Devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview was prepared by Dmitriy Byshonkov, the author of the GameDev Reports by the devtodev Telegram channel. You can read the May and June reports.

Contents

- Game Developer Collective: 59% of game developers pessimistic about the current state of the industry

- Newzoo: How people engage with Games in 2024

- AppMagic: Top Mobile Games by Revenue and Downloads in June 2024

- VG Insights: Cooperative Games on Steam in 2024

- Niko Partners: Chinese Gamers in 2024

- IDC: Global AR/VR Device Shipments Plummeted by 67.4% YoY in Q1 2024

- Gaming in Turkey: Turkish Gaming Market in 2023

- Games & Numbers (June 26 - July 10)

- Circana: The US gaming market declined in May 2024

- Layer Licensing: IP Collaborations in Games in recent years

- Brightmine: The average salary of females in the UK is £8,000 less than that of male

- ERA: Game Sales in the UK Dropped by 29.4% in the First Half of 2024

- Sensor Tower: Korean Mobile Gaming Market in H1'2024

- Splitmetrics: VR games Downloads on Android grew by 40% in H1'24

- InvestGame: Gaming Investment Market in Q2'24

- Nintendo Switch - the longest-lasting home (?) console in Nintendo's history

- Sensor Tower: Mobile Games by Korean Developers Worldwide

- GSD & GfK: PC & Console Games Sales in Europe in June 2024 and H1'24

- AppMagic: Peak Games Earned Over $5B - and Returned to Growth

- Comscore & Anzu: Study of the American Gaming Audience

- Monthly Audience of WeChat Mini Games Reached 500M Users

- Games & Numbers (July 11 - July 23)

- How to Market a Game: Results of the H1'24 and Q2'24 in Steam for Indie Games

- Sensor Tower & Adjust: Trends of the Japanese Mobile Market in 2024

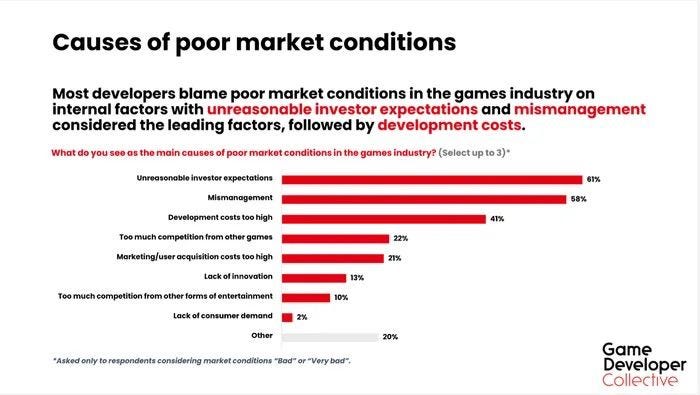

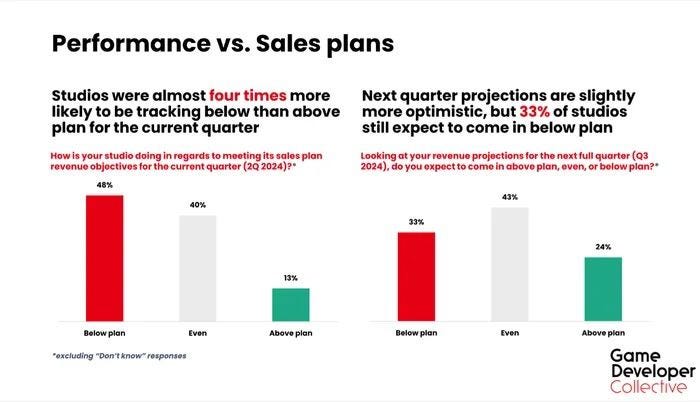

Game Developer Collective: 59% of game developers pessimistic about the current state of the industry

In May 2024, more than 600 game developers were surveyed.

- The overall attitude towards the state of the industry is negative, with 59% expressing this view. Only 13% of those surveyed said everything is going well in the industry.

-

25% are optimistic and believe that things will get better soon. 49% do not expect improvements in the next six months, and 19% think things will only worsen.

-

Developers also pointed out who they think is to blame for this situation. Among those dissatisfied with the state of the industry, 61% blamed unrealistic investor expectations. 58% cited poor management. Other reasons mentioned include increasing budgets (41%), competition from other games (22%), and the need for high marketing expenses (21%).

-

Currently, 48% of workers report that they are not meeting their revenue/sales targets. 40% are on target, and only 12% are ahead of plan.

-

Workers are more optimistic about the future. 34% believe they will exceed their targets in the next quarter (Q3’24); 43% plan to meet their targets; and 33% think they will not meet their goals.

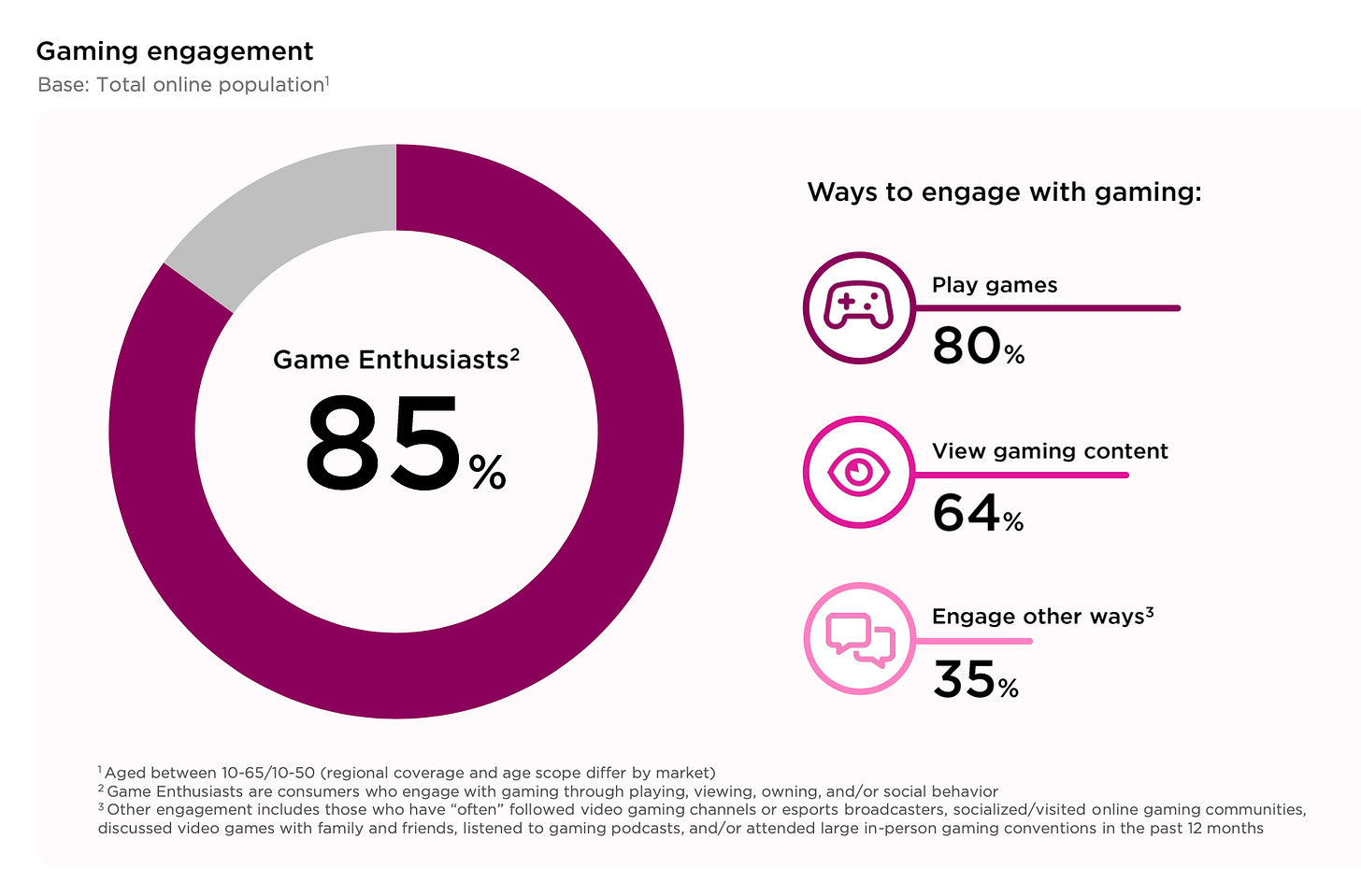

Newzoo: How people engage with Games in 2024

The study is based on a survey of 73,000 people from 36 countries.

General Stats

-

80% of people play games.

-

64% of people watch gaming content; 35% engage in other ways (discuss with friends, are part of the communities, etc.).

-

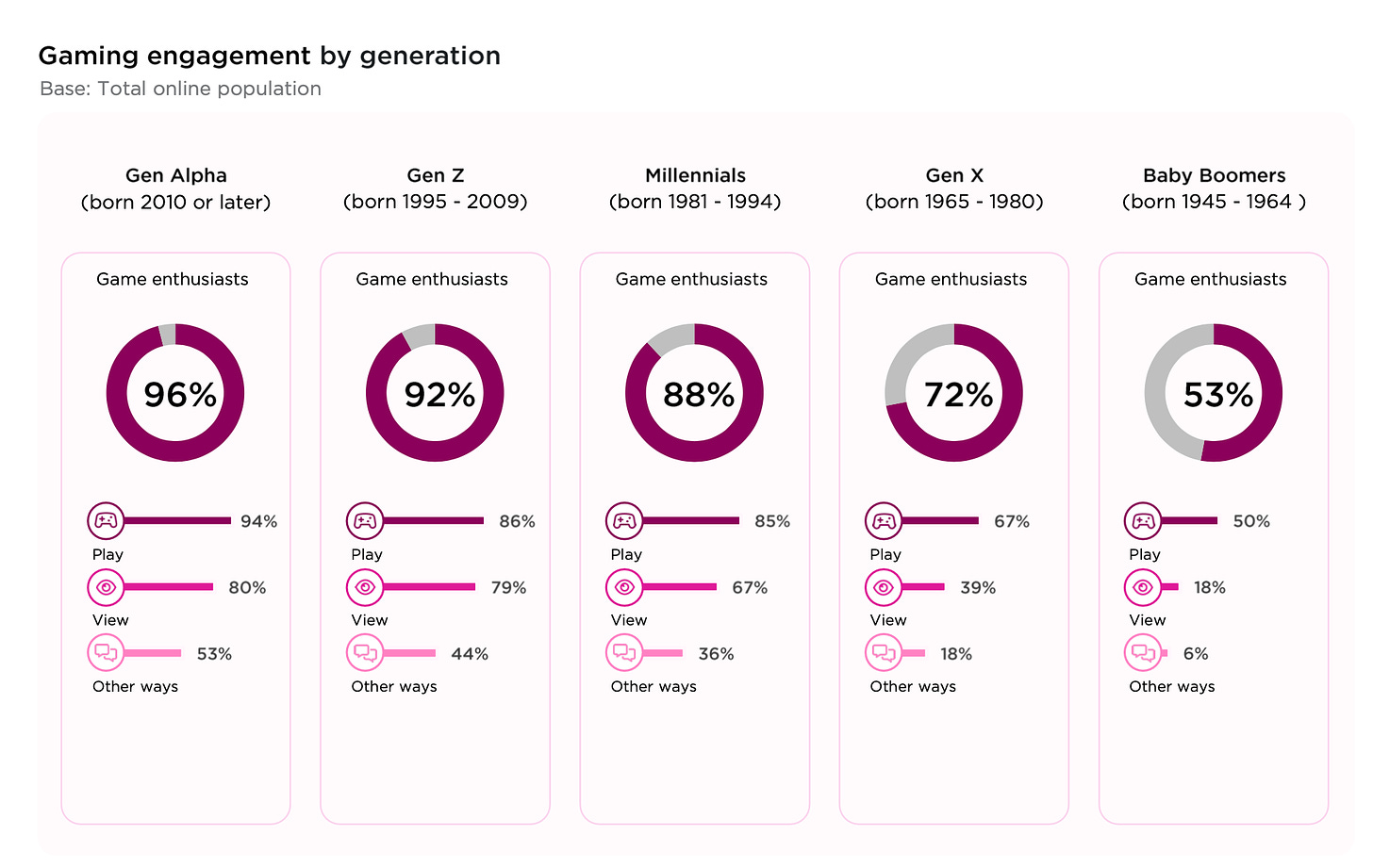

The most engaged segments in gaming are Generation Alpha and Generation Z (over 90% of them interact with games). 94% of Generation Alpha plays games.

-

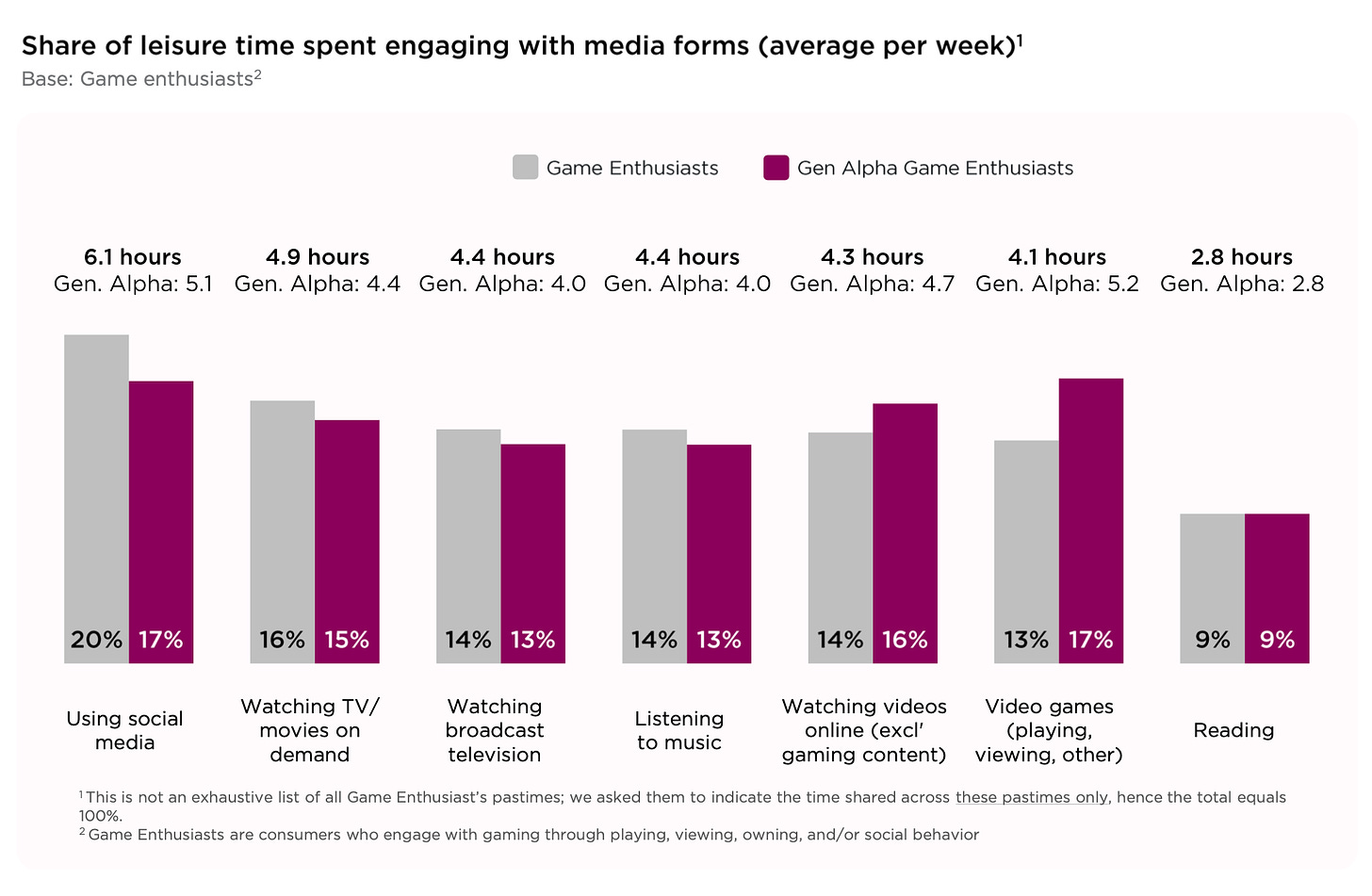

Generation Alpha is the first to spend more time on games (5.2 hours per week) than on social media (5.1 hours per week).

-

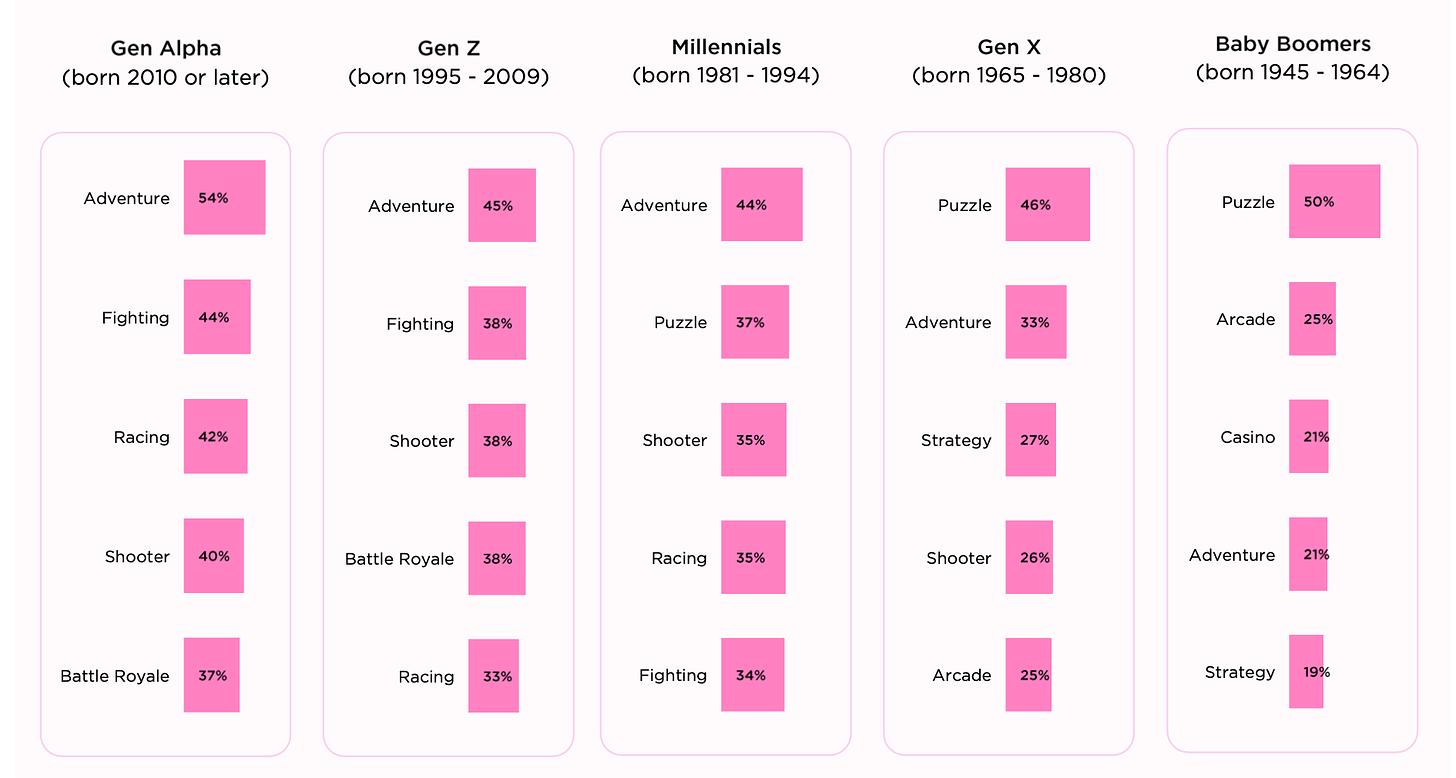

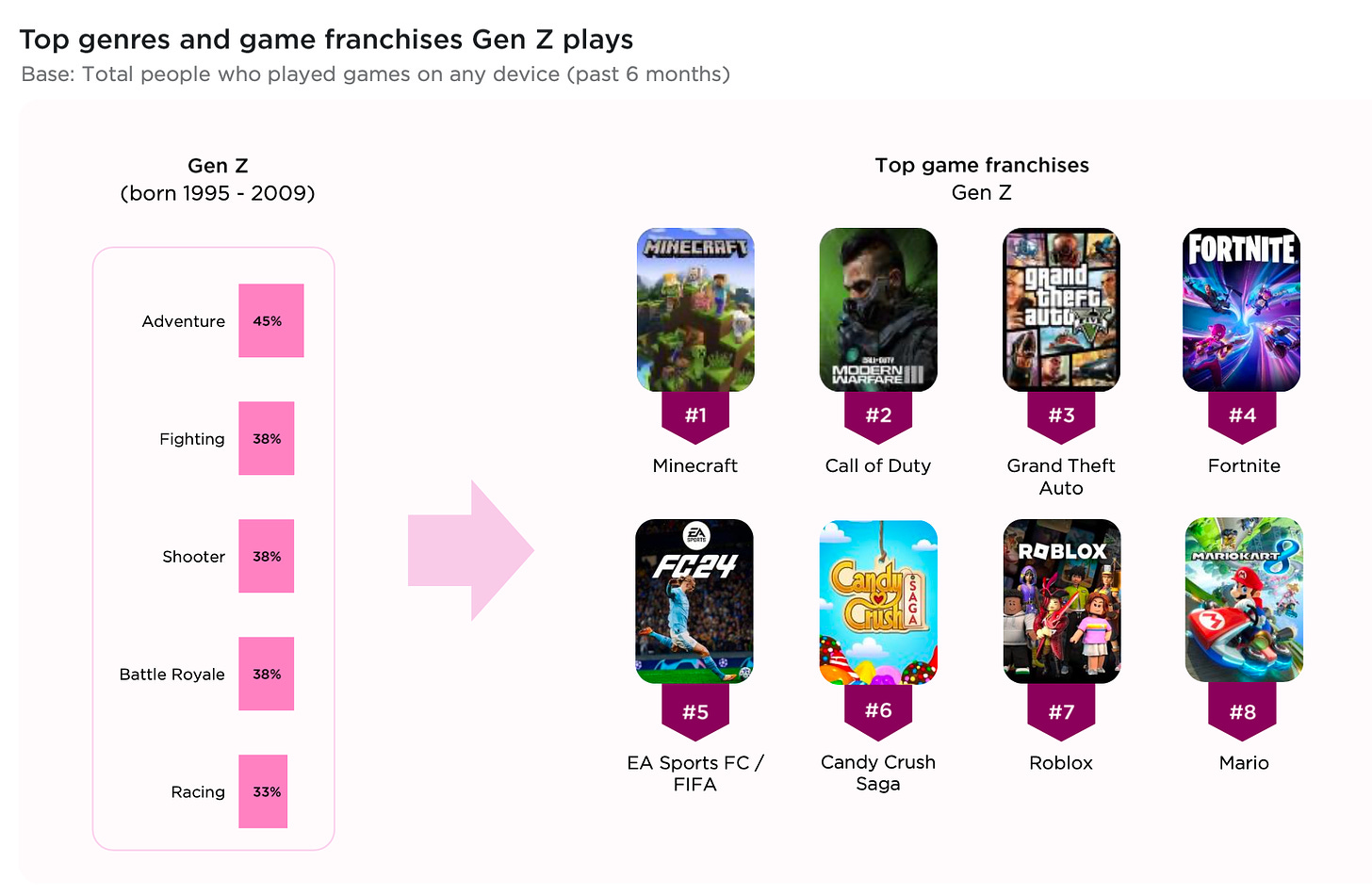

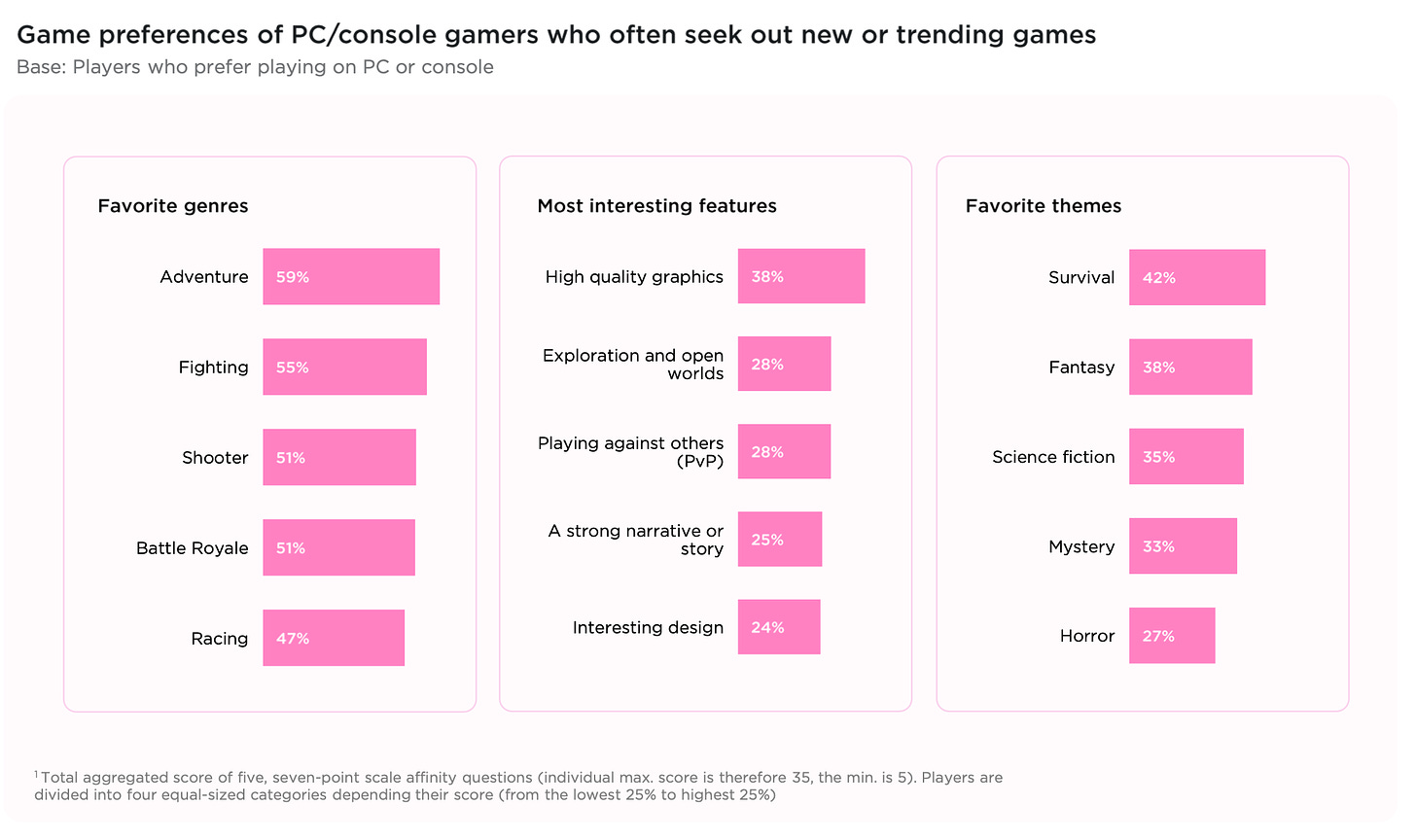

Adventure games are the most popular genre among Generation Alpha, Generation Z, and millennials. Older people prefer puzzle games.

-

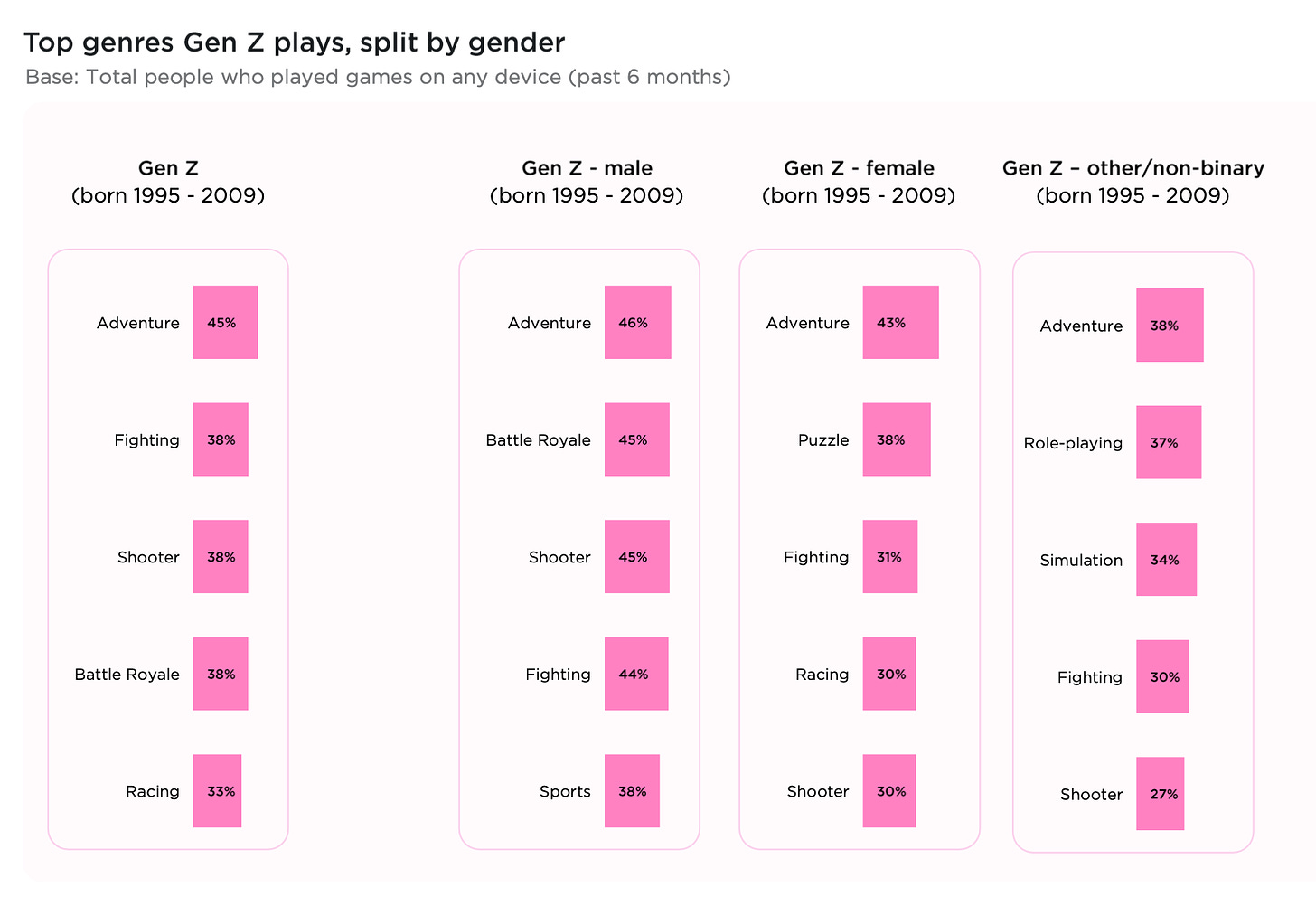

Generation Z also loves shooters and fighting games.

-

Minecraft, Call of Duty, and Grand Theft Auto are the most popular franchises among Generation Z users.

PC and Console Players

-

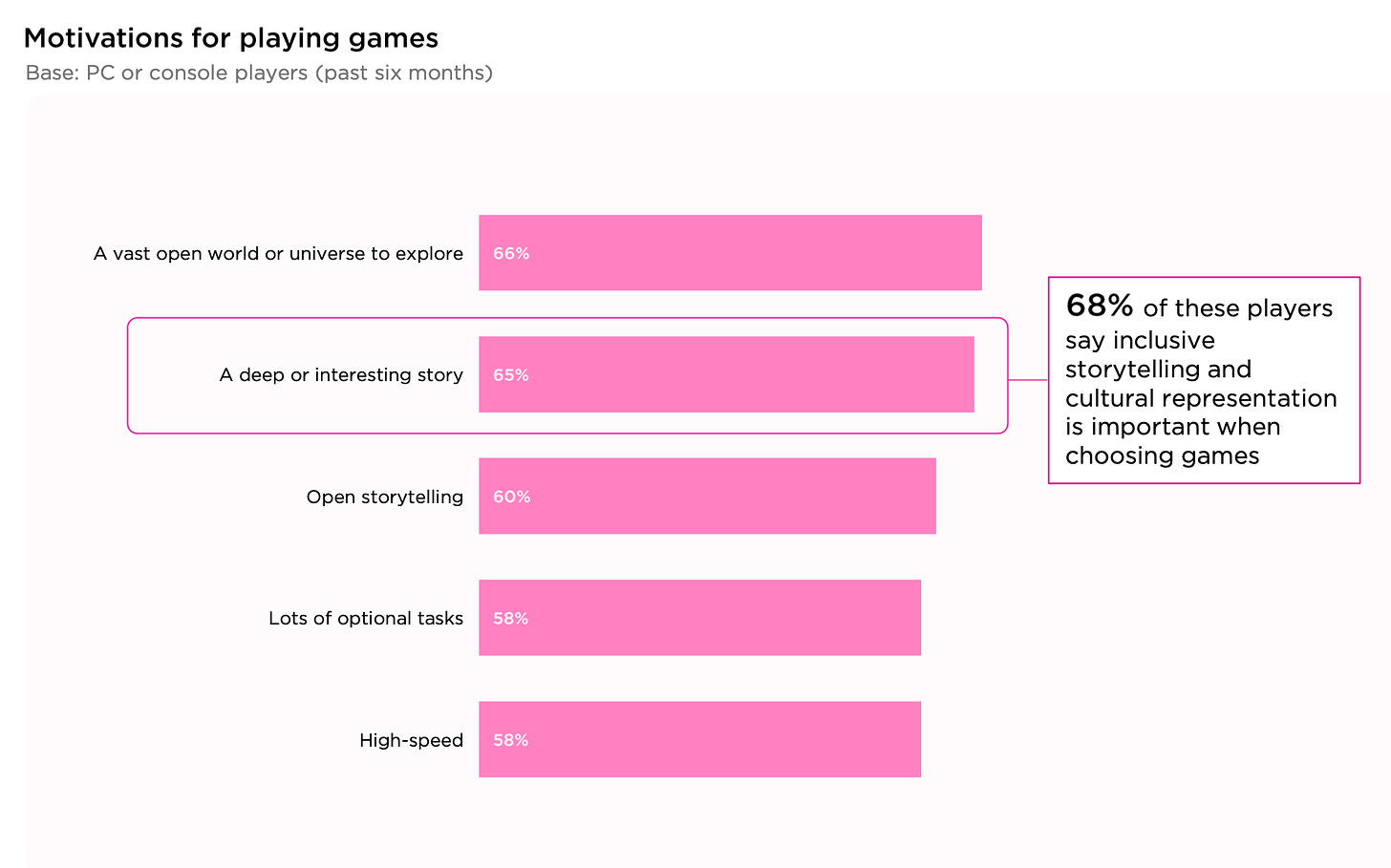

For PC and console players, a large open world (66%) and an interesting story (65%) are important.

-

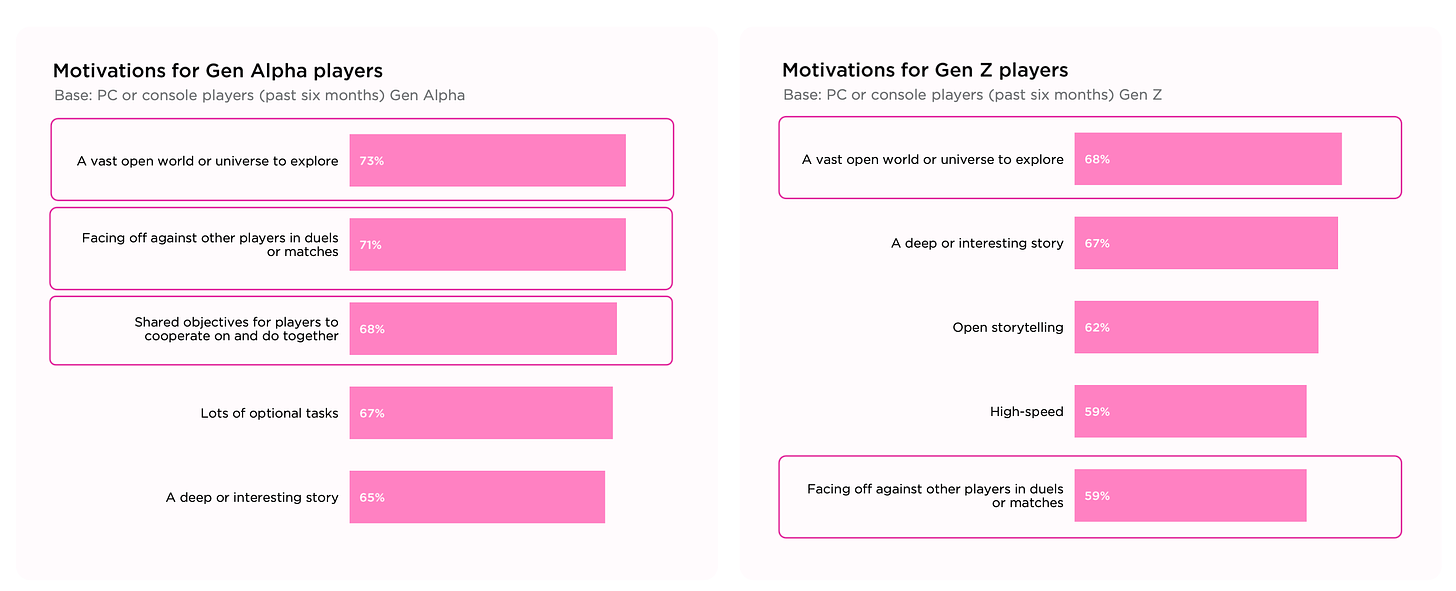

For younger players, motivations also include the ability to complete tasks with friends, fight with them, and socialize.

Time and Money Spent by Users

-

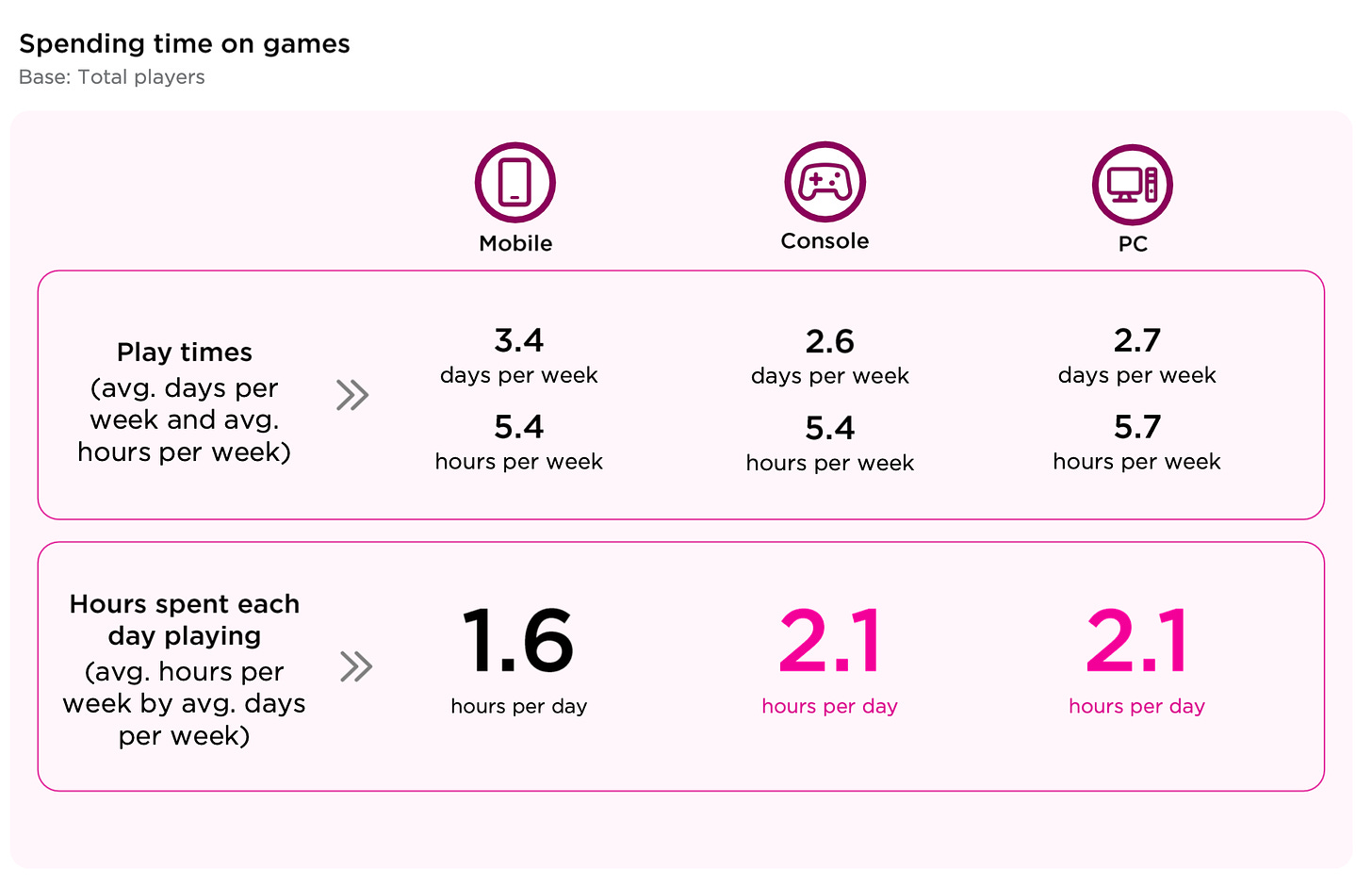

PC and console players play more per day on average — 2.1 hours, compared to mobile device players — 1.6 hours. However, on mobile devices, people play an average of 3.4 days a week, while on PC/consoles — 2.6-2.7 days a week. As a result, the total number of hours spent playing per week is almost equal.

-

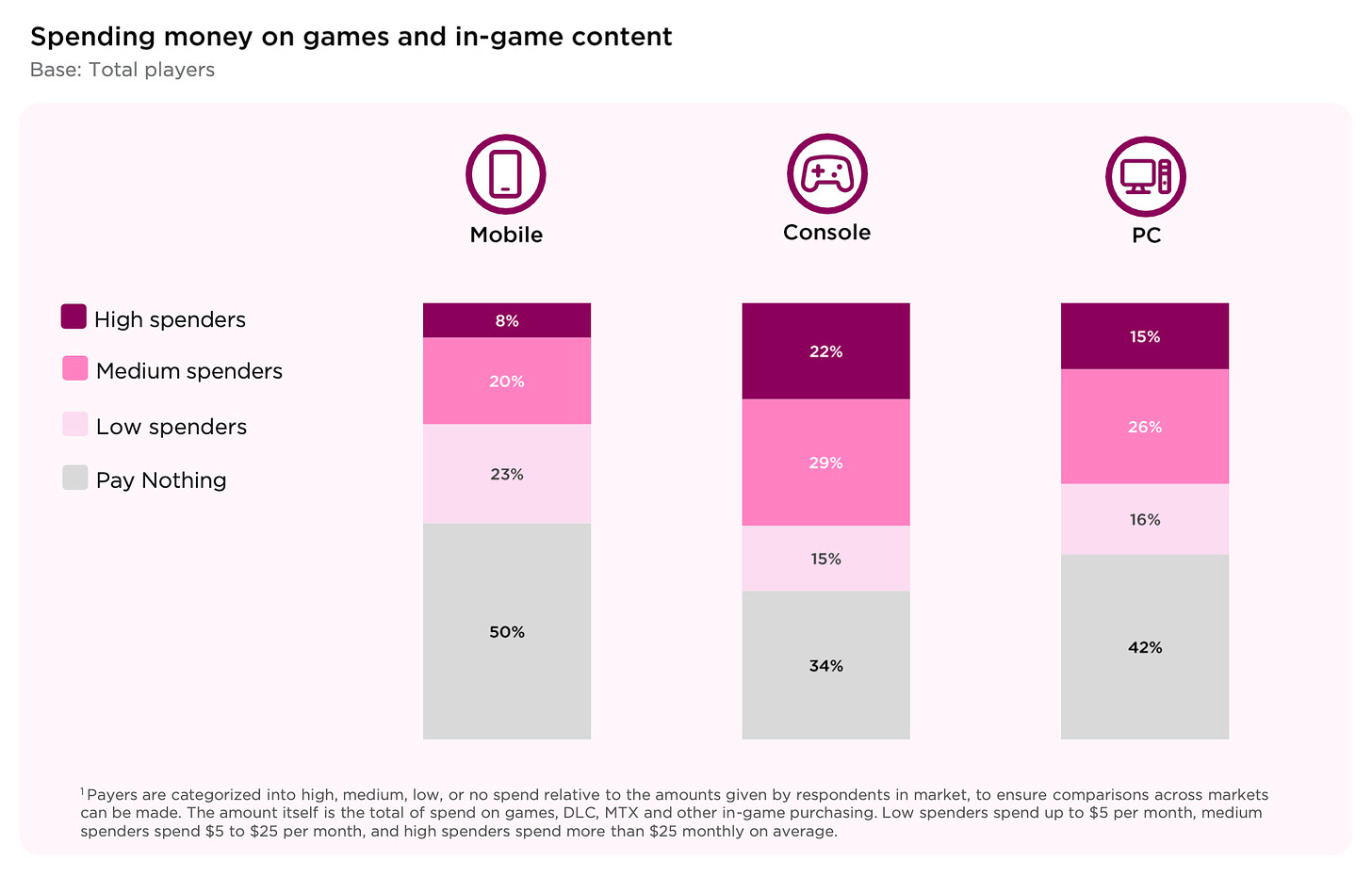

More than half of console players spend more than average. 22% of them spend more than $25 per month on games. On PC, this figure is 15%; on mobile devices — 8%.

-

Half of mobile device players do not pay for games.

-

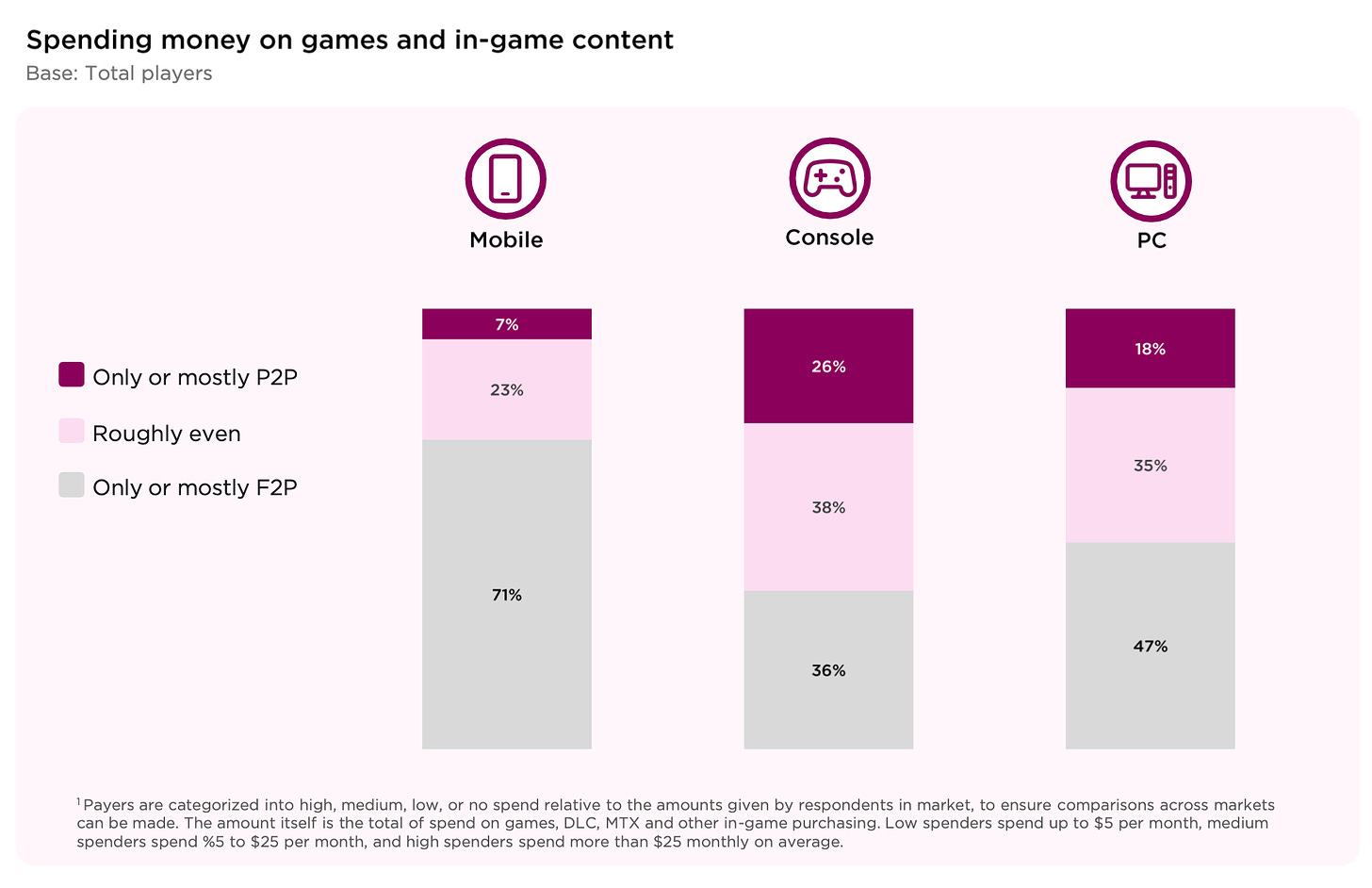

Newzoo shows that 47% of PC players; 71% of mobile device players, and 36% of console players mainly play free games. For example, only 26% of people are willing to pay for games on consoles, and only 7% on mobile devices.

-

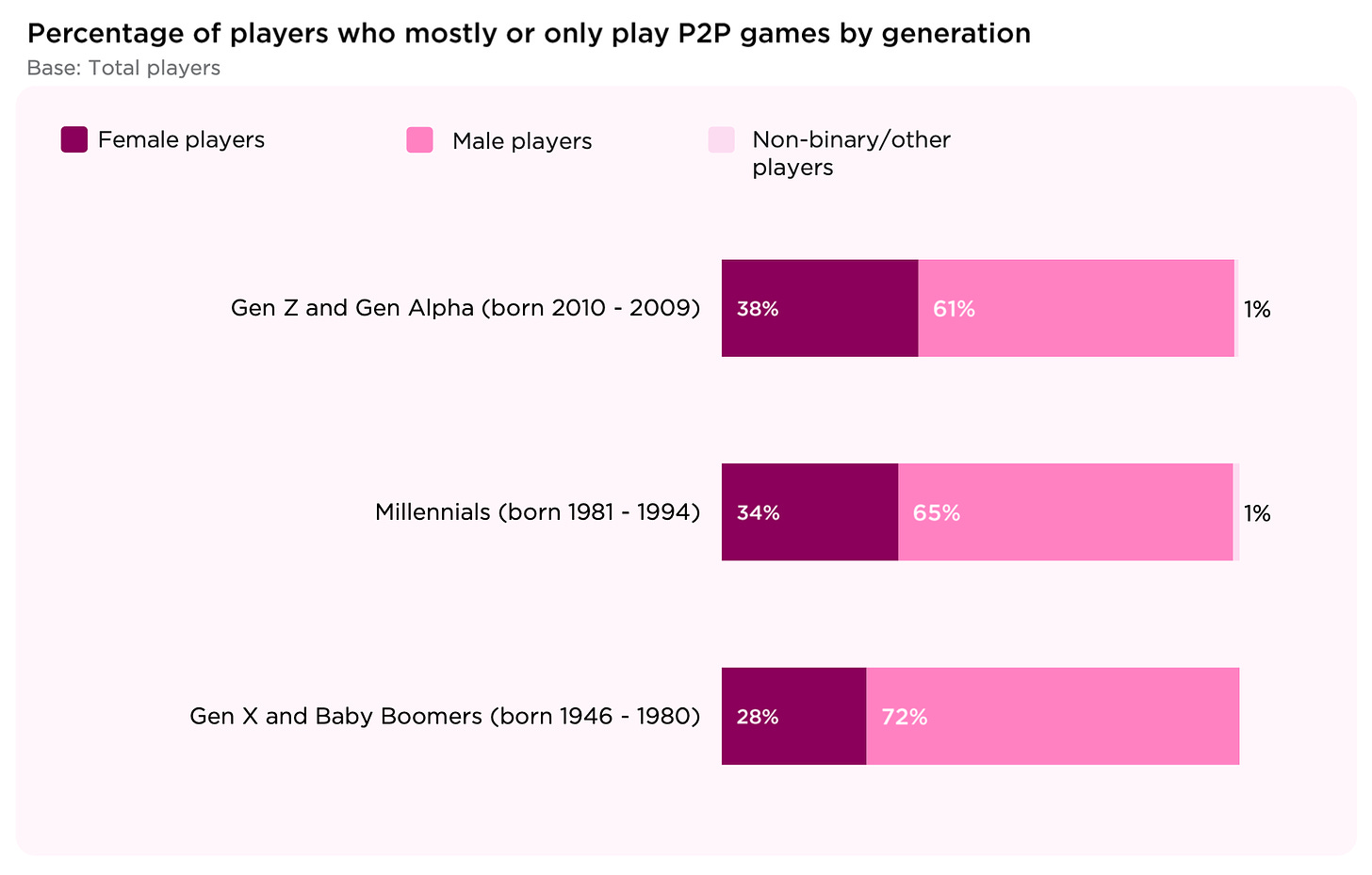

The percentage of the female audience willing to pay for games grows from generation to generation.

The audience that is looking for new titles

-

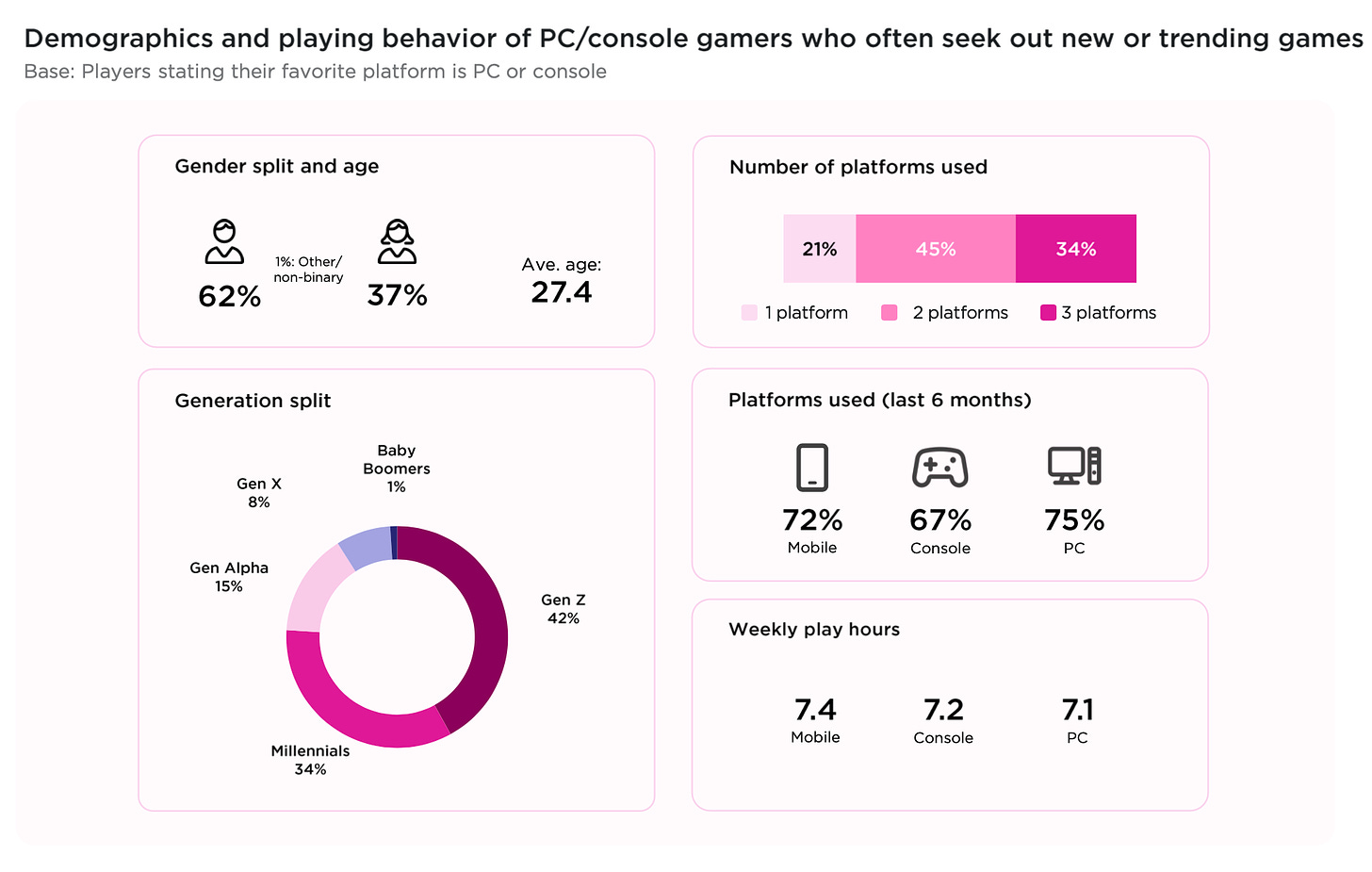

31% of PC and console players note that they are constantly looking for new games.

-

One-third of such active audience have 3 platforms; 45% have two. They are distinguished by the fact that they spend almost twice as much time playing games per week as the average player. The average age is 27.4 years, and 62% of such players are male.

-

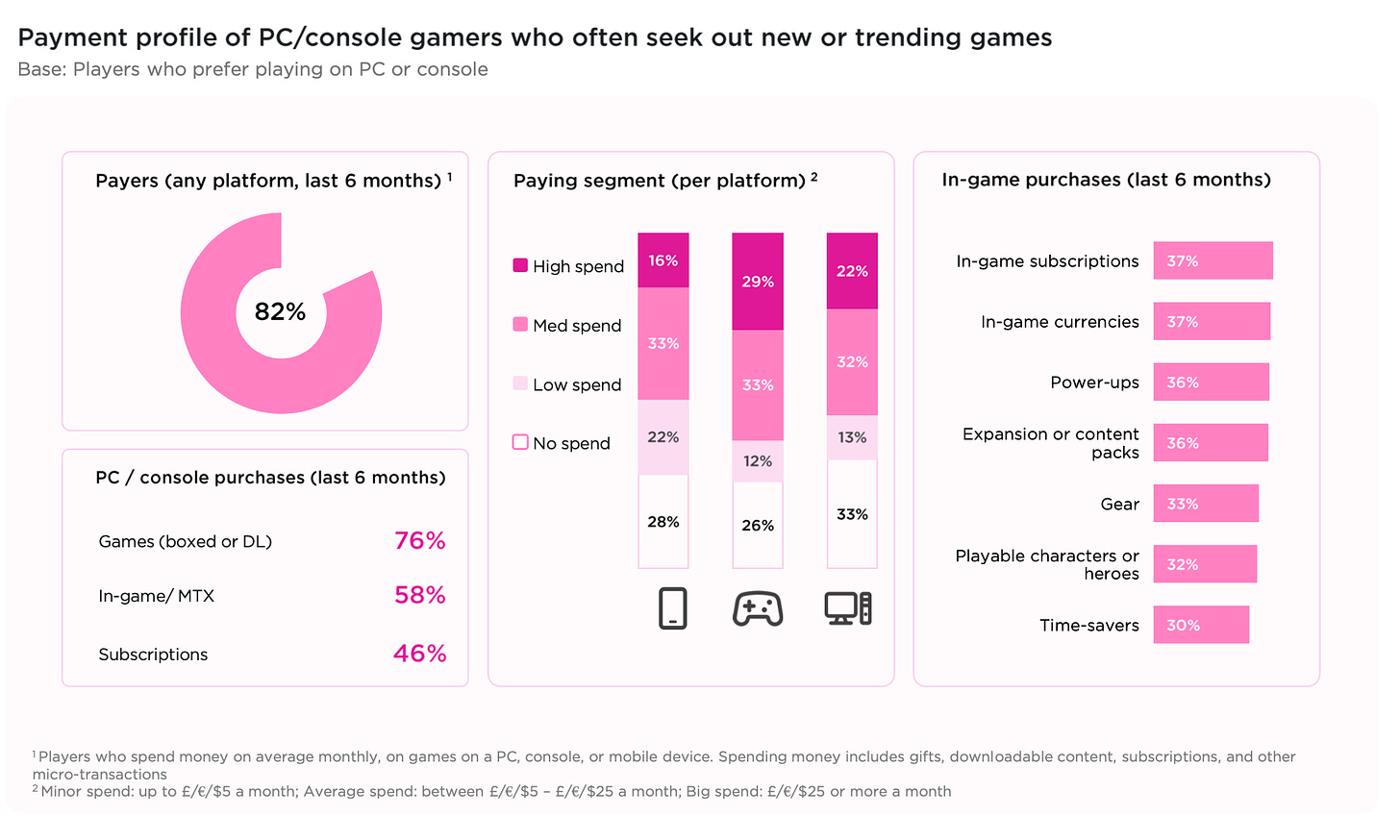

82% of this audience have paid for games in the last six months. The majority of high-spenders are on console.

-

These users prefer adventure games (59%); good graphics are important to them (38%); and among gameplay aspects, survival elements are important (42%).

-

At the same time, this audience continues to play global blockbusters.

-

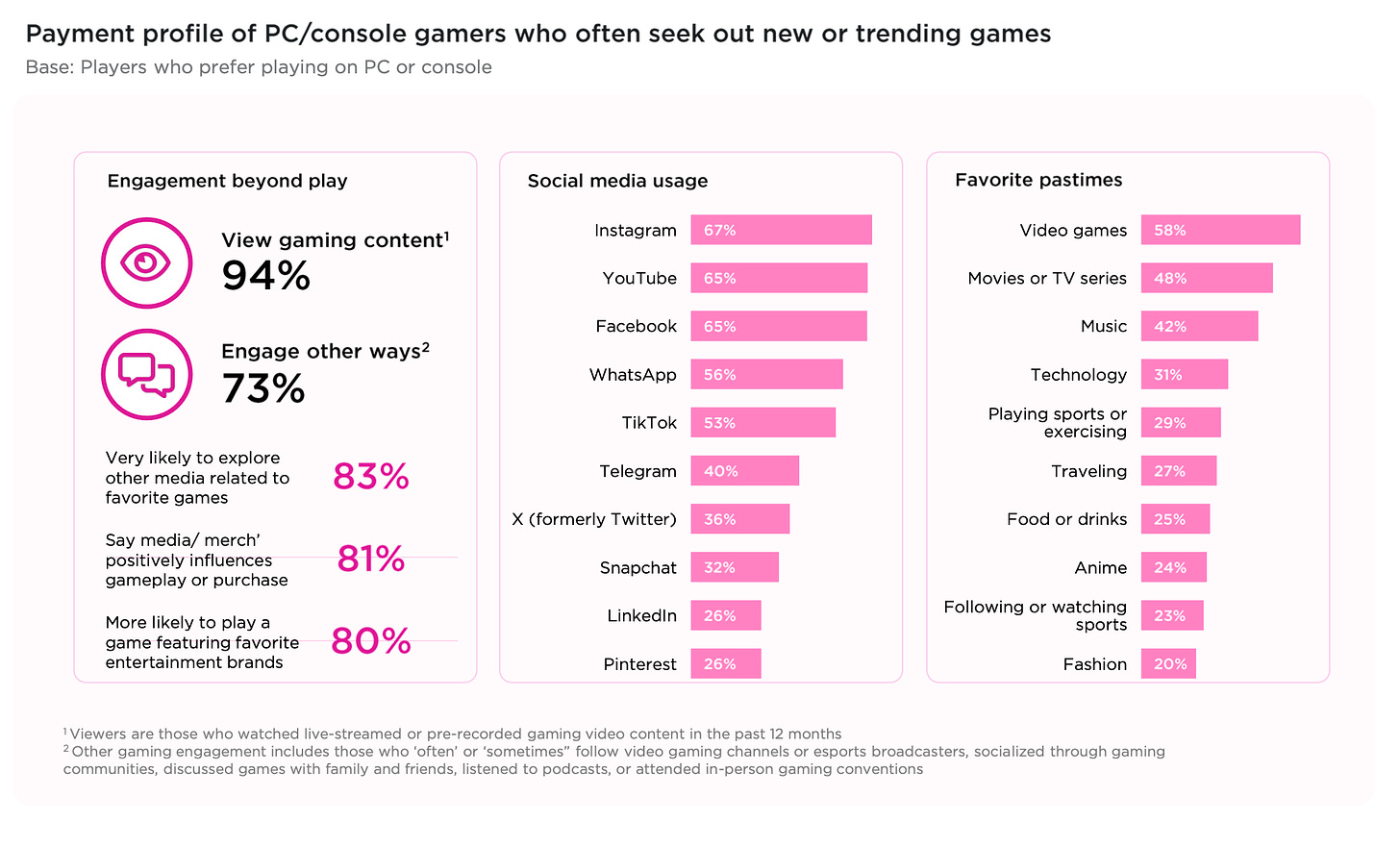

More than 90% of this audience watches gaming content; 73% communicate with the community. Instagram (67%); YouTube (65%); Facebook (65%) are the main social networks.

-

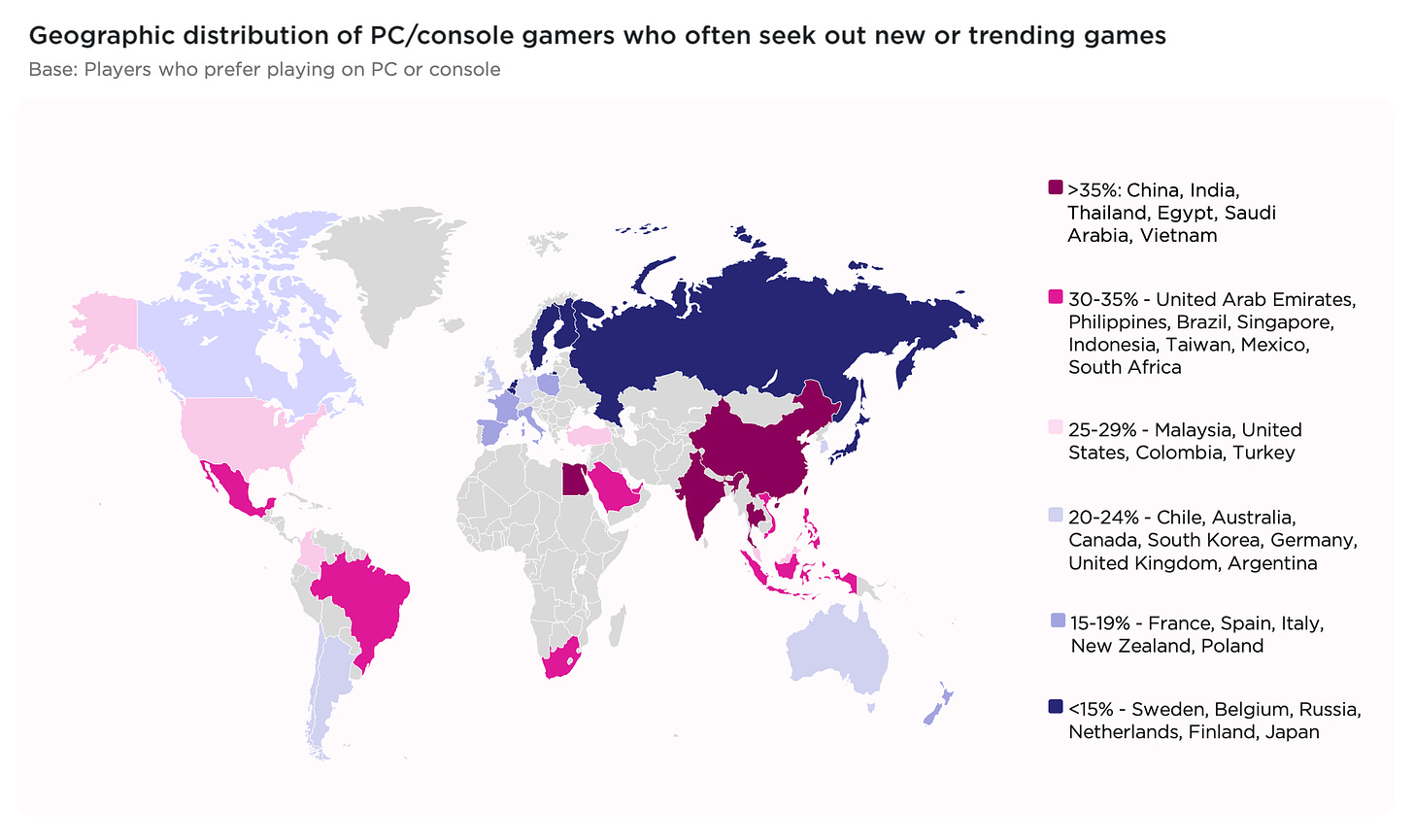

Most users in search of new gaming experiences are in China, India, Thailand, Egypt, Saudi Arabia, and Vietnam (more than 35% of the total volume). There are also many in the UAE, Philippines, Brazil, Singapore, Indonesia, Taiwan, Mexico, and South Africa. Overall, players from emerging markets (SEA; MENA; LATAM) tend to be more open to new projects.

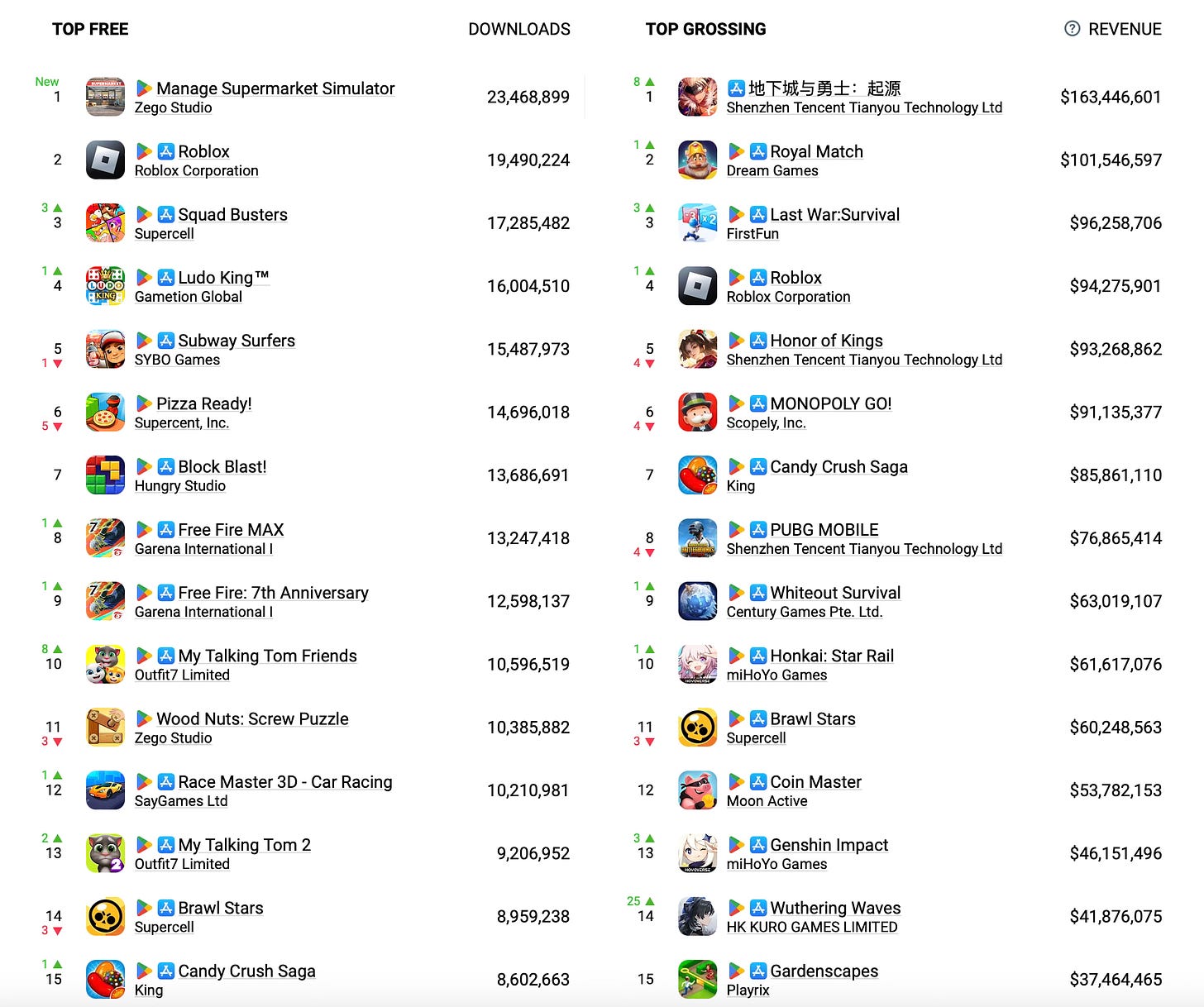

AppMagic: Top Mobile Games by Revenue and Downloads in June 2024

AppMagic provides revenue data excluding net of store commissions and taxes.

Revenue

-

Dungeon & Fighter Mobile earned $163.4 million in June, ranking first in revenue by a significant margin. Previously, Sensor Tower reported $270 million in revenue (including commissions and taxes). Importantly, this data refers only to iOS and only to China.

-

Royal Match came in second place with $101.5 million in (net) revenue. Last War: Survival ranked third with $96.3 million. The project has been growing since October 2023, when scaling began.

-

Honor of Kings showed its lowest revenue level since October 2019 - $93.2 million.

-

Monopoly GO! also saw a decline in revenue, earning the same amount as in July 2023 - $91.1 million.

❗️As usual, it's important to note that we are not seeing the full revenue of these projects. A significant portion of payments might be made through off-store methods.

-

Wuthering Waves is showing excellent results. The game almost matched the revenue of Genshin Impact, earning $41.9 million in June, which is 2.5 times more than the previous month.

Downloads

-

The download rankings are less dynamic but still interesting. There is a new leader - Manage Supermarket Simulator. The game was downloaded 23.5 million times in June.

-

However, if you consider both versions of Free Fire (Max and the regular one), it becomes the leader in downloads - 25.8 million installations in June.

-

Squad Busters continues its triumphant march, with 17.3 million downloads.

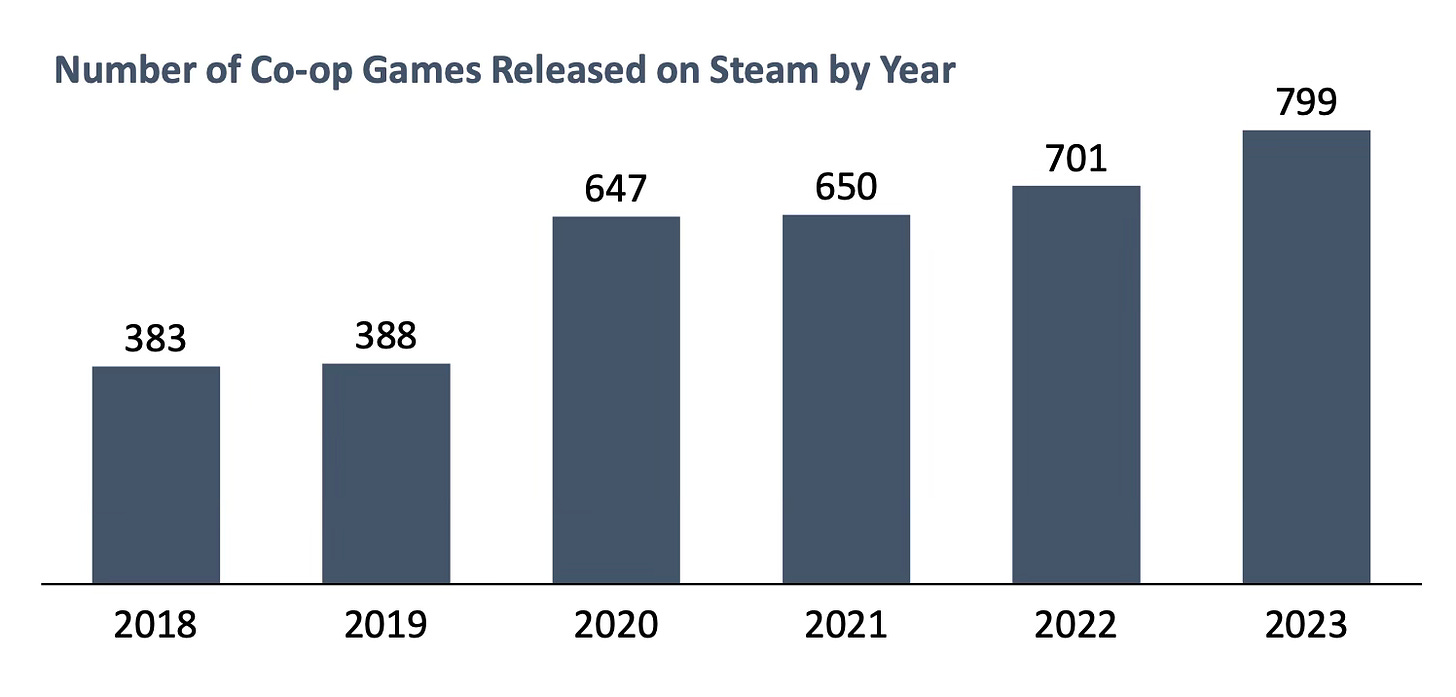

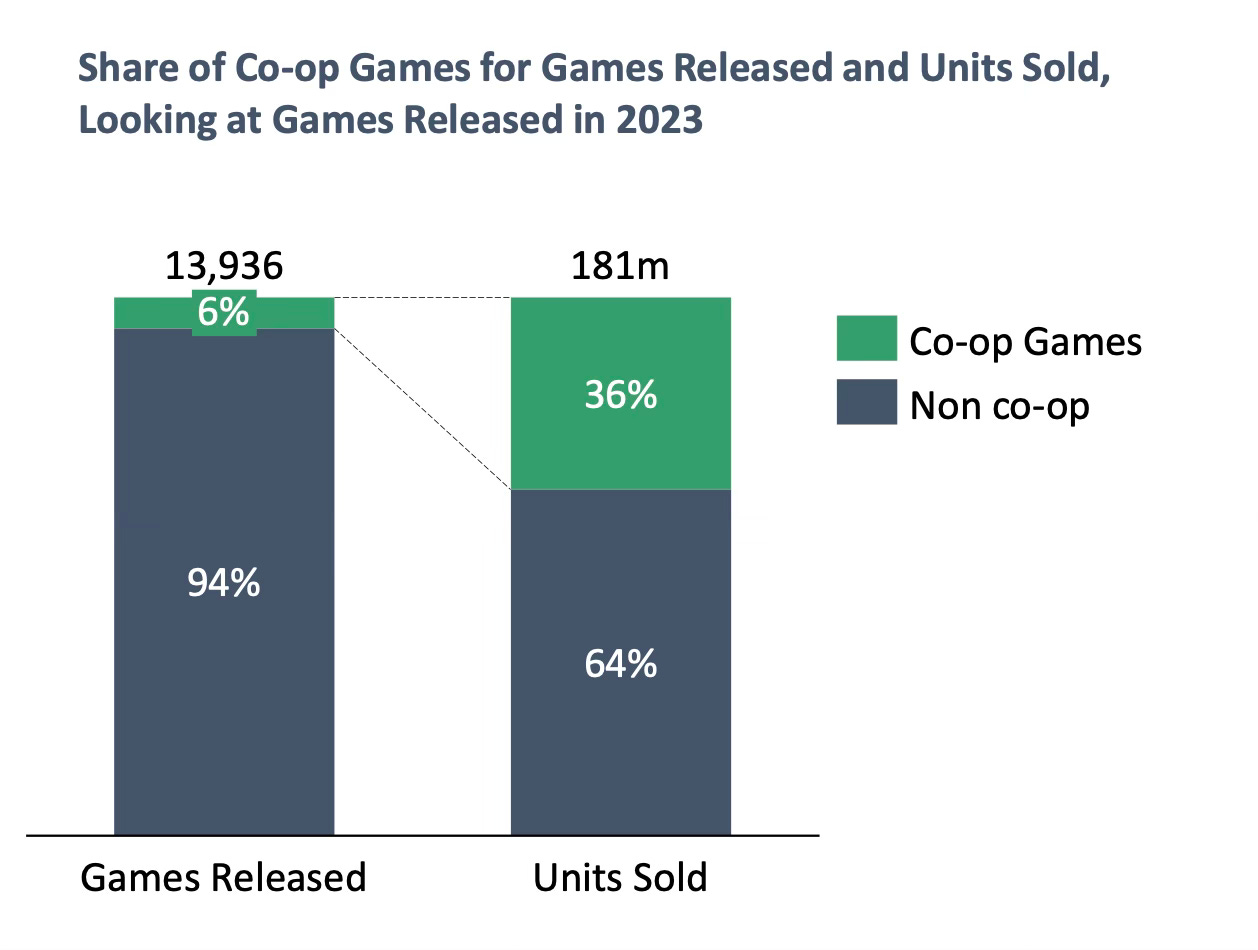

VG Insights: Cooperative Games on Steam in 2024

Co-op titles are games with predominantly PvE mechanics.

-

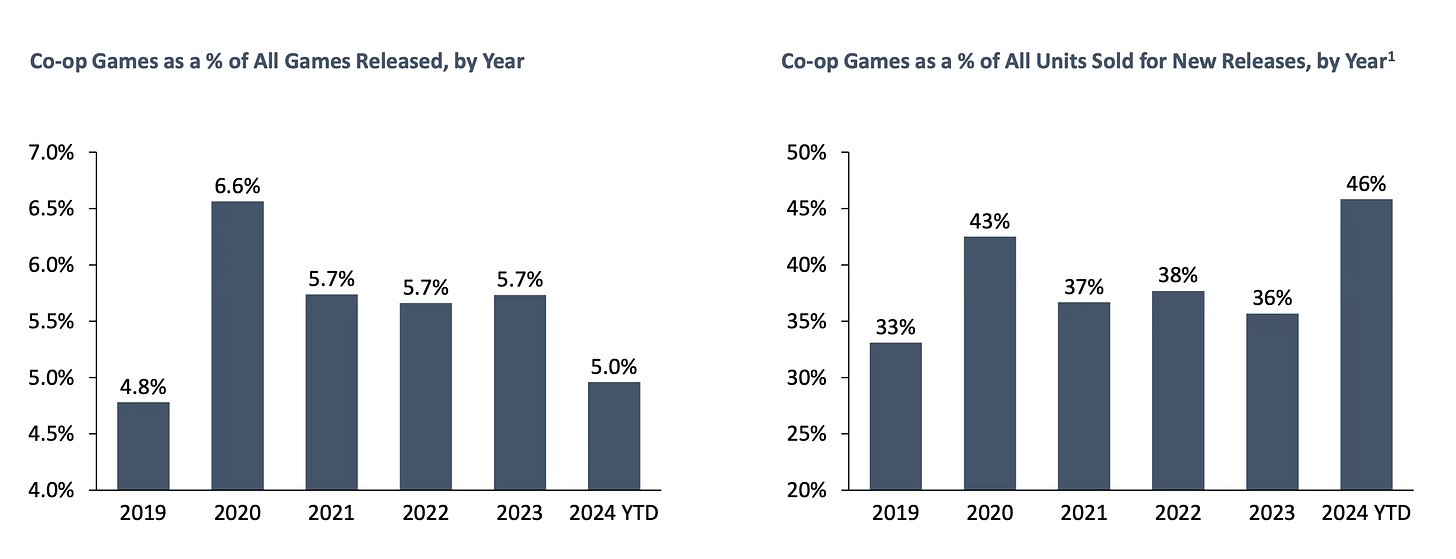

The number of cooperative games released surged in 2020 (from 388 in 2019 to 647). It seems developers recognized the importance of socialization during the pandemic. Since then, the number of cooperative games released each year has only increased. In 2023, 799 such projects were released.

-

In 2023, cooperative games accounted for 6% of the total number of games released on Steam. At the same time, they made up 36% of all units sold.

-

In 2024, the situation looks even more disproportionate. Cooperative games make up 5% of all released games; they account for 46% of all copies sold. Of course, this is significantly influenced by titles like Helldivers II, Palworld, and Content Warning. Nevertheless, the share of sales for cooperative games has not dropped below 33% over the past five years.

❗️The consumption pattern has a major influence here. Cooperative games are often played with friends, hence the high virality factor.

-

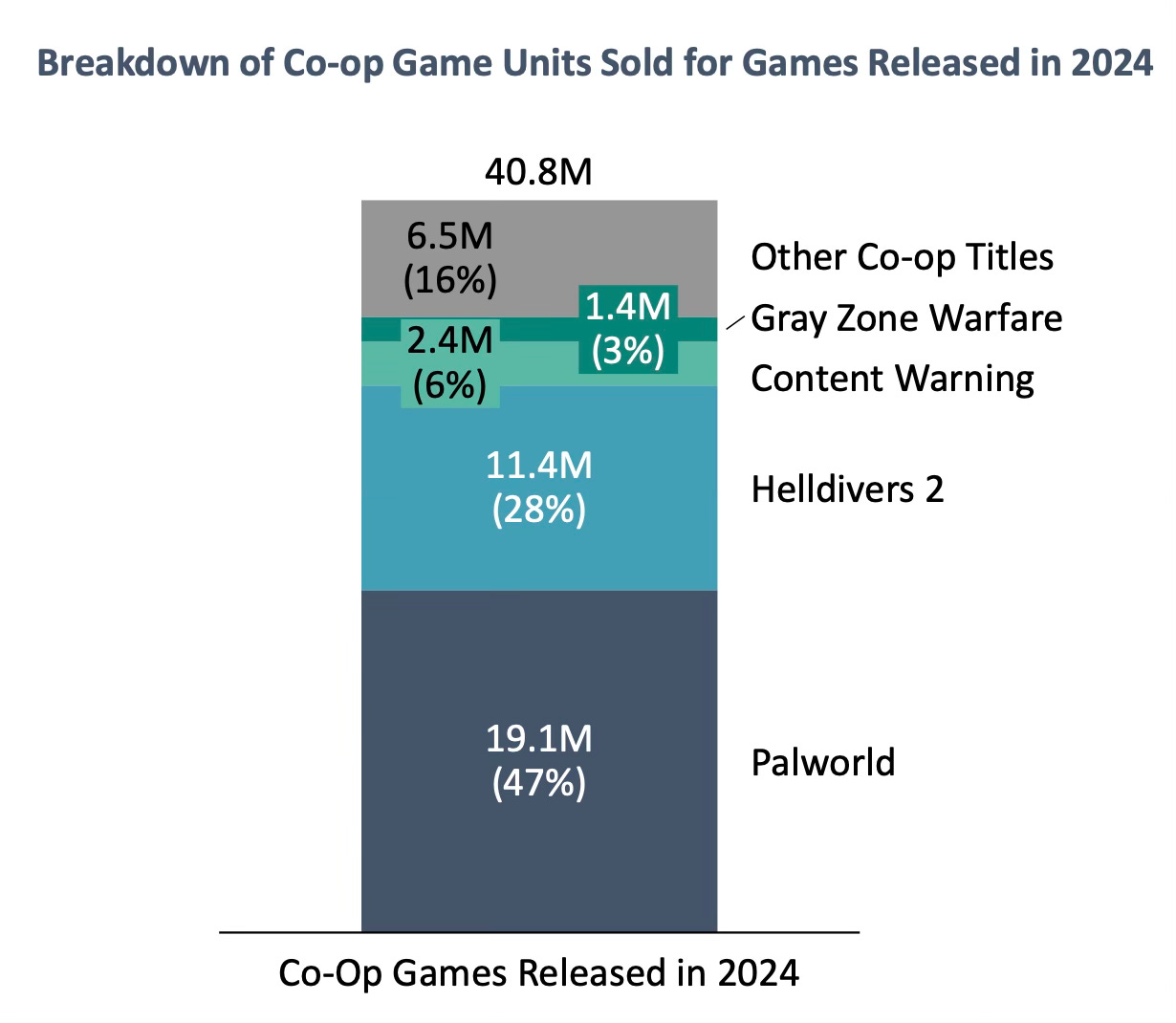

According to VGI, the largest cooperative games in 2024 are: Palworld (19 million copies; peak CCU - 2.1M); Helldivers II (11 million units; peak CCU - 459k); Content Warning (2.5 million copies; peak CCU - 204k); Gray Zone Warfare (1.4 million copies; peak CCU - 73k).

❗️In my opinion, Gray Zone Warfare doesn't quite fit this list. It’s more of an Extraction Shooter, although it does have cooperative missions.

-

In 2024, more than 40 million copies of co-op games were sold. Palworld accounts for 47% of this volume; Helldivers II for 28%. The other projects make up 16%.

-

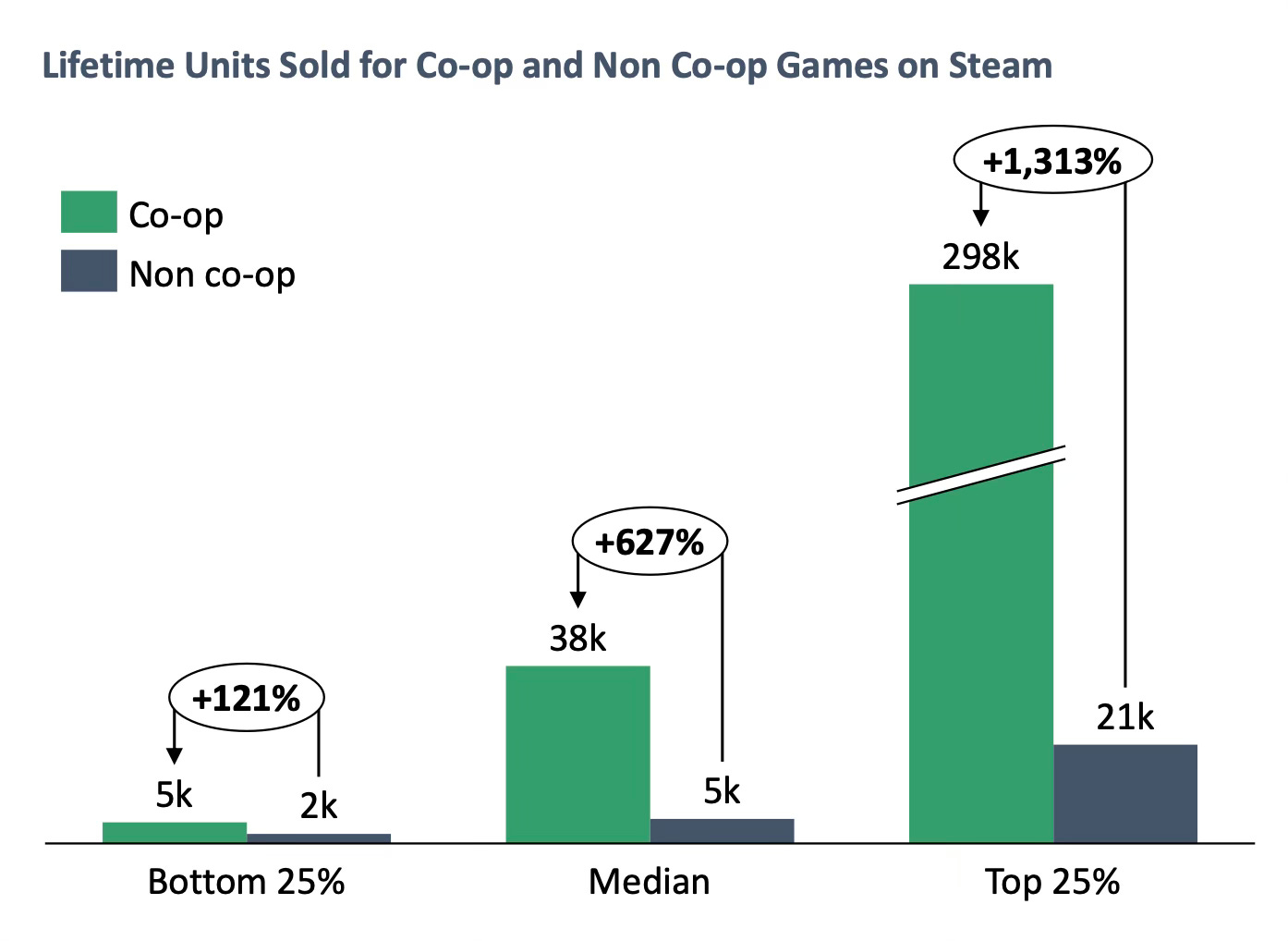

Cooperative games on Steam outperform single-player games in terms of sales. A typical cooperative game sells around 40,000 copies compared to 5,000 for a single-player game.

-

When considering the worst 25% of representatives, cooperative games sell 121% better. When comparing the top 25% in terms of copies sold, cooperative games sell 1313% better. Taking the median, cooperative games sell 627% better.

-

VGI notes that 106 cooperative games on Steam have sold more than 5 million copies.

-

Key features of cooperative games: they are viral; generate memes and absurd situations; are fun to stream; and most of them have high replayability.

Niko Partners: Chinese Gamers in 2024

Daniel Ahmad, Director of Research & Insights at Niko Partners, shared this information on his LinkedIn.

-

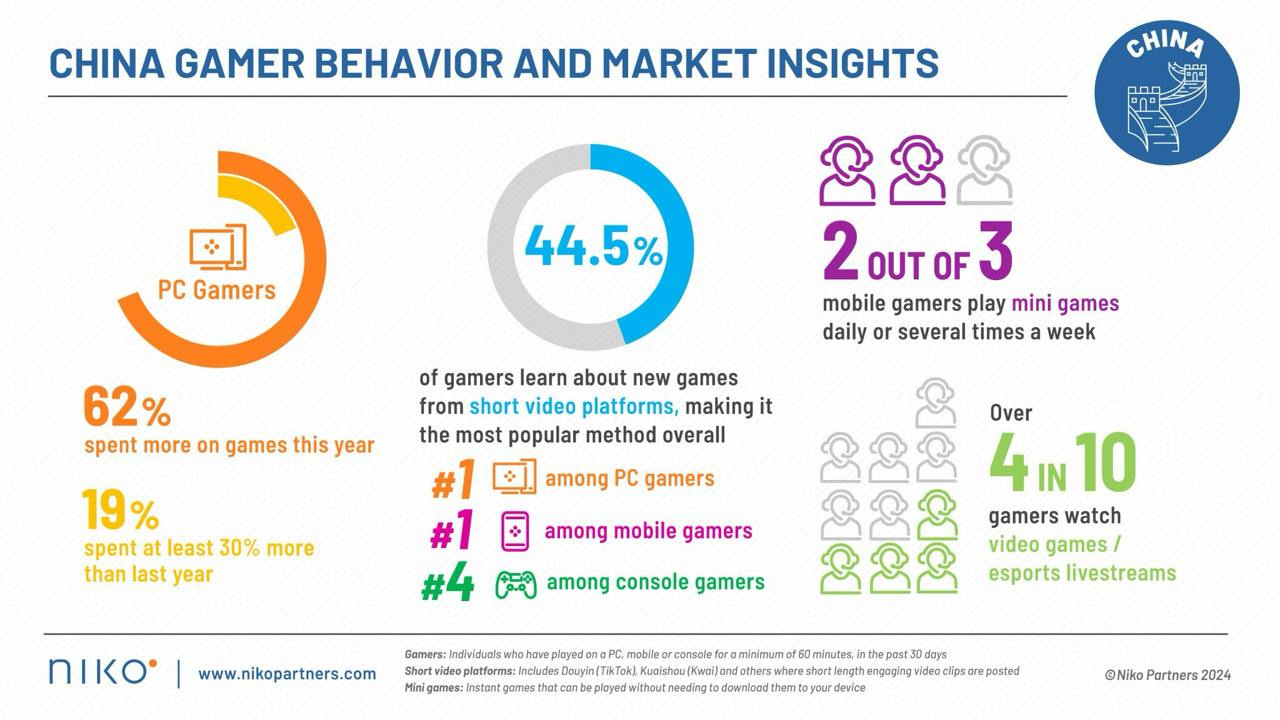

62% of PC users have spent more this year compared to the previous one. 19% noted that they spent at least 30% more.

-

Two-thirds of mobile gamers in China play mini-games on WeChat. This is the fastest-growing mobile segment in the country.

-

There are 650 million gamers in China.

-

44.5% of Chinese PC & Mobile gamers learn about new games through short video services. For console players, it ranks 4th on the list (apparently, console players rely on more comprehensive sources).

-

43.9% of gamers watch streams or esports competitions. 68.6% of them do so on Douyin.

-

Gamers aged 18 to 22, who experienced restrictions on gaming time for children and adolescents, play more than those not affected by this legislation. It turns out that the ban had the opposite effect once players reached adulthood.

-

Companies from Japan, the US, and South Korea are the main suppliers of gaming content to the Chinese market. Interestingly, three years ago, no South Korean games had a license in China.

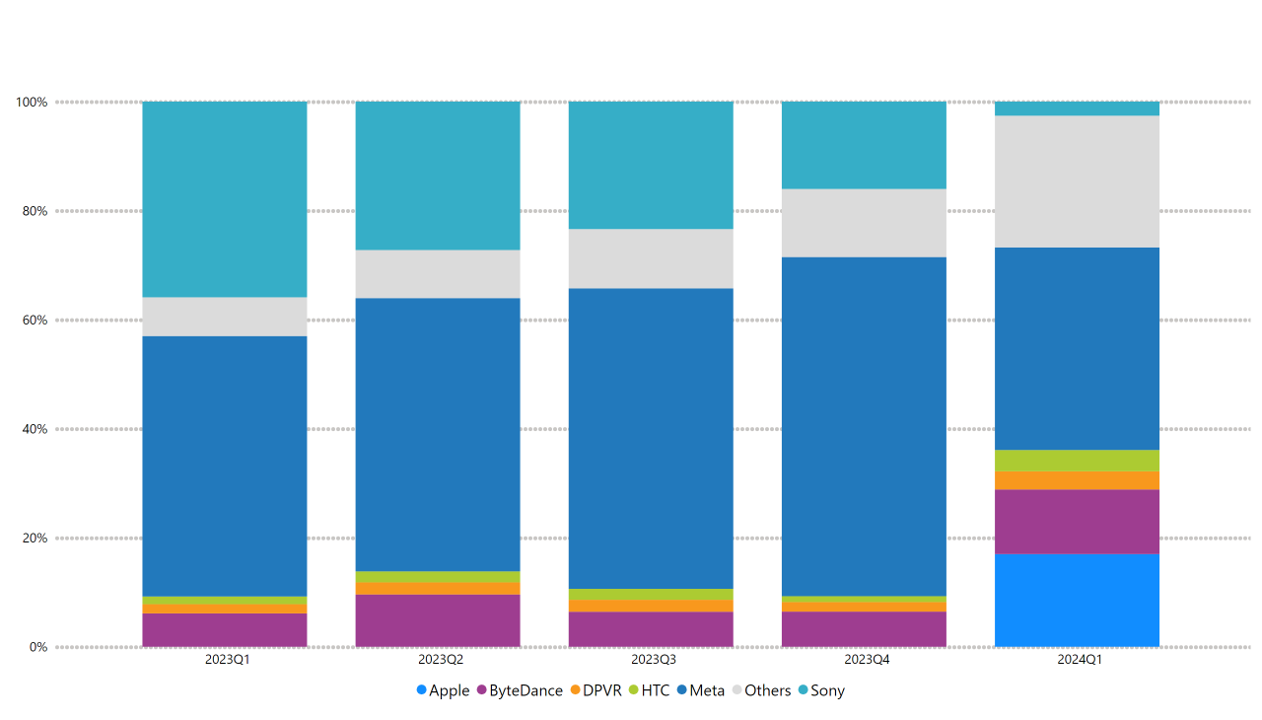

IDC: Global AR/VR Device Shipments Plummeted by 67.4% YoY in Q1 2024

-

According to estimates by Telecoms outlet, around 300,000 devices were shipped in Q1’24.

❗️It’s important to note that these figures refer to shipments, meaning that these devices still need to be sold by the stores.

-

The average price of AR/VR devices has risen to over $1,000, driven by the release of the Apple Vision Pro and Meta Quest 3.

-

However, IDC analysts believe that prices for devices will decrease in the future.

-

Meta remained the segment leader (with 37.2% of the market), followed by Apple in second place, despite not having the most successful launch (with 17% of the market). Bytedance (11.9%), DPVR, and HTC are slowly increasing their market shares, while Sony, on the contrary, is actively losing ground.

-

IDC believes that device shipments will return to growth this year, with a volume increase of 7.5% in 2024 compared to 2023. The company expects an average annual growth rate of 43.9% from 2024 to 2028.

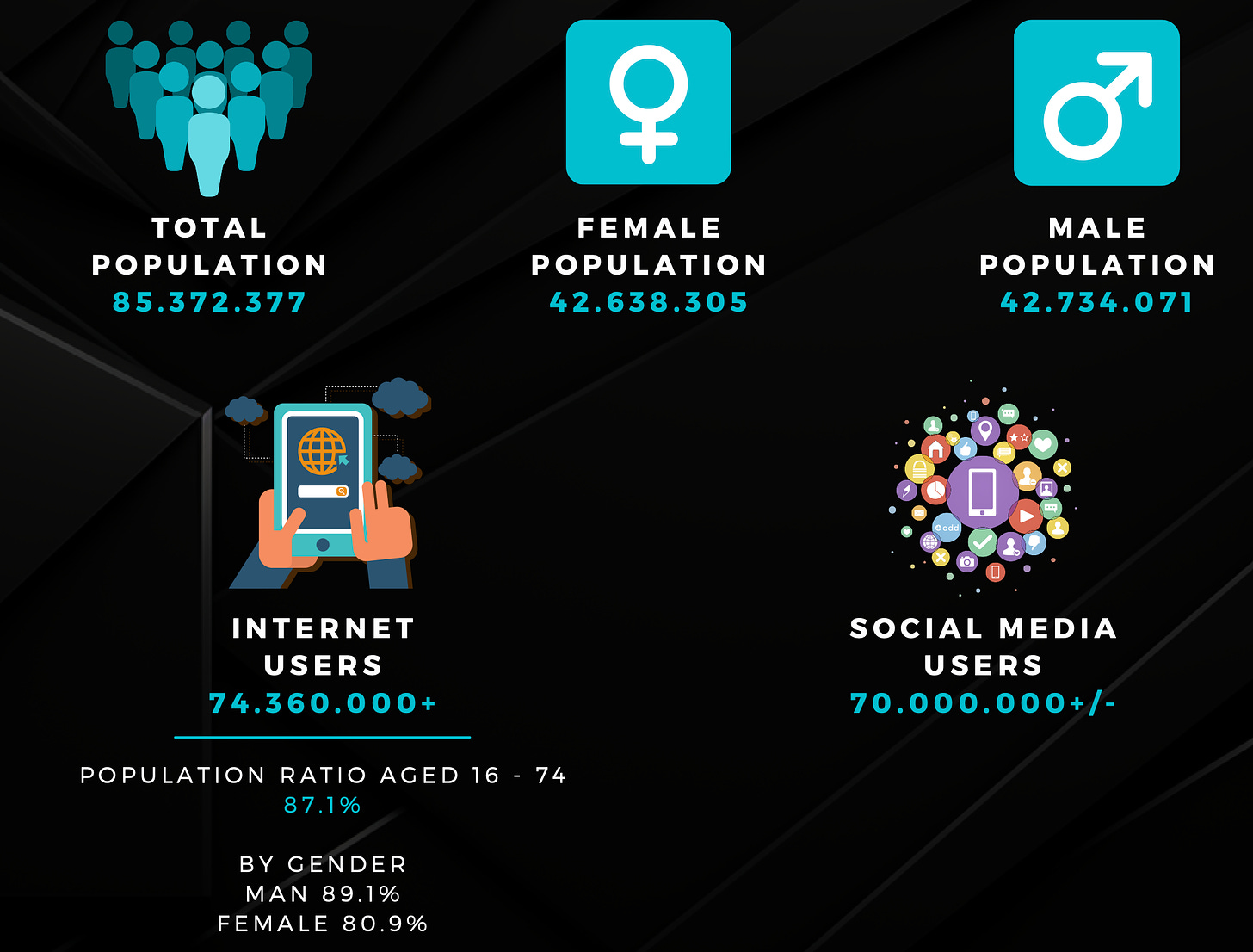

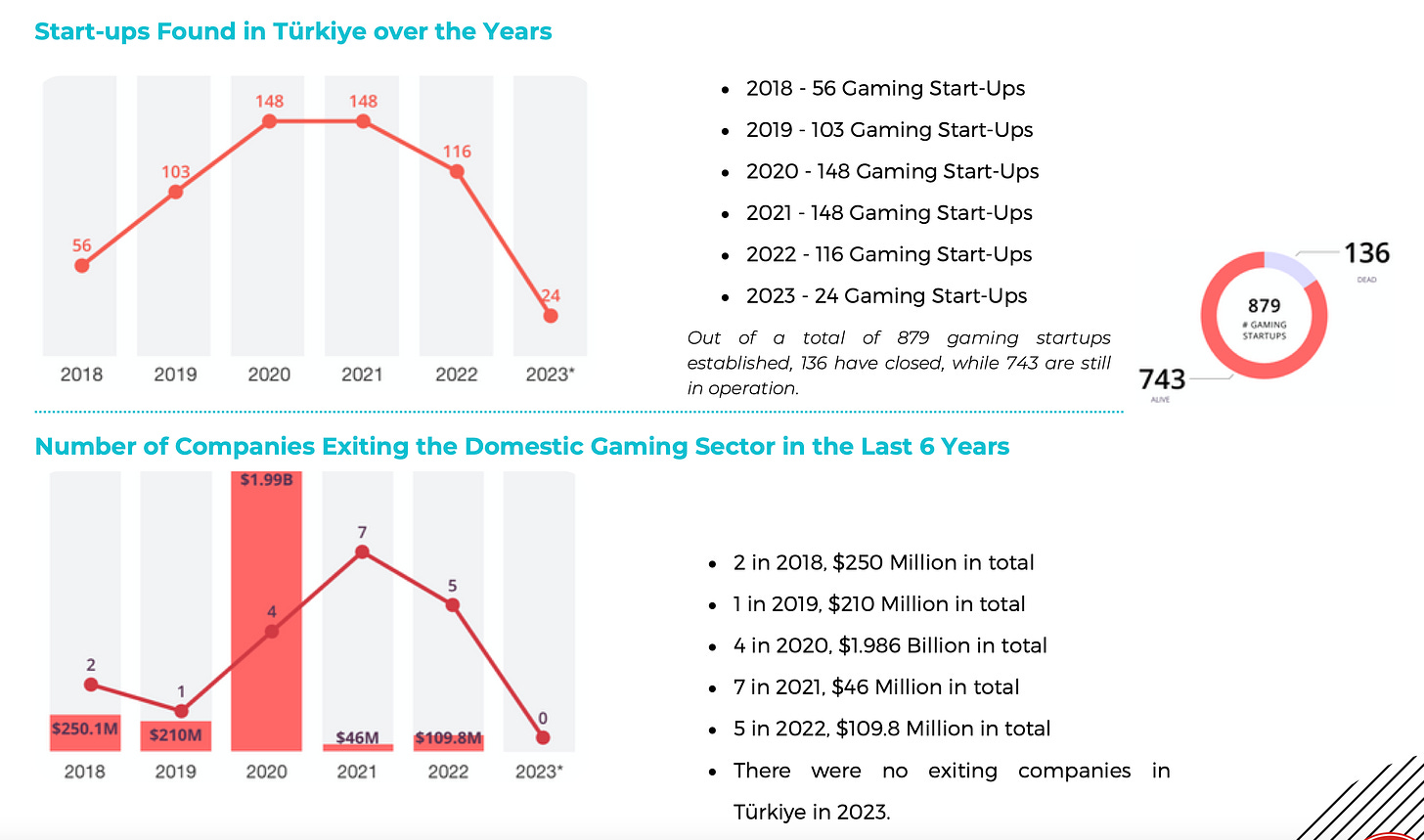

Gaming in Turkey: Turkish Gaming Market in 2023

-

The population of Türkiye grew to 85.37 million people in 2023. The gender split between males and females is equal.

-

74.36 million Turkish residents are active internet users.

-

Localization is important for Turkish users. The country ranks 66th out of 113 countries in English proficiency.

-

Music plays a significant role in the lives of Turkish gamers. Therefore, collaborations with local artists are an opportunity to capture the audience.

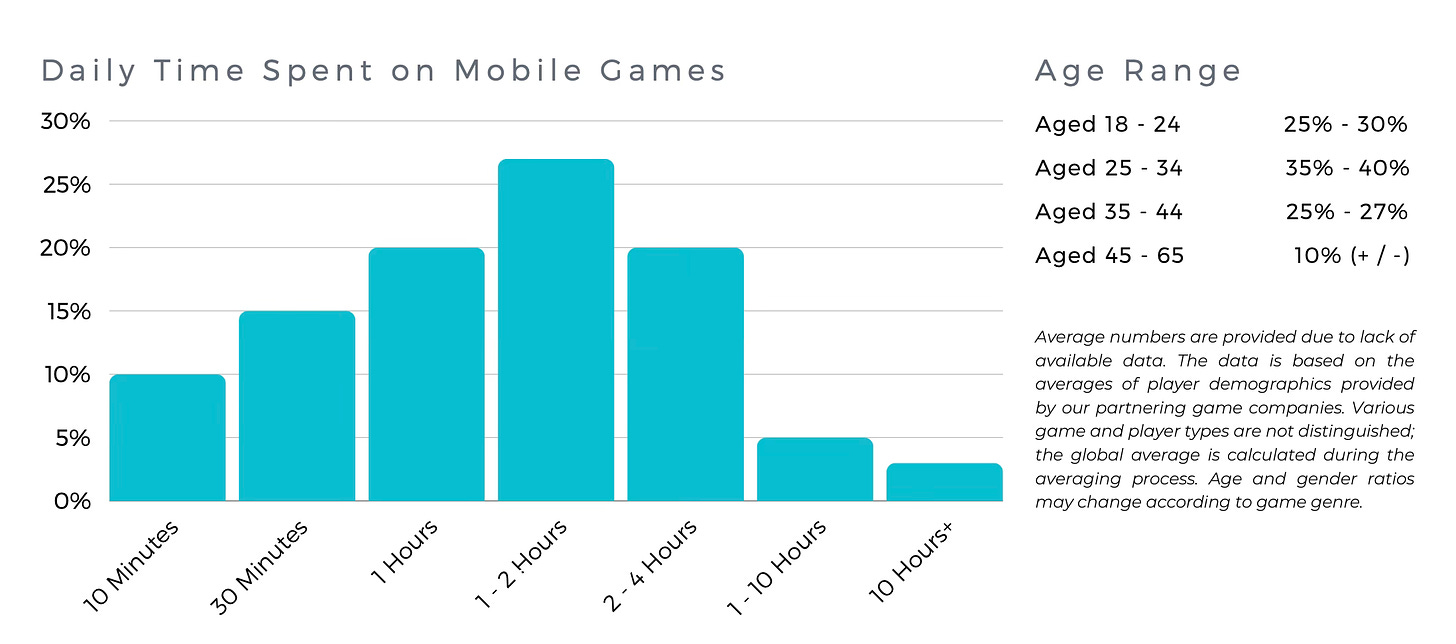

Habits of Turkish Mobile Gamers

-

Most players are between the ages of 18 and 35.

-

27% of mobile gamers spend 1 to 2 hours a day on mobile games; 20% spend 2 to 4 hours; the same percentage spend 1 hour a day.

-

The main motivation for Turkish players is relaxation and stress relief.

-

The top revenue-generating genres among Turkish users are strategy, RPG, Battle Royale, and MOBA. Hyper-casual projects lead in downloads.

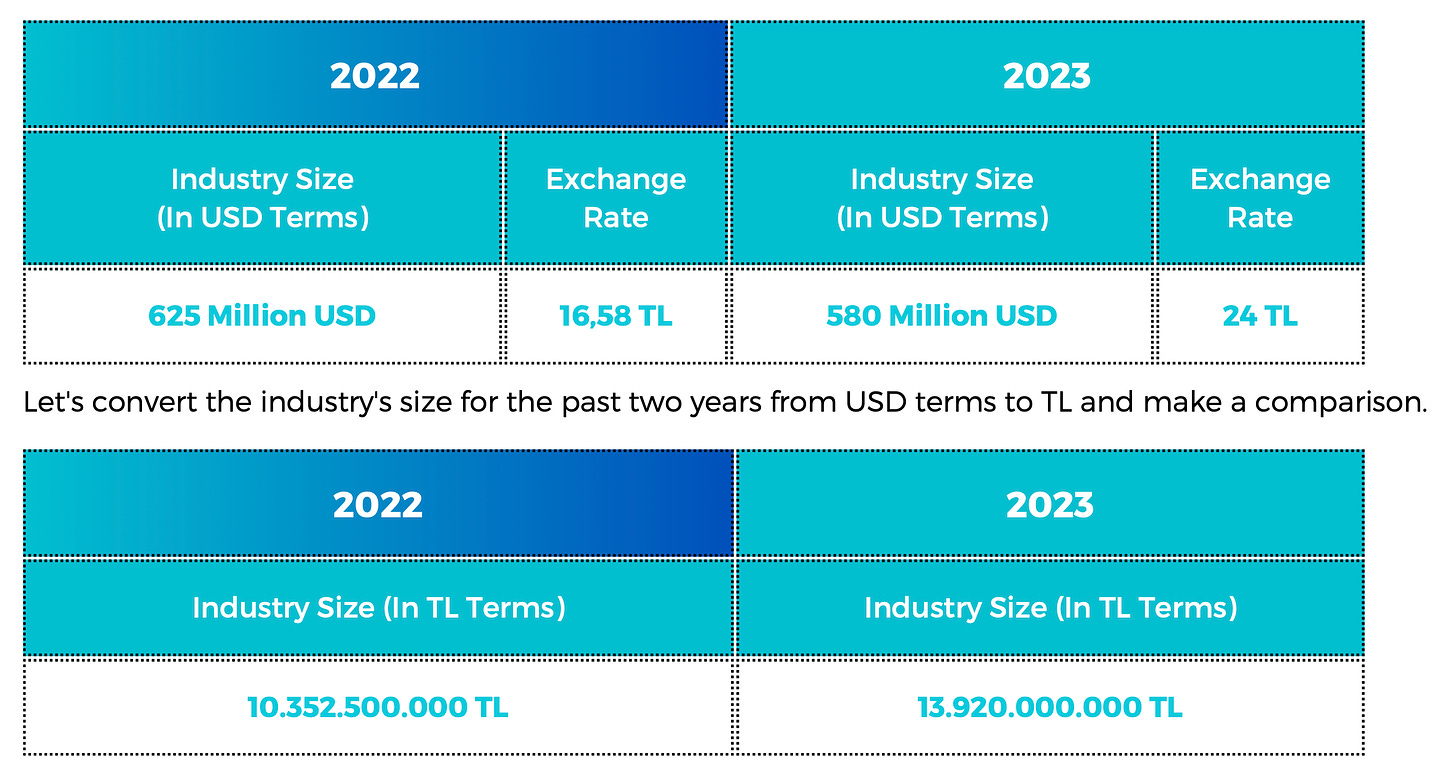

Turkish Gaming Market

-

The volume of the Turkish market in 2023 amounted to $580 million. There are 47 million gamers in the country. The market fell in dollar terms compared to last year, but grew by 34.46% in local currency (Turkish lira). This was influenced by inflation.

-

Mobile games dominate in Türkiye.

-

Due to the unstable currency exchange rate, many platforms (Prime Gaming, PS Plus, Xbox Game Pass) have switched their prices to USD.

-

In 2023, 40 investment deals were made in Türkiye. However, the number of investments in startups decreased significantly, and there were no exits.

Games & Numbers (June 26 - July 10)

PC/Console Games

-

Total sales of A Way Out have reached 8 million copies. The game was released in 2018, and it sold 1 million copies in the first two weeks.

-

Dragon Ball Z: Kakarot achieved the same milestone, with 8 million copies sold.

-

Players bought 5 million copies of the Elden Ring DLC Shadow of the Erdtree in 3 days.

-

In a video dedicated to the anniversary of Dave the Diver, Mintrocket game director announced that total sales of the game have reached 4 million.

-

The developers of Stellar Blade received $15.8 million in royalties from Sony by the end of May. According to their forecasts, game sales exceeded 1 million copies.

-

The First Descendant may have had nearly 500,000 concurrent players at its peak. On Steam, there were 260,000, and Nexon reported that half of the active audience is on consoles.

-

Drug Dealer Simulator 2 from Byterunners Studio sold more than 100,000 copies in 10 days. Moreover, sales of the first part increased by 66,000 copies following the sequel's release.

-

Arc System Works shared that Guilty Gear Strive surpassed 3 million players. The game was available on subscription services, so it's hard to say what the actual sales are.

-

The total number of players in XDefiant exceeded 11 million. Insider Tom Henderson reported that Ubisoft aimed for 5 million users in a month.

Mobile Games

-

Zenless Zone Hero approached its launch on July 4 with 45 million pre-registrations. This is twice as many as Honkai: Star Rail (23 million). However, AppMagic data shows that the game launched weaker than both Genshin Impact and Honkai: Star Rail—over the first 3 days, the game was installed more than 50 million times; but the revenue (after deducting commissions and taxes) for the first 5 days was $24.6 million (half of what Honkai: Star Rail made at launch).

-

Pokemon GO has earned more than $8 billion since its release—not including payments outside of app stores.

-

Garena Free Fire has earned over $4 billion after deducting commissions and taxes over 7 years of operation, according to AppMagic. Free Fire Max contributed $615 million to this amount.

-

Toon Blast surpassed $2.5 million in revenue and had its best half-year since 2021. In the first half of 2024, the game earned $223.4 million after deducting commissions and taxes.

-

World of Tanks Blitz has earned more than $1 billion since its release.

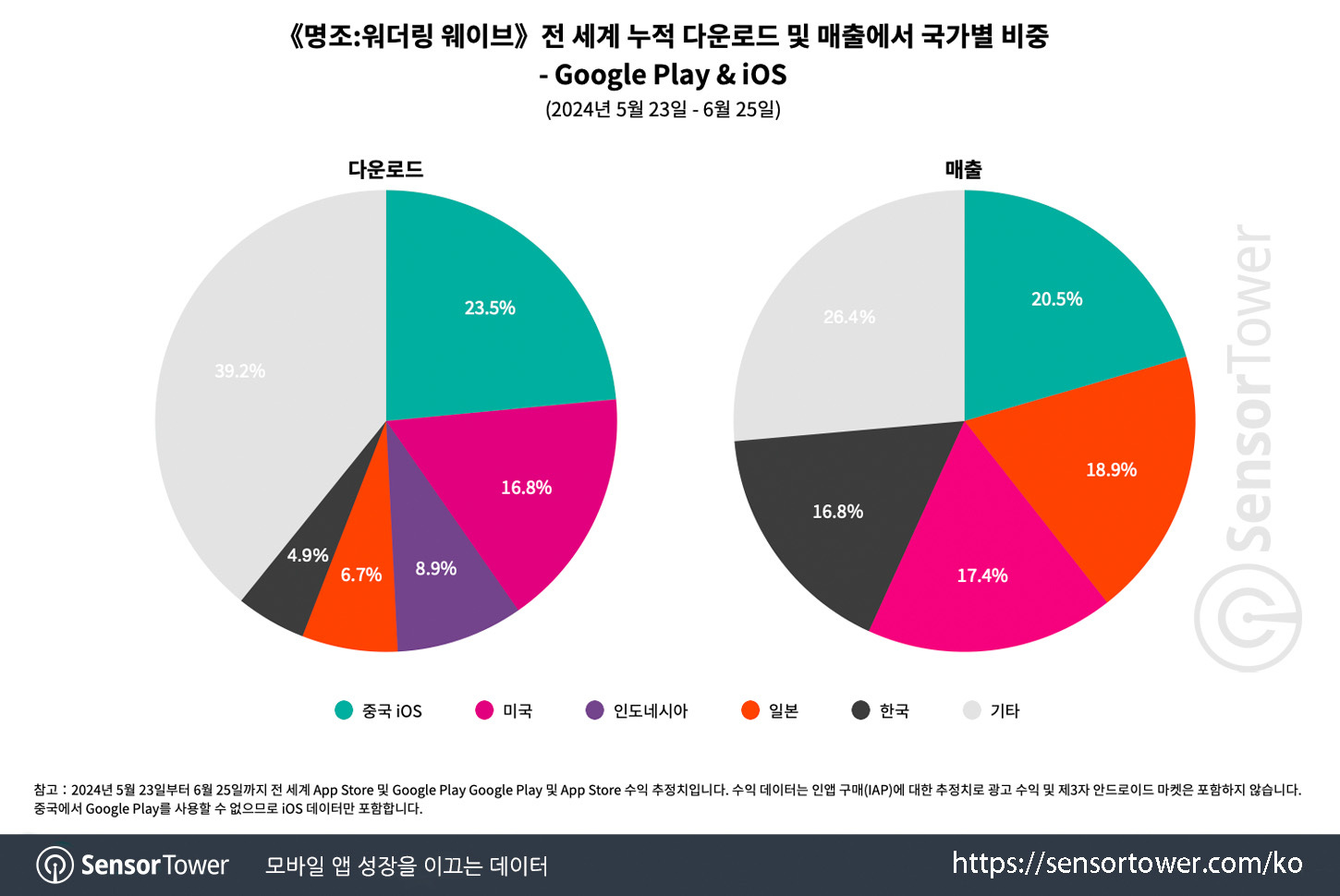

- Sensor Tower reports that Wuthering Waves earned $66 million in just over a month; the game was downloaded more than 15 million times. Most of the revenue came from Japan (18.9%), the USA (17.4%), and South Korea (16.8%). The highest revenue per download (RPD) was in Korea ($16).

-

Using AppMagic, MobileGamer looked into how Warcraft Rumble is doing—over 8 months, the game earned $39.1 million after taxes and commissions. In June 2024, the game earned $1.7 million.

- One Piece Treasure Cruise is the newest billion-dollar game. It was released 10 years ago; in Japan, it earned 67% of all revenue; in South Korea—10%; in the USA—8%. The RPD in Japan is $60.

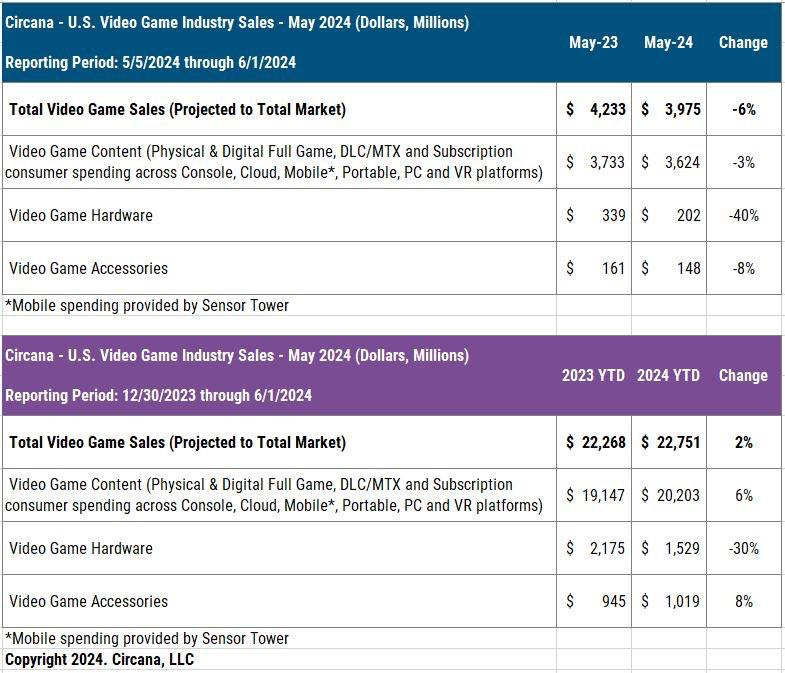

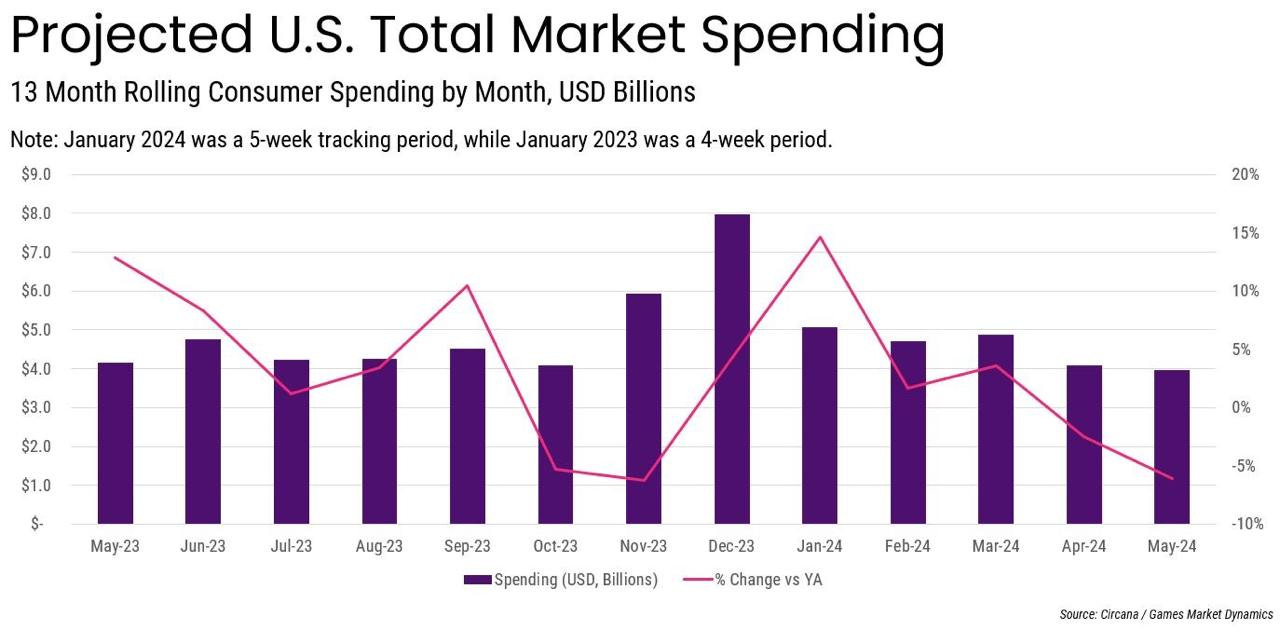

Circana: The US gaming market declined in May 2024

-

In May 2024, Americans purchased gaming products worth $3.975 billion. This is 6% less than a year earlier.

-

For the first 5 months of 2024, the volume of the American gaming industry amounted to $22.8 billion. This is 2% more than for the same period in 2023.

-

Sales of gaming content fell by 3% to $3.6 billion. The 13% growth in the mobile segment could not offset the 40% drop in console game sales.

❗️Such figures for the decline in console sales can partly be explained by the release of The Legend of Zelda: Tears of the Kingdom in May 2023.

-

PlayStation 5 is the sales leader by units and revenue. Xbox Series is second in terms of dollar value; Nintendo Switch in terms of units sold.

-

PS5 is currently 8% ahead of its sales dynamics in the US. Xbox Series lags 13% behind Xbox One and falls short of Xbox 360.

-

Sales of accessories fell by 8% compared to the previous year. The most successful accessory in monetary terms in May was the PlayStation Portal.

Top-selling Premium games in the US in May

-

Ghost of Tsushima returned to the top of the charts after 4 years. The game became the leader in dollar sales.

-

At the same time, Ghost of Tsushima narrowly surpassed Paper Mario: The Thousand-Year Door, which only includes physical sales.

-

Helldivers II still holds the top spot in sales in 2024. Call of Duty: Modern Warfare III is in second place; Dragon’s Dogma II is in third.

-

The most profitable mobile games in the US in May 2024 are MONOPOLY GO!; Royal Match and Roblox.

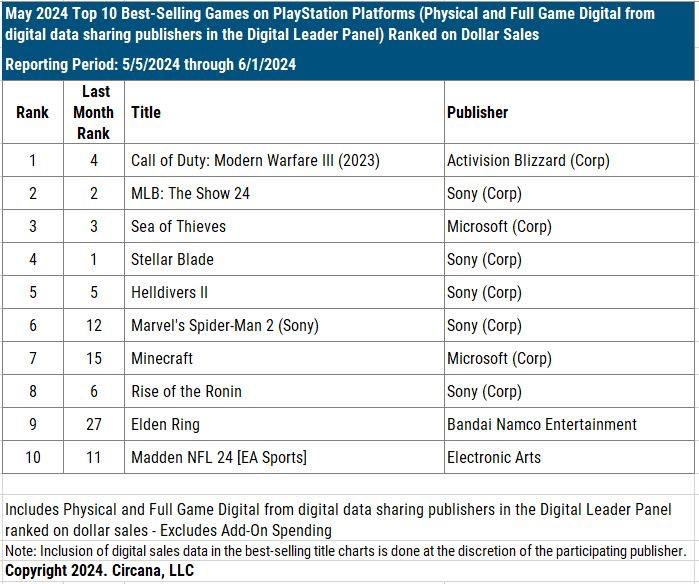

PC/Console charts

-

Top sellers on PlayStation are Call of Duty: Modern Warfare III; MLB: The Show 24 and Sea of Thieves.

-

Elden Ring, thanks to the release of DLC, made it into the top 10.

-

There are updates in the PlayStation MAU ranking - XDefiant appeared for the first time (5th position), and Multiversus returned (10th position).

-

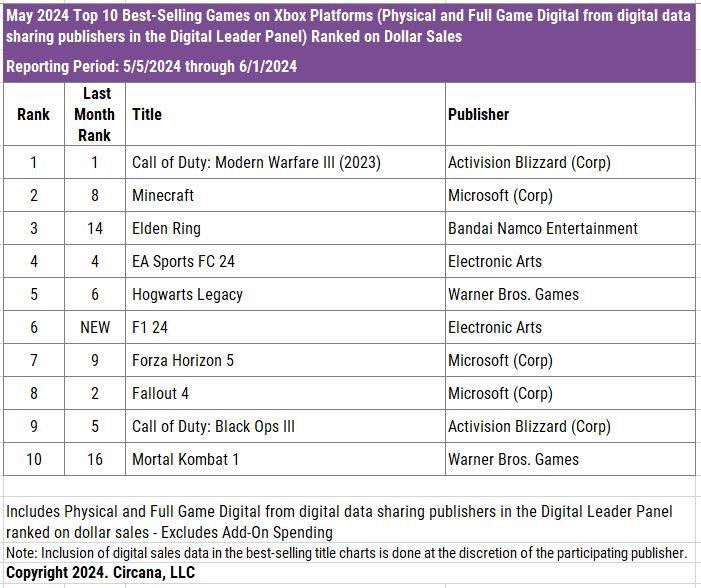

On Xbox, the top sellers are Call of Duty: Modern Warfare III; Minecraft and Elden Ring. F1 24 made it into the top 10 for the first time.

-

The Xbox MAU ranking is more stable, and it also includes XDefiant.v

-

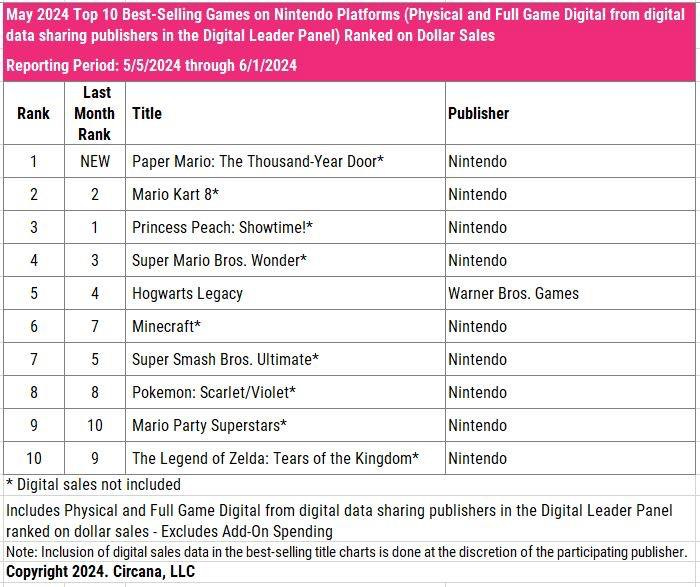

The new leader in the Nintendo sales ranking is Paper Mario: The Thousand-Year Door.

-

In the Steam MAU ranking in the US, Helldivers II holds the lead. In May, V Rising jumped to 6th position, and Hades II entered the ranking for the first time (8th position).

Layer Licensing: IP Collaborations in Games in recent years

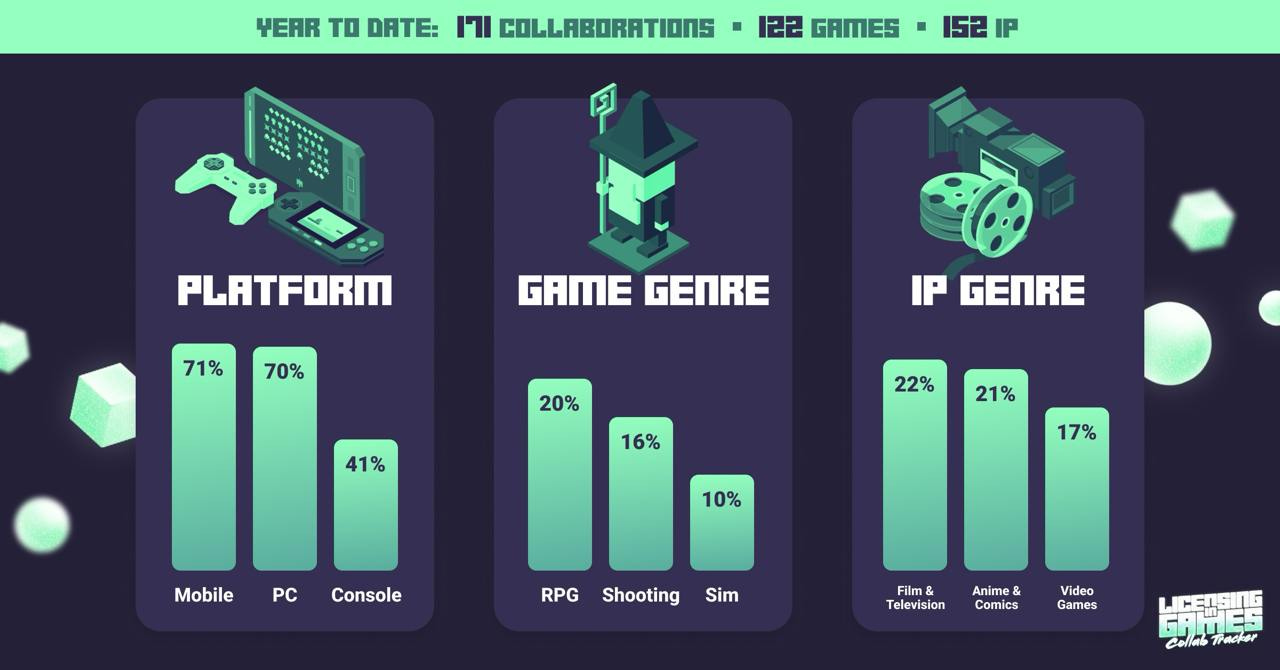

Layer Licensing has launched a tool to track collaborations in games and share statistics about them. Data has been collected since May 2023, accounting for 171 collaborations in 122 games using 152 IPs.

- Out of the total volume of collaborations, 71% were in mobile games, 70% in PC games, and 41% in console games.

❗️If a collaboration was in a game available on multiple platforms, it was counted for each platform.

-

The most popular genres for IP collaborations are RPGs (20%), shooters (16%), and Simulation games (10%; this category includes Minecraft and Roblox).

-

Collaborations are least common in adventure and arcade games.

-

Movie and TV IPs are the most frequently featured in games (22%). Following are anime and comics (21%) and collaborations with other games (17%).

-

Collaborations with musicians make up 6% of the total number of collaborations, and those with luxury and fashion brands account for 3%.

Brightmine: The average salary of females in the UK is £8,000 less than that of male

The study is based on data from more than 25 companies with a total of over 3,000 employees.

- The average base salary for males in the UK is £49,695; for females, it is £41,174.

-

The wage gap is 17.1%. This is higher than the national average gap (14.7%) but lower than the gap in technology industries (25.8%).

-

According to Brightmine, the highest proportion of women is found among office managers (98%); and in management (77%).

-

Men are most represented among game artists (97%); marketers (97%), and QA specialists (96%).

❗️The gender distribution by profession does not reflect the subjective picture of what I see in studios. It would be interesting to have a look at the sample.

ERA: Game Sales in the UK Dropped by 29.4% in the First Half of 2024

ERA only accounts for sales of physical and digital versions of games. DLC, microtransactions, and mobile game revenue are not included.

- In the first half of 2024, game sales reached £348.6 million. This is 29.4% less than the previous year.

-

Sales of physical copies of games fell by 40% (to £111.7 million); digital sales fell by 23% (to £236.9 million).

-

ERA also shared results from other industries. Revenue in the video segment, which includes streaming, is growing - up 5.4% YoY (£213.7 million) in the first half of the year.

-

The music segment (excluding streaming) saw the most growth in the first half of 2024 - up 7.9% to £163.8 million. Despite ERA not accounting for streaming revenue, the association notes an 11% increase in consumption.

Sensor Tower: Korean Mobile Gaming Market in H1'2024

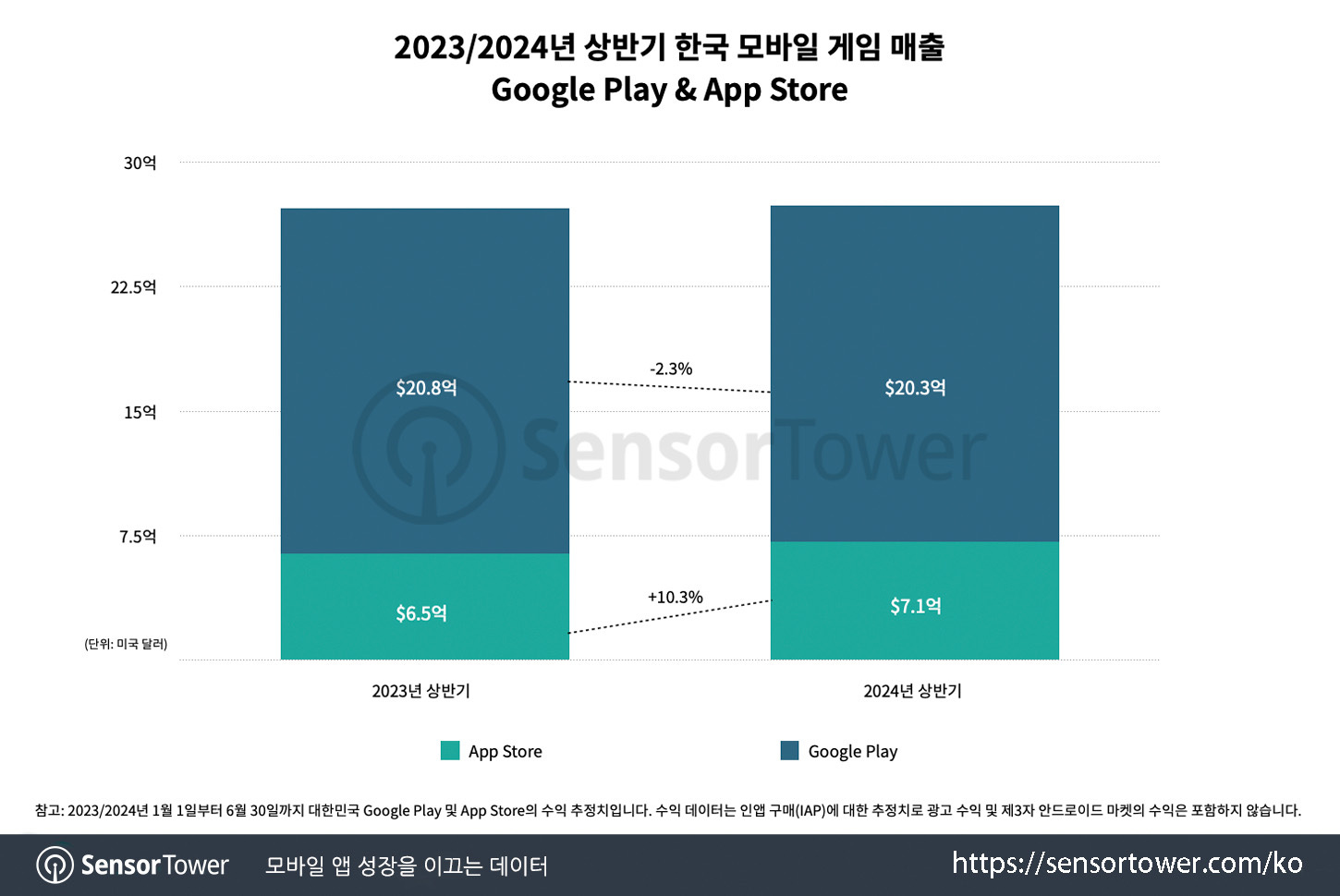

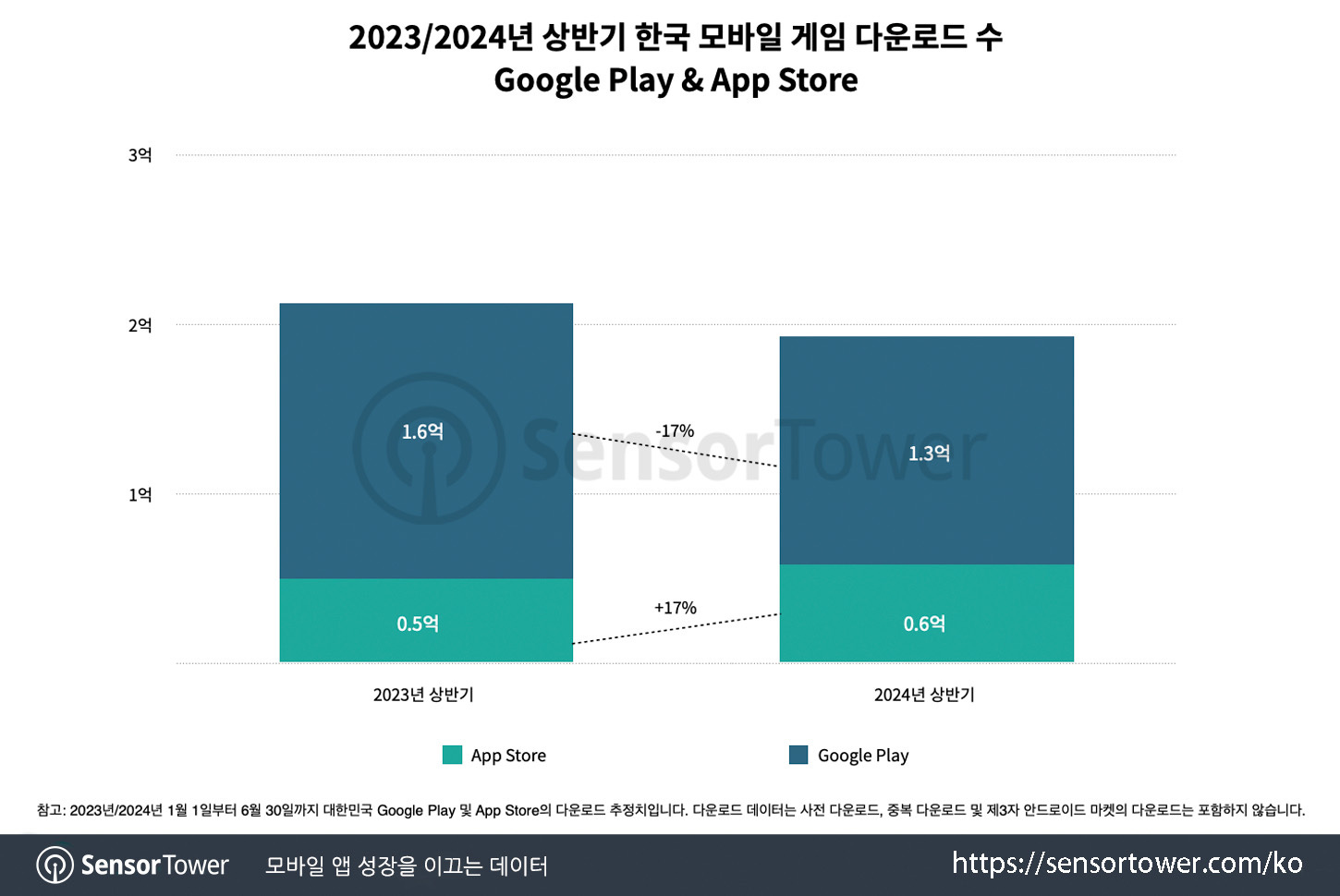

-

Revenue from mobile games in South Korea in the first half of the year reached $2.75 billion. This is $30 million more than the same period in 2023.

-

Google Play revenue decreased by 2.3% YoY; however, on iOS, it increased by 10.3%.

-

The Korean market saw a decline in downloads in the first half of 2024. Google Play downloads fell by 17%, but App Store downloads increased by the same percentage.

Successful Games

-

Last War: Survival became the market leader in revenue and ranked second in downloads in the first six months. The game has earned over $600 million worldwide since its launch, with 26% of that amount coming from South Korea.

-

Legend of Mushroom ranked third in revenue and first in downloads in the first half of 2024. Since its release, the game has generated $350 million in revenue, with South Korea accounting for 34%.

-

Games from the Lineage series and Odin: Valhalla Rising continue to perform strongly.

-

Brawl Stars performed well in South Korea in the first half of the year. The game ranked 7th in revenue and 8th in downloads. In May 2024, the game earned more than $10 million in the local market, the highest amount since May 2019. It also has the highest retention rates (7, 30, and 60 days) among all top games in the country.

-

Supercell's new game, Squad Busters, entered the top downloads list (4th place) despite being released on May 29.

-

In the first half of 2024, 5 out of the top 10 games by revenue were foreign. This hasn't happened in South Korea since 2017.

Most Successful Publishers

-

NCSoft maintained its leadership in revenue among publishers. Kakao Games ranked second, and FirstFun (creators of Last War: Survival) ranked third.

-

5 out of the top 10 publishers by revenue were foreign, marking the first time this has happened in the past 10 years.

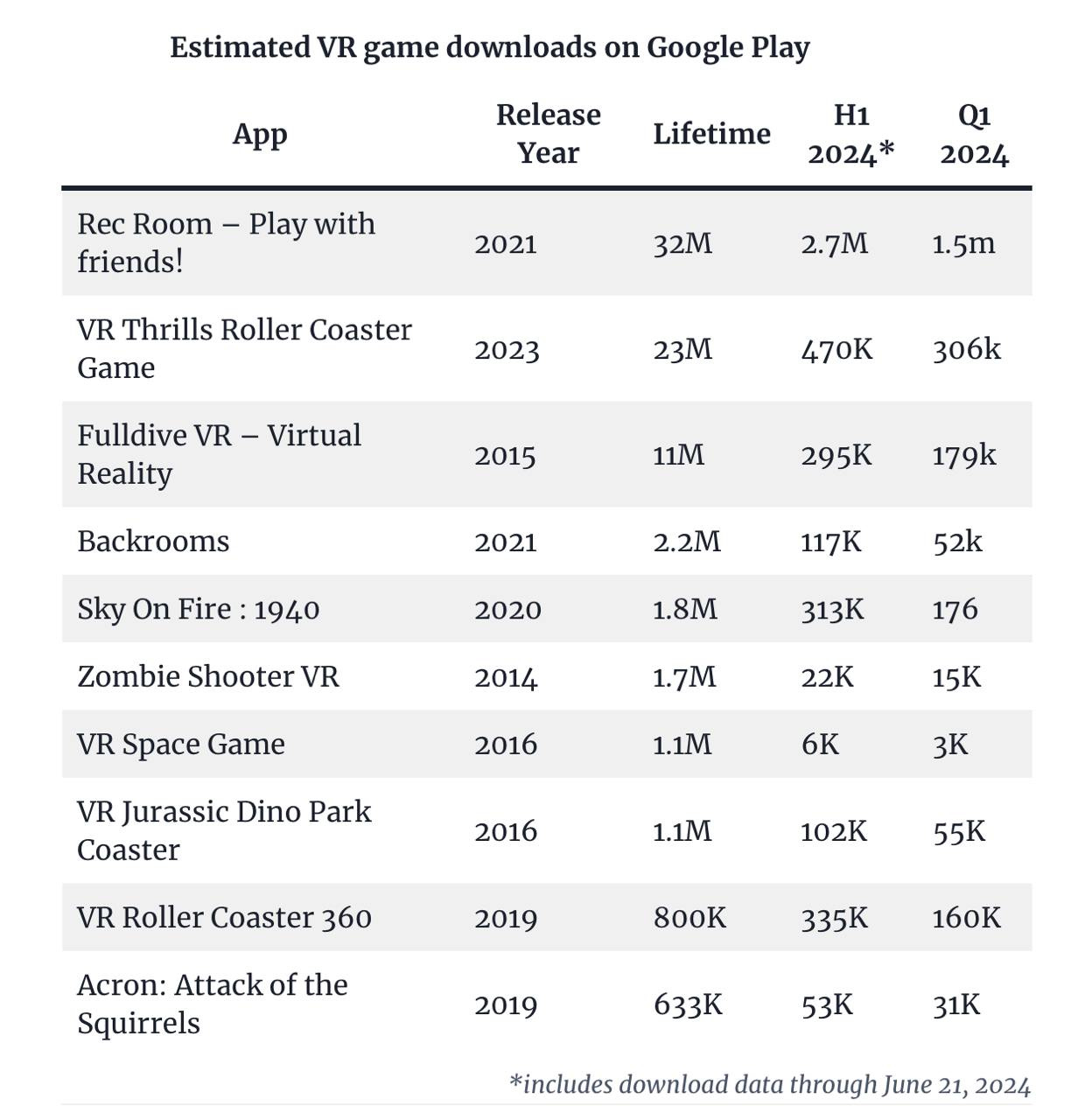

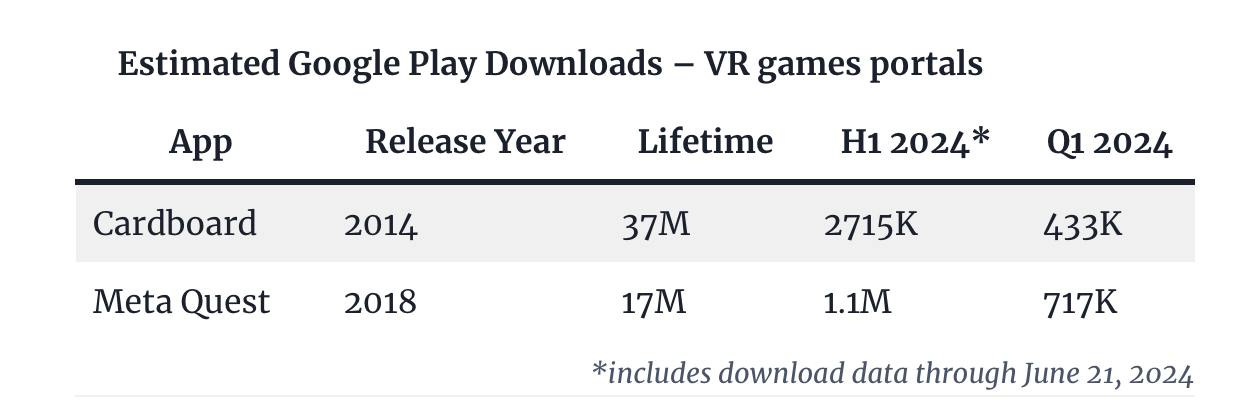

Splitmetrics: VR games Downloads on Android grew by 40% in H1'24

App Radar was used to calculate the installs.

- The 28 most successful VR games in the year's first half were downloaded 5.5 million times. This is 40% more than the previous year.

-

Splitmetrics notes that the total number of downloads for the year was 10 million in 2022; in 2023 - 8 million.

-

The top five most successful VR games by downloads are Rec Room (2.7 million installs); VR Thrills: Roller Coaster Game (470 thousand installs); VR Roller Coaster 360 (335 thousand downloads); Sky on Fire: 1940 (313 thousand downloads), and Fulldive VR (295 thousand downloads).

-

The most downloaded VR game on Google Play by a large margin is Rec Room (32 million lifetime downloads). In second place is VR Thrills Roller Coaster Game (23 million); in third place is Fulldive VR - Virtual Reality (11 million).

-

However, the rankings do not include app stores - Cardboard (37 million downloads) and Meta Quest (17 million).

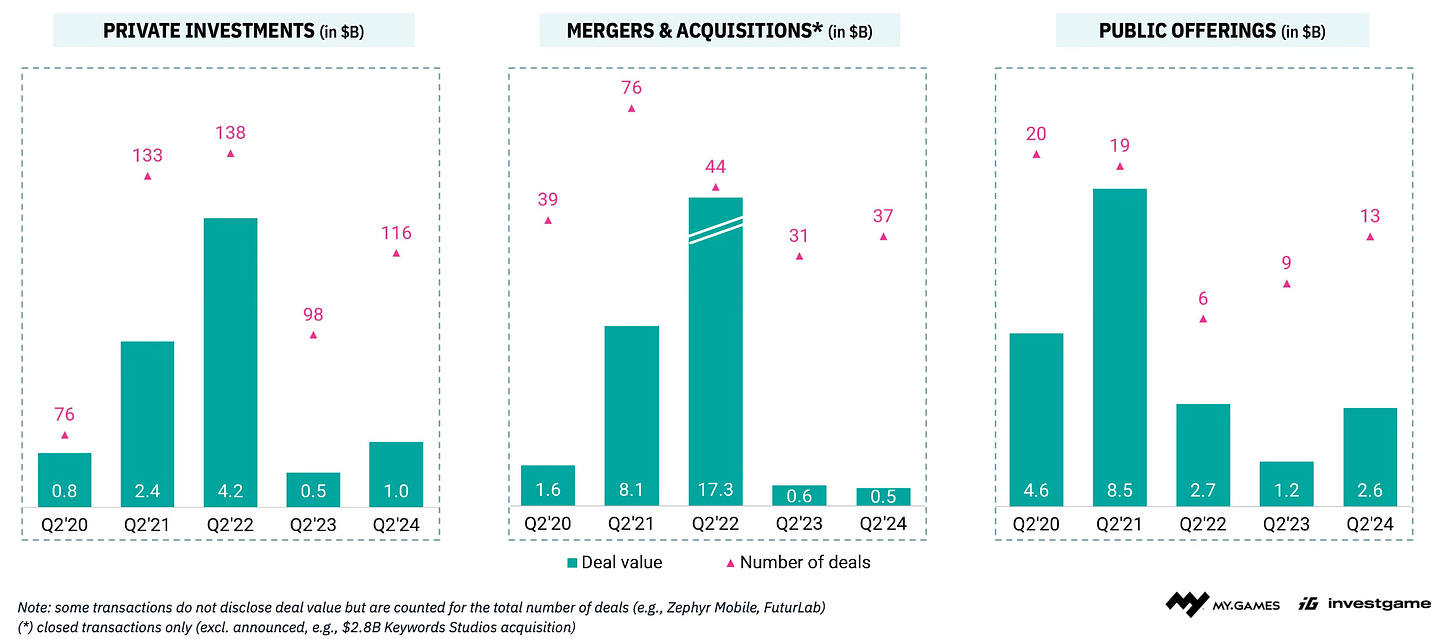

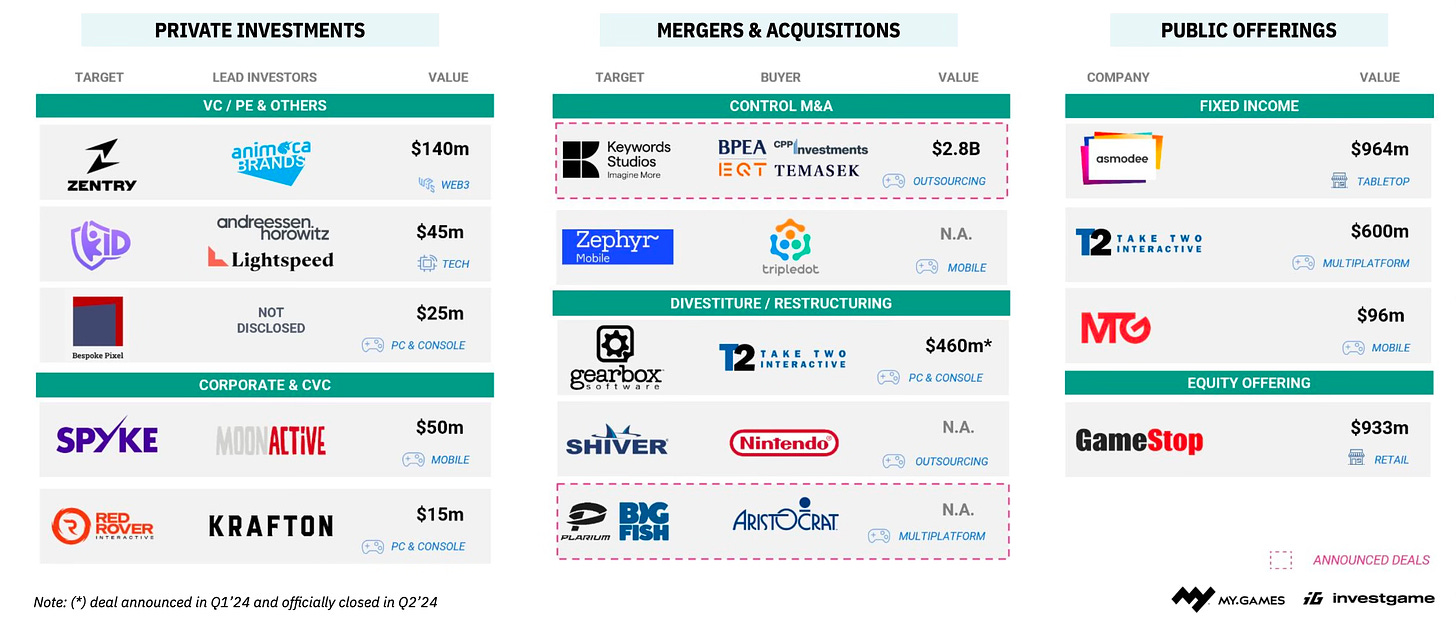

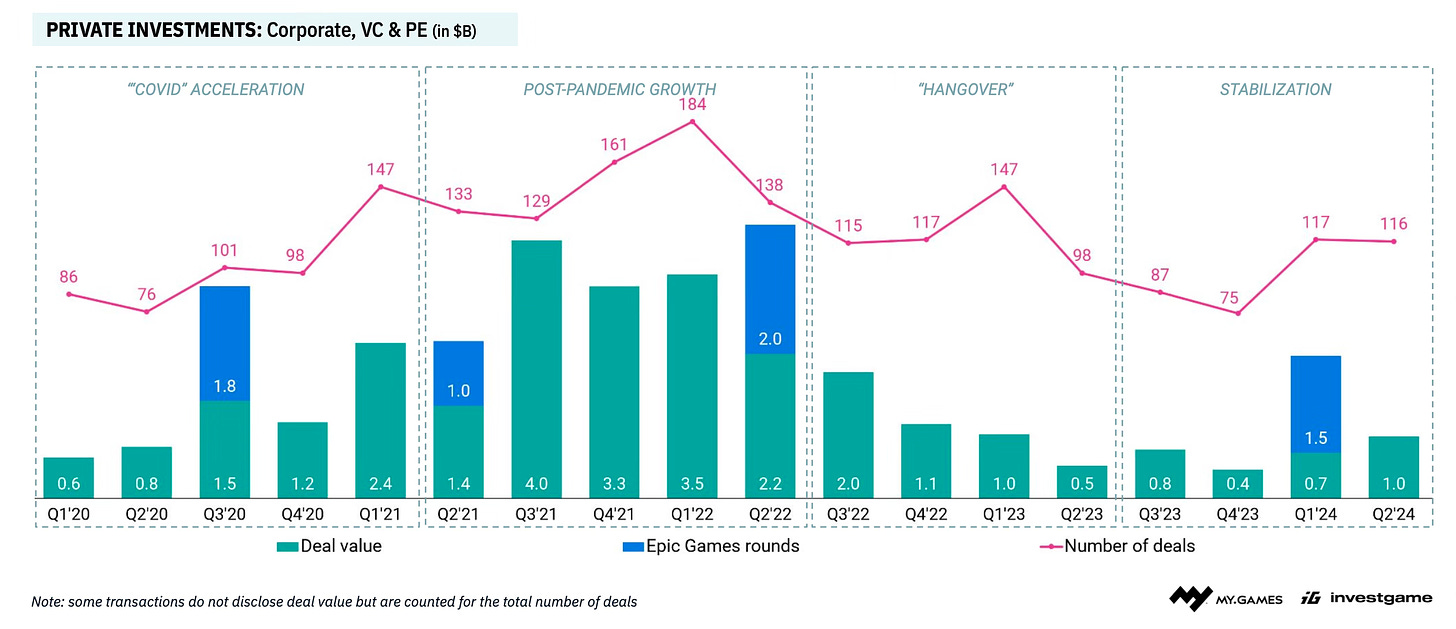

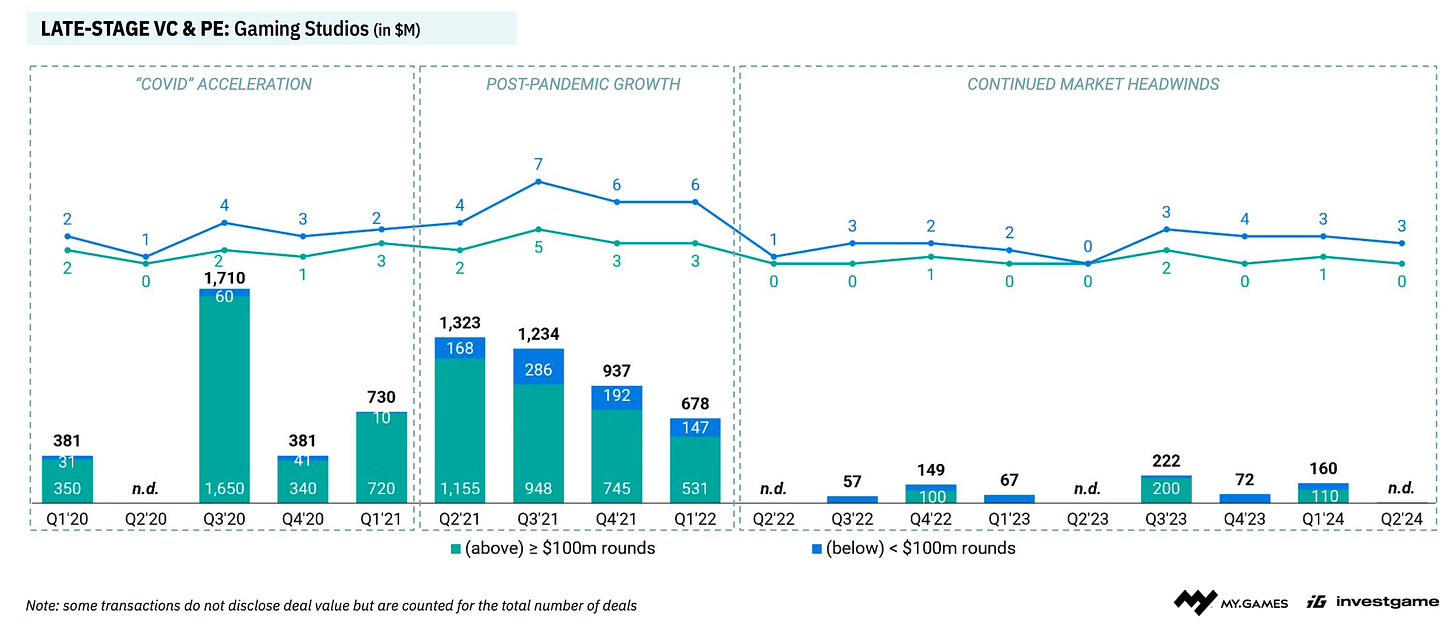

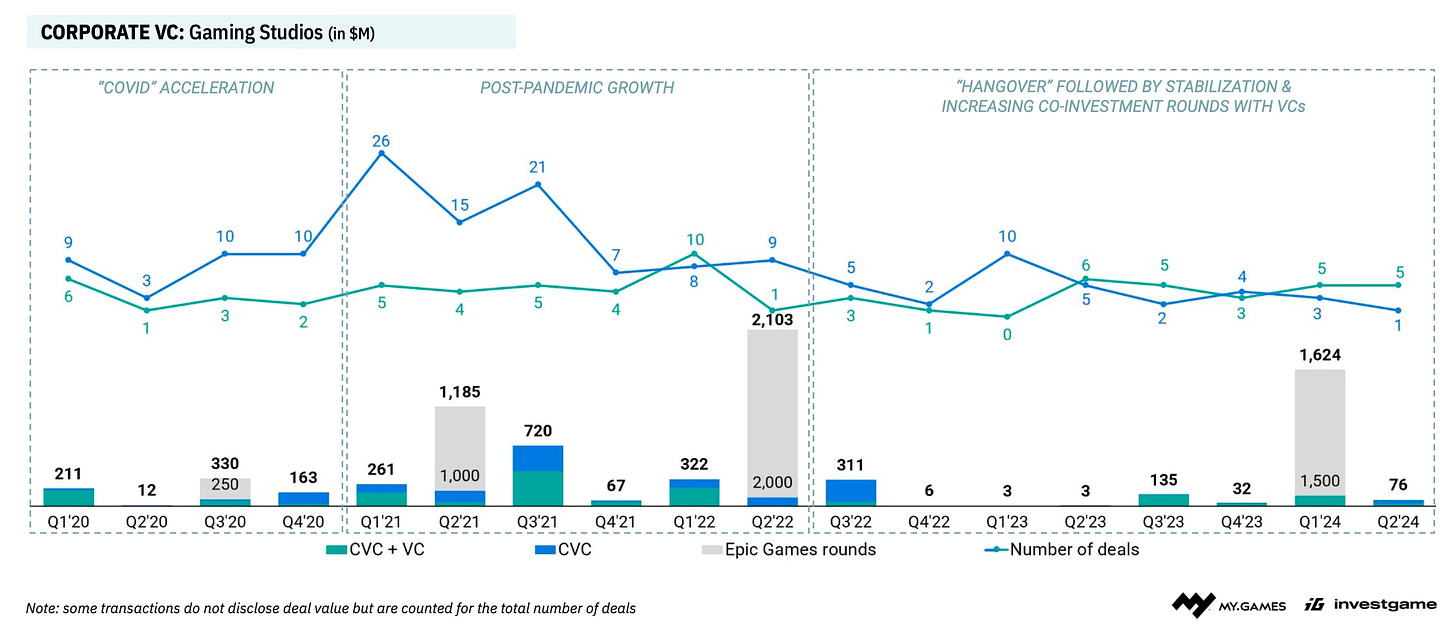

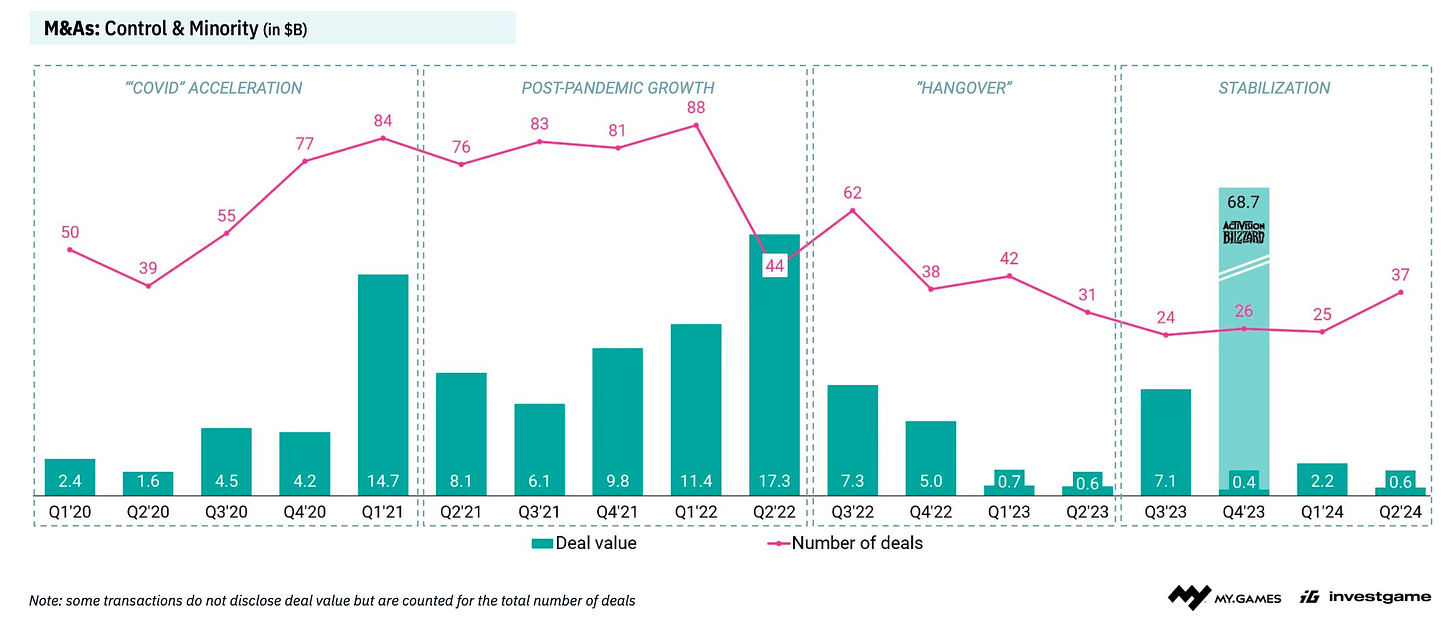

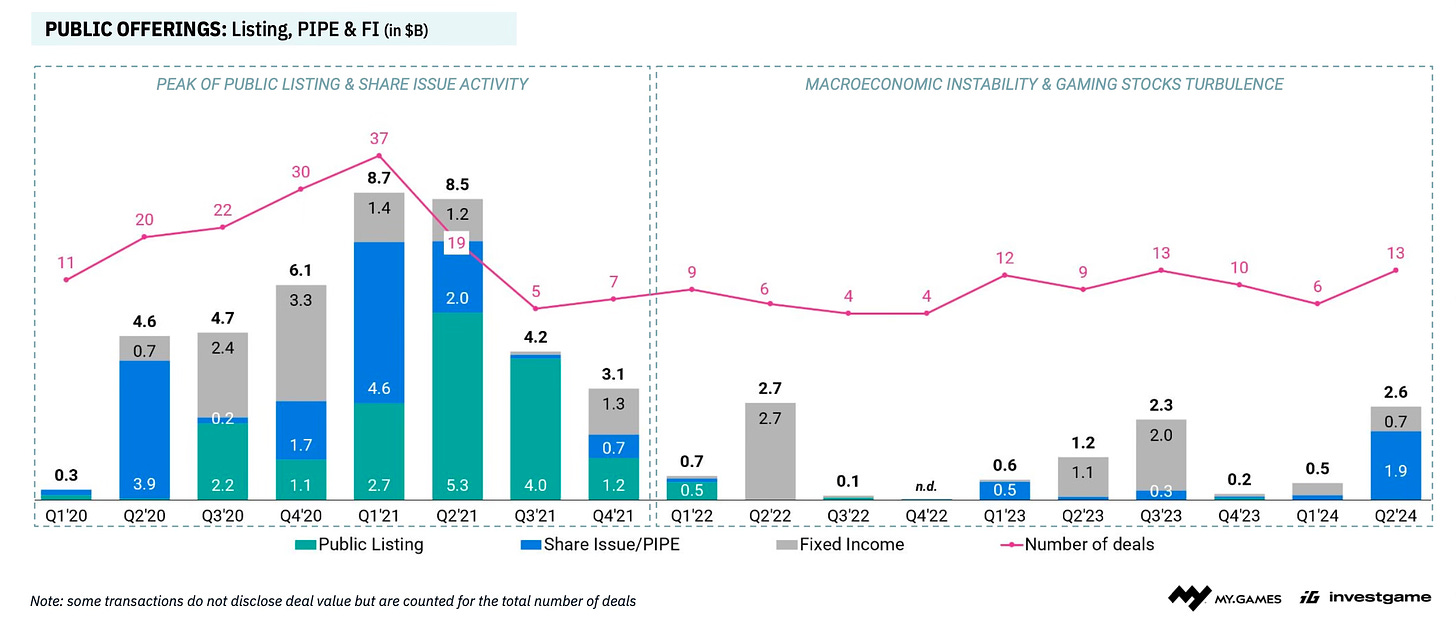

InvestGame: Gaming Investment Market in Q2'24

- Investment activity is growing compared to the second quarter of the previous year. In the case of private investments and public offerings, both the number and volume of deals have increased. The number of M&A deals has also increased, although their volume has slightly decreased (InvestGame notes that the $2.8 billion purchase of Keywords Studios is not included).

Private Investments

-

In Q2’24, 116 deals were made with a total volume of $1 billion. In terms of volume, this is (almost) the annual maximum, excluding the Q1’24 quarter, which involved the Epic Games transaction. In terms of the number of deals, it's one less than in Q1'24 (which had a record number of deals for the year).

-

There were 30 early-stage gaming deals in Q2'24, amounting to $125 million ($73 million for pre-seed; $52 million for Series A). It looks like the market is reaching a new plateau in terms of the volume and number of such deals.

-

The number of late-stage investment deals is minimal - not a single one was publicly announced in Q2'24. However, InvestGame experts note 3 deals with a volume of less than $100 million.

-

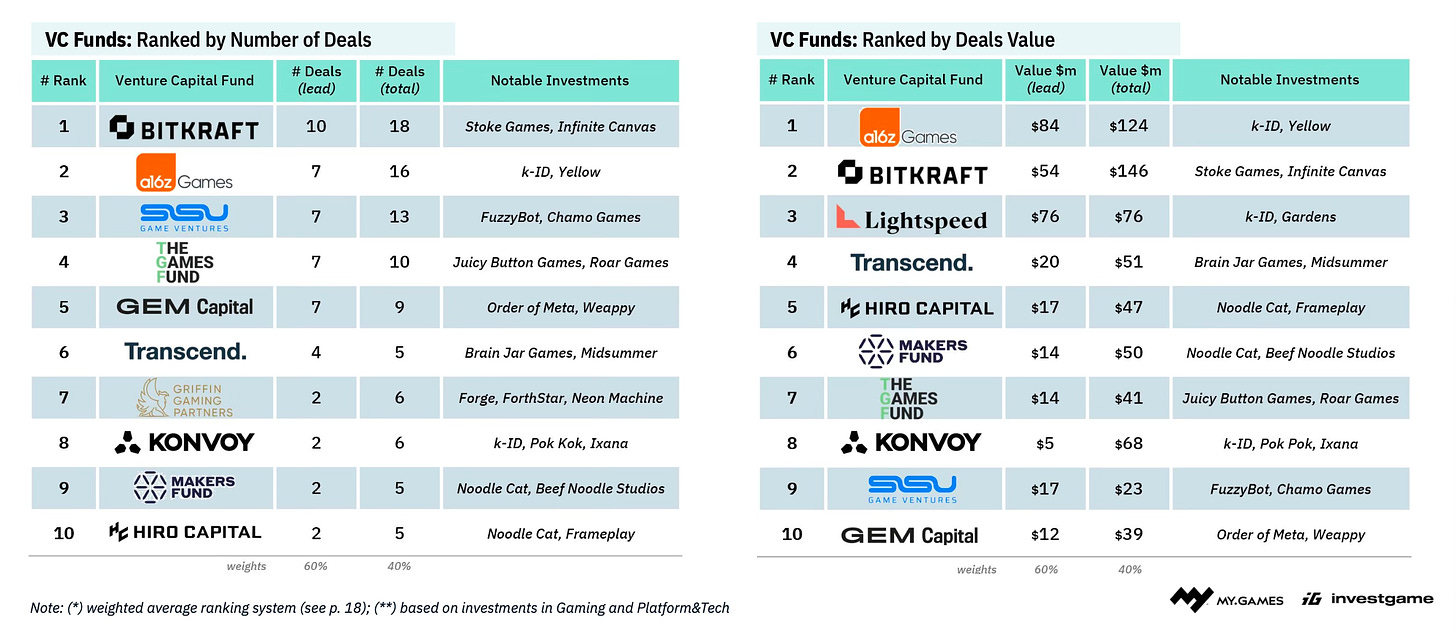

Bitkraft, A16Z Games, Lightspeed, Sisu Game Ventures, Transcend, The Games Fund, GEM Capital, and Hiro Capital are the most active VC funds both in terms of deal volume and quantity.

-

The activity of corporate VC funds remains low. In Q2'24, $76 million was spent. There were several joint deals with traditional VC funds, which can be explained by the desire to reduce risks in the deal.

-

The number of early-stage VC deals in the US, Europe, and Asia is almost equal.

M&A

-

The number of deals in Q2'24 increased to 37 - the maximum since Q1'23.

-

However, the volume of deals is one of the lowest since Q1'20 and matches the result of Q2'23. The only lower volume was in Q4'23, excluding the closed Microsoft and Activision Blizzard deals.

Public Offerings

-

In Q2'24, the number of transactions with public companies increased, but as noted by InvestGame, this growth is not due to public offerings. Most of the transactions are related to investments through additional share issuance and raising funds using fixed-income instruments (bonds, preferred shares, etc.).

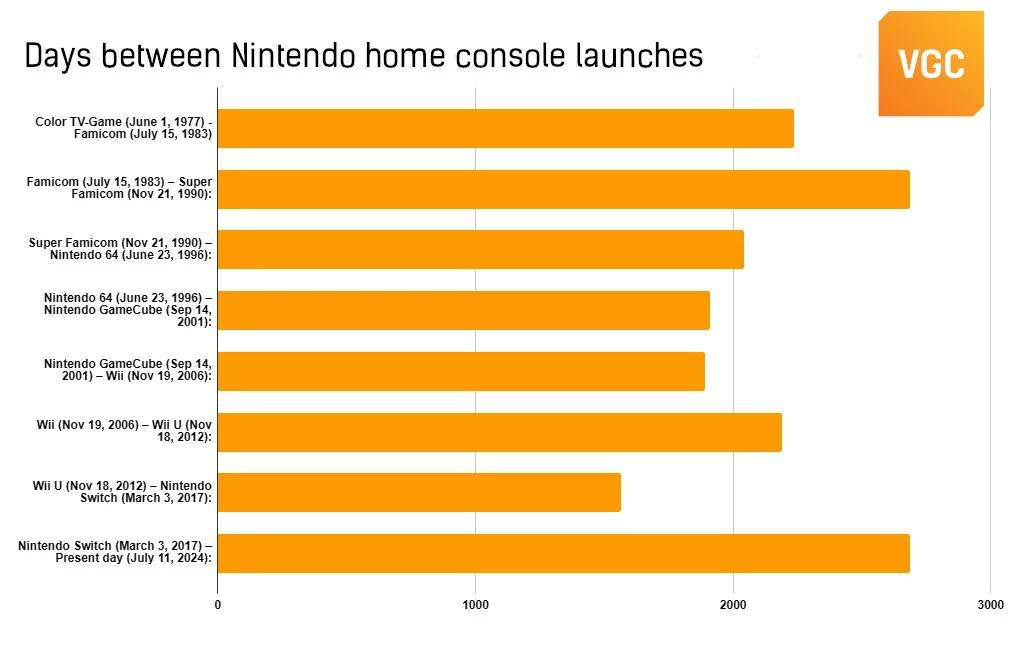

Nintendo Switch - the longest-lasting home (?) console in Nintendo's history

The VGC portal compared the time intervals between the releases of Nintendo consoles. Only the release date of a new generation was considered.

- Since its release on March 3, 2017, the Nintendo Switch has been on the market for 2695 days. The previous record belonged to the Famicom (2686 days), which was replaced by the Super Famicom.

-

The shortest lifespan was with the Wii U - between the console's release and the appearance of the next system, 1566 days passed.

-

However, the Game Boy holds the record for Nintendo among all consoles (including handhelds). The console remained on the market for 4352 days until the Game Boy Advance was released.

-

Nintendo's most successful system in history - the Nintendo DS - was on the market for 2288 days.

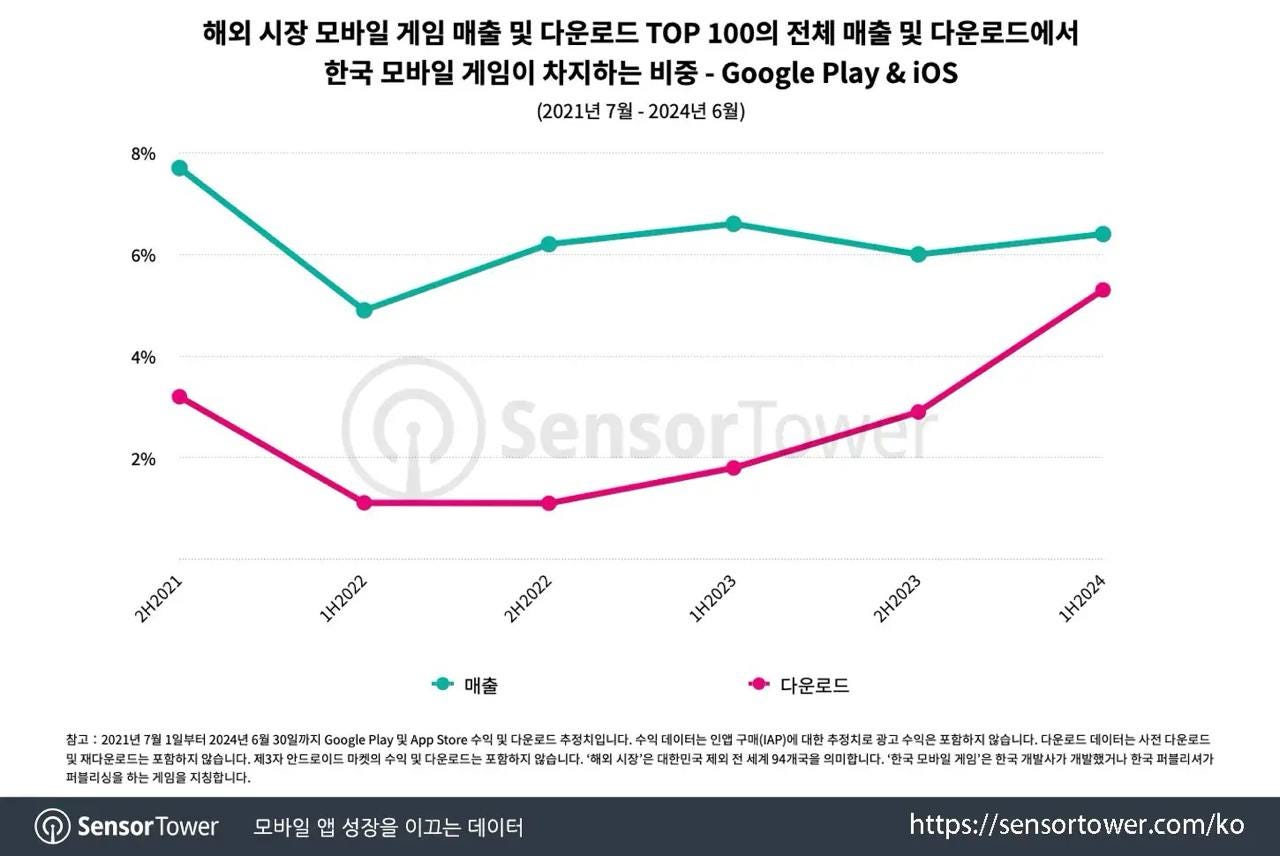

Sensor Tower: Mobile Games by Korean Developers Worldwide

-

Over the past 3 years, the revenue share of games by Korean developers in the global top-100 charts has averaged 6%. In the first half of 2024, it increased to 6.5%. However, the record remains for the second half of 2021 - during that period, the share of Korean games in the top 100 by revenue almost reached 8%.

-

One of the factors for growth in 2024 was the release of Dungeon Fighter Mobile, which became a hit in the Chinese market.

-

The South Korean leaders in revenue in the first half of 2024 are Dungeon Fighter Mobile, PUBG, and Goddess of Victory: Nikke. The list includes 4 casino games - 1 from DoubleUCasino and 3 from Netmarble.

-

In terms of downloads, games by Korean developers have shown growth since the second half of 2022. They grew from a 1% share in the top 100 downloads in the second half of 2022 to 5.5% in the first half of 2024.

-

The success of Supercent in the hyper-casual and hybrid-casual project markets is helping South Korean developers bite off a market share in downloads. Of the top-10 downloaded games by Korean developers, 6 are from Supercent. PUBG is also performing well.

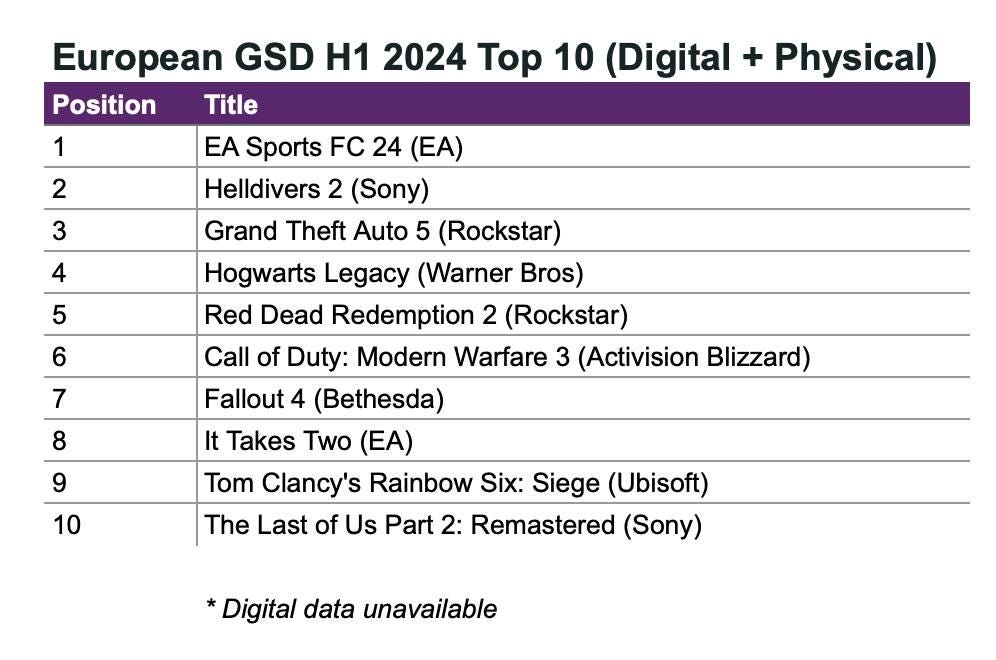

GSD & GfK: PC & Console Games Sales in Europe in June 2024 and H1'24

The analytical platforms report only the actual sales figures obtained directly from partners. The mobile segment is also not considered.

H1’24 Results

-

Almost 80 million copies of PC and console games were sold in the first half of 2024. This is 1.6% less than in the same period last year.

-

Only 2 games from the top 10 for the first half of the year were released in 2024 - Helldivers II (2nd place) and The Last of Us: Part II - Remastered (10th place).

❗️Palworld is not on the list because the company does not share sales data with GSD. Therefore, actual sales may be higher.

-

In the first half of 2024, console sales fell by 24% year-over-year (YoY). Total sales amounted to 2.2 million devices.

-

PlayStation 5 sales fell by 16%; Nintendo Switch - by 32%; Xbox Series S|X - by 37%.

-

Sales of accessories also dropped - by 8.4%.

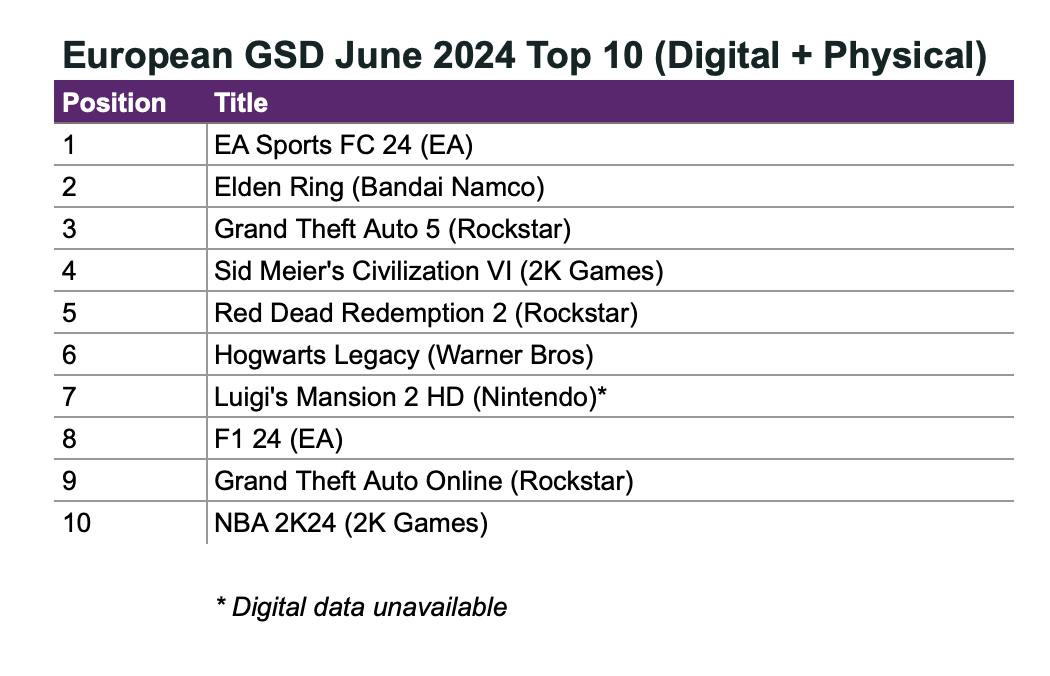

June’24 Results

-

In June, 11.3 million copies of games were sold - 19% less than a year earlier. But it's important to note that last year, Diablo IV and Final Fantasy 16 were released in this month.

-

Sales of EA Sports FC 24 in June were 7% better than FIFA 24 sales a year ago. This is likely related to the Euro 2024.

-

Sales of Elden Ring increased by 454% thanks to the release of the DLC Shadow of the Erdtree. The game ranked second in the June chart.

-

Luigi's Mansion 2 HD is the best-selling new release of June. The game ranked 7th, with only physical sales counted (Nintendo does not share digital sales). However, the initial sales of the game were only a third of the initial sales of Luigi's Mansion 3 in 2019.

-

In Europe (excluding the UK and German markets), just over 300 thousand consoles were sold in June. This is 24% less than a year earlier.

-

PlayStation 5 sales in June fell by 10%. The decline is more noticeable on other platforms.

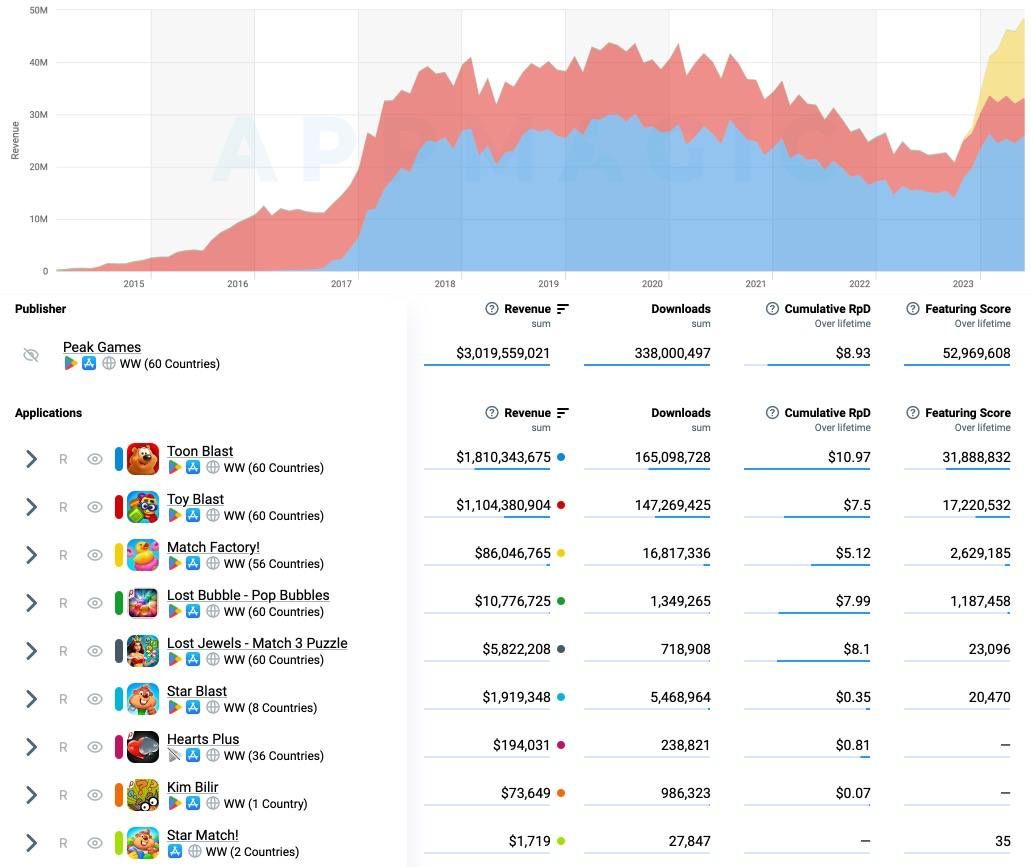

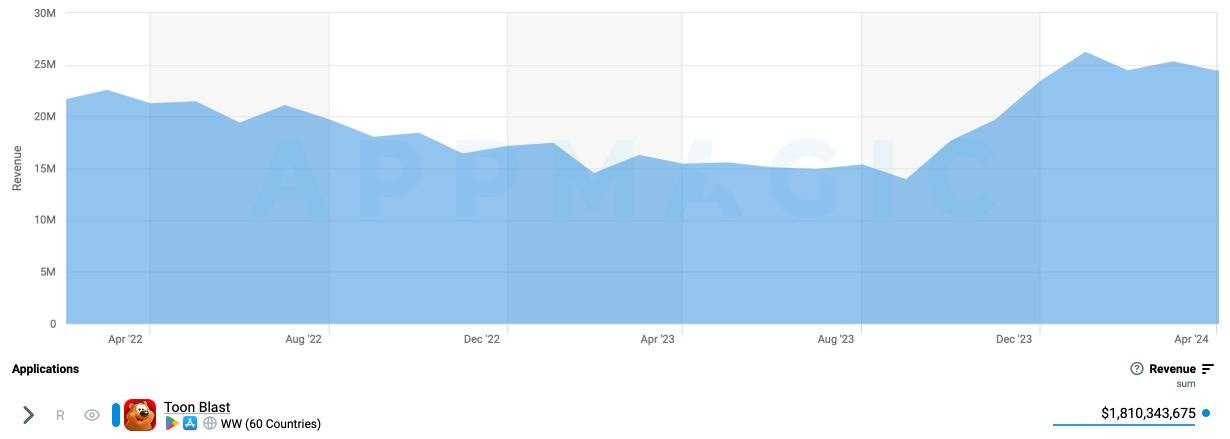

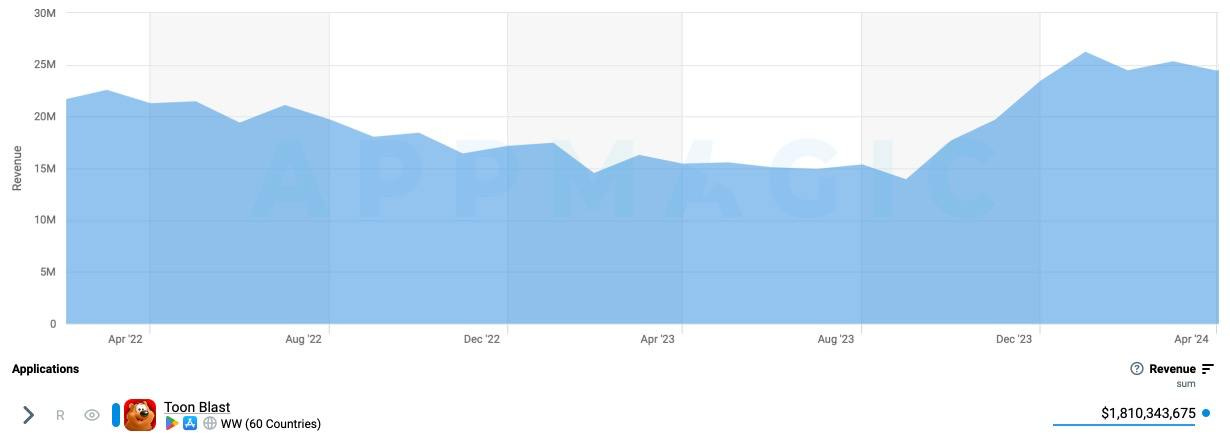

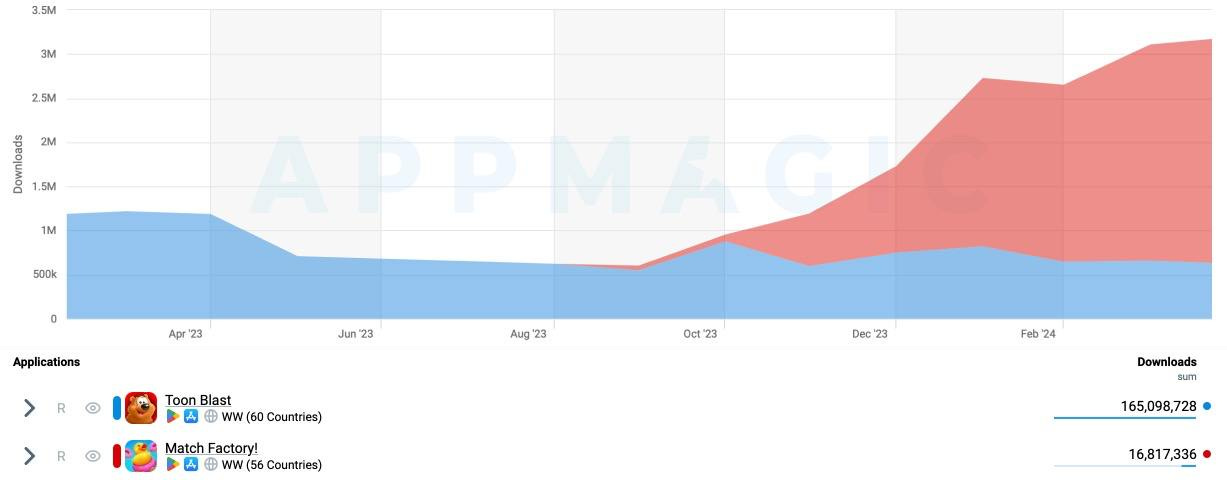

AppMagic: Peak Games Earned Over $5B - and Returned to Growth

-

97% of the company's revenue came from two projects - Toon Blast (60%) and Toy Blast (37%).

-

In October 2023, Toon Blast returned to growth. Monthly IAP revenue (after platform fees and taxes) increased from $13 million to $26 million and seems to have reached a new plateau.

-

Another factor contributing to the return to growth was the release of Match Factory! in September 2023. The game reached a level of $15 million in monthly IAP revenue (after taxes and fees).

❗️In reality, the company's revenue is even higher because advertising revenue is not being counted.

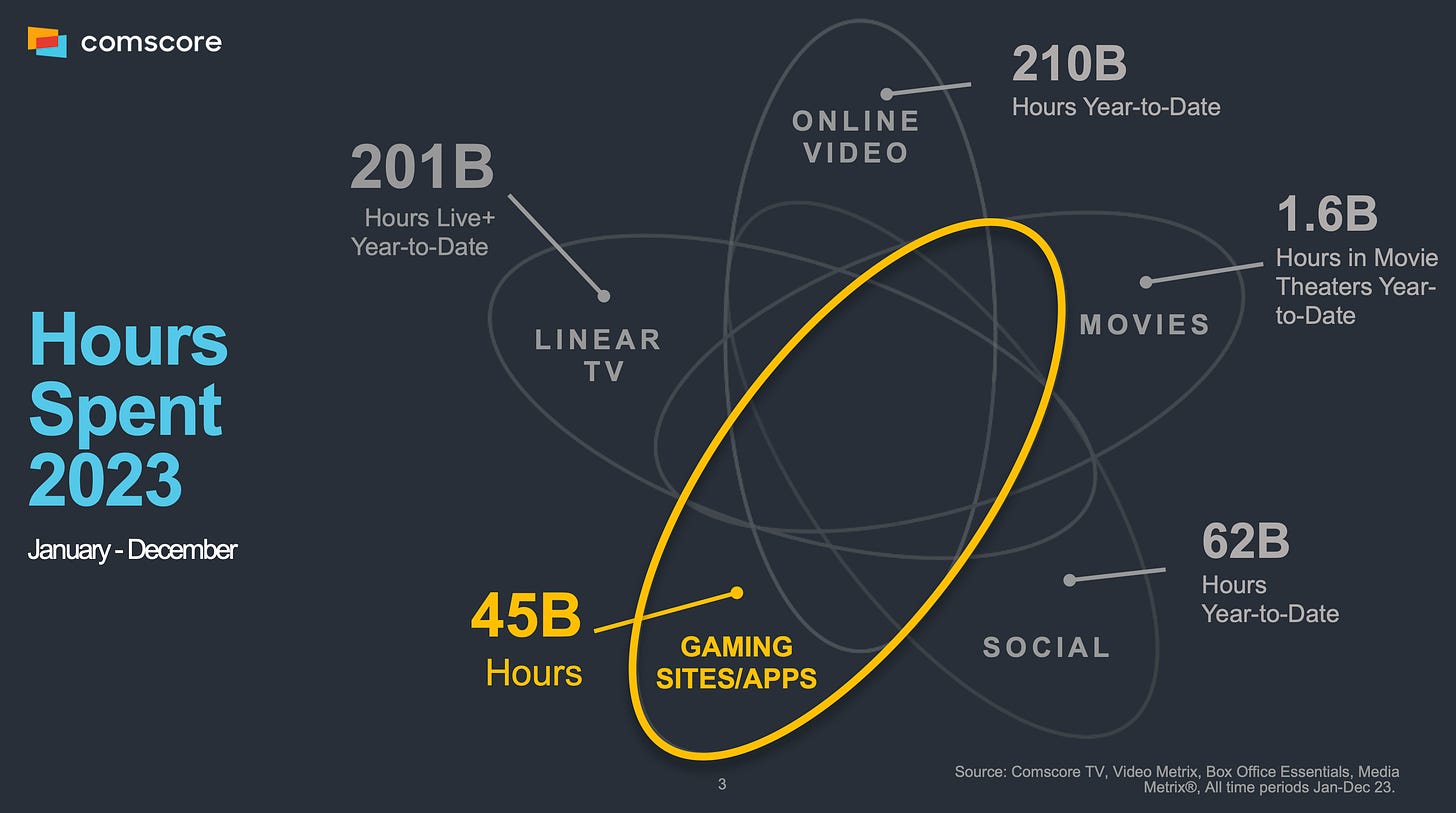

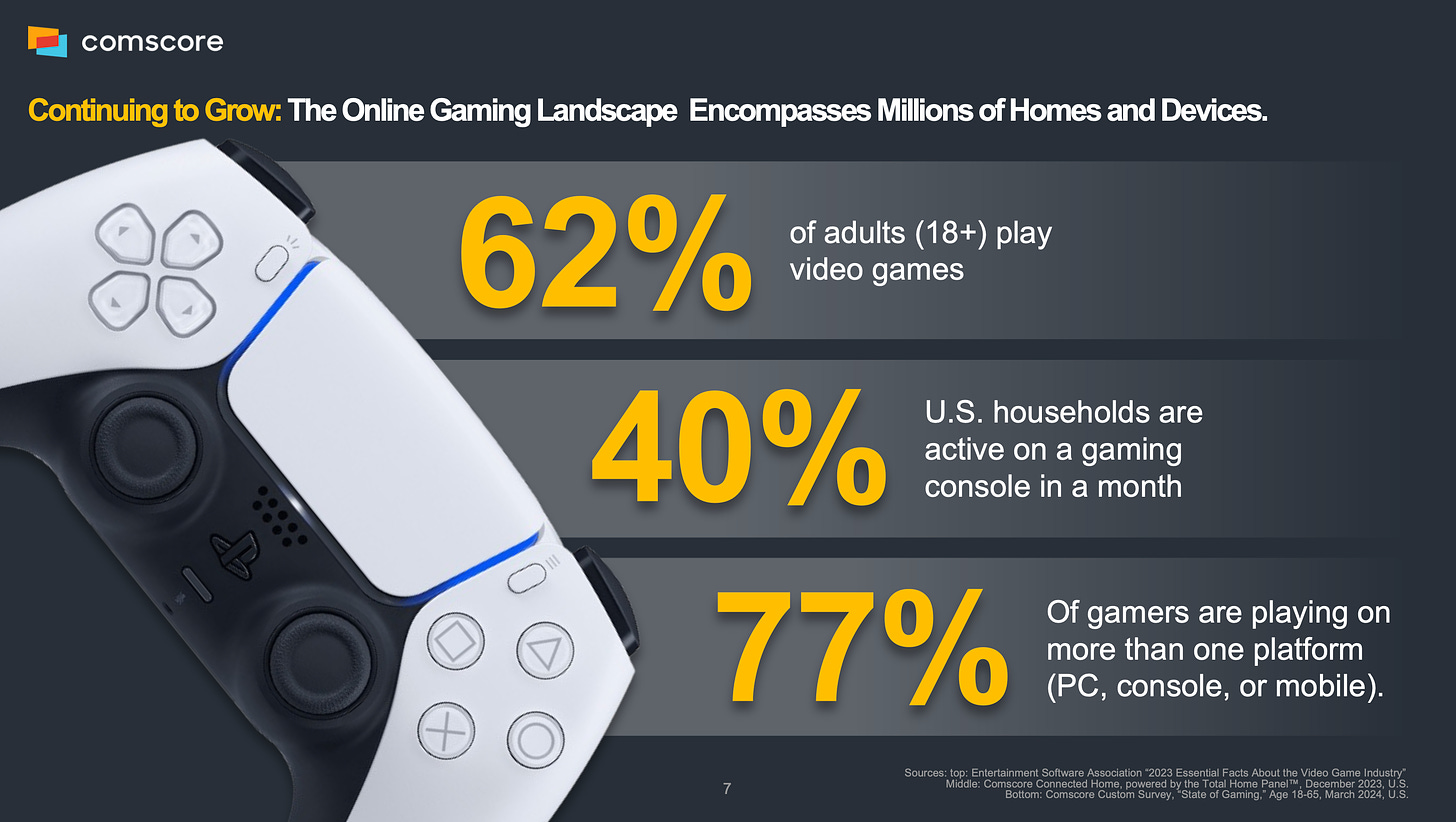

Comscore & Anzu: Study of the American Gaming Audience

The study was conducted in March 2024 among people aged 18 to 65 in the US. The sample size was 4570 people. Gamers are those who typically play games several times a week and have played at least once in the past month.

- In 2023, American users spent 45 billion hours on games and related activities. This is less than the time spent watching online videos (210 billion hours); television (201 billion hours); and time on social media (62 billion hours).

-

62% of Americans over 18 years old play games.

-

40% of households in the USA play on a console at least once a month.

-

77% of American gamers play on more than one platform. 40% play on all platforms (mobile, PC, consoles).

-

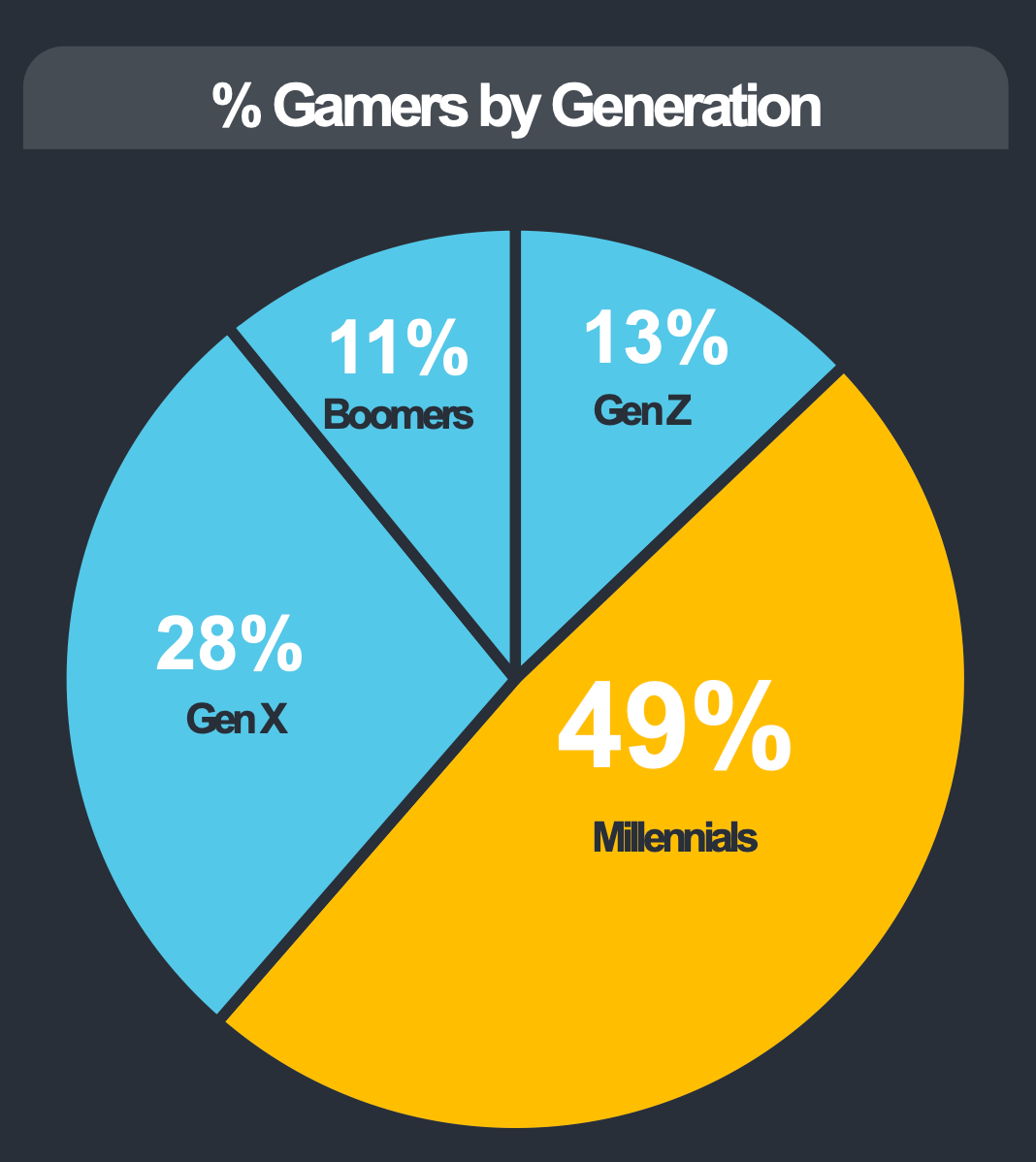

49% of American gamers are millennials. This is the largest group. 28% are Generation X; 13% are Generation Z; 11% are boomers.

-

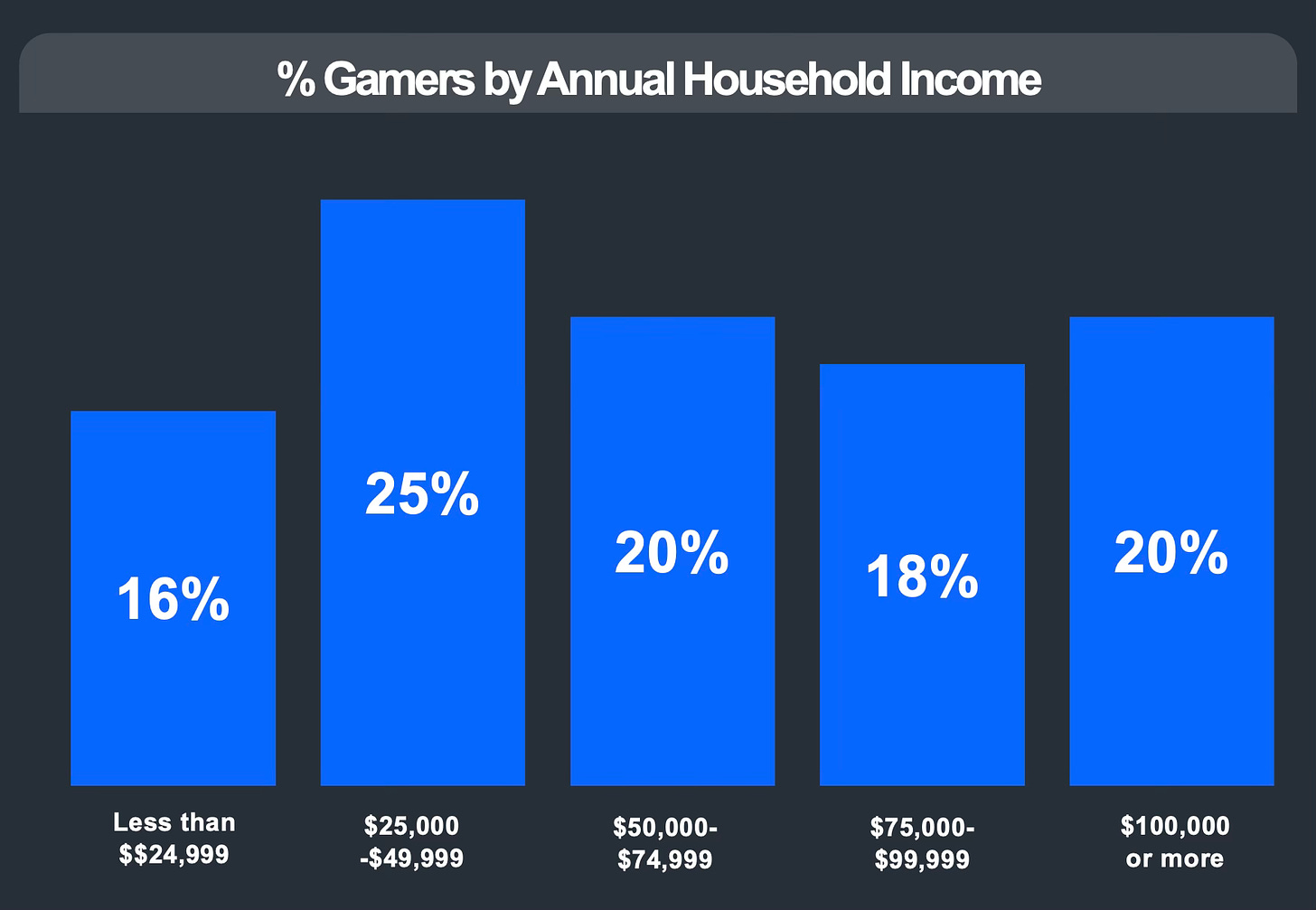

63% of gaming households earn between $25,000 and $100,000 a year. 16% earn less than $25,000; 20% earn more than $100,000.

-

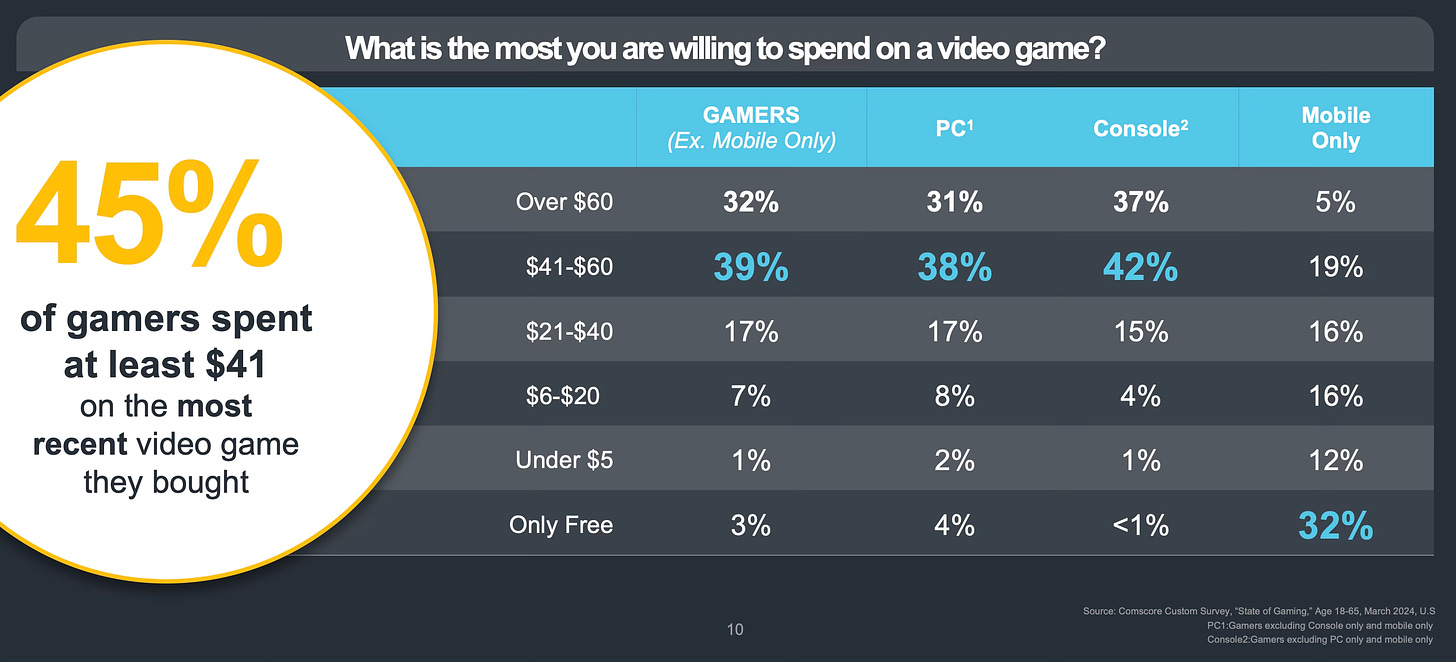

PC and console gamers traditionally are willing to pay more for games. 45% spent more than $41 on the last game they bought. 32% of mobile gamers in the USA are not willing to pay for games.

-

The most popular genres on PC are FPS (49%); Action/Adventure (47%); and RPG (47%). On consoles - Action/Adventure (65%); FPS (59%); and sports games (46%).

Monthly Audience of WeChat Mini Games Reached 500M Users

-

The MAU of WeChat mini-games reached half a billion people. It was not specified in which month this milestone was reached or how long it has been maintained.

-

The total audience of the platform currently exceeds one billion people.

-

55% of the audience are male. 85% of players are over 24 years old.

-

In 2023, 240 games earned more than $1 million per quarter.

-

The platform hosts over 400,000 developers. 80% of the teams have fewer than 30 people.

Games & Numbers (July 11 - July 23)

PC/Console Games

-

Terraria is a super hit. The game has sold over 58.7 million copies in 13 years. Out of this, the last 23.7 million copies were sold from 2021 to the present.

-

More than 2.2 million people purchased early access to EA Sports College Football 25 for $100. Additionally, 600 thousand people played the game through the EA Play subscription. Analysts did not expect this result and have already doubled their sales forecasts for the project.

-

The summer sale on Steam helped Arma 3 increase its sales by 500 thousand copies. 100 thousand people bought the game on the first day of the discounts. The game is already more than 10 years old.

-

The First Descendant launched successfully with 10 million players in the first week. The peak concurrent users (CCU) on Steam reached 264 thousand.

-

Sales of Pacific Drive exceeded 600 thousand copies. The game was released in February this year on PlayStation 5 and PC.

-

The cooperative horror game Murky Divers sold 100 thousand copies in the first two weeks after its release in Early Access.

-

The crime scene cleaner simulator, Crime Scene Cleaner, has over 490 thousand wishlists. This great news was shared by the head of PlayWay, Krzysztof Kostowski.

Mobile Games

-

Wuthering Waves’ revenue exceeded $100 million in its first two months. 23% of it came from Japan; 22% from China; 17% from South Korea; and a similar percentage from the USA.

-

Zenless Zone Zero earned more than $50 million in gross revenue in the 11 days after its release. The figures were shared by AppMagic. 47% of the revenue came from China; 27% from Japan. And yes, this is only about mobile devices - the game is also available on PC and PlayStation 5.

-

The second attempt at a global launch for Honor of Kings helped the game achieve more than 50 million installs outside of China in its first month. However, revenue figures are not as encouraging yet.

-

Mobile downloads of Loop Hero exceeded 1 million copies. The publisher called the percentage of purchases "significant," without specifying the exact number.

How to Market a Game: Results of the H1'24 and Q2'24 in Steam for Indie Games

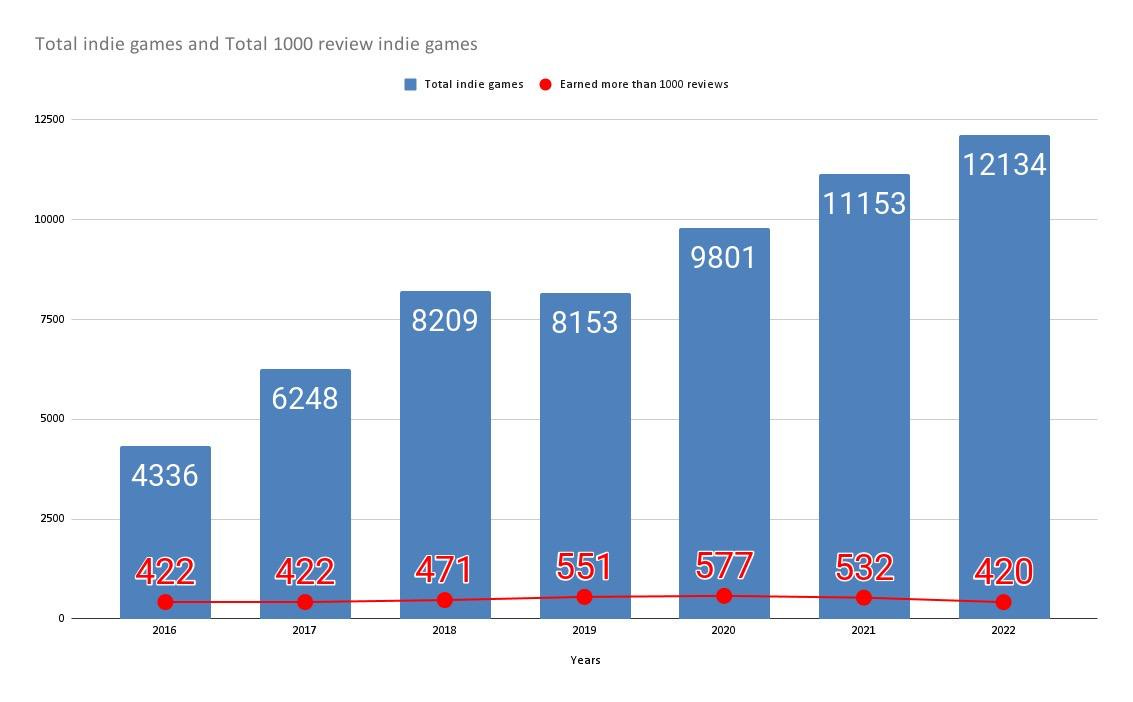

Chris Zukowski (blog author) highlights games with at least 1000 reviews on Steam. AAA projects and games based on major IPs have been removed from the sample. Niche projects for different markets (like Chushpan Simulator) have also been excluded.

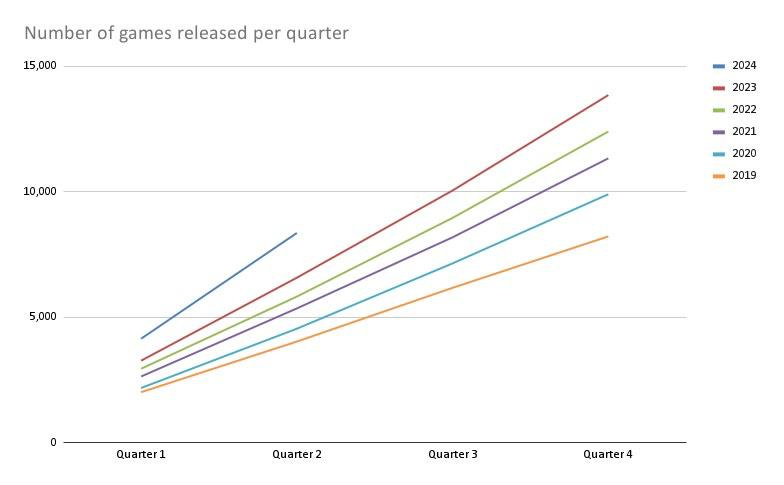

In the first half of 2024, 8362 games were released on Steam. This is 27% more than the same period in 2023.

❗️ Over the past 5 years, the number of new games on Steam has only grown.

-

In the first quarter of 2024, 72 games reached the milestone of 1000 reviews. In the second quarter, another 160 games were added to them (119, excluding AAA and major IP projects).

-

For the past 8 years, the number of games on Steam with more than 1000 reviews has remained roughly the same - about 500 games per year. This is bad news because competition increases as the number of released games grows.

-

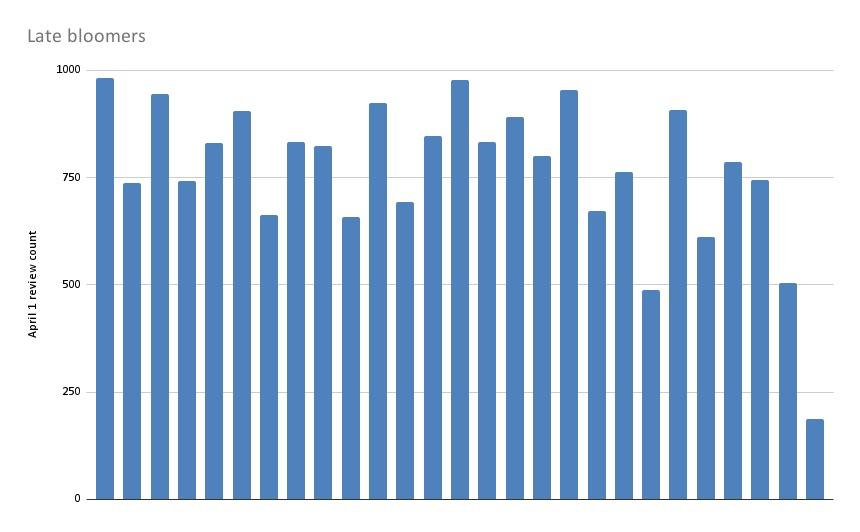

Chris also counted the number of “sleeper hits” - projects that did not receive 1000 reviews in the quarter of their release but did so in the following quarter. There were 28 such games in Q2 2024. Most of them were close to this mark in the release quarter.

❗️ The overall conclusion is that if your game sells poorly at the start, it is highly likely to continue selling poorly.

-

The popularity of Action Roguelikes inspired by Vampire Survivors has declined. In 2022, 10 projects reached the 1000+ review mark. In 2023, there were 17. But in 2024, there was only 1, Deep Rock Galactic Survivors.

-

Horror games continue to be popular. Also successful are games where you need to build something; simulate something; or craft something.

-

10% of all projects on Steam that reach 1000+ reviews are for adult audiences. This was the case in 2022, 2023, and seems to be the case in 2024.

-

Only 1 VR game in the past couple of quarters has exceeded 1000 reviews - UNDERDOGS.

Overview of the Japanese Market

- In 2023, more than 73% of Japan’s population used smartphones, and internet penetration reached 93%.

- The total spending by Japanese users on mobile applications amounted to $179 billion, with only China and the USA ahead.

- In Q1’24, 8 out of the top 10 apps by revenue were games. The only non-gaming apps in the top 10 were piccoma (a manga app - ranked 1st) and LINE (a messaging app - ranked 4th).

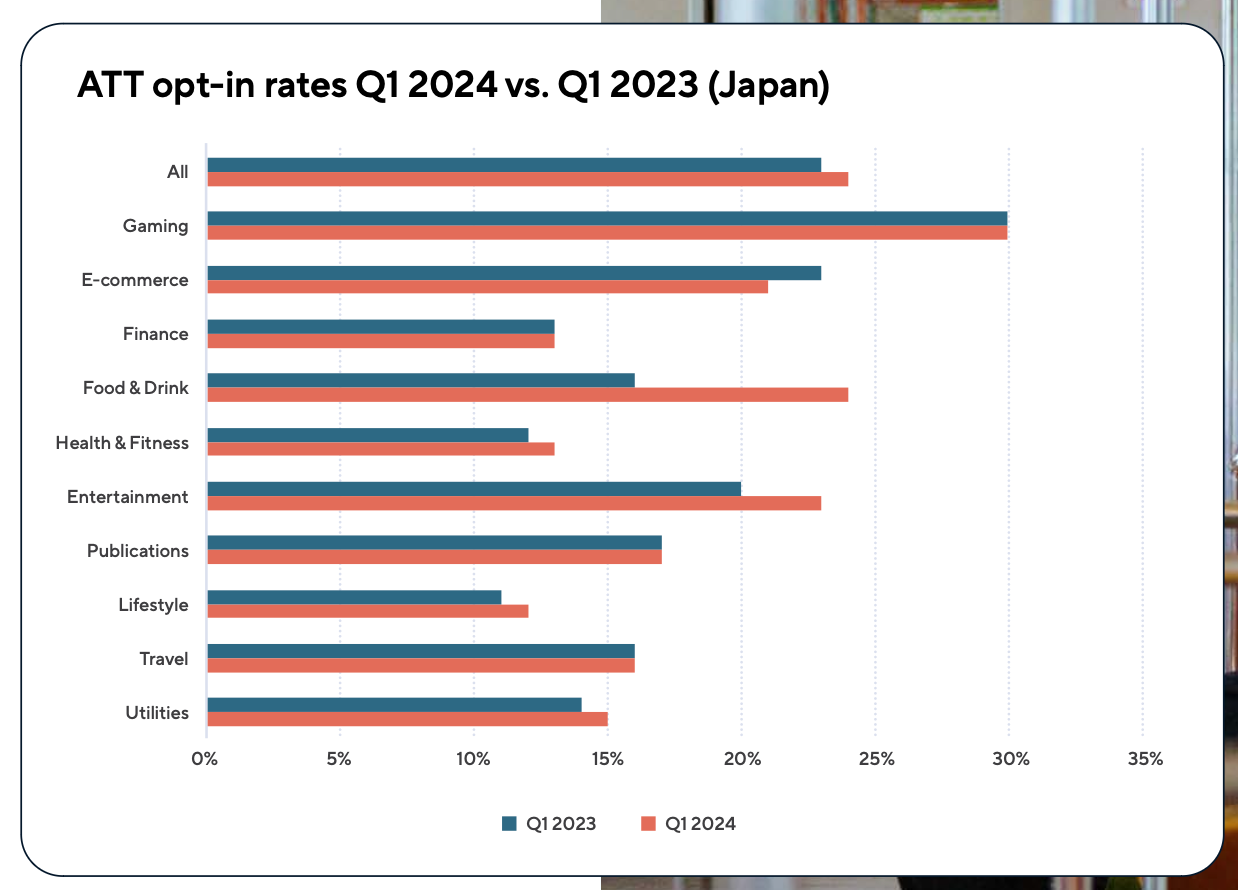

- ATT opt-in rates in Japan have been growing year by year. The highest rate in Q1’24 was for games at 30%, the same as the previous year.

- Overall app downloads declined in 2023 but saw a 3% increase at the beginning of 2024 (Q1’24 compared to Q4’23).

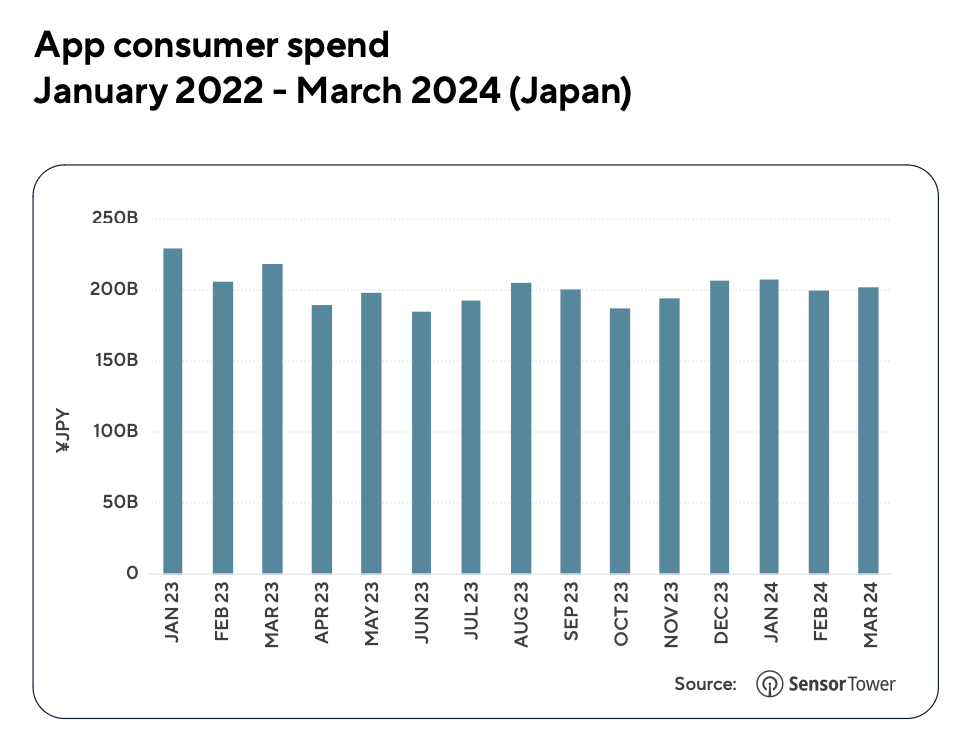

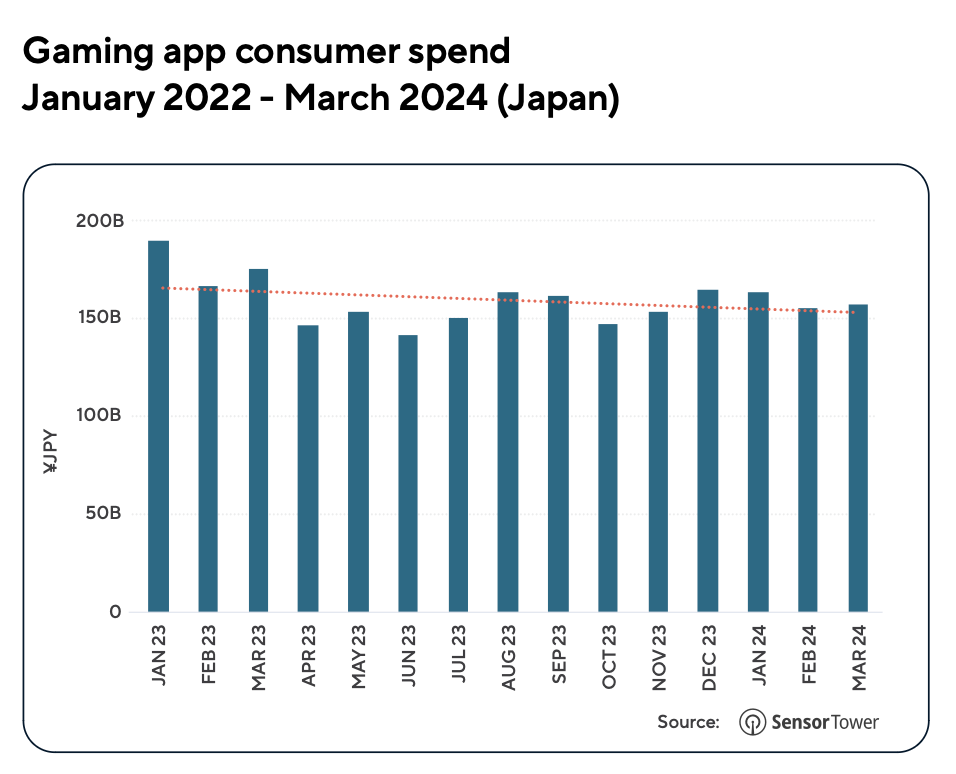

- Revenue-wise, the market has plateaued, though there was a 3.5% increase in Q1’24 compared to the previous quarter.

Japanese Mobile Market

- Revenue in the Japanese mobile market has been relatively flat since the start of 2023. However, there was a 2.23% increase in Q1’24 compared to the previous quarter.

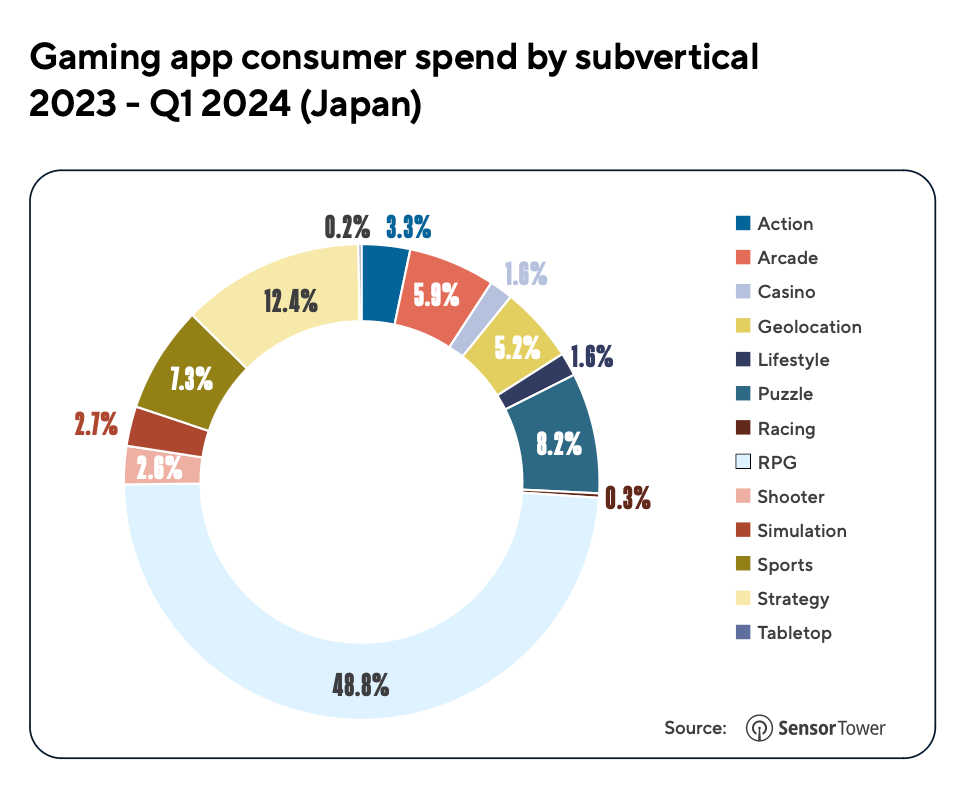

- RPGs accounted for 48.8% of total market revenue, followed by strategy games (12.4%) and puzzle games (8.2%).

- Action games saw the highest revenue growth in Q1’24 with a 21.6% increase. Puzzle games also grew significantly by 13.8%.

- Monster Strike, Uma Musume Pretty Derby, and Fate/Grand Order topped the revenue charts in Q1’24.

- Fat Goose Gym, Legend of Mushroom, and Locked Rings led in downloads in Q1’24.

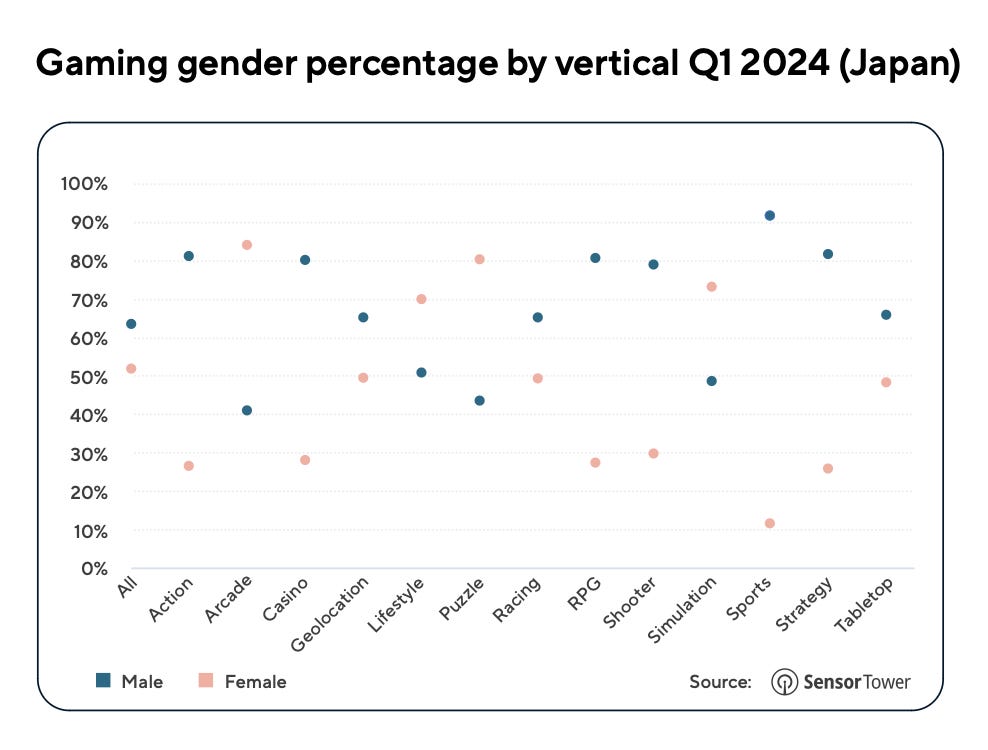

- The gaming audience in Japan is predominantly male (63.6%). In certain genres (e.g., sports games), the male audience reaches 91.8%, while in arcade games, the majority are female (58.9%).

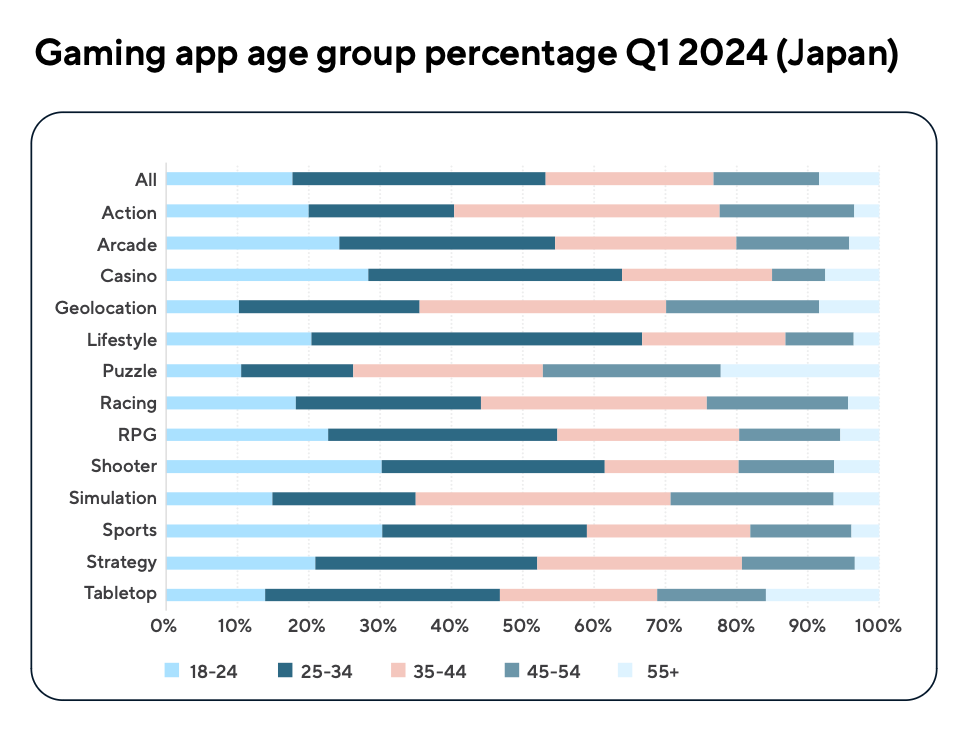

- The largest segment of Japanese mobile gamers (35.5%) is aged 25-34, making it the most active demographic.

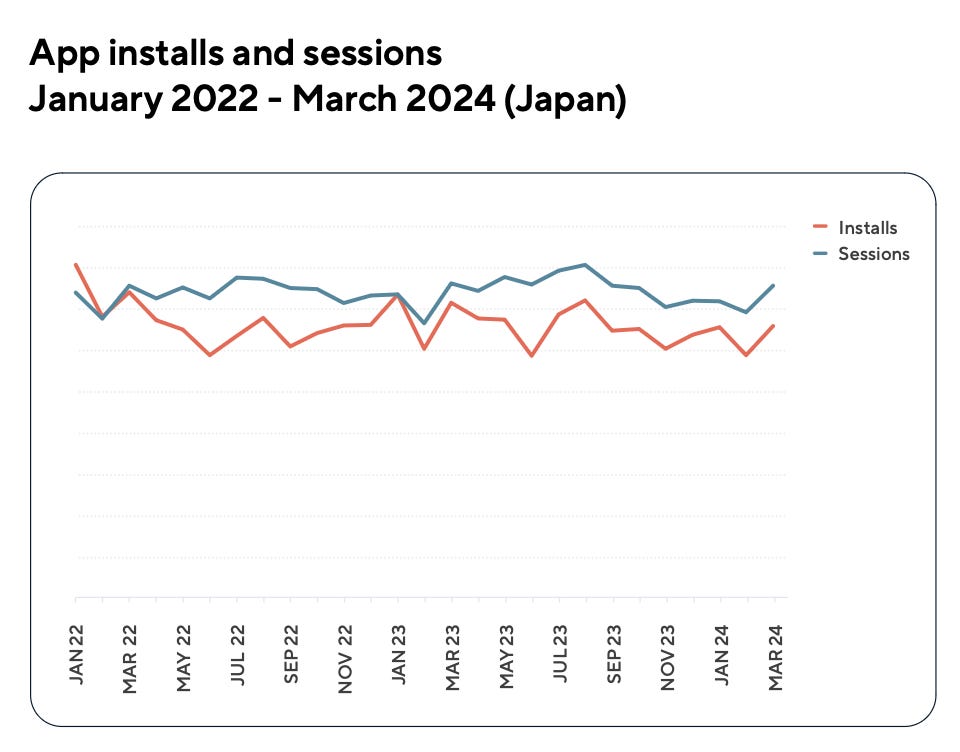

Downloads and Sessions in the Japanese Mobile Market

-

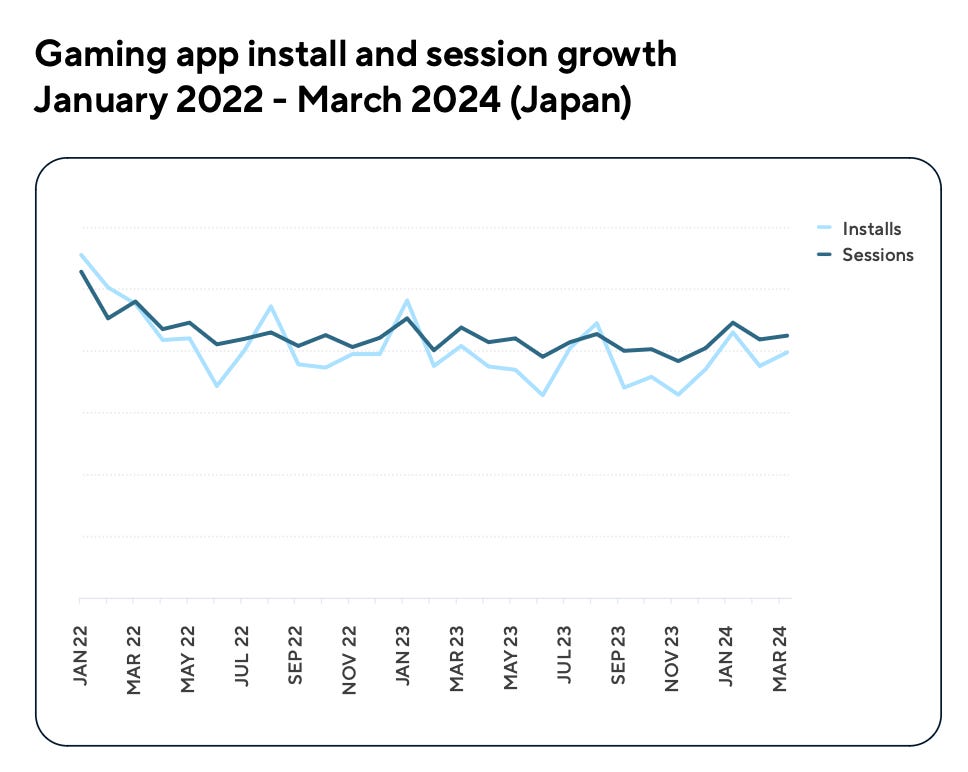

Game downloads in Japan began to decline in early 2022, with the drop stabilizing by 2023. In Q1’24, according to Adjust, downloads increased by 18% compared to Q4’23. The number of sessions also increased by 1% over the same period.

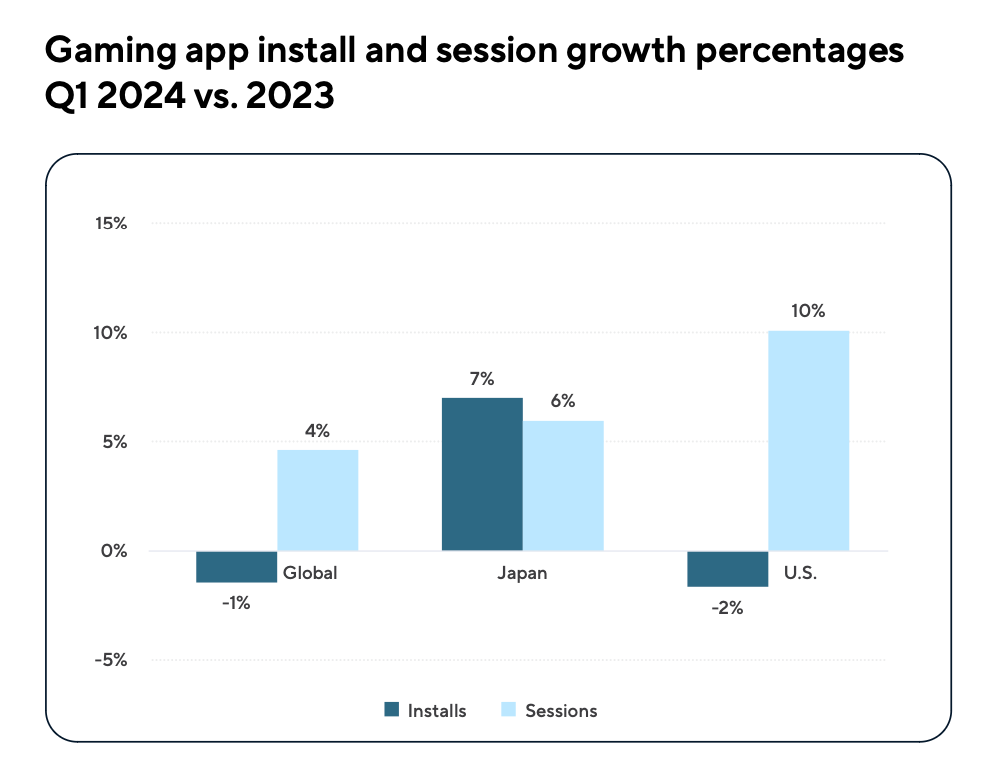

- Comparing Q1’24 to the average figures for 2023, downloads rose by 7% and sessions by 6%. Globally, downloads fell by 1% while sessions increased by 4%; in the US, downloads decreased by 2% while sessions grew by 10%.

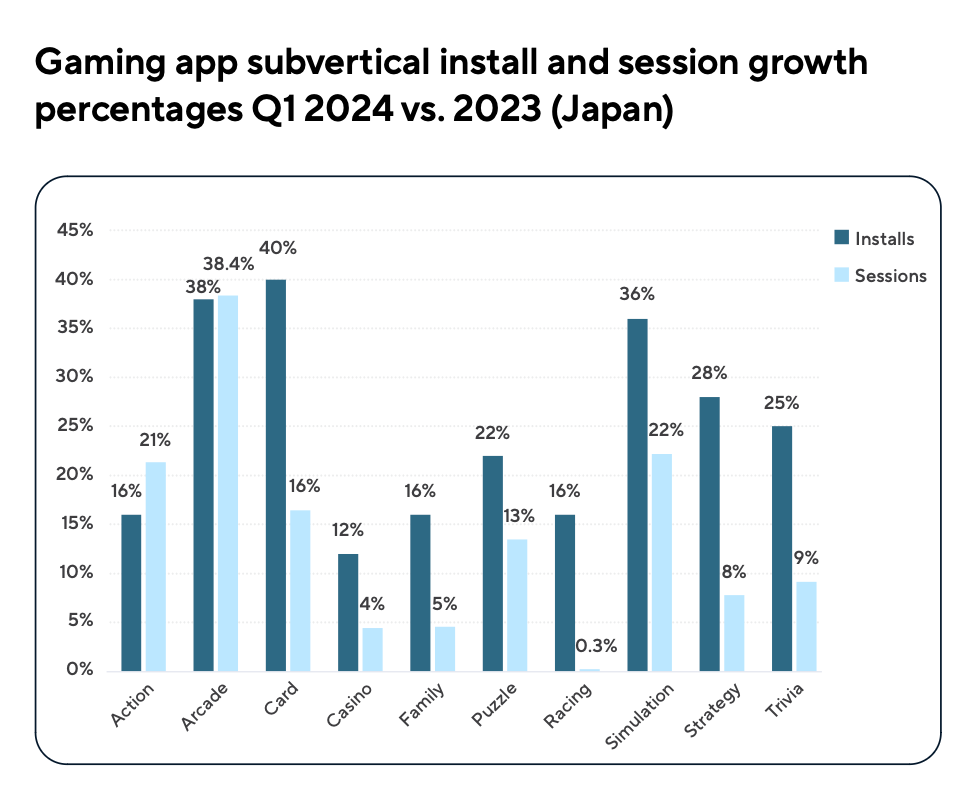

- The growth leaders in Q1’24 were arcade games (sessions up by 38.4%, downloads by 38%), card games (downloads up by 40%, sessions by 16%), and simulation games (downloads up by 36%, sessions by 22%), compared to the average values of 2023.

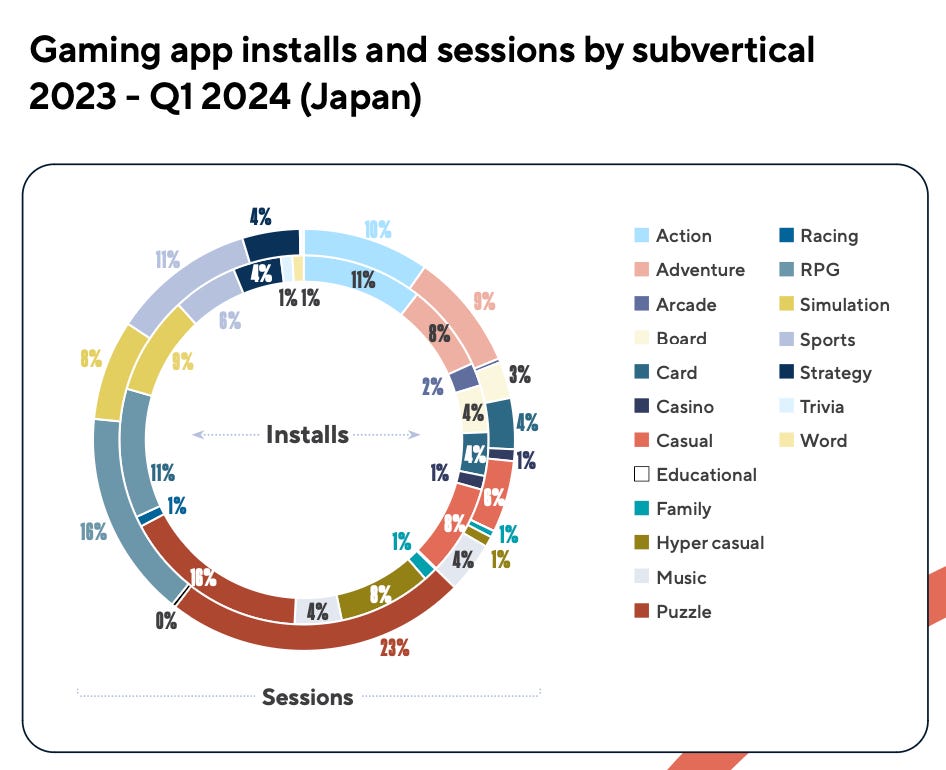

- Since the beginning of 2023, the highest percentage of installations has been for puzzle games (16%), RPGs (11%), and action games (11%). In terms of sessions, puzzles lead (23%), followed by RPGs (16%) and sports projects (11%).

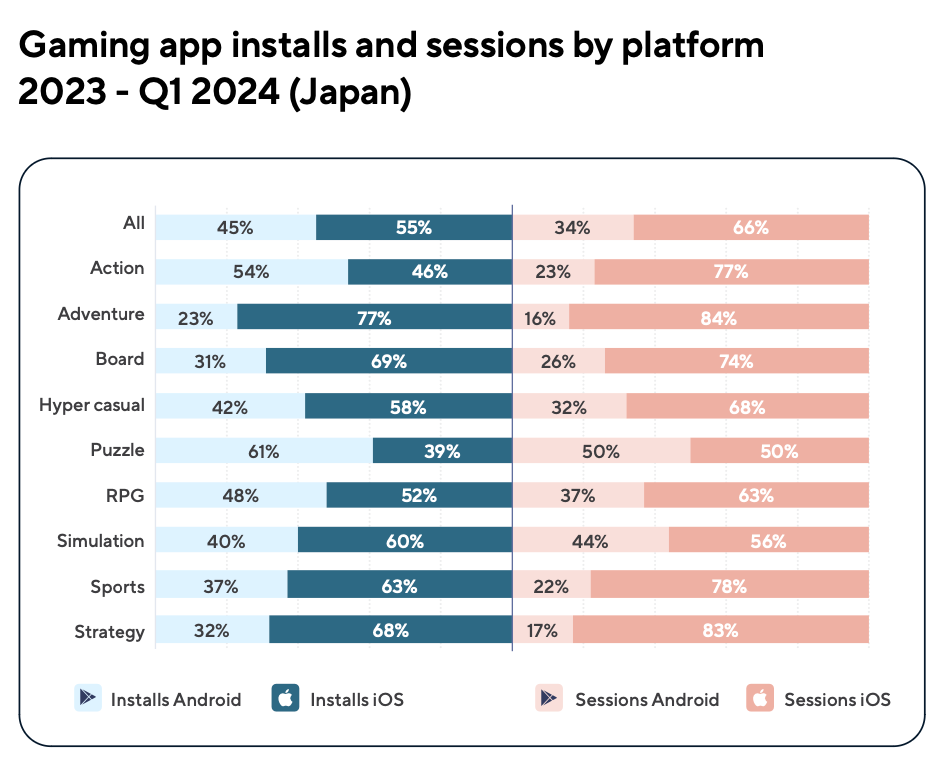

- Overall, game app downloads in Japan are balanced between devices, with 55% on iOS and 45% on Android. Some genres, such as adventure games, are dominated by iOS (77%).

- In terms of session share, iOS leads, accounting for 66% of the total volume. The average session length increased from 26.37 minutes in 2022 to 27.37 minutes in Q1’24.

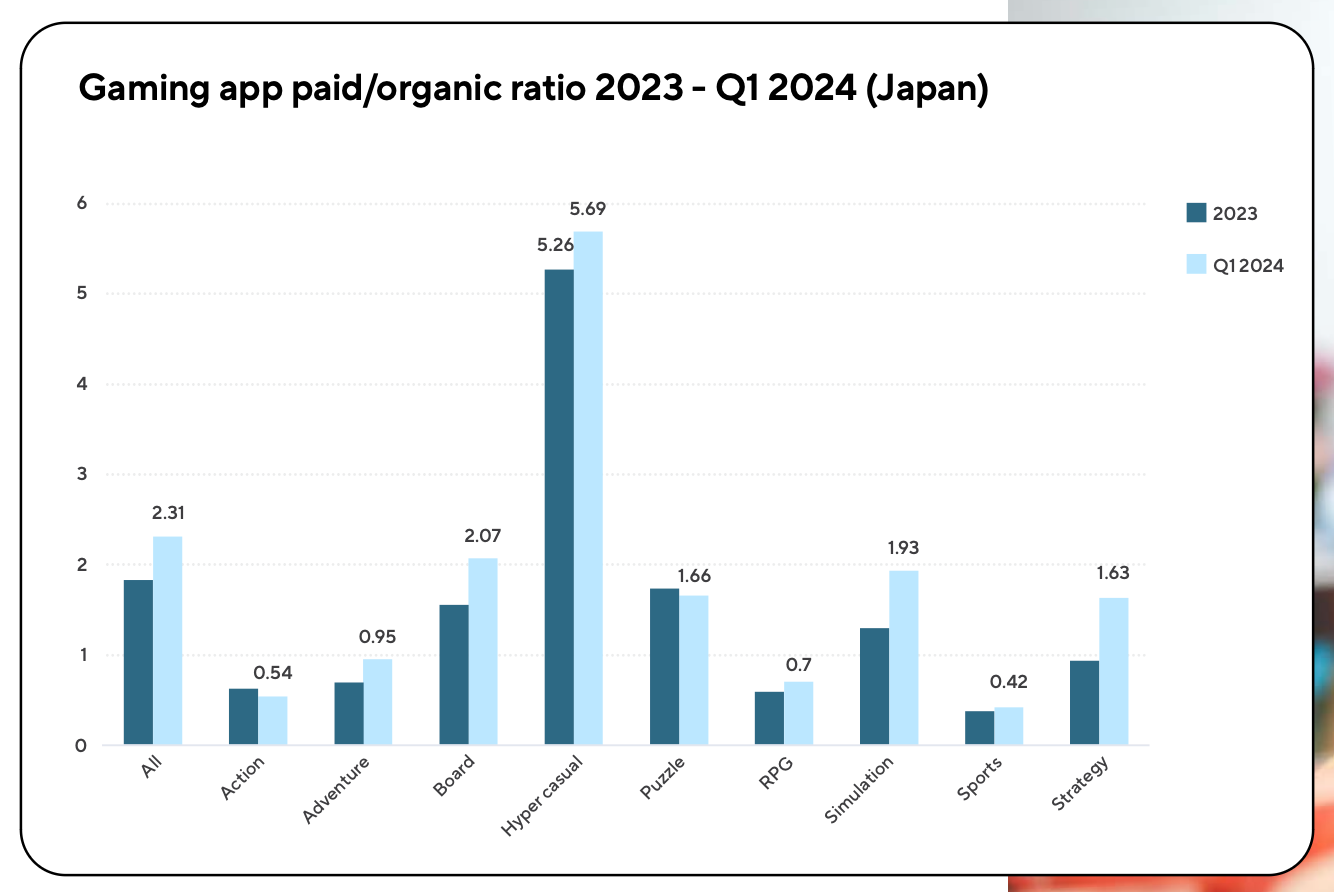

- The ratio of paid to organic traffic in Japan increased in Q1’24. The average for 2023 was 1.82, rising to 2.31 in Q1’24, indicating an increase in paid traffic. Spending grew the most on hyper-casual projects, board games, and the simulation genre.

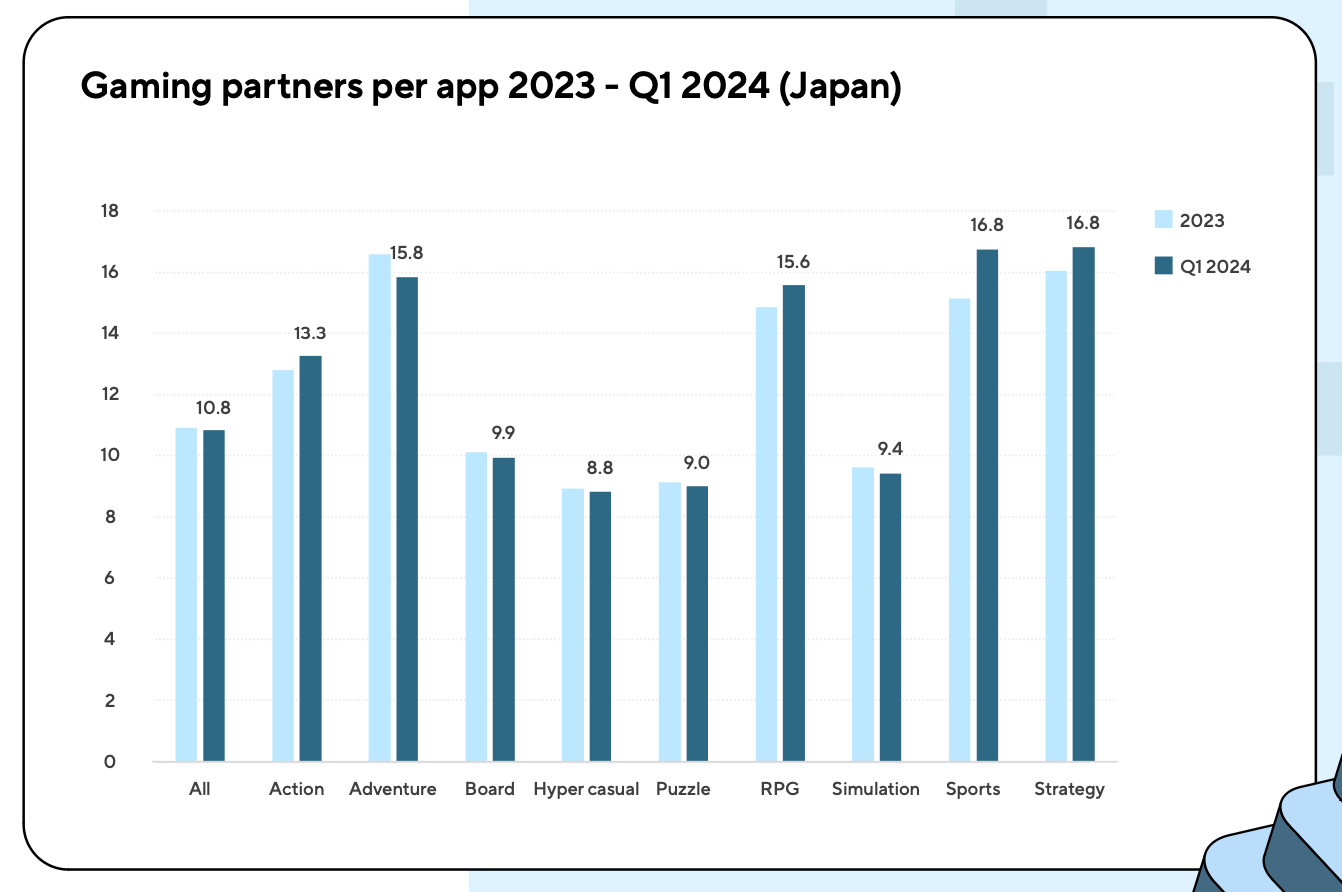

- The number of advertising partners remained stable, slightly decreasing from an average of 10.9 in 2023 to 10.8 in Q1’24. This suggests companies prefer to spend more on established channels.

Japanese Market Benchmarks - Retention, ARPMAU, eCPI, and more

-

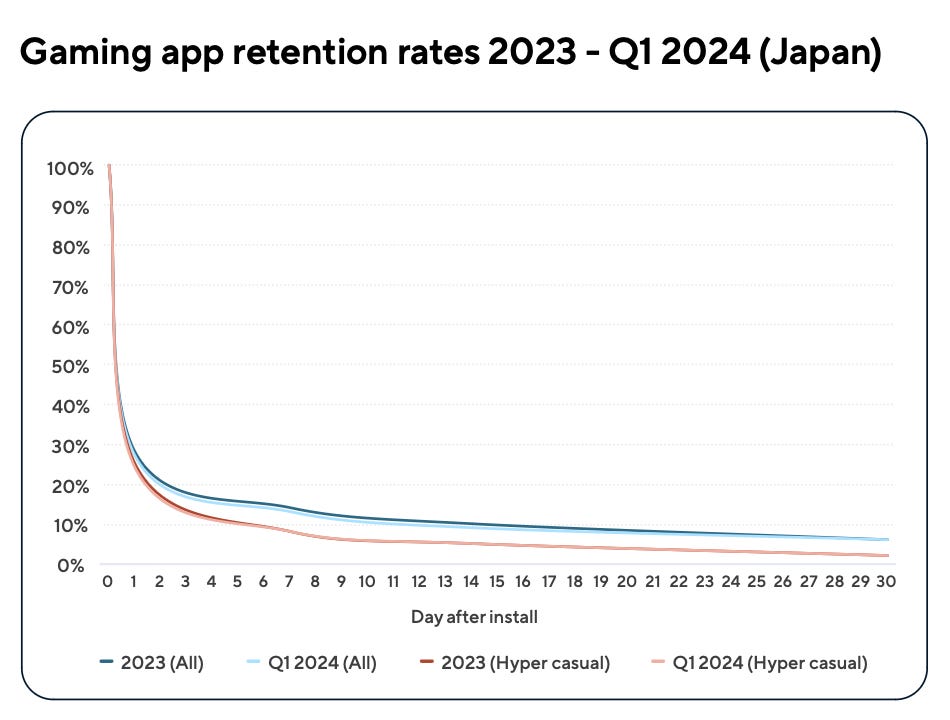

In 2023, the average D1 Retention was 28%; by day 7, it is dropping to 14%. In Q1’24, the average D1 Retention was 27%, and D7 Retention was 13%. The weakest metric was for hyper-casual games (D1 Retention - 25%; D30 Retention - 5%). RPGs (32%) and simulation games (31%) had the strongest 1-day retention.

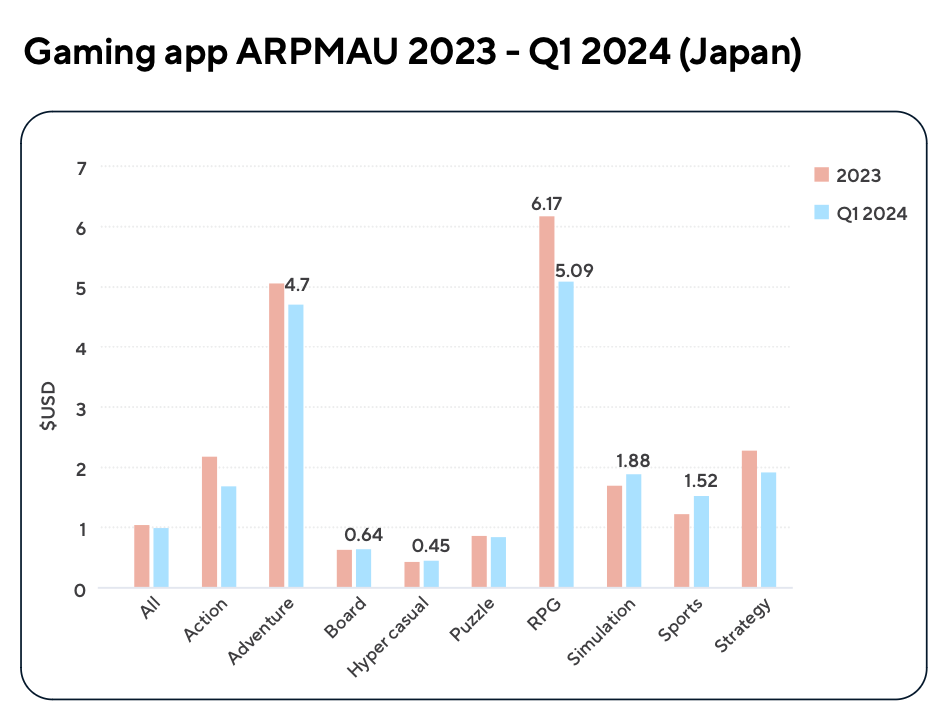

- ARPMAU (average revenue per monthly active user) fell from $1.04 in 2023 to $0.99 in Q1’24. RPGs had the highest ARPMAU - $6.17 in 2023 and $5.09 in Q1’24; adventure games followed with $5.06 in 2023 and $4.7 in Q1’24. Hyper-casual games had the lowest ARPMAU - $0.43 in 2023 and $0.45 in Q1’24.

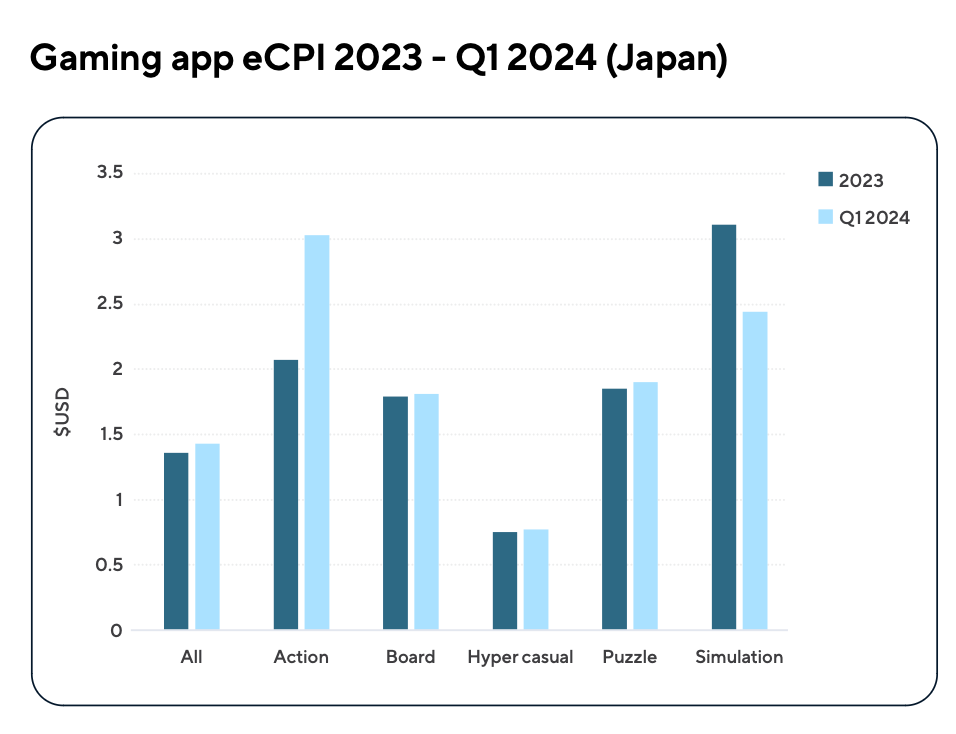

- eCPI (effective cost per install) in Japan increased from an average of $1.36 in 2023 to $1.43 in Q1’24. The most significant growth was in action games ($2.07 in 2023 vs. $3.03 in Q1’24). However, eCPI in simulation games decreased from $3.11 in 2023 to $2.44 in Q1’24.

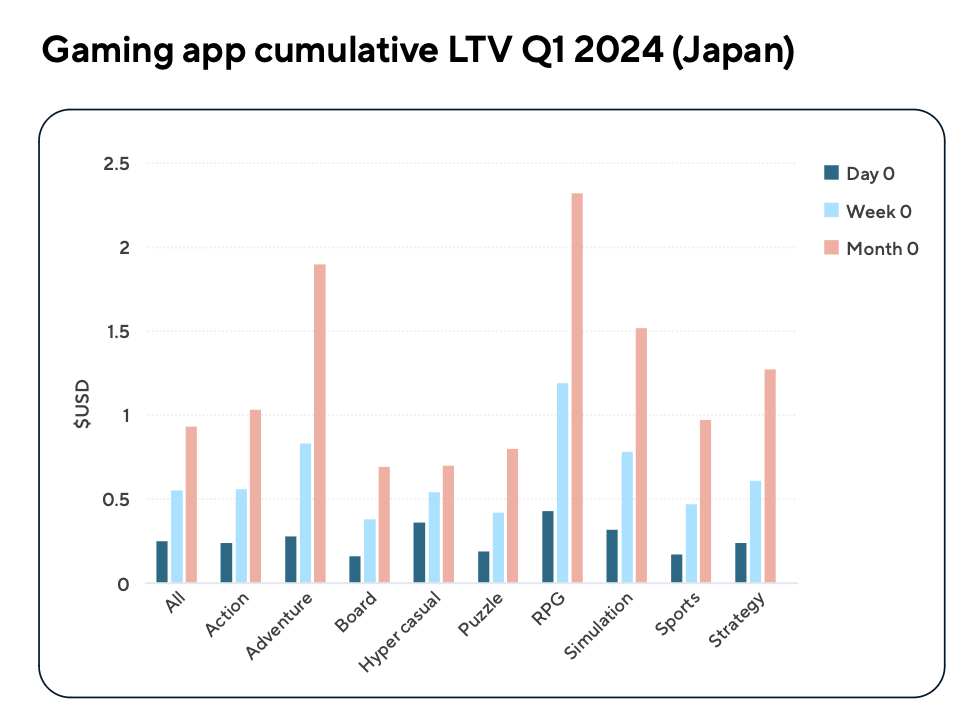

- The highest first-month cumulative LTV was for RPGs ($2.32) and adventure games ($1.9). The first-day LTV for hyper-casual games was comparable to that of RPGs in Japan.

PC and Console Market

- Adjust and Sensor Tower report that Japanese youth prefer consoles (72%). Mobile devices follow in popularity (64%), with PCs at 15%.

- Companies note that given the high competitiveness of the mobile market, expanding to new platforms could bring additional revenue sources.

Tune in next month for more updates!

In the meantime, you can take a look at our free demo to better understand how devtodev helps game projects grow and increase revenue.