Devtodev is helping you keep in touch with what’s happening in the game market. Every month we publish an overview of reports on the most popular games worldwide, top-grossing games, successful releases, favorite video game types, trends, etc. This overview was prepared by Dmitriy Byshonkov, the author of the GameDev Reports by the devtodev Telegram channel. You can also read the August and September reports.

Contents

- Mintegral: Media Buying in Mobile Games in H1'24 in the US

- Games & Numbers (September 18 - October 1; 2024)

- Bain & Company: The Gaming Industry in 2024

- AppMagic: Top Mobile Games by Revenue and Downloads in September 2024

- StreamHatchet: Co-op Games have doubled in popularity among viewers over the last 2 years

- Kadokawa ASCII Research Laboratories: The Japanese Gaming Market Grew in 2023

- InvestGame & GDEV: The History of Gaming IPOs

- Ampere Analysis: PlayStation 5 Pro will sell worse than PS4 Pro

- AppMagic: Hypercasual Market in Q3 2024

- Niko Partners: India Gaming Market in 2024

- GSD & GfK: UK PC/Console games market grew in September'24 amid new releases

- GSD & GfK: PC/Console game sales in Europe increased by 20% in September'24

- Circana: U.S. Gaming Market Declined by 7% in August 2024

- Games and Numbers (October 2 - October 15, 2024)

- InvestGame & GDEV: The History of Web3 Gaming Investments

- Video Game Insights: Indie Games on Steam in 2024

- InvestGame: Gaming Investment Market in Q3'24

- Famitsu: The Legend of Zelda: Echoes of Wisdom tops Japan's physical sales chart in September 2024

- Wall Street Journal: PlayStation 5 sales outpace Xbox Series sales by more than 2 times

- Mariusz Gąsiewski (Google): Mobile Market in the first 3 quarters of 2024

- Omdia: Subscription Services don't impact the way games are designed

- MIDiA Research: Most PC and Console gamers prefer single-player games

- Circana: The U.S. Gaming Market Declined by 6% YoY in September 2024

- Mordor Intelligence: The African gaming market will reach $3.72B by the end of 2029

- StreamElements & Rainmaker.gg: Game Streaming in September 2024

Mintegral: Media Buying in Mobile Games in H1'24 in the US

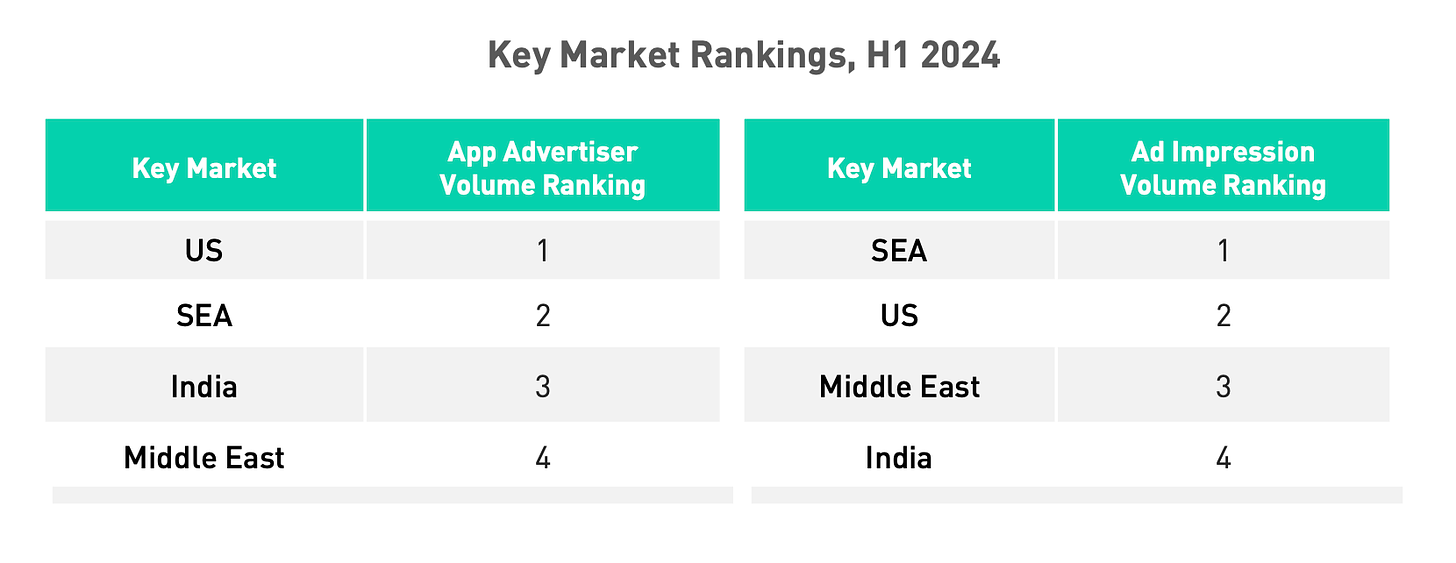

- The US market ranks first globally in the number of gaming advertisers and second in the number of ad views. Southeast Asia ranks second after the US in the number of advertisers and first in ad views.

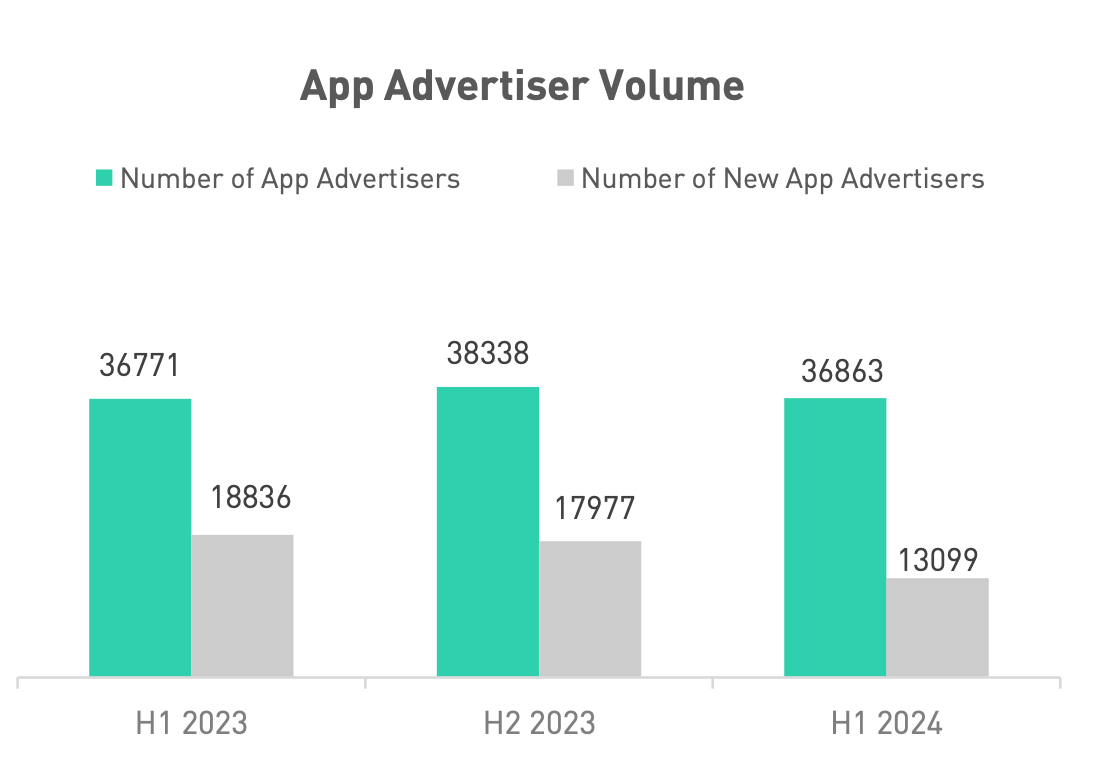

- The number of advertisers in the US market increased by only 0.25% since 2023. However, the percentage of new advertisers decreased by 29%.

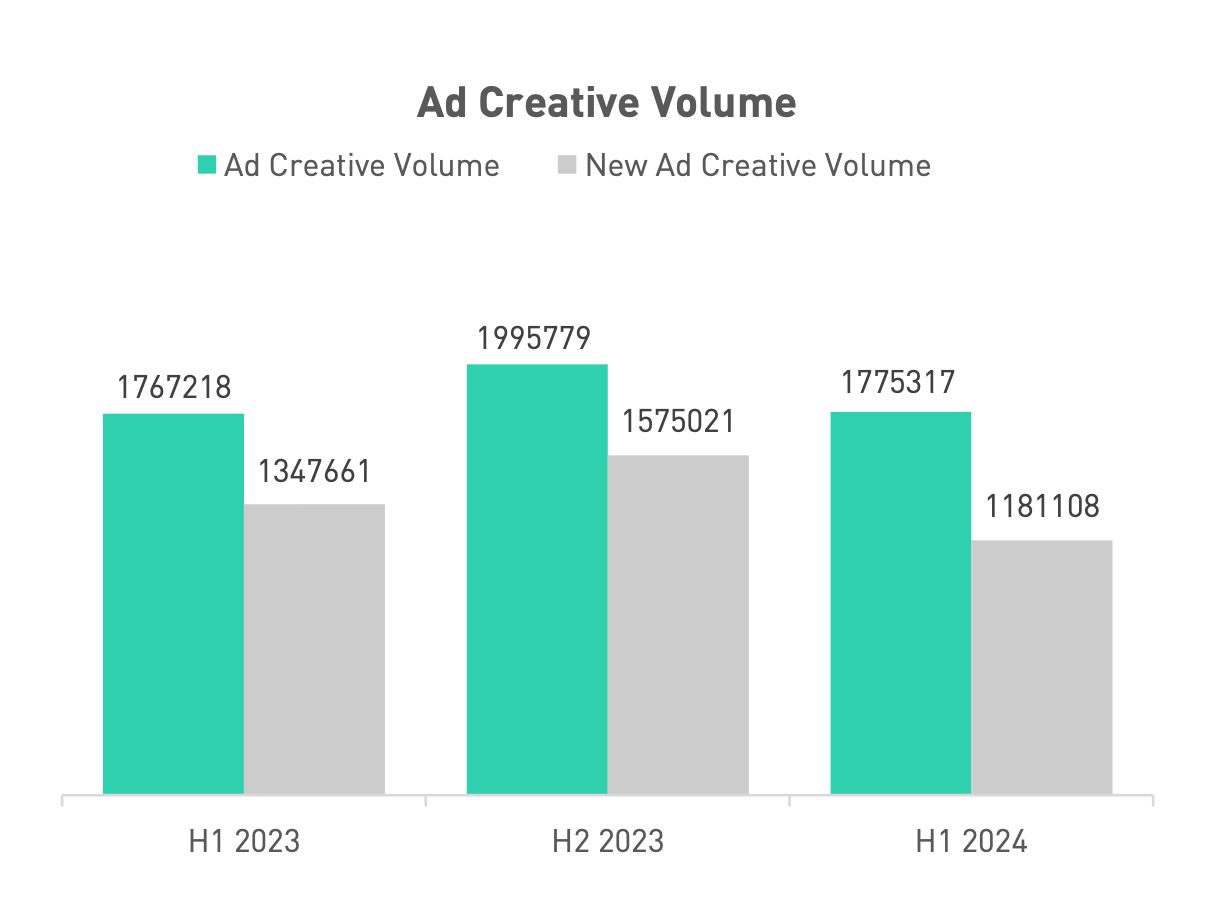

- The number of ad creatives in H1'24 grew by 0.46% year-over-year (YoY). The share of new creatives dropped by 12%.

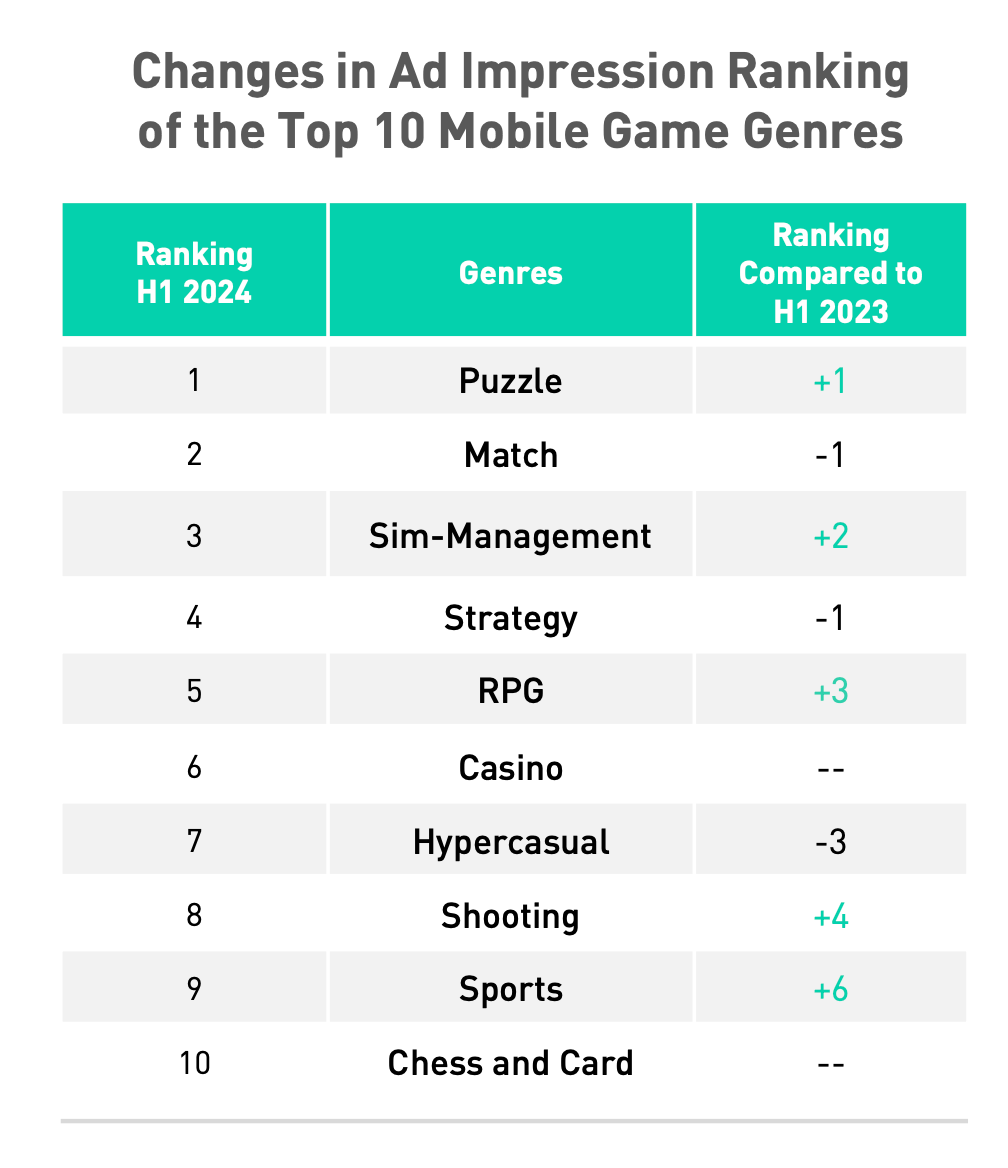

- Regarding ad views in the US in H1'24, puzzle, match-3, and simulation games lead the way. At the same time, there is growth in sports games (+6 positions), shooters (+4 positions), and RPGs (+3 positions).

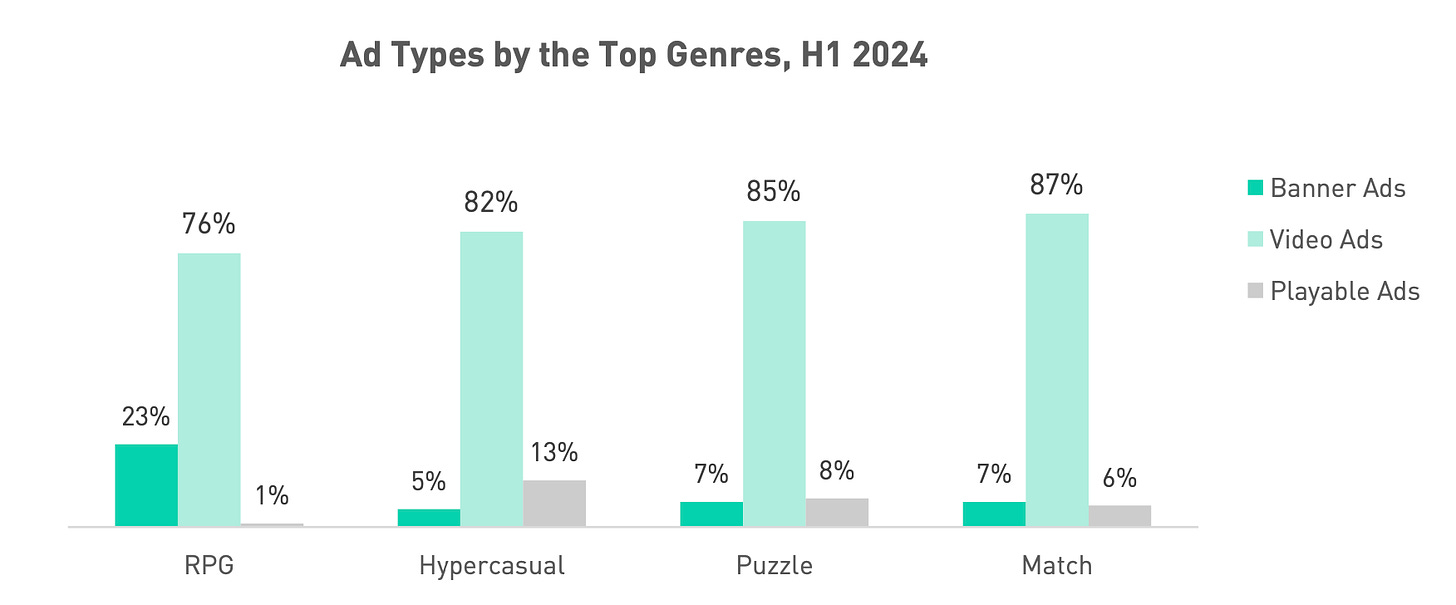

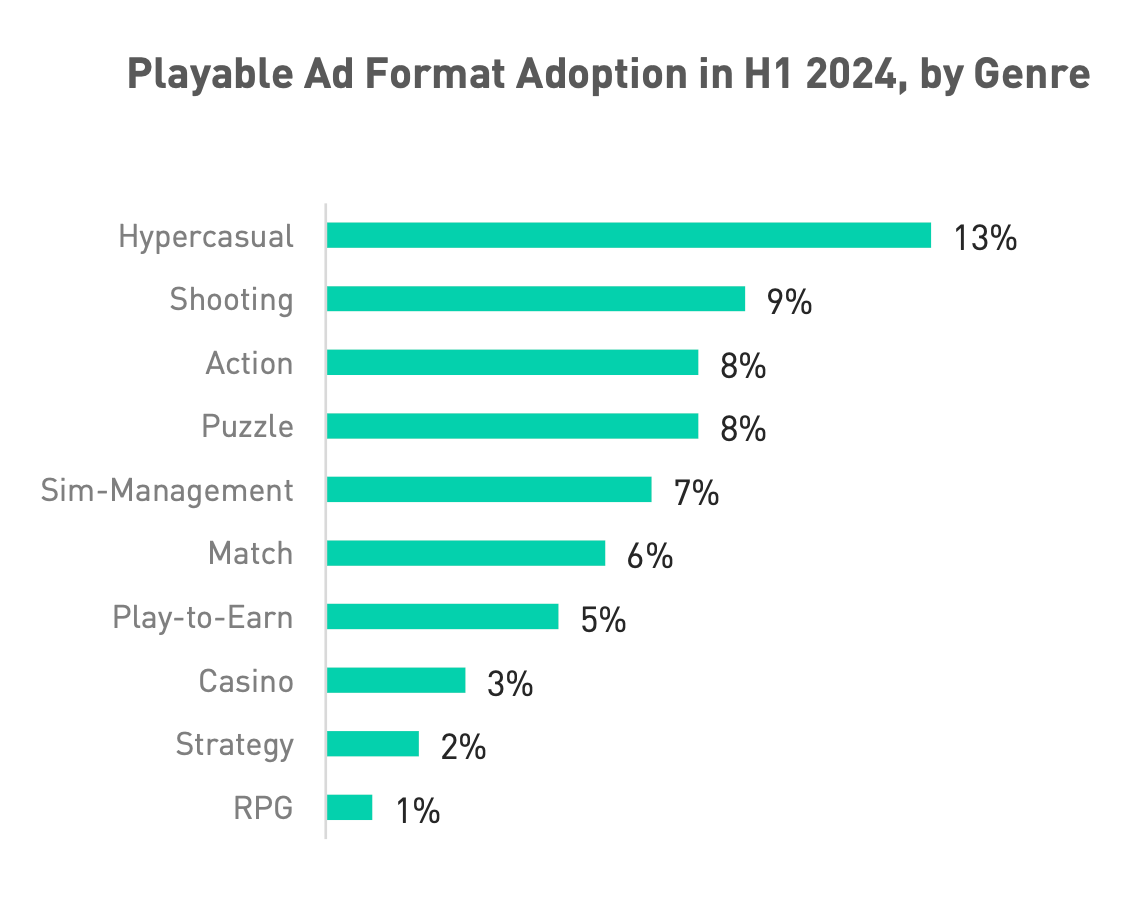

- Video ads are the most popular format in the US. Playable ads are most frequently used in hyper-casual projects (13%), shooters (9%), and action games (8%).

- The popularity of playable formats increased from 3% in H1'23 to 7% in H1'24.

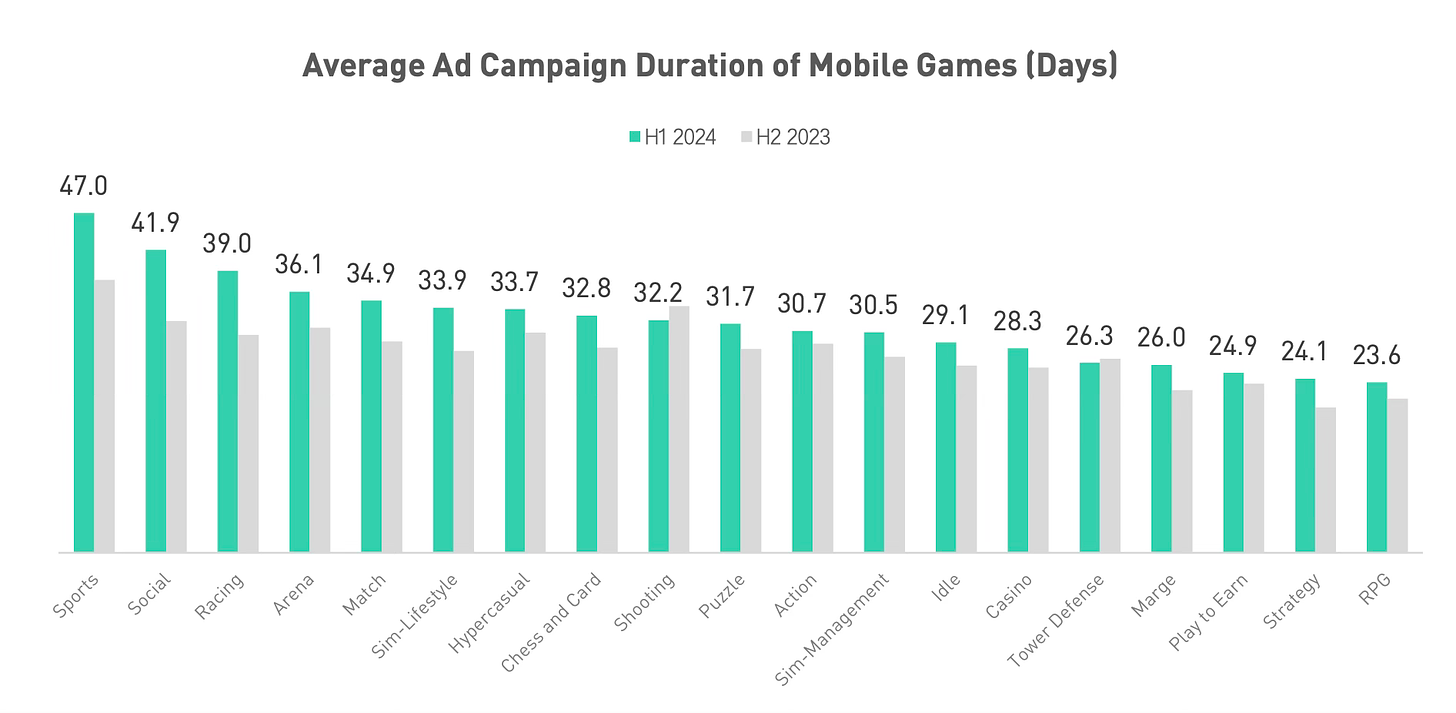

- The longest ad campaign durations are seen in sports games (47 days), social games (41.9 days), and racing games (39 days). The shortest are in strategy games (24.1 days) and RPGs (23.6 days).

Games & Numbers (September 18 - October 1; 2024)

PC/Console Games

-

According to VGI estimates, Black Myth: Wukong is the best-selling game on Steam in 2024, with over 20 million copies sold.

- More than 14 million people have played Football Manager 24. This number reflects player counts, not sales, as the game was available through subscription services.

- The total sales of Ghost of Tsushima exceed 13 million copies. Recently, Sucker Punch announced a sequel to the series: Ghost of Yōtei.

- Warhammer 40,000: Space Marine 2 is the second most successful new release in the European market in 2024. According to GSD, only Helldivers II performed better.

- The meditative platformer GRIS, published by Devolver Digital, has been purchased over 3 million times since its release in December 2018.

- Manor Lords has sold over 2.5 million copies since its release on April 16, 2024.

- Sales of Unicorn Overlord have exceeded 1 million copies.

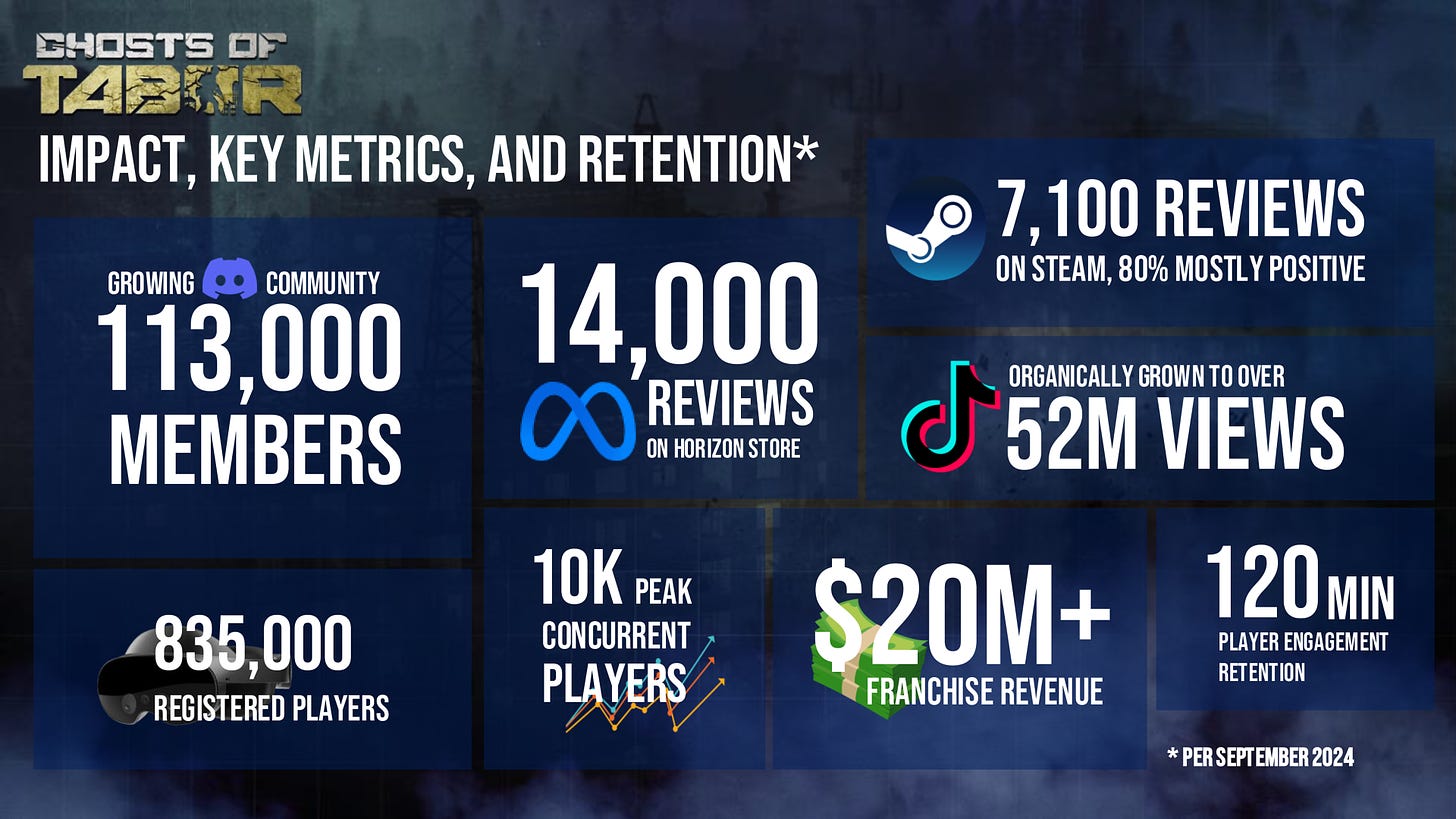

- Revenue from the VR shooter Ghosts of Tabor has surpassed $20 million, as reported by the developers themselves.

- Players have purchased Dome Keeper, published by Raw Fury, more than 1 million times.

- In the first 3 days of sales, Frostpunk 2 sold 350,000 copies.

- Sales of Dragon Age: Inquisition has exceeded 12 million copies. While many considered the game a "commercial failure," the studio disagrees.

- Ampere Analysis estimates that Star Wars: Outlaws sold 800,000 copies in its release week. Ubisoft has not officially disclosed the numbers.

- More than 40 million people have played Respawn Entertainment’s Star Wars Jedi franchise. These numbers reflect player counts, not sales, as the series' games have appeared in subscription services.

- The number of players in Core Keeper has reached 3 million. The game launched in Early Access in March 2022.

Mobile Games

-

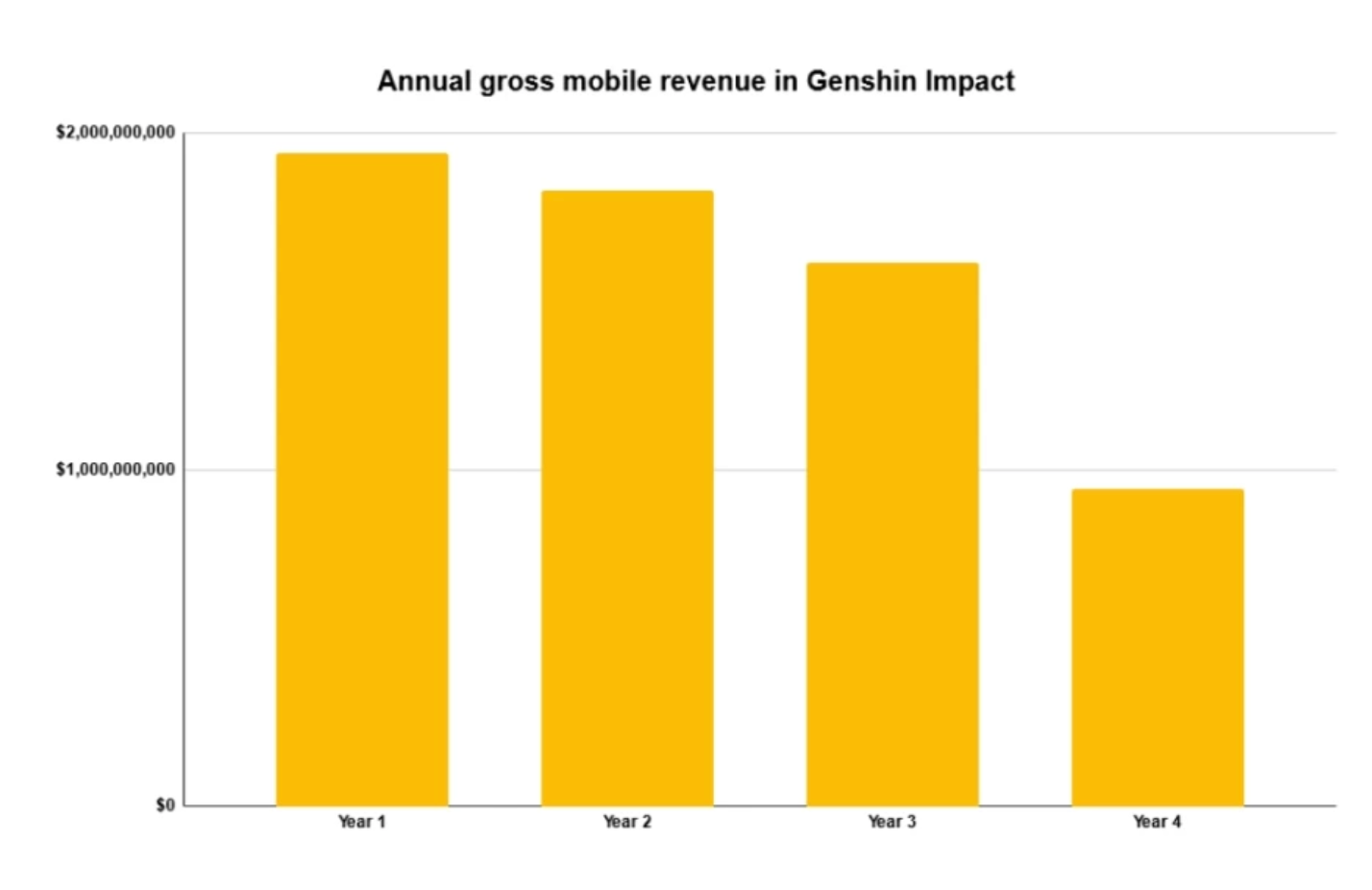

On September 28, Genshin Impact celebrated its 4th anniversary. According to AppMagic, the game has generated $6.3 billion in revenue on mobile platforms. In its last year, it earned $931.4 million, the lowest annual revenue to date. However, this does not account for some users who may be migrating to PCs and consoles.

- Dungeon & Fighter: Mobile earned over $808.9 million in China alone and only on iOS, according to AppMagic. On its best revenue day (June 22, 2024), the game made $9.9 million. In September, the game averaged $5 million per day.

- Total revenue for Pixel Gun 3D on all platforms since its launch in 2013 has reached $210 million, with over 220 million downloads.

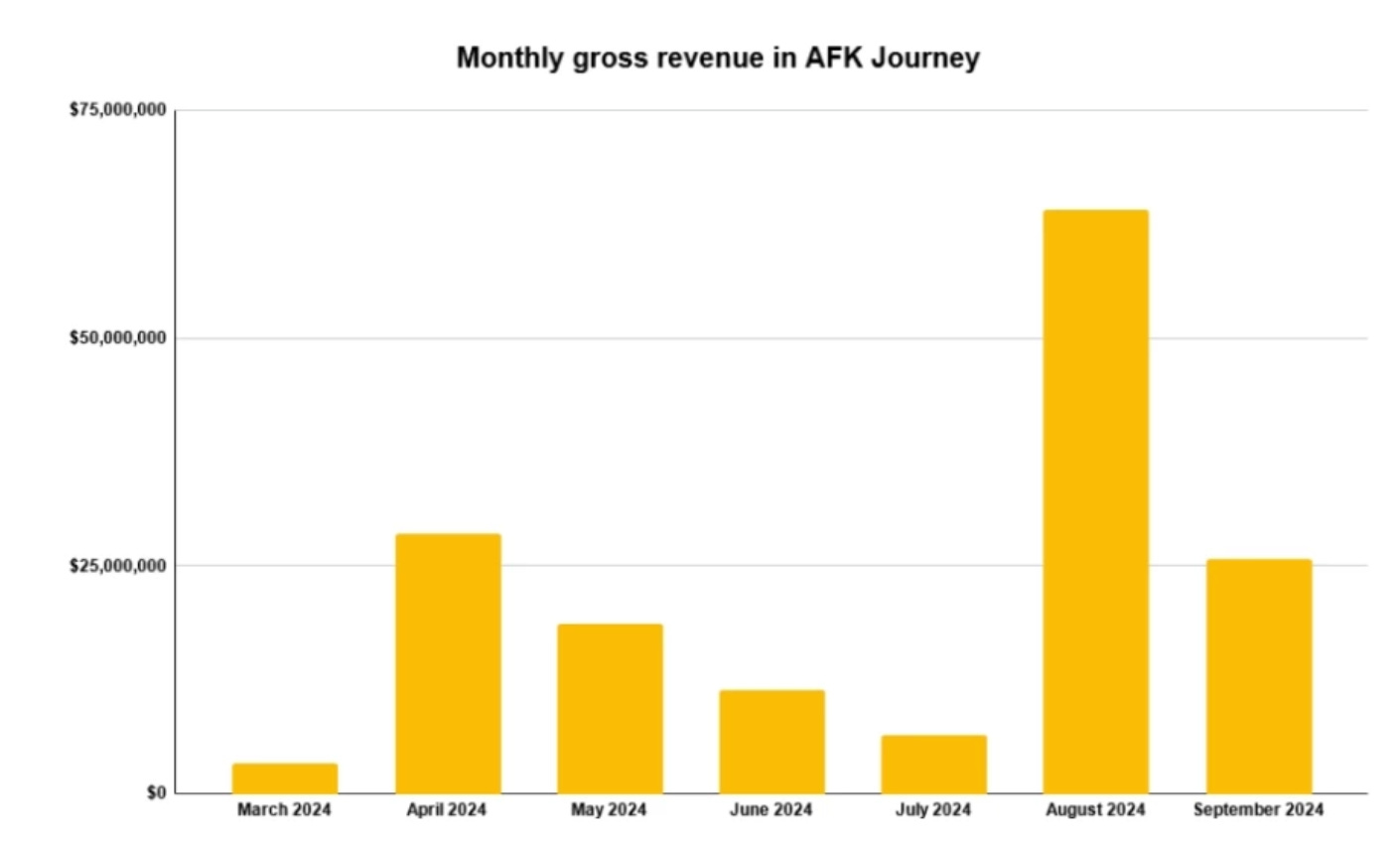

- Revenue for AFK Journey in less than six months has amounted to $158.3 million, according to AppMagic. Most of the revenue (over 70%) now comes from Asian regions, and in the first four months after launching in the West, the game earned $71 million.

- Pokemon Sleep generated $120 million in revenue over 14 months. 74% of all revenue comes from Japan, and 13% from the US.

- Final Fantasy VII Ever Crisis has been downloaded 9 million times in a year. In addition to mobile platforms, the game is also available on Steam.

Platforms

-

The mobile version of the Epic Games Store has been downloaded more than 10 million times. It was released in August 2024.

Bain & Company: The Gaming Industry in 2024

Consulting company Bain & Company has prepared a comprehensive report on the gaming industry in 2024, analyzing player habits, distribution, marketing, and business aspects.

Players and Their Preferences

Bain & Company surveyed over 5,000 people from six different countries.

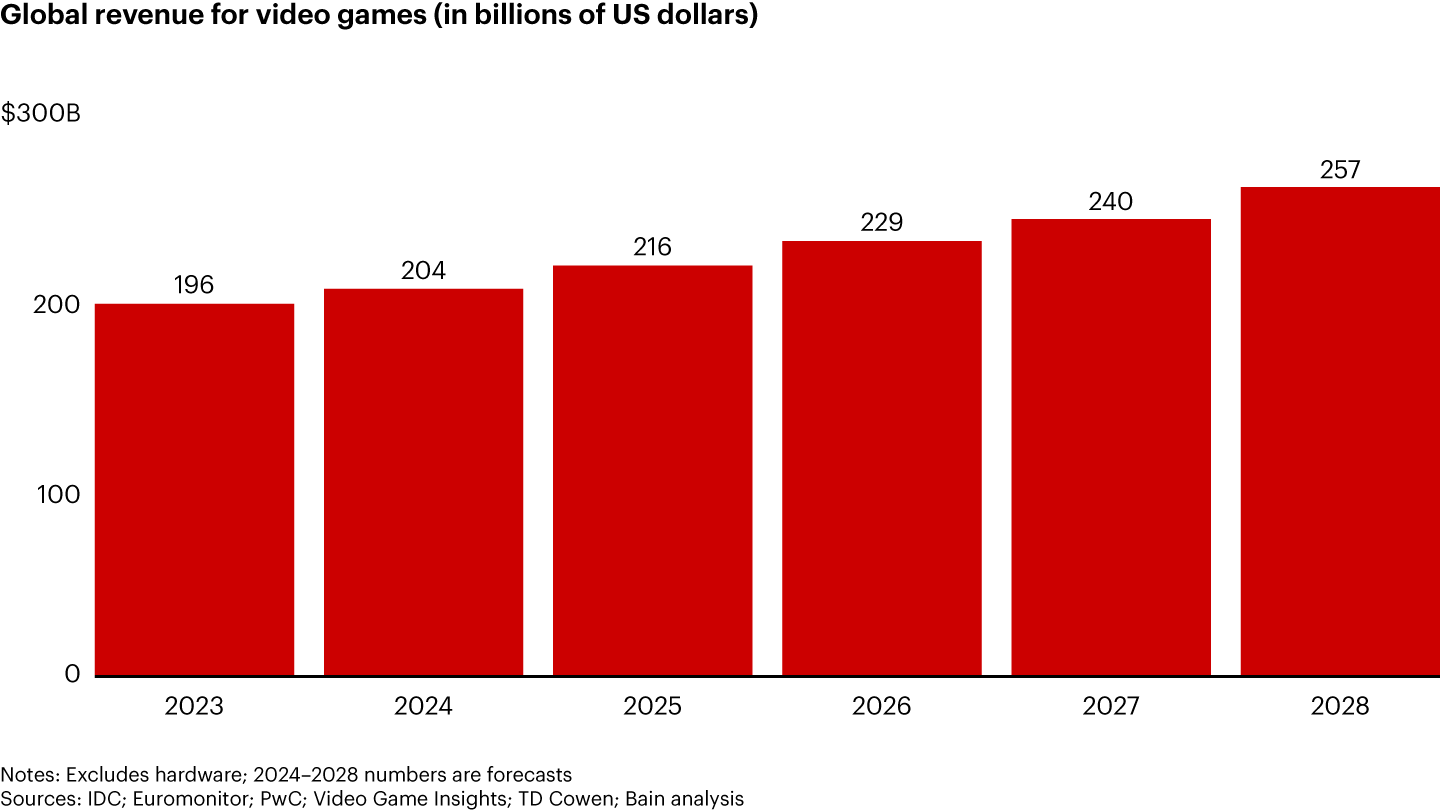

- According to Bain & Company, the gaming industry in 2023 was valued at $196 billion. This is more than the combined revenue of video streaming ($114 billion), music streaming ($38 billion), and movie theater earnings ($34 billion). By 2028, the industry is expected to grow at an average annual rate of 6%, reaching $257 billion.

- 52% of respondents play games regularly.

- Nearly 80% of young players (ages 2 to 18) spend 30% of their time on games. Among those older than 45, the percentage of such engaged players drops to 31%.

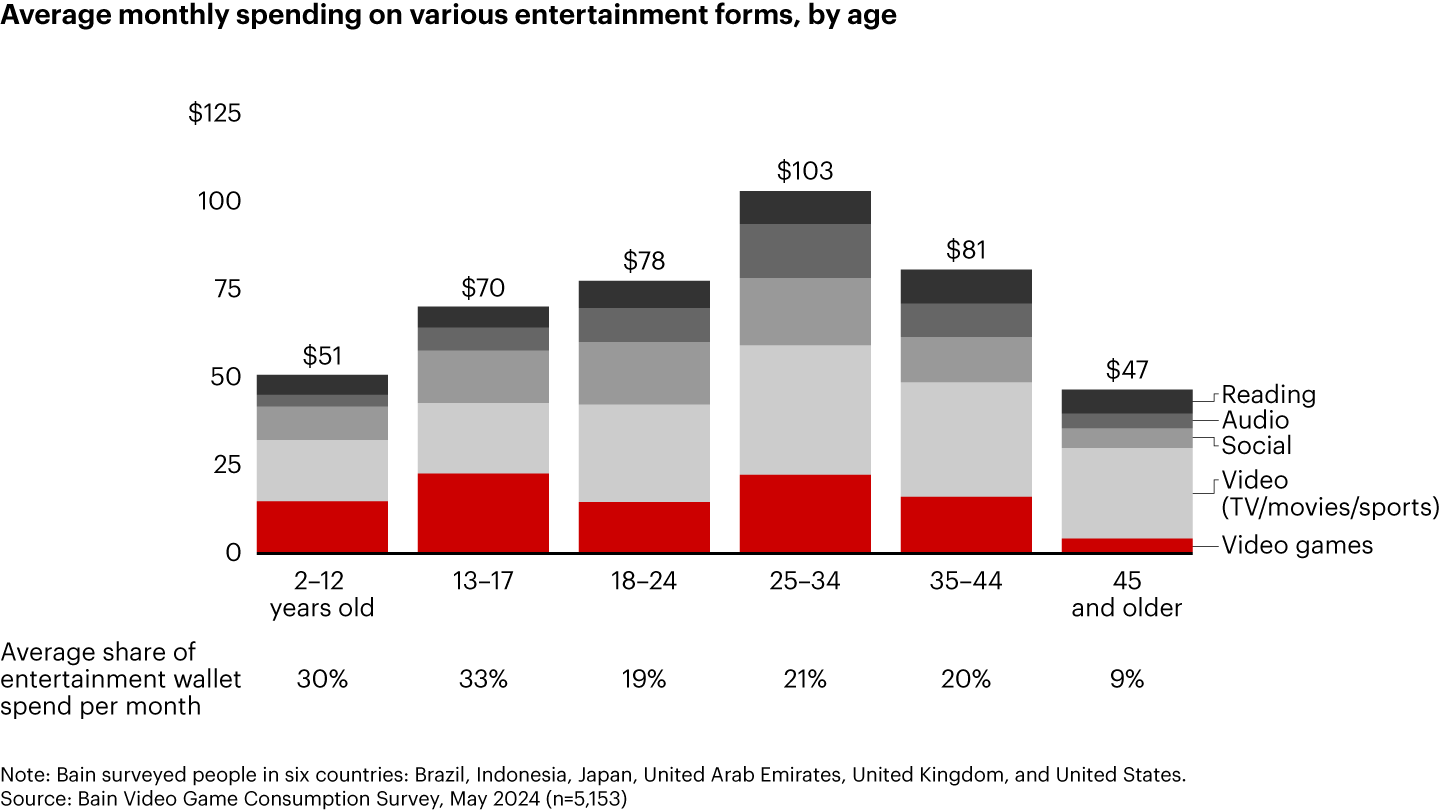

- Young users spend a large portion of their budget on games. In absolute terms, players aged 25 to 34 lead in spending. This age group also spends the most on entertainment in general.

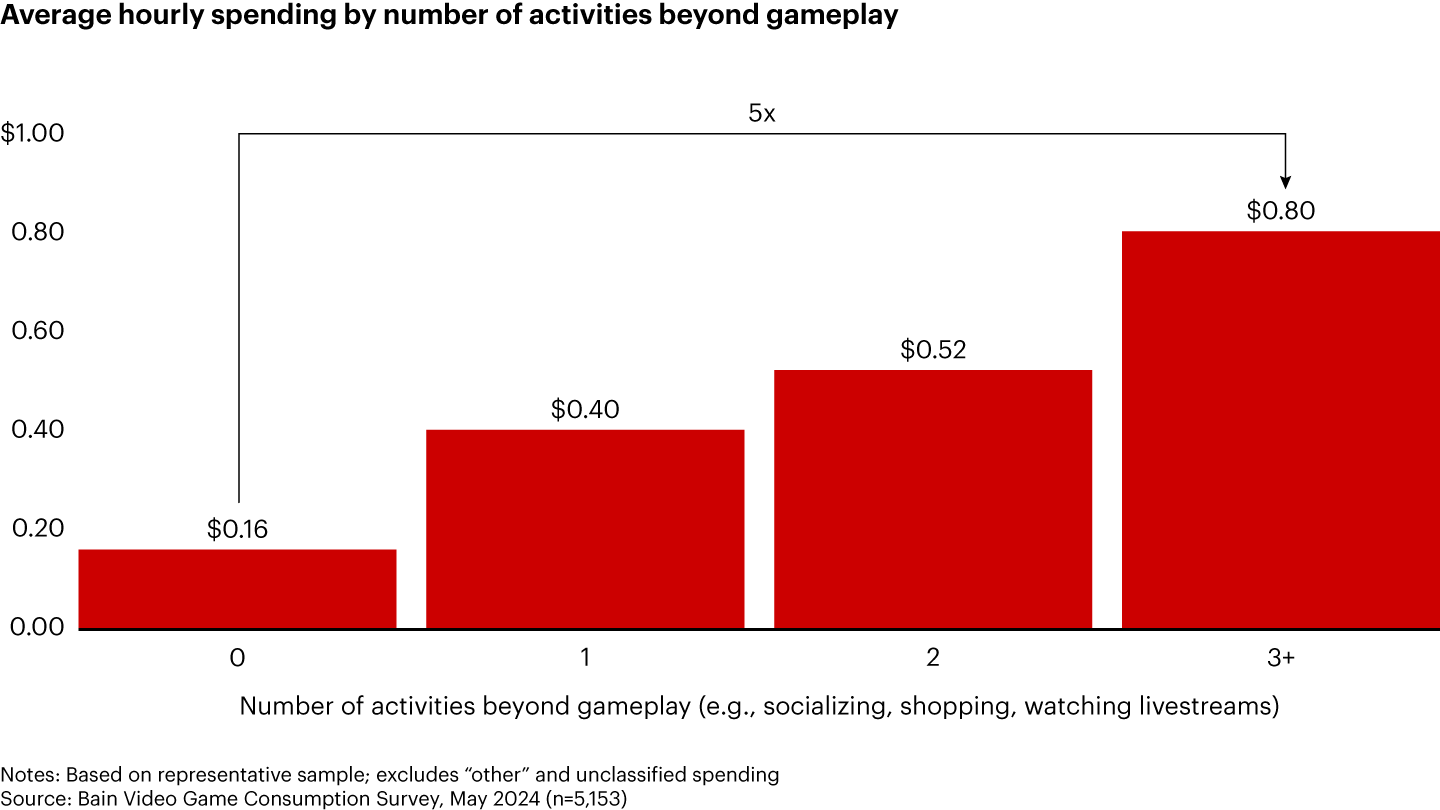

- Gamers not only play games—they socialize, discuss games, buy game-related merchandise, and watch videos. The more involved a player is in these side activities, the more they tend to spend in the games themselves.

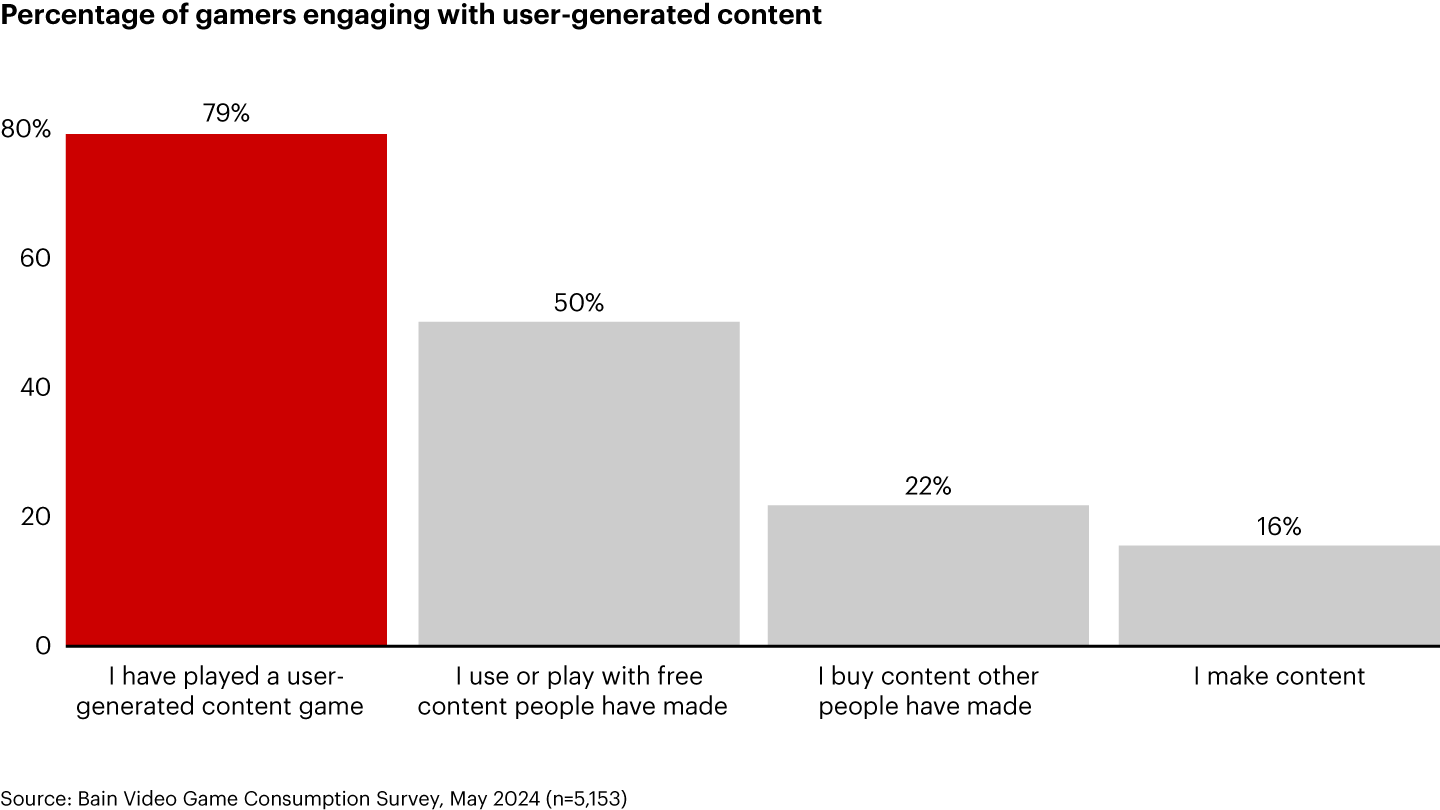

- 79% of users play content created by other players, while 16% participate in creating content themselves.

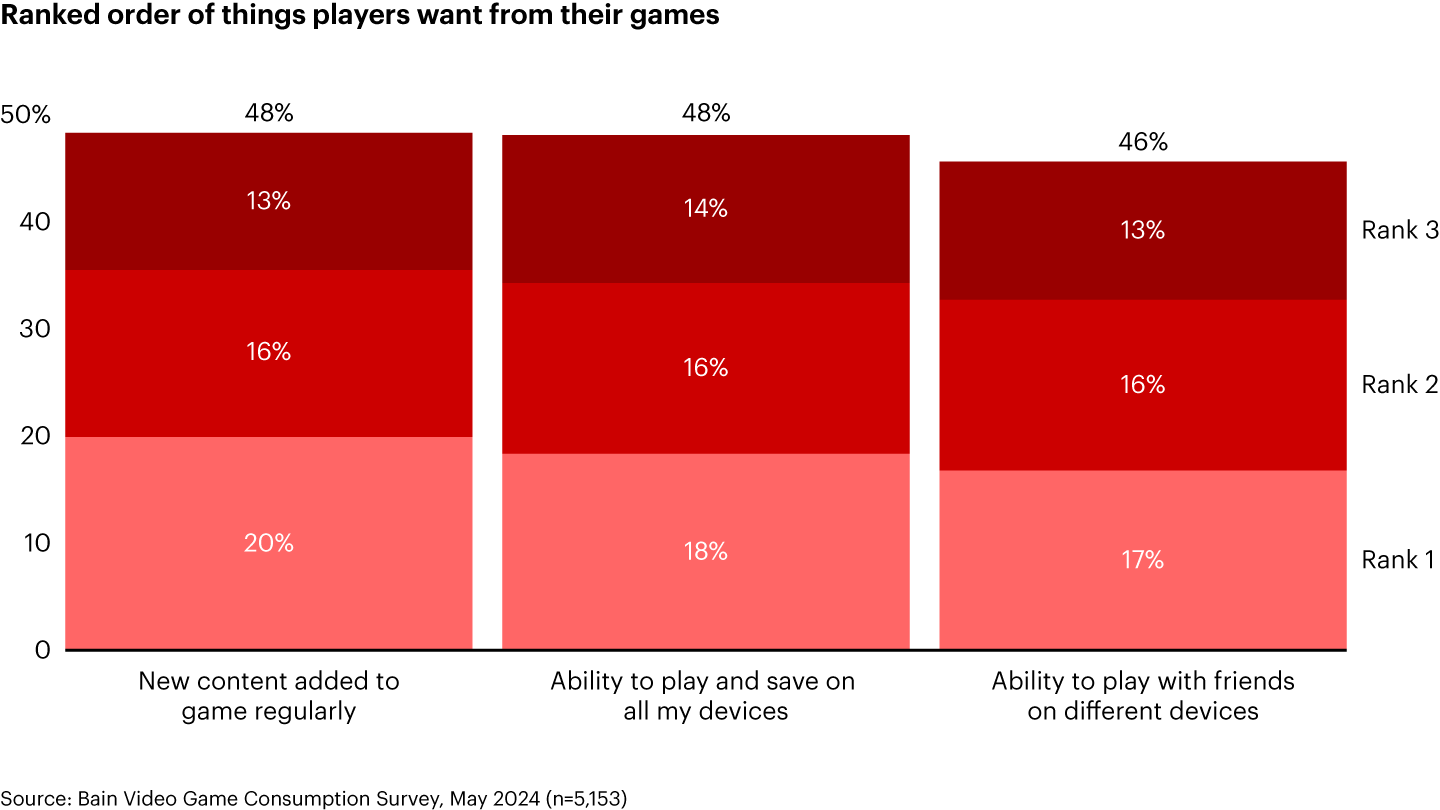

- Almost 70% of gamers play on at least two devices. For 48% of the audience, it's important to be able to play with users from different platforms and carry over their progress. This is reflected in game development, as 95% of studios with more than 50 employees are working on cross-platform support for their games.

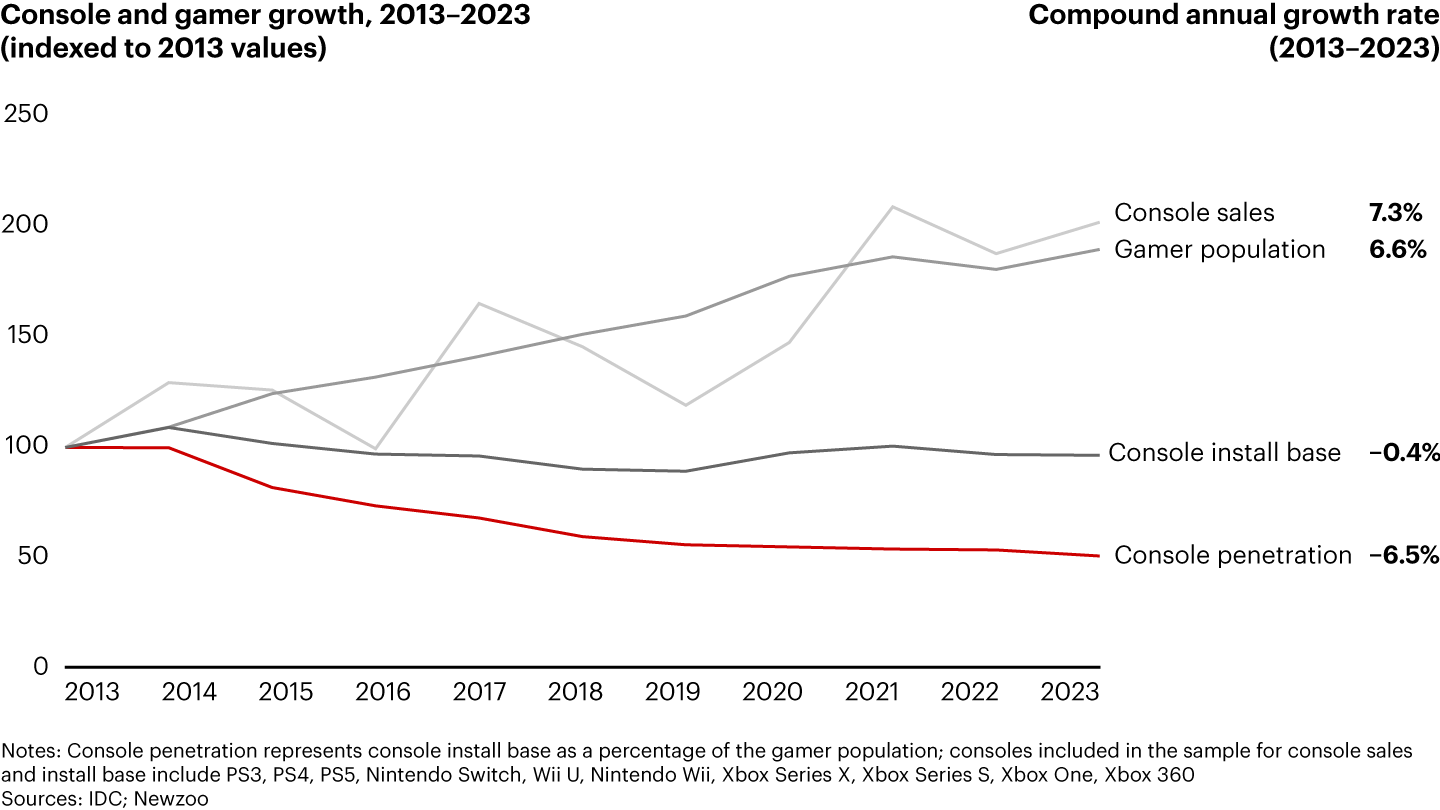

Game Distribution

- Despite the growth in absolute sales, console penetration has not changed in the past 10 years, even though the gaming audience has significantly increased.

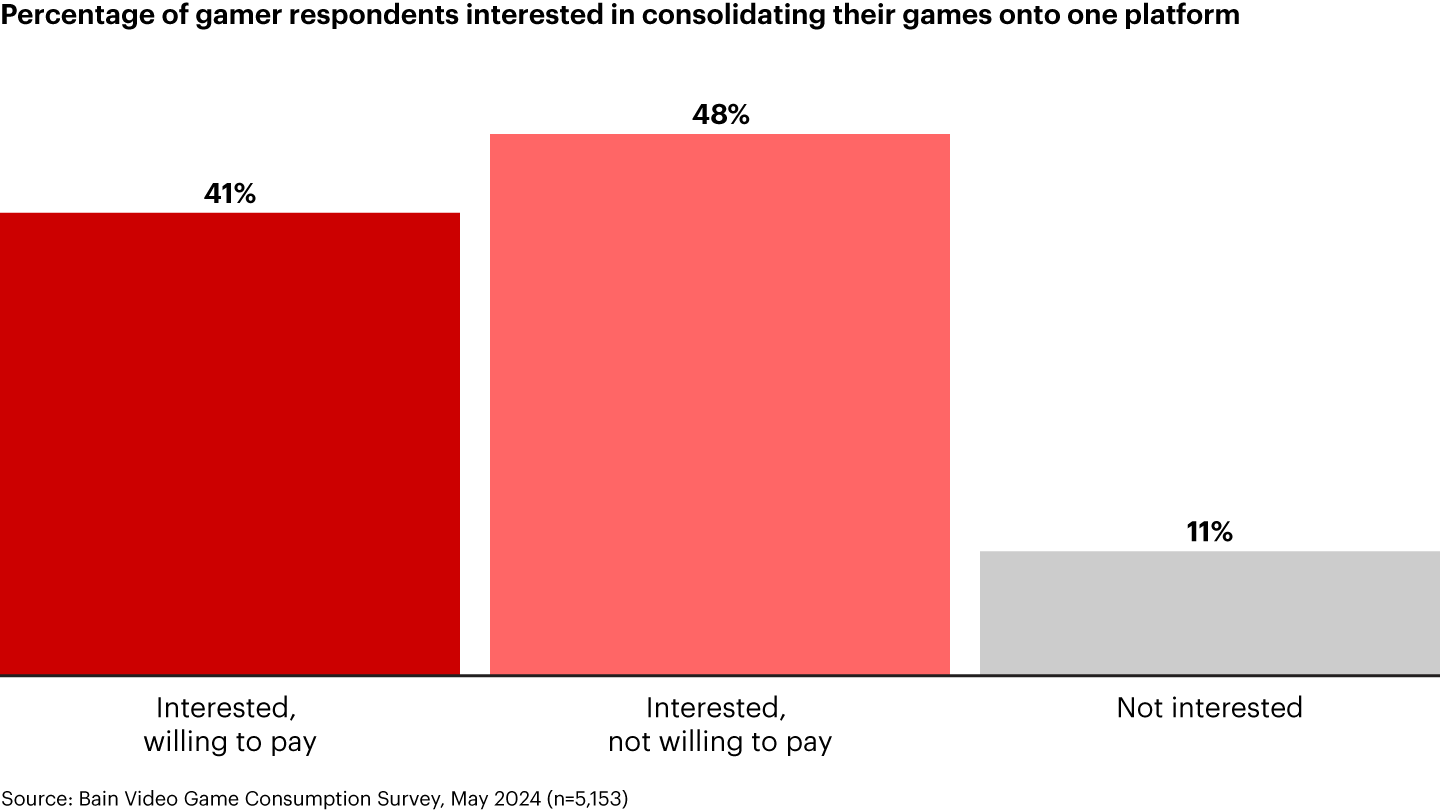

- 41% of users are interested and willing to pay for a single platform to consolidate all game content. Another 48% are also interested but are not willing to pay for this solution.

Marketing in Mobile Games

-

67% of players say they consume other forms of media (such as TV shows or movies) while playing games.

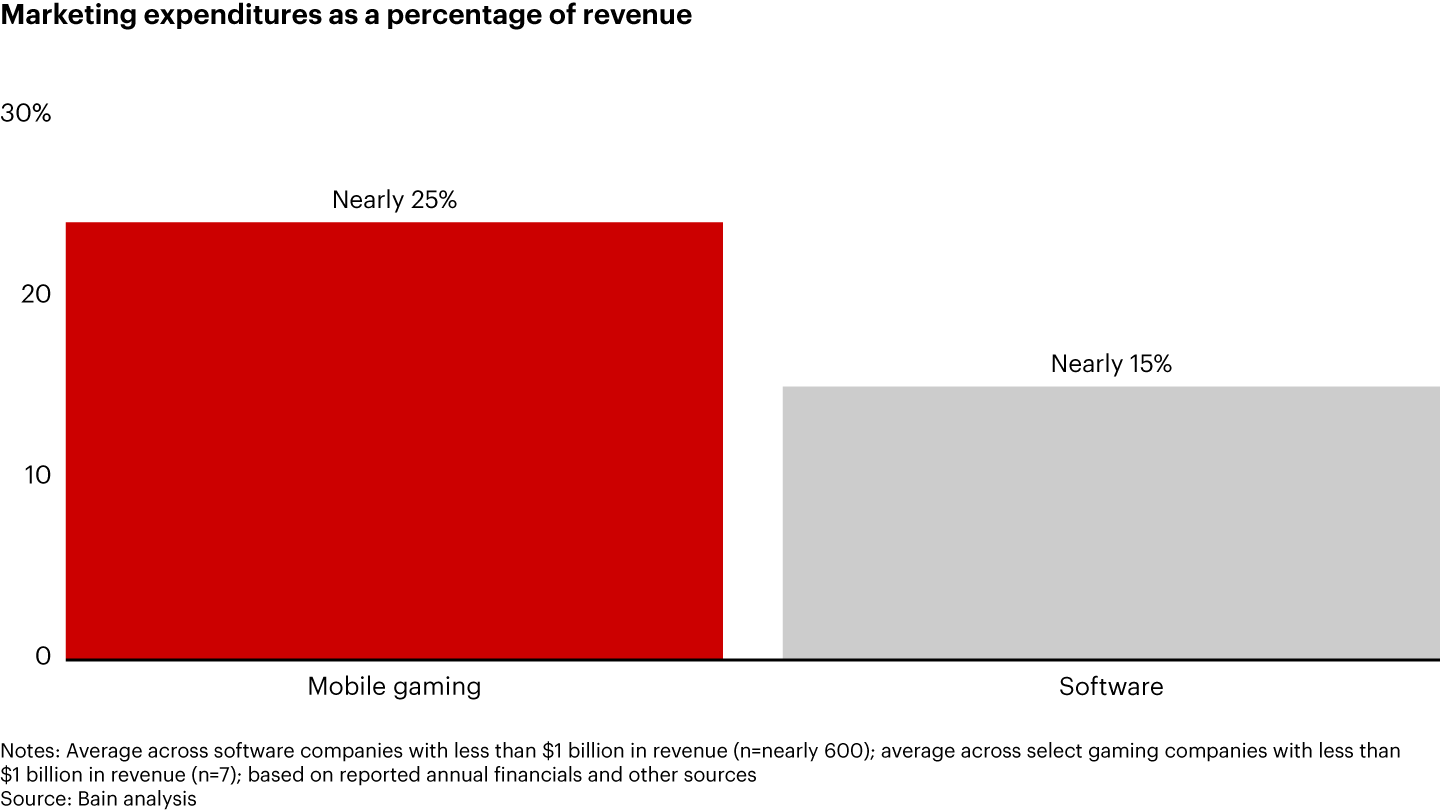

- Gaming companies with annual revenues of less than $1 billion spend an average of 25% on marketing. Some companies spend even more. This is significantly higher than in software companies in general.

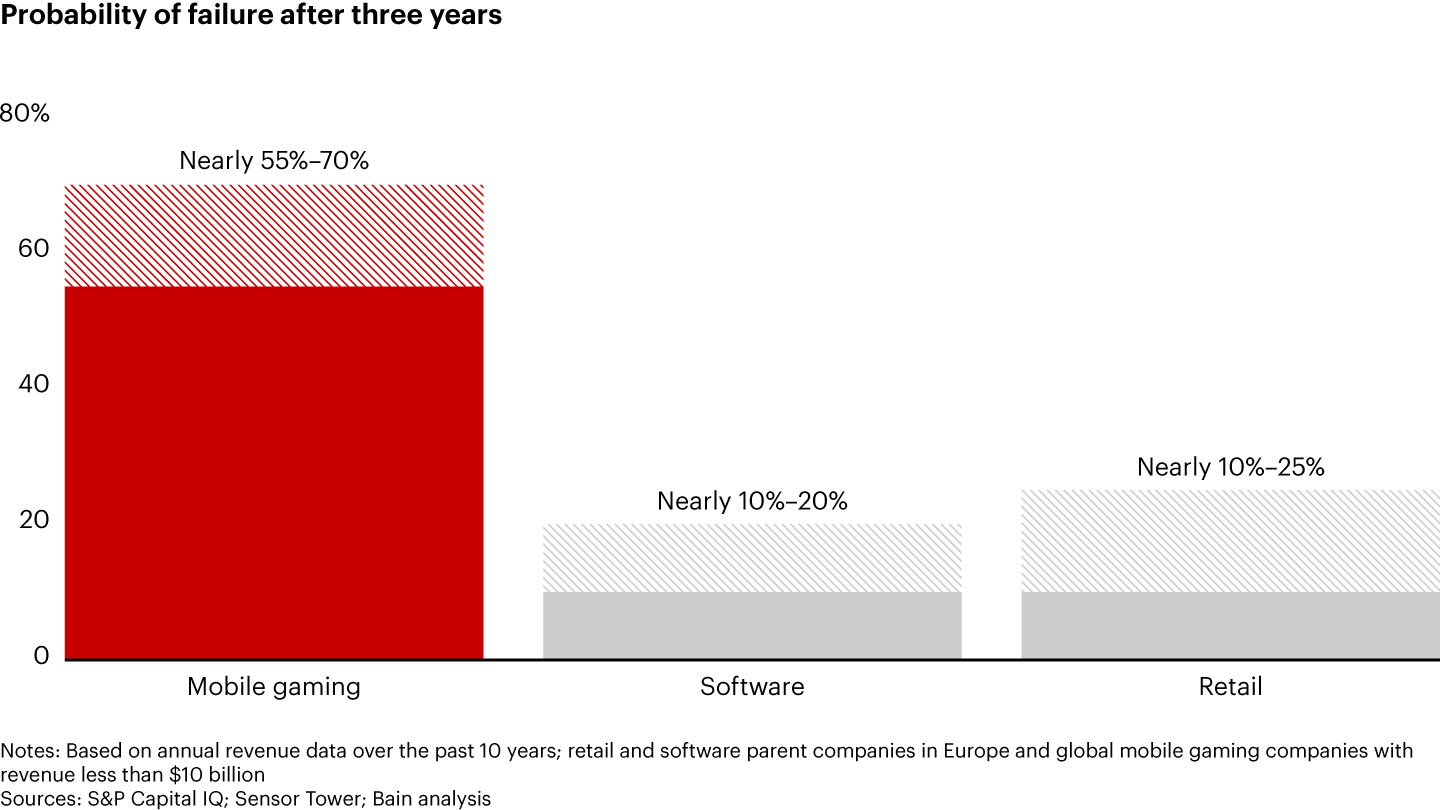

- The mobile gaming market is a much riskier business for companies with annual revenues under $10 million. The likelihood of revenue decline over a three-year horizon is much higher here (55-70%) than in software development (10-20%) or retail (10-25%).

Changes in Gaming Companies Over the Last 10 Years

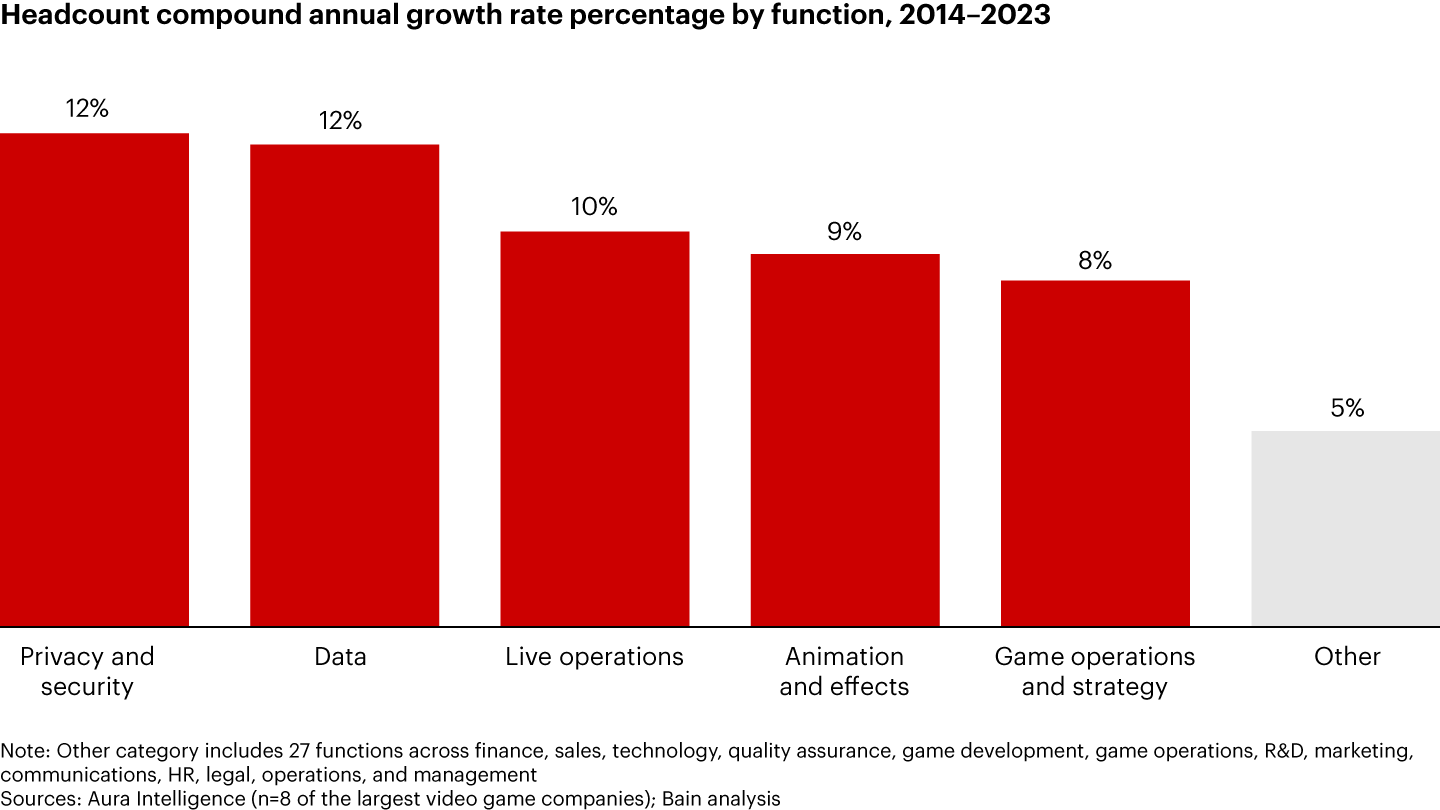

- Over the past 10 years, the demand for specialists in security, data, animation, LiveOps, and project operations has grown significantly. These roles were hired, on average, twice as often as other types of specialists. This indicates changes in how games are developed and operated.

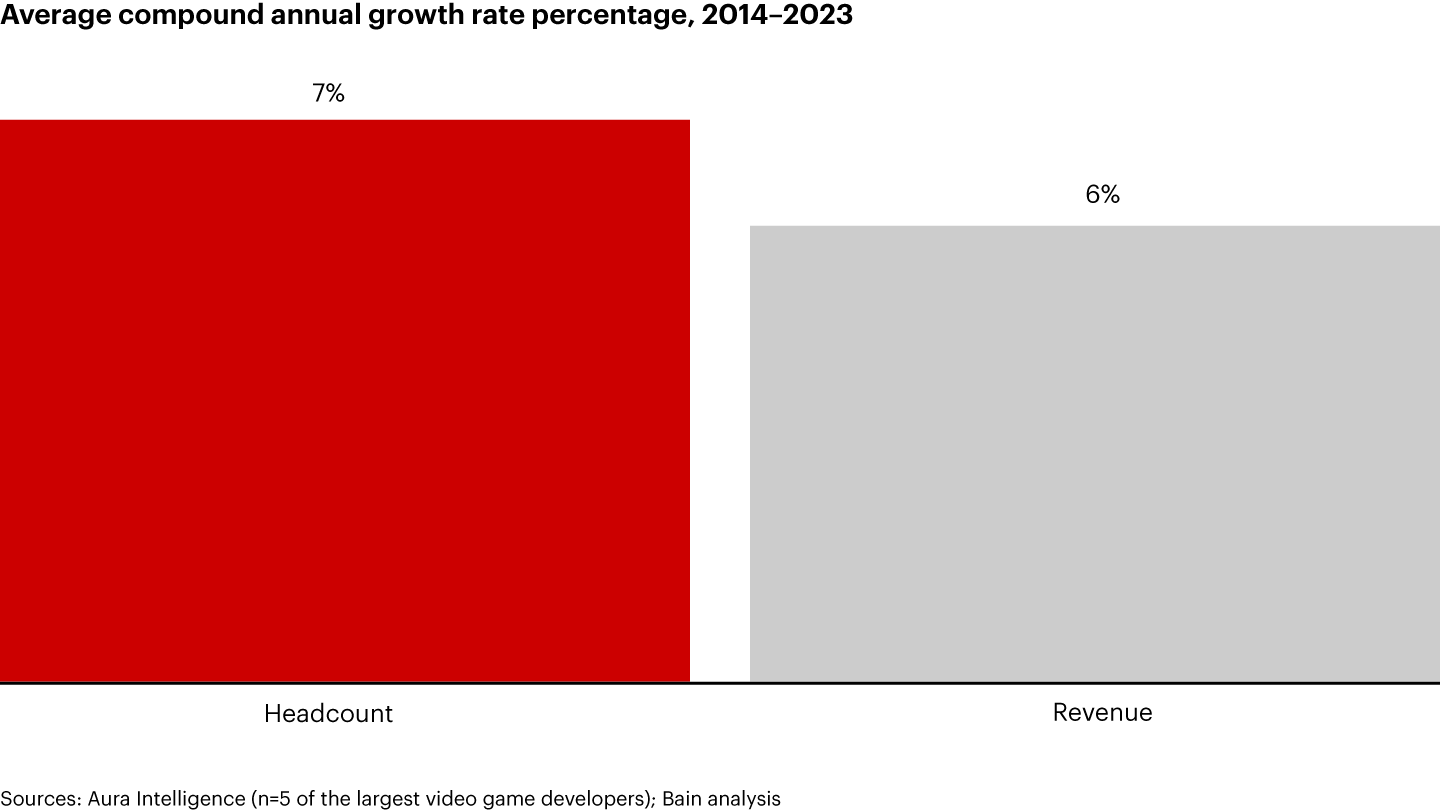

- Large companies have grown by an average of 6% annually in revenue over the past 10 years, but their workforce has grown by 7% annually. This suggests a weak correlation between the number of employees and business efficiency.

AppMagic: Top Mobile Games by Revenue and Downloads in September 2024

AppMagic provides revenue data after store commissions and taxes are deducted.

Revenue

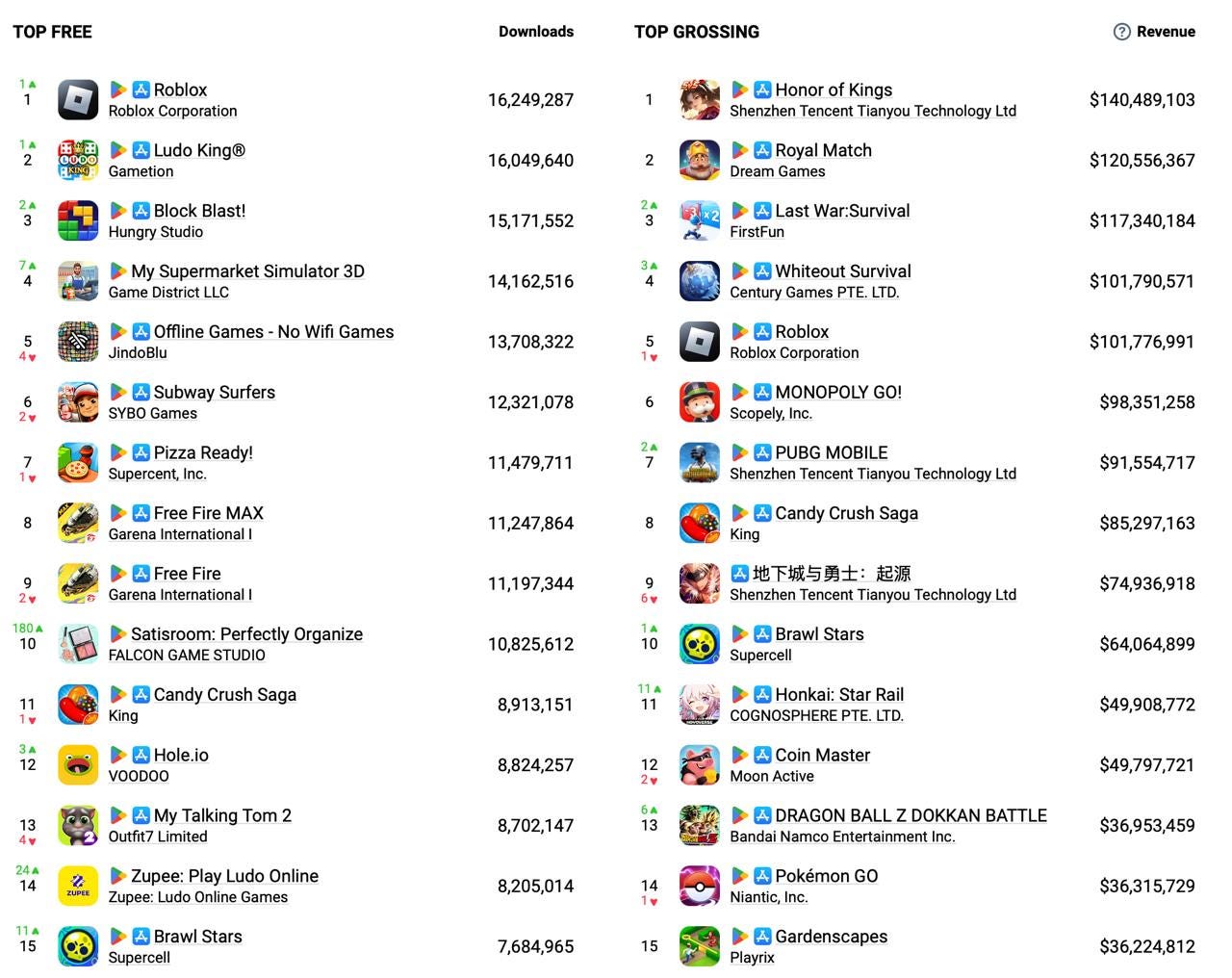

- Honor of Kings returned to the top spot, earning over $140 million in September. 97% of the revenue comes from China (without accounting for Android versions).

- Last War: Survival continues to grow in revenue. The game earned $117.3 million in September—the best result since its launch. 31% of the revenue comes from the US, 24% from Japan, and 15% from South Korea.

- Whiteout Survival is following a similar but slightly more modest trajectory. The game earned $101.7 million in September, also a record.

- Dungeon Fighter Online continues to decline in revenue. The game dropped to 9th place in the chart, earning $74.9 million.

Downloads

-

The top ranking remains mostly unchanged. In first place is Roblox (16.2 million downloads), followed by Ludo King (16 million), and Block Blast! (15.1 million).

- Satisroom: Perfectly Organise saw a significant rise in downloads, with 10.8 million in September. It’s a soothing game where players organize items, clean up chaos, and remove dirt. The top download markets were Brazil, Mexico, and Indonesia. In terms of revenue, South Korea leads with 36%.

StreamHatchet: Co-op Games have doubled in popularity among viewers over the last 2 years

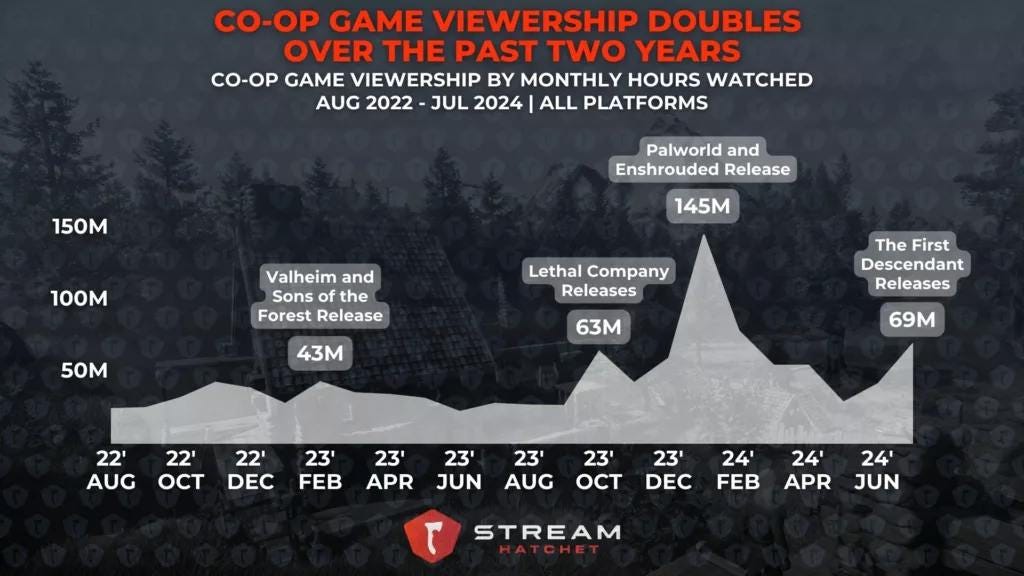

The company defines co-op games as those where cooperative gameplay is the core feature. The study included games with the "co-op" tag on Steam and excluded games with the "PvP" tag.

- The number of hours spent watching co-op games has roughly doubled since August 2022. This is largely due to the release of major co-op titles like Lethal Company, Palworld, Enshrouded, and The First Descendant.

❗️It would be interesting to see data from 2019 to account for pandemic-related figures.

- The top co-op games by watch hours over the past year are Palworld (111 million hours), Lethal Company (97.8 million hours), Monster Hunter: World (63.4 million hours), ARK: Survival Evolved (59.9 million hours), and Helldivers II (45 million hours).

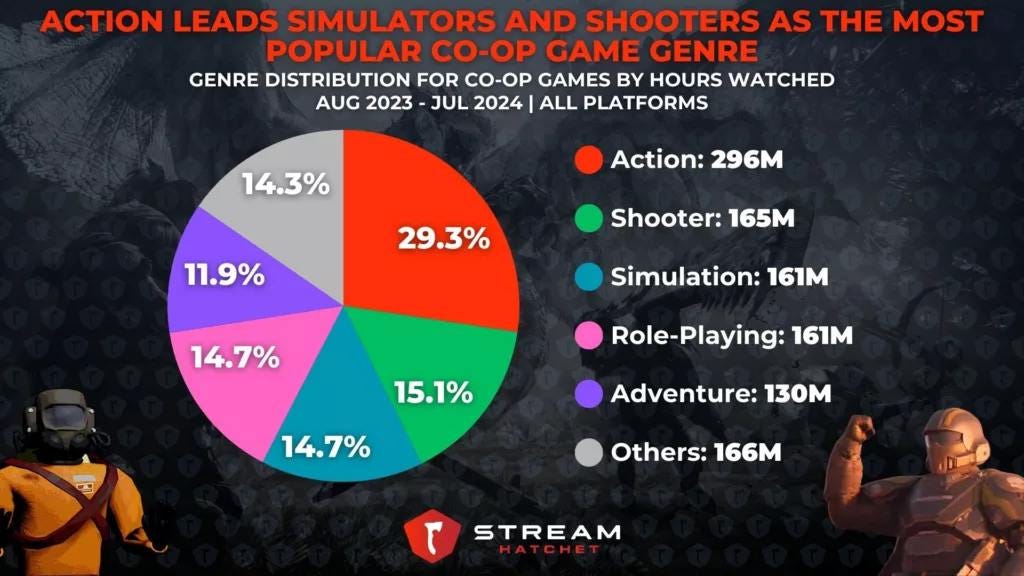

- The most popular co-op genres are action (296 million hours), shooters (165 million hours), simulators (161 million hours), and RPGs (161 million hours).

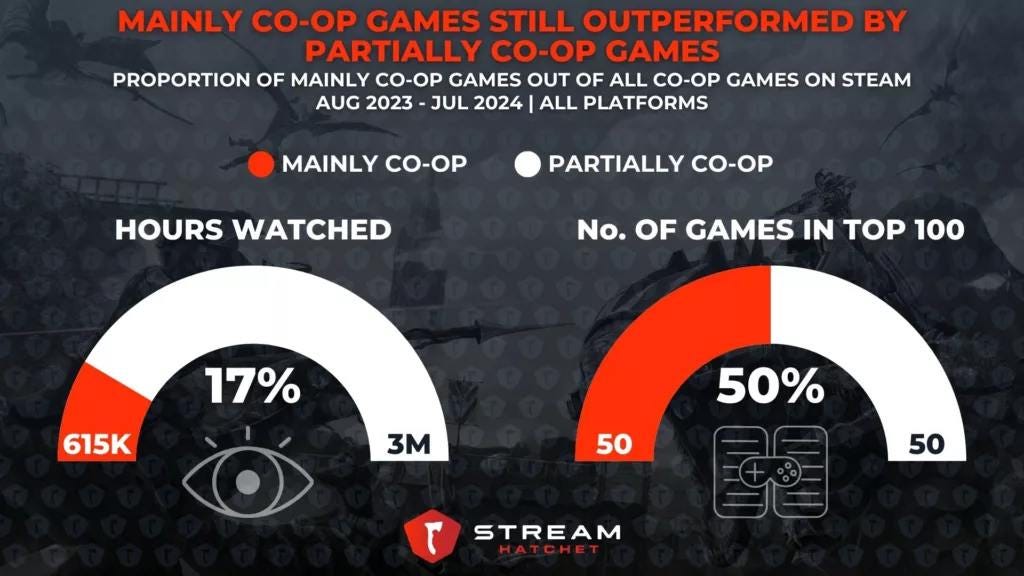

- StreamHatchet also looked at projects with "partial co-op." This includes games like Call of Duty (with its zombie mode), Granblue Fantasy: Relink, and other titles where co-op is present but not the main mode. When looking purely at viewership, 83% of views still come from these types of games.

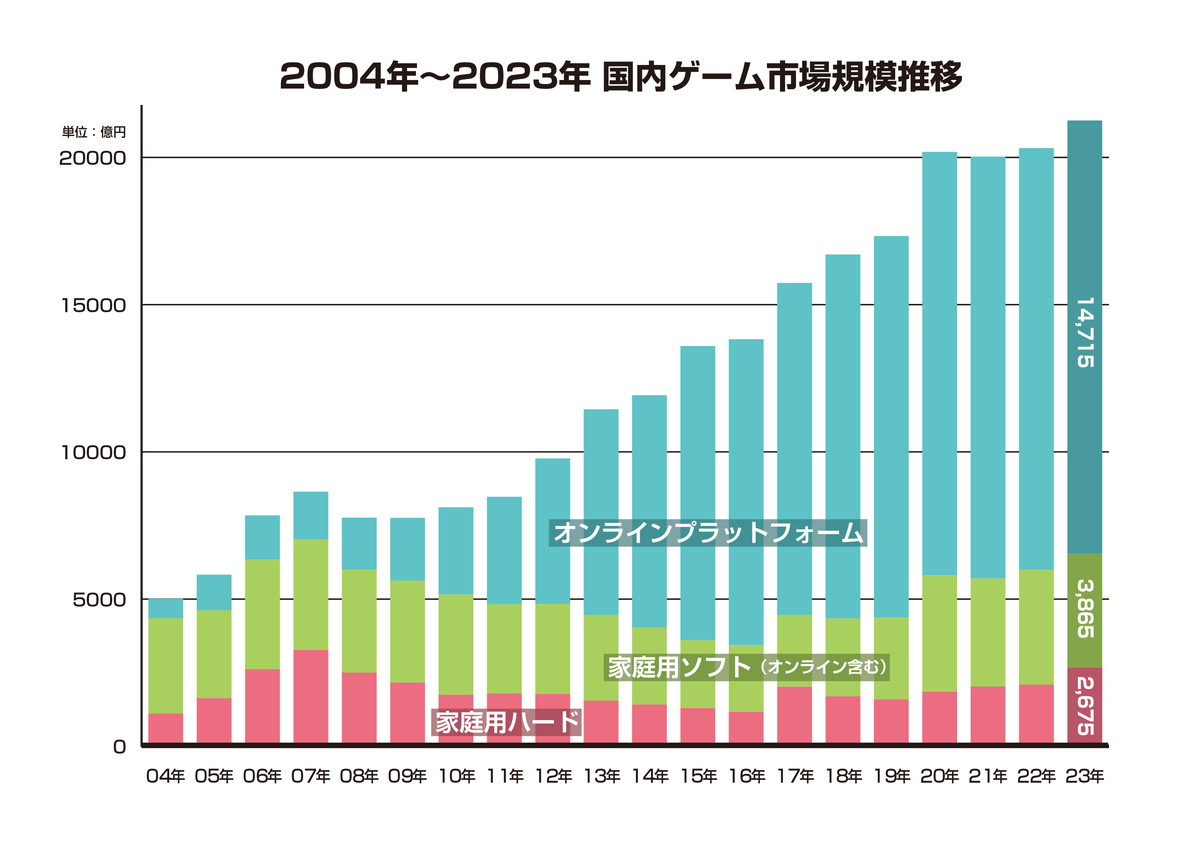

Kadokawa ASCII Research Laboratories: The Japanese Gaming Market Grew in 2023

- Sales of gaming consoles in Japan grew by 27.5% year-on-year in 2023. This growth was driven by increased sales of both the PlayStation 5 and the Nintendo Switch (despite being near the end of its lifecycle).

- Console game sales also increased. However, the most significant growth was seen in PC games, which rose by 24.9%.

- Revenue from mobile games fell by 0.7% in 2023. But due to the strength of the PC/console segment, overall sales of gaming content for the year increased by 3.9%.

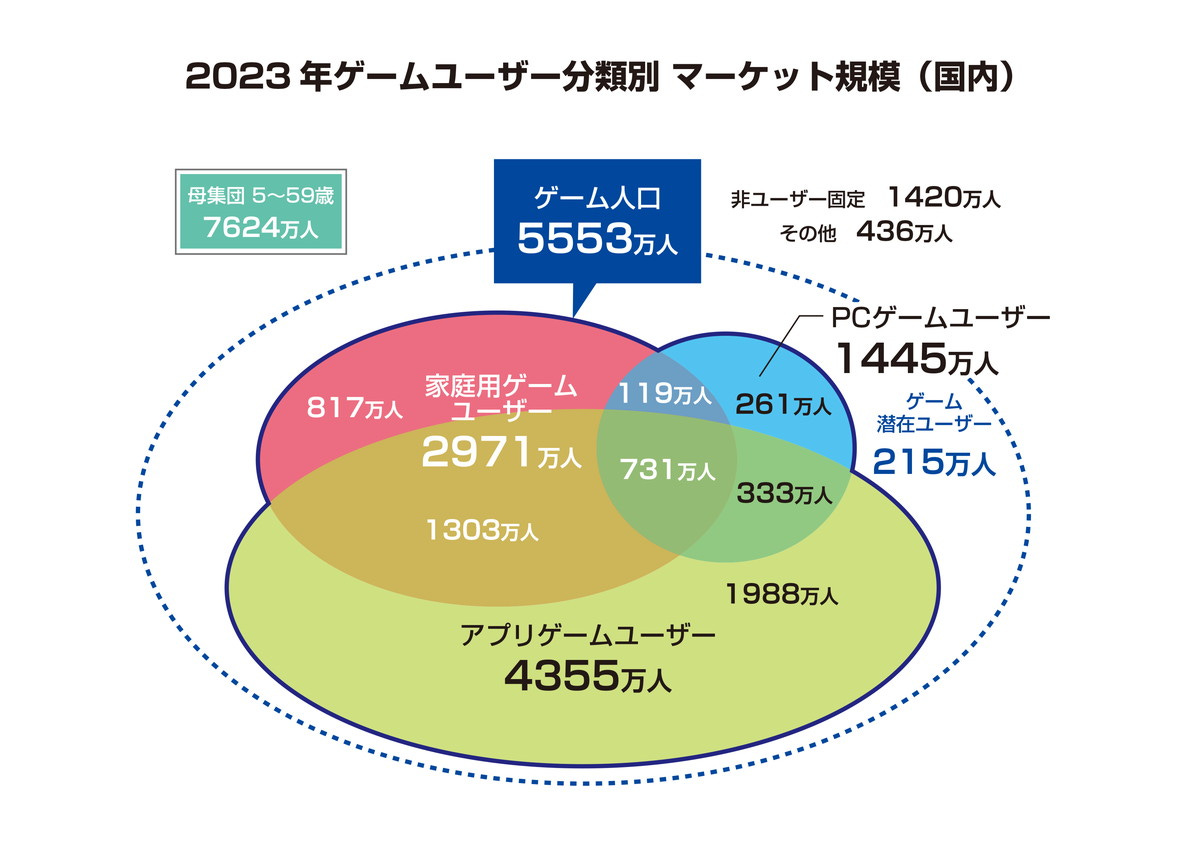

- The number of active gamers in Japan grew by 2.8% in 2023, reaching 55.5 million people. The number of mobile gamers increased by 10%, while console gamers grew by 4%.

❗️It’s important to note that the increase in mobile gamers may be due to users playing on an additional platform.

InvestGame & GDEV: The History of Gaming IPOs

In this material, the InvestGame team examines how the landscape of gaming IPOs has changed, which gaming companies have benefited, and how companies from different segments have fared after going public.

A total of 87 companies were analyzed, each of which had a post-IPO valuation that exceeded $100 million at least once.

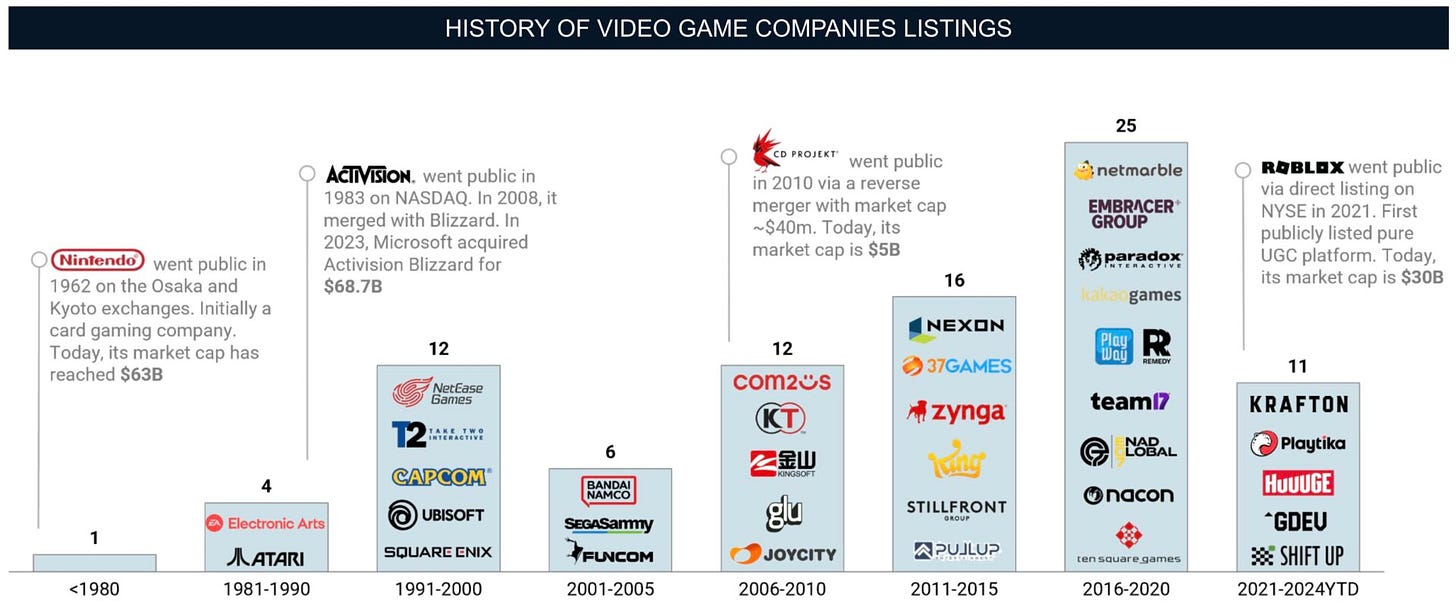

History of Gaming IPOs

- Before 2006, 23 gaming companies went public. Most of them were already in the gaming business, but the first—Nintendo—initially went public on local stock exchanges in Kyoto and Tokyo as a playing card manufacturer (hanafuda). The gaming division came later.

- Between 2006 and 2010, 12 companies went public. From 2011 to 2015, another 16 companies did the same. IPOs reached their peak between 2016 and 2020, with 25 companies going public during that period.

- Since 2021, companies' interest in IPOs has declined, with only 11 companies going public. Only one of these—Shift Up (July 2024)—happened after 2022. Market corrections, rising interest rates, and weak multipliers have all affected business owners' interest in going public.

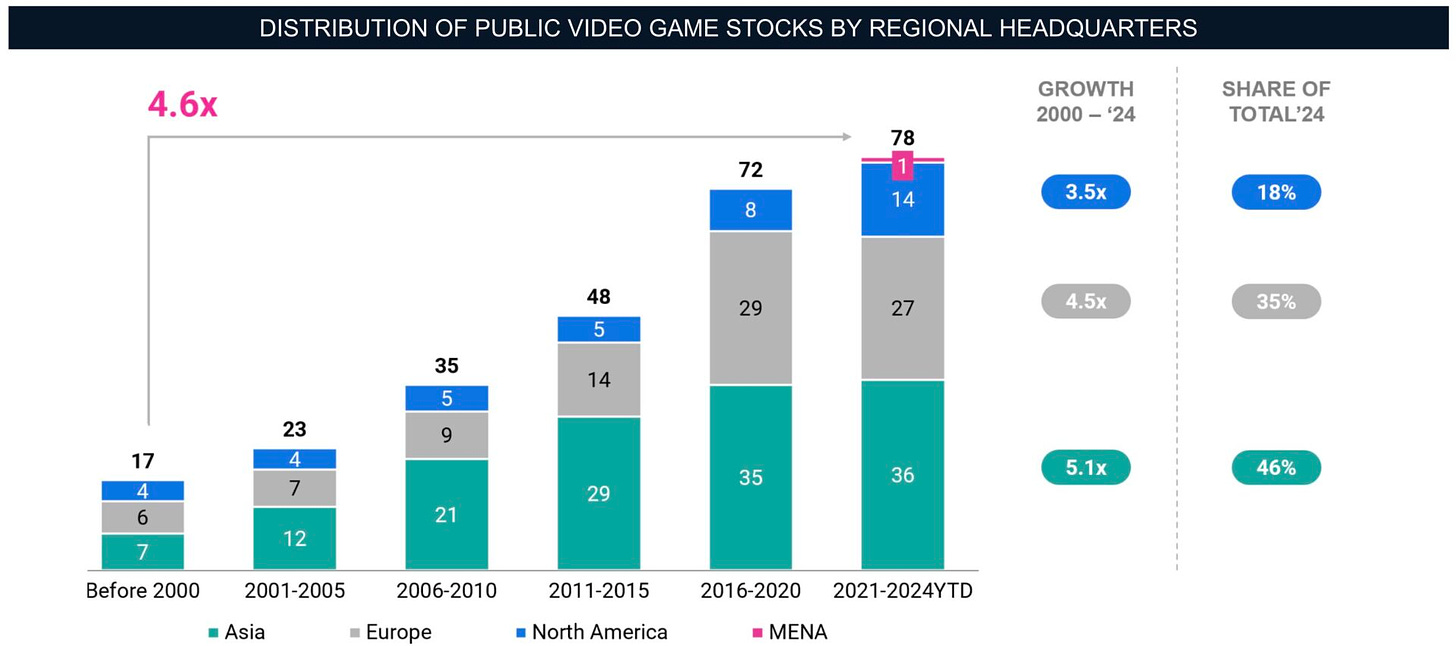

Public Offerings by Region

- Asia is the leader in public offerings. As of 2024, 46% of all public companies are from Asia. Another 35% are from Europe, 18% from the U.S., and 1% from the MENA region (Playtika).

- In Asia, the number of public companies has grown by 5.1 times over the past 24 years. In Europe, it has grown by 4.5 times, and in the U.S., by 3.5 times.

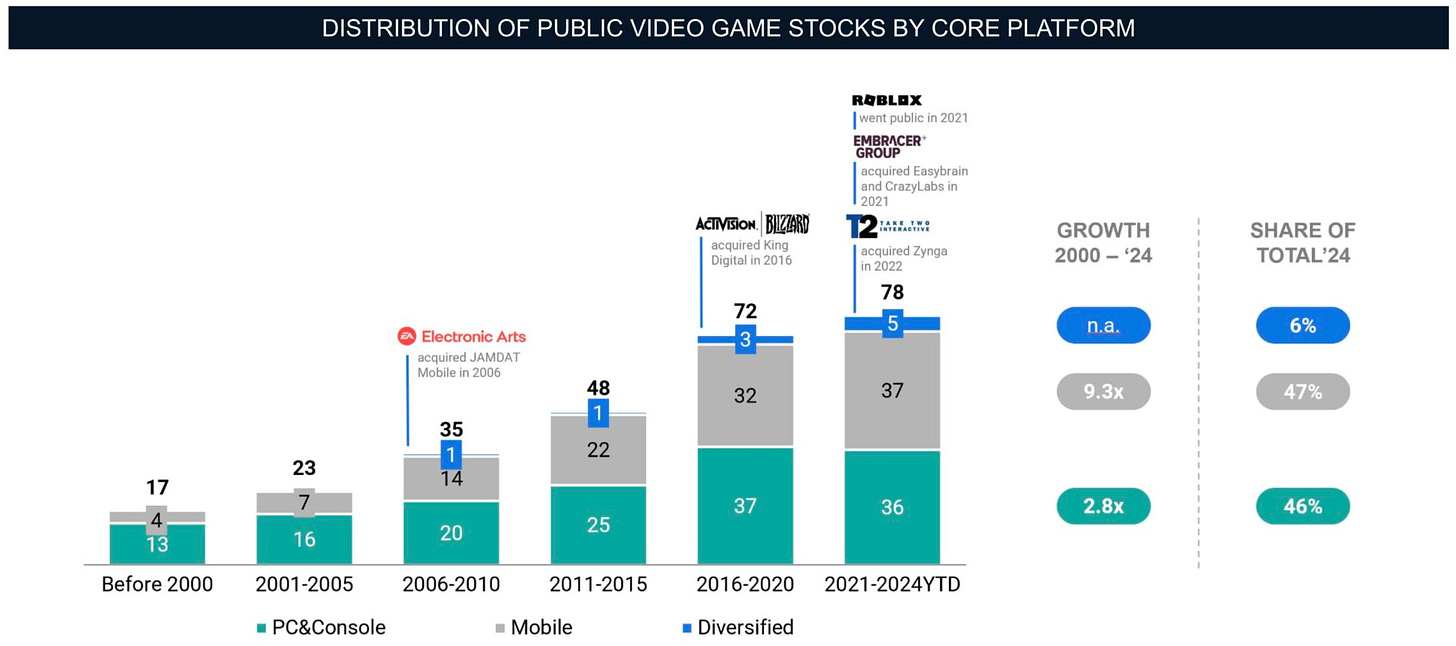

Platform Distribution

- PC/console companies dominated IPOs until 2000. Currently, 46% of all public companies specialize in this segment. The number of companies has increased by 2.8 times since 2000.

- The most significant growth has been in the mobile segment. The number of public companies has grown by 9.3 times since 2000, and now 47% of all public gaming companies specialize in mobile games.

- Historically, diversified companies make up 6%. However, more companies are now trying to expand to new platforms. From 2021 to 2024, 46% of all public companies were diversified.

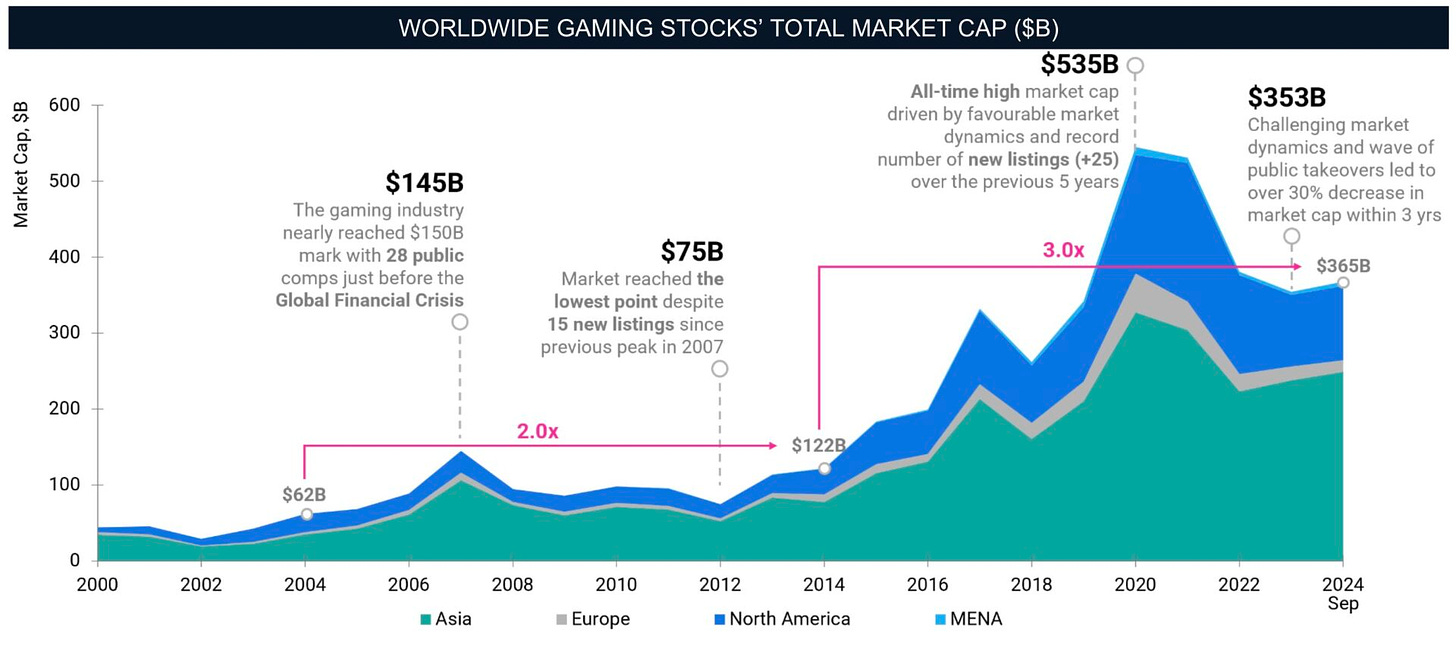

Gaming Market Capitalization

- The capitalization of the gaming market gradually grew until 2007, reaching $145 billion. After the 2007 global financial crisis, it dropped to $75 billion but recovered to $122 billion by 2014.

- The most significant growth occurred between 2014 and 2020, when gaming market capitalization skyrocketed to $535 billion, driven by favorable financial conditions and a record number of IPOs.

- The consequences are well known. By 2024, the gaming market's capitalization has dropped to $353 billion, which is 30% lower than the peak years prior.

- It's important to note that Asian companies contribute the most to gaming market capitalization—about 70% of the total.

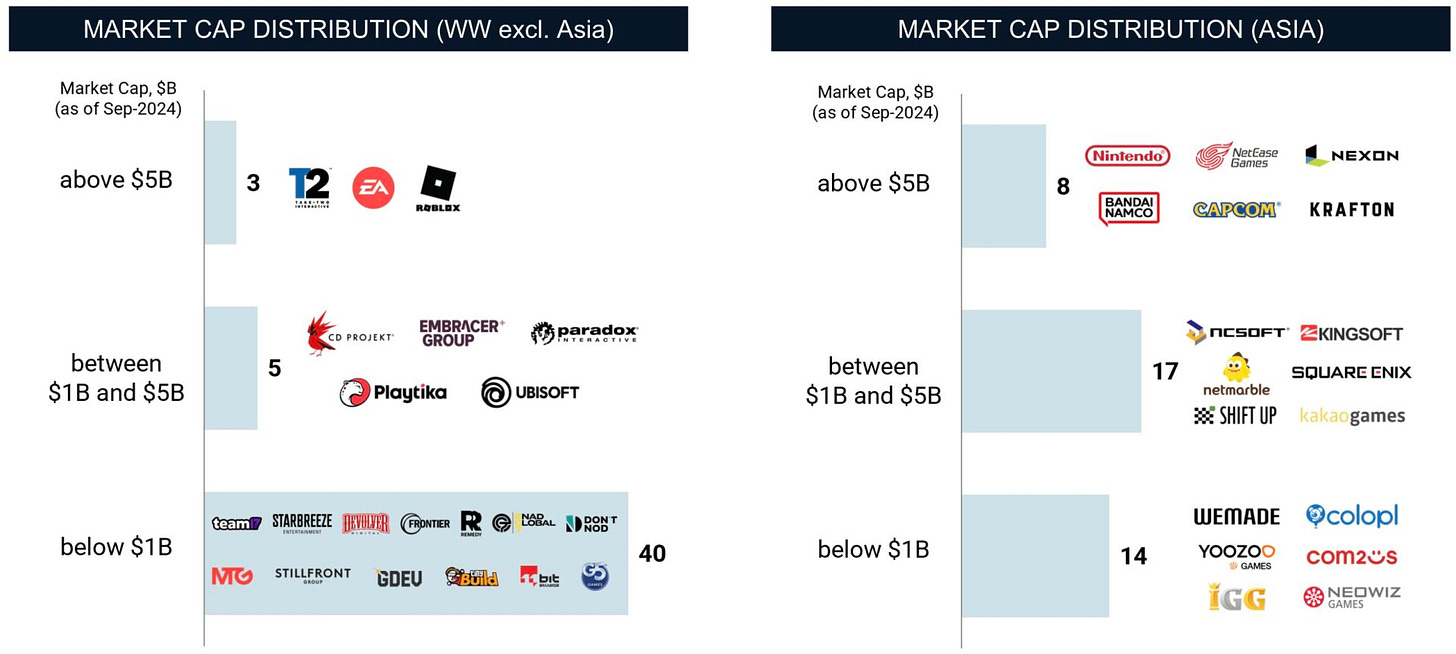

- As of 2024, there are 13 companies with a capitalization of over $5 billion—8 of them are in Asia. There are 22 companies with a capitalization of over $1 billion but less than $5 billion—17 of them are in Asia. Among companies with a capitalization of less than $1 billion (those included in InvestGame's analysis), there are 54, and only 14 of them are in Asia.

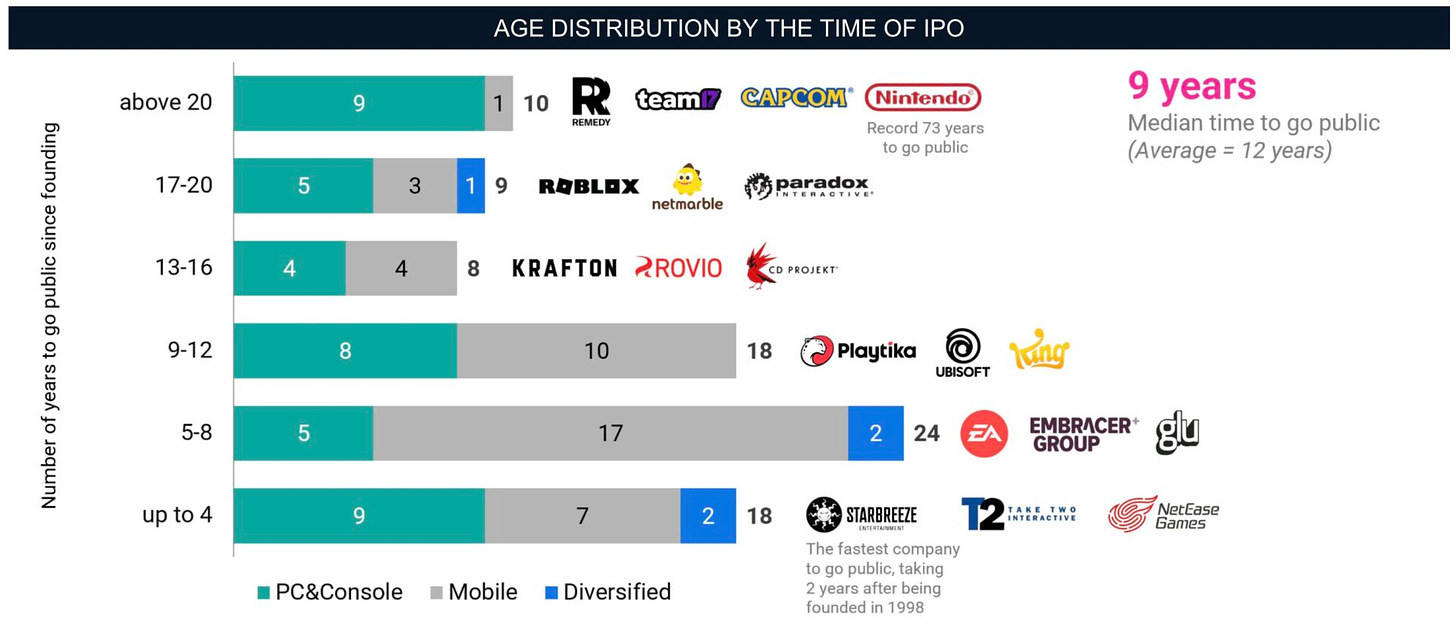

Age of Public Companies and Time to IPO

- Most public gaming companies today are over 20 years old. Many well-known companies, such as Nintendo, Activision Blizzard, and Electronic Arts, are over 40. On average, Asian public companies are 28 years old, and Western ones are 23 years old.

- The median time for a gaming company to go public is 9 years (with an average of 12 years) after their founding.

- Between 5 and 12 years after being founded, 48% of companies from the analyzed sample went public.

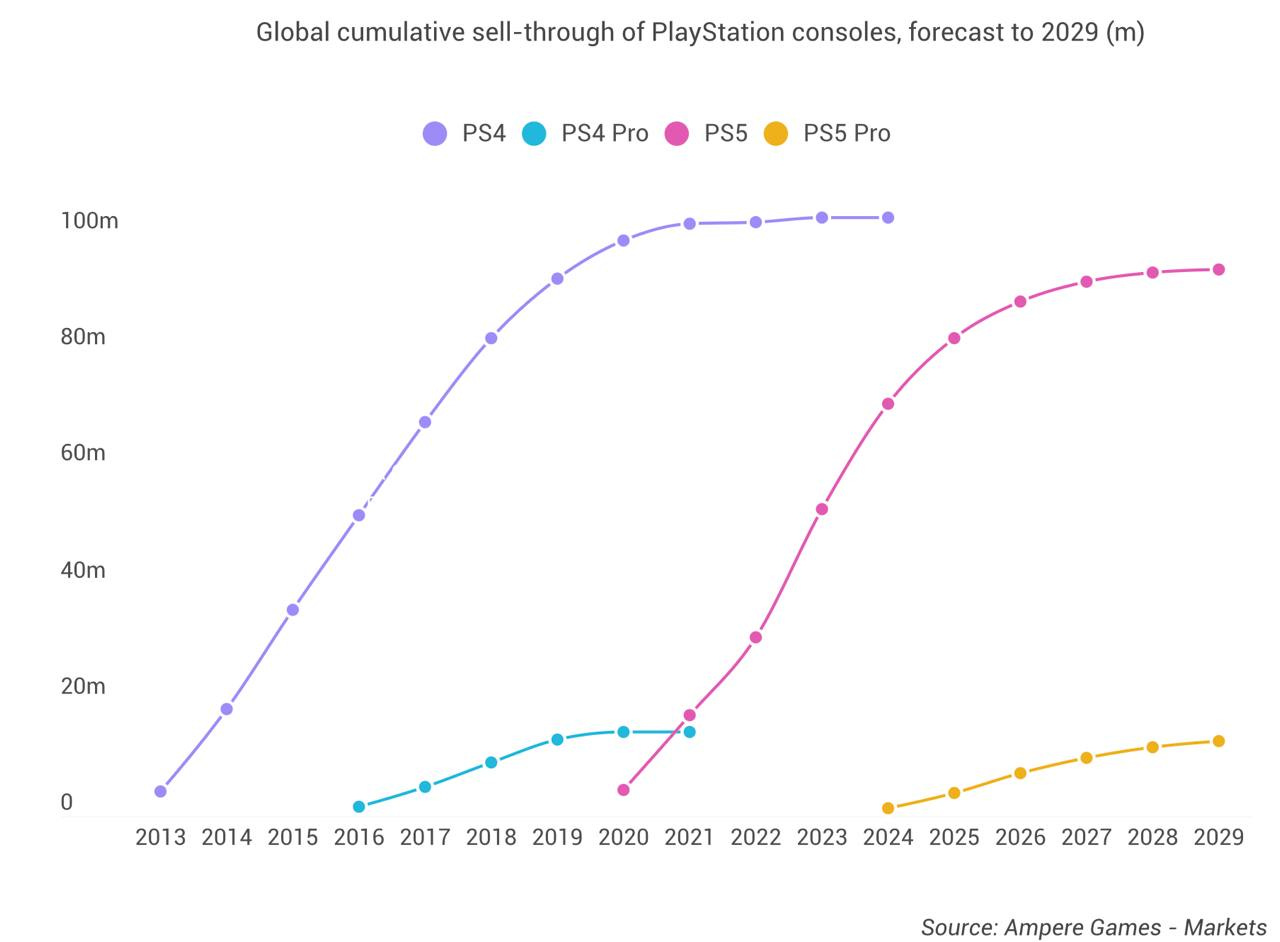

Ampere Analysis: PlayStation 5 Pro will sell worse than PS4 Pro

- Analysts expect Sony to sell 1.3 million PS5 Pro units by the end of the year, compared to 1.7 million PS4 Pro units sold during its release window.

- According to Ampere Analysis, total sales of the PS4 Pro reached 14.5 million units, accounting for 12% of all PS4 sales. It is anticipated that the PS5 Pro will achieve similar percentage, with an estimated 13 million units sold by the end of 2029.

- The price difference between the PS5 Pro and the standard PS5 ranges from 40% to 50%, depending on the region. For the PS4 Pro, this difference was 33%.

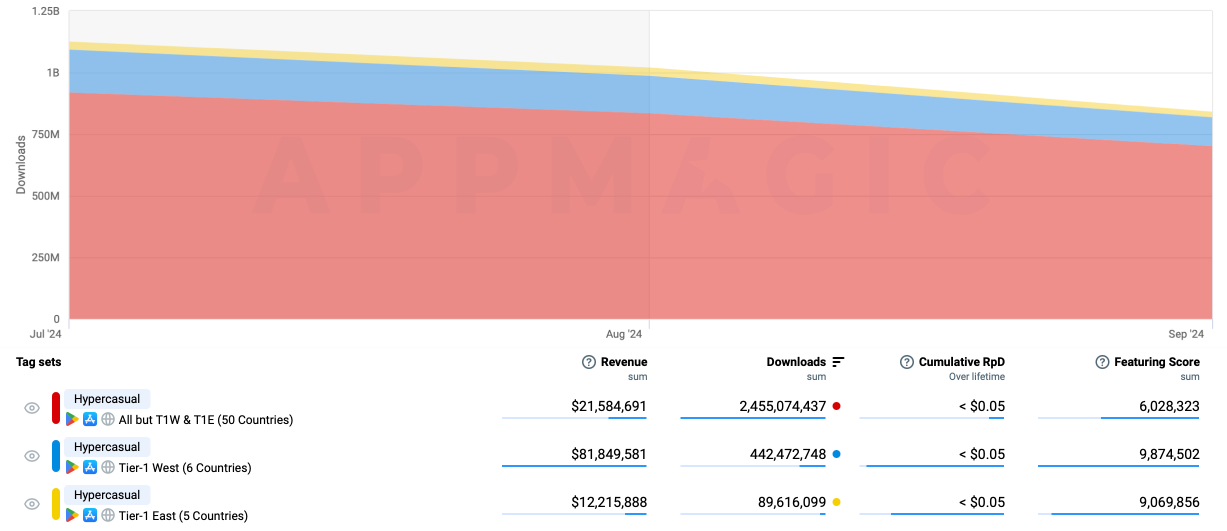

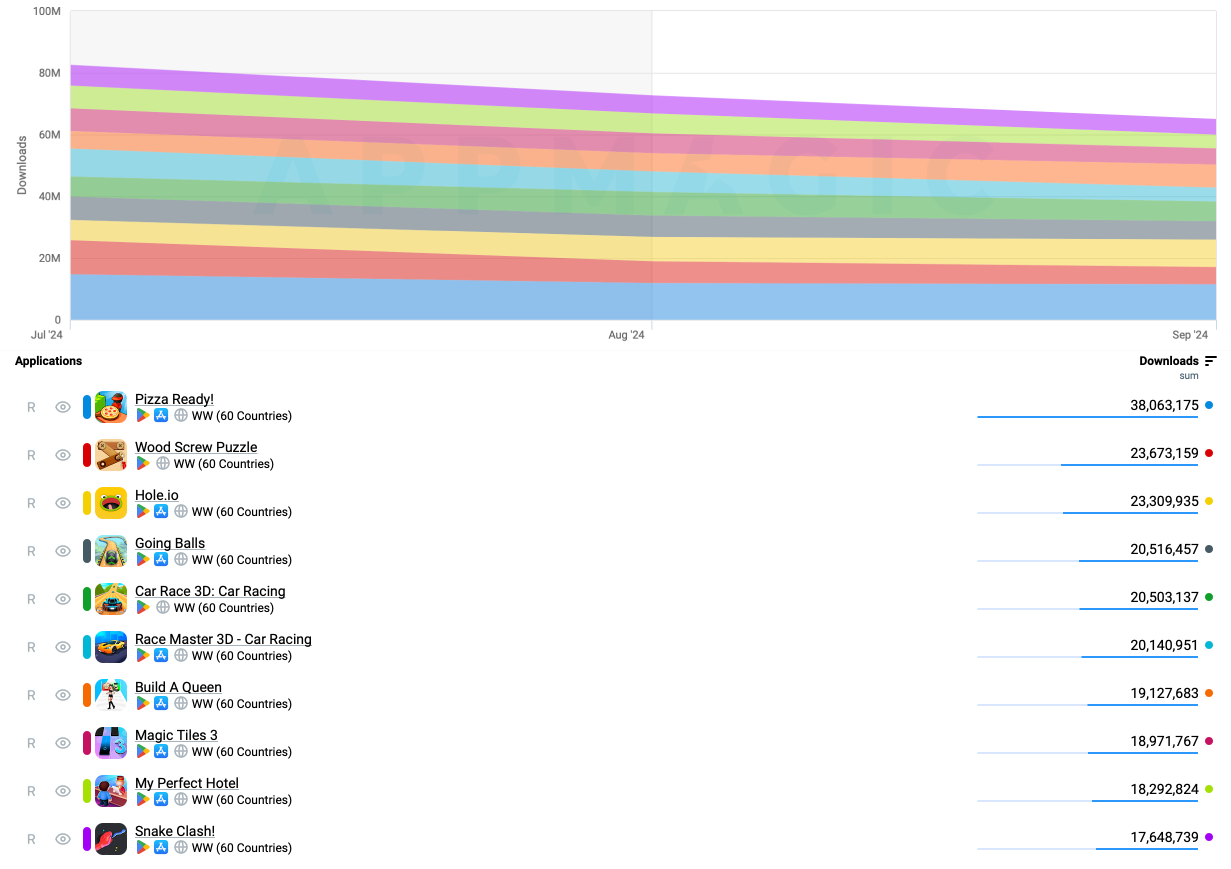

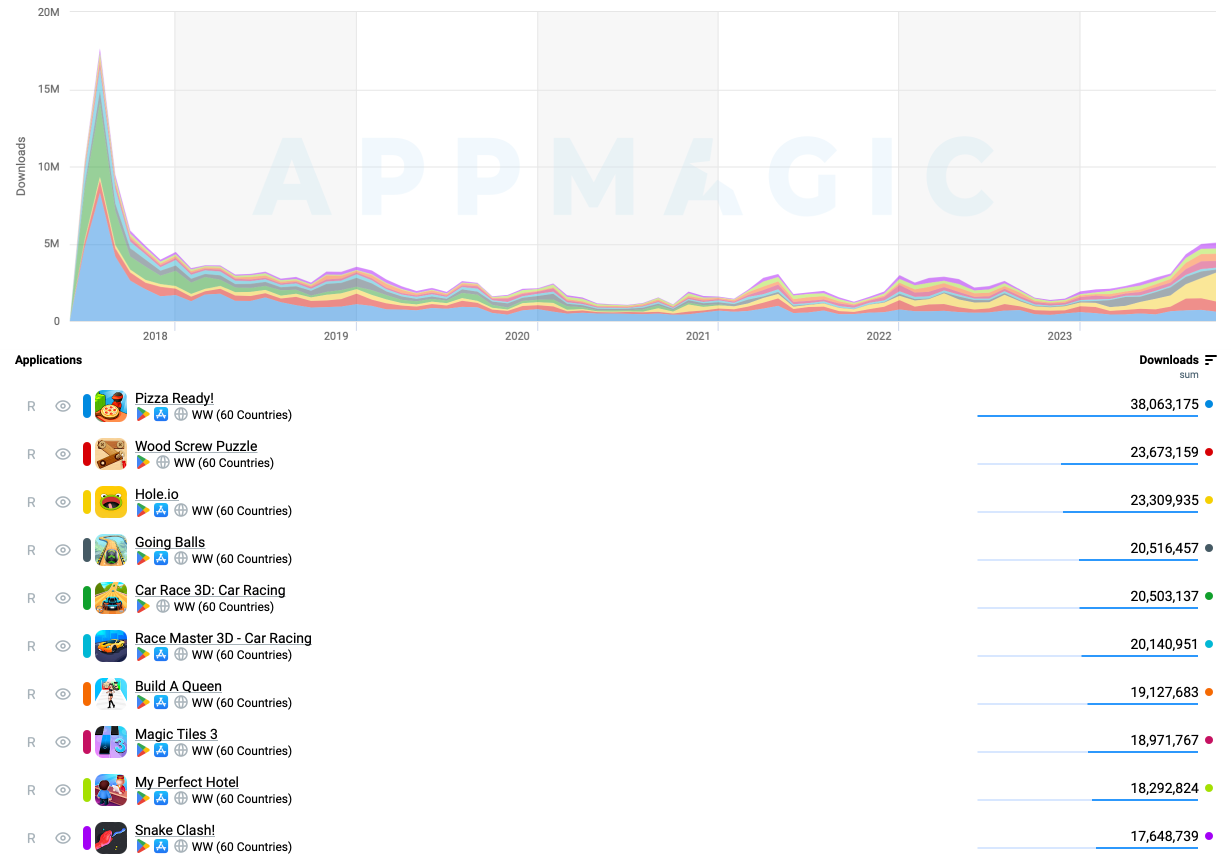

AppMagic: Hypercasual Market in Q3 2024

Market Data

- In Q3 2024, hyper-casual games were downloaded 2.98 billion times, 12% less than in the previous quarter.

- Comparing Q3 2024 to Q3 2023, there was an overall decline of 11%. Downloads in Western Tier-1 countries fell by 8%, while in Eastern Tier-1 countries, the numbers remained steady.

Top-10 Games by Downloads

- The trend of declining downloads among the top 10 games is evident in Q3 2024.

- Two new projects made it into the top 10. One is Hole.io by Voodoo, with 23 million downloads in Q3 2024. Interestingly, the game was initially released in 2018, when it was downloaded 25 million times. Its resurgence in popularity is largely due to a surge in downloads from India and Brazil.

- Snake Clash! is the second newcomer in the top 10, with 18 million downloads in Q3 2024. It was released by Supercent in May 2023.

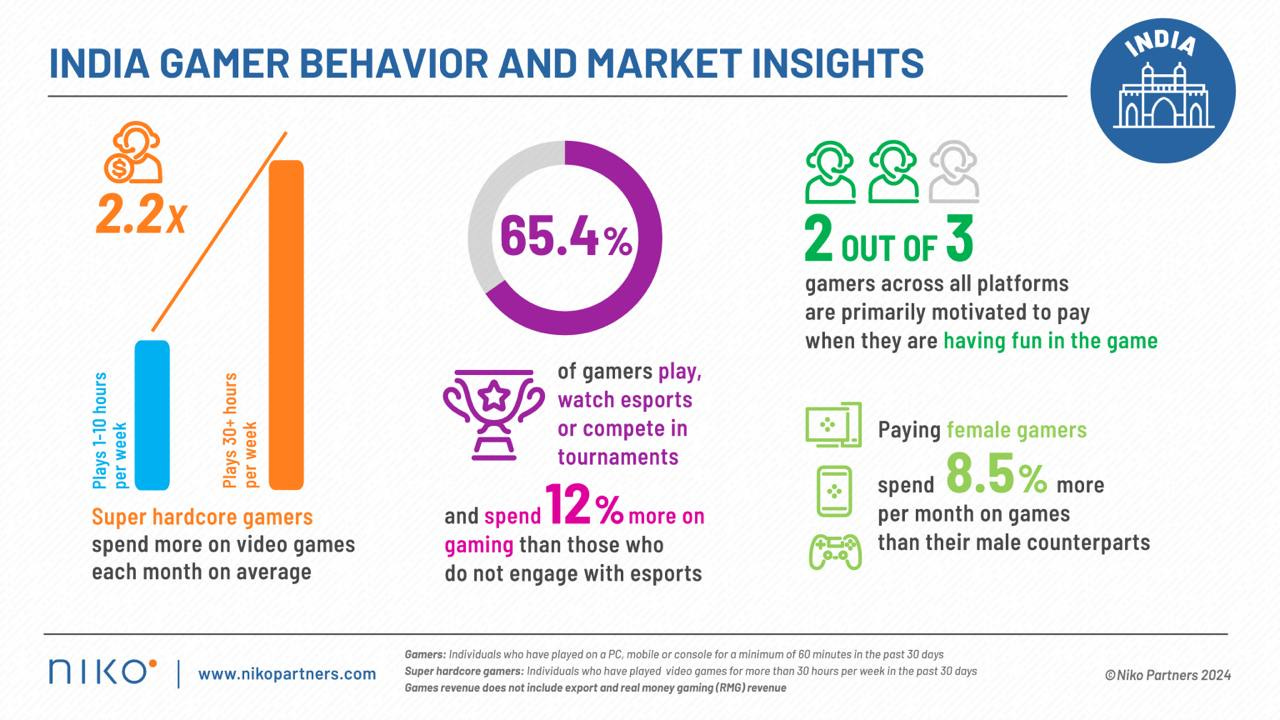

Niko Partners: India Gaming Market in 2024

Market Overview

-

By the end of 2023, the Indian gaming market was valued at $830 million, representing a 15.9% increase from 2022.

- Niko Partners analysts expect the Indian market to grow by 13.6% to reach $943 million in 2024. By the end of 2028, it is projected to reach $1.4 billion, with a compound annual growth rate of 11.1%.

- Currently, the Indian market is the fastest-growing among all those tracked by Niko Partners.

- Mobile games make up 77.9% of the market revenue, PC games account for 14.5%, and console games make up 7.7%.

- The gaming audience in India reached 453.9 million people in 2023. This number is expected to grow to 508.6 million in 2024 and reach 730.7 million by 2028, with an average annual growth rate of 10%.

❗️Niko Partners does not include the Real-Money Gaming (RMG) segment in India, which accounts for more than half of the gaming revenue.

Indian Player Behavior

-

77.3% of PC gamers reported spending more time on games in Q1 2024 compared to the previous year.

- Female players who make in-game purchases spend 8.5% more than male players.

- Niko Partners analysts expect that as disposable incomes rise and high-end devices become more accessible, ARPU in India will increase.

- 57% of mobile gamers in India have played Battle Royale games in the past three months, with Battlegrounds Mobile India and Garena Free Fire leading the pack. Six out of ten paying users in these games purchase a Battle Pass.

- 65.4% of Indian gamers engage with esports, and these users tend to spend 12% more on games.

- 57.2% of Indian players discover new games through streamers and influencers.

- Social features and the ability to play together are key factors for Indian gamers when choosing a game.

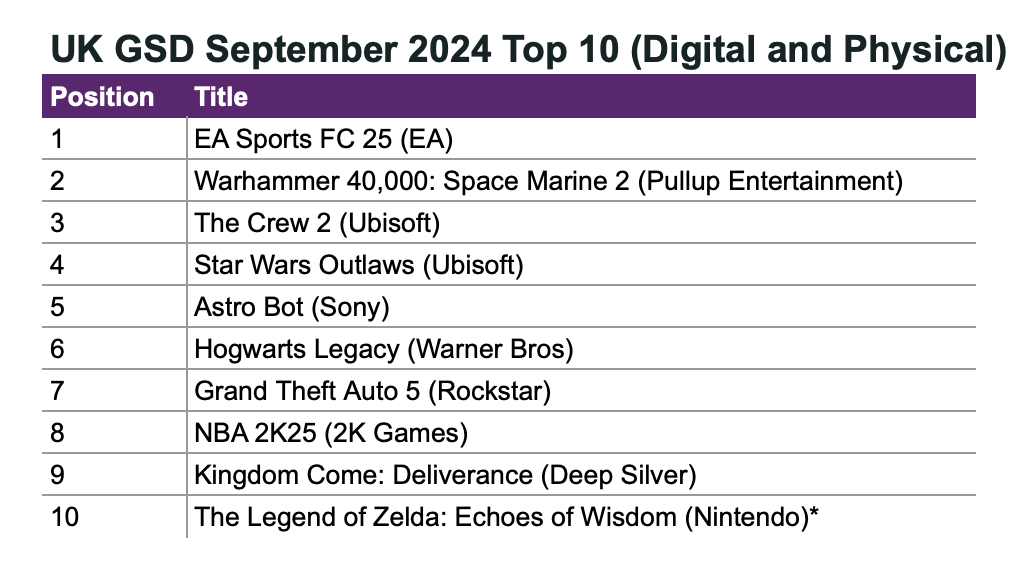

GSD & GfK: UK PC/Console games market grew in September'24 amid new releases

Game Sales

- In September, 3.88 million PC and console games were sold in the UK, an 8% increase from last year.

- Six new games entered the top 10 in sales.

- EA Sports FC 25 is leading the chat. The game launched 4.6% lower than its predecessor in the series, but premium early access (which is more expensive) sold better. From a revenue perspective, EA might have still gained.

- Warhammer 40,000: Space Marine 2 debuted in second place, just behind the football simulator. It is currently the third best-selling new game in the UK, following EA Sports FC 25 and Helldivers II.

- The Crew 2 ranked third because Ubisoft been selling it for £0.99.

- Star Wars Outlaws launched in fourth place, which is hardly a success. The game's initial sales in the UK were weaker than Avatar: Frontiers of Pandora, released in December 2023.

- In fifth place is Astro Bot, selling 24% better than Ratchet & Clank: Rift Apart, released in 2021.

- NBA 2K25 launched 14% lower than its predecessor.

- The last newcomer in the top 10 was The Legend of Zelda: Echoes of Wisdom. After a week of sales, it performed 14% worse than the remake of The Legend of Zelda: Link’s Awakening. However, it's important to note that Nintendo does not disclose digital sales figures for its games.

Hardware Sales

-

Over 126,000 consoles were sold in the UK in September, 35% less than last year.

- PS5 was the best-selling console by a significant margin, followed by the Xbox Series S|X in second place, and Nintendo Switch in third.

- The PS5 Digital had its second-best month ever in the UK (the best was in December 2023). It's unclear whether this is due to Astro Bot, the numerous releases, or just a coincidence.

- Console sales in the UK fell 32% year-over-year in the first three quarters.

- 743,000 accessories were sold in September, an 11% increase from last year. The black and white DualSense controllers held the top two spots.

- The PS5 disc drive ranked 8th among accessories in revenue and 21st in units sold.

- The PlayStation Portal was the top-grossing accessory and ranked 8th in units sold in the first nine months of 2024.

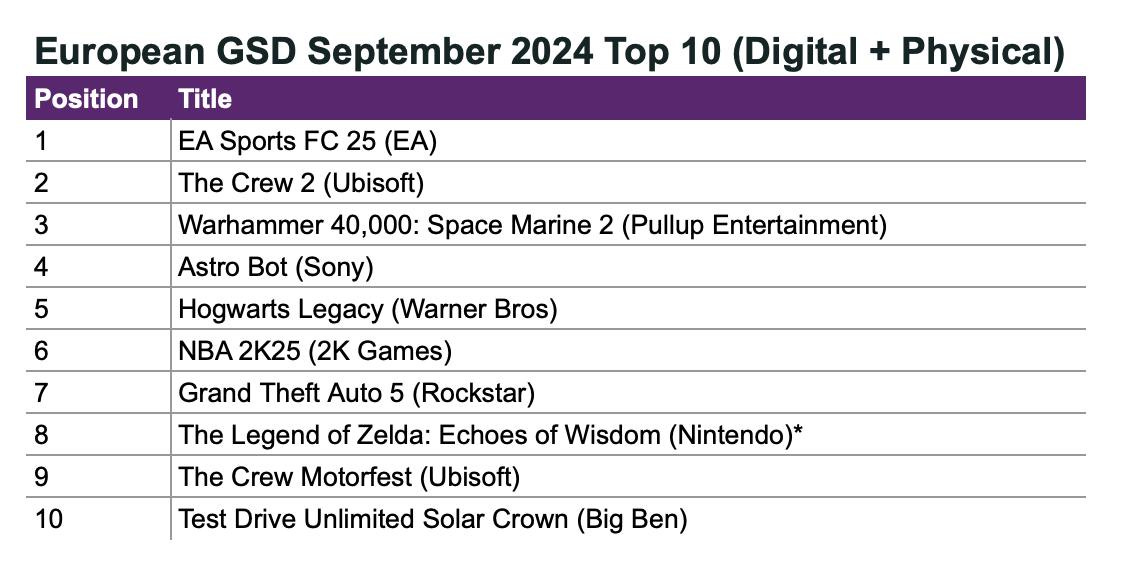

GSD & GfK: PC/Console game sales in Europe increased by 20% in September'24

Game Sales

- 17.6 million PC and console games were sold in Europe last month, 20% more than in September 2023.

- EA Sports FC 25 topped the chart, launching 2% lower than the previous installment in the series. However, sales of the premium (and more expensive) version of the game increased by 10% compared to last year, so EA likely benefited in revenue.

- The Crew 2 ranked second due to a promotion where the game was sold for €1.

- Warhammer 40,000: Space Marine 2 secured third place. Like in the UK, the game ranked 3rd in the 2024 new game sales chart. It surpassed Dragon's Dogma 2, The Last of Us Part 2: Remastered, and Final Fantasy VII Rebirth. It also became the fastest-selling game in the franchise's history in Europe.

- Astro Bot had a strong start. Compared to similar titles, its launch sales were 34% higher than Sonic Frontiers and 52% better than Crash Bandicoot 4: It's About Time. The European launch also outperformed Ratchet & Clank: Rift Apart by 7.5%.

- Other new entries in the top 10 include NBA 2K25 (with sales 1% higher than NBA 2K24 over the same period) and The Legend of Zelda: Echoes of Wisdom. For the latter, Nintendo only shares physical sales data, which is 15% lower than the 2019 remake of The Legend of Zelda: Link's Awakening. However, digital sales are likely to have grown significantly since then.

- Harry Potter Quidditch Champions debuted at the 28th position in the chart.

Hardware Sales

- 335,000 consoles were sold in September in Europe, 18% less than last year.

- The PS5 leads by a wide margin, although its sales were 17% lower than last year. The Nintendo Switch is in second place (with a 1.5% YoY sales increase), while the Xbox Series S|X is in third, with sales plummeting by 58% compared to September 2023.

- 1.1 million accessories were sold in September, down 2.4% from last year. The DualSense controller was a best-seller.

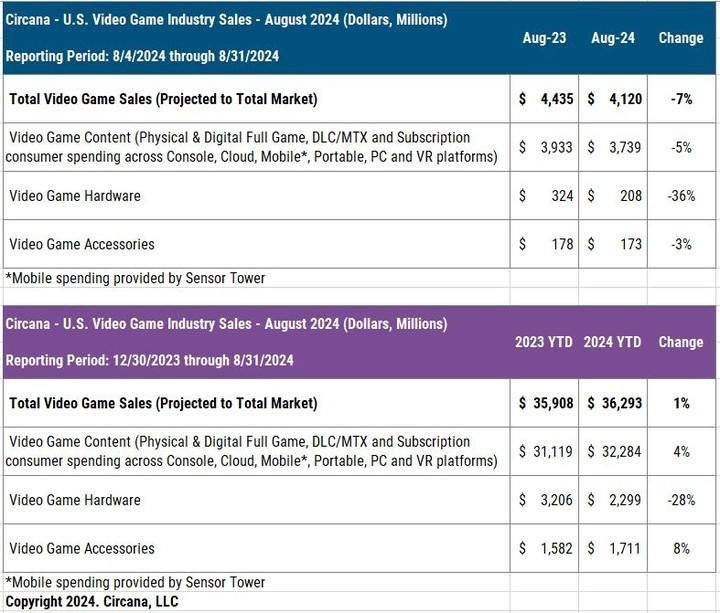

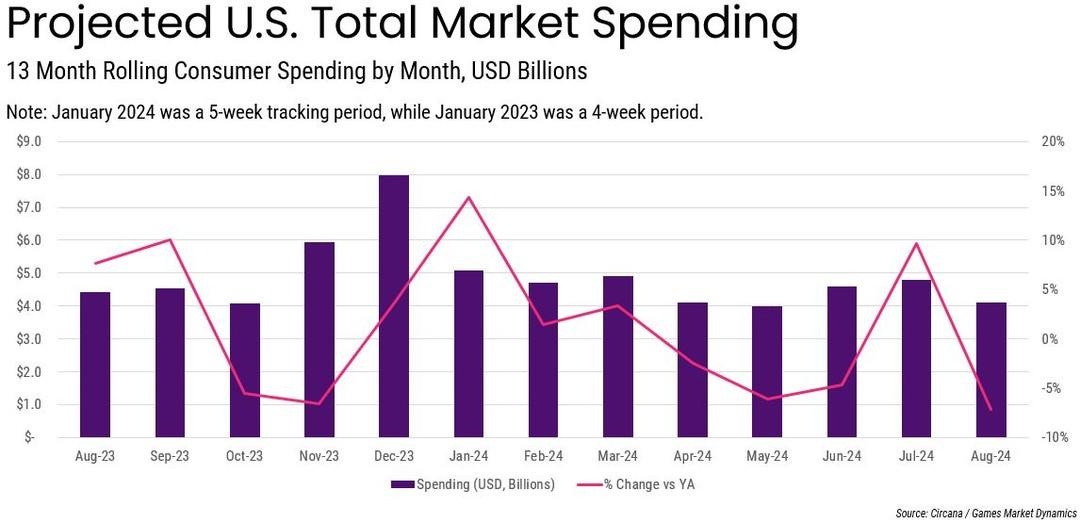

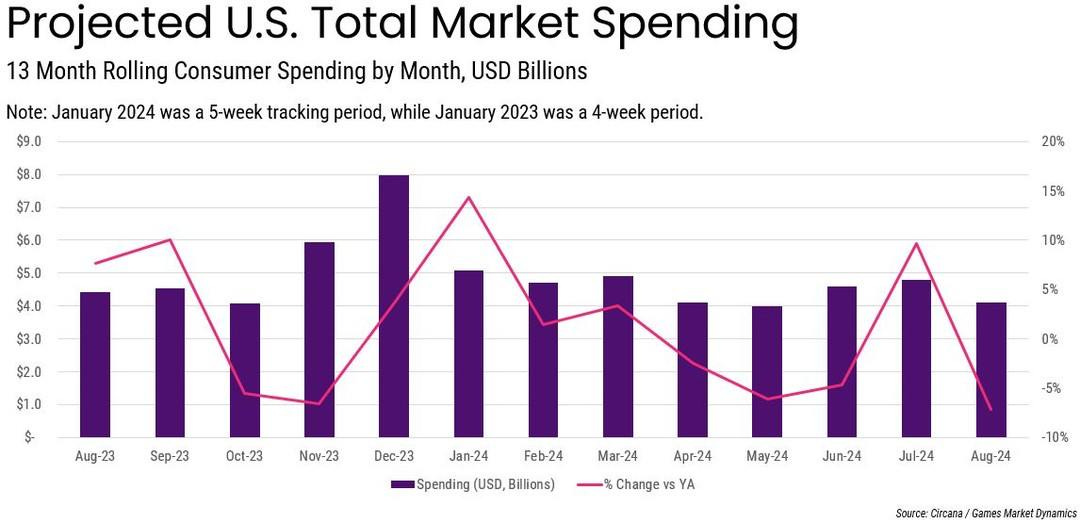

Circana: U.S. Gaming Market Declined by 7% in August 2024

Market Overview

-

American consumer spending on gaming products in August reached $4.12 billion, down 7% compared to the previous year.

- While mobile market revenue grew by 5%, it wasn't enough to reverse the negative trend. Total content sales dropped to $3.739 billion (-5% overall).

- Hardware sales plummeted by 36% year-over-year. All consoles declined at least 34%, with the biggest drop for the Nintendo Switch (-41% YoY). The PS5 was the best-selling system in both revenue and unit sales.

- Accessory sales decreased by 3%. PlayStation Portal sales (and the category of Remote Play devices) increased, though it’s unclear what other devices contributed besides Sony's. Gamepad sales fell by 10%. The DualSense controller was the top seller in terms of revenue, while PlayStation Portal led the category over the first 8 months of 2024.

- As of August 2024, the U.S. market size stood at $36.3 billion. For the first 8 months of the year, results are 1% better than the same period in 2023. There was growth in content (+4% YoY, thanks to the mobile market) and accessories (+8% YoY). However, hardware sales were down 28% compared to 2023.

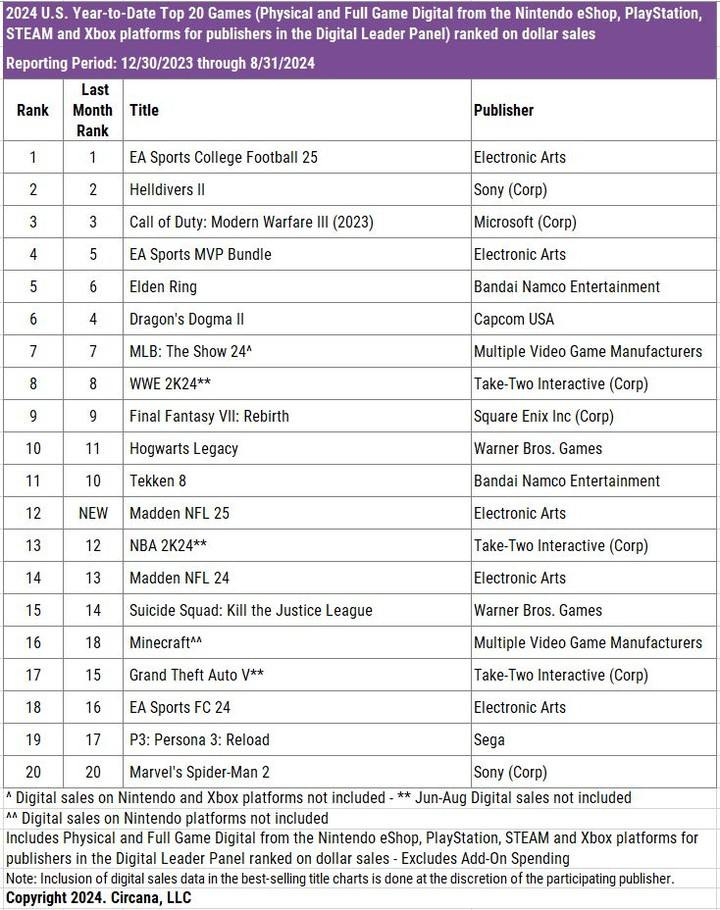

Best-Selling Games

- Madden NFL 25 debuted at the top of the U.S. market. This marks the 25th consecutive year that the game has been the best-selling title in August, starting with Madden NFL 2001 in August 2000.

❗️Black Myth: Wukong did not make the chart because the publisher chose not to share digital sales data—only physical copies were considered. However, the game ranked 12th in MAU in the U.S.

- Second place went to EA Sports College Football 25, third to Star Wars: Outlaws (new release), and fourth to the EA Sports MVP Bundle (which includes Madden NFL 25 and EA Sports College Football 25). It was an exceptionally successful month for EA.

- Other new releases in the month included Visions of Mana (10th place) and Gundam Breaker 4 (11th place).

- For overall 2024 sales, EA Sports College Football 25 leads, followed by Helldivers II and Call of Duty: Modern Warfare III. Although Madden NFL 25 launched recently, it has already climbed to 12th place.

- The top mobile games in August were MONOPOLY GO!, Roblox, and Royal Match. Sensor Tower analysts noted that MONOPOLY GO! revenue was down 32% compared to its peak in March 2024, but it still managed to top the chart.

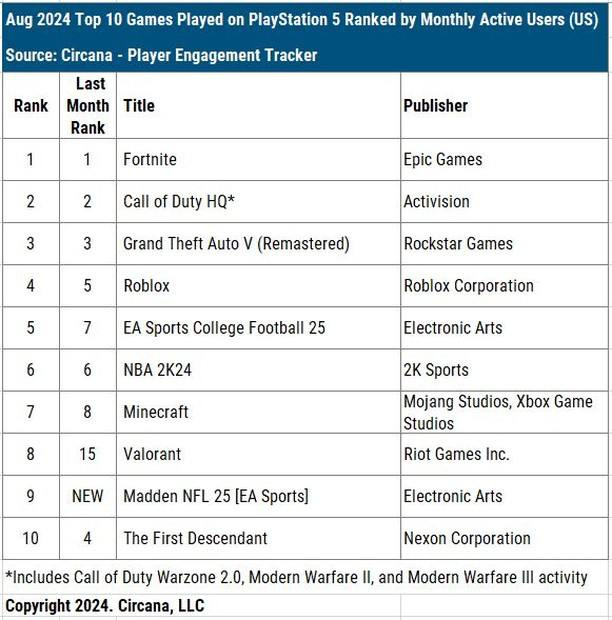

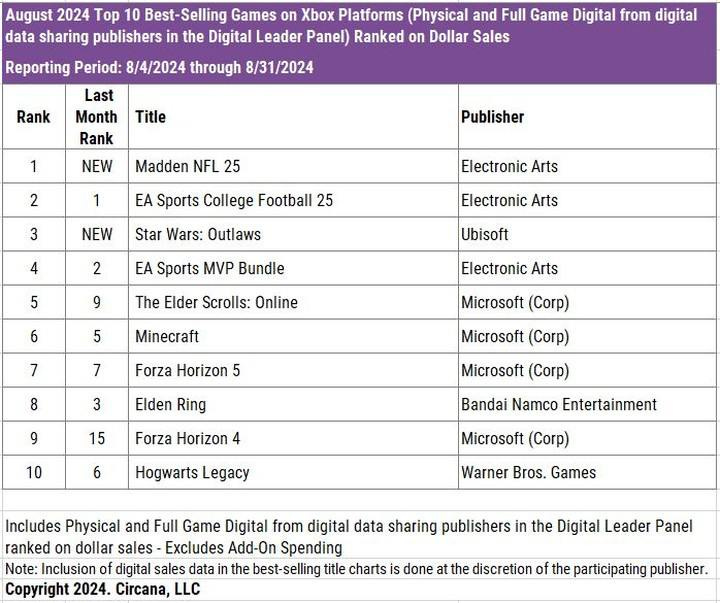

PC/Console Charts

- On PlayStation, three new games entered the top 10: Madden NFL 25 (1st place), Star Wars: Outlaws (3rd place), and Visions of Mana (10th place).

- There were also changes in the MAU ranking. Valorant climbed to 8th place, and Madden NFL 25 debuted at 9th. The top spots were still held by Fortnite, Call of Duty, and GTA V.

- The Xbox sales chart almost mirroring PlayStation’s, except that Visions of Mana didn’t make the list.

- The top MAU game on Xbox was Mafia: Definitive Edition, which joined Xbox Game Pass on August 13.

- Only physical copies are counted in the Nintendo Switch sales charts, and there were no major new releases.

- Deadlock became the MAU leader on Steam in August in the U.S., even though Valve did not heavily promote the game. Risk of Rain 2 climbed to 9th place.

Games and Numbers (October 2 - October 15, 2024)

PC/Console Games

- The Tomb Raider series has sold over 100 million copies. The series will celebrate its 28th anniversary on October 24.

- The development of Black Myth: Wukong cost $42.4 million, as reported by a Game Science representative at the Global Digital Trade Expo. The company also utilized tax credits amounting to $3.96 million. This figure does not include marketing expenses.

- Total sales of Detroit: Become Human have surpassed 10 million copies since its release in 2018.

- Hooded Horse shared its portfolio results for the last 12 months. The company's games have sold over 4.5 million copies, and their wishlist count has exceeded 9.5 million. The top sellers are Manor Lords (2.5 million copies), Against The Storm (1.2 million copies), and Workers & Resources: Soviet Republic (600,000 copies). The most wishlisted games are Falling Frontier (600,000 wishlists), Nova Roma (350,000), and Super Fantasy Kingdom (250,000).

- According to Niko Partners, Palworld has been purchased by at least 5 million people in China, making it a top-3 market alongside Japan and the US.

- Metaphor: ReFantazio, a new RPG from the creators of Persona, launched with great success, selling over one million copies within 24 hours.

- Insider Gaming reports that Star Wars: Outlaws has barely exceeded 1 million copies sold a month after its release.

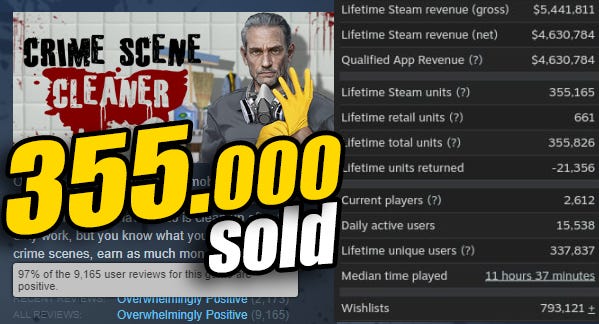

- Crime Scene Cleaner sold 355,000 copies on Steam within 60 days of its release, generating $5.4 million in revenue.

- The peak MAU for Fortnite was 110 million, as Tim Sweeney shared, during the last holiday season.

- More than 3 million players joined the new MMORPG Throne and Liberty from NCSOFT and Amazon Games within its first week.

- More than half a million people played Tiny Glade within two weeks of its release, according to a post from the developers.

- According to VGI, Deadlock has already surpassed 3.5 million wishlists.

Mobile Games

- According to Niko Partners, Genshin Impact has surpassed $5 billion in gross revenue in China.

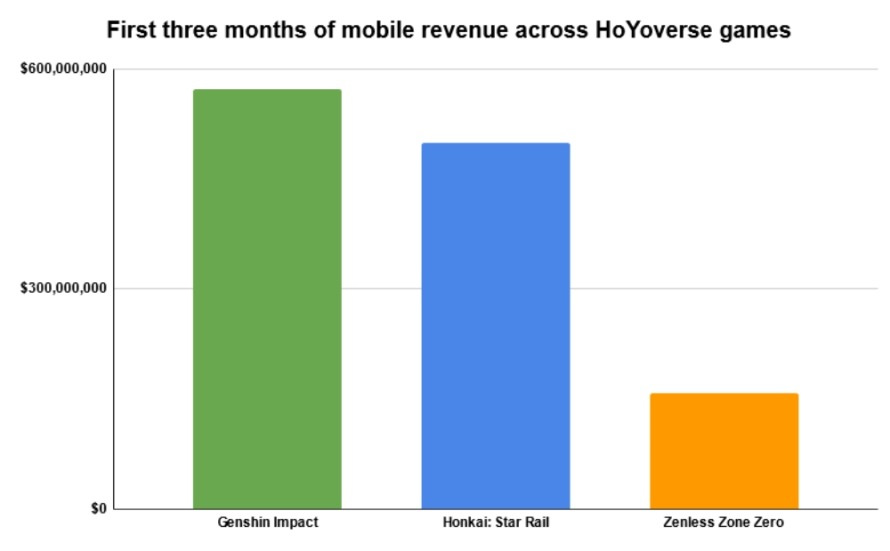

- Zenless Zone Zero generated over $150 million in mobile revenue in less than three months since its release. In comparison, Genshin Impact earned $572.1 million and Honkai: Star Rail $498.4 million in the same period.

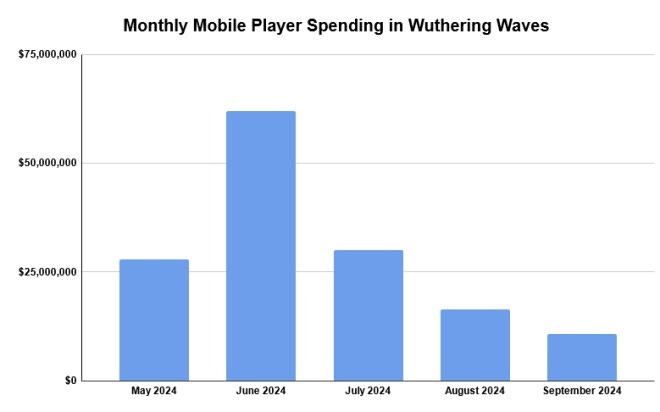

- Wuthering Waves has earned more than $150 million in its first five months. China and Japan account for 23% of this sum, South Korea 17%, and the US 15%. However, the game's trend appears to be declining.

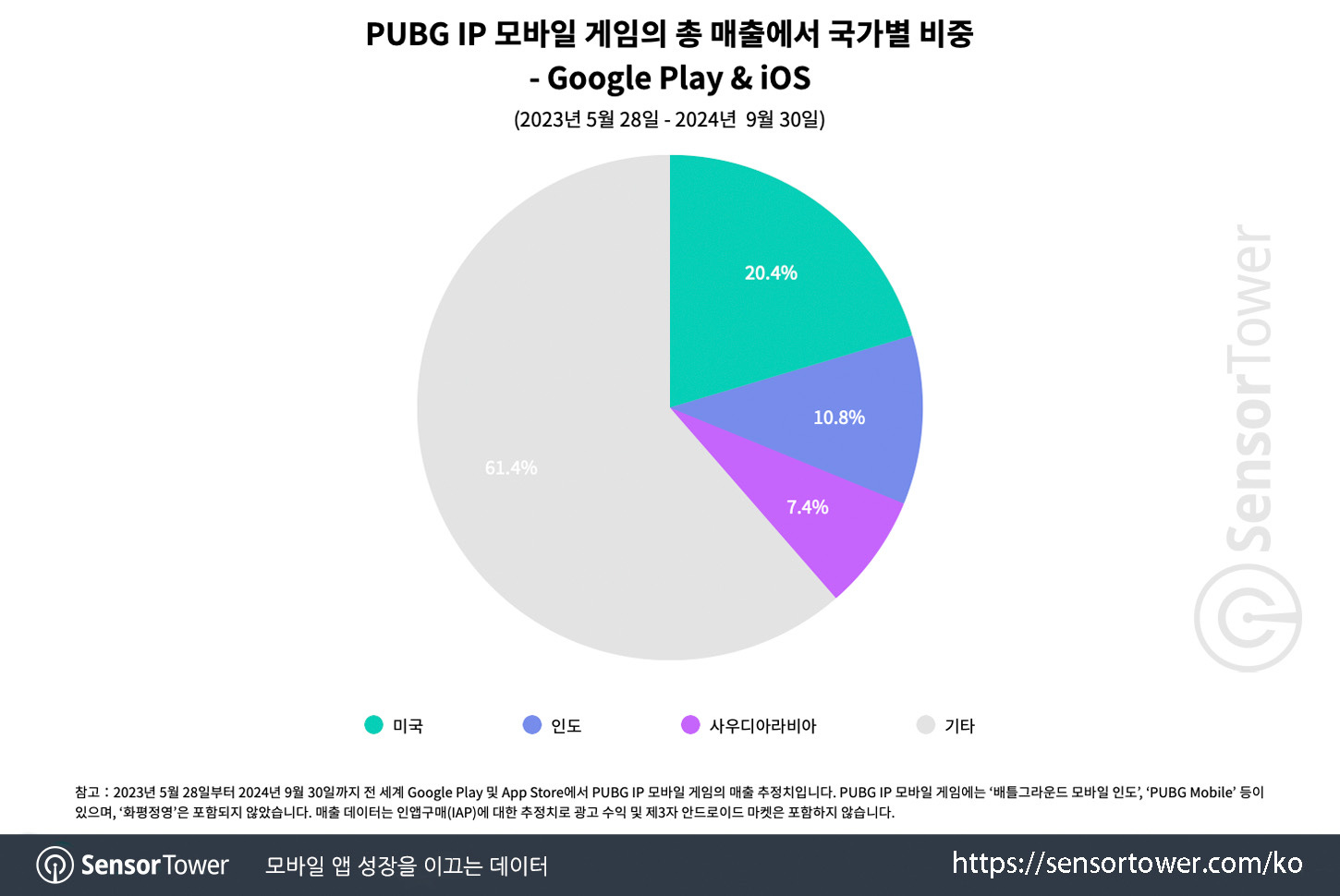

- India is the second-largest market for PUBG. In 2023, it accounted for 10.8% of the game's total revenue, while the US took the top spot with 20.4%. KRAFTON has earned over $200 million from the game in India.

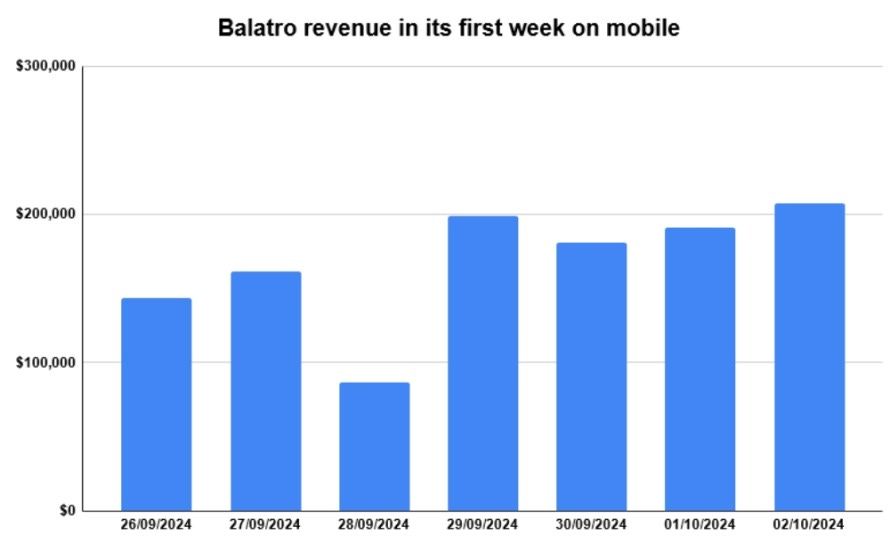

- The net revenue for Balatro on mobile devices approached $1 million within its first seven days, according to AppMagic. It was previously reported that the game was purchased over half a million times, with 60% of the revenue coming from the US.

Platforms

- Epic Games Store attracted 70 million players in September.

Transmedia

- The Fallout series has been watched by more than 100 million people worldwide.

InvestGame & GDEV: The History of Web3 Gaming Investments

InvestGame only considers private investments; public offerings and token sales are not included.

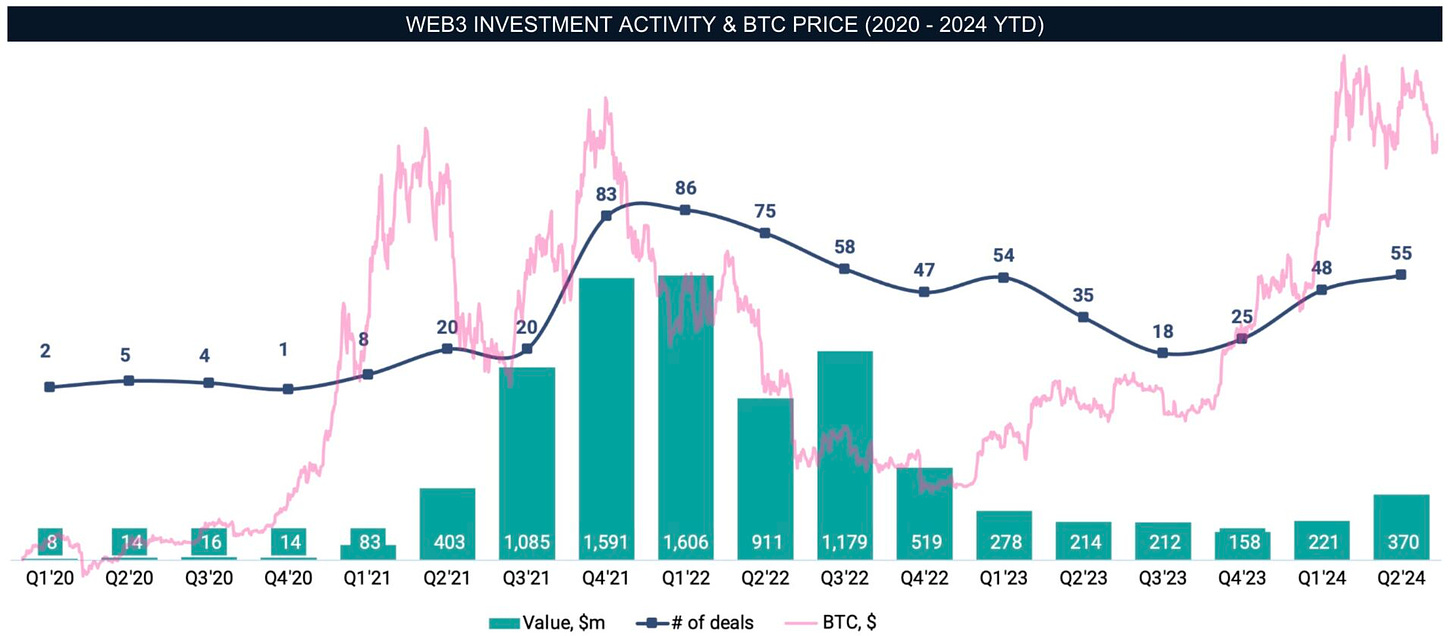

Market Overview

- A surge in investment activity began in late 2020 and early 2021, coinciding with the rapid rise in Bitcoin's value.

- The peak of investment activity occurred in Q1 2022, with 85 publicly announced deals totaling $1.6 billion.

- After that, the market declined, accompanied by significant events: in March 2022, the Ronin network from the creators of Axie Infinity was hacked; LUNA crashed in May 2022; and the crypto exchange FTX shut down at the end of the year. Business activity reached its lowest point in Q3 2023, with 18 deals worth $212 million. The lowest point regarding money invested was in Q4 2023, at $158 million.

- There is no direct correlation between Bitcoin's value and business activity in the market. Since late 2023, Bitcoin's value has steadily increased, but the Web3 investment market hasn't followed suit, indicating deeper fundamental issues.

Web3 Market Investment Structure

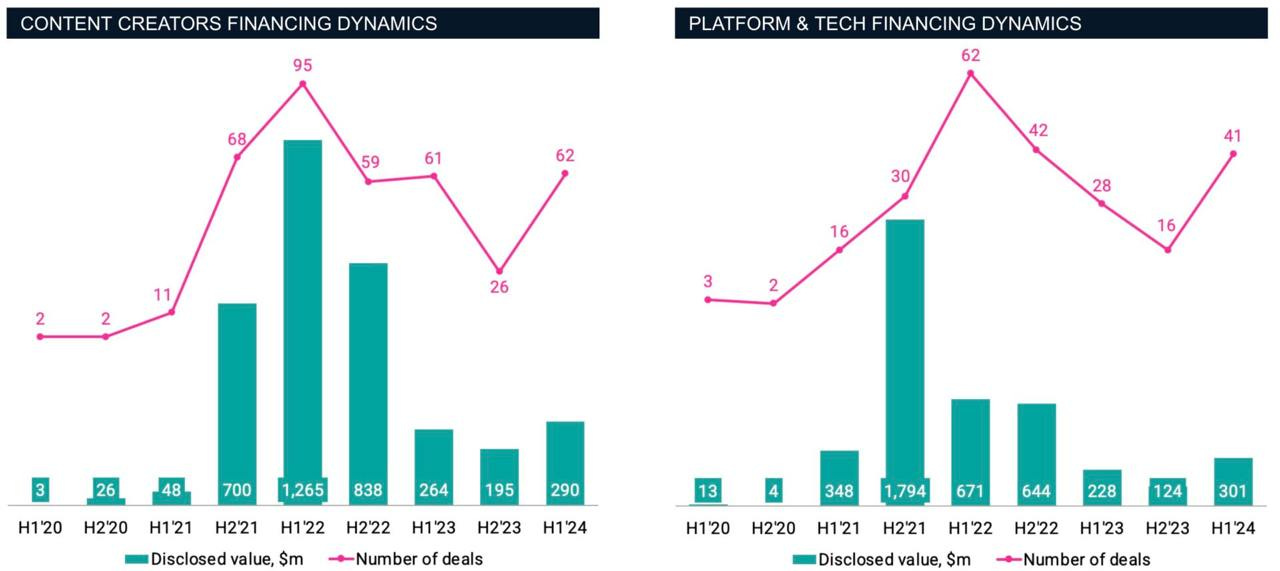

- Crypto gaming startups can be divided into two categories: content (games) and platform/tech developers.

- In 2020, there were 9 public deals (4 content-focused, 5 platform-focused) totaling $46 million.

- In 2021, the number of publicly announced deals increased to 125 (79 content-focused, 46 platform and technology-focused), with a total deal value of $2.9 billion.

- The peak of Web3 startup deals occurred in 2022, with 258 deals (154 content-focused, 104 platform-focused) totaling $3.418 billion.

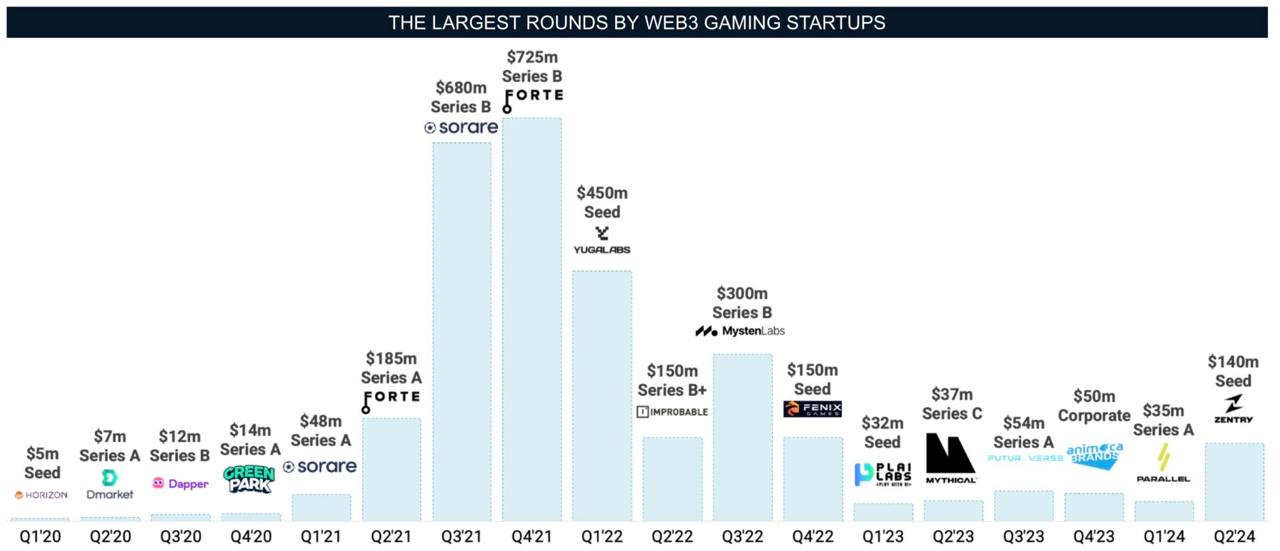

- The most notable VC deals during the market's peak were Forte, Sorare, Yugulabs, and Mystery Labs, which attracted nearly $2.4 billion, accounting for 30% of all investments in crypto gaming startups from 2020 to 2024.

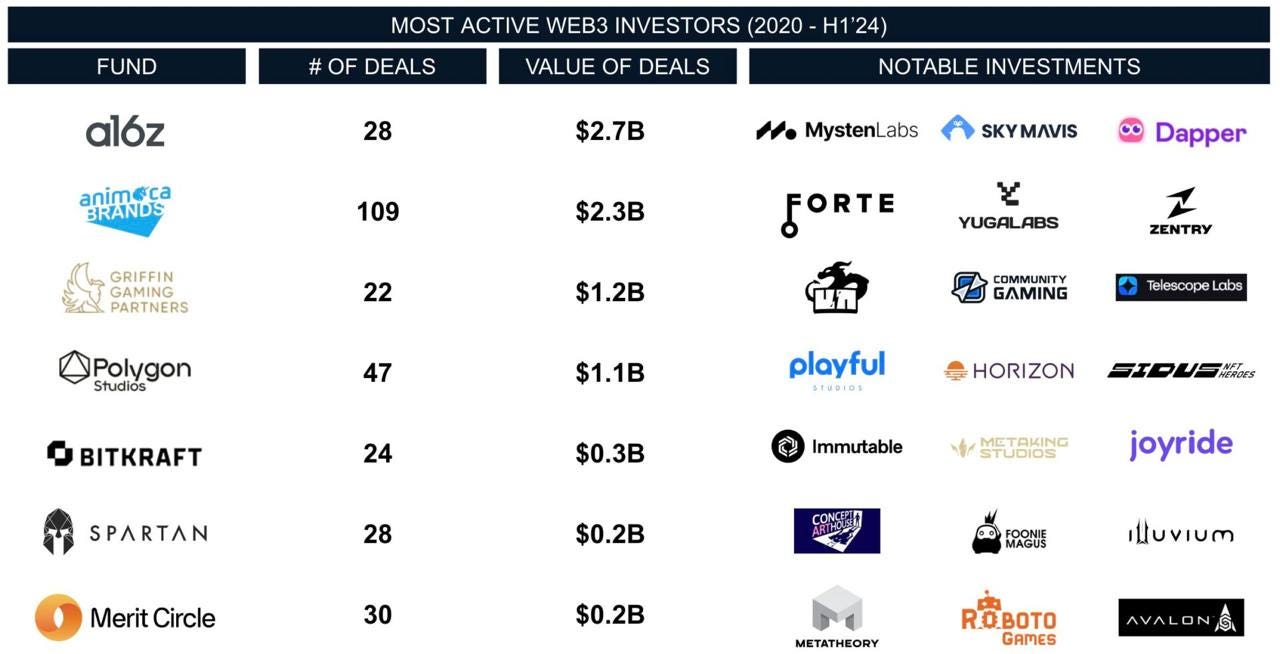

Most Active Investors

- Animoca Brands is the most active crypto investor in terms of the number of investments (109 disclosed deals), with a total investment of $2.3 billion.

- However, Andreessen Horowitz (a16z) holds the record in terms of deal value, with 28 deals totaling $2.7 billion.

- Other notable investors in the market include Griffin Gaming Partners (22 deals worth $1.2 billion) and Polygon (47 deals worth $1.1 billion).

Exits

- Many crypto companies have attracted venture investor interest, but there have been relatively few M&A deals due to the industry's early stage and the need to deliver on promises.

- The largest deal was the acquisition of SundayToz by Wemade for $115 million.

- Animoca Brands has conducted at least 6 M&A deals, but their values remain undisclosed.

- Between 2020 and 2024, InvestGame tracked a total of 33 M&A deals worth $146 million.

Video Game Insights: Indie Games on Steam in 2024

Market Overview

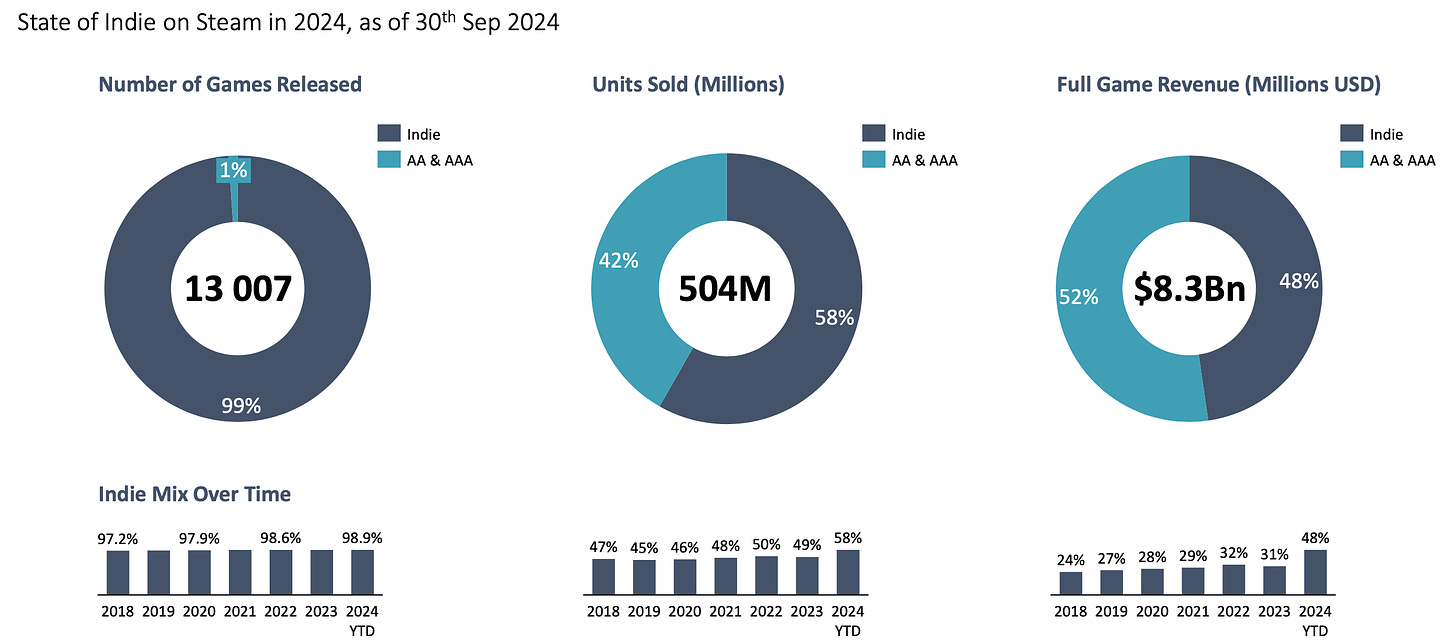

- 99.9% of all games released on Steam are indie games.

- As of the end of September 2024, indie games account for 58% of all copies sold on Steam, which is a record high since 2018.

- In terms of revenue, indie games also make up 48% of all money generated on Steam. The previous record was in 2022 (32% of all revenue). This means indie games earn as much on Steam as AA/AAA releases.

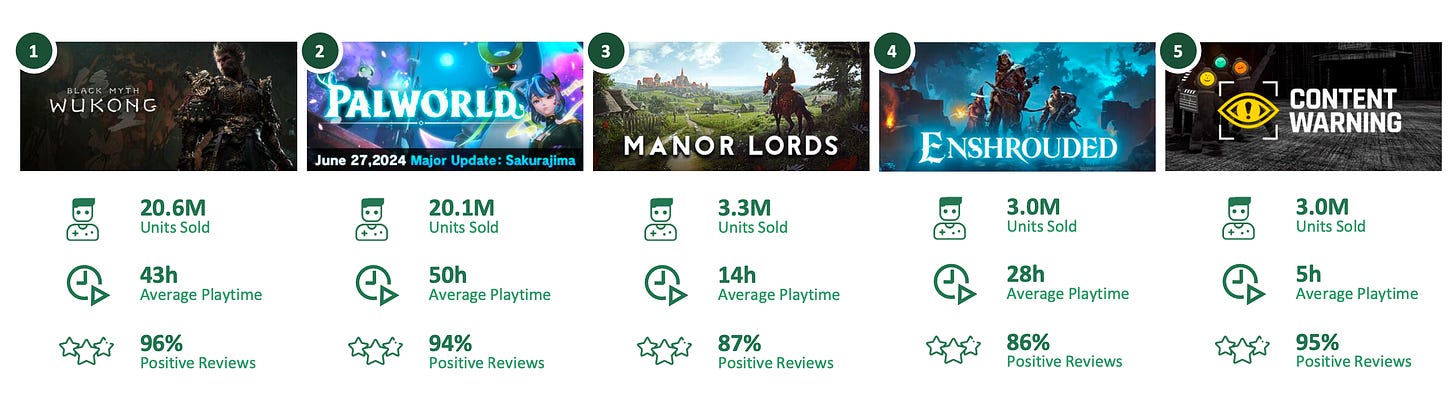

- The most successful indie releases this year include Black Myth: Wukong (20.6 million copies sold), Palworld (20.1 million copies), Manor Lords (3.3 million copies), Enshrouded (3 million copies), and Content Warning (3 million copies).

❗️VGI notes that the concept of "indie games" is becoming increasingly blurred in today’s market. The quality of these games can match that of AAA releases (Black Myth: Wukong), and what appear to be indie projects may actually be backed by large companies (Dave the Diver). For VGI's criteria on indie games, see here.

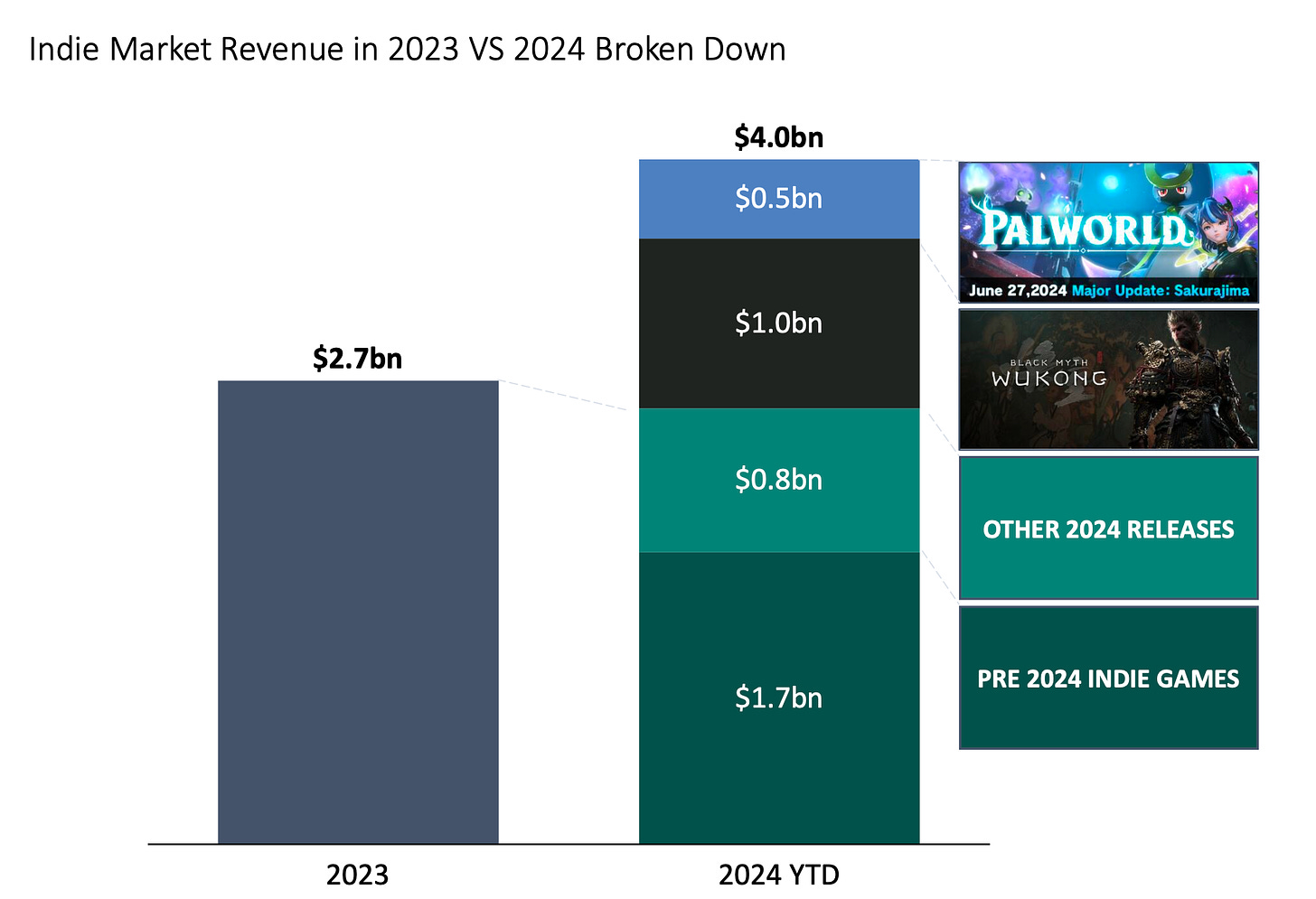

Indie Market Growth

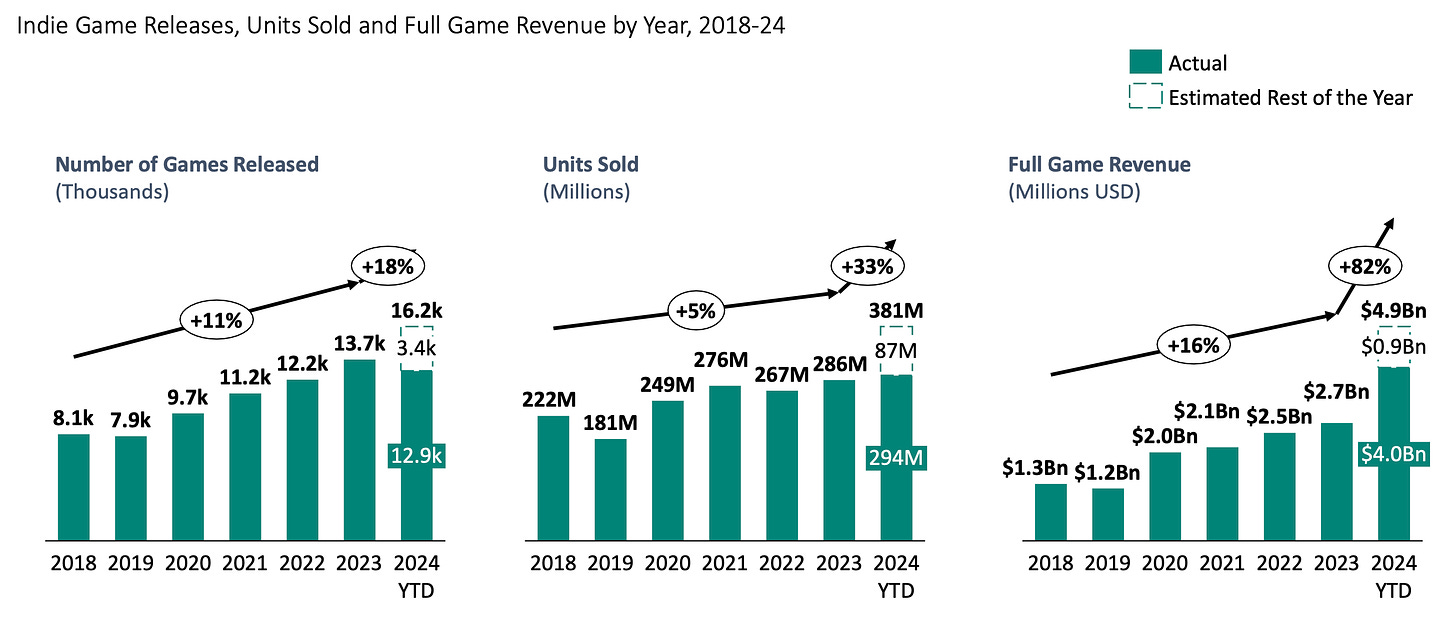

- The average annual growth rate of the indie market by the number of games was 11% up to 2024. In 2024, the number of games is expected to be 18% higher than the previous year.

- The average annual growth rate in terms of copies sold was 5% until 2024, and in 2024, this figure is expected to increase to 33% year-over-year (YoY).

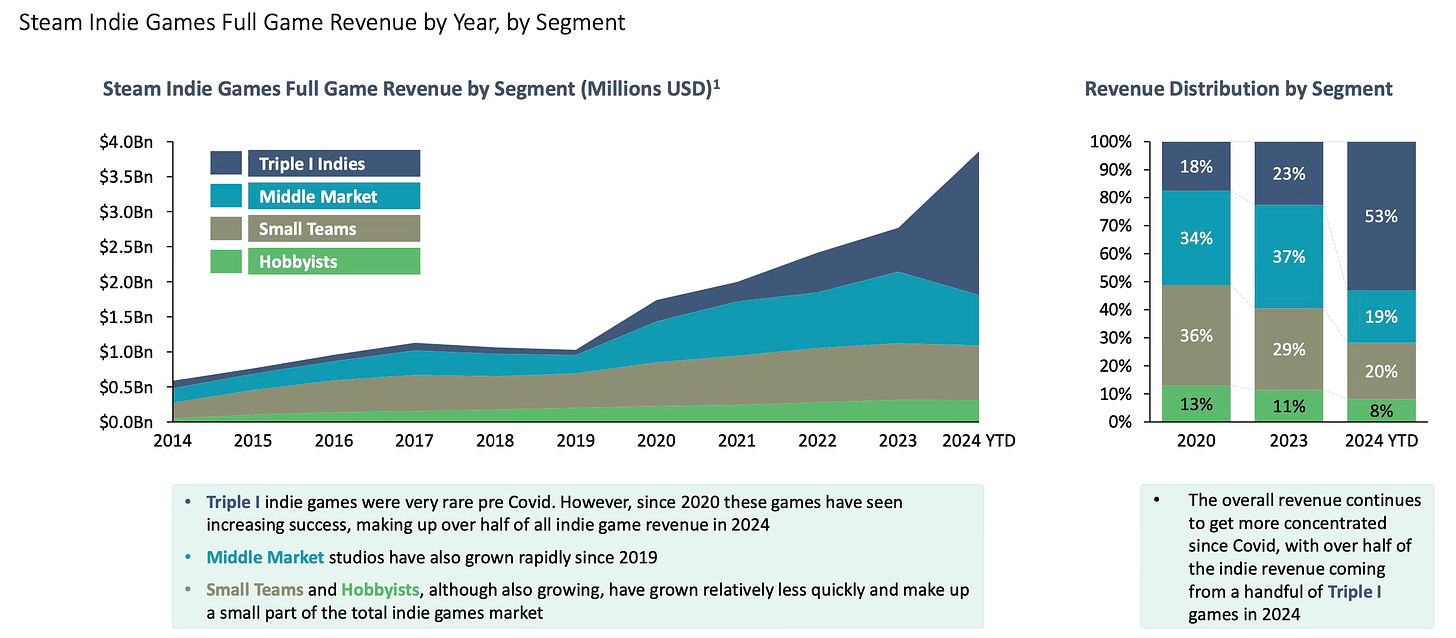

- Revenue grew at an average rate of 16% annually from 2018 to 2023. In 2024, revenue growth is expected to reach 82% YoY.

- The majority of revenue in 2024 came from two projects: Black Myth: Wukong ($1 billion) and Palworld ($500 million). All other indie games released in 2024 earned less than Black Myth: Wukong alone ($800 million). Indie games released before 2024 accounted for 43% of all revenue.

❗️If we exclude Black Myth: Wukong, the market growth in 2024 would be 11%—lower than the average annual rate from 2018 to 2023.

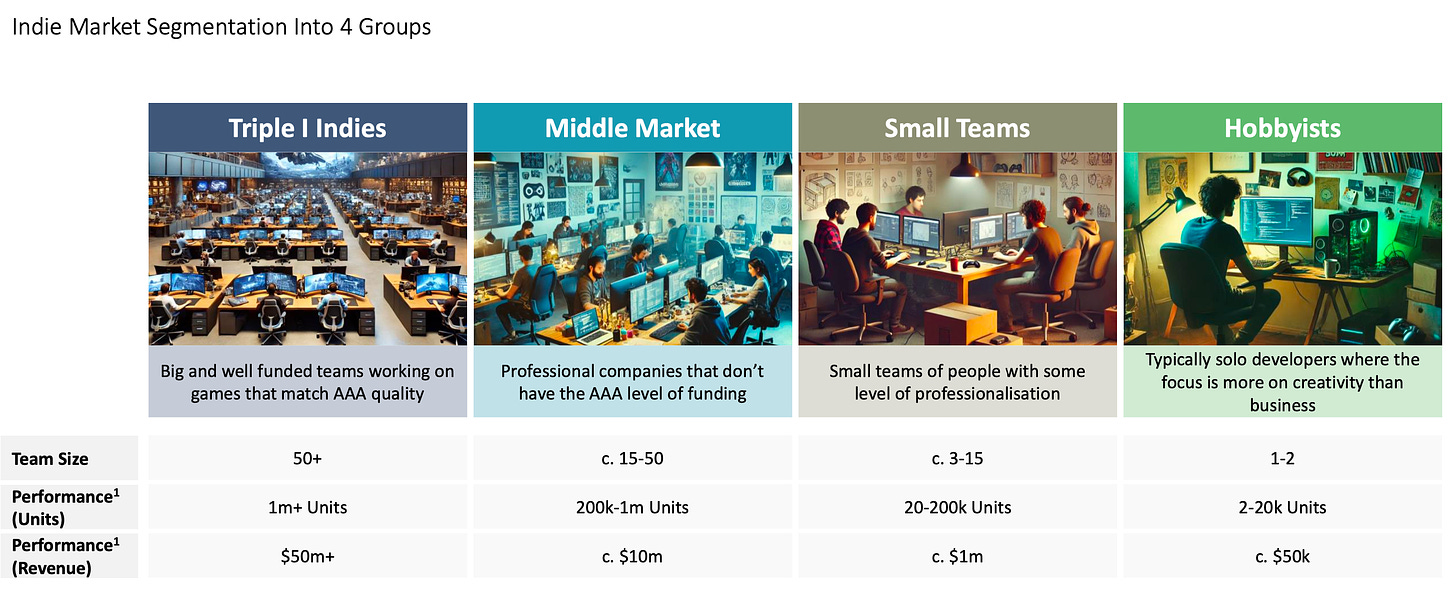

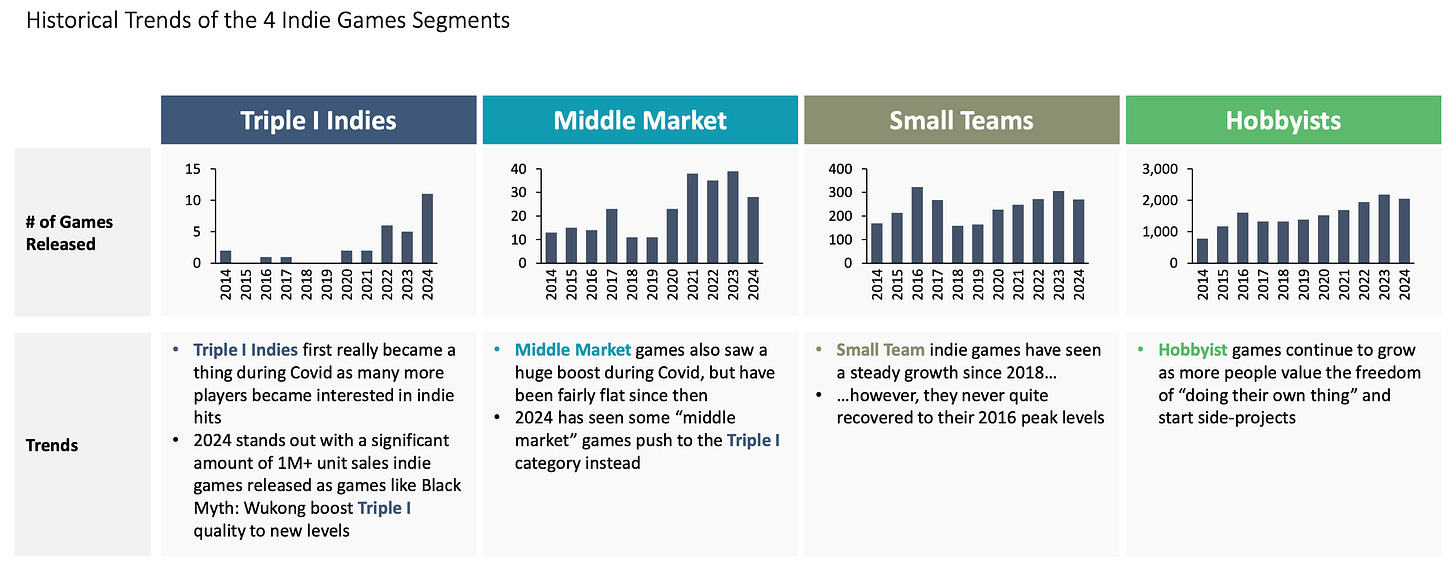

Indie Market Segments

- VGI identifies four main groups of indie developers: Triple-I (50+ people; 1M+ copies sold; $50M+ revenue), Middle Market (15-50 people; 200,000 - 1M copies sold; $10M revenue), Small Teams (3-15 people; 20,000 - 200,000 copies sold; $1M revenue), and Hobby Developers (1-2 people; 2,000 - 20,000 copies sold; $50k revenue).

- The most significant growth in the number of released games since the start of the pandemic has been among Triple-I developers. There has also been an increase in projects from mid-sized developers.

- In terms of revenue, Triple-I developers are capturing an increasingly significant market share. As of 2024, games from these developers account for 53% of all revenue.

State of Indie Teams

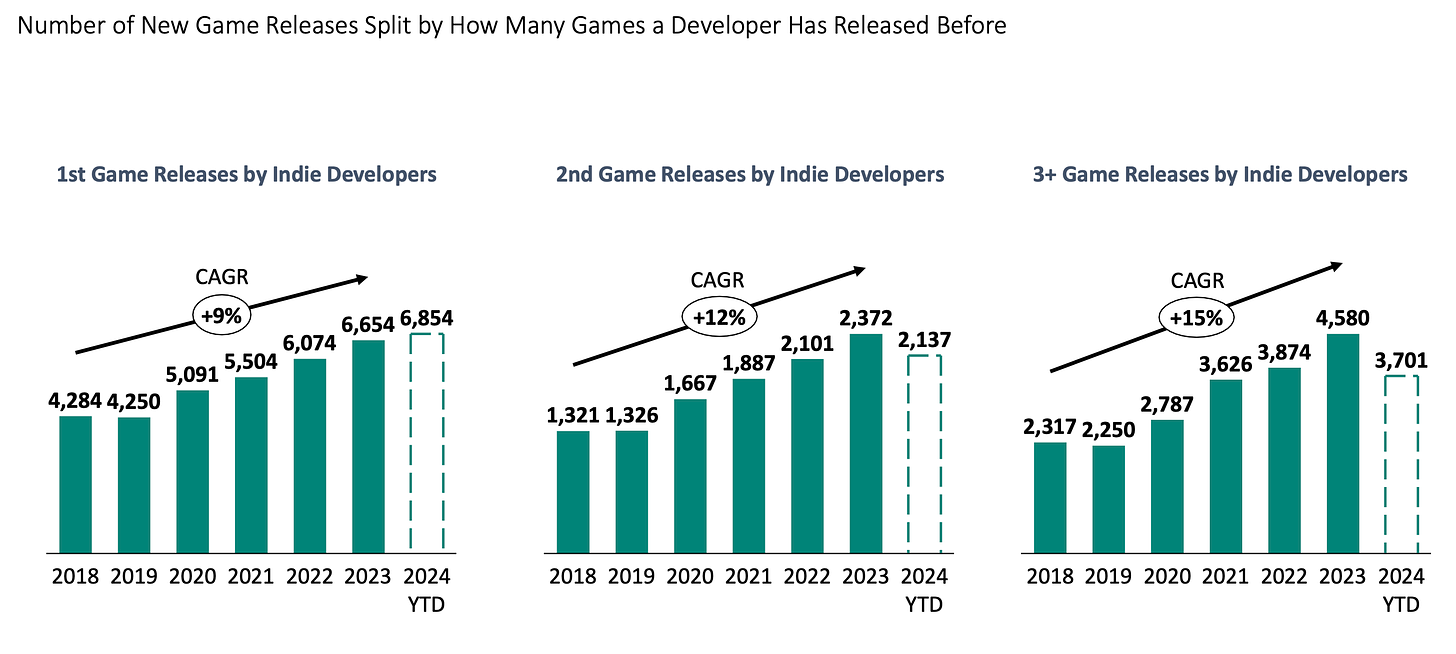

- Indie developers are actively gaining experience. The number of teams releasing their second and third games is growing (+12% and +15% CAGR, respectively).

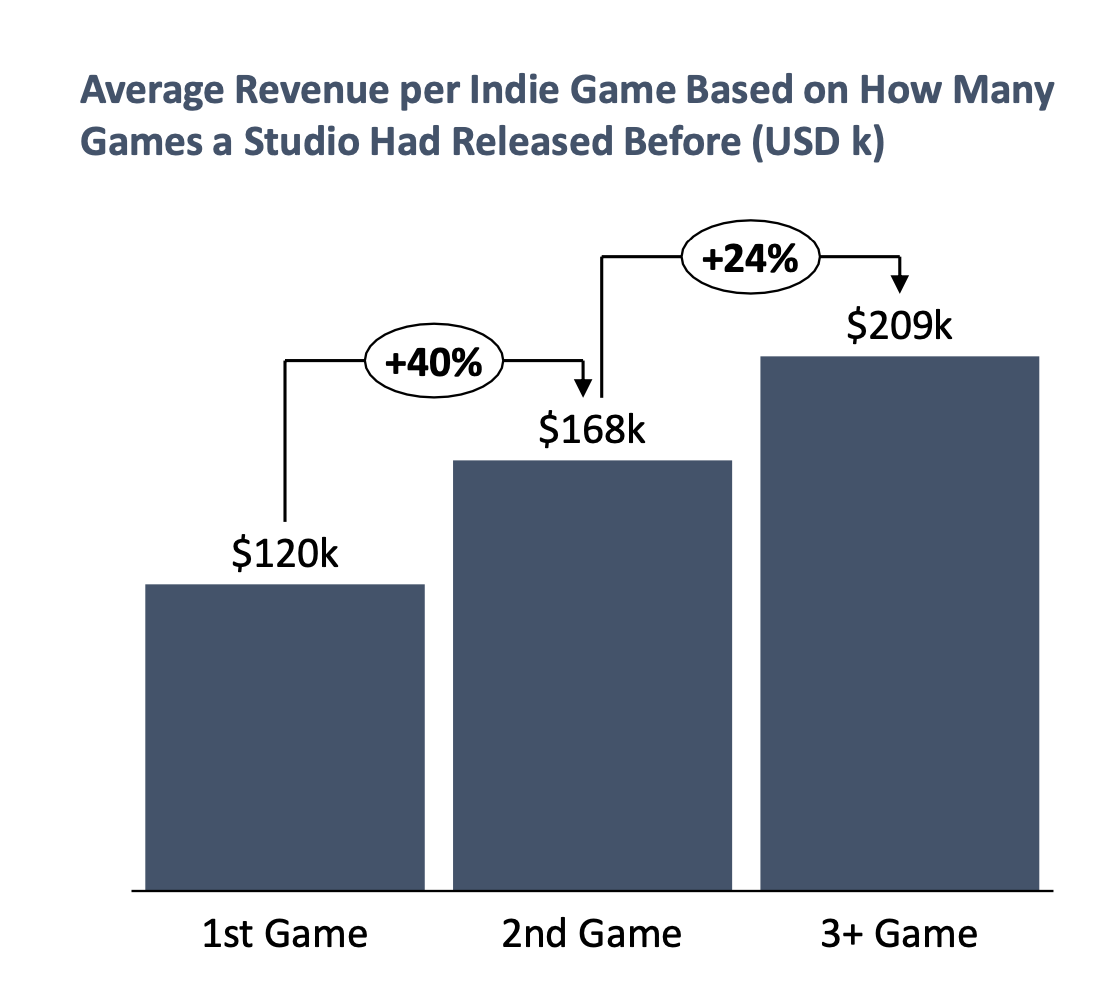

- According to statistics, each new game tends to be more successful than the previous one. The second game, on average, sells 40% better, and the third game sells 24% better than the second. The hits of 2023-2024 (Palworld, Baldur’s Gate III, Lethal Company, V Rising) were not the first games from these studios.

InvestGame: Gaming Investment Market in Q3'24

❗️Smart people told me, that “Minority M&A” is when you’re buying the major enough stake to dictate strategic decisions, yet you don’t have the majority part of the company. It’s something new to me.

Private Investment

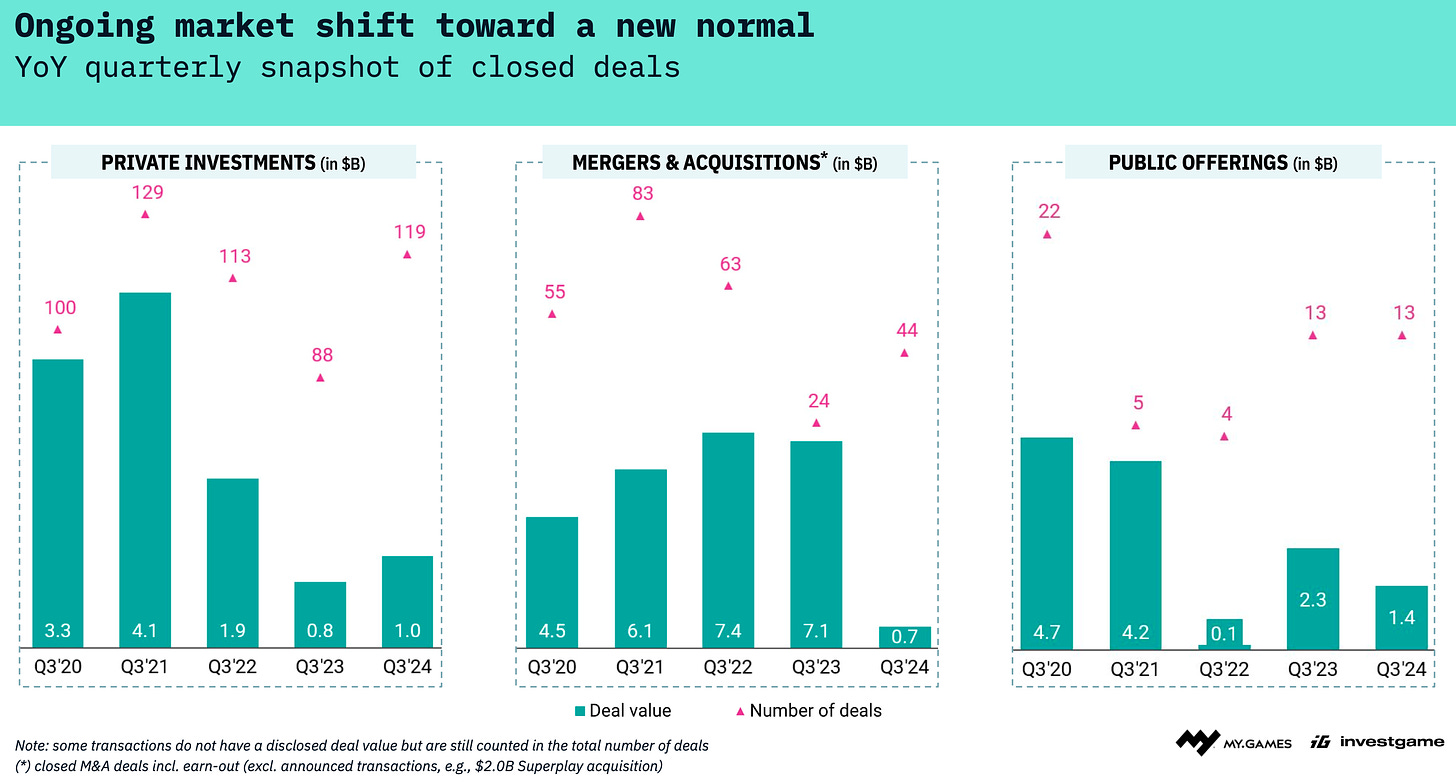

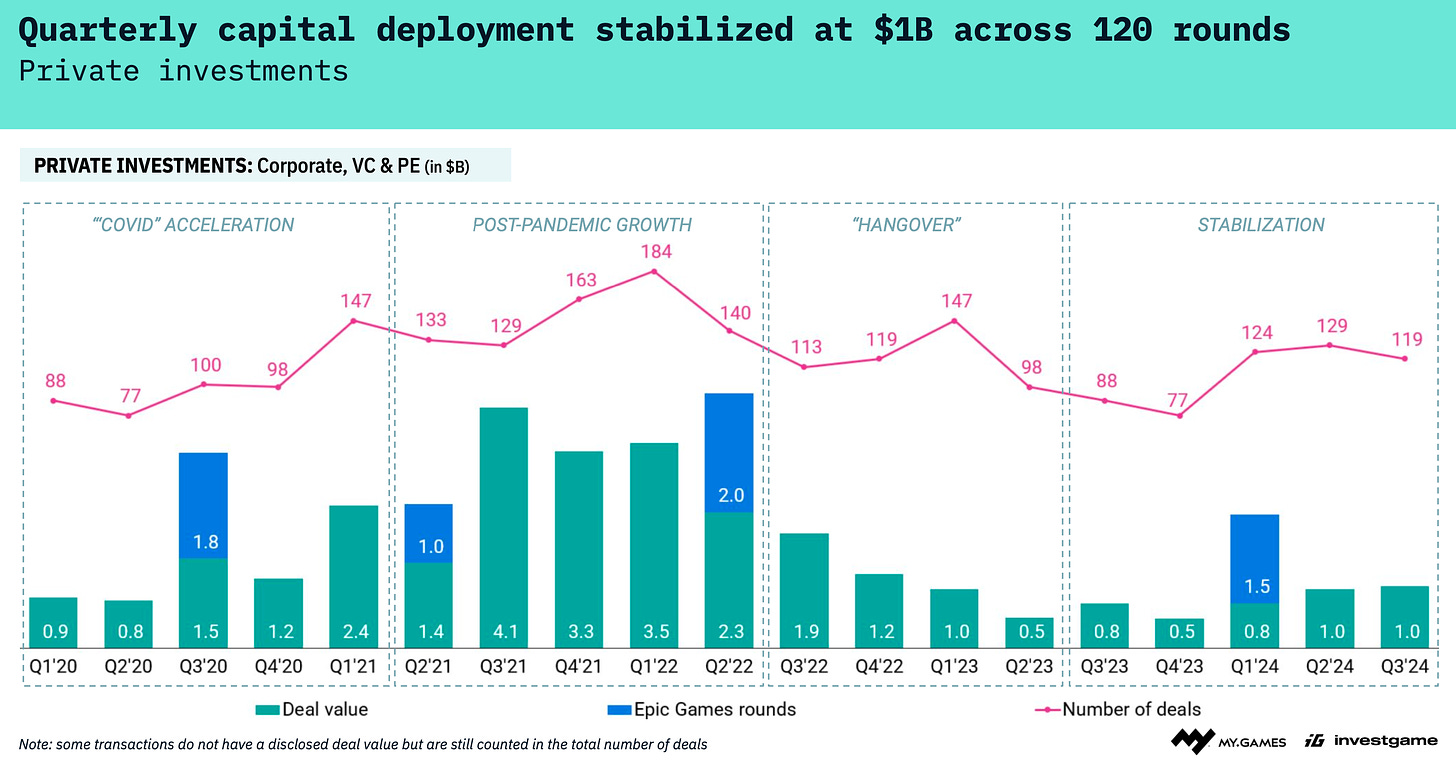

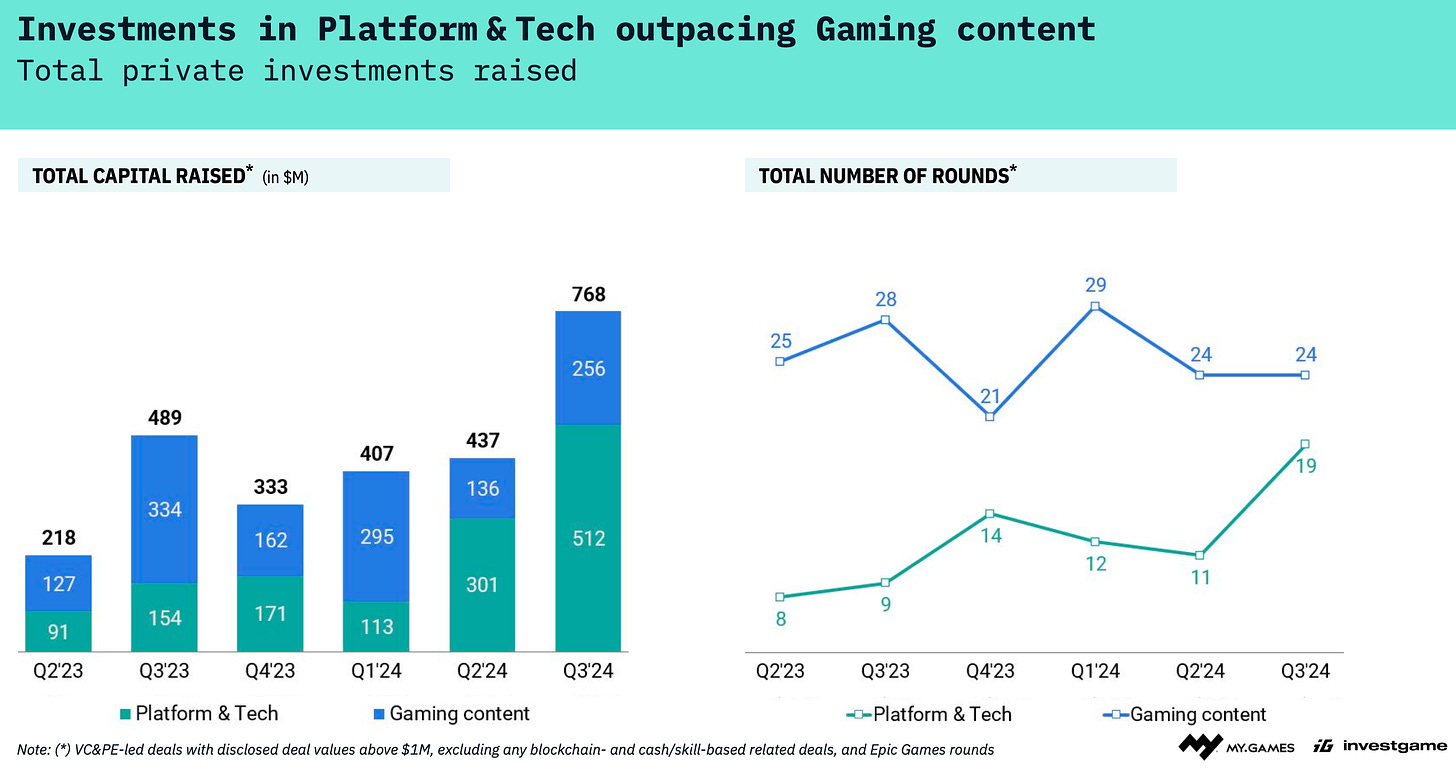

- In the third quarter of 2024, there were 119 deals (compared to 88 in Q3 2023) totaling $1 billion (compared to $0.8 billion in Q3 2023). Investment activity is approaching the levels of the peak year of 2021, but the deal sizes are significantly lower.

- Overall, after a decline from the peak levels of 2022, the market has stabilized. However, the volume and number of deals in 2024 are generally higher than those in 2023.

Investments in Content Companies

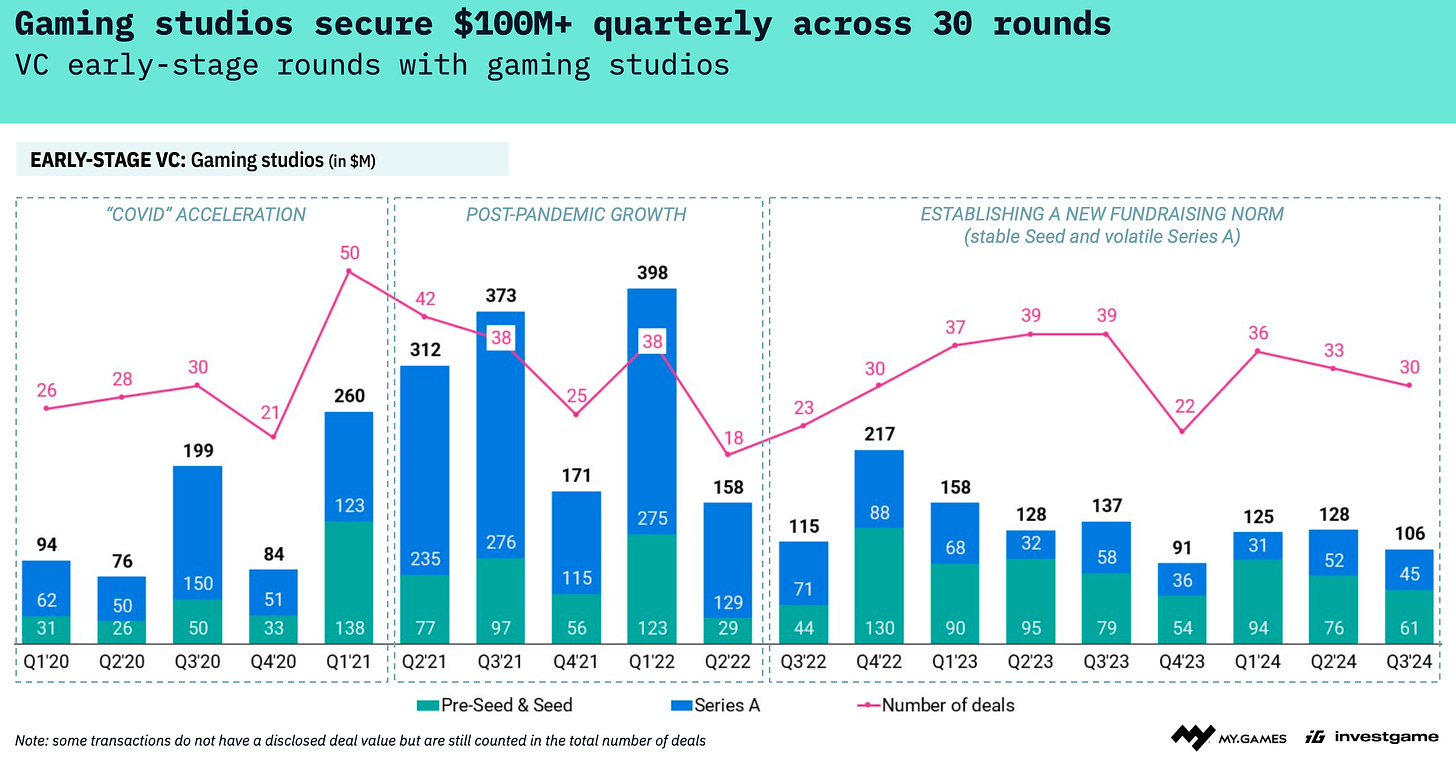

- Focusing on early-stage deals with content companies, the number of rounds and investment volumes are decreasing in 2024. Most deals are still in seed and pre-seed rounds, although Series A deals had a significant share in Q3 2024.

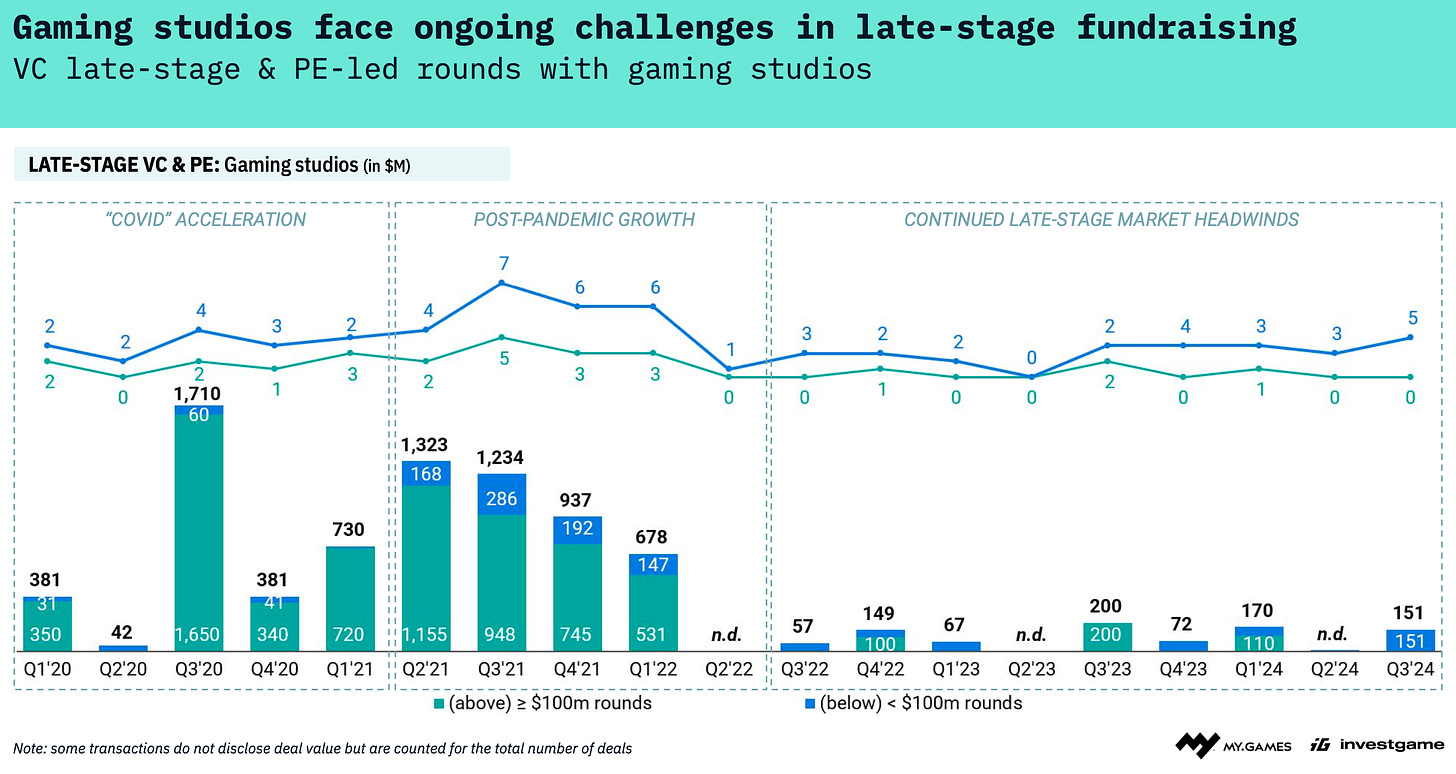

- There are major issues with late-stage funding for gaming companies. In Q3 2024, the total volume of such investments amounted to $151 million, spread across five deals.

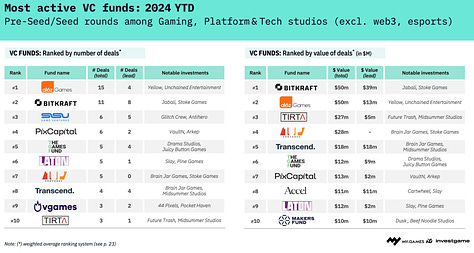

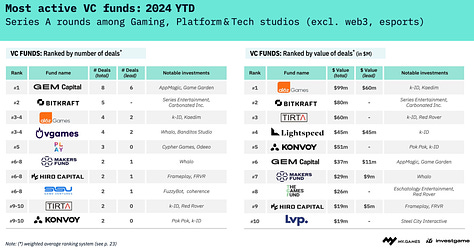

- The most active early-stage investors include a16z Games, BITKRAFT, SISU Game Ventures, TIRTA, GEM Capital, and vgames. For Series B and later stages, the leaders are Lightspeed Ventures and Makers Fund.

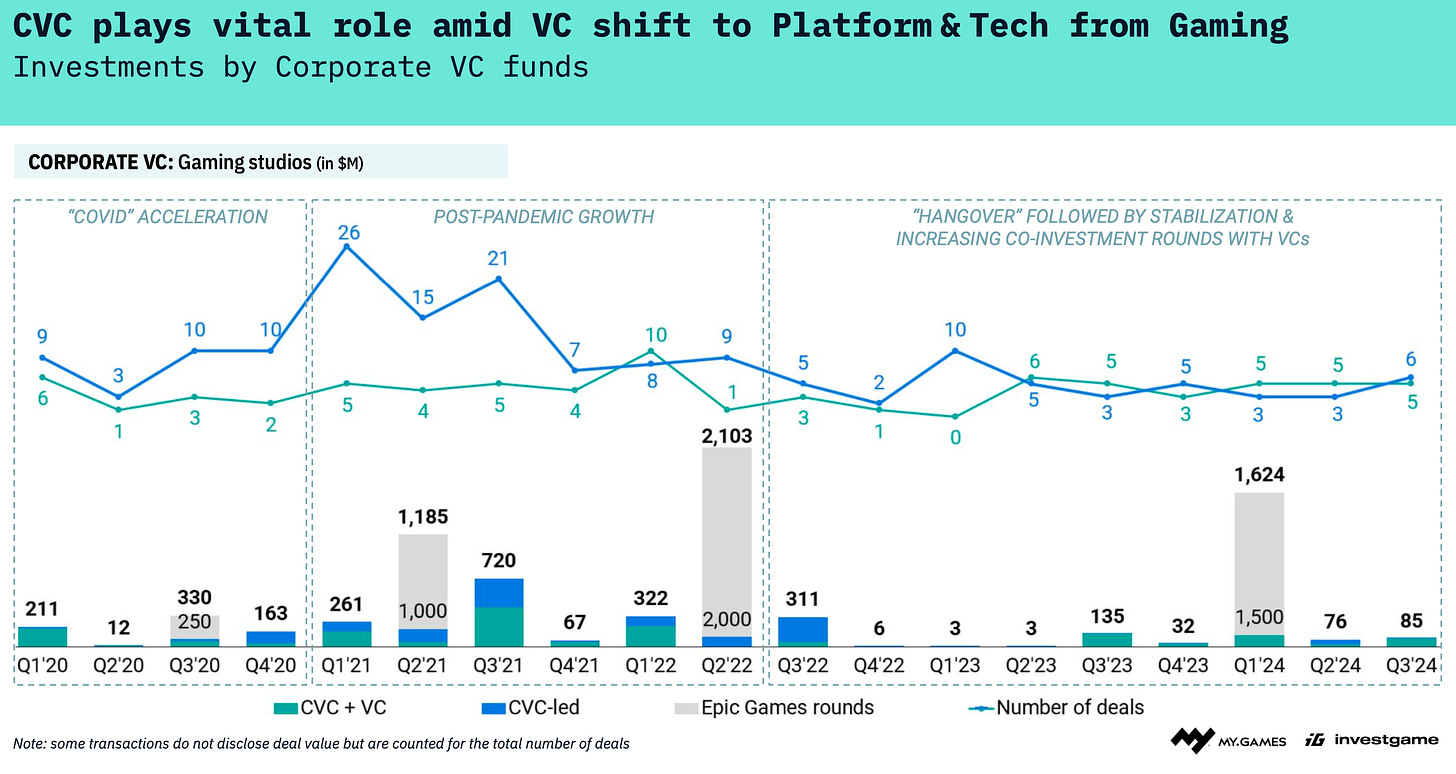

- Since the beginning of 2020, corporate VC funds have played a significant role in deals. In some quarters, they accounted for the majority of transactions.

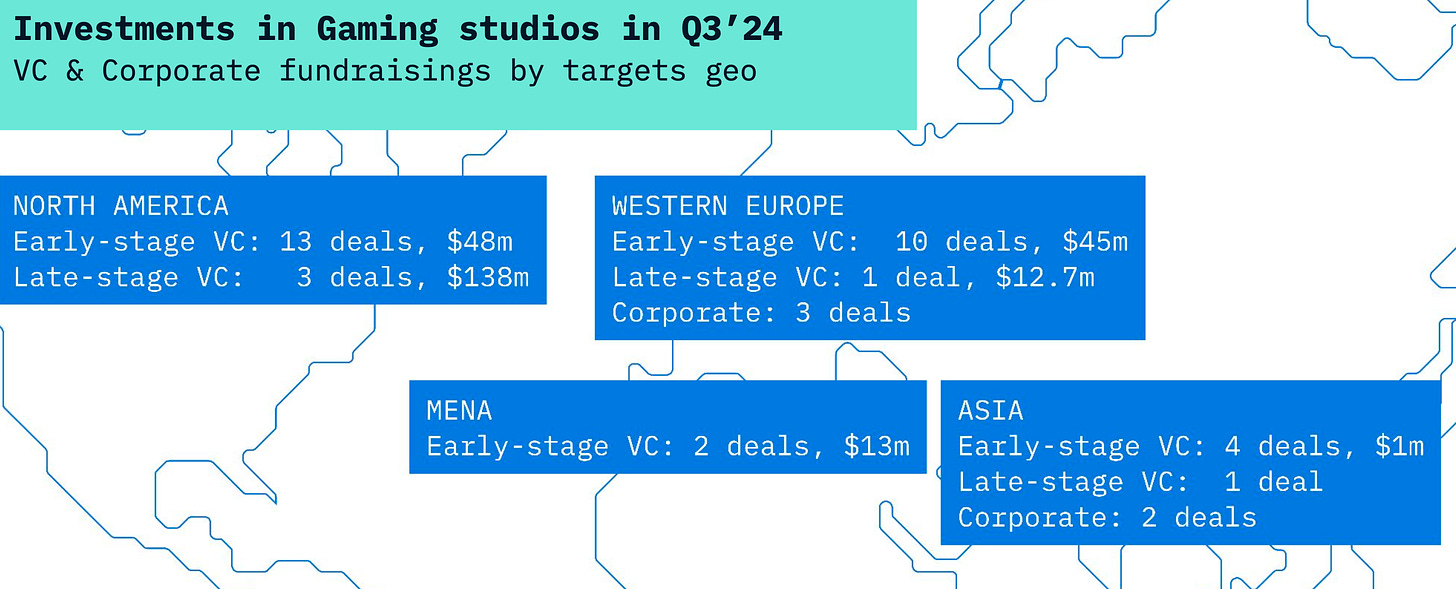

- The main regions for venture investments in Q3 2024 were North America (13 early-stage deals, 3 late-stage deals) and Europe (10 early-stage deals, 1 late-stage deal, 3 deals involving corporate VC funds).

Investments in Gaming Platforms and Technology

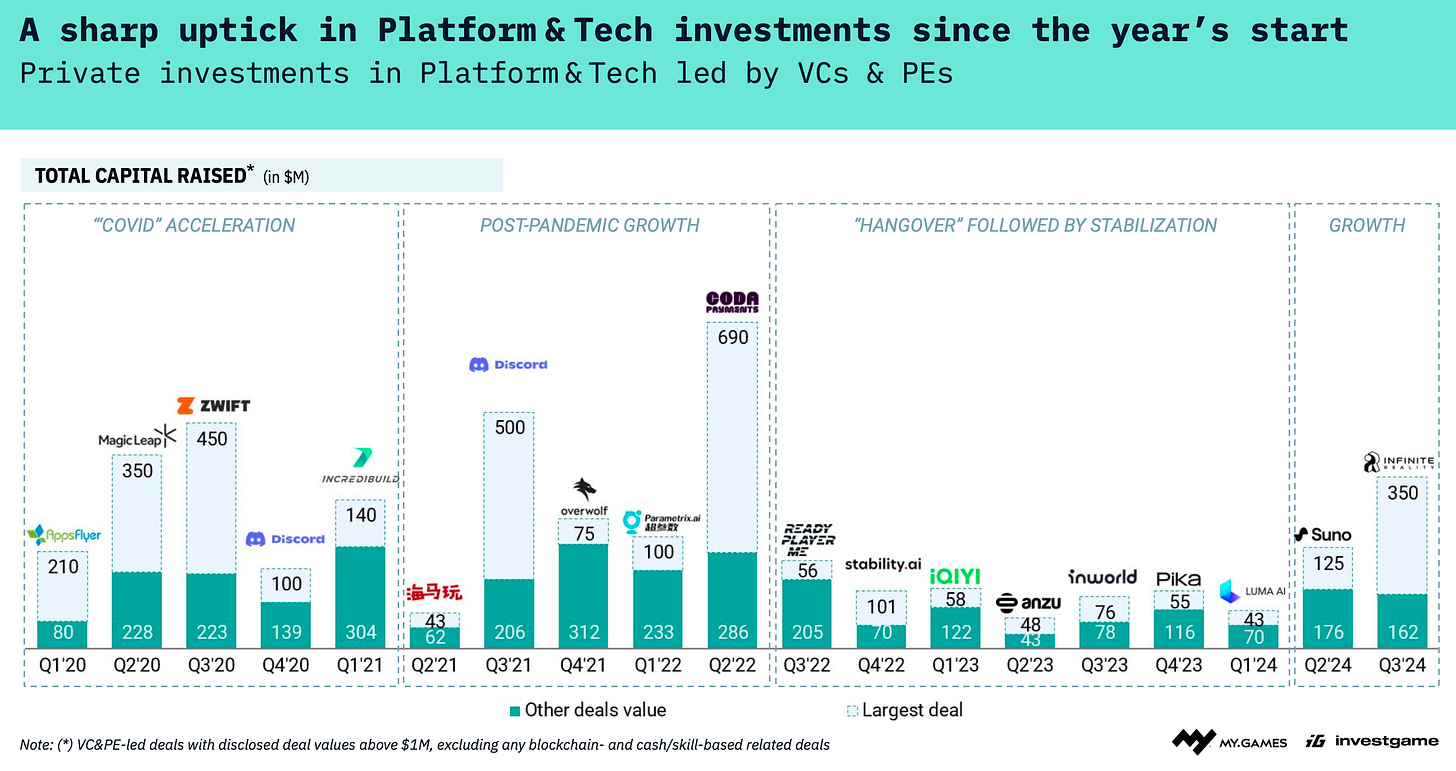

- Investor interest in technology startups has increased in Q2 and Q3 2024.

❗️InvestGame doesn’t include blockchain or skill/cash-games startups.

- The deal volume was $301 million in Q2 2024 (11 transactions) and $512 million in Q3 2024 (19 transactions), which is 2.5-3 times higher than investments in content.

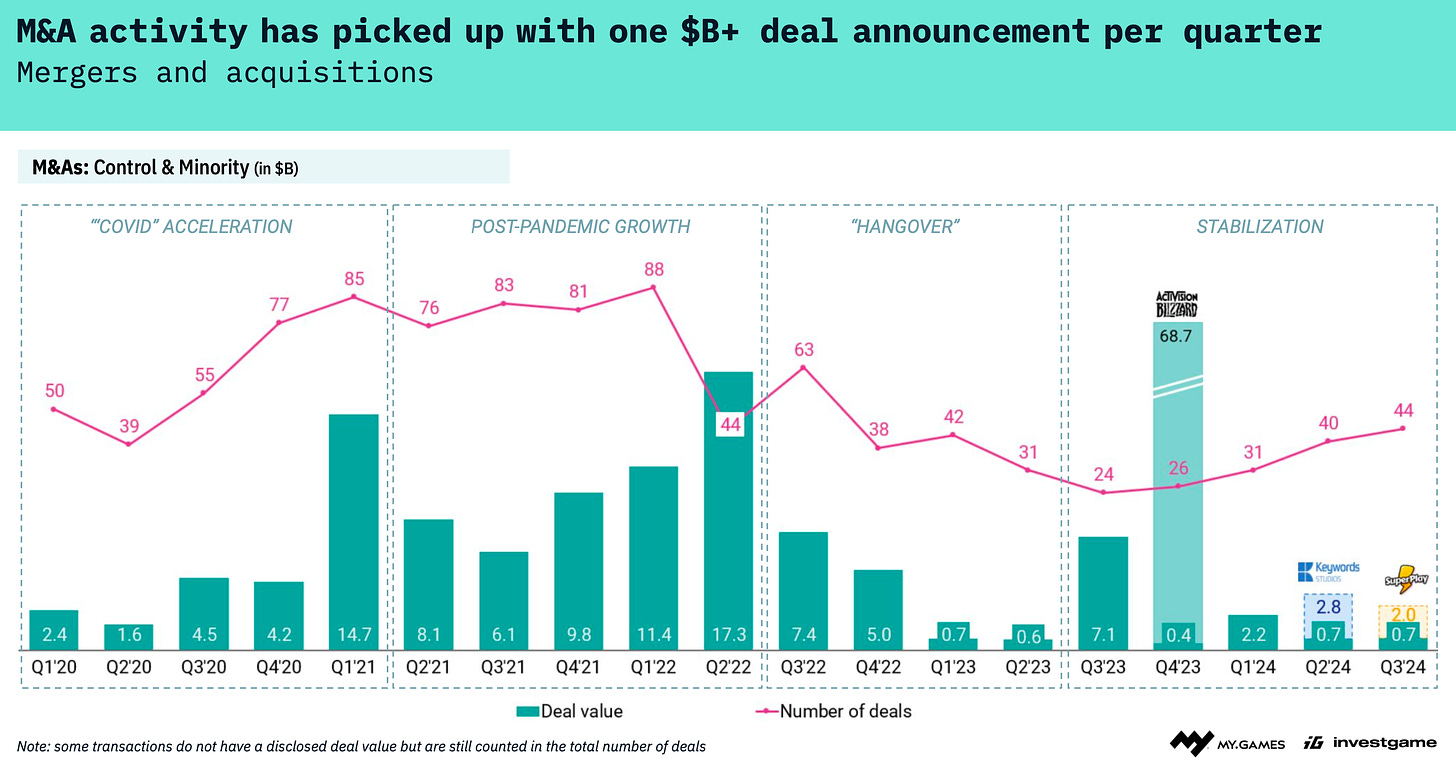

Mergers and Acquisitions

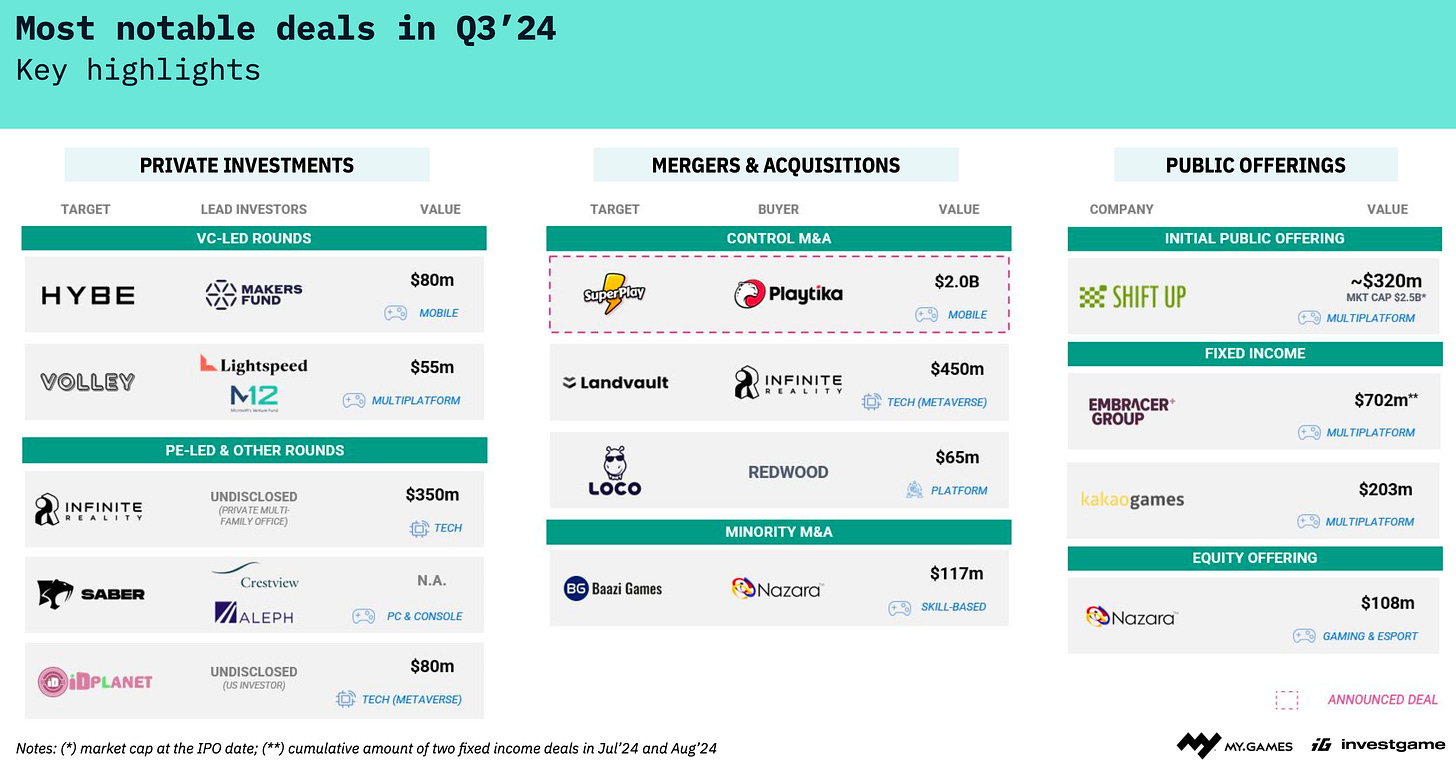

- There were 44 M&A deals in Q3 2024 (compared to 24 in Q3 2023), but their total volume—$0.7 billion—is significantly lower than in previous years.

- The number of M&A deals has been increasing in 2024, with at least one significant deal each quarter. In Q2 2024, it was Keywords; in Q3 2024, it was SuperPlay.

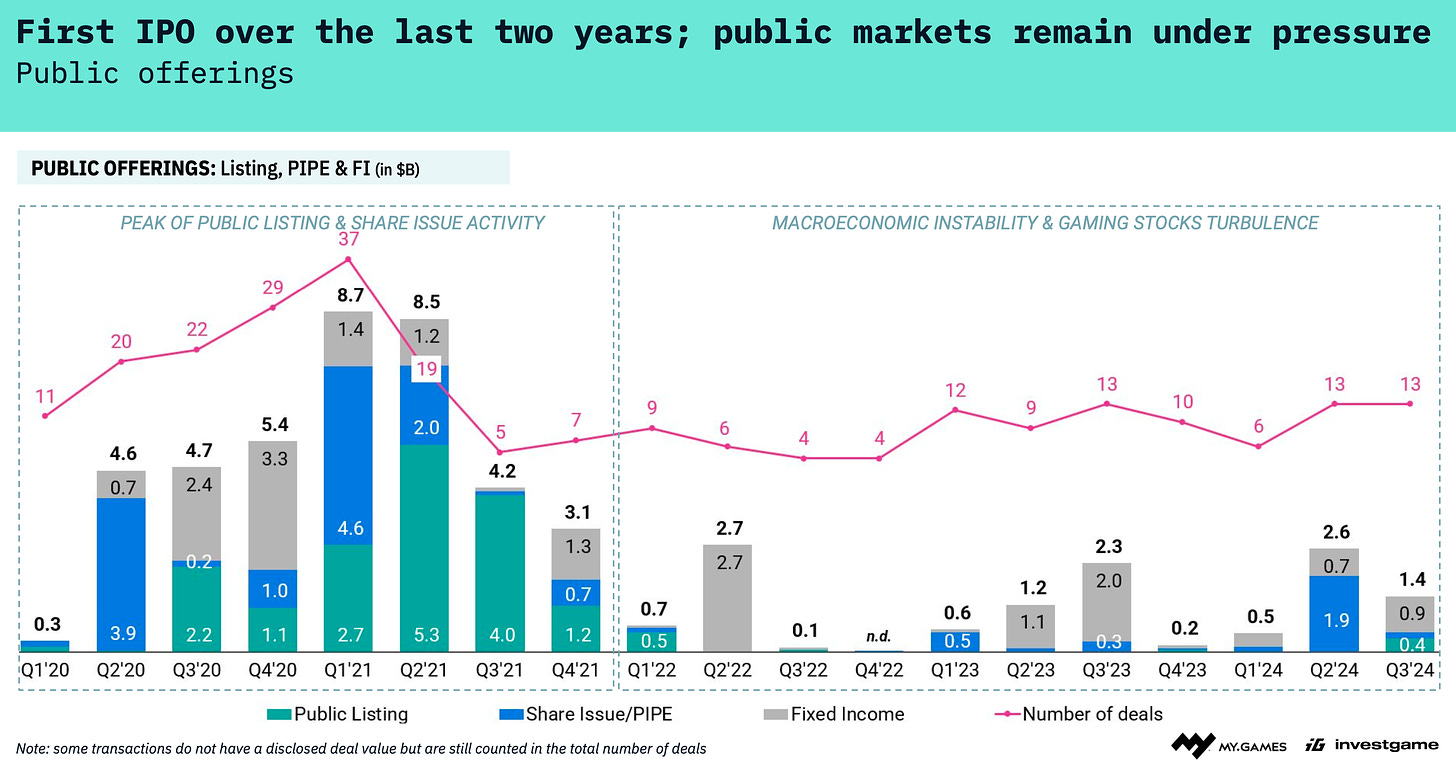

Public Offerings

- In Q3 2024, 13 companies went public, with total IPO volume reaching $1.4 billion. This is more than in Q3 2022 but less than in Q3 2023.

- The market for public offerings remains challenging. However, for the first time in two years, a gaming company, South Korea's ShiftUp, went public.

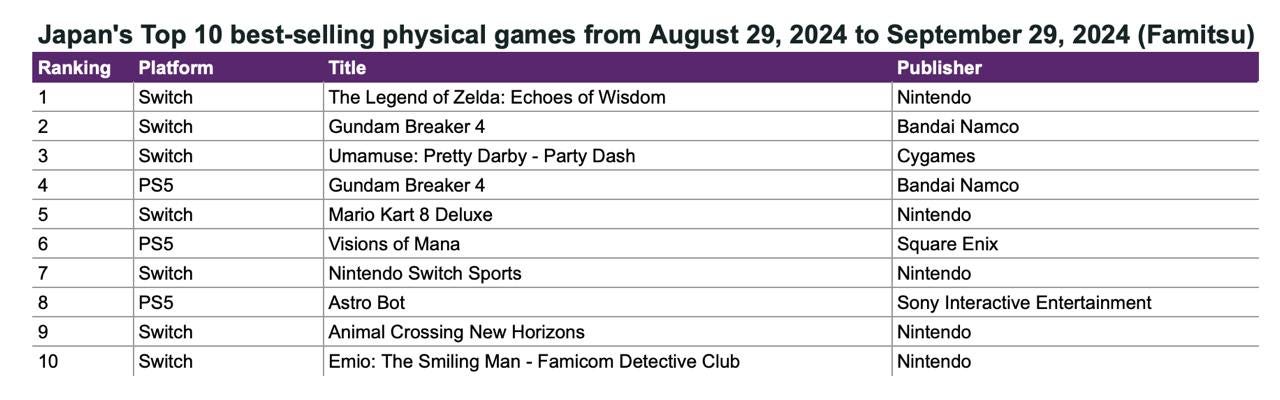

Famitsu: The Legend of Zelda: Echoes of Wisdom tops Japan's physical sales chart in September 2024

Game Sales

- The Legend of Zelda: Echoes of Wisdom sold over 200,000 physical copies in its first four days of sales in September. It outsold its nearest competitors by more than twice as much, even considering that many other titles had been on sale for the entire month.

- Gundam Breaker 4 secured second place. The Nintendo Switch version sold 68,000 copies, with nearly 62,000 more added from the PS4 and PS5 versions. This is better than the 2018 release New Gundam Breaker (106,000 physical copies lifetime) but lower than Gundam Breaker 3 (190,000 physical copies in its first month). However, back then, digital versions were less popular.

- 18 out of the top 30 games were new releases. Umamusume: Pretty Derby – Party Dash had a strong start with over 50,000 copies sold, as did Visions of Mana (54,000 copies on PS4 and PS5) and Astro Bot (35,000 copies).

- Mario Kart 8 reached a significant milestone, surpassing 6 million physical copies sold in Japan.

Hardware and Accessories Sales

- 50% of September's sales were for the Nintendo Switch OLED model, with 193,647 units sold.

- The PlayStation 5 was purchased 60,427 times, accounting for 15.6% of the total volume.

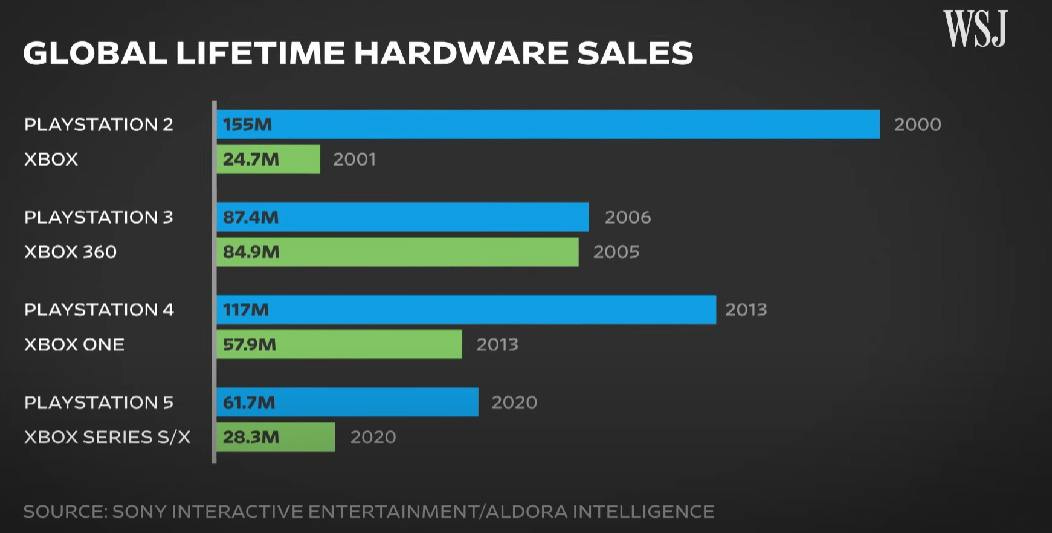

Wall Street Journal: PlayStation 5 sales outpace Xbox Series sales by more than 2 times

WSJ used data from the analytics company Aldora.

- Aldora reports that by mid-2024, 28.3 million Xbox Series S|X consoles had been sold.

- At the same time, Sony reported 61.7 million consoles sold as of June 30 this year, resulting in a sales difference of 2.18 times.

- In the previous generation, the PlayStation 4 outsold its competitor by 2.02 times (117 million PS4s compared to 57.9 million Xbox Ones).

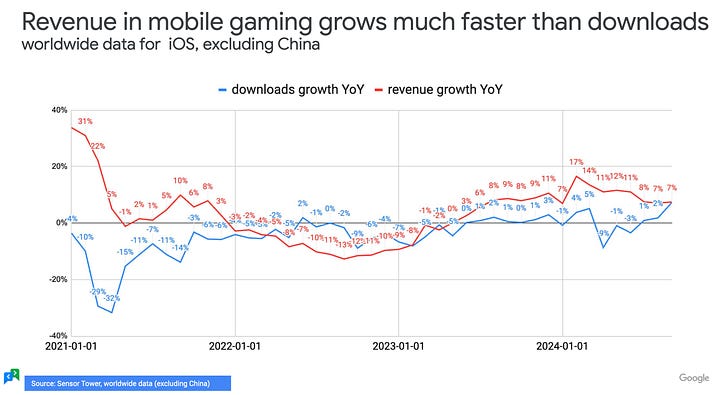

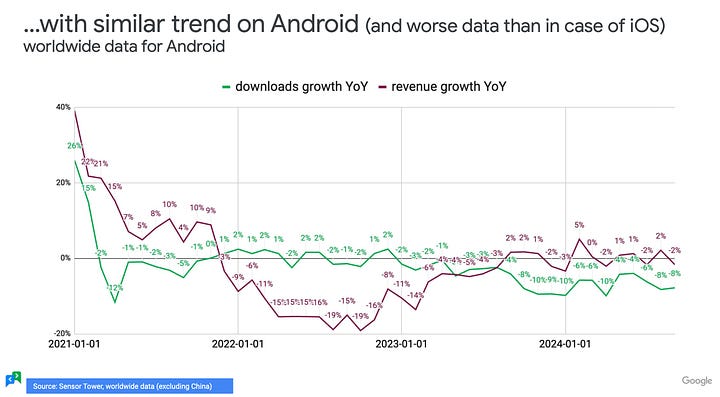

Mariusz Gąsiewski (Google): Mobile Market in the first 3 quarters of 2024

Mariusz often shares insights into the mobile market on his LinkedIn page.

Overall gaming market situation

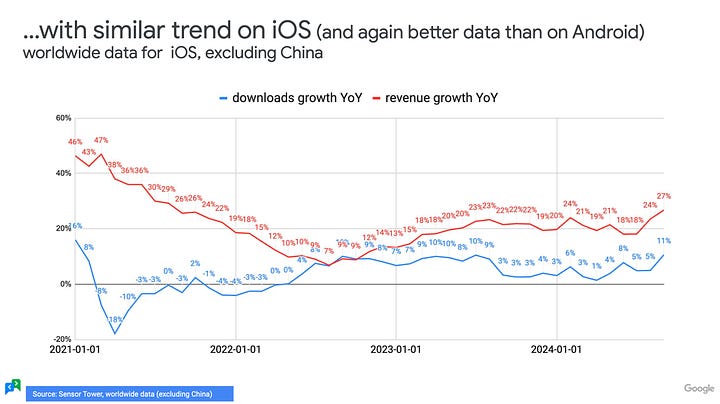

- Revenue on iOS has been growing since the beginning of the year. Although the growth rate has slowed to 7% per month, the positive trend has continued since mid-2023.

- At the same time, revenue growth on Android is struggling. Periods of slight growth are followed by periods of slight decline. Overall, game revenue on Android has remained at the same level throughout 2024.

- As for downloads, the situation is more clear-cut. On Android, there is a consistent decline in downloads that has been ongoing since early 2023. On iOS, audience growth is in the negative zone, but there are signs of a potential increase.

Gaming Apps vs. Non-Gaming Apps

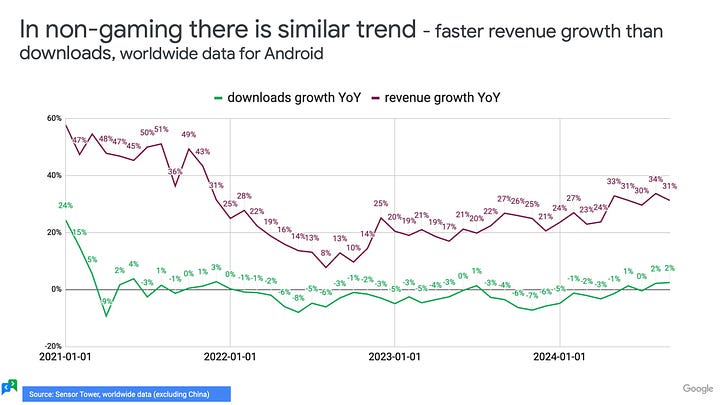

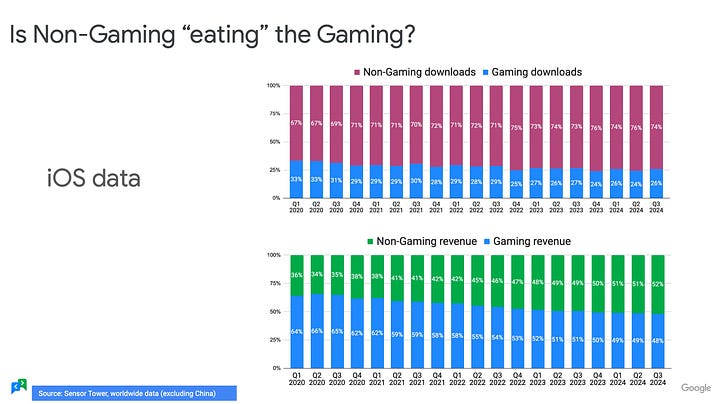

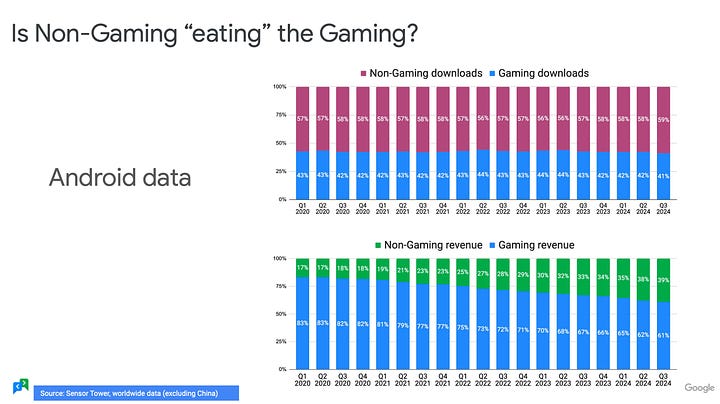

- Non-gaming apps are seeing revenue growth on both iOS and Android.

- Downloads on iOS are slightly decreasing, while on Android, they are growing.

- Many in the industry are discussing how non-gaming apps are taking revenue away from games. The share of non-gaming app revenue has been steadily increasing over the past four years. However, the share of downloads has not grown as significantly over the same period.

- It's hard to say whether the growth of non-gaming app revenue is hurting games. But it is clear that non-gaming apps are growing faster than the gaming market.

Omdia: Subscription Services don't impact the way games are designed

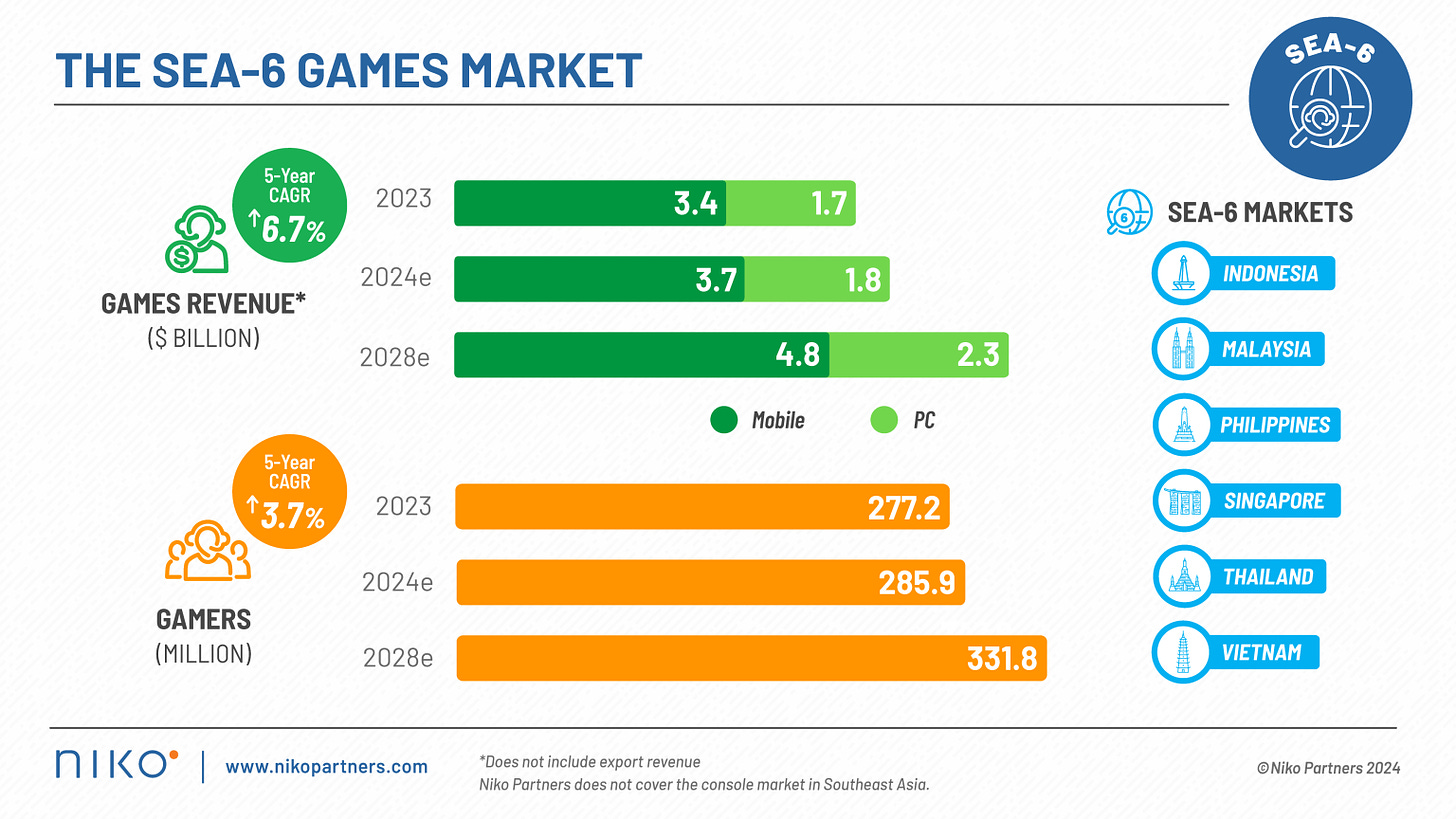

Niko Partners uses the abbreviation SEA-6, which refers to the markets of Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

Overall markets condition

- By the end of 2023, the gaming market volume in these six countries reached $5.1 billion (+8.8% YoY). In mid-2023, Niko Partners predicted it would grow to $5.8 billion.

- In 2024, the market volume is expected to increase to $5.5 billion, and by 2028, it could reach $7.1 billion, with a projected annual growth rate of 6.7%.

- Niko Partners anticipates that by 2028, there will be 332 million gamers in these six countries—equivalent to the entire population of the U.S. today.

- By the end of 2024, SEA-6 will have 285.9 million gamers (+3.2% YoY).

- Thailand and Indonesia have the highest growth rates in gaming revenue. Niko Partners also advises including localization for these languages, and it is important to localize for Vietnam as well.

- Games developed by local studios are actively supported by players and the local press.

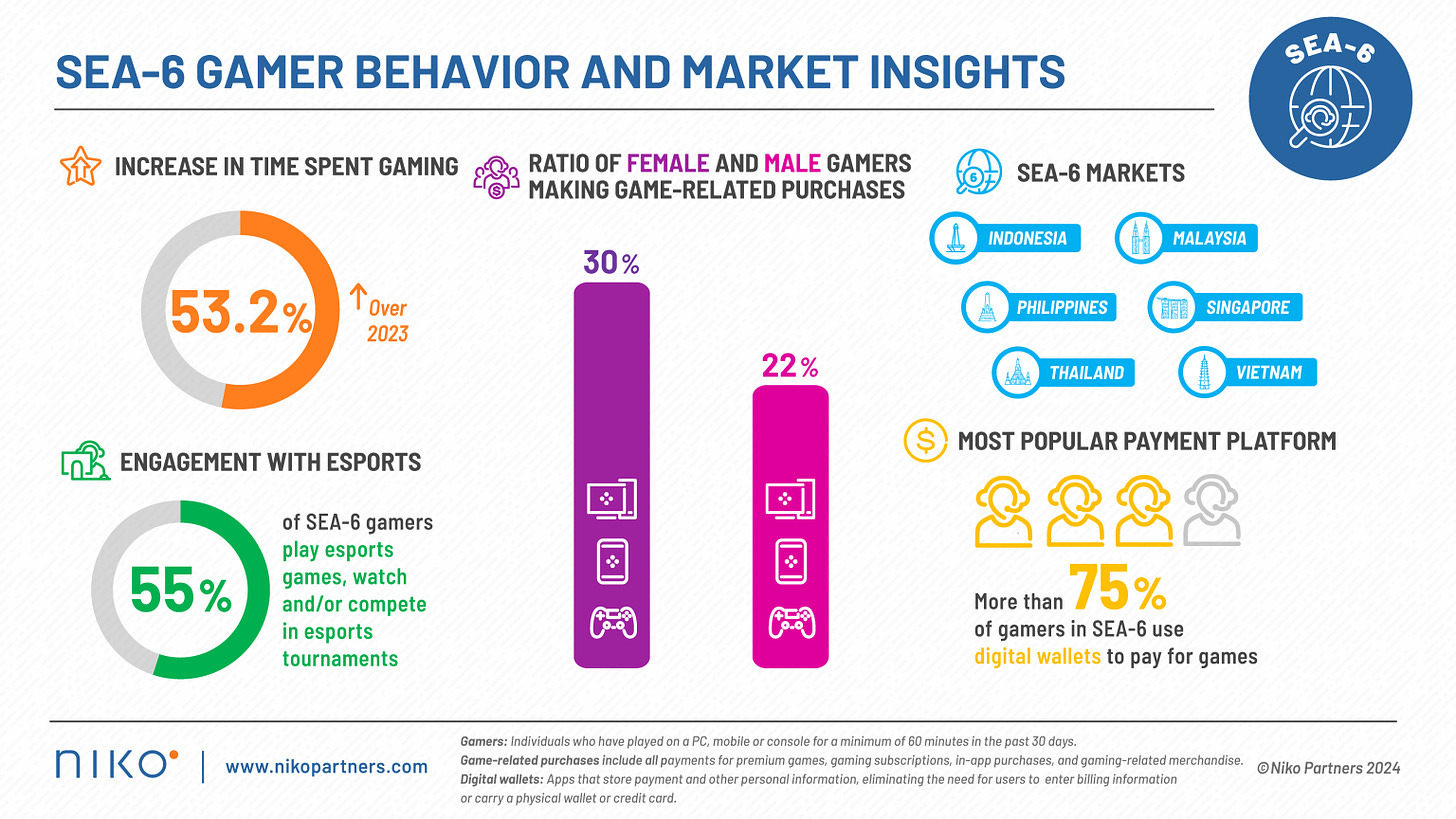

Player Behavior in SEA-6 Countries

- In 2024, players spent 53.2% more time in games than in 2023, with the biggest increases in Thailand and Vietnam.

- More than half of the gamers in SEA-6 countries engage with esports. The most popular games in the region have esports components.

- Women are more likely to make in-game purchases (30%) than men (22%).

- Issues of representation and accessibility are important to players in the region.

Payments in SEA-6 Countries

- More than 75% of gamers use digital wallets for in-game payments.

- Players over 25 years old tend to use cards, while younger players (under 21) prefer to pay in cash (e.g., through retail outlets).

Play-to-Earn and Crypto Games in SEA-6

- Play-to-earn mechanics are appealing in the region, except in Singapore. These models are particularly popular in Malaysia, the Philippines, and Thailand.

- Overall, the Web3 market is actively developing in the region.

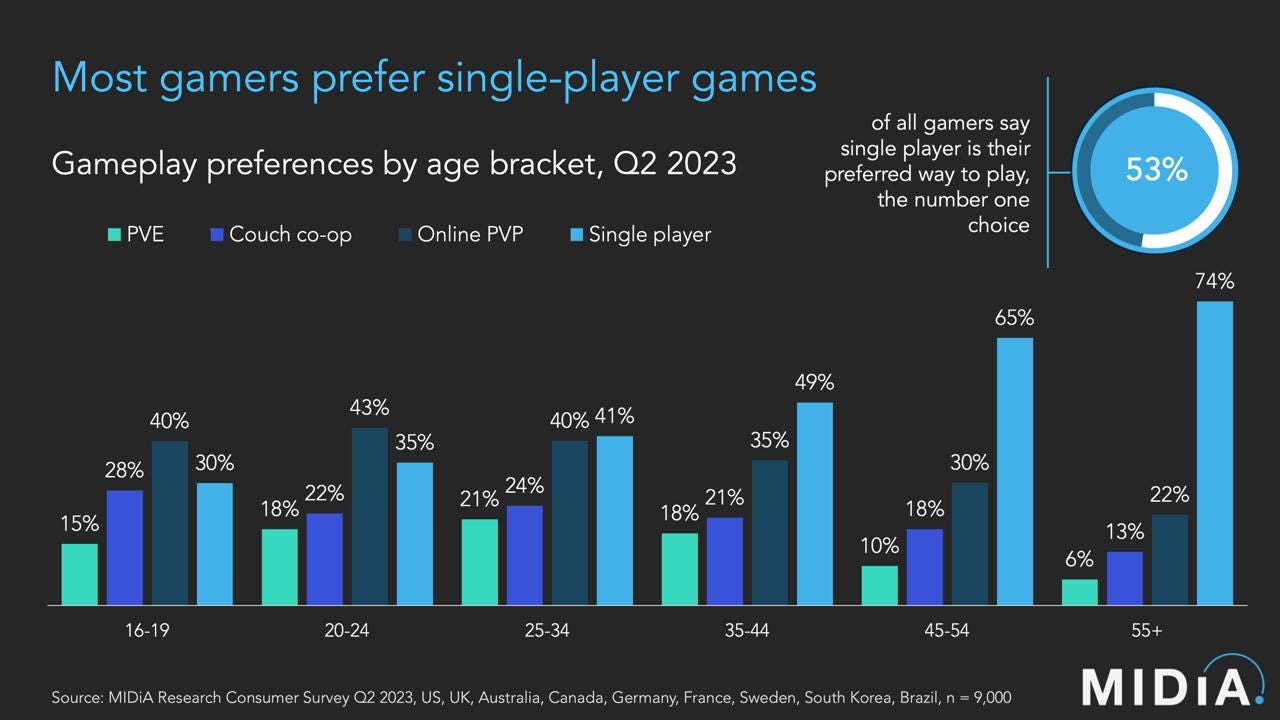

MIDiA Research: Most PC and Console gamers prefer single-player games

The company surveyed 9,000 gamers in the second quarter of 2023 across the U.S., U.K., Australia, Canada, Germany, France, Sweden, South Korea, and Brazil.

- On average, 53% of gamers prefer single-player games.

- There is a noticeable correlation: the younger the gamer, the more likely they are to play multiplayer games (especially online PvP). The older the gamer, the greater their interest in single-player games.

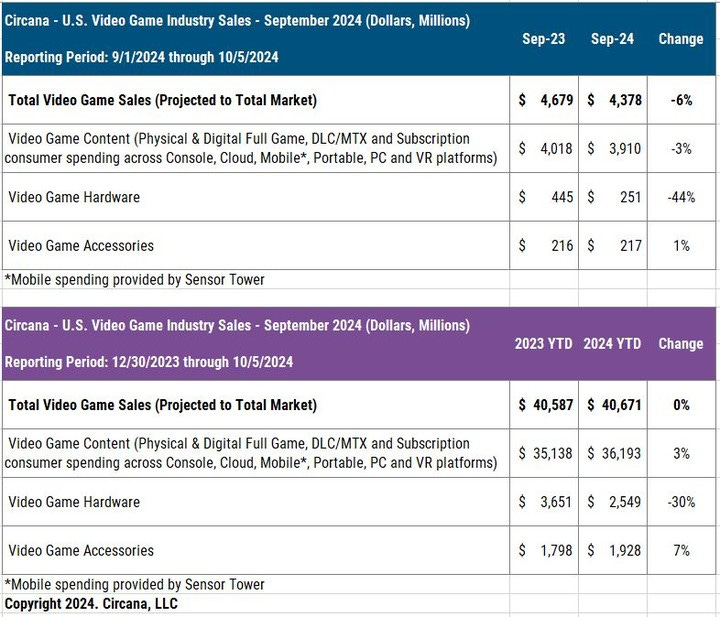

Circana: The U.S. Gaming Market Declined by 6% YoY in September 2024

Overall market status

- Content sales in September dropped by 3% compared to last year, amounting to $3.91 billion.

- Hardware sales plunged by 44%, falling to $251 million, marking the lowest figure since September 2019.

- The biggest drop was seen in Xbox Series S|X sales (-54% YoY), followed by PlayStation 5 (-45% YoY) and Nintendo Switch (-23% YoY).

- Despite the decline, PS5 still leads in both unit sales and revenue. In September, 40% of PS5 sales were for the digital version, accounting for 18% of overall U.S. sales.

- The accessories segment showed a slight growth of 1% YoY, reaching $217 million. The PlayStation Portal remained the revenue leader. Currently, 3% of PS5 owners in the U.S. own this streaming system.

- By the end of the first 9 months, 2024 is nearly on par with 2023 in terms of total revenue ($40.671 billion vs. $40.587 billion in 2023). The start of the year was more active.

- Spending on mobile games in the U.S. during the first 9 months of 2024 was $1.7 billion higher than in 2023. However, sales of console games fell by $0.8 billion.

Best-selling Games

- EA Sports FC 25 debuted at the top spot in September. It marked the biggest launch of a football game in U.S. history in terms of revenue.

- Other notable releases in the month include Astro Bot, The Legend of Zelda: Echoes of Wisdom (excluding physical sales), NBA 2K25 (excluding physical sales), NHL 25, Marvel vs. Capcom Fighting Collection: Arcade Classics, and Warhammer 40,000: Space Marine II (excluding physical sales).

❗️Black Myth: Wukong is not included in the list because its developers do not share sales data with Circana.

- EA Sports College Football 25, Helldivers II, and Call of Duty: Modern Warfare II have been the top-selling games on the U.S. market over the past 9 months. EA Sports FC 25 entered the list in 10th place.

- The top mobile games in the U.S. by revenue are MONOPOLY GO!, Royal Match, and Roblox. Brawl Stars saw a 64% revenue increase thanks to a collaboration with SpongeBob SquarePants.

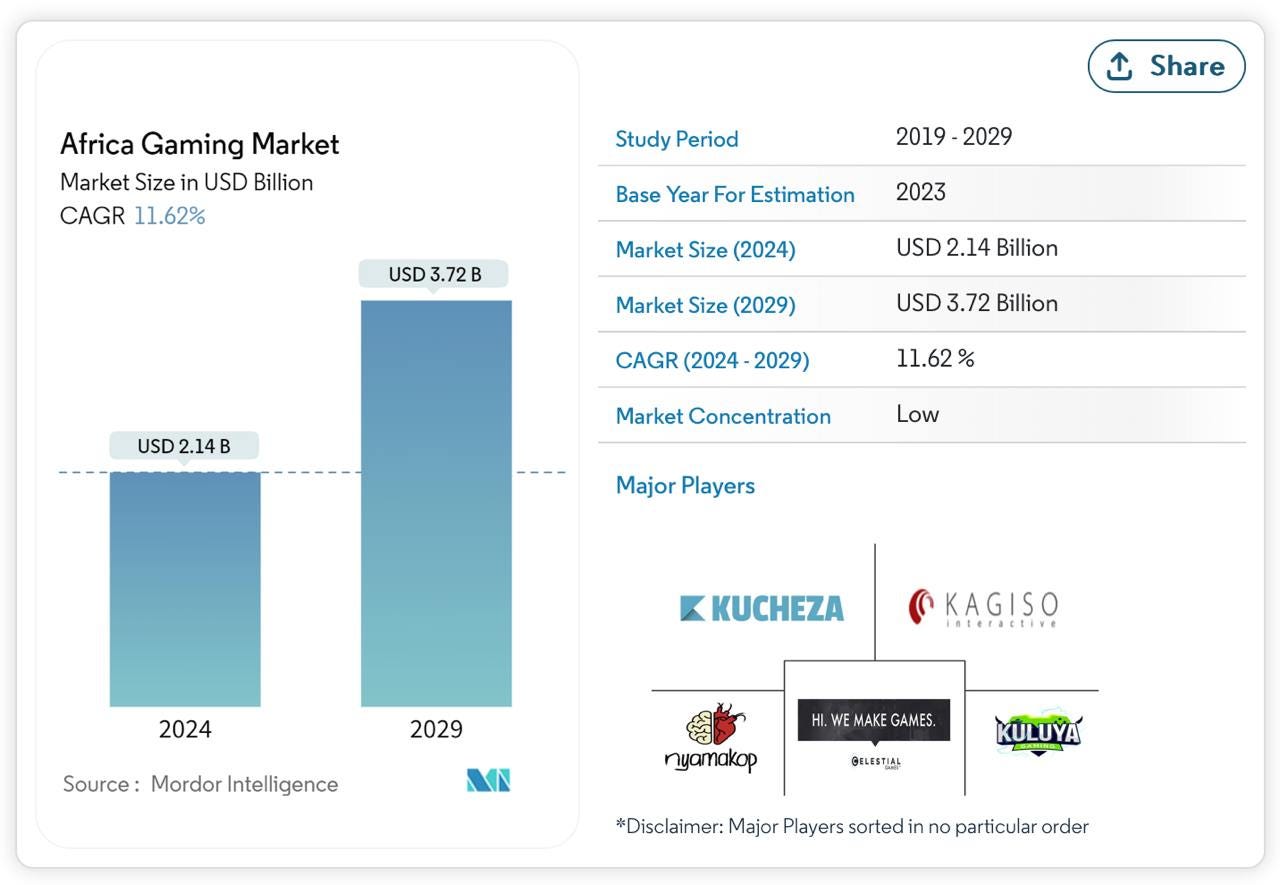

Mordor Intelligence: The African gaming market will reach $3.72B by the end of 2029

- Analysts at Mordor Intelligence estimate that the market will reach $2.14 billion by the end of 2024. The average annual growth rate until 2029 is expected to be 11.62%, reaching $3.72 billion.

- Revenue growth will primarily be driven by the mobile segment, influenced by improved access to mobile phones and connectivity.

- According to UN forecasts, by 2050, half of Africa’s population will be under 24 years old, making it one of the youngest regions in the world.

❗️However, Africa is not homogeneous. Countries on the continent vary in language and economic capacity, meaning growth will be concentrated in developing countries like Nigeria, South Africa, and Egypt.

- Internet penetration in Sub-Saharan African countries is expected to reach 50% only by 2030.

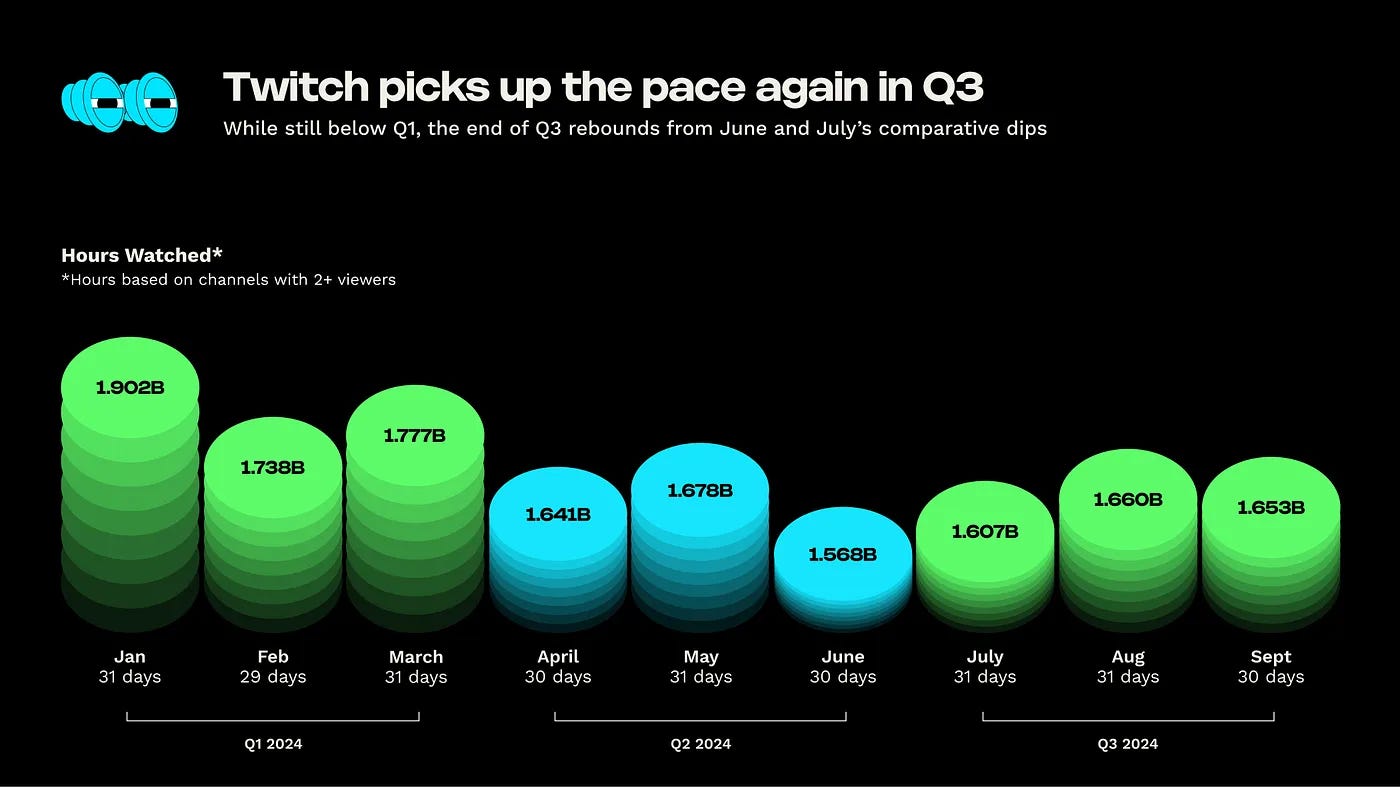

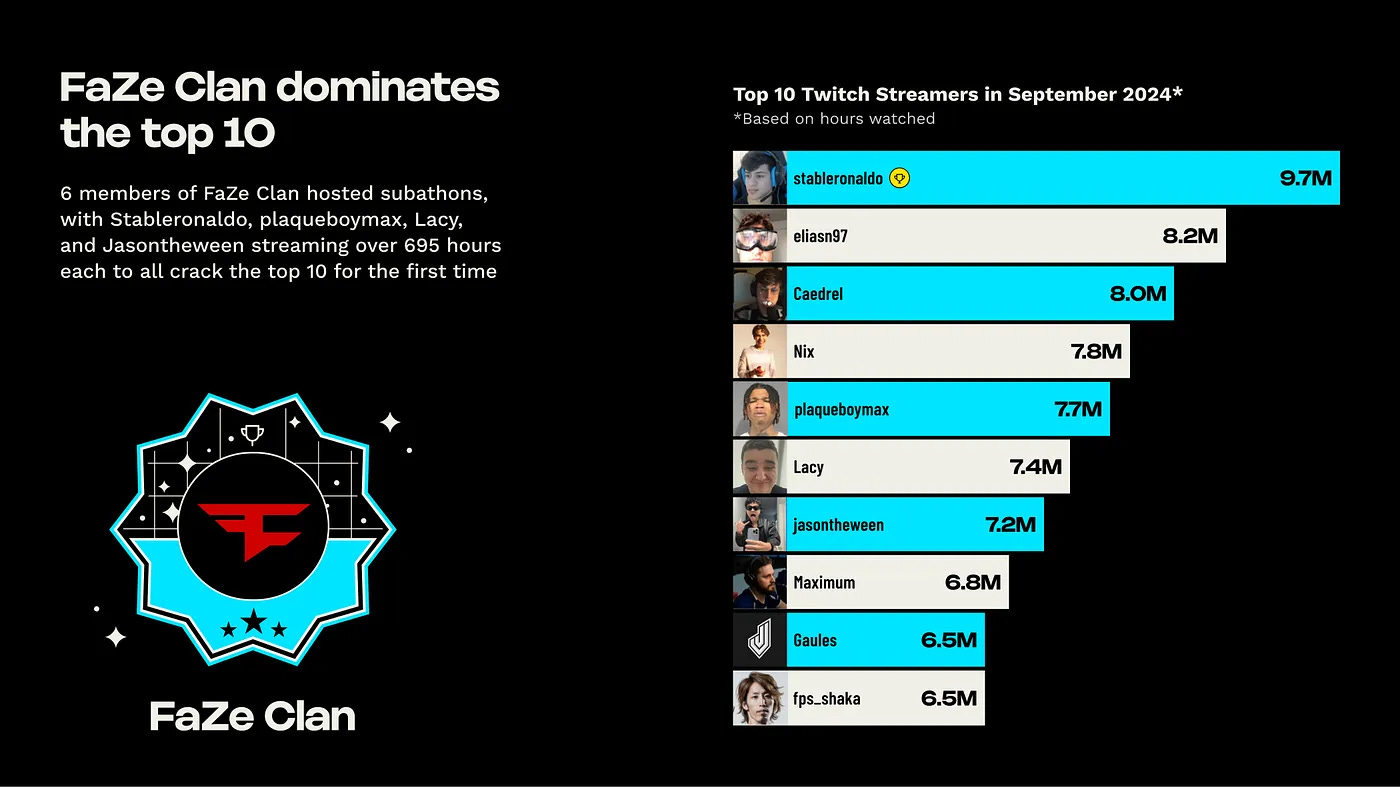

StreamElements & Rainmaker.gg: Game Streaming in September 2024

- The number of views on Twitch in Q3'24 recovered after a dip in Q2'24.

- September 2024 was the leader in daily views (55 million per day), the highest since April of this year.

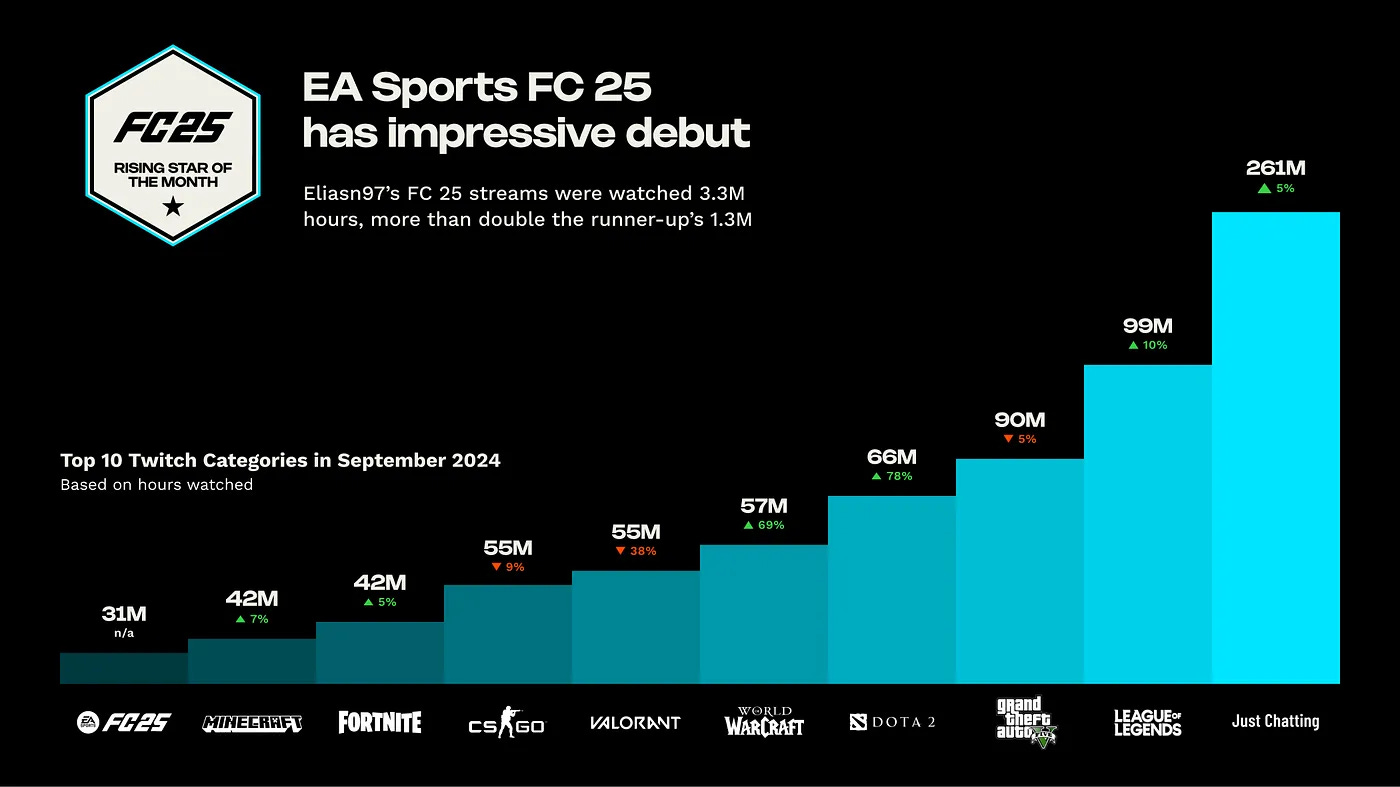

- EA Sports FC 25 climbed into the top 10 most-watched games with 31 million hours viewed. The last new game to achieve this was Palworld in January.

- The top spots remain occupied by the usual titles: League of Legends (99 million hours), Grand Theft Auto V (90 million hours), DOTA 2 (66 million hours—a 78% increase thanks to The International), World of Warcraft (57 million hours—a 69% increase).

Stay tuned for more updates next month!

Meanwhile, you can check out our free demo to see how devtodev can help your game project succeed.