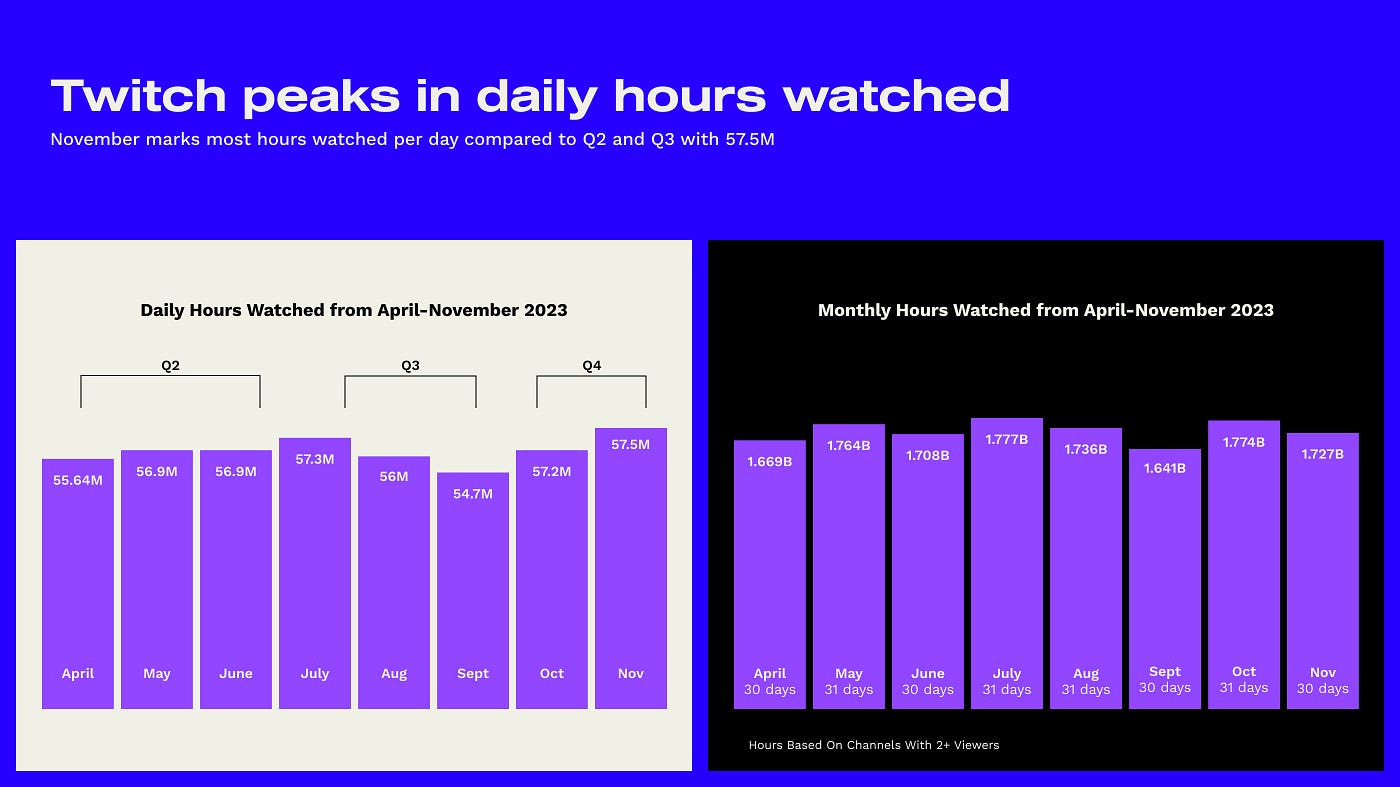

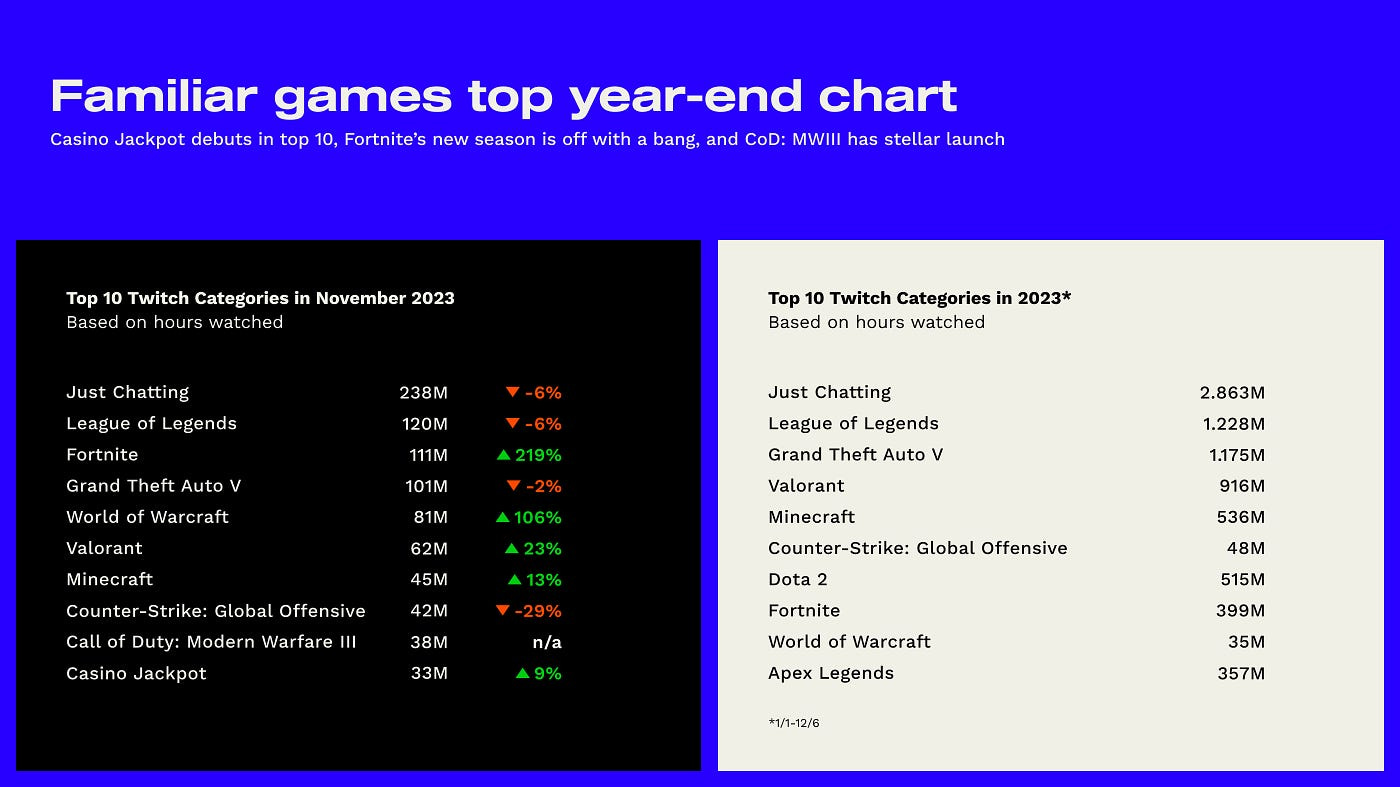

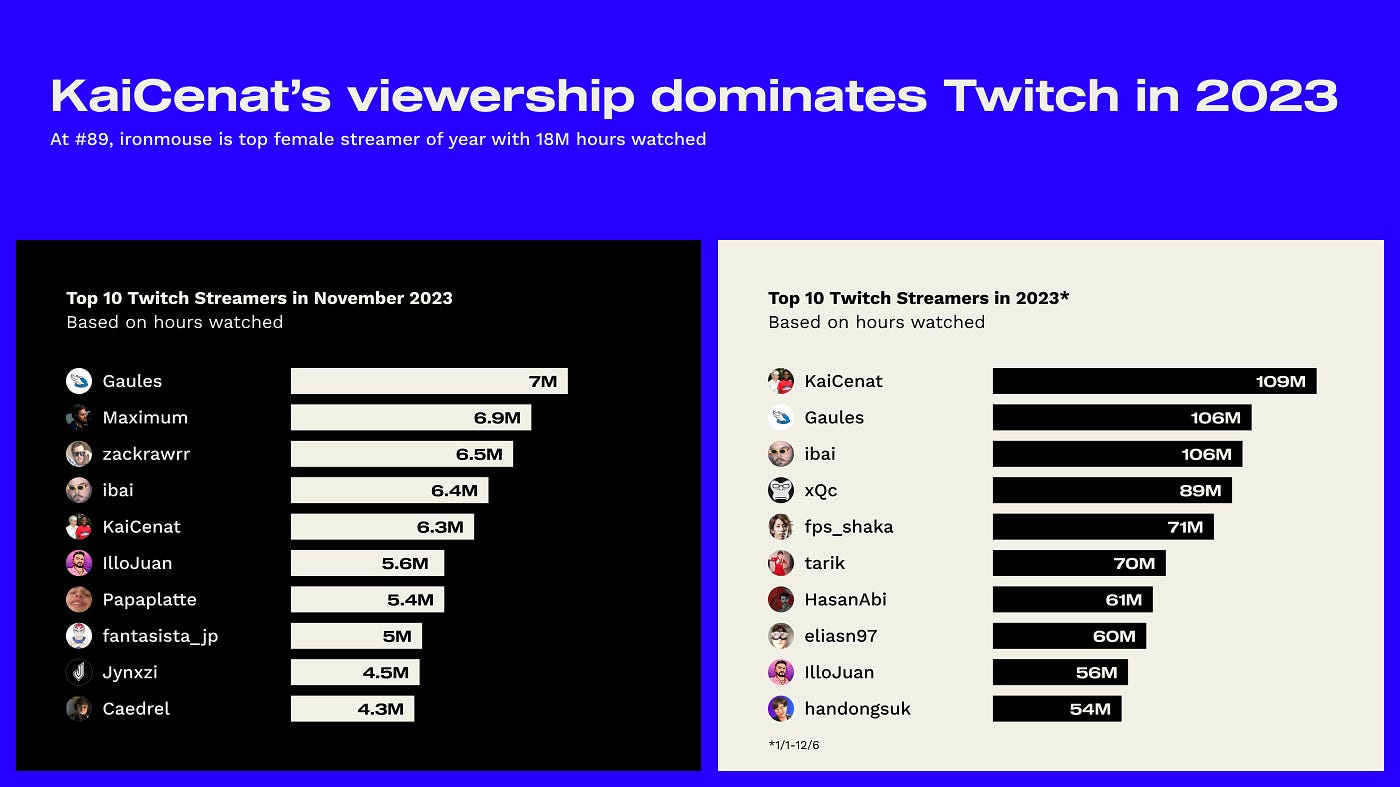

StreamElements & Rainmaker.gg: State of the Streaming Market in November 2023 and year's results

-

The total number of hours watched on Twitch in November declined compared to October (1.774 billion versus 1.727 billion), but this is due to one fewer day in November.

-

When comparing the daily number of hours watched, November, with a daily average of 57.5 million hours, is the best month since April 2023.

-

League of Legends (120 million hours), Fortnite (111 million hours), and Grand Theft Auto V (101 million hours) were the top games on Twitch in November in terms of views.

-

Looking at the year as a whole, the leaders are League of Legends (1.228 billion hours), Grand Theft Auto V (1.175 billion hours), and Valorant (916 million hours).

-

Diablo IV had the best start in 2023. In the first week, the game received 70 million hours of views. Following were Hogwarts Legacy (50 million hours) and Baldur’s Gate III (22 million hours). Notably, in 2023, only 9 new games entered the top 10 on Twitch.

-

KaiCenat is the most popular streamer on Twitch, with 109 million hours of views. His main content is entertainment, not game streaming. On the other hand, Gaules (106 million hours) specializes in Counter-Strike. The only woman in the top 100 is Ironmouse (18 million hours).

The PlayStation 5 has surpassed the 50M sales mark

-

It took just over 3 years for the console to achieve this milestone. In terms of sales dynamics, it slightly lags behind the PS4 - Sony's previous console reached the same circulation a week earlier.

-

In the period from July to December 2023, Sony managed to sell 10 million consoles.

-

In July, when they announced 40 million sales for the PS5, it was trailing behind the PS4 by two months in terms of dynamics. The second half of 2023 turned out to be very successful.

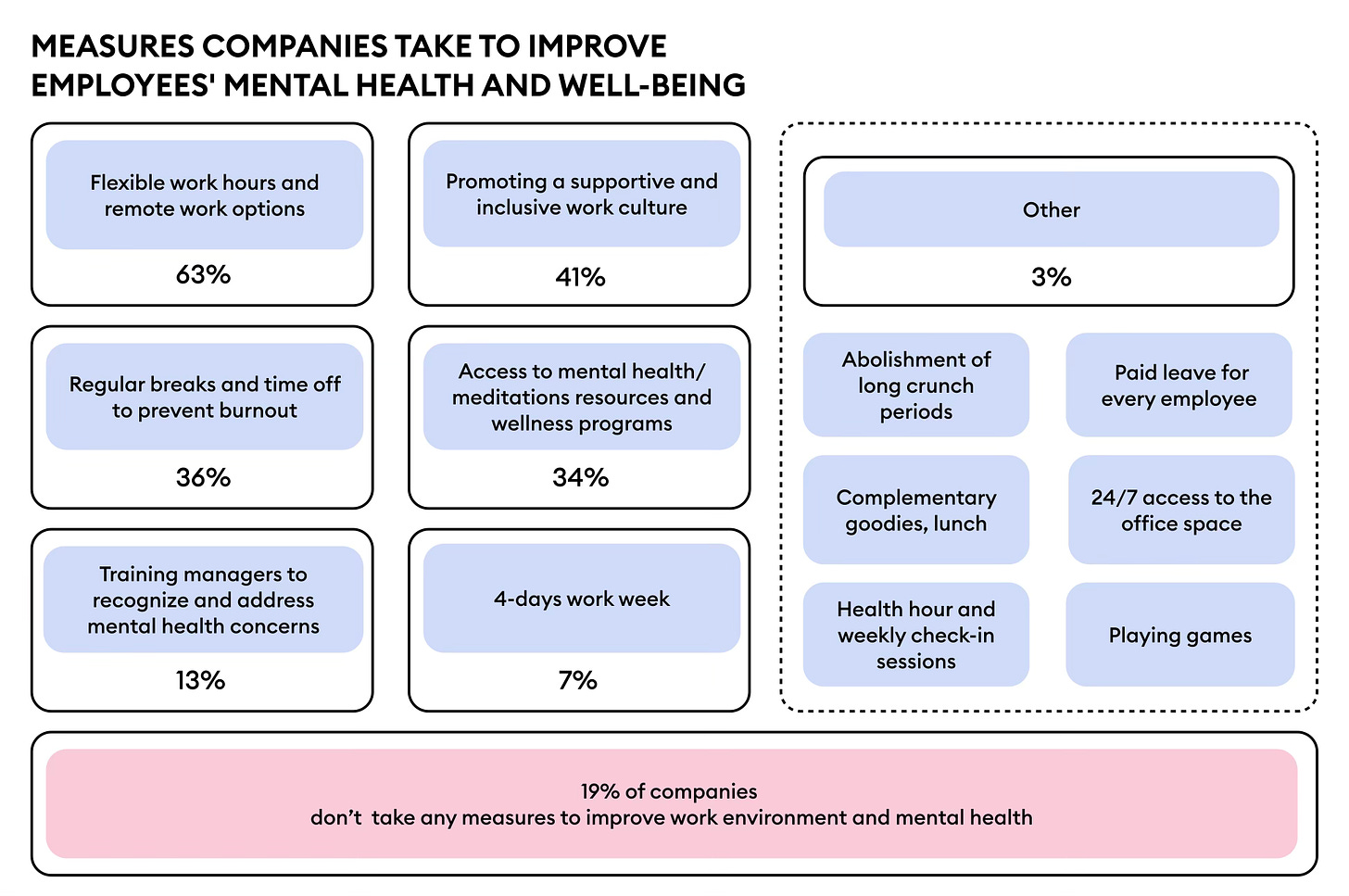

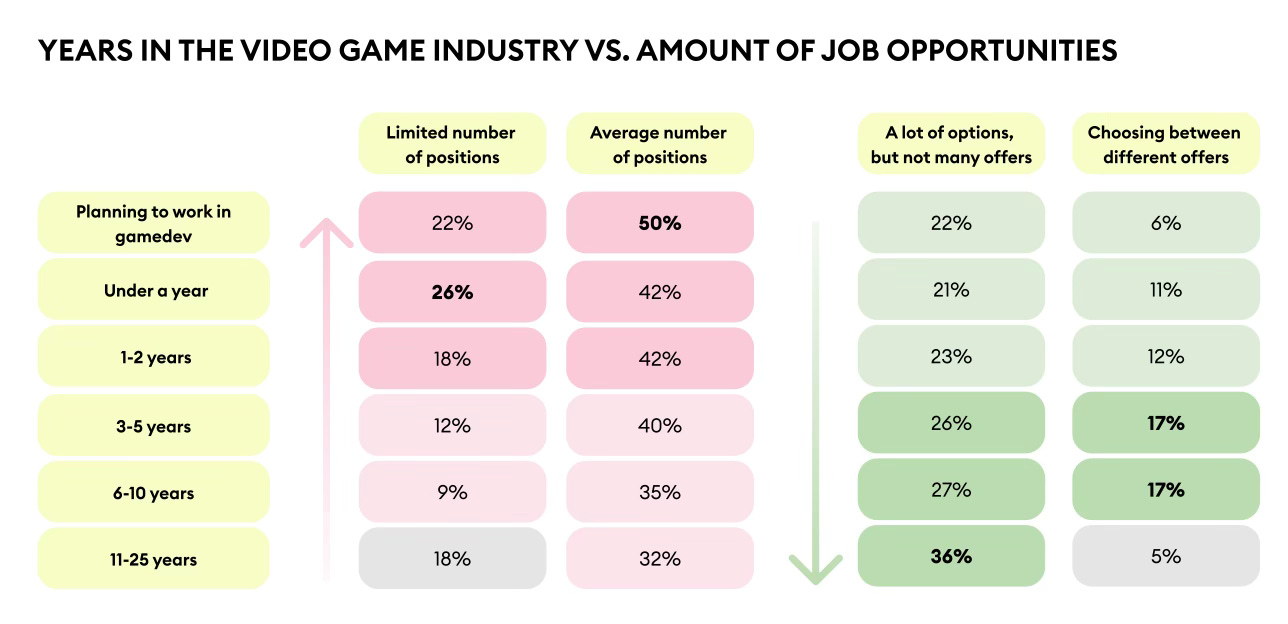

80LV: Culture, Mental Health, and HR Trends in the Gaming Industry in 2023

80LV surveyed 503 gaming industry professionals from 56 countries.

-

Only 26% of employees are satisfied with their current workplace and the company's cultural code.

-

Surveys showed that the majority of employees do not feel loyalty to their studios. Most respondents would not recommend their companies as places to work (76.3%). The main areas for improvement include manager awareness, employee support, and remote work opportunities.

-

Only 13% of surveyed companies offer training and courses for managers.

-

For 40% of employees, company culture is very important.

-

19% of surveyed employees note that companies do nothing to support the mental health of their employees. 52% note that their companies take no action to support inclusivity and equality in the workplace.

-

The most popular support methods for employees in companies are flexible start times and the ability to work remotely (63%); promotion of an inclusive culture in the workplace (41%); breaks and the option to take time off to avoid burnout (36%); access to meditation and sports resources (34%); a 4-day workweek (7%).

-

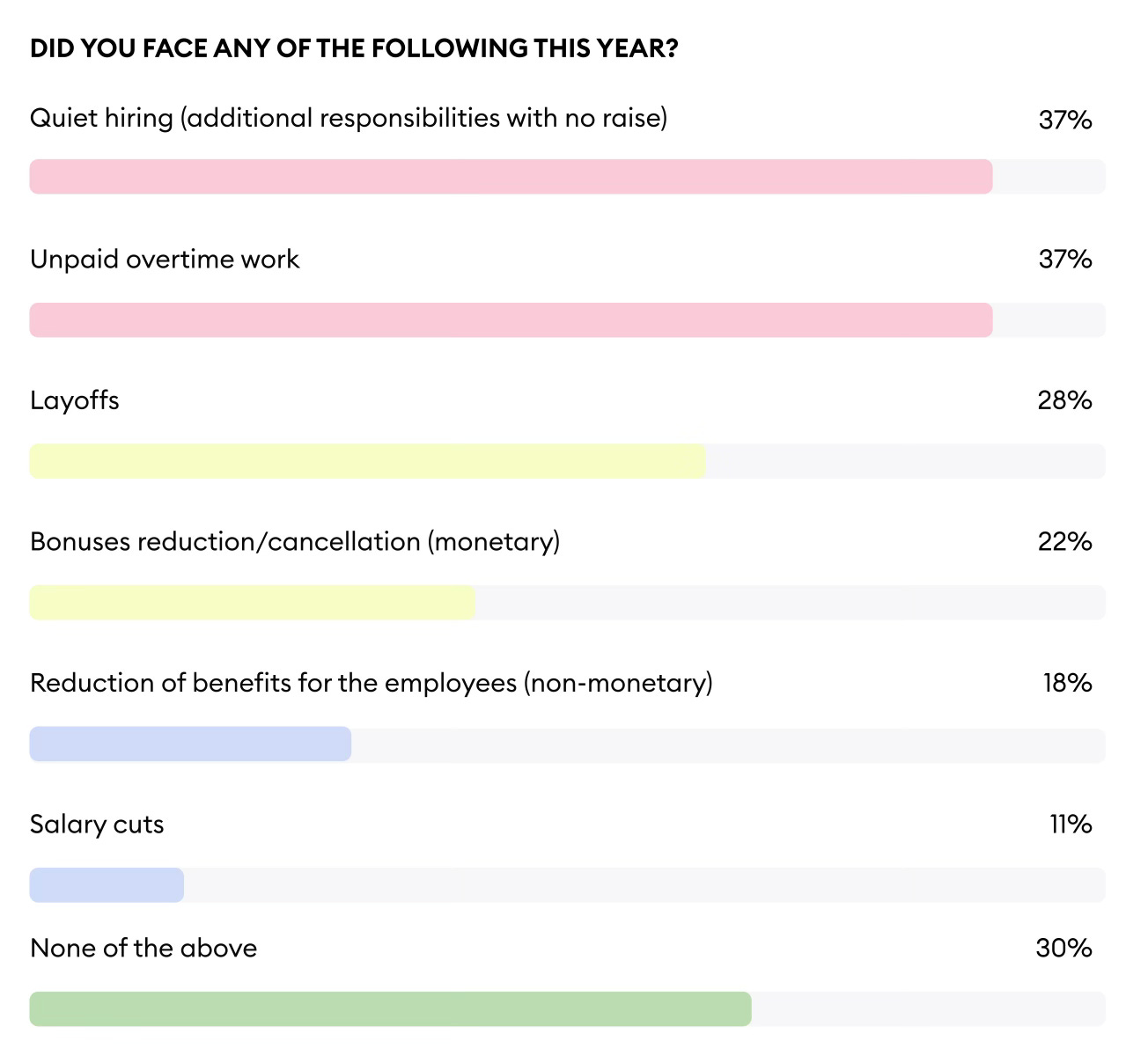

28% of employees faced layoffs in their companies in the last year.

-

47% of respondents in 2023 were looking for a new job but couldn't find one. 34% did not look for a new job. 19% looked for and found one.

-

Despite discussions about AI risks, only 3% of respondents noted that layoffs occurred due to automation.

-

37% of employees noted that in 2023 they had more responsibilities, but their salary did not change. The same percentage noted that they were not paid for overtime. And 11% of respondents faced a salary reduction.

-

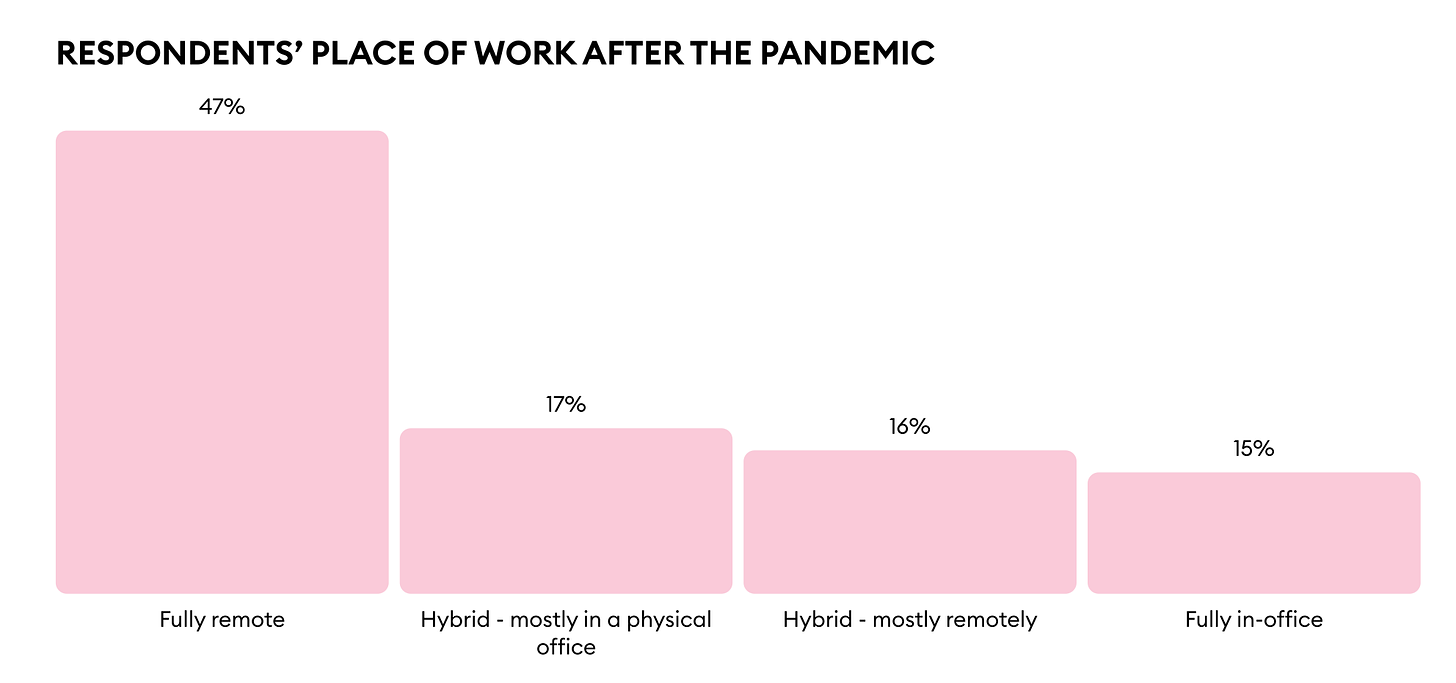

After the end of the pandemic, 47% of respondents continued to work remotely. 33% started working in a hybrid format, and 15% returned to offices. The rest 5% was missed somewhere.

Ampere Analysis: PlayStation 5 in 2023 Outpaced Xbox Series S|X Sales by 3 times

-

According to Ampere Analysis calculations, PS5 sales in 2023 increased by 65% and reached 22.5 million units.

-

Sales of Xbox Series S| X's sales decreased by 15% to 7.6 million units.

-

Nintendo Switch sales also fell by 18% to 16.5 million consoles.

-

Matt Piscatella, an analyst at Circana, notes that in the United States, the PS5 sells better than the PS4.

-

Sony had previously announced that it aims to sell 25 million PS5 units in the 2023 fiscal year, which will end on March 31, 2024.

data.ai: In 2023, 19 mobile games surpassed the $1 billion revenue mark

-

The number of games surpassing the $1 billion total revenue mark has been consistent over the last 4 years—19 games (18 in 2021) per year.

-

In 2023, the elite list includes Age of Origins; Arena of Valor; Arknights; Boom Beach; DoubleU Casino; EA Sports FC Mobile 24 Soccer; eFootball 2024; League of Legends: Wild Rift; Lightning Link Casino; Lineage W; Marvel Strike Force; Odin Valhalla Rising; One Piece Treasure Cruise; PokoPoko; Puzzles & Survival; Royal Match; Solitaire - Grand Harvest; War and Order; and World Series of Poker.

-

The list includes 3 4X strategies; 2 MMORPGs; 2 battlers; 2 Match-3 games; and 2 slots. 5 games are classified as RPGs by data.ai, but this category includes MOBA, MMORPG, and battlers.

-

Camel Games is the only studio (aside from Tencent) whose two games surpassed the $1 billion mark in 2023. We are talking about Age of Origins and War and Order—both are 4X strategies. The company is based in China.

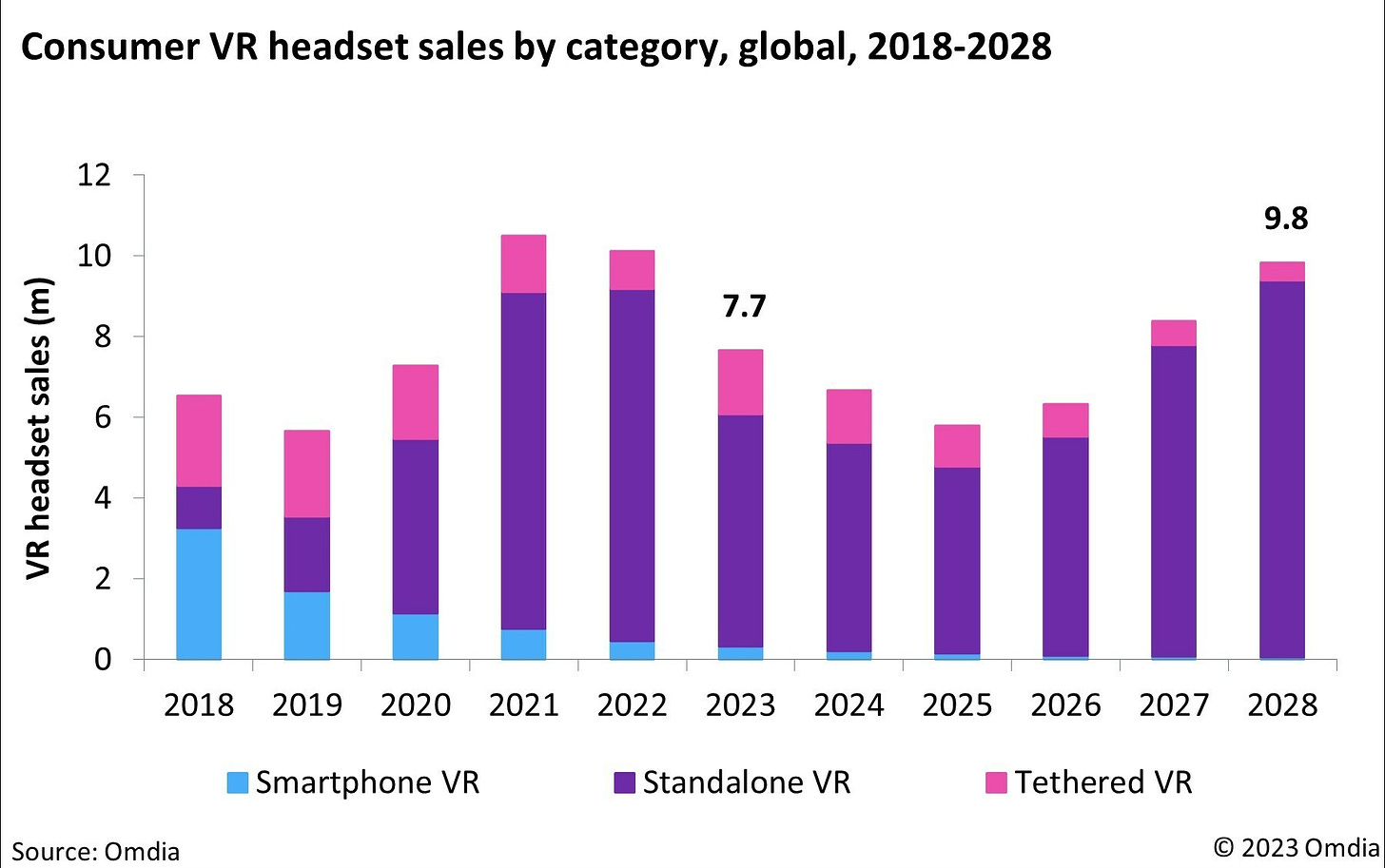

Omdia: Sales of VR devices will decline until 2026

-

Sales of VR devices in 2023 decreased by 24%—from 10.1 million devices in 2022 to 7.7 million.

-

Omdia expects a further decline in 2024 by 13% and another equal percentage drop in 2025.

-

The market is projected to return to growth only in 2026 and approach 2022 levels by 2028.

-

Omdia estimates that the active user base of VR device owners at the end of 2023 is 23.6 million people.

-

Spending on VR content in 2023 declined from $934 million in 2022 to $844 million. It is expected that this market segment will return to growth in 2024, with content sales reaching $2.3 billion annually by 2028. The primary focus is on VR/AR devices from Apple.

-

Reasons for the decline include inflation, a reduction in the real income of the population, and subpar performance of three devices: Meta Quest 3 (high price), Sony PlayStation VR 2 (limited content), and Pico 4 (ByteDance is downsizing the VR division).

-

Additionally, Omdia analysts believe that portable systems are affecting VR device sales. Therefore, the release of Nintendo Switch 2 and Steam Deck OLED will negatively impact VR device sales.

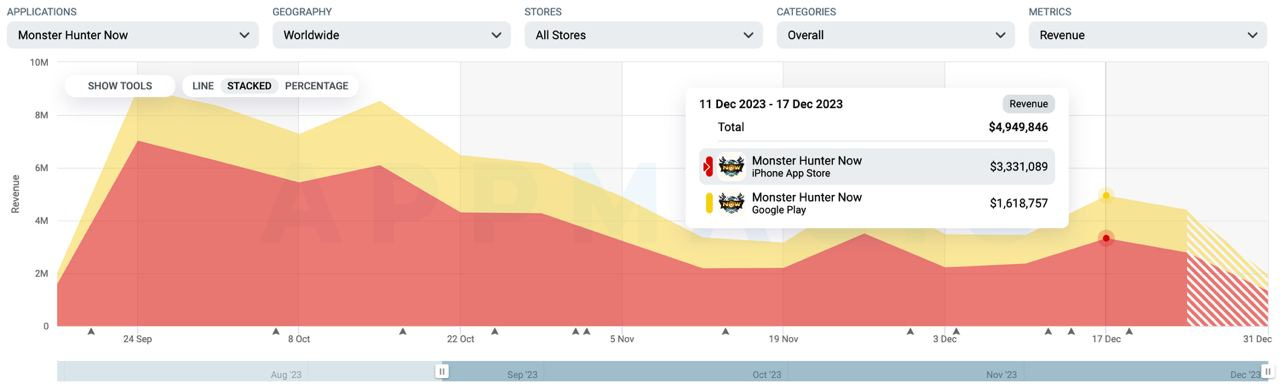

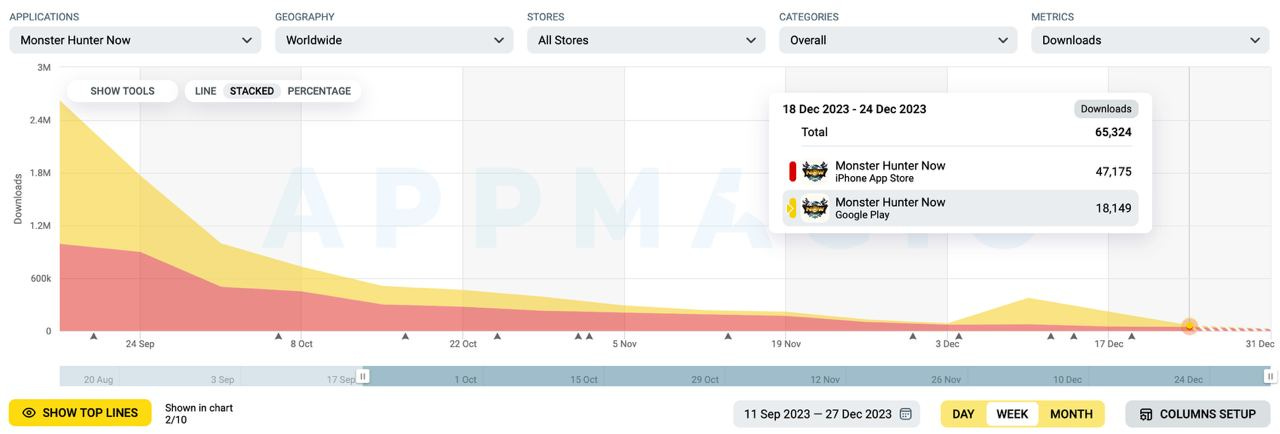

Monster Hunter Now has surpassed the $100M revenue mark

-

From September 14 to December 14, the game earned $73.3 million, according to AppMagic data. This includes store commissions and taxes, so users in the game have already paid over $100 million.

-

The game's revenues in November-December stabilized at $3.5 million weekly.

-

70% of the game's revenue comes from Japan; 10% from Hong Kong; 7% from Taiwan, and 6% from the USA.

-

Since September 14, the game has been downloaded over 9.2 million times.

-

34% of downloads are from Japan; 14% from the USA; 12% from Taiwan.

-

The game's Revenue per Download (RpD) varies significantly in different regions. In leading Asian markets, each download brings developers $14.47. However, in leading Western markets, each download accounts for $3.28.

-

Monster Hunter Now has already become the second-highest-grossing game for Niantic after Pokemon GO.

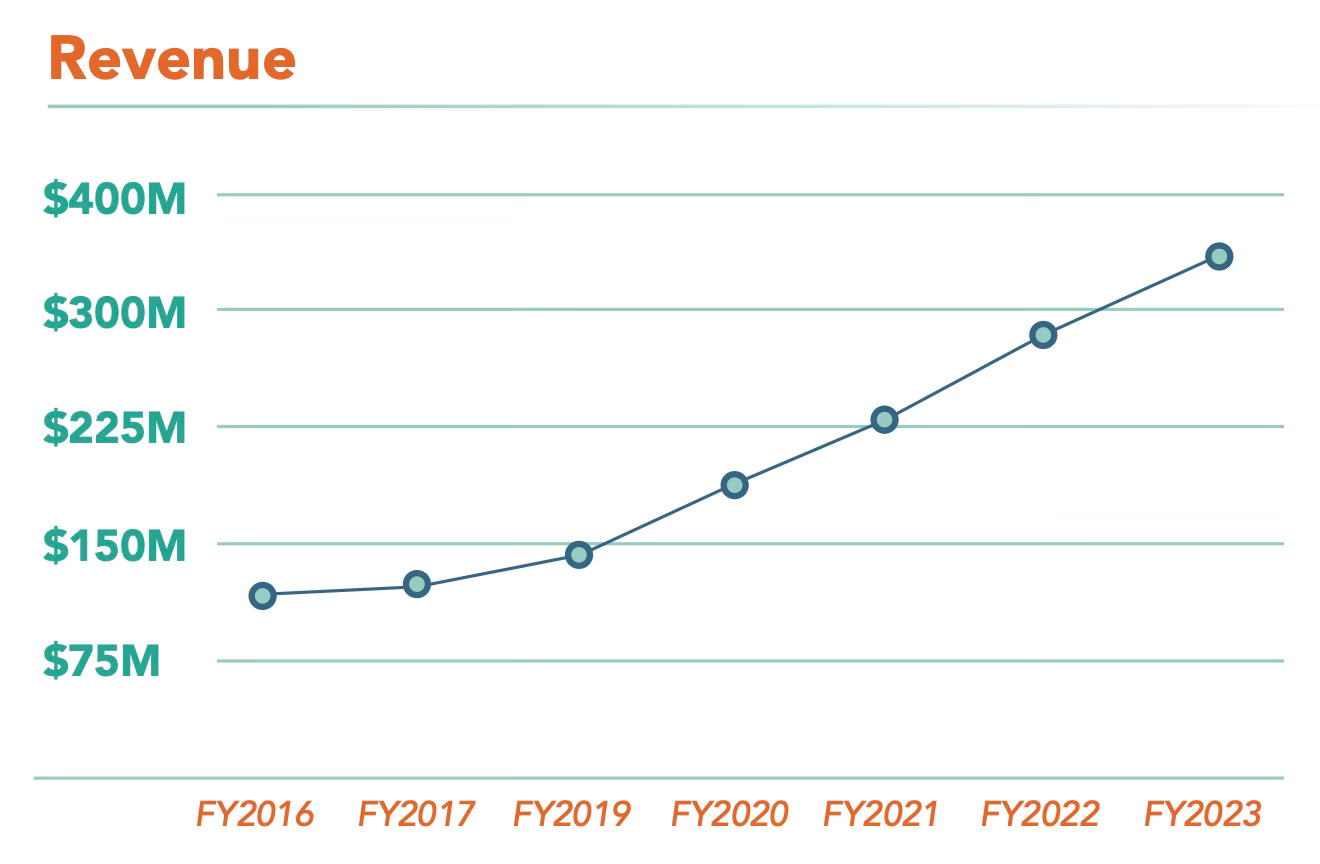

Rush Royale has surpassed the $280M revenue mark

-

In the year 2023, the game earned $120 million, which is 30% more than the previous year. The project achieved daily revenue exceeding $1 million five times.

-

Since its launch in 2020, the game has been downloaded over 73 million times. According to data.ai, this makes it the largest Tower Defense game in the world.

-

In June 2023, MY.GAMES reported that Rush Royale's revenue exceeded $230 million, and the total downloads surpassed 63 million.

The total sales of Anthem seem to have exceeded 5M copies

-

The troubled looter-shooter from Bioware was released on January 25, 2019. The game was preceded by a massive marketing campaign, and the release trailer was directed by Neill Blomkamp (director of District 9, Elysium, and Chappie).

-

The game's release was overshadowed by poor reviews from both critics and players. The project received 59 points on Metacritic, but users rated it even lower. Despite this, Anthem sold over 2 million copies in the first week—a remarkable result for a new IP.

-

Despite Bioware completely discontinuing support for the project in 2021, Anthem continued to sell. According to a former company marketer on Linkedin, the total sales of the game exceeded 5 million copies.

-

In February 2019, SuperData reported that the game had earned over $100 million (with $3.5 million coming from in-game purchases).

-

EA itself claimed that its target for lifetime sales was 6 million copies.

-

Considering that the game was heavily discounted (currently being sold for $0.99), it can be assumed that the game earned just over $120 million over its entire lifetime. Considering the development budgets from 2015 to 2019, it is quite possible that the game, after many years, has almost reached the break-even point. However, for an outside observer, the game's history is an undeniable failure

The Pokemon GO Fest 2023 events brought $323 million to the economies of the countries where they were held

The study was conducted by Statista in collaboration with Niantic.

-

Over 194 thousand people attended events in New York, London, and Osaka. It is estimated that they spent $323 million during their trip to the event (including $73.8 million in tax payments).

-

For comparison, the Champions League final in Istanbul brought the city $80 million; Eurovision in Liverpool - $66.2 million; and Taylor Swift's performance in Kansas City - $48 million.

New York Event

- 74 thousand tickets were sold; 58% of participants were aged 27 to 44.

-

On average, each visitor spent $783 on the event.

-

The overall economic impact is estimated at $140.1 million (including $28.1 million in taxes).

London Event

- 62% of visitors came to London from other countries. 60% of visitors were aged 25 to 44.

-

Each visitor spent an average of $522 on the event.

-

49% of event attendees plan to revisit London within the next 12 months.

-

The overall economic impact is estimated at $58.75 million ($28.1 million in tax payments).

Osaka Event

- 78% of visitors came to Pokemon GO Fest 2023 from other cities. 2% came from other countries (mostly from the USA).

-

On average, each visitor spent $335 on the event.

-

Those who attended the event in Osaka spent $11.7 million on shopping.

-

The overall economic impact is estimated at $38 million ($11.6 million in taxes).

Tune in next month for more updates!